Official Vehicle Repayment Agreement Document

In the panorama of financial agreements, the Vehicle Repayment Agreement forms a pivotal bridge between buyers and sellers, ensuring a transparent and structured payment plan for vehicles. Such an agreement outlines crucial details including, but not limited to, the total purchase price, interest rates, repayment schedule, and the consequences of defaulting on payments. It serves as a binding legal document that protects both parties involved, offering a clear roadmap of financial obligations that must be met. This form is particularly beneficial in scenarios where vehicles are purchased through financing options or under installment plans, providing a sense of security and predictability to the transaction. In its essence, the Vehicle Repayment Agreement delineates the rights and responsibilities of each party, making it an indispensable tool in the realm of vehicle transactions. By meticulously detailing the terms of repayment, it not only facilitates a smoother financial agreement but also minimizes potential disputes, laying the groundwork for a mutually beneficial relationship between the lender and the borrower.

Document Example

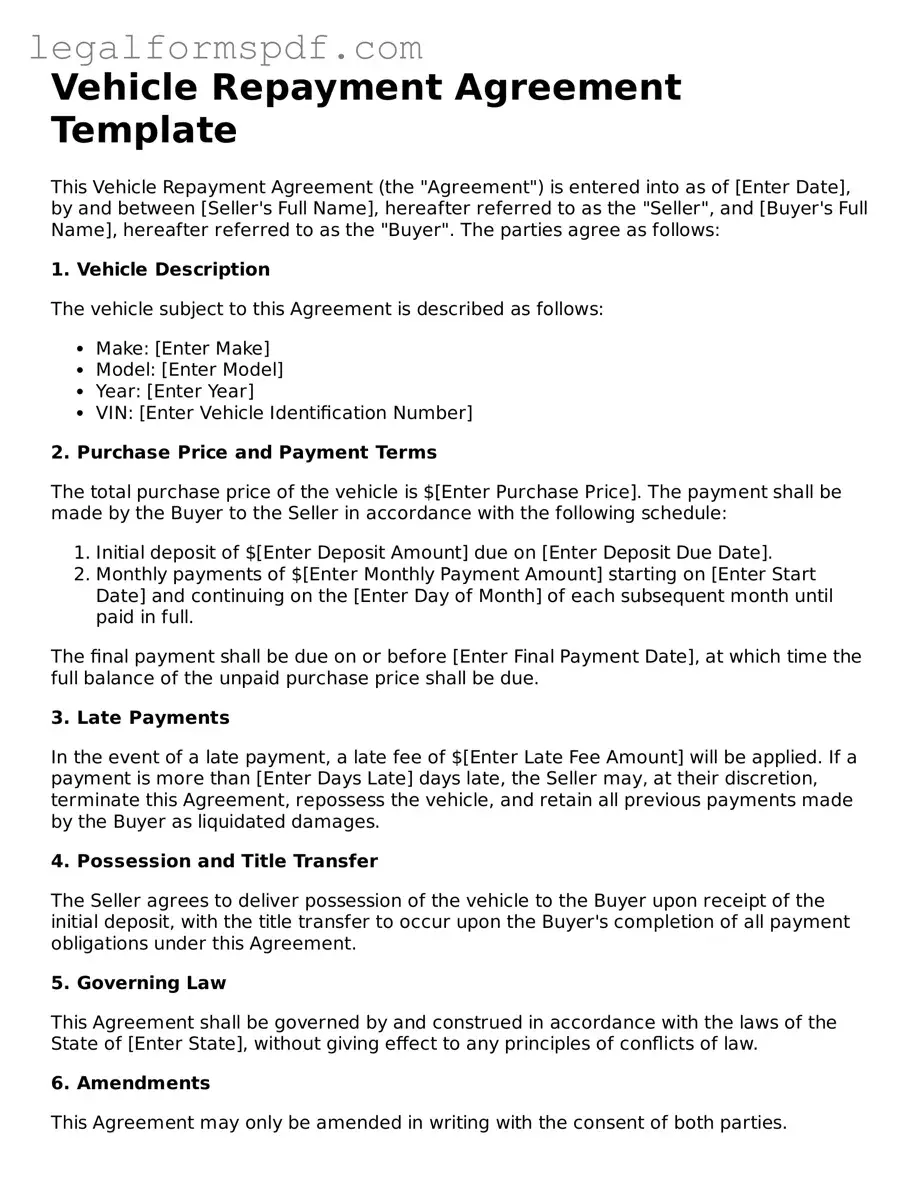

Vehicle Repayment Agreement Template

This Vehicle Repayment Agreement (the "Agreement") is entered into as of [Enter Date], by and between [Seller's Full Name], hereafter referred to as the "Seller", and [Buyer's Full Name], hereafter referred to as the "Buyer". The parties agree as follows:

