Official Owner Financing Contract Document

When purchasing a home, the path to homeownership can take various forms, each tailored to meet the unique needs and circumstances of the buyer and seller. Among these options is an owner financing agreement, a distinctive method that allows a buyer to purchase a home directly from the seller, bypassing the conventional bank mortgage process. This arrangement holds particular appeal for buyers who may not qualify for traditional financing due to credit issues or other financial barriers. For sellers, it offers a potential increase in the pool of buyers and, possibly, a quicker sale. Yet, navigating an owner financing contract demands a comprehensive understanding of its components, such as the interest rate, payment schedule, and terms regarding default and foreclosure, to safeguard the interests of both parties. Furthermore, it's essential to recognize the legal implications, including how the title transfer is handled and the necessity for a promissory note that outlines the loan's repayment conditions. This approach to buying a home can provide a flexible and accessible path for many, but it requires careful consideration and thorough preparation to ensure a successful and fair transaction for all involved parties.

Document Example

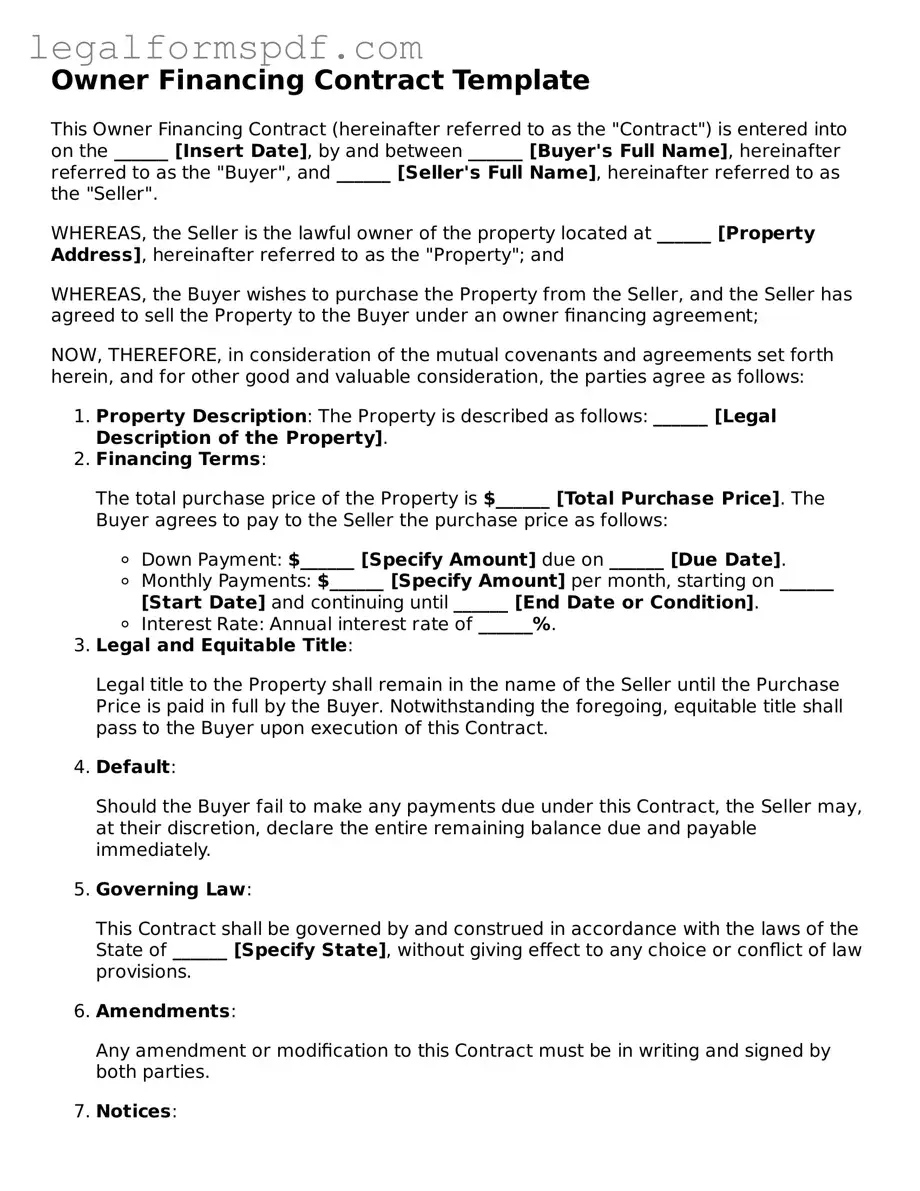

Owner Financing Contract Template

This Owner Financing Contract (hereinafter referred to as the "Contract") is entered into on the ______ [Insert Date], by and between ______ [Buyer's Full Name], hereinafter referred to as the "Buyer", and ______ [Seller's Full Name], hereinafter referred to as the "Seller".

WHEREAS, the Seller is the lawful owner of the property located at ______ [Property Address], hereinafter referred to as the "Property"; and

WHEREAS, the Buyer wishes to purchase the Property from the Seller, and the Seller has agreed to sell the Property to the Buyer under an owner financing agreement;

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the parties agree as follows:

- Property Description: The Property is described as follows: ______ [Legal Description of the Property].

- Financing Terms:

The total purchase price of the Property is $______ [Total Purchase Price]. The Buyer agrees to pay to the Seller the purchase price as follows:

- Down Payment: $______ [Specify Amount] due on ______ [Due Date].

- Monthly Payments: $______ [Specify Amount] per month, starting on ______ [Start Date] and continuing until ______ [End Date or Condition].

- Interest Rate: Annual interest rate of ______%.

- Legal and Equitable Title:

Legal title to the Property shall remain in the name of the Seller until the Purchase Price is paid in full by the Buyer. Notwithstanding the foregoing, equitable title shall pass to the Buyer upon execution of this Contract.

- Default:

Should the Buyer fail to make any payments due under this Contract, the Seller may, at their discretion, declare the entire remaining balance due and payable immediately.

- Governing Law:

This Contract shall be governed by and construed in accordance with the laws of the State of ______ [Specify State], without giving effect to any choice or conflict of law provisions.

