Official Personal Guarantee Document

When business owners seek financing or credit, lenders often require more than just a handshake to seal the deal. To mitigate their risk, financial institutions might ask for a pledge that provides them with a fallback should the business fail to meet its obligations. Here is where the concept of a Personal Guarantee comes into play, serving as a pivotal component in the world of business transactions. Essentially, it's an agreement that obligates the person signing it to assume responsibility for repaying a debt in the event that the business cannot. This form not only underscores the lender's need for security but also signifies the faith the guarantor has in the business's potential and commitment to its success. Delving into the details of a Personal Guarantee form reveals its structural elements, conditions under which it can be invoked, and the implications for both the guarantor and the lender. Understanding these fundamentals is crucial for anyone involved in business financing, from the seasoned entrepreneur looking to expand operations to the novice venturing into their first business. The form's presence in a lending agreement signals a serious step in the financial relationship, one that necessitates a thorough comprehension before any commitments are made.

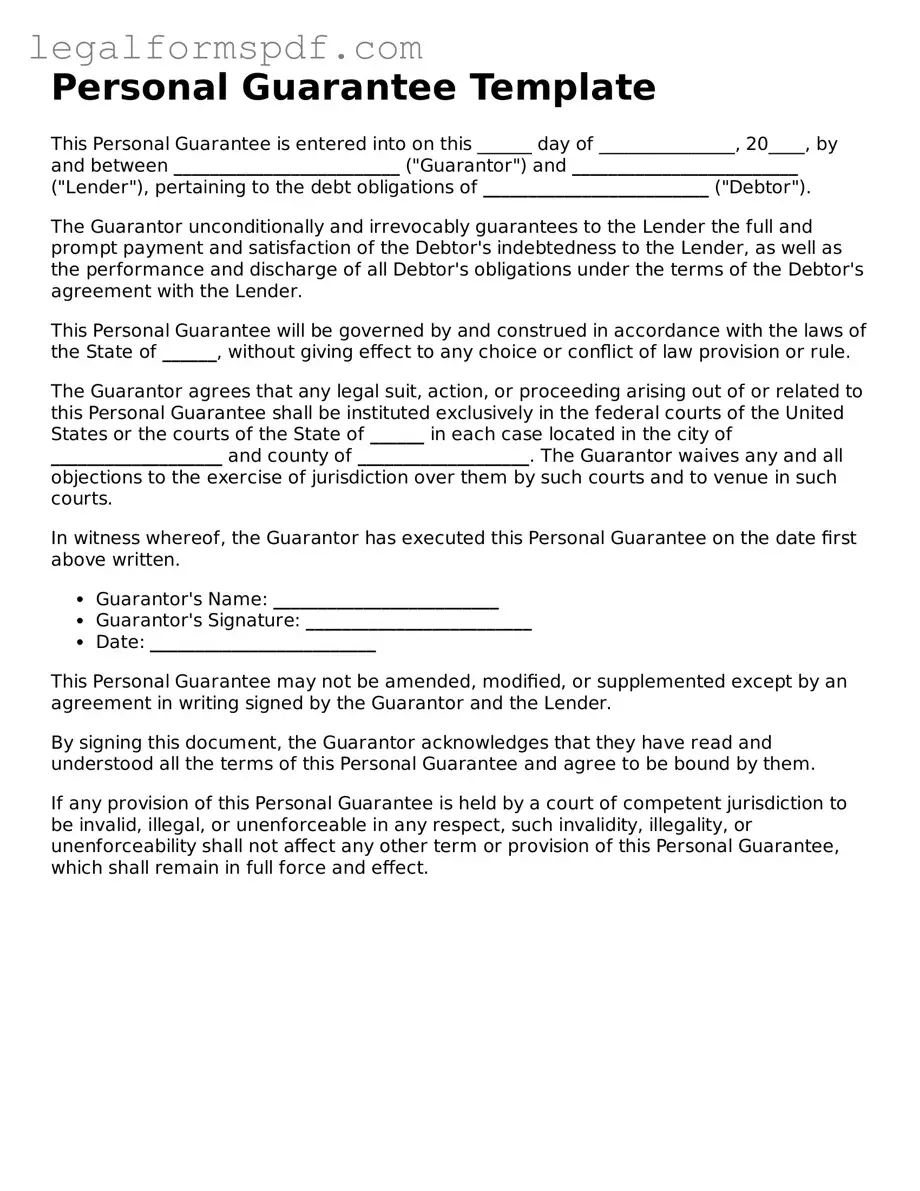

Document Example

Personal Guarantee Template

This Personal Guarantee is entered into on this ______ day of _______________, 20____, by and between _________________________ ("Guarantor") and _________________________ ("Lender"), pertaining to the debt obligations of _________________________ ("Debtor").

