Fillable Real Estate Purchase Agreement Document for Georgia

When individuals decide to buy or sell property in Georgia, the transaction is solidified through a crucial document known as the Georgia Real Estate Purchase Agreement. This form, pivotal in the real estate transaction process, outlines the terms and conditions agreed upon by both parties. It includes vital details such as the purchase price, property description, closing date, and any contingencies that must be met before the sale is finalized. Ensuring these elements are carefully documented in the agreement protects all parties involved, providing a clear path forward to transferring ownership. The form serves not only as a binding contract but also as a guide through the often complex process of buying or selling property, addressing legal requirements and setting expectations for both buyers and sellers. Its role in the real estate process in Georgia cannot be understated, acting as the linchpin that secures the integrity and success of property transactions.

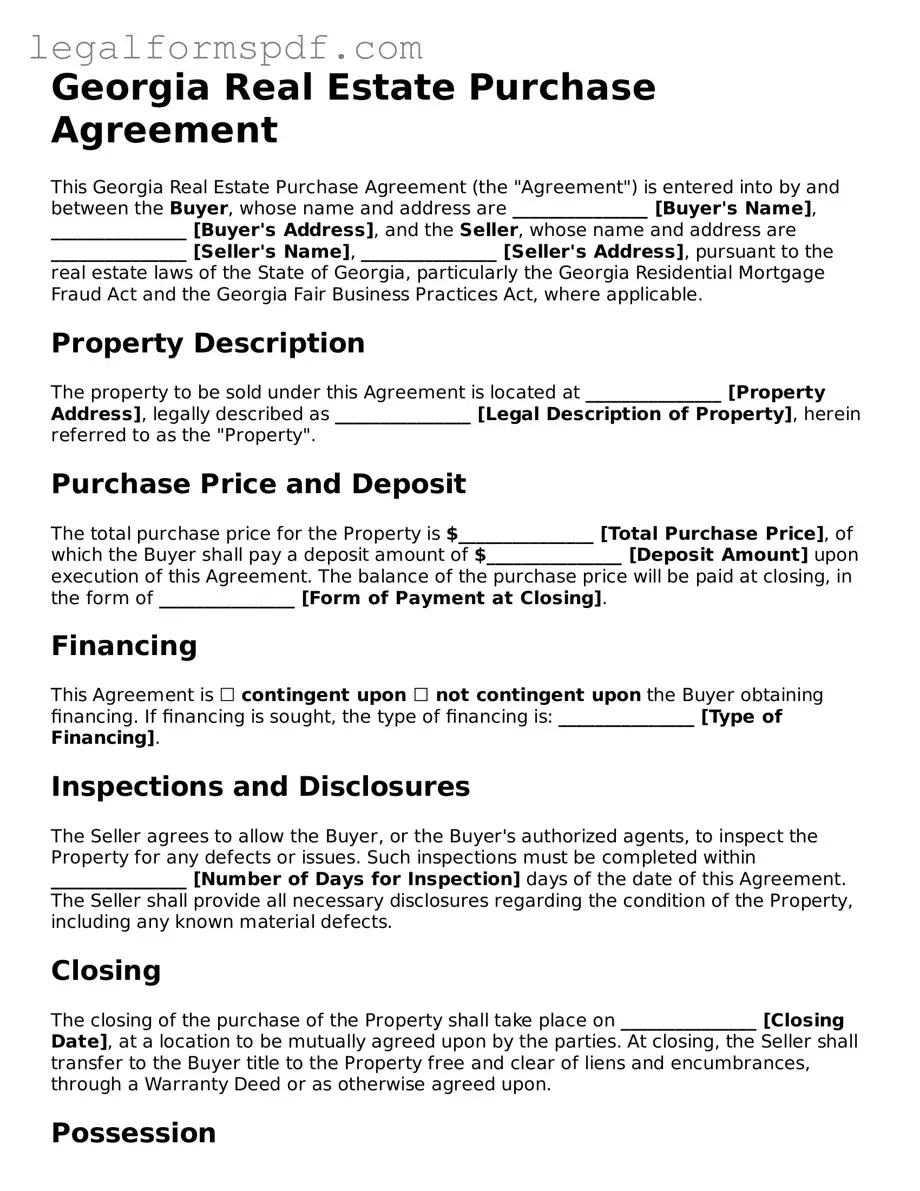

Document Example

Georgia Real Estate Purchase Agreement

This Georgia Real Estate Purchase Agreement (the "Agreement") is entered into by and between the Buyer, whose name and address are _______________ [Buyer's Name], _______________ [Buyer's Address], and the Seller, whose name and address are _______________ [Seller's Name], _______________ [Seller's Address], pursuant to the real estate laws of the State of Georgia, particularly the Georgia Residential Mortgage Fraud Act and the Georgia Fair Business Practices Act, where applicable.

Property Description

The property to be sold under this Agreement is located at _______________ [Property Address], legally described as _______________ [Legal Description of Property], herein referred to as the "Property".

Purchase Price and Deposit

The total purchase price for the Property is $_______________ [Total Purchase Price], of which the Buyer shall pay a deposit amount of $_______________ [Deposit Amount] upon execution of this Agreement. The balance of the purchase price will be paid at closing, in the form of _______________ [Form of Payment at Closing].

Financing

This Agreement is ☐ contingent upon ☐ not contingent upon the Buyer obtaining financing. If financing is sought, the type of financing is: _______________ [Type of Financing].

Inspections and Disclosures

The Seller agrees to allow the Buyer, or the Buyer's authorized agents, to inspect the Property for any defects or issues. Such inspections must be completed within _______________ [Number of Days for Inspection] days of the date of this Agreement. The Seller shall provide all necessary disclosures regarding the condition of the Property, including any known material defects.

Closing

The closing of the purchase of the Property shall take place on _______________ [Closing Date], at a location to be mutually agreed upon by the parties. At closing, the Seller shall transfer to the Buyer title to the Property free and clear of liens and encumbrances, through a Warranty Deed or as otherwise agreed upon.

Possession