- Amendments:

Any amendment or modification to this Contract must be in writing and signed by both parties.

- Notices:

All notices, requests, demands, and other communications under this Contract shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing, if mailed to the party to whom notice is to be given, at their address as provided in this Contract.

- Binding Effect:

This Contract shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, legal representatives, successors, and assigns.

- Entire Agreement:

This Contract constitutes the entire agreement between the parties pertaining to the subject matter contained in it and supersedes all prior and contemporaneous agreements, representations, and understandings of the parties. No supplement, modification, or amendment of this Contract shall be binding unless executed in writing by all parties.

IN WITNESS WHEREOF, the parties have executed this Contract as of the date first above written.

Seller's Signature: _______________________ Date: ______ [Insert Date]

Buyer's Signature: _______________________ Date: ______ [Insert Date]

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | Owner financing contracts allow sellers to finance the purchase of a property directly to the buyer. |

| 2 | These contracts eliminate the need for buyers to obtain traditional financing through a bank or other financial institution. |

| 3 | Interest rates in owner financing contracts can be negotiated between the buyer and seller and may differ from market rates. |

| 4 | Payment terms, such as the down payment, monthly payment amount, and the duration of the loan, are also subject to negotiation. |

| 5 | Owner financing contracts typically include a balloon payment clause, requiring the buyer to pay off the remaining balance at a specific time. |

| 6 | If a buyer defaults on the contract, the seller may retain the property and any payments made up to that point. |

| 7 | The contract must comply with federal and state laws, which can vary significantly from one state to another. |

| 8 | Some states require owner financing contracts to be recorded with the local government, similar to traditional mortgage agreements. |

| 9 | The use of an escrow service is often recommended to handle the exchange of funds and documentation, ensuring both parties' interests are protected. |

| 10 | Certain tax implications for both buyer and seller may arise from an owner financing arrangement, impacting the overall cost or benefit. |

Instructions on Writing Owner Financing Contract

When entering an owner financing agreement, clarity, accuracy, and understanding between the buyer and seller are paramount. Such agreements offer a pathway towards home ownership for buyers unable to secure traditional mortgage financing, while providing sellers with a potential income stream. However, the complexity of this transaction underscores the importance of the owner financing contract, a legally binding document that outlines the terms and conditions of the sale. Completing this form requires careful attention to detail and a thorough understanding of the agreement's specifics.

