Fillable Real Estate Purchase Agreement Document for Texas

In the vibrant and ever-changing landscape of Texas real estate, entering into the process of buying or selling property marks a major step for any individual. Central to this transaction is the Texas Real Estate Purchase Agreement, a pivotal document that outlines the terms and conditions of the property sale between buyer and seller. This comprehensive agreement encapsulates crucial details such as the purchase price, property description, financing arrangements, closing terms, and any contingencies that could affect the transaction's progression. Understanding each element of this agreement is essential, as it legally binds the parties and sets the stage for a successful transfer of ownership. The form not only provides a clear framework for the transaction but also ensures that both parties are aware of their rights and obligations, thereby facilitating a smoother path to closing. Whether you are stepping into the market as a first-time home buyer or an experienced investor, being well-versed in the nuances of the Texas Real Estate Purchase Agreement can significantly impact the outcome of your real estate endeavors.

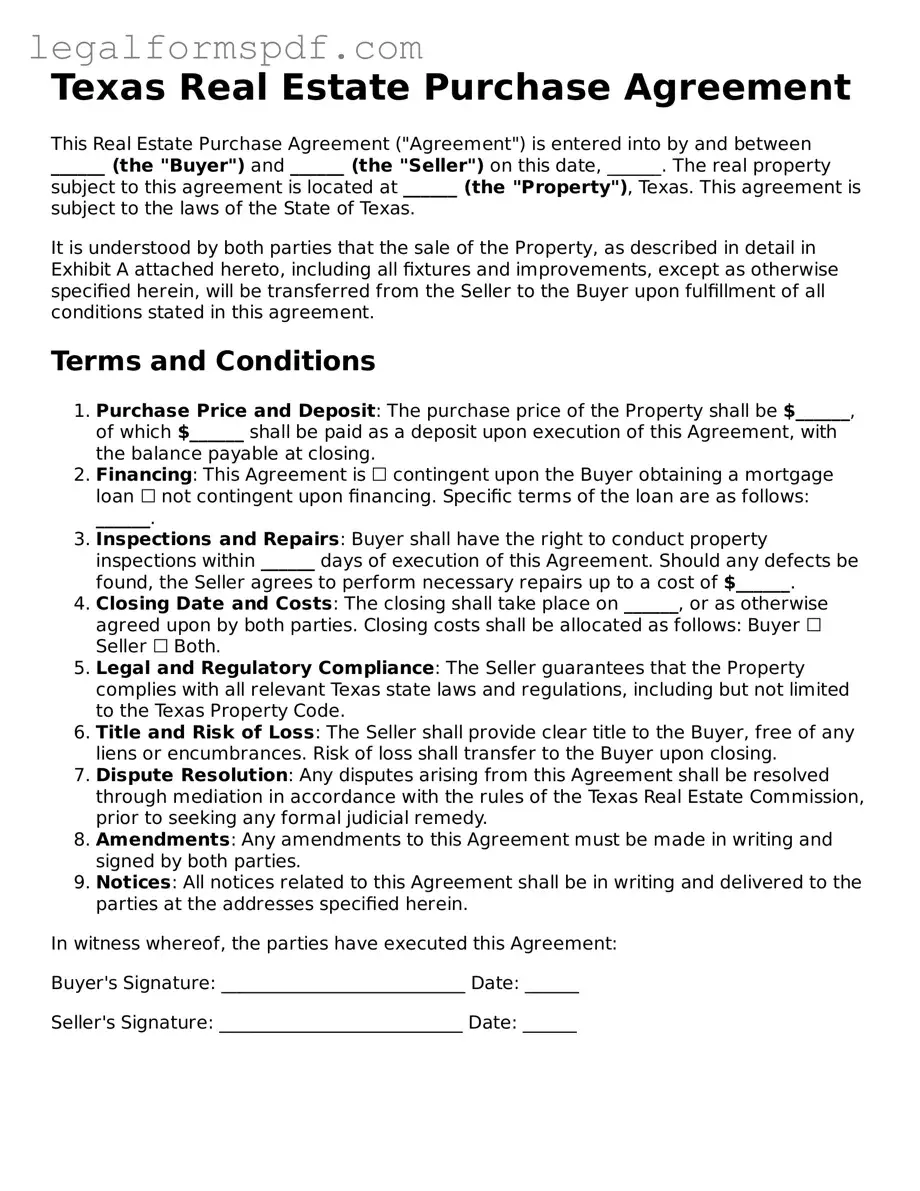

Document Example

Texas Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between ______ (the "Buyer") and ______ (the "Seller") on this date, ______. The real property subject to this agreement is located at ______ (the "Property"), Texas. This agreement is subject to the laws of the State of Texas.

