Fillable Real Estate Purchase Agreement Document for Florida

In Florida, engaging in the process of buying or selling property is a significant step that involves detailed documentation to ensure a smooth and legally binding transaction. At the heart of this process is the Florida Real Estate Purchase Agreement form, a crucial document that outlines the terms and conditions agreed upon by both the buyer and the seller. This comprehensive form covers all major aspects of the real estate transaction, including the identification of both parties involved, the description of the property being bought or sold, the purchase price, and the terms of payment. Additionally, it delves into specifics such as any contingencies that might allow either party to back out under certain conditions, such as failed inspections or the inability of the buyer to secure financing. The agreement also addresses the allocation of various closing costs, delineating who is responsible for paying what, and sets forth any warranties or disclosures that the seller must provide to the buyer, thereby creating a transparent and legally enforceable outline of the sale's progression from offer to closing.

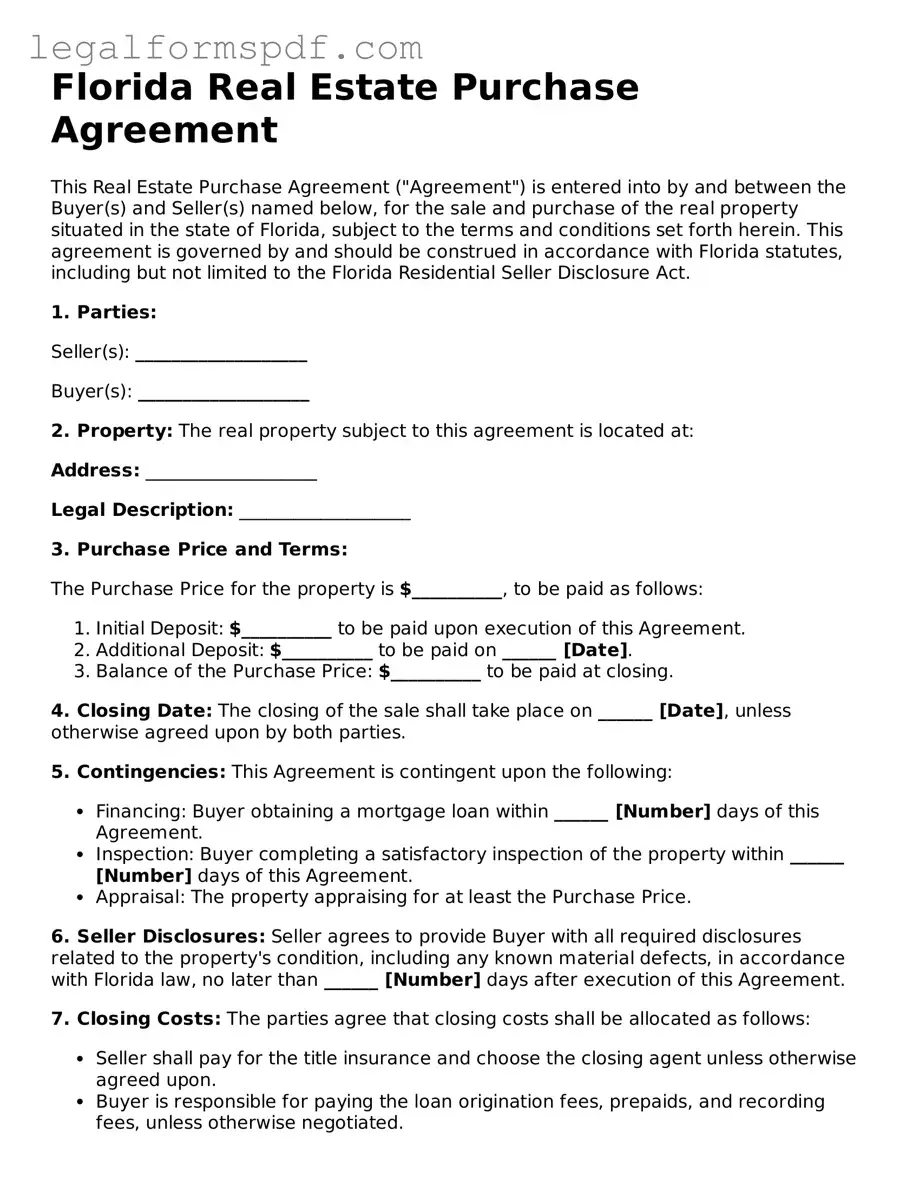

Document Example

Florida Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between the Buyer(s) and Seller(s) named below, for the sale and purchase of the real property situated in the state of Florida, subject to the terms and conditions set forth herein. This agreement is governed by and should be construed in accordance with Florida statutes, including but not limited to the Florida Residential Seller Disclosure Act.

