Fillable Real Estate Purchase Agreement Document for Pennsylvania

Embarking on the journey of buying or selling real estate in Pennsylvania involves navigating through numerous documents and legalities, with the Pennsylvania Real Estate Purchase Agreement form standing out as a cornerstone document. This vital piece of paperwork outlines the terms and conditions of the sale, capturing details such as the purchase price, closing date, and any contingencies that the transaction may hinge upon. It not only serves as a legally binding contract between the buyer and seller, detailing their rights and obligations but also provides a clear roadmap for the entire transaction, setting out the expectations for both parties. Ensuring that all aspects of this agreement are thoroughly understood and correctly executed is crucial, as it can significantly impact the outcome of the real estate transaction. From the identification of the property and the parties involved to the delineation of inspection rights and potential financing conditions, the Pennsylvania Real Estate Purchase Agreement form encapsulates the essence of the transaction, therefore demanding meticulous attention from all parties involved.

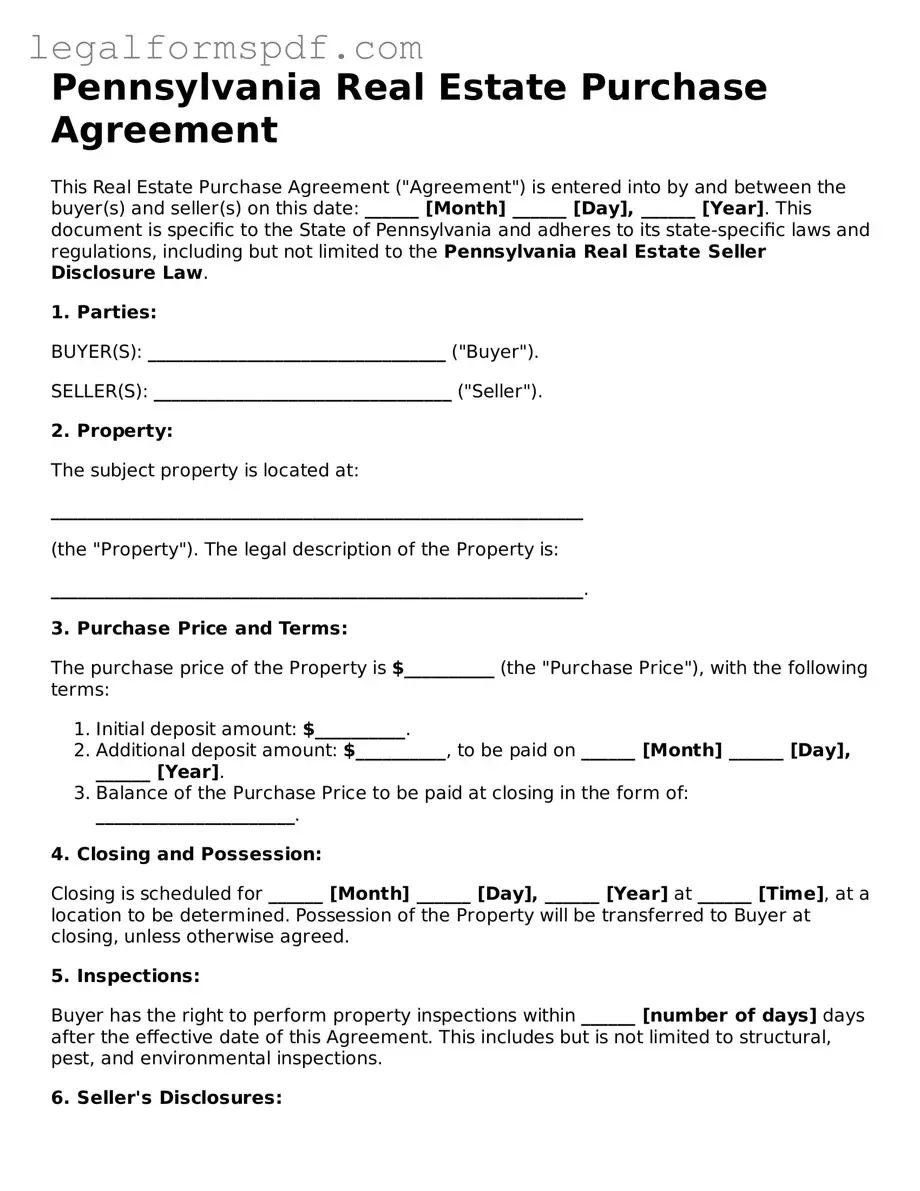

Document Example

Pennsylvania Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the buyer(s) and seller(s) on this date: ______ [Month] ______ [Day], ______ [Year]. This document is specific to the State of Pennsylvania and adheres to its state-specific laws and regulations, including but not limited to the Pennsylvania Real Estate Seller Disclosure Law.

1. Parties:

BUYER(S): _________________________________ ("Buyer").

SELLER(S): _________________________________ ("Seller").

2. Property:

The subject property is located at:

___________________________________________________________

(the "Property"). The legal description of the Property is:

___________________________________________________________.

3. Purchase Price and Terms:

The purchase price of the Property is $__________ (the "Purchase Price"), with the following terms:

- Initial deposit amount: $__________.

- Additional deposit amount: $__________, to be paid on ______ [Month] ______ [Day], ______ [Year].

- Balance of the Purchase Price to be paid at closing in the form of: ______________________.

4. Closing and Possession:

Closing is scheduled for ______ [Month] ______ [Day], ______ [Year] at ______ [Time], at a location to be determined. Possession of the Property will be transferred to Buyer at closing, unless otherwise agreed.

5. Inspections:

Buyer has the right to perform property inspections within ______ [number of days] days after the effective date of this Agreement. This includes but is not limited to structural, pest, and environmental inspections.

6. Seller's Disclosures:

Seller agrees to provide Buyer with a completed and signed Pennsylvania Real Estate Seller Disclosure Statement prior to or at the time of executing this Agreement.