It is understood by both parties that the sale of the Property, as described in detail in Exhibit A attached hereto, including all fixtures and improvements, except as otherwise specified herein, will be transferred from the Seller to the Buyer upon fulfillment of all conditions stated in this agreement.

Terms and Conditions

- Purchase Price and Deposit: The purchase price of the Property shall be $______, of which $______ shall be paid as a deposit upon execution of this Agreement, with the balance payable at closing.

- Financing: This Agreement is ☐ contingent upon the Buyer obtaining a mortgage loan ☐ not contingent upon financing. Specific terms of the loan are as follows: ______.

- Inspections and Repairs: Buyer shall have the right to conduct property inspections within ______ days of execution of this Agreement. Should any defects be found, the Seller agrees to perform necessary repairs up to a cost of $______.

- Closing Date and Costs: The closing shall take place on ______, or as otherwise agreed upon by both parties. Closing costs shall be allocated as follows: Buyer ☐ Seller ☐ Both.

- Legal and Regulatory Compliance: The Seller guarantees that the Property complies with all relevant Texas state laws and regulations, including but not limited to the Texas Property Code.

- Title and Risk of Loss: The Seller shall provide clear title to the Buyer, free of any liens or encumbrances. Risk of loss shall transfer to the Buyer upon closing.

- Dispute Resolution: Any disputes arising from this Agreement shall be resolved through mediation in accordance with the rules of the Texas Real Estate Commission, prior to seeking any formal judicial remedy.

- Amendments: Any amendments to this Agreement must be made in writing and signed by both parties.

- Notices: All notices related to this Agreement shall be in writing and delivered to the parties at the addresses specified herein.

In witness whereof, the parties have executed this Agreement:

Buyer's Signature: ___________________________ Date: ______

Seller's Signature: ___________________________ Date: ______

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Texas Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the purchase and sale of real estate in the state of Texas. |

| Governing Law | This agreement is governed by Texas laws, specifically those relating to real estate transactions. |

| Required Disclosures | Under Texas law, sellers must provide certain disclosures about the property’s condition, including any known defects and the presence of lead-based paint if the property was built before 1978. |

| Formal Requirements | The agreement must be in writing, contain a description of the property, and be signed by both the buyer and seller to be enforceable. |

| Earnest Money | A provision for earnest money deposits is often included, acting as a sign of the buyer's commitment and to be applied towards the purchase price at closing. |

| Closing Date | The document specifies a closing date, which is when the final transaction is completed, title is transferred, and financial exchanges are made. |

| Contingencies | Buyers may set contingencies that must be met before the transaction can go forward, such as obtaining financing, selling a current home, or satisfactory inspection results. |

| Property Description | The agreement includes a detailed description of the property being sold, including its address, legal description, and any exclusions from the sale. |

| Signature Requirement | To be valid, the agreement must be signed by all parties involved in the transaction, typically the buyer(s) and seller(s). |

Instructions on Writing Texas Real Estate Purchase Agreement

Filling out a Texas Real Estate Purchase Agreement is a crucial step in the process of buying or selling property in the state. This document outlines the terms and conditions of the sale, ensuring that both parties understand their rights and obligations. While the form may seem daunting at first, following a step-by-step guide can simplify the process. It's important to complete this document accurately to avoid any potential legal issues in the future. Below are the detailed steps you'll need to take to fill out the form properly.

- Begin by entering the date of the agreement at the top of the form.

- Next, fill in the full legal names of both the buyer(s) and seller(s) in the designated sections.

