Fillable Real Estate Purchase Agreement Document for North Carolina

In the complex and often intricate sphere of real estate transactions, the North Carolina Real Estate Purchase Agreement stands as a cornerstone document, pivotal in both its scope and function. This form, meticulously crafted to comply with the state's laws, establishes the terms under which real estate property is sold and purchased in North Carolina, embodying the essence of the agreement between buyer and seller. It details critical elements such as the offer price, financing conditions, inspections to be completed, closing dates, and any contingencies that may affect the final sale. By doing so, it not only defines the rights and responsibilities of each party involved but also serves as a binding legal contract once signed, providing a clear pathway through the transaction process. The form's comprehensive nature ensures that all relevant aspects of the deal are addressed, promoting transparency and fostering a sense of security for both parties as they navigate through the complexities of transferring property ownership.

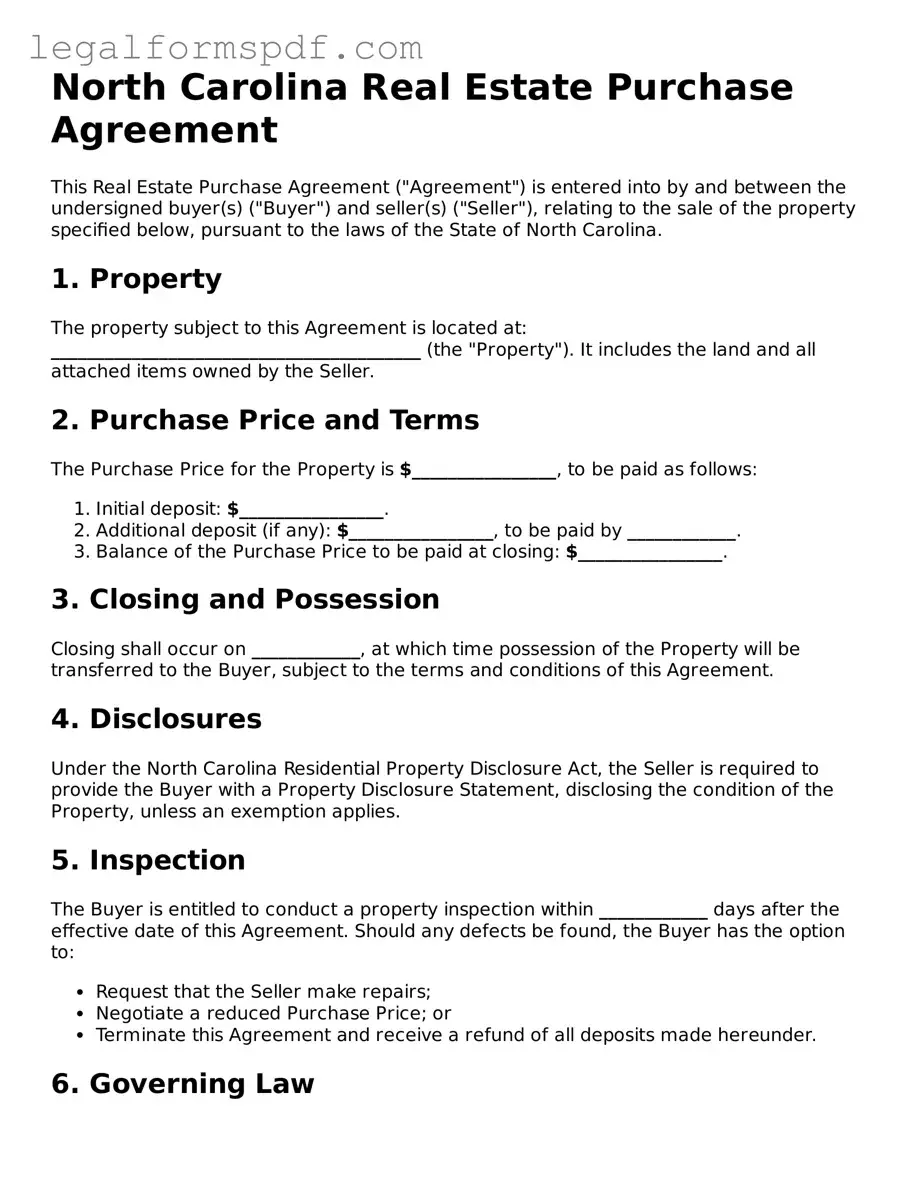

Document Example

North Carolina Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the undersigned buyer(s) ("Buyer") and seller(s) ("Seller"), relating to the sale of the property specified below, pursuant to the laws of the State of North Carolina.