1. Parties:

Seller(s): ___________________

Buyer(s): ___________________

2. Property: The real property subject to this agreement is located at:

Address: ___________________

Legal Description: ___________________

3. Purchase Price and Terms:

The Purchase Price for the property is $__________, to be paid as follows:

- Initial Deposit: $__________ to be paid upon execution of this Agreement.

- Additional Deposit: $__________ to be paid on ______ [Date].

- Balance of the Purchase Price: $__________ to be paid at closing.

4. Closing Date: The closing of the sale shall take place on ______ [Date], unless otherwise agreed upon by both parties.

5. Contingencies: This Agreement is contingent upon the following:

- Financing: Buyer obtaining a mortgage loan within ______ [Number] days of this Agreement.

- Inspection: Buyer completing a satisfactory inspection of the property within ______ [Number] days of this Agreement.

- Appraisal: The property appraising for at least the Purchase Price.

6. Seller Disclosures: Seller agrees to provide Buyer with all required disclosures related to the property's condition, including any known material defects, in accordance with Florida law, no later than ______ [Number] days after execution of this Agreement.

7. Closing Costs: The parties agree that closing costs shall be allocated as follows:

- Seller shall pay for the title insurance and choose the closing agent unless otherwise agreed upon.

- Buyer is responsible for paying the loan origination fees, prepaids, and recording fees, unless otherwise negotiated.

8. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

9. Signatures: This Agreement shall be considered legally binding upon the signatures of both parties.

Date: __________

Seller(s) Signature: ___________________

Buyer(s) Signature: ___________________

This template is provided as a courtesy and should be reviewed by a licensed attorney in Florida to ensure compliance with current laws and to accommodate any specific needs or modifications required by the parties involved.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by Florida state laws, specifically those that relate to the buying, selling, and leasing of residential properties. |

| Form Requirement | In Florida, a written real estate purchase agreement is required to be legally binding. |

| Identification of Parties | The agreement must clearly identify the buyer(s) and seller(s) by their full names, ensuring that all parties are recognized legally. |

| Description of Property | The legal description of the property, including its address and any identifying details as per public records, must be included in the agreement. |

| Purchase Price and Terms | The agreement must state the purchase price, including how it is to be paid and any terms related to the payment or financing. |

| Closing and Possession Dates | It must specify the date by which the closing of the sale will occur and when the buyer will take possession of the property. |

| Disclosures | Florida law requires certain disclosures to be made by the seller, such as the presence of lead paint in properties built before 1978. |

| Dispute Resolution | The agreement should outline how disputes related to the agreement will be resolved, whether through arbitration, mediation, or court action. |

| Signatures | For the agreement to be enforceable, it must be signed by all parties involved in the transaction. |

Instructions on Writing Florida Real Estate Purchase Agreement

Filling out the Florida Real Estate Purchase Agreement is a critical step in the process of buying or selling property in the state. This legal document outlines the terms and conditions of the sale, including the purchase price, property description, closing date, and any contingencies that must be met before the transaction can be finalized. Ensuring that all information on the form is accurate and complete is essential for both parties to protect their interests and make the transaction as smooth as possible. The following instructions are designed to guide you through each section of the form, helping you understand what information is required so you can confidently complete the form.

- Gather Necessary Information: Before you start, collect all the necessary details such as the legal description of the property, the agreed-upon purchase price, and any personal information for both the buyer and seller that the form requires.

- Identify the Parties: Fill in the legal names of both the buyer(s) and seller(s) in the designated sections, ensuring they are accurate and match any identification documents.

- Describe the Property: Enter the legal description of the property being sold. This usually includes the lot number, subdivision, and other details that can be found on the property's deed or previous sales agreement.