- Begin by stating the full legal names of both the buyer and the seller. Ensure the spelling matches other legal documents to avoid potential discrepancies.

- Specify the address of the property being sold, including the city, state, and zip code, to ensure there is no confusion about the location of the property in question.

- Detail the financial terms, starting with the sale price of the property. This is followed by the down payment amount and the resulting balance to be financed.

- Document the interest rate agreed upon for the financing. It's crucial this matches what was discussed to avoid future disputes. Remember, this rate must comply with state usury laws.

- Clarify the loan's duration, specifying the number of years or months until the full amount is due. Include any provisions for balloon payments or early payoff penalties.

- Outline the monthly payment amount, including principal and interest. If applicable, itemize any included amounts for insurance and property taxes.

- Enumerate any additional responsibilities of the buyer, such as maintenance, insurance, and tax obligations. Explicitly stating these responsibilities will prevent misunderstandings.

- Include a clause about the default process. It should detail what constitutes a default and the steps for remedy or property reclamation by the seller.

- Signify a section for legal descriptions and any pertinent attachments. These might include property inspections, agreed-upon repairs, or other conditions of the sale.

- Conclude with signature lines for the buyer, seller, and a witness or notary public. Make sure the date of signing is clearly written to mark the agreement's commencement.

After completing the form, both parties should review the document thoroughly, ensuring that all information is accurate and reflects their understanding of the terms. Each party should retain a copy for their records. This contract serves not only as a record of the sale but also as a guidepost for the relational and financial arrangements agreed upon. It’s a testament to the parties' commitment to a mutual goal and a foundation for their financial interaction concerning the property.

Understanding Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legal document that outlines the agreement between a seller and a buyer for the purchase of property, where the seller provides the financing for the buyer instead of a traditional lender like a bank. This type of contract can offer more flexible terms for both parties and is often used when the buyer may not qualify for a traditional mortgage.

What are the key components of an Owner Financing Contract?

The key components of an Owner Financing Contract typically include the sale price of the property, the down payment amount, the interest rate, the length of the loan term, payment amounts and schedule, and any other conditions or terms agreed upon by both parties. It should also detail the responsibilities of both the buyer and the seller regarding property taxes, insurance, and maintenance.

How is the interest rate determined in an Owner Financing Contract?

The interest rate in an Owner Financing Contract is negotiated between the buyer and the seller. It often depends on the seller's requirements, the buyer's creditworthiness, the local real estate market conditions, and current traditional mortgage rates. However, it's crucial that the agreed-upon rate is fair and complies with state usury laws to avoid legal issues.

What are the benefits of using an Owner Financing Contract?

Owner Financing Contracts offer benefits for both buyers and sellers. Buyers can avoid the stringent requirements and fees of traditional lenders, and may negotiate more flexible terms. Sellers can potentially sell their property faster, often at a higher price, and earn interest on the loan. It's an effective method to create a win-win situation for both parties involved.

Are there any risks involved with Owner Financing?

Yes, there are risks for both the buyer and the seller. The buyer may pay a higher interest rate compared to traditional mortgages and risks losing their investment if they default on payments. For sellers, the primary risk is the buyer's default, which could require initiating foreclosure proceedings to regain ownership of the property. Proper vetting and legal advice can mitigate these risks.

Can the buyer sell the property before the Owner Financing Contract is fully paid off?

Yes, a buyer can sell the property before the contract is fully paid off, but this usually requires the seller's approval and may be subject to specific terms in the contract. The original owner financing terms may allow for a due-on-sale clause that requires the buyer to pay off the remaining balance upon selling the property.

What happens if the buyer defaults on the Owner Financing Contract?