7. Contingencies:

This Agreement is contingent upon the following:

- Buyer obtaining financing.

- The Property passing all agreed upon inspections.

- Any other contingencies agreed upon by Buyer and Seller:

___________________________________________________________.

8. Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of Pennsylvania.

9. Signatures:

This Agreement is not valid until signed by both Buyer and Seller. By signing below, both parties acknowledge they have read, understood, and agreed to all terms and conditions set forth in this Agreement.

BUYER'S SIGNATURE: _________________________ DATE: ______ [Month] ______ [Day], ______ [Year]

SELLER'S SIGNATURE: _________________________ DATE: ______ [Month] ______ [Day], ______ [Year]

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | Pennsylvania Real Estate Purchase Agreements are governed by the laws of the state of Pennsylvania, including statutes related to real estate, contracts, and disclosures. |

| Required Disclosures | In Pennsylvania, sellers must provide buyers with a property disclosure statement detailing the condition of the property, including any material defects. |

| Use of Agreement | This form is used when buying or selling property in Pennsylvania to outline the terms and conditions of the sale, including price, property description, and closing details. |

| Customizability | Though the form has standard clauses, parties can add custom terms and contingencies to address specific needs or concerns about the property transaction. |

| Closing Process | The agreement details the closing process, specifying responsibilities of both buyer and seller, including any agreed-upon inspections, closing date, and transfer of ownership. |

Instructions on Writing Pennsylvania Real Estate Purchase Agreement

Filling out a Pennsylvania Real Estate Purchase Agreement is a critical step in the process of buying or selling property in the state. This document legally binds the buyer and seller to the transaction's terms and conditions, including the purchase price, property description, and closing details. It's essential to approach this task with attention to detail to ensure all parties understand their obligations and rights. The following guidelines are designed to help you navigate the form effectively, ensuring a smooth and legally compliant transaction.

- Begin by entering the date of the agreement at the top of the form.

- Next, write the full legal names of both the buyer(s) and seller(s) in the designated spaces.

- Provide a comprehensive description of the property being sold. This includes the address, legal description, and any other identifying details.

- Enter the agreed-upon purchase price in the section provided for financial details.

- Detail the terms of payment, including any deposit amount, financing arrangements, and deadlines for payment completion.

