Fillable Real Estate Purchase Agreement Document for New York

When embarking on the journey of buying or selling property in the bustling markets of New York, the Real Estate Purchase Agreement form emerges as a cornerstone document that outlines the terms and conditions of the transaction. This legally binding contract records everything from the purchase price to the details about the property being bought or sold, including its location and any applicable legal descriptions. Furthermore, it delves into the responsibilities of both parties involved, specifying timelines for inspections, contingencies that may terminate the agreement, and the expected closing date. Also noteworthy is the detailing of financial arrangements, such as earnest money deposits and the balance payment method, whether through financing or otherwise. Moreover, this form addresses the allocation of various costs and specifies any personal property that will be included or excluded in the sale. Essentially, the New York Real Estate Purchase Agreement form serves as the blueprint for the transaction, providing transparency, establishing expectations, and safeguarding the interests of both the buyer and the seller in the complex world of real estate transactions.

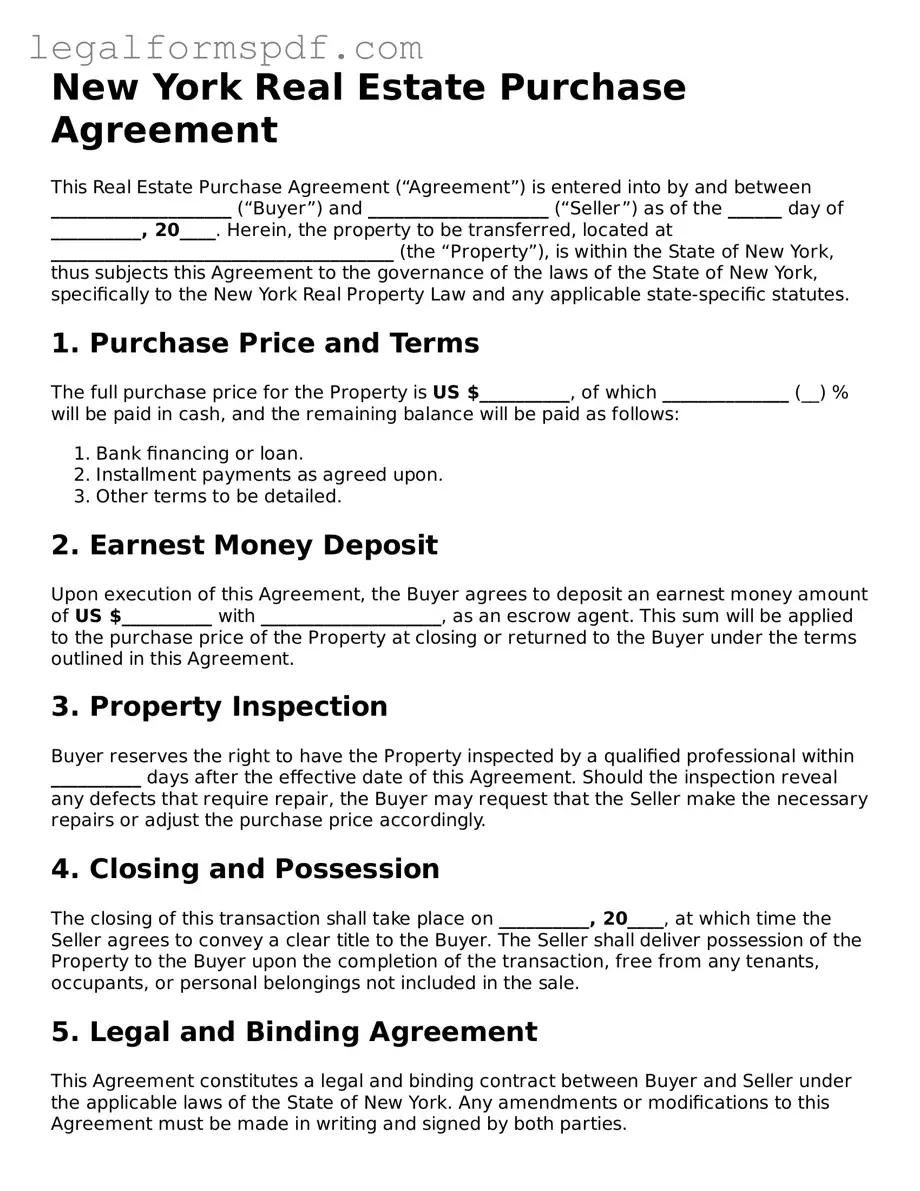

Document Example

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between ____________________ (“Buyer”) and ____________________ (“Seller”) as of the ______ day of __________, 20____. Herein, the property to be transferred, located at ______________________________________ (the “Property”), is within the State of New York, thus subjects this Agreement to the governance of the laws of the State of New York, specifically to the New York Real Property Law and any applicable state-specific statutes.