- In the property description section, provide the complete address of the property being sold, including the county. Also, include any legal descriptions or identifiers if available.

- Specify the sale price in the section provided, detailing both the total amount and how it will be financed, if applicable.

- Fill in the details about the earnest money deposit, including the amount and the entity holding the deposit.

- Outline the closing costs and specify which party (buyer or seller) will be responsible for each cost.

- Indicate any property disclosures the seller must provide, such as known defects or lead-based paint disclosures, as required by law.

- Detail any included fixtures or appliances in the sale in the appropriate section.

- Set the closing date, by which all transactions and document signings should be completed.

- Specify any contingencies that must be met before the sale can be finalized, such as the buyer obtaining financing or the results of a home inspection.

- Both the buyer(s) and seller(s) must sign and date the form, indicating their agreement to the terms outlined.

After completing the form, it's advisable for both parties to review the details carefully to ensure accuracy. Any amendments should be made in writing and signed by both parties. Once finalized, the Texas Real Estate Purchase Agreement becomes a legally binding document, governing the sale of the property. Ensuring that each step is accurately completed can help facilitate a smooth transaction for both the buyer and seller.

Understanding Texas Real Estate Purchase Agreement

What is a Texas Real Estate Purchase Agreement?

A Texas Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of real property in the state of Texas. This document specifies the agreed-upon price, the description of the property, the responsibilities of both the buyer and seller, and any contingencies that must be met before the sale can be finalized.

Who needs to sign the Texas Real Estate Purchase Agreement?

The Texas Real Estate Purchase Agreement must be signed by all parties involved in the transaction. This includes the buyer(s) and seller(s) of the property. If the property is owned by more than one person, each owner must sign the agreement. Similarly, if the property is being purchased by more than one person, each buyer must sign the agreement.

Are there any contingencies that should be included in the agreement?

Yes, contingencies are essential components of a Real Estate Purchase Agreement. Common contingencies include the buyer's ability to obtain financing, the results of a home inspection, and the sale of the buyer's current home. These conditions must be met for the sale to proceed, providing protection for both the buyer and seller.

What happens if either party wants to back out of the agreement?

If a party wishes to back out of the agreement, they may face certain legal consequences, depending on the specifics of the contract and the reasons for terminating the agreement. If the termination is due to an unfulfilled contingency, the withdrawing party may do so without penalty. Otherwise, breaching the agreement can lead to loss of earnest money or other financial penalties as outlined in the agreement.

Is an earnest money deposit required in the Texas Real Estate Purchase Agreement?

While not legally required, an earnest money deposit is commonly included as part of a Texas Real Estate Purchase Agreement. This deposit acts as a sign of the buyer's good faith intention to purchase the property and is typically held in an escrow account until the sale is finalized or terminated under the terms of the agreement.

Can amendments be made to the agreement after it has been signed?

Yes, amendments to the agreement can be made after it has been signed, but they must be agreed upon by all parties involved. Any changes or additions must be documented in writing and signed by both the buyer and seller, indicating their mutual consent to the modifications.

Where can I obtain a Texas Real Estate Purchase Agreement?

A Texas Real Estate Purchase Agreement can be obtained from a licensed real estate agent, a legal professional specializing in real estate law, or through reputable online legal document services. It is crucial to ensure that the form is up-to-date and specific to the laws of the state of Texas.

Common mistakes

In the complex process of real estate transactions, completing the Texas Real Estate Purchase Agreement form with accuracy is crucial. A common mistake is overlooking the full legal names of all parties involved. This detail ensures clarity about the transaction's stakeholders, yet people frequently resort to nicknames or omit middle names, potentially leading to disputes or confusion later in the process.

Another error occurs in the property description section. Some buyers or sellers provide an address only, neglecting the detailed legal description of the property. This description, which includes lot, block, subdivision, and any easements or rights of way, is essential for unambiguous identification of the property in question. A mere address does not suffice for legal purposes and can lead to significant complications.

The agreement terms, particularly regarding earnest money (the deposit made to demonstrate the buyer's commitment), often trip people up. Incorrectly specifying the amount, or failing to outline the holder and conditions for the return or forfeiture of these funds, undermines the security of both parties’ intentions. This oversight can lead to disputes if the deal does not close as planned.

