Official Mortgage Lien Release Document

Homeownership is a milestone many aspire to achieve, and finally paying off a mortgage is a monumental achievement that signifies financial freedom and security. Yet, the journey does not end with making the last payment. The formal acknowledgment that the mortgage has been paid in full and the lien on the property has been removed comes in the form of a Mortgage Lien Release form. This crucial document is the evidence needed to prove the homeowner now fully owns the property, free and clear. It's important for homeowners to understand the significance of this form, the process involved in obtaining it, and the peace of mind it brings once filed properly. With it, a record is established in the public domain, ensuring that the mortgage lender releases their claim to the property. Without it, homeowners may face unexpected legal and financial challenges. The form serves as the final chapter in the narrative of homeownership, allowing individuals to truly claim their property as their own.

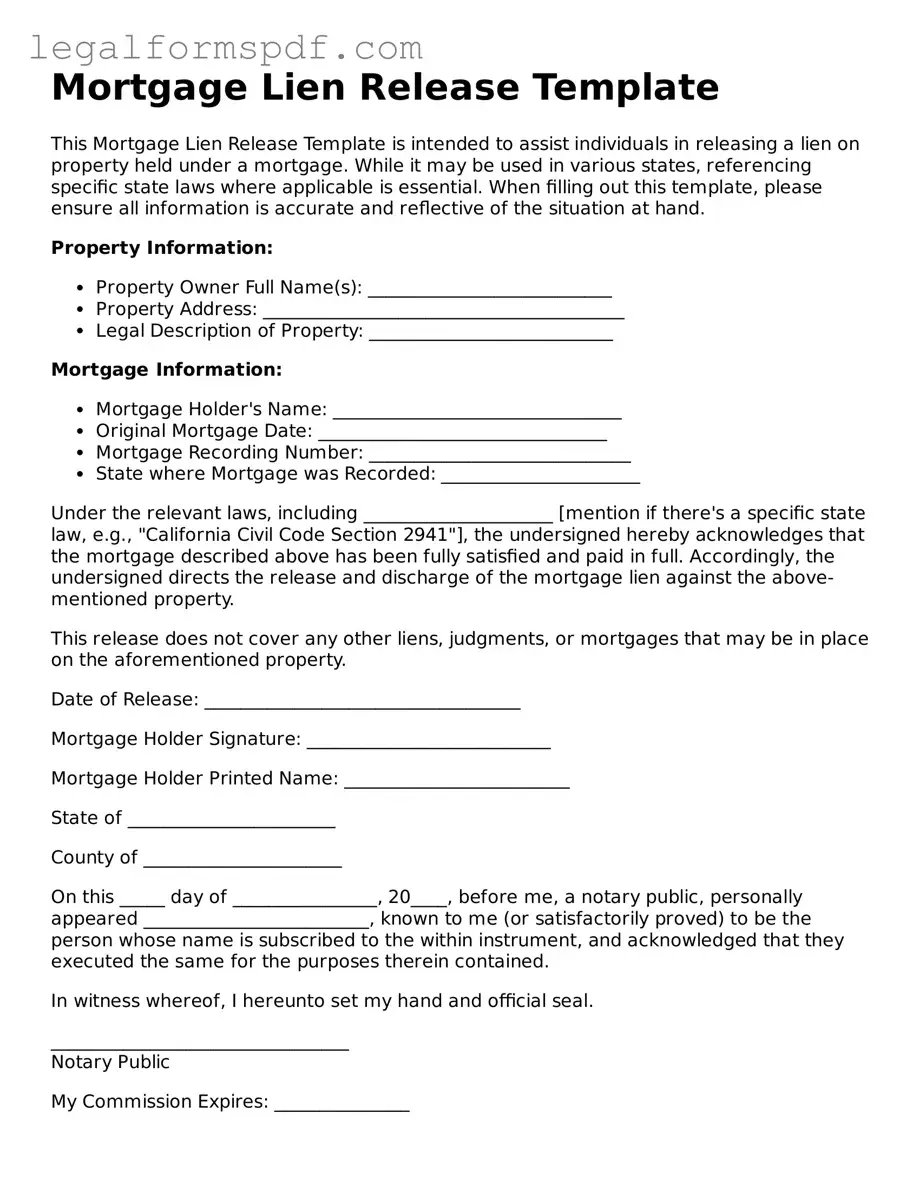

Document Example

Mortgage Lien Release Template

This Mortgage Lien Release Template is intended to assist individuals in releasing a lien on property held under a mortgage. While it may be used in various states, referencing specific state laws where applicable is essential. When filling out this template, please ensure all information is accurate and reflective of the situation at hand.