1. Purchase Price and Terms

The full purchase price for the Property is US $__________, of which ______________ (__) % will be paid in cash, and the remaining balance will be paid as follows:

- Bank financing or loan.

- Installment payments as agreed upon.

- Other terms to be detailed.

2. Earnest Money Deposit

Upon execution of this Agreement, the Buyer agrees to deposit an earnest money amount of US $__________ with ____________________, as an escrow agent. This sum will be applied to the purchase price of the Property at closing or returned to the Buyer under the terms outlined in this Agreement.

3. Property Inspection

Buyer reserves the right to have the Property inspected by a qualified professional within __________ days after the effective date of this Agreement. Should the inspection reveal any defects that require repair, the Buyer may request that the Seller make the necessary repairs or adjust the purchase price accordingly.

4. Closing and Possession

The closing of this transaction shall take place on __________, 20____, at which time the Seller agrees to convey a clear title to the Buyer. The Seller shall deliver possession of the Property to the Buyer upon the completion of the transaction, free from any tenants, occupants, or personal belongings not included in the sale.

5. Legal and Binding Agreement

This Agreement constitutes a legal and binding contract between Buyer and Seller under the applicable laws of the State of New York. Any amendments or modifications to this Agreement must be made in writing and signed by both parties.

6. Signatures

This Agreement becomes effective when signed by both parties. The signatures below serve as acceptance of all the terms and conditions outlined in this Agreement.

Buyer's Signature: ____________________ Date: ____/____/20____

Seller's Signature: ____________________ Date: ____/____/20____

PDF Specifications

| Fact Name | Description |

|---|---|

| 1. Purpose | The New York Real Estate Purchase Agreement form is designed to document the sale and purchase of real estate property in New York State, ensuring that all details of the transaction are formally recorded. |

| 2. Required Disclosures | Under New York State law, sellers must provide certain disclosures to buyers, such as the Property Condition Disclosure Statement, before any purchase agreement can be ratified. |

| 3. Governing Law | This agreement is governed by New York State law, including all matters of interpretation, rights, and duties of the parties involved. |

| 4. Binding Effect | Once signed, the agreement becomes a legally binding contract between the buyer and seller, obligating both parties to fulfill their respective duties as outlined in the agreement. |

| 5. Customizability | While there is a standard form, parties may modify or add specific terms as long as they comply with New York State laws and regulations. |

| 6. Signature Requirements | All parties involved must sign the agreement for it to become effective. Electronic signatures are recognized as valid under New York law. |

| 7. Down Payment | The agreement must detail the amount of down payment and the terms under which it is to be held until closing. |

| 8. Closing Date | The agreement must specify the closing date, which is when the transaction must be completed, and the ownership of the property is officially transferred. |

| 9. Contingencies | Parties can include contingencies that must be met for the transaction to proceed, such as obtaining financing, selling a current home, or clear inspection reports. |

| 10. Cancellation Clauses | The terms under which either party can terminate the agreement, and any associated penalties or return of deposit, must be clearly outlined in the document. |

Instructions on Writing New York Real Estate Purchase Agreement

Filling out a New York Real Estate Purchase Agreement Form is a crucial step in the process of buying or selling property in the state. This legally binding agreement outlines the terms and conditions of the sale, including the purchase price, property description, and closing details. It serves as a comprehensive record of the transaction, ensuring both parties are clear about their obligations. To ensure a smooth process, it's important to complete the form accurately and thoroughly. Following a step-by-step guide can help navigate the complexities of this important document.

- Gather all necessary information about the property, including the legal description, address, and any identifying details that will make the property clearly identifiable in the document.

- Identify the buyer and seller by their full legal names to prevent any ambiguity regarding the parties involved in the transaction.

- Specify the purchase price agreed upon by both parties. This should be written in both numerical and written form to avoid discrepancies.

- Detail the terms of the payment, including any deposits made, financing arrangements, and how the remaining balance will be paid at closing.