Financing terms are yet another aspect often mishandled in these forms. Buyers sometimes leave these sections vague, not stipulating the loan type, amount, or deadlines for securing financing. This ambiguity can lead to misunderstandings, potentially derailing the sale if financing fails to materialize as the seller expected.

Closing costs and who bears them is another critical area frequently filled out incorrectly. Buyers and sellers sometimes assume standard practices will apply without specifying in the agreement, leading to disagreements and potential deal breakdowns over who pays for what. Explicitly outlining responsibilities for costs such as title insurance, inspections, and repairs is vital for a smooth closing.

The failure to specify deadlines accurately throughout the agreement is a mistake with far-reaching implications. Vague or missing deadlines for actions like inspections, loan approval, and closing can create chaos, forcing parties into rushed decisions or, worse, causing the deal to fall apart.

Contingencies are often misunderstood or incorrectly documented. These conditions, which allow parties to back out under specific circumstances, must be clearly defined. For instance, failing to detail the conditions under which a buyer can terminate the agreement based on a home inspection can lead to legal battles and lost earnest money if issues arise.

Inclusions and exclusions of sale items frequently cause confusion. The agreement should meticulously list what is included or excluded from the sale (like appliances or fixtures). Overlooking this can lead to disputes at closing over items buyers assumed were part of the deal.

Signatures and dates, seemingly the simplest part, are surprisingly often mishandled. The agreement must be signed by all parties with authority to sell or purchase the property, and dated accurately. Missing signatures or incorrect dates can invalidate the entire agreement, delaying the transaction significantly.

Lastly, many fail to consult a legal or real estate professional when filling out this form. This oversight can lead to the aforementioned mistakes and others, as individuals may not understand the legal ramifications of their agreements. Professional advice can ensure that all parties’ rights are protected and the transaction proceeds smoothly.

Documents used along the form

In the process of buying or selling real estate in Texas, the Real Estate Purchase Agreement form is central. However, it's just one piece of the puzzle in what can be a complex transaction. There are a number of additional forms and documents often used alongside this agreement to clarify terms, outline responsibilities, and ensure legal compliance. The following list outlines some of these key documents and their purposes, helping parties navigate the buying or selling process with more ease and understanding.

- Disclosures related to lead-based paint: Required for homes built before 1978, this form informs buyers of the presence of lead-based paint and its hazards.

- Seller’s Disclosure Notice: This document, mandated by Texas law, requires sellers to disclose known defects and various conditions of the property, giving buyers detailed insights into the property's state.

- Loan Estimate and Closing Disclosure: Provided by lenders to buyers financing the purchase, these documents detail loan terms, projected monthly payments, and closing costs associated with the mortgage.

- Title Insurance Commitment: This document outlines the terms under which the title insurance company agrees to insure the buyer's and lender's title, detailing any exclusions or exceptions.

- Survey: A survey shows property boundaries, easements, and encroachments, helping both parties understand the exact dimensions and limitations of the property.

- Home Inspection Report: Prepared by a professional home inspector, this report covers the condition of the home’s structure, systems, and other elements, and may influence final negotiations.

- Appraisal Report: An appraisal determines the property’s market value and is usually required by lenders to ensure the property’s value matches or exceeds the purchase price.

- Home Warranty Agreement: This optional agreement provides buyers with coverage for certain home repairs and systems failures for a set period post-purchase.

Each of these documents plays a crucial role in the transparency, security, and efficiency of the real estate transaction. Buyers and sellers are encouraged to fully understand and properly manage these additional forms and documents to support a successful, smooth transaction. Legal or real estate professionals can provide essential guidance and support in navigating these documents effectively.

Similar forms

The Bill of Sale shares similarities with the Texas Real Estate Purchase Agreement as it serves as a documented agreement between a buyer and seller over the sale of an item, often used for personal property like vehicles or equipment. Both documents outline the terms of the sale, including description of the item being sold, the purchase price, and the parties’ information, thus ensuring a mutual understanding and legal protection in the transaction.