The Guarantor unconditionally and irrevocably guarantees to the Lender the full and prompt payment and satisfaction of the Debtor's indebtedness to the Lender, as well as the performance and discharge of all Debtor's obligations under the terms of the Debtor's agreement with the Lender.

This Personal Guarantee will be governed by and construed in accordance with the laws of the State of ______, without giving effect to any choice or conflict of law provision or rule.

The Guarantor agrees that any legal suit, action, or proceeding arising out of or related to this Personal Guarantee shall be instituted exclusively in the federal courts of the United States or the courts of the State of ______ in each case located in the city of ___________________ and county of ___________________. The Guarantor waives any and all objections to the exercise of jurisdiction over them by such courts and to venue in such courts.

In witness whereof, the Guarantor has executed this Personal Guarantee on the date first above written.

- Guarantor's Name: _________________________

- Guarantor's Signature: _________________________

- Date: _________________________

This Personal Guarantee may not be amended, modified, or supplemented except by an agreement in writing signed by the Guarantor and the Lender.

By signing this document, the Guarantor acknowledges that they have read and understood all the terms of this Personal Guarantee and agree to be bound by them.

If any provision of this Personal Guarantee is held by a court of competent jurisdiction to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other term or provision of this Personal Guarantee, which shall remain in full force and effect.

PDF Specifications

| Fact | Detail |

|---|---|

| Definition | A Personal Guarantee form is a legal document that makes an individual personally liable for a debt or obligation in the event that the primary borrower fails to fulfill the terms of the agreement. |

| Primary Purpose | It is used to provide security to lenders or landlords that someone will be responsible for paying back a loan or lease if the original party does not. |

| Common Use Cases | They are often required for small business loans, commercial leases, and other financial agreements where the borrower might have limited assets or credit history. |

| Governing Law | The governing law depends on the state in which the agreement is executed. Each state may have different requirements and regulations surrounding personal guarantees. |

| Risks for Guarantors | Signing a personal guarantee exposes the guarantor’s personal assets, including bank accounts, real estate, and other valuable possessions, to potential legal action if the debt is not repaid. |

Instructions on Writing Personal Guarantee

When you're stepping into a commitment that involves financial responsibility, a Personal Guarantee form is a document you'll likely encounter. This agreement is a legally binding promise by an individual (the guarantor) to pay back a loan if the primary borrower fails to do so. It's a serious undertaking, ensuring that the lender has another means of recovering the loan if things don't go as planned. While it might feel daunting, filling out this form is straightforward if you follow a step-by-step approach. Here's how to get started.

- Begin by clearly printing your full name at the top of the form. This ensures there's no confusion about who the guarantor is.

- Enter your personal contact information, including your phone number and email address. This information is crucial for any necessary communication regarding the guarantee.

- Provide your residential address in the section designated for guarantor details. Be specific to include any apartment number and ZIP code to avoid any confusion.

- Next, detail your relationship to the borrower. Whether you're a friend, relative, or business associate, it's important to state this clearly.

- In the section asking for the details of the guarantee, specify the loan amount you're guaranteeing. It's essential to write this amount in both words and figures for clarity.

- Review the terms and conditions of the Personal Guarantee carefully. This part of the form outlines what is expected of you as the guarantor. Understanding these terms fully is crucial before moving forward.

- Sign and date the form in the designated areas. Your signature is a critical component, as it is your official agreement to the obligations laid out in the form.

- If required, have your signature witnessed. Some forms necessitate a witness to your signature, so ensure this step is completed if it's applicable. The witness should also sign and date the form.

After you've filled out and signed the Personal Guarantee form, the next steps typically involve submitting the document to the relevant party, usually a lender or legal representative. They will review the guarantee and might ask for additional documentation or clarification on certain points. It's also a good idea to keep a copy of the form for your records. Taking on the role of a guarantor is a substantial responsibility, so staying informed and connected with the borrower to monitor the loan's progress is wise.