- Include any contingencies that must be satisfied before the transaction can be finalized. Common contingencies include property inspections, financing, and the sale of another property.

- List any items or fixtures that will be included or excluded from the sale. This ensures both parties have a clear understanding of what is being bought and sold.

- Outline the closing details, including the date, location, and responsibilities of each party in preparation for the transfer of ownership.

- Both parties should review the agreement thoroughly to ensure all information is accurate and reflects their understanding of the transaction.

- Have both the buyer and seller sign and date the agreement. Depending on state laws and the complexity of the transaction, it may also be advisable to have the signatures notarized to validate the document.

Completing the New York Real Estate Purchase Agreement is a pivotal moment in the process of transferring property. By methodically following these steps and ensuring that all details are accurately reflected in the document, parties can confidently move forward toward closing. It's crucial that both parties understand the agreement thoroughly and seek clarification or legal advice if any element is unclear, as this document forms the legal foundation of the real estate transaction.

Understanding New York Real Estate Purchase Agreement

What is a New York Real Estate Purchase Agreement?

A New York Real Estate Purchase Agreement is a contract used to outline the terms and conditions between a buyer and seller regarding the sale and purchase of real estate property in New York. This document includes important details such as the purchase price, property description, financing conditions, and the rights and obligations of both parties.

Do I need a lawyer to create a New York Real Estate Purchase Agreement?

While it's not legally required to have a lawyer to create a Real Estate Purchase Agreement in New York, it's strongly recommended. A lawyer can help ensure that the agreement complies with all state laws, and accurately reflects the terms of the deal, protecting both the buyer's and seller's interests.

What information do I need to include in a Real Estate Purchase Agreement?

The agreement should include the full names of the buyer and seller, a detailed description of the property (including the address and legal description), the purchase price, the terms of payment, and any contingencies that may affect the sale (such as financing approval or the sale of the buyer's current home). Information about the closing date and any items included or excluded from the sale should also be specified.

Are there any contingencies that should be included in the agreement?

Yes, including contingencies in the agreement is critical for protecting both parties. Common contingencies include a satisfactory home inspection, the buyer's ability to secure financing, and the sale of the buyer's current home. These conditions should be clearly stated, including what will happen if they are not met by a specific deadline.

Can I back out of a Real Estate Purchase Agreement once it's signed?

Backing out of a signed Real Estate Purchase Agreement is possible but may have legal consequences. If the agreement contains contingencies that have not been met, such as unsatisfactory home inspection results, the buyer can typically withdraw without penalty. However, if a buyer backs out without a contingency-related reason, they may forfeit their deposit or face other penalties as outlined in the agreement.

What happens if there are disputes over the Real Estate Purchase Agreement?

If disputes arise over the agreement, it's recommended to first attempt to resolve them through negotiation or mediation. If these efforts fail, the parties may need to resort to arbitration or legal action. It's important to understand that legal disputes can be costly and time-consuming, so it’s best to try to resolve issues amicably if possible.

Is a Real Estate Purchase Agreement legally binding in New York?

Yes, a Real Estate Purchase Agreement is legally binding in New York once it is signed by both the buyer and seller. This means that both parties are legally obligated to follow through with the terms of the agreement, and failure to do so can result in legal repercussions.

Common mistakes

Filling out the New York Real Estate Purchase Agreement form can be a daunting task, especially for those who are unfamiliar with the process. One common mistake is neglecting to provide all necessary details about the property in question. This includes but is not limited to the full address, legal description, and any unique identifiers of the property. Failing to provide comprehensive details can lead to misunderstandings or disputes later in the transaction process.

Another frequently seen issue is not specifying the terms of the sale accurately. This encompasses the purchase price, deposit amounts, and the detailed terms of the financing. When individuals overlook these critical elements, it leaves room for ambiguity and can result in financial discrepancies between the buyer and seller, potentially derailing the sale.

Incorrect or incomplete information about the parties involved is also a prevalent mistake. Every party involved in the transaction – whether they are buyers, sellers, or legal representatives – must be correctly identified with their full legal names and contact information. Misidentifying parties or providing incomplete information can cause significant legal complications and may even invalidate the agreement.

A further error often made involves the dates relevant to the transaction, such as the closing date and any contingencies that allow parties to back out of the agreement under specific circumstances. People sometimes fail to clearly specify these dates or misunderstand their legal implications, which can lead to confusion and disputes over timelines and obligations.