1. Property

The property subject to this Agreement is located at: _________________________________________ (the "Property"). It includes the land and all attached items owned by the Seller.

2. Purchase Price and Terms

The Purchase Price for the Property is $________________, to be paid as follows:

- Initial deposit: $________________.

- Additional deposit (if any): $________________, to be paid by ____________.

- Balance of the Purchase Price to be paid at closing: $________________.

3. Closing and Possession

Closing shall occur on ____________, at which time possession of the Property will be transferred to the Buyer, subject to the terms and conditions of this Agreement.

4. Disclosures

Under the North Carolina Residential Property Disclosure Act, the Seller is required to provide the Buyer with a Property Disclosure Statement, disclosing the condition of the Property, unless an exemption applies.

5. Inspection

The Buyer is entitled to conduct a property inspection within ____________ days after the effective date of this Agreement. Should any defects be found, the Buyer has the option to:

- Request that the Seller make repairs;

- Negotiate a reduced Purchase Price; or

- Terminate this Agreement and receive a refund of all deposits made hereunder.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of North Carolina.

7. Signatures

This Agreement is effective upon the signature of both parties.

Buyer's Signature: __________________________________ Date: ______________

Seller's Signature: __________________________________ Date: ______________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The North Carolina Real Estate Purchase Agreement is a legally binding document used for the purchase and sale of real property in the state of North Carolina. |

| 2 | This agreement outlines the terms and conditions agreed upon by both the buyer and the seller, including but not limited to the purchase price, property description, and closing details. |

| 3 | Governing Law: The North Carolina Real Estate Purchase Agreement is governed by North Carolina General Statutes, particularly those pertaining to real estate transactions. |

| 4 | All parties involved must provide full disclosure regarding the physical condition of the property, adhering to North Carolina's residential property disclosure requirements. |

| 5 | Upon agreement, a due diligence period is commonly set to allow the buyer to conduct inspections and review the property title, during which the buyer may withdraw from the contract under specified conditions. |

| 6 | Closing costs and procedures are detailed within the agreement, specifying which party is responsible for certain expenses and indicating any escrow arrangements. |

| 7 | Amendments or addendums to the agreement must be agreed upon in writing by both the buyer and the seller to be legally binding. |

Instructions on Writing North Carolina Real Estate Purchase Agreement

Filling out a real estate purchase agreement is a significant step when buying or selling property in North Carolina. This document outlines the terms and conditions of the sale, ensuring both the buyer and seller are on the same page. Completing this form correctly is crucial to avoid any potential issues down the line, and knowing what comes next can help keep the process smooth. Once the form is fully completed and signed, it’s typically followed by a period of due diligence, where the buyer may conduct inspections and review any association rules or local regulations. Afterward, if all conditions are met satisfactorily, the closing process begins, culminating in the transfer of ownership.

- Gather all necessary information, including the full names and contact details of both the buyer and seller, and a legal description of the property being sold.

- Enter the agreed-upon purchase price of the property in the designated section.

- Specify the terms of the deposit, including the amount and the institution holding the funds.

- Outline any items that will be included or excluded from the sale, such as appliances, fixtures, or furniture.

- Detail the inspection requirements and any other conditions that must be satisfied before the sale can proceed.

- Include financing details, stating how the buyer intends to pay for the property, whether through a mortgage, cash, or other means.

- Set a closing date, by which all transactions and document signings should be completed.

- State any contingencies that could void the agreement, such as the buyer’s inability to secure financing or unsatisfactory inspection results.

- Review the agreement thoroughly to ensure all information is correct and complete. Both the buyer and seller should initial each page, indicating their agreement with the terms as presented.

- Sign and date the document in the presence of a notary public or attorney, along with any required witnesses. Ensure both parties receive a copy of the signed agreement.