- Agree on the Purchase Price: Write the agreed-upon purchase price in the section provided. Make sure this number matches what was negotiated during the offer stage.

- Outline Terms of Payment: Specify how the purchase will be financed, whether it's through a conventional loan, FHA/VA financing, or another method. Include any earnest money deposit that will be made upfront.

- Set Closing and Possession Dates: Determine the closing date when the final sale will be executed and the property will officially change hands. Also, agree on when the buyer will take possession of the property.

- Identify Contingencies: List any conditions that must be met before the sale can be finalized. Common contingencies include home inspections, financing approval, and the sale of the buyer's current home.

- Include Additional Terms: If there are any specific details or stipulations not covered in the standard sections of the form, add them here. This can include items left behind by the seller, special conditions regarding the title, or any repairs that need to be made before closing.

- Review and Sign: Both the buyer and seller should carefully review the entire agreement to ensure all information is correct and complete. Once satisfied, each party should sign and date the form in the presence of a witness or notary, as required.

After completing these steps, it's important to distribute copies of the signed agreement to all involved parties, including any real estate agents or attorneys representing the buyer or seller. This document will serve as the legal contract governing the sale of the property, and it's crucial to keep it safe and accessible throughout the remainder of the transaction process. Depending on the details of your agreement, you may also need to take additional steps, such as applying for financing, scheduling a home inspection, or securing homeowners insurance, before the sale can be finalized.

Understanding Florida Real Estate Purchase Agreement

What is a Florida Real Estate Purchase Agreement?

A Florida Real Estate Purchase Agreement is a legally binding document between the seller and buyer of a property. It outlines the terms and conditions of the sale, including the purchase price, property description, closing date, and any conditions that must be met before the sale is finalized. This document ensures that both parties understand their rights and obligations.

Do I need a lawyer to create a Real Estate Purchase Agreement in Florida?

While it is not legally required to have a lawyer create a Real Estate Purchase Agreement in Florida, it is highly recommended. Real estate transactions can be complex, and a lawyer can help ensure that your interests are protected, that the agreement complies with all state laws, and that any unique situations are properly addressed.

Can I write my own Real Estate Purchase Agreement in Florida?

Yes, you can write your own Real Estate Purchase Agreement in Florida. However, it's important to ensure that the document includes all necessary legal terms and conditions and complies with Florida real estate laws. Using a standard template or seeking professional advice can help in preparing an effective agreement.

What should be included in the Florida Real Estate Purchase Agreement?

A Florida Real Estate Purchase Agreement should include the full names of the buyer and seller, a detailed description of the property, the purchase price, the closing date, signatures of both parties, and any contingencies, such as financing approval or the sale of another property. It's also crucial to include any agreed-upon terms regarding who will pay certain closing costs, any earnest money deposit details, and any disclosures related to the property's condition.

How is a Real Estate Purchase Agreement in Florida finalized?

To finalize a Real Estate Purchase Agreement in Florida, both the buyer and seller must sign the document. Before signing, both parties should thoroughly review the agreement to ensure it accurately reflects their understanding of the terms of the sale. Once signed, the agreement becomes legally binding. The next steps typically involve meeting any contingencies listed in the agreement, such as securing financing, and then closing the sale.

What happens if someone breaches the Real Estate Purchase Agreement in Florida?

If either the buyer or seller breaches the Real Estate Purchase Agreement in Florida, the non-breaching party has several potential remedies. These can include seeking enforcement of the agreement through specific performance, which means asking a court to force the sale or purchase as agreed, or seeking financial damages for any loss incurred due to the breach. The specific remedies available will depend on the terms of the agreement and the nature of the breach.

Common mistakes

Filling out the Florida Real Estate Purchase Agreement form can be a complex process, fraught with potential pitfalls. One common mistake is failing to provide accurate personal information. This may seem trivial, but incorrect or incomplete names, addresses, or contact information can cause significant delays and even legal complications down the line. It's crucial that all personal details mirror official documents precisely.

Another frequently encountered error is neglecting to specify the property's legal description accurately. The legal description is more detailed and technical than just the address; it includes the lot, block, subdivision, and sometimes even coordinates. Missing or inaccurately describing the property can lead to confusion about the asset being sold and purchased, affecting the entire transaction.

