Fillable Real Estate Purchase Agreement Document for Michigan

When navigating the journey of buying or selling property in Michigan, one document stands as a cornerstone in the process: the Michigan Real Estate Purchase Agreement form. This pivotal piece of paperwork captures all essential details of the transaction, offering clarity and legal protection for both parties involved. It outlines terms including the sale price, property description, financing arrangements, and contingencies such as inspections and appraisals that might impact the deal. Additionally, it addresses timelines for each step towards closing, ensuring that both the buyer and seller understand their obligations and deadlines. Through the meticulous details captured within, this agreement not only facilitates a smoother transaction process but also solidifies the commitments made by all parties, reducing the potential for misunderstandings or disputes. It's the blueprint that guides both buyers and sellers, ensuring that their interests are safeguarded as they move forward with one of the most significant financial decisions of their lives.

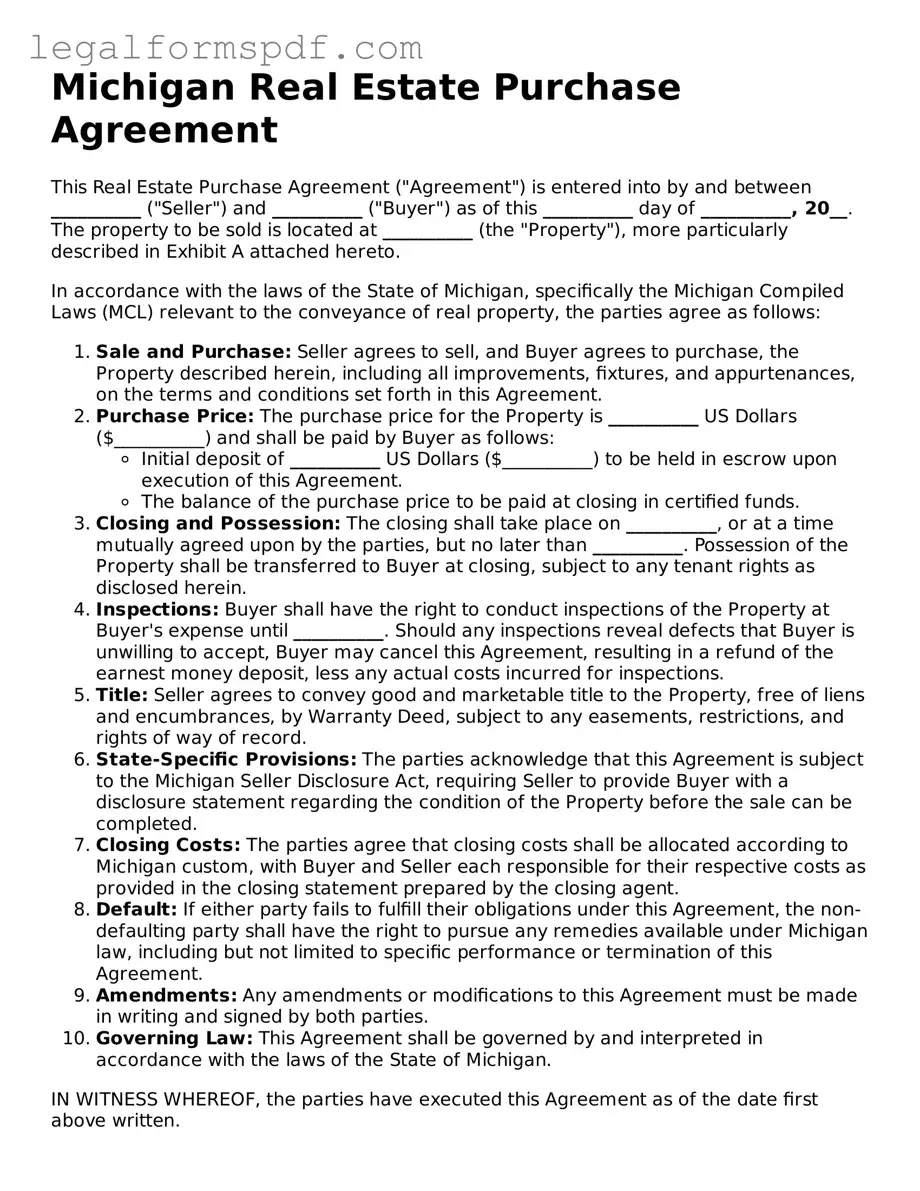

Document Example

Michigan Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between __________ ("Seller") and __________ ("Buyer") as of this __________ day of __________, 20__. The property to be sold is located at __________ (the "Property"), more particularly described in Exhibit A attached hereto.