If the buyer defaults on the Owner Financing Contract, the seller may have the right to reclaim the property through foreclosure, depending on the terms of the contract. The specific legal steps and rights in the case of default should be clearly outlined in the contract to protect both parties.

Do both parties need a lawyer for an Owner Financing Contract?

While not always legally required, it is highly recommended that both parties engage with a lawyer when drafting and finalizing an Owner Financing Contract. A lawyer can help ensure that the contract complies with all state laws and regulations, advise on potential risks, and ensure that the terms are clear and enforceable.

How can an Owner Financing Contract be terminated early?

An Owner Financing Contract can be terminated early if both the buyer and the seller agree to the termination and its terms. This could involve the buyer refinancing the remaining balance with a traditional mortgage or paying off the balance in full. Alternatively, if the contract includes specific clauses allowing for early termination under certain conditions, those clauses would dictate the process.

Common mistakes

When individuals decide to navigate the complexities of buying or selling real estate through owner financing, they are often stepping into an arena that requires careful attention to detail and a deep understanding of the contract they are about to sign. A common mistake is overlooking the importance of specifying all the terms clearly. This includes not just the principal amount or the interest rate, but also the repayment schedule, late payment fees, and conditions under which the contract might be considered in default. Leaving these terms vague can lead to disputes that could have been easily avoided with more precise language.

Another area where people frequently falter is in failing to conduct a thorough due diligence process. This might mean not verifying the buyer's creditworthiness effectively or, from the buyer's perspective, not ensuring a clear title. Unfortunately, this lapse can lead to significant problems down the road, such as unexpected claims against the property or a buyer who defaults on their payments, leaving the seller in a difficult position.

A mistake that can have serious implications is not stipulating the procedures for addressing default and possession rights in the contract. Without a clear framework for resolving these issues, the parties may end up in a legal limbo that could have been prevented. It is crucial to outline the steps and legal recourses available should the buyer fail to make timely payments or otherwise violate the terms of the contract.

Not consulting with a legal professional is another oversight many people make. While it might seem like an unnecessary expense, having an expert review the contract can save a tremendous amount of time, money, and stress in the long run. A lawyer can identify potential issues, ensure the contract is in compliance with local and state laws, and offer advice on how to protect one's interests effectively.

Last but not least, many fail to properly record or register the contract with the relevant municipal or county office. This administrative step is crucial not only for tax purposes but also for establishing the legality of the sale and protecting both parties' interests in the event of a dispute. Neglecting this step can undermine the legal standing of the agreement, potentially leading to challenges that could threaten the ownership or financing arrangement.

Documents used along the form

When buyers and sellers decide upon owner financing arrangements for real estate transactions, they often rely on the Owner Financing Contract form as a cornerstone document. However, this form does not exist in isolation. To create a complete legal framework for the transaction, parties typically need to incorporate several other documents. These additional forms help to clarify terms, safeguard interests, and comply with local, state, and federal laws.

- Promissory Note: This document complements the Owner Financing Contract by specifying the financial details of the transaction. It outlines the loan amount, interest rate, repayment schedule, and consequences of default. Essentially, it is a promise by the buyer to pay back the borrowed amount under agreed-upon terms.

- Deed of Trust or Mortgage: Depending on the state in which the property is located, either a deed of trust or a mortgage will be used. This document secures the loan by using the property as collateral. It grants the lender the right to foreclose on the property if the buyer fails to fulfill the repayment obligations.

- Title Report: Before finalizing the owner financing deal, a title report is essential to ensure the property is free of liens, encumbrances, or legal disputes. It provides a detailed history of the property, affirming the seller's legal right to finance the sale and informing the buyer of any issues that must be resolved before proceeding.

- Insurance Policies: Insurance documents are crucial in owner financing arrangements. These typically include homeowner’s insurance to protect against property damage and, in some cases, title insurance to protect the buyer against potential title defects. Both the buyer and seller should agree on the required policies and confirm their activation before closing the sale.