Incorrectly filling out financial details is yet another area where many stumble. The purchase price, deposit amounts, financing terms, and closing costs must be detailed with utmost accuracy. An error in these figures can lead not only to misunderstandings but also to renegotiations and, in some cases, the loss of the sale. It's vital to double-check these numbers and ensure they're agreed upon by all parties.

Omitting contingencies is also a common oversight. These provisions allow either party to back out under specific circumstances, like failing to secure financing, unsatisfactory inspection results, or the inability to sell an existing home. Neglecting to include necessary contingencies can trap buyers or sellers in a contract without an escape route if things don't go as planned.

Another mistake involves misunderstanding closing dates and possession terms. These aspects must be clearly defined to avoid disputes about when the buyer can take possession of the property. A clearly stated timeline helps all parties manage their expectations and arrangements, such as movers and property vacating.

Subject to much confusion as well is the allocation of closing costs. Without a clear agreement on who pays for what, buyers or sellers can be caught off guard by unexpected expenses. This understanding should be established in the contract to prevent any surprises at closing.

Amendments and additions to the contract without proper clarification or consent is a mistake that can introduce significant legal vulnerabilities. Any change to the agreement needs to be clearly written, understood, and signed by both parties. Failure to do so can lead to enforceability issues or even nullify the agreement.

Lastly, there's the mishandling of the earnest money deposit. This shows the buyer's good faith and intention to proceed with the purchase. Mismanaging these funds, or failing to outline the terms for its forfeiture or return, can lead to conflicts and legal complications. The agreement must specify how the deposit is handled, by whom, and under what conditions it may be retained or refunded.

While filling out the Florida Real Estate Purchase Agreement form, being thorough, precise, and clear can help avoid these and other mistakes. Taking the time to review each section, seeking clarification when necessary, and ensuring all parties have a mutual understanding can significantly streamline the buying or selling process, making it as smooth and efficient as possible.

Documents used along the form

When you're buying or selling a property in Florida, the Real Estate Purchase Agreement is a crucial document, but it's often just the beginning of the paperwork. Several other forms and documents typically accompany this agreement to ensure that all aspects of the property transaction are addressed comprehensively. These documents vary depending on the specific needs of the transaction but often include forms that address inspections, loans, and disclosure requirements. Here's a closer look at some of these critical documents.

- Seller's Disclosure Form: This document is where the seller discloses information about the property's condition, including any known defects or issues that could affect the property's value. It's a crucial form for buyers to understand exactly what they are purchasing.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law. It informs buyers about the presence of lead-based paint in the property, which is critical for health and safety considerations.

- Home Inspection Report: After an offer is accepted, a home inspection is typically conducted to assess the property's condition. This report outlines the inspector's findings, including any problems or repairs that may be necessary. It can influence negotiations after the agreement is signed.

- Loan Application Form: Buyers who are financing their purchase with a mortgage will need to complete a loan application form. This document starts the process of obtaining a loan and includes information about the buyer's financial situation.

- Title Insurance Commitment: This document outlines the terms under which a title insurance company will issue a policy. Title insurance protects the buyer and lender from any legal claims that may arise over property ownership. The commitment will detail any exceptions or exclusions to coverage.

Understanding these documents can make the real estate buying or selling process smoother and more predictable. Each one plays a role in ensuring that both parties are informed and protected throughout the transaction. Whether you're a first-time homebuyer or a seasoned investor, being familiar with these forms will help you navigate the complexities of real estate transactions in Florida.

Similar forms

The Residential Lease Agreement shares similarities with the Florida Real Estate Purchase Agreement in that both establish a binding agreement between two parties. In the Residential Lease Agreement, the parties involved are the landlord and the tenant, whereas in the Real Estate Purchase Agreement, they are the buyer and the seller of the property. Both documents outline terms such as payment, duration of agreement, and responsibilities of each party, although the focus varies - one on leasing terms and the other on the terms of sale.

The Bill of Sale is akin to the Florida Real Estate Purchase Agreement as it serves as a legal document which records the transfer of ownership of an item from seller to buyer. It is often used for the sale of personal property. Like the Real Estate Purchase Agreement, it includes essential details like the identification of parties, description of the property being sold (albeit typically not real estate), price, and conditions of the sale. Both documents provide legal protection and serve as a record of the transaction.