1. Vehicle Description

The vehicle subject to this Agreement is described as follows:

- Make: [Enter Make]

- Model: [Enter Model]

- Year: [Enter Year]

- VIN: [Enter Vehicle Identification Number]

2. Purchase Price and Payment Terms

The total purchase price of the vehicle is $[Enter Purchase Price]. The payment shall be made by the Buyer to the Seller in accordance with the following schedule:

- Initial deposit of $[Enter Deposit Amount] due on [Enter Deposit Due Date].

- Monthly payments of $[Enter Monthly Payment Amount] starting on [Enter Start Date] and continuing on the [Enter Day of Month] of each subsequent month until paid in full.

The final payment shall be due on or before [Enter Final Payment Date], at which time the full balance of the unpaid purchase price shall be due.

3. Late Payments

In the event of a late payment, a late fee of $[Enter Late Fee Amount] will be applied. If a payment is more than [Enter Days Late] days late, the Seller may, at their discretion, terminate this Agreement, repossess the vehicle, and retain all previous payments made by the Buyer as liquidated damages.

4. Possession and Title Transfer

The Seller agrees to deliver possession of the vehicle to the Buyer upon receipt of the initial deposit, with the title transfer to occur upon the Buyer's completion of all payment obligations under this Agreement.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [Enter State], without giving effect to any principles of conflicts of law.

6. Amendments

This Agreement may only be amended in writing with the consent of both parties.

7. Signatures

Both parties acknowledge they have read and understand the terms of this Agreement and voluntarily sign their names as evidence of their acceptance of these terms.

___________________________ ___________________________

[Seller's Full Name] [Buyer's Full Name]

Date: __________________ Date: __________________

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | Outlines the terms under which a borrower agrees to repay the lender for a vehicle loan. |

| Components | Includes borrower and lender information, vehicle description, loan amount, interest rate, repayment schedule, and signatures. |

| Governing Law | The agreement is typically governed by the state laws where the agreement is signed or where the lender operates. |

| Customization | Forms can be customized to accommodate special terms, including early repayment options or penalties for late payments. |

| Significance | Legally binding and essential for providing a clear understanding of the repayment obligations and protecting both parties' interests. |

| Enforcement | In the event of a default, the lender may have the right to repossess the vehicle under certain conditions outlined in the agreement. |

Instructions on Writing Vehicle Repayment Agreement

Completing a Vehicle Repayment Agreement form is a key step in ensuring both parties involved in the vehicle transaction are fully aware of and agree on the repayment terms. This agreement outlines the loan amount, repayment schedule, interest rate, and consequences of failing to make timely payments. Here's how to fill out this form accurately:

- Start by entering the date the agreement is made at the top of the form.

- Fill in the full legal names and addresses of both the borrower and the lender.

- Specify the total loan amount that the borrower agrees to repay. Ensure this figure is accurate and includes the entire loan amount.

- Detail the repayment schedule, including the start date, frequency of payments (monthly, weekly, etc.), and the amount of each payment. Be clear and precise to avoid confusion.

- State the interest rate, if applicable, that applies to the loan. This should be agreed upon by both parties before filling out the form.

- Enter any late fees or penalties for missed payments. It’s important these terms are understood and agreed upon by both parties.

- Clearly outline the collateral, if any, that is being used to secure the loan. In the case of a vehicle repayment agreement, this will typically be the vehicle itself.

- Both parties should carefully read the entire agreement to ensure all the information is correct and fully understood.

- Once all sections of the form are completed, both the borrower and the lender must sign and date the agreement. Make sure the signatures are witnessed, as per the legal requirement.

- Finally, distribute copies of the signed agreement to both parties for their records, keeping the original in a safe place.

By following these steps, both the borrower and the lender will have a clear understanding of the repayment terms and conditions, helping to prevent any potential disputes or misunderstandings during the course of the loan repayment. Remember, it’s always recommended to review the completed form with a legal advisor to ensure all legal requirements are met.

Understanding Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legally binding document between a buyer and a seller, primarily used when the buyer is purchasing a vehicle through installments. This agreement outlines the repayment schedule, interest rates if applicable, the total amount to be repaid, and other conditions related to the sale and financing of the vehicle.

Why do I need a Vehicle Repayment Agreement?