Property Information:

- Property Owner Full Name(s): ___________________________

- Property Address: ________________________________________

- Legal Description of Property: ___________________________

Mortgage Information:

- Mortgage Holder's Name: ________________________________

- Original Mortgage Date: ________________________________

- Mortgage Recording Number: _____________________________

- State where Mortgage was Recorded: ______________________

Under the relevant laws, including _____________________ [mention if there's a specific state law, e.g., "California Civil Code Section 2941"], the undersigned hereby acknowledges that the mortgage described above has been fully satisfied and paid in full. Accordingly, the undersigned directs the release and discharge of the mortgage lien against the above-mentioned property.

This release does not cover any other liens, judgments, or mortgages that may be in place on the aforementioned property.

Date of Release: ___________________________________

Mortgage Holder Signature: ___________________________

Mortgage Holder Printed Name: _________________________

State of _______________________

County of ______________________

On this _____ day of ________________, 20____, before me, a notary public, personally appeared _________________________, known to me (or satisfactorily proved) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________________

Notary Public

My Commission Expires: _______________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Mortgage Lien Release form is a legal document used to cancel a mortgage lien, indicating that the borrower has paid off their mortgage loan in full. |

| Primary Purpose | The form serves to release the borrower from the obligation of the lien, thereby eliminating the lender's legal right to repossess the property in question. |

| Key Contents | This document typically includes information such as the property's legal description, the names of the borrower and lender, the date the mortgage was paid off, and the original loan amount. |

| Recording Requirement | Once signed, the Mortgage Lien Release must be filed with the county recorder's office or similar local government entity to be official and enforceable. |

| State-Specific Regulations | Some states have specific forms and procedures for filing a Mortgage Lien Release, including notarization requirements and filing fees. |

| Legal Effect | After the filing, the property is free from the mortgage lien, and the owner holds clear title, proving they own the property outright. |

Instructions on Writing Mortgage Lien Release

Once a mortgage has been fully paid, the next critical step involves obtaining a formal Mortgage Lien Release. This document serves as a legal confirmation that the borrower has fulfilled their payment obligation, thereby releasing the lien on their property. It’s a document of significant importance as it officially restores full ownership rights to the property owner, ensuring there are no legal claims against the property due to the previous mortgage. The process to fill out this form is straightforward. Following these steps ensures that the release is accurately documented and legally sound.

- Gather necessary information: Before starting, ensure you have all relevant details such as the loan number, original loan date, the full names and addresses of the borrower and lender, and the property's legal description.

- Complete the header section: Fill in the county and state at the top of the form where the property is located. This detail is crucial for the form’s recording in public records.

- Enter the parties’ details: Input the full legal names and addresses of both the lender (or the lienholder) and the borrower. These should match the details in the original mortgage documents.

- Provide the loan information: Detail the original loan amount, the date the loan was secured, and the loan number. This information validates the debt that has been settled.

- Describe the property: Accurately describe the property using its legal description as found on the deed. Do not use the property's address alone. The legal description ensures there is no ambiguity about the property being released from the lien.

- Sign and date the form: The lender, or an authorized representative, must sign and date the form. The signature must be witnessed and/or notarized as required by state laws. This formalizes the release of the mortgage lien.

- File the form with the county recorder’s office: Submit the completed form to the county recorder or land records office where the property is located. There may be a filing fee. Once recorded, the mortgage lien is officially released, and the property owner holds clear title.

Following these steps meticulously is crucial for accurately completing the Mortgage Lien Release form. This process not only ensures that the property is free from claims by the lender but also officially updates public records, reflecting the change in ownership status. It’s advisable to keep a copy of the recorded form for personal records and future reference.

Understanding Mortgage Lien Release

What is a Mortgage Lien Release form?

A Mortgage Lien Release form is a legal document used to cancel a lien on a property. This lien typically comes from a mortgage, indicating that a lender has a financial interest in the property. Upon full repayment of the mortgage, the lender releases this interest by issuing the Mortgage Lien Release form, clearing the title and officially making the homeowner the sole owner of the property.

