Fillable Vehicle Purchase Agreement Document for Texas

Entering into the process of buying or selling a vehicle in Texas involves more than just a handshake and a verbal agreement. It is a transaction that requires the careful completion of specific documentation to ensure the legitimacy and legality of the transfer. Primarily, the Texas Vehicle Purchase Agreement form stands as a pivotal document in this process. This form not only lays out the details of the vehicle being bought or sold, including make, model, year, and VIN but also specifies the terms of the sale, such as the sale price and any warranties or conditions pertaining to the sale. It serves as a binding contract between the buyer and seller, providing a clear record of the agreement and the transaction's terms. The importance of this document cannot be overstated, as it provides both parties with legal protection. It also acts as a key piece of evidence in case any disputes arise post-sale regarding the terms of the agreement or the condition of the vehicle at the time of purchase. Understanding the Texas Vehicle Purchase Agreement form, therefore, is essential for anyone looking to engage in the purchase or sale of a vehicle within the state, ensuring that the process is conducted smoothly and in accordance with Texas law.

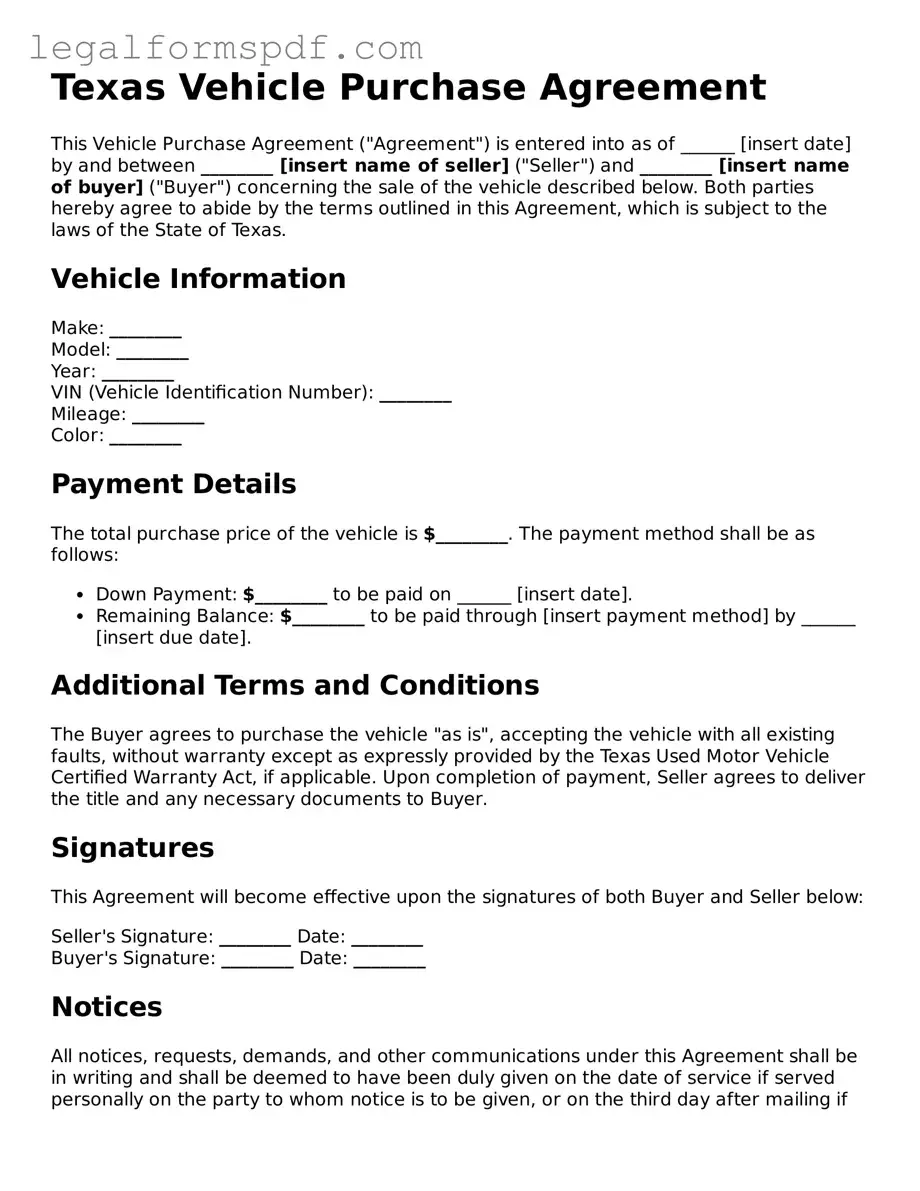

Document Example

Texas Vehicle Purchase Agreement

This Vehicle Purchase Agreement ("Agreement") is entered into as of ______ [insert date] by and between ________ [insert name of seller] ("Seller") and ________ [insert name of buyer] ("Buyer") concerning the sale of the vehicle described below. Both parties hereby agree to abide by the terms outlined in this Agreement, which is subject to the laws of the State of Texas.