This agreement provides a clear structure for the repayment process, protecting both parties' interests. For the seller, it secures the promise of payment in installments. For the buyer, it clarifies their obligations and the terms of acquiring the vehicle, including what happens if they fail to make timely payments.

What information is included in a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement typically includes the buyer’s and seller’s details, vehicle description, purchase price, down payment, interest rate (if applicable), repayment schedule, late payment penalties, and conditions for what happens in the event of default. It also outlines the legal rights and responsibilities of each party.

How do I write a Vehicle Repayment Agreement?

Writing a Vehicle Repayment Agreement requires careful attention to detail. Begin by including the full names and contact information of both the buyer and seller. Describe the vehicle in detail, including its make, model, year, and VIN. Clearly lay out the financial terms, including the total purchase price, down payment, interest rate, and the repayment schedule. Include any penalties for late payments and terms of default. Have both parties sign and date the agreement, ideally in the presence of a witness or notary public.

Is a Vehicle Repayment Agreement legally binding?

Yes, once signed by both parties, a Vehicle Repayment Agreement becomes a legally binding contract. Both the buyer and seller are then obligated to fulfill their parts of the agreement. Failure to adhere to the terms can lead to legal consequences, including lawsuits for breach of contract.

Can I modify a Vehicle Repayment Agreement?

Modifications to a Vehicle Repayment Agreement can be made if both parties agree to the changes. Any amendments should be made in writing and signed by both parties, with the document noting the date of modification. It is important to keep these amendments with the original agreement to ensure clarity and legal validity.

What happens if the buyer defaults on the agreement?

In the event of a default, the agreement outlines the remedies available to the seller, which may include repossessing the vehicle. The specific consequences will depend on the terms set out in the agreement, such as allowing a grace period for late payments or enforcing penalties. It's vital that both parties understand these terms before entering into the agreement.

Common mistakes

One common mistake individuals make when filling out a Vehicle Repayment Agreement form is neglecting to read the terms carefully before signing. This document often contains critical information regarding interest rates, payment schedules, and the consequences of late payments. Without a clear understanding of these details, individuals risk agreeing to terms that may not be in their best interests.

Another error involves not verifying the information provided in the form. It's essential to check the accuracy of all details, including personal information, the vehicle's description, and the repayment terms. Incorrect information can lead to future disputes or legal issues, potentially complicating the repayment process.

Many people also fail to negotiate terms that could be more favorable to their financial situation. Accepting the first offer without discussion may result in higher interest rates or an unrealistic payment schedule. Negotiation can often lead to better terms that make repaying the loan more manageable.

Not considering the overall cost of the loan is another oversight. This cost includes not only the principal amount but also the interest, fees, and any additional charges. Failing to account for these can lead to underestimating the total amount to be repaid, which might strain one's financial resources in the long run.

A critical mistake is not keeping a copy of the signed agreement. Having a record of the signed document is essential for reference in case of discrepancies or conflicts during the repayment period. It serves as evidence of the agreed terms and conditions.

Another common oversight is ignoring the importance of a co-signer's role. If the agreement involves a co-signer, it's crucial to understand how this affects the responsibility for the loan. Both the primary signer and the co-signer should be aware of their obligations to prevent misunderstandings or legal complications if issues with repayment arise.

Lastly, many individuals neglect to consider their ability to fulfill the agreement's terms in case of financial hardship. Life is unpredictable, and financial situations can change. It is wise to discuss and understand the options available, such as deferment or refinancing, should one become unable to make timely payments.

Documents used along the form

When individuals enter into a Vehicle Repayment Agreement, it often necessitates considering additional documentation to ensure that all aspects of the transaction are clear and legally binding. These documents serve to protect the interests of both the borrower and the lender by providing detailed records of the agreement and ensuring compliance with state and federal laws.

- Bill of Sale: This document serves as a record of the transaction between the buyer and the seller, detailing the transfer of ownership of the vehicle. It typically includes the vehicle's make, model, year, VIN (Vehicle Identification Number), and the purchase price.

- Promissory Note: A promissory note outlines the borrower's promise to repay the loan under the terms agreed upon. It includes the loan amount, interest rate, repayment schedule, and any collateral securing the loan (in this case, the vehicle).

- Loan Agreement: Similar to the Vehicle Repayment Agreement, a more comprehensive loan agreement may include additional terms and conditions of the loan. It can cover aspects such as default conditions, dispute resolution methods, and prepayment penalties.

- Amortization Schedule: This document details how the loan will be repaid over time, breaking down each payment into principal and interest components. It provides a clear schedule for the borrower and ensures both parties understand when the loan will be fully paid off.