Last but not least, overlooking the requirement for disclosures and inspections is a critical mistake. Sellers are obligated to disclose certain information about the property's condition and history, and buyers often have the right to conduct inspections. Failure to address these issues in the agreement can lead to legal issues post-sale, including disputes over property conditions not disclosed or inspected prior to purchase.

Given these common pitfalls, parties involved in filling out the New York Real Estate Purchase Agreement form should proceed with caution, ensuring they provide all necessary and correct information to facilitate a smooth transaction process.

Documents used along the form

When purchasing real estate in New York, it's not just about signing a purchase agreement and exchanging keys. The process involves a series of documents, each serving a specific purpose to ensure the sale is legal, binding, and in accordance with state laws. The New York Real Estate Purchase Agreement is a critical document outlining the terms and conditions of the sale, but it's just a part of a larger ensemble of forms and documents that buyers and sellers encounter. Understanding these documents can demystify the process and help all parties involved feel more confident and informed. Let's explore some of the most commonly used documents alongside the Purchase Agreement.

- Residential Property Disclosure Form: This document requires sellers to disclose any known defects or issues with the property. It's a crucial piece of information for buyers, helping them make informed decisions.

- Title Insurance Policy: A protection for buyers against potential ownership claims on the property after purchase. It ensures the buyer's ownership rights are protected against certain undiscovered defects in the title.

- Home Inspection Report: A detailed assessment of the property's condition conducted by a professional inspector. This report covers structural elements, systems, and other aspects of the property, identifying any repairs or issues that need attention.

- Pest Inspection Report: Specifically focuses on uncovering any signs of pest infestations, such as termites, that could affect the property’s value and habitability.

- Appraisal Report: An appraisal report provides an estimate of the property's value. Lenders often require this document to ensure the property is worth the amount being borrowed for its purchase.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law. It informs buyers about the presence of lead-based paint in the property, which can pose health risks.

- Loan Documents: These documents encompass the terms and conditions of the mortgage agreement between the borrower (buyer) and lender. They outline the loan amount, interest rate, payment schedule, and other critical terms.

- Closing Statement: A comprehensive summary of the financial transactions and fees involved in the real estate transaction. It details the payments made by and due to all parties involved, including any adjustments and closing costs.

While this list is not exhaustive, it highlights the essential documents that typically accompany the New York Real Estate Purchase Agreement. Each document plays a pivotal role in the buying and selling process, providing transparency, legal protection, and peace of mind for both parties. As tedious as paperwork can be, it's the backbone of a successful real estate transaction, ensuring that every aspect of the sale is agreed upon, legally compliant, and thoroughly documented.

Similar forms

The Residential Lease Agreement shares similarities with the New York Real Estate Purchase Agreement, primarily in delineating the terms under which a property will be occupied. While the purchase agreement culminates in the transfer of ownership from seller to buyer, a residential lease agreement establishes the conditions under which a tenant can occupy a property for a set period. Both documents are legally binding and specify details such as payment terms, duration, and responsibilities of each party, albeit serving fundamentally different purposes – one for ownership, the other for rental.

Similarly, a Bill of Sale document possesses parallels to the Real Estate Purchase Agreement, as both serve as written records of a transaction between a seller and a buyer. Particularly in real estate, a bill of sale might accompany personal property transactions that occur in tandem with the purchase of a home, such as furniture or appliances. Each document outlines the item(s) being transferred, the agreed-upon price, and the parties involved, thereby providing a legal record of the transfer of ownership, although a bill of sale is more commonly associated with personal property than real estate transactions.

The Land Contract is another document closely related to the New York Real Estate Purchase Agreement, in its facilitation of real estate transactions through seller financing. Unlike traditional purchase agreements that often involve mortgage lenders, a land contract allows the seller to finance the purchase directly, with the buyer making payments to the seller. Both documents establish the conditions of the sale, including payment schedule, interest, and the transfer of property title, but a land contract retains the title in the seller's name until the buyer completes payment.

An Earnest Money Agreement also bears a resemblance, as it is an integral part of many real estate transactions, typically preceding the final purchase agreement. This document highlights a buyer's intention to purchase and includes payment of earnest money as a sign of good faith. The earnest money amount and conditions under which it may be refunded are specified, similar to how a purchase agreement outlines the terms of the sale. Both documents play crucial roles in the negotiation process, solidifying the buyer's commitment and detailing the agreement's specifics.