When do I need a Mortgage Lien Release form?

You need a Mortgage Lien Release form when you have fully repaid your mortgage loan. It's essential to ensure that this document is filed to remove the lien from your property's title, officially showing that you own the property free and clear of any mortgage obligations.

How do I obtain a Mortgage Lien Release form?

Typically, the lender is responsible for preparing and filing the Mortgage Lien Release form once the final mortgage payment is processed. However, it's advisable to follow up with your lender to ensure this document has been completed and filed. If necessary, you can also contact your local county recorder's office or consult with a legal professional to obtain this form.

What happens if I don't file a Mortgage Lien Release form?

If a Mortgage Lien Release form is not filed, the lien will remain on your property's title, indicating that the lender still has a financial claim on the property. This can cause complications when you decide to sell or refinance your property, as clear title is required for these transactions.

Is there a deadline for filing a Mortgage Lien Release form?

There is no set federal deadline for filing a Mortgage Lien Release form, but it's generally in your best interest to do so as soon as possible after your mortgage is paid off. Some states may have specific requirements or timelines, so it's advisable to check local laws and regulations.

Can I file the Mortgage Lien Release form myself?

Yes, in many cases, homeowners can file the Mortgage Lien Release form themselves. This process typically involves obtaining the form from the lender or local county office, completing it, and then submitting it to the county recorder's office. Despite this, it's often helpful to seek guidance from a professional to ensure accuracy and compliance with local laws.

What information is needed to fill out a Mortgage Lien Release form?

Completing a Mortgage Lien Release form usually requires information such as the names of the borrower and lender, the address of the mortgaged property, the date the mortgage was paid off, and details about the original mortgage agreement, including the recording information. It's crucial to provide accurate information to ensure the successful release of the lien.

What should I do after filing a Mortgage Lien Release form?

After filing a Mortgage Lien Release form, it's important to keep a copy for your records and monitor your property's title to ensure the lien has been removed. This can often be done by checking with the local county recorder's office or a title company. Ensuring the lien is released helps maintain clear ownership and avoids future legal complications.

Common mistakes

Filling out a Mortgage Lien Release form is a crucial step in the process of clearing the title on a property once the mortgage has been paid off. However, mistakes can and do happen. One common error is not providing complete information about the mortgagor and mortgagee. This includes full legal names, addresses, and other identifying details. Incomplete or incorrect information can lead to delays or the lien not being released properly. Ensuring every detail is accurate and complete is paramount.

Another significant mistake is not accurately describing the property in question. The legal description of the property, which goes beyond just the address, must match the description used in the original mortgage documents. This description often includes lot numbers, block numbers, subdivision names, and sometimes metes and bounds. Any discrepancy in the property description can render the release invalid, leaving the lien technically in place, which can be a nightmare for property owners attempting to sell or refinance.

Not obtaining or notarizing signatures correctly is another frequent issue. A Mortgage Lien Release form generally requires the signature of the lienholder, acknowledging that the debt has been satisfied and that they agree to release the claim on the property. This signature often needs to be notarized to confirm its authenticity. When signatures are missing, or the notarization process is not completed correctly, the document may not be legally binding. This oversight can lead to questions about the lien's validity later on.

Lastly, failing to file the form with the appropriate county or local office is a critical step that can easily be overlooked. After the Mortgage Lien Release form is correctly filled out and notarized, it needs to be recorded with the county recorder's office or similar authority. This step is crucial because it officially removes the lien from the public record, clearing the title to the property. Without this recordation, the lien could still appear as an outstanding obligation, affecting the property's title and potentially complicating future transactions.

Documents used along the form

When it comes to real estate transactions, particularly those involving the resolution and clearing of financial obligations, a variety of important documents usually accompany a Mortgage Lien Release form. The Mortgage Lien Release form itself is a critical document indicating that the borrower has fully repaid the loan secured by the property, thus removing the lender's rights to the property. Alongside this form, there are several other key documents used to ensure that the process is thorough, legally binding, and clearly recorded.

- Title Search Report: This document is an essential part of any real estate transaction. It provides a detailed history of the property, including ownership, encumbrances, and liens. The Title Search Report ensures that the property in question is free from any undisclosed liens or claims before the Mortgage Lien Release is executed.

