Fillable Real Estate Purchase Agreement Document for Illinois

When individuals or businesses in Illinois decide to buy or sell property, a critical step in the process involves the completion of a Real Estate Purchase Agreement form. This document serves as the formal contract between the buyer and seller, laying out the terms and conditions of the sale. Key components of this agreement include the identification of both parties involved, the precise description of the property being transferred, the purchase price along with the payment terms, and any contingencies that must be met before the transaction can be finalized. Additionally, it specifies the obligations of both the buyer and seller, the closing date, and details regarding the handling of taxes, insurance, and adjustments. The form ensures that all aspects of the property sale are clearly understood and agreed upon, minimizing the potential for disputes and misunderstandings. This essential tool in the real estate transaction process not only provides legal protection to both parties but also outlines the pathway for the transfer of property ownership in Illinois, making it a cornerstone of any successful real estate deal.

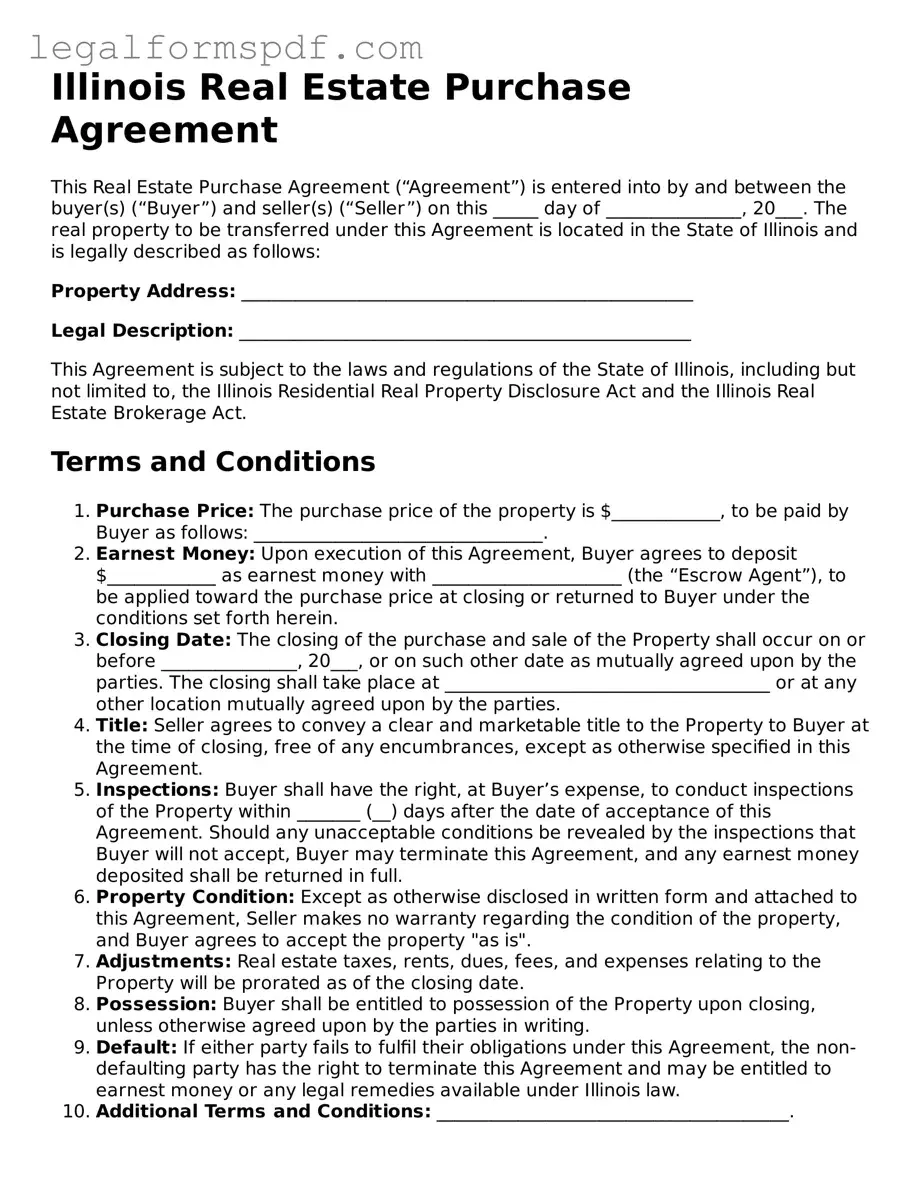

Document Example

Illinois Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between the buyer(s) (“Buyer”) and seller(s) (“Seller”) on this _____ day of _______________, 20___. The real property to be transferred under this Agreement is located in the State of Illinois and is legally described as follows:

Property Address: __________________________________________________

Legal Description: __________________________________________________

This Agreement is subject to the laws and regulations of the State of Illinois, including but not limited to, the Illinois Residential Real Property Disclosure Act and the Illinois Real Estate Brokerage Act.

Terms and Conditions

- Purchase Price: The purchase price of the property is $____________, to be paid by Buyer as follows: ________________________________.

- Earnest Money: Upon execution of this Agreement, Buyer agrees to deposit $____________ as earnest money with _____________________ (the “Escrow Agent”), to be applied toward the purchase price at closing or returned to Buyer under the conditions set forth herein.

- Closing Date: The closing of the purchase and sale of the Property shall occur on or before _______________, 20___, or on such other date as mutually agreed upon by the parties. The closing shall take place at ____________________________________ or at any other location mutually agreed upon by the parties.

- Title: Seller agrees to convey a clear and marketable title to the Property to Buyer at the time of closing, free of any encumbrances, except as otherwise specified in this Agreement.