Possession of the Property shall be granted to the Buyer at closing, unless otherwise agreed upon by the parties in writing.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

Signatures

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute the same instrument.

IN WITNESS WHEREOF, the parties hereto have executed this Georgia Real Estate Purchase Agreement as of the ___ day of __________, 20__.

Buyer's Signature: ___________________________ Date: ________________

Seller's Signature: __________________________ Date: ________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Georgia Real Estate Purchase Agreement is a legally binding document used for the purchase and sale of real property in the state of Georgia. |

| 2 | It outlines the terms and conditions of the sale, including the purchase price, financing conditions, and inspection rights. |

| 3 | Governing laws for this agreement in Georgia include the Georgia Residential Mortgage Fraud Act and the Georgia Fair Lending Act among other state property and contract laws. |

| 4 | Both the buyer and seller are required to disclose specific information, making the process transparent and reducing the risk of future legal disputes. |

| 5 | Provisions for earnest money deposits are included, which serve as a good faith deposit from the buyer to secure the agreement. |

| 6 | The agreement allows for inspections and appraisals to be conducted, often a condition of the buyer's financing. |

| 7 | Closing dates and possession dates are clearly specified, ensuring both parties are aware of the timeline for the sale and transfer of the property. |

Instructions on Writing Georgia Real Estate Purchase Agreement

Filling out a Real Estate Purchase Agreement in Georgia is an important step in the process of buying or selling property. This document outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies that must be met before the sale can be finalized. A properly executed agreement protects both the buyer and seller and ensures that each party understands their obligations. It's crucial to complete this form with care to avoid any legal issues down the line.

Here are the steps needed to fill out the Georgia Real Estate Purchase Agreement:

- Start by entering the date the agreement is being made at the top of the form.

- Fill in the full legal names of both the buyer(s) and seller(s) in the designated spaces.

- Provide a detailed description of the property being sold, including its address, legal description, and any personal property included in the sale.

- Enter the purchase price the buyer agrees to pay for the property.

- Outline the terms of the agreement, specifying whether the purchase is contingent upon certain conditions, such as the buyer obtaining financing or the sale of their current home.

- Specify the amount of earnest money the buyer must deposit and the account where it will be held.

- Detail the closing date and location where the sale will be finalized.

- Include any additional terms or conditions that are part of the agreement, such as seller concessions, home warranty plans, or property inspections.