Getting through the paperwork is a big step, but it's just one part of the process. After completing the North Carolina Real Estate Purchase Agreement, each party should prepare for the next stages, which may involve more documentation, meetings, and legal checks. This preparation ensures that the path to closing the sale is as smooth and swift as possible, allowing both buyer and seller to look forward to the successful completion of their transaction.

Understanding North Carolina Real Estate Purchase Agreement

What is a North Carolina Real Estate Purchase Agreement?

A North Carolina Real Estate Purchase Agreement is a legal document used during the process of buying or selling property in North Carolina. This legally binding contract outlines the terms and conditions agreed upon by both the buyer and seller, including information such as the purchase price, property description, financing details, and any contingencies that need to be met before the sale is finalized.

Who needs to sign the North Carolina Real Estate Purchase Agreement?

The North Carolina Real Estate Purchase Agreement must be signed by both the buyer(s) and seller(s) to be considered legally binding. In some cases, if either the buyer or seller is a corporate entity or a partnership, a representative authorized to sign on behalf of the organization will also need to provide a signature.

Are there any disclosures required in North Carolina when selling property?

Yes. In North Carolina, sellers are required to complete a Residential Property and Owners' Association Disclosure Statement. This document requires sellers to disclose specific information regarding the condition of the property, including details about the structure, systems, and any homeowners' association (HOA) obligations. Certain sales, such as those between close family members or of new construction, may be exempt from these disclosure requirements.

What happens if either party wants to back out of the North Carolina Real Estate Purchase Agreement?

If either party wishes to back out of the agreement, the consequences depend on the terms outlined within the contract itself and the timing of the decision. Most agreements include contingencies that must be met for the sale to go through (such as financing approval or satisfactory property inspections). If these contingencies cannot be met, the agreement may be voided, and the earnest money deposit may be returned to the buyer. However, if one party simply changes their mind without a contractual basis, they could face legal repercussions or the forfeiture of the earnest money deposit.

Is an attorney required for real estate transactions in North Carolina?

While North Carolina law does not mandatorily require an attorney for real estate transactions, it is highly recommended to consult one. An attorney can provide valuable guidance throughout the purchasing process, helping to draft and review the purchase agreement, ensuring that all legal requirements are met, and facilitating the closing process. Some aspects of the transaction, such as title searches and the closing itself, typically involve legal representation in North Carolina.

How is the purchase price determined in the North Carolina Real Estate Purchase Agreement?

The purchase price in a North Carolina Real Estate Purchase Agreement is determined through negotiations between the buyer and seller. Once a price is agreed upon, it is documented in the agreement. This price can be influenced by various factors, including market conditions, the property's condition, and any included personal property or concessions from the seller, such as assistance with closing costs.

Can the North Carolina Real Estate Purchase Agreement be modified after it has been signed?

Yes, the North Carolina Real Estate Purchase Agreement can be modified after it has been signed, but any modifications must be agreed upon by both parties. Modifications are typically documented in writing and signed by both the buyer and seller, often in the form of an addendum to the original agreement. It is crucial that any changes are clearly documented to prevent future disputes.

Common mistakes

When stepping into the world of real estate transactions in North Carolina, navigating the Real Estate Purchase Agreement form is a pivotal step. However, this process is fraught with potential pitfalls that can lead to unnecessary headaches or, even worse, derail the transaction altogether. Understanding these common mistakes can save both buyers and sellers a great deal of stress.

One common mishap is not double-checking personal information. It might seem basic, but incorrect or incomplete names, addresses, and contact information can lead to significant delays. This is especially true if the errors aren't caught until deep into the transaction process. Ensuring that every piece of personal information is accurate and matches identification documents is crucial.

Another frequent error is not specifying the details of the property correctly. This includes the legal description of the property, not just the street address. The legal description encompasses the boundaries and dimensions of the property, which are critical for legal purposes. Overlooking these details can cause confusion and disputes later on.

Skipping over the contingency clauses is a mistake many people regret. These clauses protect both the buyer and the seller by outlining conditions that must be met for the transaction to proceed. Without clearly defined contingencies regarding financing, inspections, and appraisals, parties may find themselves in binding agreements that are not in their best interest.