- Insurance Confirmation: Proof of insurance is often required to ensure that the vehicle, which serves as collateral for the loan, is adequately protected against theft, loss, or damage. This document confirms that the vehicle meets the insurance requirements outlined in the agreement.

- Title Documents: The vehicle's title documents are crucial for proving ownership. When a loan is involved, these documents may be held by the lender or include a lien indicating the lender's interest in the vehicle until the loan is fully repaid.

In conclusion, when engaging in a Vehicle Repayment Agreement, it is essential to gather and complete relevant supplementary documents. These forms serve not only as legal protection but also as a clear guideline for the responsibilities and expectations of each party involved. Proper documentation ensures a smoother transaction and helps in avoiding potential disputes or misunderstandings.

Similar forms

A Personal Loan Agreement is quite similar to a Vehicle Repayment Agreement as it outlines the terms between a borrower and a lender for the loaned money. In this case, the borrowed amount doesn't have to be for purchasing a vehicle. Still, the concepts of repayment schedule, interest rate, and consequences of non-payment are shared attributes between these documents.

A Mortgage Agreement shares traits with a Vehicle Repayment Agreement by securing a loan with a physical asset. While a Mortgage Agreement uses real estate, a Vehicle Repayment Agreement uses a vehicle as collateral. Both documents detail the borrower's obligations and outline what happens if the borrower fails to make payments.

A Lease Agreement, much like the Vehicle Repayment Agreement, involves agreements about using an asset. However, a Lease Agreement is typically used for renting property, equipment, or vehicles, specifying terms like lease payments, duration, and return conditions, rather than outlining a purchase repayment plan.

A Bill of Sale complements the Vehicle Repayment Agreement by providing a detailed receipt of the transaction between a buyer and a seller. It proves ownership transfer but doesn't manage the payment process or terms over time, which the Vehicle Repayment Agreement does.

An IOU (I Owe You) document, simpler than a Vehicle Repayment Agreement, is a casual document that acknowledges debt from one individual to another without including the comprehensive terms of repayment, interest, and collateral that a Vehicle Repayment Agreement would.

A Promissory Note also bears similarity to a Vehicle Repayment Agreement because it's a promise to pay back a loan under specified terms. Though Promissory Notes can apply to any loan, they might not always secure the loan with collateral like a vehicle, making them less specific in scope.

Credit Card Agreements share the foundation of specifying how a borrower will repay a debt, just like a Vehicle Repayment Agreement. These documents detail interest rates, minimum payments, and fees, but apply to revolving credit rather than a term loan for a physical asset.

A Debt Settlement Agreement is similar to parts of a Vehicle Repayment Agreement that might involve negotiating the repayment terms to settle a debt. It typically comes into play when the borrower can't meet the original terms, leading to an agreement to pay off a portion of the debt under new conditions.

A Loan Modification Agreement, similar to a Vehicle Repayment Agreement, changes the terms of an existing loan due to the borrower's inability to stick to the original terms. It could adjust the interest rate, extend the payment period, or change the monthly payment amount to accommodate the borrower's current financial situation.

Lastly, a Co-Signer Agreement has parallels to a Vehicle Repayment Agreement because it involves guaranteeing the loan for another person. This document is critical when the primary borrower might not have sufficient credit history or income to qualify on their own, thus requiring another individual to share the repayment responsibility.

Dos and Don'ts

When it comes to filling out the Vehicle Repayment Agreement form, attention to detail is crucial. This document outlines the terms agreed upon between the borrower and the lender for repaying the loan used to purchase a vehicle. To ensure a smooth and error-free process, here are important dos and don'ts to consider:

Do:

- Read the entire form carefully before you start filling it out. Understanding every clause and section will help you provide accurate information and comply with the terms set forth.

- Use black or blue ink for filling out the form if you're doing it by hand. These colors are generally required for official documents because they ensure legibility and permanence.

- Provide accurate personal information. This includes your full name, address, contact details, and any other personal information requested on the form. Accuracy here is vital for legal and contact purposes.

- Double-check the repayment terms, including the interest rate, repayment schedule, and any penalties for late payments. Understanding these terms is essential to ensure you can comply with the repayment plan.

- Keep a copy of the completed form for your records. Once the form is filled out and submitted, having your own copy will help you keep track of your obligations and serve as evidence of the agreement.

Don't:

- Rush through the process. Taking your time to fill out each section accurately will help prevent mistakes that could delay the loan process or lead to misunderstandings later on.

- Leave blanks in any section unless expressly instructed to do so. If a section does not apply to your situation, consider filling it with "N/A" (not applicable) instead of leaving it empty.