The Property Disclosure Statement closely aligns with the purpose of a Real Estate Purchase Agreement by informing the buyer of specific details about the property’s condition. Sellers are required to disclose known defects which could affect the property's value or desirability. While the disclosure statement focuses on the condition and characteristics of the property, the purchase agreement provides the framework for the transaction itself, including the agreed-upon price and terms of the sale. Both are essential for transparency and ensuring informed decisions during the transaction.

The Power of Attorney for Real Estate Transactions document also shares similarities with the purchase agreement. This document grants an individual the authority to act on behalf of another in real estate transactions, potentially including signing a purchase agreement. It specifies the powers granted, which can range from buying or selling property to managing real estate assets. While the purchase agreement finalizes the terms of the sale, a power of attorney can enable the transaction by authorizing another to act on a party's behalf.

A Title Insurance Commitment can be considered akin to a Real Estate Purchase Agreement because it relates to the condition of the property’s title preceding the final transaction. It outlines any defects, liens, or encumbrances found on the property’s title and provides insurance against future claims. Like the purchase agreement, it plays a pivotal role in the property’s transfer process, ensuring the buyer receives a clear title and detailing what protections are offered against possible title issues.

Lastly, the Home Inspection Report bears relevance to the Real Estate Purchase Agreement as it provides a comprehensive account of the property’s condition before the sale is finalized. It details the findings of a professional home inspector concerning the property's structural integrity, systems, and any repairs needed. While the inspection report informs the condition of the property, influencing the negotiation process, the purchase agreement formalizes the sale's conditions, including how such repairs are addressed. Both documents work in concert to ensure that parties are informed and agreeable to the terms based on the property’s current state.

Dos and Don'ts

Filling out the New York Real Estate Purchase Agreement is a critical step in the process of buying or selling property. This document serves as the formal contract between the buyer and seller, setting the terms of the sale. To help guide you through this process, here are some dos and don'ts to consider:

Do:

- Review the entire form before filling it out. Ensuring you understand each section can prevent mistakes and protect your interests.

- Use clear and precise language. Avoid ambiguous terms that can lead to misunderstandings or legal disputes.

- Verify all names and addresses. Double-check the spelling of all parties' names and the addresses of both the property being sold and the parties involved.

- Include all relevant details about the property. This includes legal descriptions, property ID numbers, and any included or excluded fixtures.

- Specify the terms of the payment. Clearly outline the purchase price, deposit amount, balance to be financed, and any other financial arrangements.

- Seek professional advice if needed. Consider consulting with a real estate attorney or professional to review the agreement before you sign it, especially for complex transactions.

Don't:

- Leave any sections blank. If a section does not apply, write "N/A" (not applicable) to indicate this clearly.

- Ignore the fine print. Pay close attention to all clauses and conditions. They can have significant implications for your rights and obligations.

- Rush through the process. Take your time to ensure that every detail in the agreement is accurate and reflects your understanding of the deal.

- Sign until you’re ready. Never feel pressured to sign the agreement until all terms are negotiated to your satisfaction and you fully understand all the document's provisions.

- Forget to specify contingency clauses. These clauses protect you if certain conditions aren't met, like securing a mortgage or passing a home inspection.

- Underestimate the importance of the closing date. The closing date is when the sale is finalized, and ownership changes hands. Ensure this date is realistic and mutually agreed upon.

Misconceptions

Navigating the complexities of buying or selling property in New York can be challenging. Part of the challenge comes from common misconceptions about the Real Estate Purchase Agreement form, a crucial document in the transaction process. Clearing up these misunderstandings is essential for a smooth real estate transaction.

It's Just a Standard Form: Many believe that the New York Real Estate Purchase Agreement is a one-size-fits-all document. However, this agreement is often customized to fit the unique aspects of each transaction, including terms, contingencies, and specific property details. Understanding and accurately completing this form is crucial for a legally binding agreement.

Attorney Review Is Optional: In New York, attorney involvement is common and often considered necessary in the real estate transaction process. After the initial agreement, attorneys for the buyer and seller review and may negotiate changes to the purchase agreement to protect their clients' interests.

Verbal Agreements are Binding: While verbal agreements may carry some weight in casual deals, New York law requires that real estate transactions be in writing to be legally enforceable. The Real Estate Purchase Agreement must be documented, signed, and dated to be valid.