In accordance with the laws of the State of Michigan, specifically the Michigan Compiled Laws (MCL) relevant to the conveyance of real property, the parties agree as follows:

- Sale and Purchase: Seller agrees to sell, and Buyer agrees to purchase, the Property described herein, including all improvements, fixtures, and appurtenances, on the terms and conditions set forth in this Agreement.

- Purchase Price: The purchase price for the Property is __________ US Dollars ($__________) and shall be paid by Buyer as follows:

- Initial deposit of __________ US Dollars ($__________) to be held in escrow upon execution of this Agreement.

- The balance of the purchase price to be paid at closing in certified funds.

- Closing and Possession: The closing shall take place on __________, or at a time mutually agreed upon by the parties, but no later than __________. Possession of the Property shall be transferred to Buyer at closing, subject to any tenant rights as disclosed herein.

- Inspections: Buyer shall have the right to conduct inspections of the Property at Buyer's expense until __________. Should any inspections reveal defects that Buyer is unwilling to accept, Buyer may cancel this Agreement, resulting in a refund of the earnest money deposit, less any actual costs incurred for inspections.

- Title: Seller agrees to convey good and marketable title to the Property, free of liens and encumbrances, by Warranty Deed, subject to any easements, restrictions, and rights of way of record.

- State-Specific Provisions: The parties acknowledge that this Agreement is subject to the Michigan Seller Disclosure Act, requiring Seller to provide Buyer with a disclosure statement regarding the condition of the Property before the sale can be completed.

- Closing Costs: The parties agree that closing costs shall be allocated according to Michigan custom, with Buyer and Seller each responsible for their respective costs as provided in the closing statement prepared by the closing agent.

- Default: If either party fails to fulfill their obligations under this Agreement, the non-defaulting party shall have the right to pursue any remedies available under Michigan law, including but not limited to specific performance or termination of this Agreement.

- Amendments: Any amendments or modifications to this Agreement must be made in writing and signed by both parties.

- Governing Law: This Agreement shall be governed by and interpreted in accordance with the laws of the State of Michigan.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller's Signature: __________

Buyer's Signature: __________

This document does not constitute legal advice. Consider consulting a real estate attorney to ensure that this Agreement meets all legal requirements and adequately protects your interests.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Michigan Real Estate Purchase Agreement is governed by Michigan's laws, particularly those that pertain to the sale and purchase of residential property. |

| Disclosures Requirement | In Michigan, sellers are required to complete a Seller's Disclosure Statement, detailing the condition of the property, prior to the sale. |

| Parties Involved | The agreement must be executed by the legal property owner (seller) and the prospective buyer. |

| Binding Effect | Once signed, the agreement is legally binding and obligates both the seller and the buyer to fulfill their respective parts of the deal. |

Instructions on Writing Michigan Real Estate Purchase Agreement

Filling out the Michigan Real Estate Purchase Agreement form is a key step in the process of buying or selling property in Michigan. This document is legally binding and outlines the terms and conditions of the sale, including the purchase price, property description, and closing details. To ensure that this process goes smoothly, it's important to complete the form carefully and accurately. Below are step-by-step instructions to help guide you through each section of the form.

- Identify the Parties: Start by entering the full legal names of both the buyer(s) and the seller(s). Make sure the names are spelled correctly and match any identification documents.

- Describe the Property: Include the complete address of the property being sold, along with a legal description if available. This may require a copy of the property's current deed for accuracy.

- Agree on the Purchase Price: Clearly state the total amount being paid for the property. If any part of the purchase price will be paid later or in a form other than cash, specify the details of these arrangements.

