Fillable Real Estate Purchase Agreement Document for California

Embarking on the journey of buying or selling property in California is an exciting venture, yet it is accompanied by intricate legal procedures and documents. Among the most critical documents in this process is the California Real Estate Purchase Agreement form. This document serves as a binding contract between buyer and seller, outlining the terms and conditions of the sale. It covers a wide range of details including the price, closing date, contingencies (such as financing, home inspections, and title concerns), and specifics about the property itself, from its exact location to the type of title to be transferred. Essential for protecting the interests of both parties, the California Real Estate Purchase Agreement ensures clarity and sets expectations, making the complex process of transferring property more secure and transparent. By detailing obligations, this form plays a pivotal role in the smooth transition of ownership, ensuring that both parties are well-informed and agreeable to all conditions laid out before any money changes hands or keys are turned over.

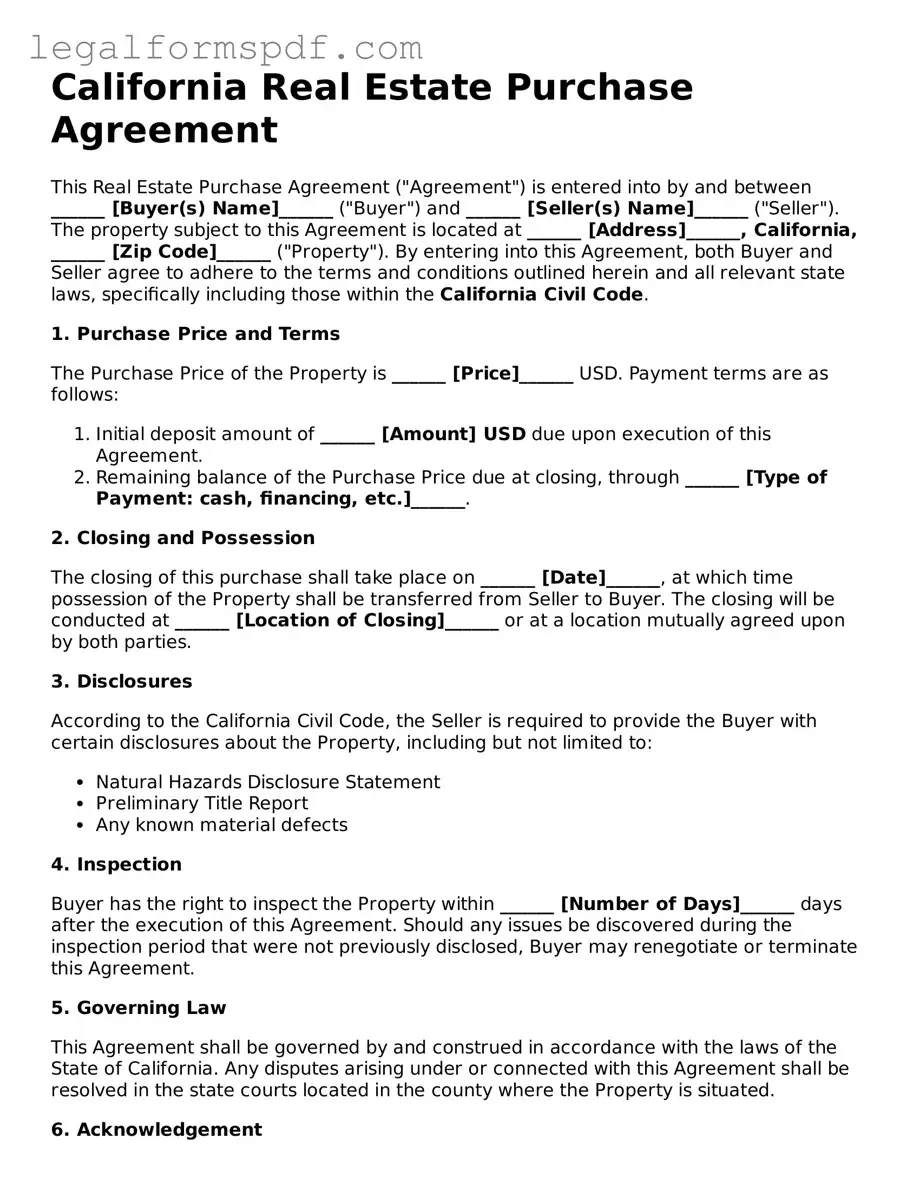

Document Example

California Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is entered into by and between ______ [Buyer(s) Name]______ ("Buyer") and ______ [Seller(s) Name]______ ("Seller"). The property subject to this Agreement is located at ______ [Address]______, California, ______ [Zip Code]______ ("Property"). By entering into this Agreement, both Buyer and Seller agree to adhere to the terms and conditions outlined herein and all relevant state laws, specifically including those within the California Civil Code.

1. Purchase Price and Terms

The Purchase Price of the Property is ______ [Price]______ USD. Payment terms are as follows:

- Initial deposit amount of ______ [Amount] USD due upon execution of this Agreement.

- Remaining balance of the Purchase Price due at closing, through ______ [Type of Payment: cash, financing, etc.]______.