Vehicle Information

Make: ________

Model: ________

Year: ________

VIN (Vehicle Identification Number): ________

Mileage: ________

Color: ________

Payment Details

The total purchase price of the vehicle is $________. The payment method shall be as follows:

- Down Payment: $________ to be paid on ______ [insert date].

- Remaining Balance: $________ to be paid through [insert payment method] by ______ [insert due date].

Additional Terms and Conditions

The Buyer agrees to purchase the vehicle "as is", accepting the vehicle with all existing faults, without warranty except as expressly provided by the Texas Used Motor Vehicle Certified Warranty Act, if applicable. Upon completion of payment, Seller agrees to deliver the title and any necessary documents to Buyer.

Signatures

This Agreement will become effective upon the signatures of both Buyer and Seller below:

Seller's Signature: ________ Date: ________

Buyer's Signature: ________ Date: ________

Notices

All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, at the address specified in this Agreement or as subsequently modified by written notice.

Entire Agreement

This Agreement constitutes the entire agreement between the parties pertaining to the subject matter hereof and supersedes all prior agreements, representations, and understandings of the parties. No supplement, modification, or amendment of this Agreement shall be binding unless executed in writing by both parties.

State Law

This Agreement shall be governed by the laws of the State of Texas.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | The Texas Vehicle Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of a vehicle in the state of Texas. |

| Governing Law | This agreement is governed by the laws of the State of Texas, including the Texas Motor Vehicle Commission Code. |

| Components | Typically includes details such as the make, model, year, VIN (Vehicle Identification Number), purchase price, and warranty information of the vehicle being sold and bought. |

| Signatory Requirements | Both the seller and the buyer must sign the agreement for it to be considered valid and enforceable. |

| Odometer Disclosure Statement | As per Texas law, the agreement must include an odometer disclosure statement, verifying the mileage of the vehicle at the time of sale. |

| Importance of Notarization | While notarization is not always required by Texas law for vehicle purchase agreements, it adds a level of authenticity and can prevent legal disputes. |

| Sale As-Is | Unless otherwise specified, vehicles are sold "as-is" in private sales, emphasizing the importance of a thorough inspection prior to purchase. |

| Document Retention | Both buyer and seller should retain a copy of the agreement for their records and any future legal or administrative needs. |

Instructions on Writing Texas Vehicle Purchase Agreement

Filling out the Texas Vehicle Purchase Agreement is a crucial step in the process of buying or selling a vehicle in the state of Texas. This document officially records the transaction between the buyer and the seller, providing a detailed account of the vehicle's condition, price, and other important terms of the sale. With the completion of this agreement, the buyer and seller can ensure that the transaction is legally binding and recognized. The following steps are designed to guide you through the process of filling out this form accurately and thoroughly.

- Start by entering the date of the transaction at the top of the form.

- Fill in the buyer's full legal name, address, and contact information in the designated section.

- Proceed to enter the seller's full legal name, address, and contact details in the corresponding section.

- Describe the vehicle being sold. This includes the make, model, year, color, VIN (Vehicle Identification Number), and odometer reading.

- Detail the purchase price of the vehicle. If there are any additional fees or taxes, include these in the designated area.

- Specify the terms of payment. Indicate whether the payment is made in full, in installments, or through a trade-in. If there are installments, provide details about the amounts and due dates.

- Outline any additional agreements or conditions related to the sale. This might include warranties, inspection requirements, or the inclusion of vehicle accessories.

- Both the buyer and the seller must sign and date the form to validate the agreement. Witness signatures may also be required, depending on local regulations.

Once the Texas Vehicle Purchase Agreement is fully completed and signed, it serves as a legal document that protects both parties in case of disputes or misunderstandings about the sale. Copies should be made and kept by both the buyer and the seller for their records. Following these steps ensures a smooth and compliant transaction, maintaining transparency and trust between the buyer and seller during the vehicle exchange.

Understanding Texas Vehicle Purchase Agreement

What is a Texas Vehicle Purchase Agreement form?