- Outline Terms of Deposit: If a deposit is being made in advance of the sale, detail the amount and the conditions under which it may be returned to the buyer or kept by the seller.

- Detail the Financing: If the purchase involves financing, such as a mortgage, describe the terms, including the amount being financed, the interest rate, and the timeline for repayment.

- Include Contingencies: Specify any conditions that must be met for the sale to proceed, such as home inspections, financing approval, or the sale of the buyer's current home. Include deadlines for each contingency.

- Set the Closing Date: Choose a date by which the sale will be finalized and the property will officially change hands. Ensure that this date allows enough time to meet all contingencies and complete necessary paperwork.

- Allocate Closing Costs: Decide which party is responsible for various closing costs, such as title insurance, property taxes, and real estate commissions. Document each party's responsibilities clearly.

- Disclose Legal Requirements: Ensure that any obligatory disclosures, such as known property defects or lead-based paint hazards, are included with the sale agreement.

- Signatures: The agreement must be signed by all parties involved in the transaction. Make sure the signatures are witnessed and/or notarized if required by state law.

After completing these steps, carefully review the agreement to confirm that all information is accurate and complete. It is advisable to have a real estate attorney review the document before signing, to ensure that it meets all legal requirements and protects your interests. Once signed, the Michigan Real Estate Purchase Agreement becomes a binding contract that guides the sale process to completion.

Understanding Michigan Real Estate Purchase Agreement

What is a Michigan Real Estate Purchase Agreement?

A Michigan Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions of the sale and purchase of real property located in Michigan. This form is used by sellers and buyers to agree on a price and other terms such as closing date, contingencies, and what is included in the sale.

When should I use a Michigan Real Estate Purchase Agreement?

This agreement should be used when a property in Michigan is being sold from one party to another. It ensures that both the seller's and buyer’s intentions are clearly communicated and legally documented. This form is crucial when transferring ownership to protect both parties’ interests throughout the transaction process.

What information is required in the Michigan Real Estate Purchase Agreement?

The form typically requires detailed information about the property, including its legal description, address, and any personal property included in the sale. It also includes the sale price, earnest money deposit, financing details, closing date, and any conditions or contingencies upon which the sale is dependent, such as financing approval or the sale of the buyer’s current home.

Are there any contingencies that can be included in the agreement?

Yes, contingencies are common in real estate transactions. They might include a satisfactory home inspection, the ability of the buyer to obtain financing, the sale of the buyer's current home, and any required repairs identified during the inspection. Each contingency should be clearly outlined in the agreement, including how they will be addressed and the timeline for resolution.

Can I customize a Michigan Real Estate Purchase Agreement?

While the core elements of a real estate purchase agreement are standard, the document can be customized to address the specific terms of a transaction. Addendums and amendments can be added to cover any special agreements between the buyer and seller. However, it’s recommended to consult with a legal professional to ensure that any modifications comply with Michigan laws and fully protect your interests.

Is a lawyer required for a Michigan Real Estate Purchase Agreement?

While Michigan law does not require a lawyer to draft or review a real estate purchase agreement, consulting with one can be beneficial. A lawyer can help ensure that the agreement complies with state laws, accurately reflects the terms of the sale, and protects your rights and interests. It is especially advisable in complex transactions or if custom terms are being added.

What happens after both parties sign the agreement?

Once the Michigan Real Estate Purchase Agreement is signed by both the buyer and seller, it becomes a legally binding contract. The next steps typically involve fulfilling any contingencies outlined in the agreement, securing financing, and preparing for the closing date where the title and ownership of the property will be officially transferred.

Can either party back out of a Michigan Real Estate Purchase Agreement?

Backing out of a signed agreement is possible but may have legal and financial consequences, depending on the terms outlined in the contract and whether any contingencies allow for cancellation. If a party backs out without legal justification, they may forfeit the earnest money deposit or face legal action for breach of contract.

How is the earnest money handled in Michigan?

In Michigan, the earnest money is typically given by the buyer to the seller as a deposit to demonstrate their commitment to the transaction. This amount is usually held in an escrow account until closing, at which point it is applied toward the purchase price. The agreement should specify how the earnest money is handled, including conditions under which it may be refunded or forfeited.