Understanding Personal Guarantee

What is a Personal Guarantee?

A Personal Guarantee is a legal commitment by an individual (the guarantor) to repay a loan if the original borrower fails to do so. It means the guarantor becomes personally responsible for the debt if the borrower defaults. This guarantee is often required by lenders before they approve a loan to a business, particularly if the business itself does not have a sufficient credit history to qualify for the loan on its own.

Who needs to sign the Personal Guarantee form?

The Personal Guarantee form must be signed by the individual who agrees to be responsible for the debt, should the original borrower default. This person is known as the guarantor. In some cases, the lender may require more than one guarantor, especially if the loan amount is significant. Additionally, all parties involved should fully understand their obligations before signing the form to ensure they are aware of the potential liabilities they are taking on.

What risks are involved with signing a Personal Guarantee?

Signing a Personal Guarantee carries significant risks. As a guarantor, you are making a promise to pay the debt if the borrower cannot. This could mean that your personal assets, including your home or savings, may be at risk if you need to fulfill the guarantee. It's important to consider the borrower's reliability and the potential for your own financial situation to change in the future before agreeing to sign a Personal Guarantee.

Can a Personal Guarantee be revoked or amended?

Once signed, a Personal Guarantee is difficult to revoke or amend without the consent of all parties involved, including the lender. If a guarantor wishes to be released from a Personal Guarantee, they must negotiate directly with the lender, who must agree to the release or amendment. It's advisable to have clear terms outlined in the original agreement about any conditions under which the guarantee can be amended or revoked to avoid future disputes.

Common mistakes

One common mistake people make when filling out a Personal Guarantee form is not understanding the scope of their liability. Many individuals rush through the paperwork without fully grasping that they are agreeing to be personally responsible for the debt or obligations of another party, such as a business. This can lead to a shocking realization later on if the business fails to meet its financial obligations, as the guarantor's personal assets could be at stake.

Another frequently seen error is failing to thoroughly review and negotiate the terms of the guarantee. Often, the language contained within these forms is dense and laden with legal terminology, making it challenging for non-experts to fully comprehend the implications. As a result, many signatories miss opportunities to limit the duration of the guarantee or restrict the amount for which they can be held liable. Such details, if not closely scrutinized and negotiated, can leave guarantors more exposed than they might have intended or realized.

Not seeking legal advice is a significant oversight many commit when encountering a Personal Guarantee form. Given the serious consequences of personally guaranteeing another's debt, it is crucial to consult with a legal professional who can clarify the legal jargon, outline the risks involved, and suggest possible alterations to the agreement. By forgoing this step, individuals risk agreeing to terms that are not in their best interest, possibly due to a misunderstanding of the contract's content and implications.

A further error involves ignoring the guarantor's current financial situation and future capacity to fulfill the guarantee should it become necessary. Some individuals do not consider their own financial health comprehensively when signing these agreements. If a guarantor's circumstances change—say, due to loss of income, significant life changes, or unforeseen debts—their ability to cover the guaranteed amount might be compromised, leading to personal financial disaster.

Lastly, many people fail to keep detailed records or a copy of the Personal Guarantee form once it's signed. This document is crucial for keeping track of the specific details and conditions of the agreement. In the absence of this documentation, disputing terms or addressing misunderstandings becomes significantly more difficult. Maintaining a comprehensive file, including all related correspondence and documents, ensures that guarantors can accurately recall and prove what was agreed should any disputes arise.

Documents used along the form

When securing a loan for a business or entering into a contractual agreement, a Personal Guarantee form is often just one part of a comprehensive documentation package. This form is critical as it assures the lender or the party offering services that an individual is willing to accept personal liability if the business fails to meet its obligations. In addition to a Personal Guarantee, there are a variety of other documents and forms commonly required to complete such transactions. These documents serve various purposes, from detailing the terms of the agreement to providing financial insights about the business.

- Loan Agreement: Outlines the terms, conditions, interest rates, and repayment schedule of a loan between a lender and borrower.

- Business Plan: Demonstrates the business's goals, strategies, market analysis, and financial forecasts, often requested by lenders to assess the viability of the business.

- Credit Application: A form filled out by businesses seeking credit, providing necessary information for the credit evaluation process.