A Texas Vehicle Purchase Agreement form is a crucial document used in the process of buying or selling a vehicle in the state of Texas. It legally documents the details of the transaction, including information about the buyer, seller, vehicle, and the terms of sale. This agreement serves as a contract between the buyer and seller, outlining their rights and responsibilities.

Why do I need a Texas Vehicle Purchase Agreement form?

Having a Vehicle Purchase Agreement form is important for several reasons. It provides a legal record of the sale, which can protect both the buyer and seller in case of disputes. It's also necessary for the buyer to register and title the vehicle in Texas, as the form contains essential information required by the Texas Department of Motor Vehicles. Furthermore, it clearly states the sale price, helping to ensure the proper sales tax is paid on the transaction.

What information do I need to fill out in the form?

To complete a Texas Vehicle Purchase Agreement form, you'll need to gather specific details. These include the full names and addresses of both the buyer and the seller, the vehicle identification number (VIN), make, model, year of the vehicle, and the purchase price. You should also include any warranty information or "as is" sale condition, terms of payment, and the sale date. Double-check all details for accuracy to ensure the process goes smoothly.

Can I sell or buy a vehicle in Texas without a Vehicle Purchase Agreement form?

While it's possible to sell or buy a vehicle without a formal agreement, it's not recommended. A Vehicle Purchase Agreement form provides a clear, legal record of the transaction, helping to protect both parties' interests and ensuring compliance with Texas law. Without this document, resolving disputes or issues with vehicle registration could become significantly more challenging. For a successful and secure vehicle transaction, completing a Vehicle Purchase Agreement form is strongly advised.

Common mistakes

One common mistake people make when filling out the Texas Vehicle Purchase Agreement form is not verifying the vehicle's information. This includes the make, model, year, VIN (Vehicle Identification Number), and mileage. Ensuring these details are accurate is crucial because they identify the specific vehicle being sold. Errors here can lead to significant issues in the future, especially if disputes arise regarding the vehicle's condition or history.

Another error involves not clearly specifying the sale terms. This part of the agreement should outline the purchase price, payment method, and any conditions of sale (such as the vehicle being sold "as is" or subject to inspection). Leaving these details vague or incomplete may lead to misunderstandings between the buyer and seller, potentially resulting in legal disputes.

Incorrectly handling the seller and buyer information is yet another slip-up. This includes their names, addresses, and contact information. It's critical to accurately record this information. It not only ensures that the contract is legally binding but also facilitates communication between parties after the sale. Inaccuracies here could complicate or invalidate the agreement.

Forgetting to include a lien release statement if the vehicle is being sold to pay off a lien is a critical mistake. If the vehicle is subject to any liens, these should be clearly stated, including the party holding the lien and the terms for its release. Failure to properly address this can hinder the transfer of a clear title to the buyer, leading to legal complications.

Failing to specify warranty information, if applicable, can also be problematic. If the seller agrees to offer a warranty, the terms, including duration and coverage specifics, should be in the agreement. Lack of clarity about the warranty can result in disputes over responsibility for post-sale vehicle issues.

Omitting signatures and dates at the end of the agreement is a significant error. Both the buyer and seller must sign and date the agreement for it to be legally binding. This formalizes the transaction and confirms that both parties have agreed to the terms. Unsigned agreements may not be enforceable in court.

Finally, not making copies of the signed agreement for both the buyer and seller is a common oversight. Each party should have a copy for their records. This serves as proof of the transaction and can be crucial in resolving any future disputes regarding the terms of the agreement or the details of the vehicle sale.

Documents used along the form

When you purchase a vehicle in Texas, the Vehicle Purchase Agreement form is just one piece of the puzzle. This document outlines the terms of the sale, including the price, vehicle description, and any warranties. However, to ensure a smooth transfer of ownership and to comply with state laws, several other forms and documents are often required. Below is a list of documents frequently used alongside the Texas Vehicle Purchase Agreement form, each crucial for different aspects of the sale and registration process.

- Odometer Disclosure Statement: This document is needed to record the vehicle's mileage at the time of sale. It's a crucial part of the transaction because it helps prevent odometer fraud and ensures the buyer is aware of the vehicle’s condition.

- Title Application: To officially transfer the vehicle into the buyer's name, a Title Application form (Form 130-U) must be filled out and submitted to the Texas Department of Motor Vehicles (TxDMV). This step is essential for legal ownership transfer.

- Bill of Sale: While not always legally required, a Bill of Sale serves as an additional proof of purchase and details the transaction between the buyer and seller, including the sale date, purchase price, and specifics of the vehicle.

- Vehicle Inspection Report: Texas requires most vehicles to undergo a safety inspection annually. For a vehicle sale, the current inspection report assures the buyer that the vehicle meets state safety standards.