Lease Agreements, much like the Texas Real Estate Purchase Agreement, are legally-binding contracts, but differ in that they pertain to the rental of property rather than the sale. They cover terms of the rental arrangement, such as lease duration, payment amount and schedule, and responsibilities of each party, creating a framework for the rental relationship similar to how purchase agreements structure property sales.

The Warranty Deed bears resemblance to the Texas Real Estate Purchase Agreement in that it involves the transfer of property. However, it specifically guarantees that the seller holds clear title to the property and has the right to sell it, free from liens or claims. This document provides an assurance to the buyer about the status of the property that is similar in nature to the disclosures often found in real estate purchase agreements.

Quitclaim Deeds, while involving the transfer of property ownership like the Texas Real Estate Purchase Agreement, do not guarantee the title's status. They are often used between known parties, such as family members. This document effectively releases the seller’s interest in the property to the buyer, which can be likened to the finalization aspect of property sales in purchase agreements.

The Mortgage Agreement is akin to the Texas Real Estate Purchase Agreement in its role within real estate transactions, specifically regarding the financing aspect. This document outlines the borrower’s promise to repay the lender, detailed with terms including the loan amount, interest rate, and repayment schedule, similar to how purchase agreements detail the financial terms of the property sale.

The Promissory Note, often associated with real estate transactions, is similar to the Texas Real Estate Purchase Agreement as it documents the buyer's promise to pay a certain amount, either to the seller directly or to a lending institution. Although more narrowly focused on the financing aspect, both documents are integral to setting and understanding the financial obligations of the parties involved in the transaction.

The Home Inspection Report, while not a contractual agreement like the Texas Real Estate Purchase Agreement, provides crucial information that impacts the sales transaction. This report outlines the condition of the property, including any necessary repairs or problems, which can influence negotiations, price adjustments, or even the buyer's decision to proceed with the purchase, paralleling the information exchange in purchase agreements.

Title Insurance Commitment documents also share similarities with the Texas Real Estate Purchase Agreement by ensuring the buyer's protection against future claims on the property’s title. Though distinct in purpose, both documents serve to safeguard the interests of the transaction's parties, with title insurance specifically focusing on the validity of the property’s title and ownership transfer.

An Appraisal Report is indirectly related to the Texas Real Estate Purchase Agreement as it provides an expert's assessment of the property's market value. This valuation is critical in determining the appropriate purchase price and is often a requirement of lenders before financing is approved, paralleling the agreement's role in finalizing the sale terms based on accurate property information.

The Closing Statement, or HUD-1, is closely related to the Texas Real Estate Purchase Agreement as it details the final financial transactions in the property sale. This document itemizes the funds paid at closing, including down payment, fees, and credits, reflecting the agreed-upon terms in the purchase agreement and ensuring that all financial aspects of the sale are transparent and agreed upon by all parties.

Dos and Don'ts

When filling out the Texas Real Estate Purchase Agreement form, it's crucial to ensure accuracy and thoroughness to protect your interests, whether you're the buyer or the seller. Here are essential dos and don'ts to keep in mind:

Do:- Read the entire document carefully before you start filling it out. Understanding every section can help you avoid common mistakes.

- Use legible handwriting if you're filling it out by hand, or ensure a clear font if typing. This avoids confusion and potential disputes.

- Include all relevant details about the property, such as the legal description, address, and any included personal property.

- Clearly state the purchase price and the terms of payment. Ambiguity in this area can lead to significant misunderstandings down the line.

- Confirm all parties' details, including full names and contact information, to avoid any confusion about the agreement's obligations.

- Attach any required additional documents, such as disclosures or addendums, as required by Texas law.

- Have all parties review the agreement before signing to ensure that everyone understands and agrees to the terms.

- Skip sections or leave blanks if you're unsure about a section, seek clarification. Omissions can lead to disputes or a void contract.

- Assume standard clauses cover your unique situation without customization. Tailor the agreement to the specific transaction.

- Forget to specify who pays for which closing costs, as this can be a significant expense and a point of negotiation.

- Neglect to include an effective date or timeframe for each party to fulfil their obligations, such as inspections and financing contingencies.