- Have both the buyer(s) and seller(s) sign and date the agreement. Witness signatures may also be required, depending on local laws.

Once the Georgia Real Estate Purchase Agreement is fully completed and signed, it serves as a legally binding contract between the buyer and seller. It's advisable for both parties to review the document carefully, possibly with the assistance of a lawyer, before signing. This ensures that everyone involved understands their rights and obligations, helping to prevent misunderstandings or legal issues. Remember, real estate transactions can be complex, and the purchase agreement is a critical part of ensuring that the process goes smoothly for both parties.

Understanding Georgia Real Estate Purchase Agreement

What is a Georgia Real Estate Purchase Agreement?

A Georgia Real Estate Purchase Agreement is a legal document that outlines the specific terms and conditions of a sale between a buyer and a seller for real estate property located in Georgia. This agreement includes details such as the purchase price, property description, financing terms, and any contingencies that must be met before the sale can be finalized.

Who needs to sign the Georgia Real Estate Purchase Agreement?

The Georgia Real Estate Purchase Agreement must be signed by both the buyer(s) and the seller(s) to indicate their mutual agreement to the terms and conditions stated in the document. If there are co-buyers or co-sellers involved, each party must sign the agreement as well.

Is a Georgia Real Estate Purchase Agreement legally binding?

Yes, once signed by both the buyer and the seller, the Georgia Real Estate Purchase Agreement becomes a legally binding contract. This means both parties are legally obligated to fulfill their respective duties as outlined in the agreement. Failure to do so may result in legal consequences.

What details should be included in the Georgia Real Estate Purchase Agreement?

The agreement should include specific details such as the legal description of the property, the purchase price, the closing date, and the terms of payment. It should also outline any additional terms, such as contingencies related to financing, inspections, or the sale of another property, that must be satisfied before the transaction can conclude.

How can contingencies affect the sale process?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include obtaining financing, successful home inspections, and the ability of the buyer to sell their current home. If contingencies cannot be met, they can either delay the sale process or allow a party to legally withdraw from the agreement without penalty.

What happens if either party breaches the Georgia Real Estate Purchase Agreement?

If either the buyer or the seller breaches the agreement, the non-breaching party has legal recourse. Solutions can range from negotiating a settlement, seeking specific performance (compelling the breaching party to fulfill their obligations), or filing a lawsuit for damages. Mediation or arbitration clauses included in the agreement can provide alternative dispute resolution methods.

Can changes be made to the Georgia Real Estate Purchase Agreement after it’s signed?

Yes, changes can be made to the agreement after it is signed, but any modifications must be in writing and signed by both the buyer and the seller. Oral agreements or understandings are not legally enforceable under the terms of most real estate purchase agreements.

Common mistakes

Filling out the Georgia Real Estate Purchase Agreement form requires attention to detail and a clear understanding of the terms involved. One common mistake is overlooking the necessity to specify all parties involved accurately. Buyers and sellers sometimes only list one party when there are multiple, leading to potential legal complications later on. It's crucial to list every person who has a stake in the transaction to ensure that the agreement is binding for all parties involved.

Another error frequently seen is not providing a complete legal description of the property. A street address alone is not enough. The agreement should include the full legal description as found in the property's deed. This description encompasses boundaries, lot number, subdivision name, and other crucial details that uniquely identify the property. Without this information, the agreement might be considered vague, putting the transaction at risk.

Buyers and sellers often fail to agree on a specific closing date, leaving this critical field blank or vague. The closing date is when the transaction is finalized, and the property officially changes hands. Not setting a firm closing date can lead to uncertainty and scheduling conflicts. A clear, agreed-upon date helps both parties plan accordingly and avoids unnecessary stress.

Incorrectly handling the earnest money deposit detail is yet another common oversight. This deposit acts as a buyer's good faith gesture, securing their intent to purchase. Failing to specify the amount, or the holder of these funds (such as an escrow agent), can lead to disputes over the earnest money's management and return conditions should the agreement fall through.

Many also miss specifying contingencies clearly. These conditions must be met for the purchase to proceed, such as obtaining financing, selling a current home, or passing a home inspection. Without clearly defined contingencies, the buyer or seller may find themselves in a binding agreement without a clear path to address unforeseen issues.