- Corporate Resolution: A written document that records any major decisions made by a corporation's board of directors or shareholders.

- Financial Statements: Include income statements, balance sheets, and cash flow statements, giving a snapshot of the business’s financial health.

- Security Agreement: A legal contract where the borrower provides the lender a security interest in specified assets as collateral for a loan.

- UCC-1 Financing Statement: A form filed to perfect a security interest in named collateral, giving public notice to other creditors of the lender's rights.

- Guarantor’s Statement: Provides detailed information about the personal guarantor’s financial situation, complimenting the Personal Guarantee form.

- Commercial Lease Agreement: When a business secures a loan for establishing or expanding its physical location, this document outlines the terms, payments, and conditions of renting commercial property.

Understanding and properly preparing these documents can be pivotal in ensuring the success of a financial or contractual agreement. Each document plays a critical role in clarifying the obligations, rights, and financial arrangements between the parties involved, safeguarding their interests throughout the course of their agreement. As every situation is unique, parties might not need every document listed above, but having a comprehensive understanding of what may be required can provide a solid foundation for successful negotiations.

Similar forms

A Promissory Note is akin to the Personal Guarantee form in many ways, primarily in how both establish a binding commitment regarding the handling of a debt. A Promissory Note delineates terms under which a borrower promises to repay a specified sum of money to a lender by a set date or upon demand. Similar to a Personal Guarantee, it serves as a documented vow ensuring accountability for financial obligations, underscoring the individual's promise to fulfill the debt conditions explicitly laid out within the document.

Similarly, a Loan Agreement shares common ground with the Personal Guarantee, as both are formalized agreements involving financial transactions between parties. The Loan Agreement specifies the terms, interest rates, repayment schedule, and the obligations of the borrower. Conversely, a Personal Guarantee ensures the debt repayment by a third party should the initial borrower fail to meet their obligations, functioning as an added layer of security for the lender within the scope of the agreement.

A Co-signer Agreement is another document mirroring the essence of the Personal Guarantee. This agreement involves a secondary party agreeing to share the responsibility for the debt of the primary borrower. If the primary borrower defaults, the co-signer is obliged to repay. The core similarity lies in the assumption of debt responsibility by someone other than the primary debtor, ensuring lenders have an alternative means of recouping their funds.

The Indemnity Agreement parallels the Personal Guarantee concerning risk assumption and financial responsibilities. An Indemnity Agreement is a contract where one party agrees to compensate for any loss or damage incurred by another. Like a Personal Guarantee, it involves an entity or individual committing to absorb specific financial risks, making it a preventive measure against potential financial losses, thus providing a safeguard for the benefactor.

A Surety Bond is somewhat similar to a Personal Guarantee, though it involves a third-party (the surety) who guarantees the performance or obligations of one party to another. Should there be a failure in fulfilling these obligations, the surety is responsible for compensation. This triangular relationship mirrors that of a Personal Guarantee by involving a guarantor to assure the fulfillment of a commitment, serving to instill confidence in the agreement's execution.

Lastly, a Security Agreement shares similarities with a Personal Guarantee, especially in its purpose of ensuring the fulfillment of a financial obligation. In a Security Agreement, a borrower pledges an asset as collateral for a loan — if the loan is not repaid, the lender has the right to seize the asset. Like a Personal Guarantee, it provides a lender with a form of security, albeit through pledged assets rather than a personal promise of repayment by a third party.

Dos and Don'ts

When it comes to filling out a Personal Guarantee form, precision, and attention to detail are key. Here are some essential do's and don'ts to keep in mind:

Do:- Read the entire form carefully before starting to fill it out. Understanding every part will help you provide accurate information.

- Use black or blue ink if the form is being filled out by hand. This ensures clarity and legibility.

- Double-check all the information you provide for accuracy. Errors can cause unnecessary delays.

- Include all requested documents. These might include proof of income, identification, or other legal documents.

- Sign and date the form where indicated. Your signature is crucial as it validates the form.

- Keep a copy of the completed form and any correspondence for your records. This can be important for future reference.

- Contact a professional if you have questions. Legal documents can be complicated, and getting professional advice can prevent mistakes.

- Rush through the process. Taking your time can help you avoid making mistakes.

- Leave any sections blank unless instructed. If a section doesn’t apply, write “N/A” to indicate this.