- Overlook stipulating dispute resolution mechanisms in case of disagreements. Knowing how disputes will be resolved can save time and resources.

- Ignore legal advice, especially if this is your first real estate transaction or if the deal involves complex elements.

- Rely solely on verbal agreements for any part of the transaction. Ensure all agreements and amendments are in writing and attached to the purchase agreement.

Misconceptions

Many people have misconceptions about the Texas Real Estate Purchase Agreement form. Understanding these can help parties navigate their real estate transactions more smoothly. Here are six common misunderstandings:

One-size-fits-all: A common misconception is that the Texas Real Estate Purchase Agreement is a one-size-fits-all document that can be used as is for all property transactions. In reality, this agreement should be tailored to fit the specifics of each transaction, including any special terms agreed upon by the buyer and seller.

Only for residential properties: Some people think this form is exclusively for the purchase of residential properties. However, it can be modified to suit the sale and purchase of commercial properties as well, although additional terms and conditions may need to be added to address specific commercial real estate concerns.

Doesn't require professional review: There's a belief that once this form is filled out, it doesn't need to be reviewed by a professional. Contrary to this belief, it's highly advisable to have a real estate attorney or a knowledgeable real estate professional review the agreement before signing. They can provide invaluable advice to ensure that the terms protect the interests of the party they represent.

No negotiation after signing: Some parties might think that once the Texas Real Estate Purchase Agreement is signed, the terms are set in stone and cannot be changed. However, the parties can always negotiate amendments to the agreement, provided both parties agree to the changes in writing.

Binding without earnest money: Many believe that an agreement isn't binding unless earnest money is exchanged. While earnest money does show the buyer's good faith and intention to purchase, the contract becomes legally binding when both parties have signed the agreement, regardless of the exchange of earnest money.

Only important for legal disputes: People often underestimate the importance of the agreement, thinking it's only necessary in case of a legal dispute. This document serves as a roadmap for the entire transaction, detailing the rights, obligations, and timelines for both parties, and is crucial for a smooth and successful real estate transaction.

Key takeaways

Filling out a Texas Real Estate Purchase Agreement form is a crucial step in the process of buying or selling property. This document not only outlines the terms and conditions of the deal but also protects the interests of both parties involved. Here are some key takeaways to ensure you're well-informed and prepared:

- Ensure all parties are correctly identified: Include full legal names of the buyers and sellers as this establishes the parties involved in the transaction. Misidentification can lead to legal complications down the line.

- Accurately describe the property: A detailed description of the property, including its address, legal description, and any personal property being included in the sale (e.g., appliances, furniture) must be clearly listed to avoid any disputes or misunderstandings.

- Clearly state the purchase price and terms: The agreement should specify the total purchase price, the amount of earnest money, how it will be paid (e.g., cash, wire transfer), and the terms for the balance of the payment. This clarity prevents disagreement related to financial aspects.

- Understand the importance of due diligence: Buyers are typically granted a period to conduct their due diligence, including inspections, appraisal, and securing financing. The agreement should specify these timelines clearly to avoid any risk of default.

- Specify contingencies: Contingencies, such as financing, inspection, and appraisal contingencies, provide conditions under which the buyer or seller can back out of the contract without penalty. Being explicit about these can save both parties a lot of trouble.

- Outline the closing process: Detail the closing process, including the closing date, location, and who is responsible for closing costs. This ensures both parties are on the same page and can help facilitate a smoother transaction.

It's also beneficial to seek professional advice when dealing with complex agreements. A real estate attorney or a licensed real estate agent can provide valuable insight and guidance, ensuring all legal requirements are met and your interests are well protected. So, take the time to understand every aspect of your agreement, and don't hesitate to ask for help when needed.

More Real Estate Purchase Agreement State Forms

House Purchase Agreement Template - It ensures a clear transfer of property, with the title changing hands from seller to buyer upon completion.

Buyer Agreement - By setting out the transaction's financial aspects, the agreement avoids any later disputes over terms.

Generic Home Purchase Agreement - A legal undertaking that defines the terms and details under which real estate will change hands.