Omitting details about included or excluded personal property is a mistake that can lead to misunderstandings and disagreements. Items such as appliances, fixtures, and window treatments can be a significant factor in negotiations. Clearly defining which items remain with the house and which do not can prevent issues at closing.

The allocation of closing costs is often misunderstood or incorrectly filled out. Both buyers and sellers have specific costs they’re typically responsible for. Failing to clearly outline who will pay for what can lead to last-minute disagreements and could potentially derail the closing process.

Not including a clause about the current condition of the property and any warranties or disclosures can be problematic. Sellers are usually required to disclose known issues with the property, but if these are not detailed in the agreement, the buyer may face unexpected problems down the line. Explicitly mentioning the state of the property and any disclosures protects the buyer and clarifies the seller's obligations.

Overlooking the need for a professional inspection and appraisal can also be a critical mistake. These assessments provide a comprehensive look at the property's condition and value, influencing the buyer's decision and the loan approval process. Failing to include terms that allow for these evaluations can result in significant issues if the property does not meet expectations or appraisal values.

Finally, neglecting to consult a real estate professional or attorney before completing the agreement is a significant oversight. While it might seem straightforward, the Georgia Real Estate Purchase Agreement is a legally binding document that requires precise information and understanding. Professional advice can help avoid misunderstandings, legal issues, and ensure that both parties' rights are protected throughout the transaction process.

Documents used along the form

When entering the world of real estate transactions in Georgia, the Real Estate Purchase Agreement form plays a pivotal role as the cornerstone document outlining the sale's terms between buyer and seller. However, this form does not stand alone. To ensure a smooth, legally compliant transaction, several additional documents and forms often accompany it. Each of these plays a crucial role in safeguarding the interests of all parties involved and ensuring the process adheres to state law. Let's explore some of these key documents.

- Disclosures Related to Property Condition: Sellers are usually required to provide specific disclosures about the property's condition. These can range from known defects within the property to lead-based paint disclosures for homes built before 1978. These disclosures are vital for transparency and protect the buyer from unforeseen problems.

- Title Insurance and Warranty Deed: To ensure that the buyer receives clear title to the property, a title insurance policy is often purchased. This is accompanied by a Warranty Deed, which formally transfers ownership of the property from the seller to the buyer, guaranteeing that the seller holds clear title to the property.

- Loan Documents: If the purchase involves a mortgage, the buyer will need to complete various loan documents. These documents outline the terms of the mortgage agreement between the buyer and the lending institution, including the loan amount, interest rate, repayment schedule, and other loan conditions.

- Home Inspection Report: Although not always mandatory, a home inspection report is strongly recommended. This comprehensive report provides an in-depth look at the property's condition, highlighting any areas of concern or potential future issues. It gives the buyer peace of mind and can be used to negotiate repairs or adjustments to the purchase price.

- Closing Disclosure: Required for any transaction involving a mortgage, the Closing Disclosure is a form that outlines the final terms and costs of the mortgage. It provides the buyer with a detailed breakdown of the loan’s interest rate, monthly payments, and closing costs. This document must be reviewed and approved by the buyer before the closing date.

Real estate transactions are complex, and the need for these additional documents illustrates the multiple layers of protection and transparency needed in these deals. Whether you are a first-time homebuyer or a seasoned investor in Georgia, understanding the purpose and contents of these documents can significantly enhance your grasp of the real estate process. Ensuring you have all the necessary paperwork in order can lead to a smoother, more secure real estate transaction.

Similar forms

The Residential Lease Agreement shares similarities with the Georgia Real Estate Purchase Agreement as both lay the foundation for the terms of living or owning property. While the purchase agreement outlines the conditions for the sale and transfer of ownership, the lease agreement specifies the terms under which a tenant can rent property from a landlord. Both documents are crucial in establishing the rights and responsibilities of each party involved in the transaction or rental of real estate.

A Bill of Sale for personal property is akin to the Georgia Real Estate Purchase Agreement, albeit for the sale of personal items rather than real estate. Both documents serve as proof of sale and transfer of ownership, clearly outlining the specifics of the transaction including the price, date, and identifying details of the items or properties involved. This ensures a formal, legal record of the transfer, important for both buyer and seller’s records.