The Land Contract resembles the Real Estate Purchase Agreement because it is another method of buying or selling real estate. It allows the buyer to make payments to the seller for a property over time, and the title remains with the seller until the full purchase price is paid. Both documents detail property specifics, including the purchase price and payment arrangements, but the Land Contract includes terms for the transfer of the property title upon fulfillment of the contract, a feature distinct from the immediate transfer in a standard purchase agreement.

The Quitclaim Deed, while serving a different legal function, shares the characteristic of affecting the ownership of real estate like the Florida Real Estate Purchase Agreement. This document is used to transfer the owner's interests in a property to another person without guaranteeing the title's status. While the Quitclaim Deed and the Purchase Agreement both involve the transfer of real estate, the former is typically used between family members or to clear up title issues rather than to guarantee a clean title like the Purchase Agreement does.

The Warranty Deed is similar to the Florida Real Estate Purchase Agreement in its relation to real estate transactions, specifically in the guarantee it offers. The Warranty Deed provides a full guarantee from the seller to the buyer regarding the ownership of the property; it ensures that the property is free from any claims and liens. Both documents are involved in the process of selling and buying real estate, with the main difference being that the Purchase Agreement outlines the terms of the sale, while the Warranty Deed is used to actually transfer the property title to the buyer, assuring them of the property's clear legal status.

The Power of Attorney is a legal document that grants one person the authority to act on behalf of another. It can pertain to any area of life, including real estate transactions, making it similar to the Florida Real Estate Purchase Agreement in some respects. Through a Power of Attorney, an individual can authorize someone else to sign a Real Estate Purchase Agreement and other related documents on their behalf. Both are legal instruments used to facilitate the buying and selling of property, albeit with different focuses: one on authorizing actions and the other on the transaction itself.

The Home Inspection Report, while not an agreement like the Florida Real Estate Purchase Agreement, plays a pivotal role in real estate transactions as it impacts decisions within such agreements. The report provides a detailed assessment of a property's condition before purchase, including any problems that need addressing. It informs the buyer and can lead to negotiations in the Purchase Agreement terms regarding repairs or price adjustments. Thus, while one is a report and the other a contract, both are integral in the buying and selling process, ensuring informed decisions are made.

The option to purchase real estate agreement, akin to the Florida Real Estate Purchase Agreement, establishes conditions under which a property may be bought or sold, offering a right but not an obligation to buy the property within a specified timeframe. This document, like the Purchase Agreement, spells out terms such as payment amount and period, but its distinctive feature allows the buyer to "opt-out," unlike the Purchase Agreement which binds both parties to the transaction once signed and conditions met.

Dos and Don'ts

Filling out a Florida Real Estate Purchase Agreement is an important step in buying or selling property. The document outlines the terms and conditions of the sale, making it crucial to complete it accurately and thoughtfully. Here are some essential do's and don'ts to keep in mind during the process:

- Do read the entire form carefully before filling it out. Understanding every part is essential for a smooth transaction.

- Do use clear and concise language to avoid any misunderstandings or ambiguities.

- Do include all necessary details like the full legal names of the buyer and seller, a description of the property, and the purchase price.

- Do review the closing date, ensuring it is realistic and agrees with both parties.

- Do verify all numbers, including the purchase price, deposit amounts, and any adjustments or credits.

- Do check that all necessary attachments or addendums are included and correctly referenced within the agreement.

- Do have all parties sign and date the form, as an unsigned agreement may not be legally binding.

- Don't leave any sections incomplete. If a section doesn't apply, it's better to note it as "N/A" than to leave it blank.

- Don't guess or estimate information. Verify facts to ensure accuracy, especially concerning legal descriptions and financial terms.

- Don't rely solely on verbal agreements. Ensure all agreed-upon terms are documented in the agreement to avoid future disputes.

Approaching the Florida Real Estate Purchase Agreement with caution and diligence ensures the rights and responsibilities of all parties are clearly defined and protected. Keep these tips in mind for a successful and legally sound real estate transaction.