- Original Mortgage or Deed of Trust: Retrieving and reviewing the original Mortgage or Deed of Trust is important to confirm the details of the original agreement, including the obligation that has been satisfied. This document serves as the basis for asserting that the lien can be lawfully released.

- Payoff Statement: This document provides an official accounting of the total amount necessary to pay off the loan as of a specific date, including any outstanding balance, interest, fees, and other charges. The Payoff Statement is critical for ensuring that all financial obligations have been met before releasing the lien.

- Loan Satisfaction Letter: After the mortgage has been fully repaid, this letter from the lender officially acknowledges that the borrower's obligations under the mortgage have been fulfilled. The Loan Satisfaction Letter is a key supporting document for the Mortgage Lien Release.

- County Recording or Filing Receipt: Once a Mortgage Lien Release is signed and notarized, it must be filed with the appropriate county records office. The receipt from this filing is proof that the document has been legally recorded and is an essential record for both the lender and the borrower.

Together, these documents work in concert to ensure that all parties are protected and the property's title is clear. Having a comprehensive understanding and preparing all necessary documentation can significantly streamline the process of releasing a mortgage lien. Furthermore, proper filing and recording of these documents preserve the legal rights of all parties involved and provide a clear history of the property's title for future transactions.

Similar forms

A Satisfaction of Mortgage document is quite similar to the Mortgage Lien Release form. They both serve the purpose of confirming that a borrower has fully paid off their mortgage loan, which effectively removes the lien from the property's title. This process ensures that the lender no longer has a legal claim to the property due to the previously owed debt, making clear the homeowner's full ownership.

The Deed of Reconveyance is another document similar to the Mortgage Lien Release form, primarily used in states that employ deeds of trust instead of mortgage agreements. Once a borrower pays off their loan, the trustee, who holds the title in trust during the loan term, transfers the property title back to the homeowner. This action signifies the loan's satisfaction and the removal of the lender's interest in the property.

A Release of Deed of Trust operates similarly to the Mortgage Lien Release form but is specific to property titles held under a deed of trust. When the borrower completes their loan payments, the lender must sign this document to indicate that the debt has been fully paid and to release the lender's interest in the property. This document is particularly common in states that use deeds of trust instead of mortgages.

The UCC-3 Amendment form is somewhat related to the Mortgage Lien Release form as well. The UCC-3 is used to amend a previously filed UCC-1 statement, which is a notice of a lender's interest in the borrower's personal property (as opposed to real estate) used as collateral. The UCC-3 can be used to indicate the release or termination of the interest, similar to how a mortgage lien release removes a lender's interest in real property.

Loan Satisfaction Letter bears resemblance to the Mortgage Lien Release form by confirming that a borrower has successfully paid off the loan, but it can apply to various types of loans, not just mortgages. This document is a formal acknowledgement from the lender that the debtor has fulfilled their loan obligations, eliminating the lender's claim or interest arising from the loan.

Last, a Quitclaim Deed, while distinct in many respects, shares a common purpose with the Mortgage Lien Release form in that it can be used to transfer any interest in a property without making any warranties about the property's title. When a lienholder uses a quitclaim deed, it can release any interest they have in the property, effectively acting as a release of the lien, although it's broader in application and lacks the specific focus on satisfaction of debt.

Dos and Don'ts

Filing a Mortgage Lien Release form is a critical step in the process of confirming that a mortgage has been paid in full, and the lien against the property is officially removed. Handling this document properly ensures that property titles are clear, aiding in future transactions such as selling or transferring property. Here are some essential do's and don'ts to consider:

- Do verify all the information: Ensure that every detail on the form, including the spelling of names, addresses, and the legal description of the property, matches the initial mortgage documents.

- Do double-check the recording information: Make sure the book and page number or document number for the original mortgage are correct to avoid any issues with the release being properly indexed.

- Do consult with a professional: Consider seeking advice from a legal or real estate professional to ensure that the form complies with local and state requirements.

- Do keep copies: After the form is filed, keep a copy for your records and confirm with the county recorder or land registry office that the lien has been released.

- Don't leave blanks: Avoid leaving any sections of the form blank. If a section doesn’t apply, fill it in with “N/A” (not applicable) to ensure clarity.

- Don't use correction fluid: If errors are made, start over with a new form. Using correction fluid or making alterations can lead to questions about the document’s legitimacy.