- Proof of Insurance: Before the vehicle can be legally driven, the new owner must provide proof of insurance. This document ensures the vehicle is covered under the state’s required insurance policies.

- Release of Lien: If the vehicle was previously financed and the loan has been paid off, a Release of Lien is necessary to prove that there are no outstanding claims against the vehicle.

- Power of Attorney: If one party cannot be present to sign the required documents, a Power of Attorney may be needed. This legally authorizes another individual to act on behalf of the seller or buyer concerning the vehicle transaction.

Together, these documents contribute to a legally sound and transparent vehicle transaction. They protect both the buyer and seller by ensuring all aspects of the sale are appropriately recorded and acknowledged. Understanding and preparing these documents can make the vehicle purchasing process in Texas much smoother and more efficient for all parties involved.

Similar forms

The Bill of Sale is closely related to the Texas Vehicle Purchase Agreement, as both serve as proof of a transaction between a buyer and a seller. While the Vehicle Purchase Agreement outlines the terms and conditions of the sale, including warranties and payment details, the Bill of Sale acts as a receipt, confirming the transfer of ownership. It typically lists the make, model, and VIN of the vehicle, the names of the parties involved, and the sale price.

A Purchase and Sale Agreement (PSA) for real estate shares similarities with the Vehicle Purchase Agreement, in that both formalize the conditions under which property is sold. The PSA details the agreement between a buyer and seller for the purchase of real estate, including price, closing conditions, and disclosures, much like the Vehicle Purchase Agreement stipulates for a vehicle sale. However, real estate transactions involve more complex regulations and inspections.

The Loan Agreement is another document with similarities to the Texas Vehicle Purchase Agreement, especially when financing is involved in the purchase. This agreement outlines the terms of a loan provided by a lender to a borrower, including repayment schedule, interest rate, and collateral, which might be the vehicle itself. It ensures both parties are clear about the financial obligations tied to the transaction.

Lease Agreements, while primarily used for renting property, share structural similarities with the Vehicle Purchase Agreement. They both define terms between two parties—the lessee and lessor in a Lease Agreement, and the buyer and seller in a Vehicle Purchase Agreement. Each document specifies conditions such as payment amounts, duration of the agreement, and responsibilities of each party.

Warranty Documents mirror the Vehicle Purchase Agreement in terms of outlining specific guarantees provided by the seller regarding the condition of the vehicle. These documents detail the scope of what is covered by the warranty, including parts and labor, and for how long, providing the buyer with protection against certain defects or issues post-purchase.

The Title Document, essential in the sale of a vehicle, complements the Vehicle Purchase Agreement by evidencing the legal ownership of the vehicle. It specifies the owner's information and vehicle details like make, model, and year. Upon the sale of the vehicle, the title must be transferred to the new owner, formalizing the change in ownership stated in the Vehicle Purchase Agreement.

A Financing Agreement is key when a vehicle purchase involves a loan directly through the dealership or a third party. Similar to the aspects covered in a Loan Agreement, this document outlines the amount financed, interest rate, and repayment terms, and is often linked with the Vehicle Purchase Agreement when the vehicle itself is the collateral for the financing.

The Receipt serves a simpler function but is related to the Vehicle Purchase Agreement in that it provides proof of payment for the transaction. It typically includes the date of sale, amount paid, and a description of the vehicle. Unlike the more comprehensive Vehicle Purchase Agreement, a receipt is a straightforward acknowledgment of the exchange of funds.

An As-Is Sale Agreement, often included within the broader Vehicle Purchase Agreement, specifically states that the vehicle is being sold in its current condition, with all faults known or unknown. This type of agreement relieves the seller from certain liabilities regarding the condition of the vehicle post-sale and informs the buyer of their assumption of risk.

Finally, the Odometer Disclosure Statement, while not an agreement on its own, is usually required in vehicle sales to certify the accuracy of the vehicle's mileage as stated by the seller. This document supports the integrity of the Vehicle Purchase Agreement by ensuring the buyer is aware of the true mileage, which can affect the perceived value and condition of the vehicle.

Dos and Don'ts

When filling out the Texas Vehicle Purchase Agreement form, it is important to follow certain guidelines to ensure the process is completed correctly and efficiently. Below are key dos and don'ts to consider:

Do:Read the entire form thoroughly before starting to fill it out. This ensures you understand all requirements and instructions.

Use black or blue ink for better legibility and to comply with standard form requirements.

Include all relevant details such as the full names of both the buyer and the seller, the vehicle identification number (VIN), and the sale price.