- Specify any fixtures or personal property included in the sale. Be clear about what stays with the house and what the sellers are taking with them.

- Include any contingencies that must be met before the sale can proceed. These can cover home inspections, financing approval, and the sale of the buyer’s current home, among others.

- Outline the responsible parties for fees and closing costs. Typically, both buyers and sellers have specific expenses they must cover.

- Agree on a closing date by which all transactions and document signings must be completed.

- Both parties need to review the form thoroughly for accuracy and completeness. Any additional terms or conditions not covered in the standard sections should be attached as addendums.

- Finally, the buyer and seller must sign and date the agreement in the presence of a witness or notary public. Include the printed names of all parties next to their signatures.

Completing a Pennsylvania Real Estate Purchase Agreement with care not only facilitates a fair and transparent transaction but also helps to protect the interests of all parties involved. It's advisable for both buyers and sellers to consult with a real estate attorney or professional before finalizing the document to ensure their rights are well represented and all legal requirements are met.

Understanding Pennsylvania Real Estate Purchase Agreement

What is a Pennsylvania Real Estate Purchase Agreement?

A Pennsylvania Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions between a buyer and a seller for the purchase of real estate in Pennsylvania. This agreement includes details such as the purchase price, property description, financing terms, and any conditions that must be met before the sale can be completed.

Who needs to sign the Pennsylvania Real Estate Purchase Agreement?

The Pennsylvania Real Estate Purchase Agreement must be signed by the buyer(s) and the seller(s) involved in the transaction. If the property is owned by more than one person or is being bought by multiple people, each party must sign the agreement to ensure its legality and enforceability.

What happens if a buyer or seller backs out of a Pennsylvania Real Estate Purchase Agreement?

If a party backs out of a Pennsylvania Real Estate Purchase Agreement without legal justification or outside of any contingency clauses, they may face legal consequences. This could include forfeiting earnest money deposits for buyers or facing a lawsuit for specific performance or damages by sellers. Each situation varies, so it's essential to understand the terms of the agreement and seek legal advice if needed.

Are there any contingencies that should be included in the agreement?

Common contingencies in a Pennsylvania Real Estate Purchase Agreement include financing, home inspections, and appraisals. These conditions protect both the buyer and seller by allowing the transaction to be voided if certain criteria aren't met, such as the buyer obtaining a mortgage or the home passing a professional inspection.

How does the closing process work with a Pennsylvania Real Estate Purchase Agreement?

The closing process begins once all conditions of the Pennsylvania Real Estate Purchase Agreement are satisfied. During closing, the title of the property is transferred from the seller to the buyer, and the buyer completes the payment of the purchase price. This typically involves both parties, their legal representatives, and a closing agent. Closing documents and keys are exchanged, and the buyer officially becomes the property owner.

Is a real estate agent required to use the Pennsylvania Real Estate Purchase Agreement?

While a real estate agent is not legally required to use the Pennsylvania Real Estate Purchase Agreement, involving professionals can help navigate the complexities of buying or selling property. Real estate agents are familiar with the legal requirements and can ensure that the agreement is appropriately executed and filed, protecting the interests of all parties involved.

Common mistakes

In the process of filling out a Pennsylvania Real Estate Purchase Agreement, many individuals encounter pitfalls that can lead to delays, misunderstandings, or even legal challenges. These mistakes can often be avoided with attention to detail and an understanding of the document's importance. One common error is neglecting to verify the accuracy of the property's legal description. This description is crucial, as it ensures the precise location and boundaries of the property are clearly defined. Any inaccuracies can lead to disputes over what property is actually being sold.

Another oversight is failing to specify the fixtures and personal property that will remain with the home after the sale. Items such as appliances, light fixtures, and window treatments can become points of contention if not clearly listed in the agreement. Without a detailed list, the buyer and seller might have conflicting expectations about what is included in the sale, potentially leading to disputes or the need for additional negotiations.

Not setting a clear deadline for the offer's acceptance is a further mistake that can complicate the buying process. Without a defined expiration date for the offer, the seller may delay responding, leaving the buyer in limbo and possibly missing out on other opportunities. This lack of clarity can strain the buyer-seller relationship before the transaction even proceeds.