Common mistakes

When filling out the Michigan Real Estate Purchase Agreement form, one common error is not double-checking for accuracy. This document forms the basis of the real estate transaction, detailing the agreed terms between buyer and seller. Mistakes like incorrect addresses, names, or financial details can not only delay the process but could also result in financial losses. Buyers and sellers alike should ensure every detail is correct and matches the intended agreement.

Another mistake often made is overlooking contingencies. Contingencies protect both the buyer and seller, allowing either party to back out of the agreement under specific conditions, such as failed inspections or financing issues. Failing to include these could lead to being bound to a purchase or sale without a feasible way out. It's critical to understand which contingencies are appropriate for your situation and ensure they're clearly listed in the agreement.

Additionally, failing to specify fixtures and exclusions is a significant oversight. Fixtures are items permanently attached to the property, like lighting fixtures or built-in cabinets, that are typically included in the sale unless specified otherwise. If sellers intend to take certain items with them, or buyers expect items to remain, these expectations need to be clearly documented in the agreement. This prevents confusion and conflict at closing.

There's also the issue of glossing over closing costs and who bears them. The agreement should clearly outline which party is responsible for covering closing costs, which can include taxes, title insurance, and lender fees, among others. Misunderstandings about these financial responsibilities can cause disputes and delays close to the transaction's completion, a crucial time when both parties are keen on ensuring everything runs smoothly.

Lastly, not consulting with a professional is a mistake. While it's entirely possible to fill out a Michigan Real Estate Purchase Agreement on your own, the complexity and significance of this legal document often warrant professional advice. Real estate agents or attorneys can provide invaluable guidance, ensuring the agreement fully protects your interests and complies with Michigan law. This can ultimately save time, money, and stress in what is already a complex process.

Documents used along the form

In the process of purchasing real estate in Michigan, the Real Estate Purchase Agreement form is pivotal, yet it's just a part of a suite of documents necessary to ensure a smooth and legally sound transaction. These documents, whether they support the agreement, provide mandated disclosures, or facilitate the closing process, are essential for both buyer and seller to meet their obligations under Michigan law and the terms of their agreement.

- Residential Disclosure Statement: A mandated form in most transactions, it requires the seller to disclose the condition of the property, including any known defects or problems that could affect the property's value or desirability.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is federally required, informing buyers about the potential presence of lead-based paint and associated hazards.

- Seller's Deed: The legal document used to transfer property ownership from the seller to the buyer, it indicates that the seller has the right to sell the property and is doing so.

- Title Insurance Policy: Protects the buyer (and lender) from future claims against the property's title, ensuring it's free and clear of liens or disputes.

- Mortgage Pre-Approval Letter: Often submitted with the offer, this letter from the buyer’s lender indicates the buyer's ability to finance the purchase, strengthening their offer.

- Home Inspection Report: A document detailing the condition of the property, including any issues or repairs needed, typically carried out by a professional after the offer is accepted.

- Appraisal Report: Conducted by a licensed appraiser, this report determines the property's market value, ensuring the buyer does not overpay and the lender does not over-lend.

- Flood Zone Statement: Indicates whether the property is in a flood zone, affecting insurance requirements and potential rebuilding regulations.

- Home Warranty Policy: An optional agreement that provides for repairs or replacements of the home’s major components and systems, offering peace of mind to the buyer.

- Closing Disclosure: A detailed list of final transaction costs, provided to the buyer and seller, allowing them to see how the purchase price is allocated among various fees and services.

Together, these documents complement the Michigan Real Estate Purchase Agreement form, creating a comprehensive framework that addresses the legal, financial, and practical aspects of real estate transactions in Michigan. Ensuring these documents are in order, accurate, and thoroughly understood is key to a successful property transfer, safeguarding the interests of all parties involved.

Similar forms

The Michigan Real Estate Purchase Agreement form is quite like the Residential Lease Agreement, as both establish a legally binding contract between two parties. In a Real Estate Purchase Agreement, the parties agree on the sale and purchase of a property. Similarly, in a Residential Lease Agreement, the landlord and tenant agree on the terms for renting a property. Both documents outline critical terms including price or rent, property description, and the responsibilities of each party. However, the key difference lies in the intended outcome: one aims at transferring property ownership, while the other is about granting the right to use a property for a set period.