Double-check all the information for accuracy, including the VIN, to prevent any potential legal issues or delays.

Ensure that both the buyer and the seller sign and date the form to validate the agreement.

Do not leave any sections blank. If a section does not apply, write "N/A" (for Not Applicable) to indicate this.

Do not use pencil or any erasable ink, as this can cause issues with document integrity and legality.

Misconceptions

When venturing into the process of buying or selling a vehicle in Texas, it's crucial to grasp the nuances of the Texas Vehicle Purchase Agreement form. However, a variety of misconceptions surround this document, often leading to confusion and potential legal hiccups. Let's debunk some of these common misunderstandings to ensure a smoother transaction for all parties involved.

It's just a basic form; details aren't that important. Every piece of information on the Vehicle Purchase Agreement form plays a vital role in the transaction. It's not merely about the buyer's and seller's names; it acts as a legally binding document that outlines the terms, vehicle condition, and agreed-upon price, providing clarity and protection for both parties.

A verbal agreement is just as good. While verbal agreements can be compelling in some scenarios, when it comes to buying or selling a vehicle, the written word holds power. A verbal agreement leaves room for misunderstandings and misremembering of terms. The Texas Vehicle Purchase Agreement solidifies the deal in writing, making it enforceable by law.

No need for a lawyer to review it. Though the form might seem straightforward, having a legal expert review the document can prevent future complications. A lawyer can pinpoint potential issues within the agreement, ensuring that all legal bases are covered, and your rights are protected.

Any Vehicle Purchase Agreement form will work. It's essential to use the specific Texas Vehicle Purchase Agreement form. This form is tailored to comply with Texas state laws, which may differ significantly from those in other states. Using the correct state-specific document is crucial for the agreement's validity.

It's only necessary for new vehicles. The Texas Vehicle Purchase Agreement is just as important for used vehicles. Regardless of the car's age, this agreement serves as a formal record of the sale and purchase terms, ensuring both parties are on the same page and legally protected.

The price is the only important detail. While the agreed-upon price is undoubtedly a key component of the agreement, other details are equally crucial. These include the vehicle's condition, warranty information, and any additional terms or agreements made between the buyer and seller. All these elements play a crucial role in the transaction's success and legality.

Signing under pressure is legally binding. Even if a party signs the Texas Vehicle Purchase Agreement under duress or without understanding the terms fully, the law may not enforce the agreement. It's important that both parties have ample opportunity to review the document and seek legal advice if needed before signing.

All disputes must be settled in court. While legal action is one way to resolve disputes that arise from a vehicle purchase agreement, it's not the only way. Many agreements include clauses for arbitration or mediation, which can be a less adversarial and costly way to resolve conflicts. Thoroughly reviewing the agreement before signing can ensure you understand the process for dispute resolution.

Understanding the Texas Vehicle Purchase Agreement form's intricacies is crucial to a successful vehicle transaction. By dispelling these misconceptions, buyers and sellers can navigate the process more effectively, avoiding common pitfalls and ensuring a fair, legally sound agreement.

Key takeaways

When buying or selling a vehicle in Texas, utilizing a Vehicle Purchase Agreement is an important step to ensure that the transaction is properly documented and legally binding. Here are seven key takeaways about filling out and using this form:

- Accuracy is crucial. Ensure all information on the form is complete and accurate. This includes the make, model, year, VIN (Vehicle Identification Number), and the exact sale price of the vehicle.

- Both parties should provide detailed information. The full legal names, addresses, and signatures of both the buyer and seller are required to validate the agreement.

- Understand the terms. Carefully review the terms and conditions outlined in the agreement to ensure they are fair and acceptable to both parties before signing.

- Include an "as is" clause if applicable. If the vehicle is being sold without any warranties regarding its condition, explicitly stating this in the agreement can protect the seller from future disputes.

- Document the payment method. Record how the payment is made (e.g., cash, check, money order) and when it is received to provide clear evidence of the transaction.

- Keep a copy of the agreement. Both the buyer and seller should keep a copy of the signed agreement for their records. This can be crucial if any legal issues arise or to simply reference the transaction details in the future.

- Report the sale to the Texas Department of Motor Vehicles (DMV). After completing the sale, remember to notify the Texas DMV. This step is essential for the official transfer of ownership and may require additional paperwork beyond the Vehicle Purchase Agreement.

More Vehicle Purchase Agreement State Forms

Free Michigan Bill of Sale Template - Includes a comprehensive description of the vehicle, ensuring that the buyer is fully informed about what they are purchasing.