Incorrectly handling earnest money details is yet another common error. The amount, holder, and conditions for the release of earnest money must be explicitly stated. Failure to specify these details can lead to disputes and complications, should the deal fall through for any reason.

Omitting closing costs and who is responsible for them is a mistake that can lead to last-minute financial surprises. Buyers and sellers should clearly understand and agree upon who will cover these expenses, including taxes, insurance, and other fees associated with securing the property.

Not being clear about the closing date and possession date can also lead to misunderstanding and frustration. These dates need to be explicitly agreed upon to ensure a smooth transition and to avoid conflicts over when the buyer can move in.

Neglecting to specify fixtures and appliances that are included with the sale is another oversight. If it's not in writing, assumptions about what is considered included in the sale could lead to disagreements. Clearly listing what stays and what goes can prevent this issue.

Finally, failing to properly review and understand all the terms before signing is a critical mistake. It's tempting to skim through documents, especially when under time pressure. However, fully understanding every clause and condition is essential to making informed decisions and preventing future legal complications.

By being aware of these common pitfalls and approaching the North Carolina Real Estate Purchase Agreement form with care, parties can avoid these issues and work towards a successful real estate transaction.

Documents used along the form

In the dynamic landscape of real estate transactions, the North Carolina Real Estate Purchase Agreement stands as a crucial document, outlining the terms and conditions of a property sale. However, to navigate through the complexities of these transactions, several other forms and documents often accompany this agreement, each serving a distinct function to ensure a seamless and comprehensive understanding between the buyer and seller. These documents are indispensable in providing clarity, legal protection, and adherence to state-specific regulations.

- Residential Property Disclosure Form: This document is essential for sellers to disclose the condition of the property, including any known defects or malfunctions, ensuring buyers are fully informed before the sale.

- Lead-Based Paint Disclosure: For homes built before 1978, this form is mandatory and informs buyers about the presence of lead-based paint and hazards, complying with federal law.

- Loan Application Form: Buyers use this form to apply for a mortgage, providing detailed financial information to lenders to procure funding for the purchase.

- Title Search Report: This report provides a detailed history of the property’s ownership, revealing any encumbrances, liens, or easements that could affect the sale.

- Home Inspection Report: A critical document that details an inspector’s findings on the property’s condition, highlighting any areas needing repair or concern.

- Pest Inspection Report: This inspection determines the presence of wood-destroying insects or organisms, which is crucial for both buyer and seller to be aware of before completing the sale.

- Appraisal Report: A professional assessment that determines the property’s market value, often required by lenders to ensure the loan amount does not exceed the property’s worth.

- Closing Disclosure: Provided to the buyer at least three days before closing, this document outlines the final details of the mortgage loan, including the interest rate, monthly payments, and closing costs.

- Home Warranty Policy: Although not always mandatory, this policy can offer buyers protection against potential appliance or system failures within the property, providing peace of mind.

Together, these documents form a comprehensive suite, guiding both parties through the intricacies of real estate transactions. They not only facilitate transparency and protection but also ensure compliance with legal obligations, laying the groundwork for a successful property transfer in North Carolina.

Similar forms

The North Carolina Real Estate Purchase Agreement shares similarities with a Residential Lease Agreement. Both documents outline the conditions under which property can be used or occupied. While the purchase agreement facilitates the sale of the property, transferring ownership from the seller to the buyer, a residential lease agreement outlines the terms under which a tenant can rent property from a landlord for a specified period. Each agreement contains specific terms, payment details, and obligations required from the parties involved but serves different purposes in property transactions.

Comparable to a Real Estate Purchase Agreement is a Bill of Sale. This document is commonly utilized when personal property, such as vehicles or equipment, changes ownership. It functions as a formal record of the transaction and captures details like the description of the item, buyer and seller information, and the purchase price. Although a Bill of Sale is mainly used for personal property and the Real Estate Purchase Agreement for real property, both serve to evidence the transfer of ownership and detail the terms of the sale.