- Inspections: Buyer shall have the right, at Buyer’s expense, to conduct inspections of the Property within _______ (__) days after the date of acceptance of this Agreement. Should any unacceptable conditions be revealed by the inspections that Buyer will not accept, Buyer may terminate this Agreement, and any earnest money deposited shall be returned in full.

- Property Condition: Except as otherwise disclosed in written form and attached to this Agreement, Seller makes no warranty regarding the condition of the property, and Buyer agrees to accept the property "as is".

- Adjustments: Real estate taxes, rents, dues, fees, and expenses relating to the Property will be prorated as of the closing date.

- Possession: Buyer shall be entitled to possession of the Property upon closing, unless otherwise agreed upon by the parties in writing.

- Default: If either party fails to fulfil their obligations under this Agreement, the non-defaulting party has the right to terminate this Agreement and may be entitled to earnest money or any legal remedies available under Illinois law.

- Additional Terms and Conditions: _______________________________________.

Signatures

This Agreement shall not be deemed effective until signed by both Buyer and Seller. By their signatures below, the parties acknowledge that they have read, understand, and agree to all terms and conditions outlined in this Illinois Real Estate Purchase Agreement.

Buyer's Signature: ___________________________________ Date: ___________

Seller's Signature: __________________________________ Date: ___________

Witness or Notary (If required): __________________________________ Date: ___________

This template is provided as a general guideline. Consult a legal professional before signing to ensure that all provisions comply with current Illinois laws and custom.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Real Estate Purchase Agreement is governed by Illinois state laws, including the Residential Real Property Disclosure Act, which mandates sellers to disclose certain property conditions and defects to buyers. |

| Essential Elements | The form must include critical information such as property details, purchase price, earnest money deposit, financing terms, and closing and possession dates. |

| Disclosure Requirements | Sellers are required to complete a Residential Real Property Disclosure Report stating the condition of the property, including any known material defects. |

| Contingency Clauses | The agreement often contains contingency clauses that must be satisfied before the transaction can be completed, such as financing approval, home inspections, and the sale of the buyer's current home. |

Instructions on Writing Illinois Real Estate Purchase Agreement

Filling out the Illinois Real Estate Purchase Agreement is a critical step in the process of buying or selling property. This form outlines the terms and conditions of the sale, ensuring both parties are on the same page. It's important to complete this form carefully to prevent any misunderstandings or legal issues down the line. Here are the steps you need to follow to fill out the form correctly.