Another document that shares similarities with the Michigan Real Estate Purchase Agreement is the Bill of Sale. This document is used to transfer ownership of personal property (e.g., vehicles, boats, or furniture) from a seller to a buyer, much like the real estate agreement transfers real property. Both documents require detailed descriptions of what's being sold, identification of both parties, and terms of sale, including the price. The significant difference is in the type of property they cover, with the Real Estate Purchase Agreement specifically dealing with real estate transactions.

The Land Contract is also akin to the Michigan Real Estate Purchase Agreement. A Land Contract details the sale of a property directly from the seller to the buyer, with the seller providing financing to the buyer. Similar to the Purchase Agreement, a Land Contract delineates the terms of sale, such as sale price, down payment, interest rate, and payment schedule. However, the property’s title remains with the seller until the full purchase price is paid by the buyer, at which point the title is transferred, making the Land Contract a form of seller financing.

The Mortgage Agreement relates closely to the Real Estate Purchase Agreement as well. When buying a property, buyers often require a loan, and a Mortgage Agreement is the document that outlines the loan's terms from the lender to the borrower. It includes conditions such as the loan amount, interest rate, repayment schedule, and the property as collateral. Although the primary purpose of a Mortgage Agreement is to detail the loan specifics rather than the sale of the property itself, the purchase cannot typically proceed without this crucial financial arrangement, linking it closely to the purchase process.

Lastly, the Option to Purchase Agreement bears resemblance to the Michigan Real Estate Purchase Agreement. It grants the buyer the right, but not the obligation, to buy a property at a specified price within a defined period. Like the Purchase Agreement, an Option to Purchase lays out property details and purchase conditions. However, it provides a unique flexibility allowing the potential buyer to "lock in" the property and decide later whether to proceed with the purchase, contrasting with the more immediate commitment to buy as seen in a standard Purchase Agreement.

Dos and Don'ts

Filling out the Michigan Real Estate Purchase Agreement form requires careful attention to detail. The following are guidelines to help ensure the process is completed accurately and effectively.

Do's:

- Read the entire form carefully before you start filling it out. This helps you understand all the requirements and prevents mistakes.

- Use black ink or type your responses to ensure clarity and legibility. This makes the document easy to read and photocopy.

- Include all necessary details about the property, such as the legal description, which is more specific than the address and may be required for legal purposes.

- Ensure that the purchase price is clearly stated and agreed upon between the buyer and seller to avoid any confusion or dispute later on.

- Sign and date the form in the presence of a notary public to validate the agreement. Both the buyer and seller should do this.

- Keep a copy of the completed form for your records. It's important to have your own record of the agreement for future reference.

Don'ts:

- Do not leave any fields blank. If a section doesn’t apply, mark it as “N/A” (not applicable) instead of leaving it empty to avoid misunderstandings.

- Avoid using vague language. Be as specific as possible about terms, conditions, and expectations to prevent ambiguity.

- Do not rush through the form. Take your time to fill it out accurately to avoid errors that could delay the transaction or lead to legal issues.

- Do not forget to include any agreed-upon contingencies, such as the buyer's ability to obtain financing or the sale being subject to a satisfactory home inspection.

- Do not sign the form without reviewing it thoroughly. Ensure that all the information is correct and that you understand every part of the agreement.

- Avoid negotiating the terms of the purchase without legal or real estate advice. If there are any parts of the agreement that you do not understand, seek professional advice.

Misconceptions

Many misconceptions exist about the Michigan Real Estate Purchase Agreement form, which can lead to confusion and sometimes legal missteps by those involved in real estate transactions. Here, we aim to clarify some of these misunderstandings.

It’s Just a Standard Form: A common misconception is that the Michigan Real Estate Purchase Agreement is merely a standard document that doesn’t require much consideration. In reality, this form requires careful review as it outlines critical terms of the real estate transaction, such as purchase price, closing details, and contingencies.