A Loan Agreement bears resemblance to the Real Estate Purchase Agreement as well, especially in transactions where financing is involved. The Loan Agreement specifies the terms under which one party lends money to another, including repayment schedules, interest rates, and the consequences of default. When buying real estate, if financing is necessary, the terms may be detailed within the purchase agreement or require a separate loan agreement. In both cases, they are crucial for outlining the financial responsibilities and obligations of the involved parties.

The Option to Purchase Real Estate Agreement is closely related to the Real Estate Purchase Agreement but with a distinct difference. It grants an individual the exclusive right, but not the obligation, to purchase property within a predetermined timeframe. Although it doesn’t finalize the sale, it lays down terms under which the potential buyer can execute the option to buy, similar to how a purchase agreement specifies the terms of an actual sale. Both documents are pivotal in real estate transactions for securing interests and clarifying the conditions of the sale or potential sale.

A Property Disclosure Statement, while not a contract to sell or buy, often accompanies a Real Estate Purchase Agreement. This document is prepared by the seller to disclose the condition and details of the property, including any material defects or issues that could affect the property’s value or desirability. The purpose is to inform the buyer, similar to how the purchase agreement outlines terms such as the purchase price and sale conditions. Both are essential for transparency and ensuring that the buyer is fully informed before finalizing the purchase.

Lastly, an Earnest Money Agreement is another document with parallels to the Real Estate Purchase Agreement, often forming part of the purchasing process. This agreement involves the deposit of earnest money by the buyer to show good faith and secure the transaction. The agreement outlines the conditions under which the deposit is held and may be forfeited if the deal does not proceed. Although it is typically a component of the broader real estate purchase agreement, it specifically focuses on the earnest deposit and its conditions, emphasizing the buyer's commitment to proceed with the purchase.

Dos and Don'ts

When entering into the complexity of buying or selling property, the North Carolina Real Estate Purchase Agreement form plays a pivotal role. This document, rich in detail, acts as the road map for the transaction, outlining every term, condition, and contingency that the buyer and seller have agreed upon. Approaching this document requires a meticulous and informed strategy. Below are essential dos and don'ts to guide you through the process.

Do:

Ensure all parties' names are spelled correctly. The legal names of the buyer and seller should precisely match identification documents and any public records.

Include all necessary details about the property. This encompasses the legal description, property address, and any specific inclusions or exclusions the parties have agreed upon.

Review and understand all terms and conditions. This agreement contains crucial details about the transaction timeline, financial aspects, and obligations of both parties. A thorough examination can prevent misunderstandings.

Consider any contingencies. Often, agreements are subject to financing, inspection, or the sale of another property. Clearly outline these to safeguard interests.

Get professional advice. Consulting with a real estate attorney or an experienced real estate agent familiar with North Carolina laws can provide clarity and ensure the agreement meets all legal requirements.

Don't:

Leave blanks in the agreement. Unfilled sections can lead to disputes or misunderstandings. If a section doesn't apply, consider filling it with 'N/A' or 'None' to indicate it was not overlooked.

Make verbal agreements. Anything not documented in the agreement might as well not exist in the eyes of the law. Ensure all aspects of the deal are in writing.

Ignore local and state laws. North Carolina has specific regulations surrounding real estate transactions (e.g., disclosure requirements). Ignorance of these laws does not exempt one from their consequences.

Forget to specify the closing date and location. Establishing a clear timeline and location for the transaction's conclusion is essential for a smooth closing process.

Skip the final walk-through clause. This allows the buyer to inspect the property to ensure its condition hasn't changed since the agreement was signed and that agreed-upon repairs have been made.

Misconceptions

When discussing the North Carolina Real Estate Purchase Agreement, several misconceptions commonly arise. It's important to clarify these misunderstandings to ensure all parties involved in real estate transactions have a clear and accurate understanding of what to expect. Below are seven such misconceptions and the truths that dispel them.

- All real estate purchase agreements are the same. This is not accurate. While many forms follow a standard structure, each state has specific requirements and clauses. North Carolina's agreement includes particulars that conform to its state laws, customarily addressing issues like due diligence and earnest money in a manner unique to North Carolina.

- You don’t need an attorney to review the agreement. While it's true that hiring an attorney is not mandatory, it's highly advisable. Real estate transactions involve significant financial commitments and legal responsibilities. An attorney can provide critical guidance ensuring the agreement protects your rights and interests.