- Gather necessary information, including the legal names of the buyer and seller, the property address, and legal description.

- Specify the purchase price agreed upon by both parties.

- Detail the terms of the deposit, including the amount and to whom it will be paid.

- Outline any contingencies, such as financing or inspections, that need to be met before the sale can proceed.

- Include financing details, if relevant, specifying the type of loan, the amount, and the party responsible for arranging the financing.

- List any items that will be included or excluded from the sale, such as appliances or fixtures.

- Indicate the closing date and location where the sale will be finalized.

- Specify who will pay for closing costs, and what those costs include.

- Include any other agreements or provisions relevant to the sale. This might cover repairs, maintenance, or other conditions affecting the sale.

- Both the buyer and seller must sign and date the agreement to make it legally binding.

Once completed, this form serves as a binding contract between the buyer and seller. It outlines each party's obligations and helps protect both sides if disputes arise. After completion, it's usually a good idea for both parties to keep a copy of the agreement for their records.

Understanding Illinois Real Estate Purchase Agreement

What is the Illinois Real Estate Purchase Agreement?

The Illinois Real Estate Purchase Agreement is a legally binding document used in the sale and purchase of real estate in Illinois. It outlines the terms and conditions agreed upon by both the buyer and the seller. This agreement covers aspects such as the purchase price, closing date, and any contingencies like financing or inspections that need to be met before the sale is finalized.

Who needs to sign the Illinois Real Estate Purchase Agreement?

Both the buyer and the seller must sign the Illinois Real Estate Purchase Agreement for it to be legally binding. Additionally, if there are co-buyers or co-sellers involved, they must also sign the agreement. Witness signatures may be required depending on the specific circumstances of the transaction and local legal requirements.

Is it necessary to have an attorney review the agreement?

While it is not legally required to have an attorney review the Illinois Real Estate Purchase Agreement, it is highly recommended. An attorney can provide valuable insight into the terms of the agreement, ensuring that it protects your rights and interests. They can also help navigate any potential legal issues that could arise during the purchase process.

Can modifications be made to the Illinois Real Estate Purchase Agreement after it has been signed?

Yes, modifications can be made to the agreement after it has been signed, but any changes must be agreed upon by all parties involved. These modifications should be made in writing and attached to the original agreement as an amendment. Both the buyers and sellers should then sign the amendment to acknowledge the changes.

What happens if the buyer or seller breaches the agreement?

If either the buyer or the seller breaches the Illinois Real Estate Purchase Agreement, the non-breaching party may be entitled to specific legal remedies. These can include suing for damages, enforcing specific performance (compelling the breaching party to follow through with the agreement), or terminating the agreement and seeking a return of the earnest money deposit. The exact remedies available will depend on the terms of the agreement and the nature of the breach.

How does the contingency clause in the agreement work?

The contingency clause in the Illinois Real Estate Purchase Agreement outlines specific conditions that must be met for the transaction to proceed to closing. Common contingencies include the buyer obtaining financing, the sale of the buyer's current home, and satisfactory home inspections. If these conditions are not met by specified deadlines, the buyer may have the right to back out of the agreement with their earnest money deposit returned.

What is the role of earnest money in the Illinois Real Estate Purchase Agreement?

In the Illinois Real Estate Purchase Agreement, earnest money is a deposit made by the buyer to demonstrate their serious intention to purchase the property. It's held in an escrow account until closing. If the sale goes through, the earnest money is applied toward the purchase price. However, if the buyer backs out of the deal without a justifiable reason as outlined in the agreement, they may forfeit this deposit to the seller as compensation for the breach of contract.

How is the closing date determined in the agreement?

The closing date in the Illinois Real Estate Purchase Agreement is agreed upon by both the buyer and the seller and is explicitly stated in the contract. This is the date by which all aspects of the agreement must be finalized, and the property ownership is transferred from the seller to the buyer. Extensions to the closing date can be negotiated if necessary, but must be agreed upon by both parties in writing.