Underestimating the importance of the financing terms outlined in the agreement is yet another error. Buyers should ensure that the agreement specifies the type of financing they plan to use and that there is a contingency clause that allows for the cancellation of the purchase should the financing not be approved. Failing to include such details can result in the buyer being legally bound to purchase the property without the means to do so, leading to legal and financial repercussions.

Buyers and sellers alike sometimes skip the step of confirming the presence of an inspection contingency. This oversight restricts the buyer's ability to negotiate repairs or back out of the deal if significant issues are discovered during the home inspection. Including this contingency protects the buyer from unforeseen costs and complications.

Another common mistake is inaccurately calculating the closing costs and who is responsible for each cost. Misunderstandings about who pays for what can cause delays or resentment between the parties involved. It's vital to clearly outline these responsibilities in the agreement to avoid unexpected financial disputes at closing.

Not obtaining a thorough understanding of 'as is' clauses can also lead to buyer dissatisfaction. If the property is being sold 'as is,' the buyer generally assumes the risk for any necessary repairs after purchase. Overlooking this clause might leave the buyer unprepared for the condition of the property.

Additionally, ignoring the need for a clear title can lead to significant legal complications down the road. Ensuring that the property title is free of liens and disputes is essential for a smooth transfer of ownership. Failure to verify a clear title can entangle the new homeowner in legal battles that could have been avoided.

Lastly, neglecting to consult with a real estate attorney before finalizing the purchase agreement is a misstep. While the document may seem straightforward, the implications of its terms can be complex. Professional legal advice can help prevent future legal troubles by ensuring that the agreement safeguards the interests of all parties involved.

Documents used along the form

When entering into a real estate transaction in Pennsylvania, the Real Estate Purchase Agreement is a central document that outlines the terms and conditions of the sale. However, this agreement often necessitates accompanying forms and documents to ensure a thorough and legally sound process. The following is a list of documents commonly used alongside the Real Estate Purchase Agreement to facilitate a smooth property transaction.

- Seller's Property Disclosure Statement: This document is provided by the seller, disclosing the condition of the property and any known defects or problems. It is crucial for informing the buyer about the state of the property being sold.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law. It informs buyers about the presence of lead-based paint in the property.

- Home Inspection Report: Conducted by a professional home inspector, this report provides an in-depth look at the condition of the property, including structural, electrical, and plumbing systems.

- Loan Application Form: If the purchase is being financed, the buyer will need to complete a loan application form with a lender to secure mortgage financing.

- Title Insurance Policy: This policy protects both the buyer and the lender from potential losses resulting from defects in the title to the property.

- Property Appraisal Report: This report is generated by a licensed appraiser and provides an estimate of the property's market value.

- Property Survey: A survey delineates the boundaries of the property, highlighting its dimensions, and any encroachments or easements.

- Closing Disclosure: This is a detailed statement of the final loan terms and closing costs, which the buyer must receive at least three business days before the closing date.

Each of these documents plays a vital role in the real estate transaction process, providing transparency, security, and compliance with legal standards. Together with the Real Estate Purchase Agreement, they form the backbone of a real estate transaction, ensuring that both the buyer and the seller are well-informed and protected every step of the way.

Similar forms

The Pennsylvania Real Estate Purchase Agreement form shares similarities with the Residential Lease Agreement. Both documents outline the terms and conditions binding the parties involved in a transaction related to property. However, while the purchase agreement deals with the sale and transfer of ownership of real estate, the lease agreement focuses on the terms under which one party may occupy or use the property for a predetermined period.

Another document similar to the Pennsylvania Real Estate Purchase Agreement is the Bill of Sale. This document also serves as a written record of a transaction between a seller and a buyer. However, Bills of Sale are typically used for the purchase of personal property, like vehicles or equipment, rather than real estate, detailing the sale of specific items from one party to another and the terms of their transfer.