- Use pencil or erasable ink, as these can lead to changes or alterations that might not be legally binding. Permanent ink shows commitment and intention.

- Forget to sign and date the form. Your signature is a critical part of the agreement, serving as your consent to the terms and acknowledgment of your obligations under the contract.

- Overlook the need for a witness or notarization, if required. Some agreements must be signed in the presence of a witness or notarized to be legally binding. Failing to meet this requirement could invalidate the agreement.

Misconceptions

When it comes to understanding the Vehicle Repayment Agreement form, several misconceptions can lead to confusion. It's essential to dispel these myths to ensure individuals are fully informed about their rights and obligations.

Signing a Vehicle Repayment Agreement binds you only financially. Many believe that a Vehicle Repayment Agreement only outlines financial obligations. However, this document also details other essential aspects like insurance requirements, maintenance obligations, and what constitutes a default beyond missed payments.

Vehicle Repayment Agreements are non-negotiable. Contrary to common belief, the terms of a Vehicle Repayment Agreement can often be negotiated before signing. This might include the payment schedule, interest rates, and penalties for late payments. It's crucial to discuss these terms with the lender before agreeing.

All Vehicle Repayment Agreements are the same. Each agreement is unique and tailored to the specific transaction between the buyer and the lender. Factors like the loan amount, interest rate, term length, and the vehicle itself can significantly alter the terms of an agreement.

Missed payments always lead to vehicle repossession. While missing payments can result in repossession, most lenders prefer to avoid this route due to the cost and effort involved. Often, lenders are willing to work with borrowers to adjust payment plans in case of financial difficulty.

You can't sell the vehicle until the loan is paid off. While it's true you need to clear the loan before transferring ownership, you can sell the vehicle with the loan outstanding. The process involves using the sale proceeds to pay off the loan balance, with the lender providing a clear title for transfer to the new owner.

There's no way out once you sign the agreement. Although it's a binding contract, circumstances such as consumer rights violations or fraud could nullify the agreement. Furthermore, borrowers can also explore refinancing options with other lenders for better terms or to consolidate debt.

Understanding these nuances ensures a clearer perspective on navigating the complexities of Vehicle Repayment Agreements. Always consider seeking legal guidance to fully comprehend your rights and responsibilities in any contractual agreement.

Key takeaways

When dealing with a Vehicle Repayment Agreement, several critical aspects should be considered to ensure the process is handled correctly. This agreement is crucial when an individual needs to outline the terms for repaying a loan used to purchase a vehicle. Below are key takeaways that should guide individuals through filling out and using this form effectively.

- Complete Information Is Critical: Ensure all parties' details, including the lender, borrower, and any cosigners, are fully and correctly listed. This includes full names, addresses, and contact information.

- Clear Terms: The agreement must detail the loan amount, interest rate (if applicable), repayment schedule, and the total number of payments. Clear terms prevent misunderstandings.

- Vehicle Description: Include a complete description of the vehicle being financed. This should cover the make, model, year, color, and Vehicle Identification Number (VIN) to avoid any disputes over which vehicle is covered under the agreement.

- Legal Compliance: The agreement should comply with state and federal laws governing vehicle loans and sales. This may include laws about interest rates, repossession, and other finance-related regulations.

- Signatures Matter: Ensure that all parties sign and date the agreement. Signed agreements are binding contracts, and signatures provide the proof needed that all parties agreed to the terms.

- Document Witnesses or Notarization: Depending on state laws, it might be advisable, or even required, to have the agreement witnessed or notarized. This step can add an additional layer of legal validity.

- Keep Copies: All parties should retain copies of the signed agreement. Having access to the document can resolve disputes and clarify the terms if questions arise during the repayment period.

- Understand Default Consequences: The agreement should clearly spell out the consequences of defaulting on the loan, including any fees, penalties, and the potential for repossession of the vehicle.

- Amendments in Writing: Any changes to the agreement after signing should be made in writing and agreed upon by all parties. Oral agreements can be challenging to enforce and prove.

By paying attention to these key aspects, individuals can ensure a more secure and straightforward vehicle purchase and loan repayment process. Proper documentation and clear, agreed-upon terms will serve to protect all involved parties throughout the life of the loan.

Other Templates

Cease & Desist - This form is used to formally request that someone stop making false statements about another person, protecting the person's reputation.

Puppy Bill of Sale Template - A comprehensive record of the sale of a dog, ensuring both parties understand their rights and responsibilities.

Wills and Testaments - Offers a way to leave specific instructions for the care of dependents, including adult children with disabilities.