Common mistakes

One common mistake made when filling out the Illinois Real Estate Purchase Agreement form is overlooking details regarding the financial terms. Buyers and sellers often enter the basic purchase price but may neglect to provide specifics about the earnest money deposit, funding contingencies, or the allocation of closing costs. Such omissions can lead to misunderstandings or disputes as the sale progresses. It is critical for both parties to thoroughly document all financial arrangements to ensure clarity and prevent any future disputes over the terms of the agreement.

Another error involves not specifying the fixtures and personal property included in the sale. This oversight can result in confusion or conflict concerning what items are considered part of the property. Clarifying which fixtures or personal property items, such as appliances or window treatments, are included in the sale can help avoid complications at closing. Both buyers and sellers should list these items clearly in the agreement to prevent any ambiguity.

Neglecting to disclose known defects or issues with the property is also a significant mistake. Sellers are legally required to disclose any known material defects that could affect the property's value or desirability. Failure to disclose such information can lead to legal consequences, including the potential for the buyer to rescind the purchase agreement upon discovering undisclosed defects. It is in the best interest of all parties to openly share any known issues with the property to ensure a fair and transparent transaction.

Ignoring the need for a professional inspection is another common misstep. Buyers may forego an inspection either because they are unaware of its importance or in an attempt to expedite the process. However, waiving the inspection can lead to unwelcome surprises about the property's condition after the sale has been finalized. It is advisable for buyers to include an inspection contingency in the agreement, allowing them the option to renegotiate or withdraw if significant issues are discovered.

Failing to specify a closing date or misunderstanding its significance can also lead to problems. The closing date is critical as it dictates when the property's ownership will officially change hands, and it ties to several financial and logistical arrangements. If the closing date is not clearly defined or if there is a misunderstanding about its flexibility, it can result in delays and additional expenses for both parties. It is essential to agree on a realistic closing date and to understand any circumstances that might permit a change to that date.

Last, underestimating the importance of legal advice is a mistake that can have far-reaching consequences. Some parties may choose to fill out the agreement without consulting a legal professional, either to save costs or because they believe the transaction is straightforward. However, real estate transactions involve complex legal considerations, and the implications of the agreement's terms can be extensive. Seeking the counsel of a qualified attorney can prevent legal issues down the line and ensure that the agreement accurately reflects the parties' intentions and complies with state law.

Documents used along the form

In the process of buying or selling real estate in Illinois, parties often use the Real Estate Purchase Agreement as a fundamental document to outline the sale's terms and conditions. However, this agreement does not stand alone. Several other forms and documents are typically used alongside it to ensure a thorough and legally sound transaction. Each of these documents serves a distinct purpose, contributing to the clarity, legality, and effectiveness of the real estate transaction.

- Title Insurance Commitment: A document issued by a title company after a thorough examination of the public records. It serves to inform all parties involved about the title's status and outlines the conditions under which the insurer will issue a title insurance policy.

- Bill of Sale: Used to transfer personal property included in the sale of the real estate, such as appliances or furniture, from the seller to the buyer.

- Lead-Based Paint Disclosure: A must for any home sale where the property was built before 1978. This form discloses the presence of lead-based paint and gives buyers the necessary information to understand potential risks.

- Residential Real Property Disclosure Report: A statement from the seller disclosing the condition of the property, covering various aspects such as the roof, foundation, plumbing, and electrical systems.

- Home Inspection Report: Prepared by a professional home inspector, this report documents the condition of the property, identifying any issues or potential concerns that might not be immediately visible.

- Mortgage Pre-Approval Letter: A document from a lender indicating that a potential buyer has been preliminarily approved for financing up to a certain amount. It’s essential for buyers to prove their financial ability to purchase the home.

- Closing Disclosure: A form provided to the buyer and seller detailing the final transaction costs. It’s required by federal law to ensure transparency and to allow the buyer to compare costs.

- Survey: This document provides a precise measurement and description of the property's boundaries and structures. It is crucial for identifying any encroachments or zoning issues.