The Land Contract is akin to the Real Estate Purchase Agreement, as both are involved in the sale and purchase of real estate. A Land Contract, however, is a form of seller financing where the buyer makes payments to the seller for the property over time, and the title remains with the seller until all payments are made. Conversely, a Real Estate Purchase Agreement typically involves immediate transfer of ownership contingent on financing from a third party, such as a bank.

An Earnest Money Agreement often accompanies a Real Estate Purchase Agreement. This document evidences the buyer's good faith and intent to proceed with the property purchase, typically involving a deposit that will be applied to the purchase price. While it is a separate agreement, it is a critical component of real estate transactions, underscoring the buyer's seriousness about the transaction.

The Option to Purchase Agreement is somewhat related to a Real Estate Purchase Agreement, offering a right, but not an obligation, to buy a property within a specified time frame. This contrasts with a purchase agreement, which is a binding contract for the sale and purchase once signed by both parties. The option gives the holder the ability to secure a property at agreed terms while still allowing time to arrange finances or other contingencies.

Comparably, the Right of First Refusal Agreement is somewhat similar to the Real Estate Purchase Agreement. This document gives one party the opportunity to enter a transaction under specific conditions before the property is offered to anyone else. Although it doesn't guarantee a sale like a purchase agreement does, it ensures the holder is front in line should the owner decide to sell.

A Mortgage Agreement shares characteristics with the Real Estate Purchase Agreement in the context of property transactions. It outlines the borrower's promise to repay a loan used to purchase the property, securing the loan by pledging the property as collateral. While a purchase agreement facilitates the sale of the property, a mortgage agreement details the financing aspect, essential for completing many real estate transactions.

Similar to a Real Estate Purchase Agreement, a Property Management Agreement establishes the terms for managing a property on behalf of the owner, involving tasks such as maintenance, leasing, and tenant relations. While it primarily concerns the operation of a property post-purchase, it reflects the procedural and contractual nature of agreements governing the use and care of real estate assets.

Lastly, the Home Inspection Report, while not a contract, bears relevance to the Real Estate Purchase Agreement process. It provides a detailed assessment of a property's condition before the sale is finalized. It can influence the terms of the purchase agreement, including adjustments in price or conditions that need to be met before the sale proceeds. This document ensures informed decisions are made by all parties in a real estate transaction.

Dos and Don'ts

Filling out the Pennsylvania Real Estate Purchase Agreement form is a significant step in the process of buying or selling property. It outlines the terms and conditions of the sale, making it crucial for both parties to approach this document with care and attentiveness. Here are ten things you should and shouldn't do to ensure the process goes smoothly.

What You Should Do

- Ensure all parties have a clear understanding of the agreement's terms before signing.

- Double-check the legal descriptions of the property to ensure accuracy.

- Include any contingencies that protect both the buyer and the seller, such as financing approvals and property inspections.

- Document all financial details, including the purchase price, deposit amounts, and who is responsible for specific closing costs.

- Specify dates clearly, such as the offer expiration date, closing date, and possession date.

- Keep records of all communications and amendments related to the agreement.

- Review local and state laws to ensure the agreement complies with regulatory requirements.

- Use clear, unambiguous language to avoid misunderstandings.

- Seek the assistance of a legal professional if any part of the agreement is unclear.

- Ensure that all parties sign and date the agreement and keep a copy for your records.

What You Shouldn't Do

- Avoid rushing through the process without understanding every term and condition.

- Do not leave any fields blank. If something doesn't apply, mark it as N/A (not applicable).

- Refrain from making verbal agreements that contradict the written agreement.

- Avoid using vague or ambiguous terms that could be misinterpreted later.

- Do not skip having the agreement reviewed by a professional if you're unsure about legal or technical terms.

- Refrain from omitting any required disclosures about the property's condition or history.

- Avoid signing the agreement without the presence of all necessary parties.

- Do not forget to include a provision for what happens in the event of a breach of contract.

- Avoid assuming standard forms cover all specific needs or legal requirements of your transaction.

- Do not neglect to update the agreement if any terms change before closing.

Misconceptions

Understanding the Pennsylvania Real Estate Purchase Agreement is crucial for anyone entering the state's real estate market. However, misconceptions about this legal document are common. Let's clarify some of the most widespread inaccuracies.