- Use correction fluid or tape. Mistakes should be neatly crossed out, and the correct information should be printed clearly.

- Ignore any follow-up requests for information. Responding in a timely fashion is crucial.

- Forget to update your information if any changes occur before the process is completed. Keep everything current.

- Submit the form without reviewing it one last time. A final check can catch any errors you might have missed.

- Underestimate the significance of the document. This is a legal commitment that could have financial implications.

Misconceptions

When discussing Personal Guarantee forms, several misconceptions commonly arise. Understanding the facts behind these can help individuals make more informed decisions about entering into these agreements.

It’s only a formality and doesn’t hold actual weight. Many believe a Personal Guarantee is just a standard procedure without real consequences. However, this is incorrect. Signing a Personal Guarantee means you are legally promising to repay a debt if the primary borrower cannot. This can lead to significant financial and legal implications for the guarantor.

Your assets are always protected. Another common misconception is that personal assets are not at risk when you sign a Personal Guarantee. In reality, creditors may pursue your personal assets, including your home or savings, if the debt is not repaid by the business or primary borrower.

The guarantee is only effective for a limited time. Some people believe that Personal Guarantees expire after a certain period or that the obligation is limited to the original terms of the loan or agreement. This is not always the case. The guarantee can remain in effect as long as the debt is outstanding, including any extensions, renewals, or modifications to the original agreement.

Personal Guarantees are only required for high-risk loans. While it's true that Personal Guarantees are commonly requested for borrowers or businesses deemed to be higher risk, they may also be required for a range of financial agreements, irrespective of the perceived risk. Lenders often require a Personal Guarantee to provide an extra layer of security, regardless of the borrower's financial health.

Key takeaways

When someone fills out a Personal Guarantee form, they're stepping into a commitment that assures a lender or creditor will get their money back, one way or another. Whether you're a business owner who's been asked to provide a personal guarantee for a loan, or you're a lender on the verge of requiring one, understanding the implications and details of this legal document is crucial. Let's dive into some key takeaways about filling out and using the Personal Guarantee form.

- Understand Your Liability: A personal guarantee means you are personally liable if the business can’t repay the loan. This commitment bypasses the protective corporate structure, potentially putting your personal assets at risk.

- Read Every Detail Carefully: Before signing, it’s imperative to read every clause and understand the terms. The devil is in the details, and overlooking a single aspect could have significant implications.

- Know the Extent of the Guarantee: Guarantees can be limited or unlimited, meaning you're either responsible for a specific amount or an uncapped amount, respectively. Clarify this aspect to understand the depth of your commitment.

- Consider the Duration of Your Guarantee: Some guarantees are in effect until the debt is completely paid off, including any interests or fees. Understand how long your guarantee lasts and under what conditions it can be terminated.

- Be Aware of Joint and Several Liability: If there are multiple guarantors, each could be responsible for the full amount of the debt (not just their share). This means the lender can pursue any of the guarantors for the total amount owed.

- Negotiate Terms: Before signing a personal guarantee, negotiate the terms. It’s possible to limit the duration, cap the amount, or even specify conditions under which the guarantee can be reduced or voided.

- Seek Legal Advice: With such high stakes, consulting with a legal professional to review the terms of the personal guarantee is wise. They can provide valuable insights, identify potential pitfalls, and suggest negotiations.

- Prepare for Worst-Case Scenarios: Understand what would happen if the business fails to repay the loan. Prepare for this possibility by considering how you would cover the debt, potentially affecting your personal financial stability.

In essence, a Personal Guarantee form isn't something to be taken lightly. It intertwines your personal financial fate with that of your business, breaking down the traditional barriers that separate your business debts from your personal assets. Approaching this document with the seriousness it demands, equipped with knowledge and legal advice, can help you navigate the complexities of personal guarantees more effectively.

Consider More Types of Personal Guarantee Forms

Purchase Agreement Addendum - Addendums to a purchase agreement can cover a wide range of issues, including alterations to the property, fixtures to include or exclude, and specific closing conditions.

Buyer's Agent Termination Letter Sample - A critical tool for legally ending a property sale agreement, safeguarding both seller and buyer from future claims.

Seller Financing Contract - This legal document helps structure the sale in a way that aligns with both the buyer's and seller's financial situations.