Everything Is Negotiable After Signing: Another misconception is that terms can be renegotiated or withdrawn after the Real Estate Purchase Agreement is signed. While some aspects may be renegotiated under specific contingencies set forth in the agreement, it is legally binding once signed, restricting the ability to alter terms without mutual consent.

Only Basic Information Is Required: The Purchase Agreement requires detailed information, not just the names of the buyer and seller and the property address. It should include legal descriptions of the property, specific details of the transaction, sale price, contingencies, closing date, and responsibilities of each party, among other essential data.

It Determines Closing Costs: The Real Estate Purchase Agreement outlines the agreed sale price and may define who bears certain closing costs. However, actual closing costs are determined through further documentation and processes leading up to the closing date, often influenced by negotiations, inspections, and lender requirements.

Inspections Are Automatically Included: Some parties mistakenly believe that property inspections are automatically part of the Purchase Agreement. In reality, inclusion of inspections as a contingency must be explicitly stated in the agreement. This ensures that the transaction can be reassessed or renegotiated based on the inspection outcomes.

No Need for Disclosures: Sellers are sometimes under the impression that they don't need to make any disclosures within the Purchase Agreement. New York law requires sellers to provide buyers with a property condition disclosure statement or credit the buyer $500 at closing if they choose not to provide the disclosure.

Electronic Signatures Aren't Allowed: With advancements in technology, there's a misconception that electronic signatures are not permissible for Real Estate Purchase Agreements in New York. Yet, electronic signatures are generally accepted as valid and legal, provided they meet state guidelines and both parties agree to their use.

Key takeaways

When it comes to navigating the complexities of buying or selling property, the New York Real Estate Purchase Agreement plays a pivotal role. It's not just a formality; it’s a legally binding contract that outlines the terms and conditions of the real estate transaction. Below, you'll find several crucial takeaways that every party involved in a real estate transaction should understand:

- Accuracy is key: Filling out the New York Real Estate Purchase Agreement requires careful attention to detail. Every piece of information should be accurate and thoroughly verified to avoid any legal complications down the line.

- Legal descriptions matter: The form requires a detailed legal description of the property. This includes the lot number, subdivision, and any other legal identifiers. It's essential to use the exact description from the current deed to prevent disputes about what is being sold.

- Financing terms: The agreement must clearly outline the financing terms, including whether the purchase is contingent upon the buyer securing a mortgage. The specifics of the mortgage, such as the amount, interest rate, and term, should be explicitly stated if known at the time of signing.

- Contingencies: Contingencies provide conditions that must be met for the transaction to proceed. Common contingencies include home inspections, appraisals, and the buyer’s ability to secure financing. It’s crucial for both parties to understand these conditions and what constitutes satisfying them.

- Closing date: The agreement should specify the closing date or how the closing date will be determined. This date is critical as it signifies when the buyer plans to complete the purchase, and the seller agrees to hand over the keys and property rights.

- Disclosures: Sellers are often required to make certain disclosures about the property's condition and any known defects. These must be made in good faith and attached to the purchase agreement to ensure the buyer is fully informed.

- Escrow: The agreement should detail how the earnest money (a good faith deposit towards the purchase) will be handled. Typically, this involves stating which escrow agency will hold the funds and the conditions under which the deposit will be released or forfeited.

- Signature requirements: A real estate purchase agreement must be signed by both the buyer and the seller to be legally binding. Make sure all parties involved sign the document and that these signatures are witnessed if required by state law.

- Legal advice is invaluable: Given the legal and financial implications of a real estate purchase agreement, consulting with a real estate attorney before finalizing the document can prevent costly mistakes. An attorney can provide advice tailored to your specific situation and ensure that your interests are protected.

Understanding these essentials when filling out and using the New York Real Estate Purchase Agreement can greatly simplify the buying or selling process, ensuring a smoother transition for both parties involved. Always keep in mind that real estate laws can vary significantly from state to state, so it's crucial to be informed about the specifics of New York real estate legislation.

More Real Estate Purchase Agreement State Forms

Pa Real Estate Contract - Custom clauses can be added to address specific needs or concerns, such as the sale being contingent on the buyer selling their current home.

Texas Realtors Commission - Important dates, such as when the offer becomes void if not accepted, are specified, keeping the transaction process timely and efficient.

Michigan Real Estate Purchase Agreement - Ensures that both buyer and seller are fully informed of their responsibilities and the details of the property transaction.