- Contingency Removal Forms: These forms are used to remove contingencies outlined in the Purchase Agreement, such as financing or inspection contingencies, indicating that those conditions have been met.

Together, these documents form a comprehensive framework that supports the Real Estate Purchase Agreement, safeguarding the interests of both the buyer and seller. By ensuring that these documents are accurately completed and duly considered, parties can facilitate a smoother, more secure real estate transaction in Illinois.

Similar forms

The Illinois Real Estate Purchase Agreement form shares similarities with the Residential Lease Agreement, primarily because both lay down legally binding conditions between two parties regarding the use and possession of a property. A Residential Lease Agreement outlines the terms under which the tenant agrees to rent property from the landlord for a specified time and at a predetermined rent, similar to how the Real Estate Purchase Agreement specifies terms for the purchase. However, instead of facilitating a sale, a lease agreement focuses on rental terms, exhibiting the parallel nature of delineating rights, responsibilities, and obligations of involved parties concerning real property.

Comparatively, the Bill of Sale document parallels the Real Estate Purchase Agreement through its role in transitioning ownership of personal property from a seller to a buyer. Despite the Bill of Sale typically applying to personal property—like vehicles, equipment, or other movable assets—and the Real Estate Purchase Agreement to real property, both serve as crucial evidence in the change of ownership. They contain necessary details about the transaction, such as identification of the buyer and seller, description of the item or property being transferred, and terms of the agreement, thus ensuring a legally binding transfer.

Another document bearing resemblance to the Illinois Real Estate Purchase Agreement is the Loan Agreement. Loan Agreements detail the terms under which a lender provides funds to a borrower, who in the context of real estate, may use these funds to purchase property. While the Loan Agreement focuses on the relationship between borrower and lender by setting out repayment conditions, interest rates, and collateral, if applicable, it is similar to the Real Estate Purchase Agreement in addressing the financial components of transactions. Each lays a legal foundation for significant financial exchanges, highlighting obligations and setting forth conditions that protect the interests of the parties involved.

The Option to Purchase Agreement shares a fundamental connection with the Real Estate Purchase Agreement, with both facilitating the sale of property, albeit at different stages of the transaction process. An Option to Purchase gives the potential buyer the right—but not the obligation—to purchase real estate for a specific price within a predetermined period. This agreement often precedes a Real Estate Purchase Agreement, setting the stage for a future sale. It is similar in creating a legal framework that may lead to the transfer of property, underscoring the parties' intentions and outlining preliminary terms that guide the eventual sale.

Last, the Home Inspection Report, while not a contractual agreement, is closely related to the Real Estate Purchase Agreement. It typically precedes or follows the signing of the agreement and influences the finalization of the sale. This report provides a comprehensive assessment of a property's condition, detailing any issues that might affect the transaction's terms. Both documents aim to ensure transparency and protect the parties' interests by disclosing crucial information about the property. The Home Inspection Report can lead to negotiations or amendments in the Real Estate Purchase Agreement, endorsing its significance in the property transaction process.

Dos and Don'ts

When filling out the Illinois Real Estate Purchase Agreement form, it's essential to proceed with care and thoroughness. This document is legal in nature and plays a pivotal role in the process of buying or selling property. Below, you will find a concise guide outlining what should and shouldn't be done during this process.

Do's:

- Review Information Thoroughly: Before filling out the form, ensure all relevant information is at hand. This includes property details, terms of sale, and personal information.

- Use Clear and Precise Language: When detailing the terms of the agreement, clarity is key. Avoid ambiguous language that could lead to misunderstandings.

- Include All Necessary Attachments: Often, attachments such as property disclosures or inspection reports are required. Make sure these are completed and included with the form.

- Consult with a Professional: Whether it's a real estate agent, lawyer, or both, getting professional advice can prevent mistakes and ensure that the form is completed correctly.

Don'ts:

- Leave Sections Blank: If a section does not apply, it's better to mark it as "N/A" (not applicable) rather than leaving it blank. This shows that the section was not overlooked.