All Purchase Agreements Are the Same: Another misunderstanding is that all real estate purchase agreements are identical, regardless of the state. Contrary to this belief, Michigan’s purchase agreement contains specific provisions and disclosures that are unique to Michigan real estate laws and practices.

No Need for Attorney Review: Some parties might think they don’t need an attorney to review the agreement. However, having an attorney review the document can prevent legal issues later, as attorneys can spot potential problems that untrained eyes might overlook.

Filling Out the Form Is Enough: Merely filling out the form isn’t enough; it needs to be executed properly by all parties involved. This includes signatures, initialing changes, and ensuring dates and other crucial details are accurately recorded.

Verbal Agreements Will Suffice: Believing that verbal agreements can substitute for the written purchase agreement is a significant mistake. In Michigan, real estate transactions must be in writing to be enforceable, underscoring the importance of the purchase agreement document.

All Contingencies Are Standard: It’s often mistakenly believed that contingencies are standard and non-negotiable. However, contingencies, such as those for financing, inspection, and appraisal, can be customized or waived based on the agreement between the buyer and seller.

Electronic Signatures Are Not Acceptable: In today’s digital age, some might incorrectly think that electronic signatures are not permissible for real estate transactions. Michigan law allows for electronic signatures, making transactions more efficient and environmentally friendly.

It’s Only About the Sale Price: While the sale price is undoubtedly important, focusing solely on this aspect overlooks other critical components of the purchase agreement, such as terms of possession, special assessments, and any items included in or excluded from the sale.

Amendments Are Unusual: Some may believe that once the purchase agreement is signed, it’s set in stone. In fact, amendments are quite common to accommodate changes in circumstances or details that were not previously agreed upon.

Understanding the intricacies of the Michigan Real Estate Purchase Agreement form is essential for anyone looking to engage in real estate transactions within the state. By debunking these misconceptions, parties can approach transactions with a better understanding of their rights and obligations under the law.

Key takeaways

The Michigan Real Estate Purchase Agreement form is a vital tool in the process of buying and selling property within the State of Michigan. Understanding its components and the correct way to fill it out ensures a seamless transaction. Here are key takeaways to consider when dealing with this important document.

- Accuracy is Key: Ensure all information is accurate and complete. Errors can lead to delays or cancellation of the sale.

- Legal Descriptions: Include a detailed legal description of the property. This goes beyond the address and includes the lot number, subdivision, and any other legal identifiers.

- Offer and Acceptance: The form acts as an offer from the buyer to the seller. Once signed by both parties, it becomes a legally binding agreement, reflecting mutual consent.

- Financial Terms: Clearly outline the purchase price, deposit amounts, and financing arrangements. This clarity prevents misunderstandings and potential conflicts.

- Contingencies: Detail any conditions that must be met for the transaction to proceed. These often include financing approval, inspections, and appraisal results.

- Closing Dates and Costs: Specify the expected closing date and outline who is responsible for closing costs. This helps both parties plan accordingly.

- Disclosure of Defects: Sellers are required to disclose known defects of the property. Failure to do so can lead to legal liability.

- Signatures: Ensure all necessary parties sign the document. Without the proper signatures, the agreement is not legally enforceable.

- Professional Advice: Consider consulting with a real estate attorney or professional. They can provide valuable insight and ensure the agreement meets all legal requirements.

Utilizing the Michigan Real Estate Purchase Agreement form correctly facilitates a smoother transaction, with protections in place for both buyer and seller. Paying attention to the details and seeking the right advice can make the process of transferring property rights significantly more efficient and secure.

More Real Estate Purchase Agreement State Forms

Nc Real Estate Purchase Agreement - Includes terms related to the transfer of title, ensuring the seller has the right to sell the property and the title is transferred free of liens or other encumbrances.

Generic Home Purchase Agreement - A contractual arrangement that outlines the essential details and commitments in a property sale.

Nys Real Estate Contract - The form may specify penalties for either party's failure to fulfill the agreement.

Free Ohio Real Estate Purchase Contract for Sale by Owner - Prepares both parties for a transparent and fair transaction by clearly stating terms, conditions, and expectations.