The Land Contract, often utilized for seller-financed property sales, parallels the Real Estate Purchase Agreement in that it delineates the agreement between buyer and seller regarding property purchase. However, a Land Contract typically includes a payment plan, with the deed transferring to the purchaser only after the completion of all payments. This contract ensures buyers and sellers have a clear understanding of payment schedules, property rights, and responsibilities until full ownership is transferred.

Similarly, the Property Deed is directly related to the Real Estate Purchase Agreement since it is the document that officially transfers ownership of property from the seller to the buyer. While the purchase agreement outlines the terms and conditions under which the sale happens, the property deed is executed at closing to legally effect the transfer. Both are essential in the property sale process, ensuring the legality and finality of the transfer.

The Earnest Money Agreement is often a component of the Real Estate Purchase Agreement process, involving the buyer depositing a certain amount to show their genuine interest in proceeding with the purchase. Both documents serve to solidify the buyer's intent and the terms of the sale, but the Earnest Money Agreement specifically deals with the good faith deposit and conditions for its return or application toward the purchase price.

Home Inspection Reports, while not contractual agreements, closely tie to the Real Estate Purchase Agreement as they may influence the finalization or amendment of the agreement's terms. These reports detail the condition of the property and can lead to negotiations on repairs or adjustments in sale terms. The interconnectedness of these documents ensures that both buyer and seller are informed and agreeable to the property’s condition before finalizing the sale.

Financing Agreements or Mortgage Documents directly relate to many Georgia Real Estate Purchase Agreements, especially when the buyer is securing a loan to purchase the property. These documents outline the terms of the loan, including interest rates, payment schedules, and the duration of the loan. Both types of documents are integral in the property buying process, ensuring the buyer has the means to fulfill the financial commitment of the purchase agreement.

The Title Insurance Policy can be considered in tandem with the Real Estate Purchase Agreement, as it protects the buyer and the lender from potential losses caused by defects in title after the property purchase. While the purchase agreement secures the terms of the sale, the title insurance ensures that the title to the property is legally clear of issues that could affect ownership rights. Both are crucial for a secure and undisputed property transfer.

Lastly, the Property Disclosure Statement complements the Real Estate Purchase Agreement by providing detailed information about the property’s condition and history. This document allows the seller to reveal any known issues or defects that could affect the property’s value or desirability. Paired with the purchase agreement, it ensures the buyer is fully aware of what they are committing to, fostering transparency and trust in the transaction process.

Dos and Don'ts

When filling out the Georgia Real Estate Purchase Agreement form, it's crucial to ensure accuracy and completeness to avoid any potential legal issues. Here’s a guide on what you should and shouldn't do:

- Do:

- Review the entire form before you start filling it out to understand all the requirements.

- Use black ink or type your responses to ensure legibility.

- Make sure all parties involved in the transaction are correctly identified with their legal names and contact information.

- Clearly state the purchase price and any earnest money that will be deposited.

- Specify all fixtures, fittings, and any personal property that will be included or excluded from the sale.

- Include any contingencies that must be met before the transaction can proceed, such as financing or a satisfactory home inspection.

- Ensure that all necessary disclosures, such as lead-based paint disclosures for older homes, are completed and attached.

- Have all parties involved sign and date the form in the presence of a notary or witness where required.

- Don't:

- Leave any sections blank. If a section does not apply, write “N/A” to indicate this.

- Assume verbal agreements will hold up; ensure all agreements are documented in the form.

- Forget to specify the closing date and location, as this is critical to the timing of the transaction.

- Overlook local and state-specific requirements or addenda that may need to be attached.

- Sign the form without thoroughly reviewing all entered information and ensuring it's accurate.

This checklist should serve as a general guide to help you navigate the specifics of the Georgia Real Estate Purchase Agreement form. It's advisable to consult with a professional if you encounter any uncertainties during the process.