Collectively, these documents form an essential toolkit that complements the Owner Financing Contract, facilitating a secure and legally solid transaction. They serve to protect both parties’ interests, provide clear guidelines for the repayment of the loan, and help ensure a smooth and legally compliant transfer of property ownership. Understanding and correctly utilizing these forms not only helps in adhering to legal standards but also in forging a trust-based relationship between the buyer and seller. It's advisable for both parties to consult legal professionals before finalizing these documents to ensure their accuracy and legality.

Similar forms

An Owner Financing Contract is closely related to a Mortgage Agreement, as both are pivotal in real estate financing transactions. The primary function is to outline the loan's terms provided by the seller to finance the buyer's purchase of the property. Whereas a Mortgage Agreement involves a bank or financial institution lending the funds, an Owner Financing Contract allows the seller to step into this role, providing a direct financing option to the buyer with agreed terms of repayment.

Similarly, a Land Contract shares common ground with an Owner Financing Contract. A Land Contract details the sale of a property wherein the buyer makes payments to the seller in exchange for the deed to the property once the entire purchase price is paid. Like Owner Financing Contracts, Land Contracts offer an alternative to traditional financing but differ in that the title remains with the seller until the full purchase price is received.

A Promissory Note is another document that resembles an Owner Financing Contract by specifying the borrower's promise to repay a debt. It outlines the amount borrowed, interest rates, repayment schedule, and consequences of default. While a Promissory Note can be used for various types of loans, it is an essential component of owner financing, detailing the buyer's obligation to the seller.

The Deed of Trust is yet another document that parallels the Owner Financing Contract in some jurisdictions. This document involves three parties: the borrower, the lender, and a trustee, and it secures the loan by transferring the property's legal title to the trustee until the loan is paid in full. In owner-financed transactions, the seller acts as the lender, playing a crucial role similar to that in a traditional mortgage financing setup but with the added security of a trustee.

An Amortization Schedule, often included within or alongside an Owner Financing Contract, represents a detailed table of regular loan payments over time, breaking down each payment into principal and interest. This document is crucial for both parties to understand the loan's lifecycle, how each payment affects the loan balance, and the timeline for ownership transfer.

A Loan Agreement shares similarities with an Owner Financing Contract, focusing on the terms and conditions under which the loan is provided. While a Loan Agreement can encompass various types of loans, its relevance to owner financing lies in its detailed conditions of repayment, interest rates, and collateral, ensuring both parties are protected and have a clear understanding of their financial commitments.

The Right of Recission document is tangential but relevant, offering buyers a period to cancel a transaction without penalty under specific circumstances, typically within three days of the transaction. Though more common in refinancing agreements, it touches on the notion of buyer protection, a concept that also underlines the Owner Financing Contract by ensuring the buyer understands and agrees to the terms willingly and without duress.

Lastly, the Closing Statement, or HUD-1, is akin to the Owner Financing Contract in the real estate transaction process, providing an itemized list of all the costs and fees paid by the buyer and seller at closing. This document is vital in owner financing transactions, as it includes the initial down payment and any other financial terms agreed upon, confirming the transparency and mutual understanding of all costs involved.

Dos and Don'ts

Filling out the Owner Financing Contract form requires careful attention to detail. Ensuring the document is filled out correctly can prevent future disputes and legal complications. Here are nine things you should and shouldn't do:

- Do thoroughly review the entire form before filling it out. Understanding every section will help you provide accurate information.

- Do not rush through the process. Taking your time can prevent mistakes that might be difficult to correct later.

- Do use clear, legible handwriting if filling out the form by hand. Poor handwriting can lead to misunderstandings or misinterpretations.

- Do not leave any sections blank. If a section does not apply, write "N/A" to indicate this. Blank sections could be interpreted as incomplete information.

- Do verify all the numbers and calculations. This includes interest rates, payment schedules, and any other financial details.

- Do not guess or estimate figures. Verify all financial information and double-check your entries for accuracy.

- Do keep a copy of the completed form for your records. Having a copy can be invaluable if there are questions or disputes in the future.

- Do not sign the form without reading and understanding every clause. If there's something you don't understand, seek clarification.

- Do seek professional advice if necessary. A legal or financial expert can provide valuable guidance and ensure the form is filled out correctly.