- Don't forget to check deadlines: Be aware of any deadlines for filing the release form to avoid penalties or fees.

- Don't neglect to verify release recording: After submission, follow up to confirm that the release has been recorded. This step is crucial to ensure that the lien is legally removed from public records.

Misconceptions

When dealing with the process of managing or releasing a mortgage, both borrowers and lenders might encounter the Mortgage Lien Release form. This document is essential for confirming that a mortgage has been fully paid off and that the lien on the property is removed, allowing the homeowners full rights to their property. Despite its importance, there are several misconceptions about the Mortgage Lien Release form that could complicate the process for those involved. Let's clarify some of these common misunderstandings:

- Misconception #1: Once the final mortgage payment is made, the lien is automatically removed from the property.

In reality, the lien remains until the lender processes the Mortgage Lien Release form and files it with the appropriate county office. This procedural step is crucial for officially removing the lien.

- Misconception #2: The Mortgage Lien Release form is the homeowner's responsibility to file.

While it varies by state, typically, it is the lender's duty to prepare and file this form. However, homeowners should verify that this has been done to protect their property interests.

- Misconception #3: The Mortgage Lien Release form is only required for traditional mortgages.

This form is also necessary for lines of credit or loans that use your home as collateral, ensuring that all types of property liens are properly released after repayment.

- Misconception #4: There is a universal Mortgage Lien Release form that is used across the United States.

The form, its requirements, and the filing process can vary significantly between different states, necessitating a look into local regulations for accurate completion and submission.

- Misconception #5: A lawyer must always be involved in preparing and filing the Mortgage Lien Release.

While legal assistance can be helpful, particularly in complex cases, many states offer standardized forms and straightforward filing processes that homeowners can manage with the lender's assistance.

- Misconception #6: The form must be filed immediately after the last mortgage payment.

While it's beneficial to file the form promptly to avoid any complications, most jurisdictions offer a grace period for filing. This period allows the lender to prepare and the homeowner to verify the release.

- Misconception #7: The Mortgage Lien Release does not need to be notarized.

Depending on state laws, the form might require notarization to verify the authenticity of the signatures. Ignoring this step could invalidate the document.

- Misconception #8: Once the Mortgage Lien Release is filed, no further action is needed by the homeowner.

After the form is filed, homeowners should obtain a copy from the land records office to ensure their records are updated and to safeguard against any future claims on the property.

Clarifying these misconceptions is vital for a smooth transition into full property ownership. Homeowners and lenders alike benefit from understanding the specific requirements and steps involved in the process of releasing a mortgage lien. Awareness and diligence are key to ensuring the rights and protections of all parties involved.

Key takeaways

When it comes to handling a Mortgage Lien Release form, the process might seem daunting at first. However, it boils down to a few crucial steps and considerations that can streamline and demystify the process. Here are key takeaways to keep in mind:

Accuracy is key: Every detail entered into the Mortgage Lien Release form must be precise. From the borrower's full legal name to the property description and the Book and Page number where the mortgage is recorded, accuracy ensures the process moves forward without unnecessary delays. Errors, even minor, can lead to the rejection of the form, dragging out the timeline to clear the title.

Timeliness matters: Once the mortgage is paid off, initiating the lien release process promptly is critical. There are varying deadlines by state for when a lender must release a mortgage lien after the loan is satisfied. Being aware of these deadlines can prevent any legal complications and ensure the property title is cleared in a timely manner.

Understand local laws: The requirements for a Mortgage Lien Release form can differ widely from one jurisdiction to another. Some locations may require additional documentation, like a notary public's signature or specific forms that accompany the lien release. Familiarizing yourself with these local nuances can save time and frustration.

Record the release properly: After the lender fills out the Mortgage Lien Release form, it's not simply about handing it over to the borrower. The document needs to be recorded with the county clerk or land records office where the property is located. This step is pivotal to officially remove the lien from the public record and modify the property's clear title status.

Approaching the Mortgage Lien Release form with diligence and a clear understanding of the process can transform a seemingly complex endeavor into a manageable task. With attention to detail, adherence to deadlines, comprehension of local regulations, and proper recording, navigating the release of a mortgage lien can be efficiently achieved.

Consider More Types of Mortgage Lien Release Forms

Permission to Use Artwork Form - Ensures that the artist’s moral rights are preserved, respecting their integrity and original vision.