- Sign Without Reading: It can be tempting to skim through documents, especially when they appear straightforward. However, it's crucial to read every part of the agreement before signing.

- Forget to Check for Errors: Once the agreement is filled out, review it for any mistakes. Errors in personal information, property details, or terms could lead to issues down the line.

- Rely Solely on Verbal Agreements: While verbal agreements can be meaningful, they are not legally binding in the context of real estate transactions. Ensure all agreements are documented in writing.

Misconceptions

When it comes to real estate transactions in Illinois, the Real Estate Purchase Agreement form is a crucial document that outlines the terms and conditions of the sale. However, there are several misconceptions about this form that can lead to confusion or misunderstandings. Here are five common misconceptions:

- It's Just a Formality: Many believe the Real Estate Purchase Agreement is merely procedural, but it legally binds both buyer and seller to the terms laid out within. Every clause and condition can have significant legal implications.

- It's Identical Across All Transactions: Another misconception is that the agreement is a one-size-fits-all document. In reality, it can be customized extensively to match the specifics of each transaction, including contingencies, closing terms, and other details.

- No Need for Professional Review: Some people think they don’t need a professional to review the document. Given its legal importance, having a real estate lawyer or a knowledgeable professional review the agreement before signing can prevent future disputes or misunderstandings.

- Verbal Agreements Are Enforceable: While verbal agreements may seem binding, the law requires real estate agreements to be in writing and signed by both parties to be enforceable. Relying on verbal agreements can lead to significant risks.

- It Only Covers the Sale Price: Lastly, there’s a belief that the agreement only covers the sale price of the property. In reality, it encompasses much more, including terms of payment, closing dates, inspections, warranties, and other conditions that are crucial to the transaction.

Understanding these misconceptions is important for anyone involved in a real estate transaction in Illinois. It ensures that all parties have a clear understanding of their rights and obligations, leading to a smoother transaction process.

Key takeaways

Filling out and using the Illinois Real Estate Purchase Agreement can seem daunting at first glance. However, understanding its purpose and key components makes the process more approachable. Here are eight essential takeaways that can guide parties through the complexities of this critical document:

In Illinois, the Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions agreed upon by the buyer and seller of a property. It establishes the sale price, closing date, and respective obligations of each party.

Accuracy is paramount when filling out the form. Every detail, from the legal names of the parties involved to the precise description of the property, must be accurately recorded to avoid future disputes or legal challenges.

The agreement should clearly specify the financial terms, including the purchase price, deposit amount, and financing details. It should articulate the responsibilities of the buyer in securing a mortgage, if applicable, and any conditions related to financing that the agreement is contingent upon.

Inspection contingencies are a critical aspect of the agreement. These clauses allow the buyer to have the property inspected within a specified period. The agreement should detail the scope of these inspections and the implications of the findings on the continuation of the purchase process.

Closing and possession dates need to be explicitly mentioned. The agreement specifies when the transfer of ownership will officially take place and when the buyer can take possession of the property, a moment that often coincides with the closing date but can vary.

Disclosure requirements play a significant role in the agreement. In Illinois, sellers are required to disclose certain information about the property's condition and history that could affect its value or desirability. The agreement should include these disclosures or acknowledgements that such disclosures have been made.

Alterations or amendments to the agreement must be made in writing and signed by both parties. Oral agreements or understandings not explicitly detailed in the document are generally not enforceable under Illinois law.

Professional assistance can be invaluable. While it's possible for buyers and sellers to complete a Real Estate Purchase Agreement on their own, consulting with a real estate attorney or an experienced real estate professional can help ensure that the document fully protects their interests and complies with Illinois law.

Understanding these key aspects of the Illinois Real Estate Purchase Agreement can significantly smooth the transaction process, providing clarity and protection for all parties involved.

More Real Estate Purchase Agreement State Forms

Generic Home Purchase Agreement - An essential contract that forms the basis of the agreement between a seller and a buyer for the sale of property.

Pa Real Estate Contract - This form outlines the specifics of a real estate sale, including price, property details, and closing date.