- The deposit is always refundable if you back out. The truth is more complex. The agreement details circumstances under which the earnest money deposit may or may not be refundable. In North Carolina, the due diligence period offers a timeframe during which the buyer can terminate the contract for any reason. However, backing out outside of this period can result in the loss of the deposit.

- Verbal agreements are as binding as written ones. This is a dangerous misconception. In real estate, verbal agreements are not enforceable. The North Carolina agreement, like those in other states, requires all modifications and the original agreement to be in writing and signed by both parties to be legally binding.

- Sellers must fix all issues discovered during the inspection. Actually, the agreement does not automatically require sellers to fix everything identified in an inspection report. Instead, it allows the buyer to request repairs or a price adjustment, but the seller is not obligated to agree. Negotiations usually follow the inspection report's findings.

- The closing date in the agreement is set in stone. Closing dates are more flexible than many believe. They can be adjusted if both buyer and seller agree. Financing delays, inspection issues, and other contingencies can lead to a negotiated extension of the closing date documented within the agreement.

- Buyers automatically get their earnest money back if financing falls through. The truth depends on the specific terms of the financing contingency clause within the agreement. If a buyer doesn’t diligently pursue financing or fails to notify the seller of a loan rejection in a timely manner, they risk losing their deposit even if they cannot secure a loan.

Key takeaways

The North Carolina Real Estate Purchase Agreement form is a critical document in the property buying process. It legally binds the buyer and seller to a transaction involving real estate, specifying terms, conditions, and responsibilities of both parties. Understanding how to properly fill out and use this form is essential for a smooth and legally compliant transaction. Here are key takeaways to consider:

- Accurate Details: It's imperative to ensure all information is accurate and complete. This includes the full names of the buyer and seller, property address, and legal description of the property. Mistakes can lead to delays or legal complications.

- Price and Terms: The agreed-upon purchase price should be clearly stated, along with the terms of the payment. This may include down payment amounts, financing details, and any escrow arrangements.

- Disclosures: North Carolina law requires sellers to provide certain disclosures about the property's condition, including any known material defects. These must be comprehensively included in or attached to the agreement.

- Contingencies: The agreement should outline any conditions that must be met for the transaction to proceed, such as financing approval, home inspections, appraisal, and the sale of the buyer’s current home, if applicable.

- Close Date: Specify the closing date when the transaction should be completed, and ownership will transfer. This date is crucial for coordinating financing, moving, and other logistical aspects.

- Legal Compliance: The agreement must comply with all North Carolina state laws, including those related to real estate transactions, property disclosures, and closing procedures.

- Signatures: The agreement must be signed by all parties to be legally binding. Ensure that all necessary parties have signed and that the signatures are witnessed or notarized if required.

- Professional Advice: Given the legal complexities and significant financial implications, consulting with a real estate attorney or a licensed real estate agent is advisable to ensure that the agreement meets all legal requirements and protects your interests.

- Amendments: Any changes to the agreement after it has been signed must be made in writing and signed by all parties involved. Oral agreements or understandings should be avoided as they can be difficult to enforce.

- Termination Clauses: Understand the conditions under which the agreement can be terminated by either party, and the ramifications thereof. This includes any earnest money deposits and whether they are refundable under certain conditions.

Correctly filling out and understanding the North Carolina Real Estate Purchase Agreement is vital for a successful real estate transaction. It provides a roadmap for the process and sets expectations for both the buyer and seller. Attention to detail and adherence to legal requirements can prevent misunderstandings and legal issues, ensuring a smooth path to closing.

More Real Estate Purchase Agreement State Forms

House Purchase Agreement Template - Environmental disclosures required by law can be included, informing the buyer of potential hazards.

Buyer Agreement - Includes provisions for breach of contract, prescribing remedies available to the injured party.

Texas Realtors Commission - This agreement can provide a roadmap for navigating the complexities of the real estate transaction, minimizing misunderstandings and setting clear expectations.

Michigan Real Estate Purchase Agreement - Facilitates a smoother closing process by clearly laying out expectations and timelines for all involved.