It's Just a Standard Form: Many people think the Pennsylvania Real Estate Purchase Agreement is a simple, standard document where one size fits all. However, it's customizable and should reflect the specific terms agreed upon between the buyer and seller. Each transaction is unique, and the agreement can be tailored to fit the specific needs of the parties involved.

Attorney Review Isn't Necessary: Another common misconception is that lawyer review isn't required. While Pennsylvania law does not mandate an attorney's review, consulting with a legal professional can help ensure that the agreement accurately reflects the terms and protects the rights of all parties involved.

Oral Agreements are Just as Binding: People often assume that an oral agreement to sell or buy real estate is enforceable. In Pennsylvania, the Statute of Frauds requires that contracts for the sale of real estate must be in writing to be enforceable. Relying on a handshake deal can lead to significant legal and financial complications.

All Deposits Are Non-Refundable: It's a common belief that all deposits made when an offer is accepted are non-refundable. The truth is whether a deposit is refundable depends on the terms stated in the Real Estate Purchase Agreement. Certain conditions may allow a buyer to recover their deposit.

Home Inspections Aren't Important: Some people underestimate the value of a home inspection clause. Including a condition that the sale is contingent upon a satisfactory home inspection can provide the buyer with protection against unforeseen issues and the option to renegotiate or withdraw without penalty if significant problems are discovered.

Sellers Must Fix All Discovered Problems: There's a belief that sellers are obligated to fix every issue discovered during the home inspection. In reality, the agreement dictates the negotiations. Buyers can request repairs, price adjustments, or credits, but sellers aren't required to agree unless specified in the contract.

The Agreement is Only Concerned With Price: While price is a critical component, the Real Estate Purchase Agreement covers much more. It includes terms about the timeline, contingencies, which fixtures and appliances are included, and other essential details that impact both the buyer's and seller's decisions and responsibilities.

Signing the Agreement Finalizes the Sale: Signing the agreement is a significant step, but it's not the final one. The transaction is only completed after all contingencies have been met, the financing is secured, the title is clear, and the closing documents are signed and recorded. Until then, both parties have responsibilities to fulfill to ensure the sale concludes successfully.

Understanding these nuances about the Pennsylvania Real Estate Purchase Agreement can make a significant difference in the buying or selling process, potentially saving time, money, and legal headaches.

Key takeaways

When filling out and using the Pennsylvania Real Estate Purchase Agreement form, there are several key takeaways to keep in mind to ensure the process goes smoothly. This document is critical, as it outlines the terms and conditions of the sale of real estate in the state of Pennsylvania.

- Accuracy is key. Ensure all information provided in the form is accurate, including the names of the buyer and seller, property details, and the agreed-upon price. Mistakes can lead to misunderstandings or legal complications.

- Understand the terms. Both parties should thoroughly understand all the terms outlined in the agreement, including obligations, contingencies, and timelines. This understanding helps prevent disputes and ensures a smooth transaction.

- Legal advice is beneficial. Consider consulting with a legal professional before signing the agreement. They can provide valuable advice, clarify terms, and ensure your rights are protected.

- Disclosures are important. The seller must disclose certain information about the property's condition and history, which can significantly affect the buyer's decision. Make sure all required disclosures are completed and included with the agreement.

- Review contingencies carefully. Contingencies can affect both the buyer's and seller's ability to back out of the sale under specific conditions. Understanding these provisions is crucial for both parties.

- Closing details matter. Pay close attention to the closing date, final sale price, and any conditions that must be met before the sale is finalized. This can include home inspections, financing, and appraisals.

By paying attention to these aspects, parties involved in the transaction can ensure the real estate purchase agreement in Pennsylvania is filled out and used effectively, leading to a successful property transfer.

More Real Estate Purchase Agreement State Forms

Nys Real Estate Contract - Details on how any disputes between the buyer and seller will be resolved are specified.

Georgia Real Estate Contract - Provisions for the resolution of disputes between the buyer and seller, often through mediation or arbitration, are outlined in the document.