Misconceptions

Understanding the Florida Real Estate Purchase Agreement is crucial for anyone involved in buying or selling property in Florida. There are many misconceptions surrounding this document. Clearing these up can help parties involved in a real estate transaction make informed decisions.

All Florida Real Estate Purchase Agreements are the same. This is not true. While many forms follow a standard format, provisions and contingencies can vary greatly depending on the specific terms agreed upon by the buyer and seller.

A verbal agreement is as good as a written one in Florida. Florida law requires real estate purchase agreements to be in writing to be enforceable. Verbal agreements concerning real estate transactions are generally not legally binding.

The buyer always pays the real estate commission. In reality, it’s customary in Florida for the seller to pay the real estate commission, although this can be negotiated differently in the contract.

There's no need for a property inspection clause. Including a property inspection clause is critical. This clause allows the buyer to have the property inspected and can provide a way to renegotiate or withdraw from the agreement if significant issues are found.

Once signed, the purchase agreement cannot be changed. Amendments to the agreement can be made if both the buyer and seller agree to the changes in writing.

Only the price matters in the purchase agreement. Many other factors are critical in a purchase agreement, including financing terms, closing dates, inspections, and contingencies that could significantly impact the transaction.

The purchase agreement guarantees the sale will close. This is incorrect. Several factors, such as financing approval, inspections, and appraisals, can affect whether the sale ultimately closes.

You don't need an attorney to review the agreement in Florida. While Florida law does not require an attorney to review your purchase agreement, it is often wise to have legal representation to ensure your interests are protected.

The closing date in the agreement is final. The closing date can be changed if both parties agree. Delays can occur, requiring an adjustment of the original closing date.

If a buyer defaults, the seller automatically keeps the deposit. The disposition of the deposit under default conditions depends on the specific terms of the purchase agreement. Florida law provides certain protections for both buyers and sellers in instances of default.

Key takeaways

The Florida Real Estate Purchase Agreement form is a crucial document that outlines the terms and conditions of the sale and purchase of real estate in Florida. By understanding and correctly filling out this form, both buyers and sellers can ensure a smoother transaction. Below are key takeaways to assist in navigating this important process:

- Accurate Details: Provide accurate and complete information about both the buyer and seller, including full names and contact details, to ensure clear identification of the parties involved.

- Property Description: The legal description of the property, not just its address, must be accurately provided. This includes block, lot number, and any other relevant legal identifiers.

- Purchase Price and Deposit: Clearly state the purchase price of the property and the amount of deposit being made. This deposit is usually held in an escrow account until closing.

- Financing Terms: If the purchase is being financed, the agreement must specify the type of financing (e.g., mortgage, seller financing) and the terms, including the interest rate and term of the loan.

- Inspection Period: The agreement should specify a period during which the buyer can inspect the property and conduct due diligence, often referred to as the inspection period.

- Property Condition: Disclose the current condition of the property and any known defects. Florida law requires sellers to disclose certain property conditions that may materially affect its value.

- Closing Date and Costs: The anticipated closing date and the allocation of closing costs between buyer and seller should be documented.

- Contingencies: Include any contingencies on which the sale is dependent, such as the buyer obtaining financing or the sale of their current home.

- Title and Risk of Loss: The agreement should outline who will hold the title to the property until the closing date and who bears the risk of loss or damage prior to closing.

- Signatures: Ensure that all parties involved, including their legal representatives, sign the agreement. Electronic signatures are generally acceptable in Florida.

It is highly recommended that both parties consult with a knowledgeable real estate attorney before signing the Florida Real Estate Purchase Agreement. This can help prevent misunderstandings and protect the interests of both the buyer and seller. Moreover, an attorney can assist in the negotiation of terms and provide guidance on any legal requirements specific to Florida real estate transactions.

More Real Estate Purchase Agreement State Forms

Texas Realtors Commission - The document lays out the process and timeline for closing, outlining each step required to finalize the transaction legally and effectively.

Nc Real Estate Purchase Agreement - Explains the process for conducting a final walkthrough of the property before closing, ensuring the property's condition matches the agreement.

House Purchase Agreement Template - A detailed closing date in the agreement provides a clear timeline for the transaction’s completion.

Michigan Real Estate Purchase Agreement - Details the responsibilities of the buyer to secure financing and of the seller to provide a deed.