Misconceptions

When navigating the process of purchasing real estate in Georgia, understanding the Real Estate Purchase Agreement (REPA) form is crucial. Unfortunately, there are several misconceptions surrounding this legal document that can potentially confuse or mislead both buyers and sellers. Below, some of these misunderstandings are clarified:

It's just a standard form: Many believe that the Georgia Real Estate Purchase Agreement is a mere formality, a standard document without room for negotiation. In reality, it is a critical contract that outlines the terms of the sale and purchase, including price, closing conditions, and other key details. Each element can be tailored to meet the specific needs of the buyer and seller.

Attorney review is optional: Some parties might assume that attorney review of the REPA is optional or unnecessary. However, due to the complex and binding nature of the document, having it reviewed by a legal professional can prevent future disputes and ensure that the agreement complies with current laws.

Everything is negotiable until closing: A misconception exists that terms of the REPA can be renegotiated at any point up to the closing. Once the agreement is signed by both parties, it becomes a legally binding contract, and the terms can't be changed unless both parties agree to the amendments in writing.

Oral agreements are enforceable: Some might believe that verbal agreements made during the negotiation process will be honored. In Georgia, real estate transactions must be in writing to be legally enforceable, as per the Statute of Frauds. Oral agreements related to the purchase of real estate are generally not recognized by courts.

A real estate agent can give all the advice you need: While real estate agents are invaluable in finding the right property and facilitating negotiations, they may not have the legal expertise needed to provide advice on contractual matters. A lawyer specializing in real estate law should be consulted for legal advice regarding the REPA.

Deposits are always refundable: Buyers often assume that their deposit is automatically refundable if the deal falls through. The REPA specifies conditions under which a deposit may or may not be refundable. Understanding these conditions is vital, as there are circumstances under which a buyer may forfeit their deposit.

All disclosures are included in the REPA: It is a common belief that all necessary disclosures about the property's condition or history will be included within the REPA. In fact, separate disclosure forms might be required to provide comprehensive information about the property. These are essential for an informed purchase decision but are not a substitute for a buyer’s own due diligence and inspection.

Clearing up these misconceptions about the Georgia Real Estate Purchase Agreement can help both buyers and sellers navigate the transaction process more effectively, ensuring that their rights and interests are protected.

Key takeaways

Filling out and using the Georgia Real Estate Purchase Agreement form is a vital process for both buyers and sellers in the real estate market. This document is not only a legal requirement, but it also serves as the foundation for a clear, enforceable agreement between parties. Below are key takeaways that individuals should consider carefully.

- Complete Details: Ensure that all sections of the form are filled out with accurate and complete information. This includes names of parties involved, description of the property, purchase price, and any contingencies. Missing or incorrect information can lead to disputes or legal challenges down the line.

- Understand Contingencies: It’s important for both parties to clearly understand and agree upon the contingencies listed in the agreement. These conditions, which may include financing, inspections, and the sale of an existing home, must be met before the transaction can conclude successfully. Failure to meet these conditions can void the agreement.

- Consult a Professional: While filling out the form may seem straightforward, consulting with a real estate attorney or a professional can provide valuable insights. They can help clarify terms, identify potential issues, and ensure that the agreement meets all legal requirements in Georgia.

- Review Closing Costs: The agreement should clearly outline who is responsible for covering closing costs, which can include taxes, attorney fees, and other expenses associated with the sale. Understanding and agreeing to these terms ahead of time can prevent misunderstandings and financial disputes.

- Signatures Matter: The agreement must be signed by all parties involved to be legally binding. Digital signatures are often accepted, but it’s essential to follow whatever method is legally recognized and preferred in Georgia. Confirming the authenticity and validity of these signatures is critical for the enforceability of the agreement.

Properly using the Georgia Real Estate Purchase Agreement form is crucial for a smooth transition of property ownership. By paying close attention to details, understanding the conditions, and seeking professional guidance, parties can ensure that their real estate transaction is executed fairly and efficiently.

More Real Estate Purchase Agreement State Forms

House Purchase Agreement Template - The agreement details the process for handling disputes should they arise during the sale process.

Free Ohio Real Estate Purchase Contract for Sale by Owner - Earnest money requirements are defined, offering assurance to the seller of the buyer’s intent to purchase.

Nc Real Estate Purchase Agreement - Includes a clause on the condition of the property at the time of sale, ensuring it is conveyed in the agreed-upon condition.