Misconceptions

Owner financing, an alternative to traditional mortgage lending, is often misunderstood. Various misconceptions surround the Owner Financing Contract form, leading both buyers and sellers to approach these transactions with misplaced expectations or apprehensions. It is crucial to dispel these myths for a clear understanding of what owner financing entails.

- Misconception 1: The Owner Financing Contract is simpler than traditional mortgage documents. Despite the appeal of bypassing banks, these contracts involve complex legal obligations and rights. They require due diligence to protect all parties involved.

- Misconception 2: Owner financing is only for buyers with poor credit. While it provides an alternative for those struggling to secure traditional financing, it also benefits buyers looking for flexible terms and sellers aiming for a quicker sale or seeking to maximize investment returns.

- Misconception 3: The terms of owner financing contracts are not negotiable. Like any contract, terms are fully negotiable between buyer and seller, covering interest rates, repayment periods, and down payment requirements.

- Misconception 4: There's no need for a down payment. While terms vary widely, sellers often require a down payment to protect their equity and commitment in the property.

- Misconception 5: Interest rates on owner-financed loans are always higher than those of banks. The interest rate is negotiable and can be competitive with traditional lenders, depending on the risk assessment of the seller and the negotiation between the parties.

- Misconception 6: The seller retains property ownership until the loan is fully paid. Legally, the buyer holds the title from the point of sale, although the seller may hold a lien against the property as security for the loan.

- Misconception 7: Owner financing is unregulated. These transactions are subject to state laws, including usury laws limiting interest rates, and specific legal requirements to protect both buyer and seller.

- Misconception 8: Owner Financing Contracts aren’t secure. With proper due diligence, legal advice, and the correct contractual clauses, these agreements can offer security and protection similar to traditional financing methods.

- Misconception 9: There are no tax benefits to owner financing. Both parties may benefit from tax advantages: sellers can potentially defer capital gains tax, while buyers might deduct mortgage interest, depending on their financial situation and structuring of the deal.

- Misconception 10: Foreclosure is not an option in owner financing. Should the buyer default, the seller has the legal right to foreclose on the property, pursuing a similar process to that of traditional lenders, albeit governed by the terms of the owner financing agreement.

Understanding these aspects of Owner Financing Contracts is vital for anyone considering this form of property transaction. Both buyers and sellers should seek competent legal advice to navigate the complexities and ensure a secure, fair agreement that meets their needs.

Key takeaways

When engaging in a real estate transaction with owner financing, the Owner Financing Contract Form becomes a critical document that outlines the agreement between the buyer and seller regarding the terms of the property’s purchase. Here are six key takeaways to consider when filling out and using this form:

- Understanding the Terms: It is essential for both parties to fully understand and agree upon the terms of the contract, including the interest rate, repayment schedule, and any other financial obligations. These terms should be clearly stated to avoid any future disputes.

- Legal Compliance: The contract must comply with all state and federal laws. This includes adhering to regulations regarding interest rates, lending practices, and real estate transactions. Consulting with a legal professional can help ensure compliance.

- Property Description: A detailed description of the property being sold is crucial. This should include the physical address, legal description, and any other identifying information to ensure there is no confusion about the real estate in question.

- Responsibility for Expenses: The contract should clearly lay out who is responsible for expenses related to the property, such as taxes, insurance, and maintenance. Clarifying these responsibilities can prevent misunderstandings and potential legal issues down the line.

- Default and Remedies: The contract must specify what constitutes a default and outline the remedies available to both parties. This may include the right to foreclose on the property for the seller or options for the buyer to cure the default.

- Signing and Witnesses: To be legally binding, the Owner Financing Contract Form must be signed by both parties. Depending on state laws, the signing may need to be witnessed or notarized. Ensuring that these formalities are correctly followed can affect the enforceability of the contract.

By paying close attention to these key points, individuals can navigate the complexities of owner financing with greater confidence and security. The goal is to create a transparent and fair agreement that protects the interests of both the buyer and the seller.

Consider More Types of Owner Financing Contract Forms

Purchase Agreement Addendum - This form can be drafted to include contingencies that must be met before the sale can be completed, such as selling an existing home.