2. Closing and Possession

The closing of this purchase shall take place on ______ [Date]______, at which time possession of the Property shall be transferred from Seller to Buyer. The closing will be conducted at ______ [Location of Closing]______ or at a location mutually agreed upon by both parties.

3. Disclosures

According to the California Civil Code, the Seller is required to provide the Buyer with certain disclosures about the Property, including but not limited to:

- Natural Hazards Disclosure Statement

- Preliminary Title Report

- Any known material defects

4. Inspection

Buyer has the right to inspect the Property within ______ [Number of Days]______ days after the execution of this Agreement. Should any issues be discovered during the inspection period that were not previously disclosed, Buyer may renegotiate or terminate this Agreement.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California. Any disputes arising under or connected with this Agreement shall be resolved in the state courts located in the county where the Property is situated.

6. Acknowledgement

By signing below, both Buyer and Seller acknowledge they have fully read, understood, and agree to the terms and conditions laid out in this Agreement.

Buyer's Signature: __________ Date: __________

Seller's Signature: __________ Date: __________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The California Real Estate Purchase Agreement is a legal document used for the transfer of real property from a seller to a buyer in the state of California. |

| 2 | It outlines the terms and conditions of the sale, including the purchase price, financing, closing conditions, and disclosures. |

| 3 | The agreement is governed by California law, including but not limited to, the California Civil Code. |

| 4 | Mandatory disclosures required by California law must be provided, such as natural hazards, lead-based paint, and any material defects the property has. |

| 5 | Conditions for the termination of the contract are detailed within the agreement, including breach of contract and failure to meet specified contingencies. |

| 6 | It is typically prepared by a real estate agent and is subject to negotiation between the buyer and seller before reaching final terms. |

| 7 | A deposit, often known as earnest money, is usually required as part of the agreement to secure the buyer's intent to purchase. |

| 8 | The closing date, by which all transactions and documentation for the property transfer must be completed, is explicitly stated in the agreement. |

| 9 | It includes provisions for any home warranties or property insurance to be transferred or initiated by the time of sale. |

| 10 | Real estate agents, brokers, and attorneys commonly use the agreement to ensure all legal requirements for the property transfer in California are met. |

Instructions on Writing California Real Estate Purchase Agreement

Filling out a California Real Estate Purchase Agreement is a critical step in the process of buying or selling property. This document outlines the terms and conditions of the sale, ensuring both parties are clear on the agreement. By carefully following the steps to complete this form, you can confidently move forward, knowing the transaction details are correctly documented. Here’s how to fill it out:

- Start by entering the date of the agreement at the top of the form.

- Fill in the full names and contact information of both the buyer and the seller.

- Identify the property address and any legal descriptions to accurately specify the location and boundaries of the property being sold.

- Enter the purchase price agreed upon by both parties in the space provided.

- Specify the terms of the deposit, including the amount, who will hold it, and the conditions under which it may be refunded.

- Outline the financing terms, if applicable, including loan amount, type of loan, interest rate, and any financing contingencies.

- Detail any included personal property (e.g., appliances, furniture) or excluded fixtures.

- State the closing date and location where the official transfer of property will take place.

- List any contingencies that must be satisfied before the sale can be finalized, such as home inspections, appraisals, and loan approvals.

- Include clauses for any additional terms or agreements made between the buyer and the seller.

- Have both parties review the agreement carefully. Then, both the buyer and the seller must sign and date the form to make it legally binding.

- If applicable, make sure a witness or notary public also signs the agreement.

After completing these steps, you've created a binding document that outlines the specifics of your real estate transaction. Keep copies for your records and proceed with the necessary next steps, such as conducting a home inspection, securing financing, or preparing for closing day. Remember, a well-documented purchase agreement is fundamental to a smooth real estate transaction.

Understanding California Real Estate Purchase Agreement

What is the purpose of the California Real Estate Purchase Agreement form?

The California Real Estate Purchase Agreement form serves as a legally binding contract between a buyer and seller regarding the sale and purchase of real estate property in California. This form outlines the terms and conditions of the transaction, including sale price, property details, contingencies, and closing details, aiming to protect the interests of both parties involved.

Is it mandatory to use a standardized form for real estate transactions in California?

While California law does not mandate the use of any specific, standardized form for real estate transactions, the California Real Estate Purchase Agreement form is widely used due to its comprehensive nature, ensuring that all legal requirements are met and reducing the risk of disputes. It is recommended for use to ensure a smooth and legally sound transaction.

Can the California Real Estate Purchase Agreement form be modified?

Yes, the California Real Estate Purchase Agreement form can be modified to fit the specific terms and conditions agreed upon by the buyer and seller. However, care must be taken to ensure that any modifications or additions to the form comply with California laws and regulations regarding real estate transactions.

What are the key components of the California Real Estate Purchase Agreement form?

The key components of the form include the identification of the buyer and seller, a detailed description of the property being sold, the purchase price, the terms of the payment, any contingencies that must be met before closing, and the proposed date of transfer of ownership. It also includes provisions for inspections, disclosures, and any other conditions precedent to the final sale.

How does one obtain the California Real Estate Purchase Agreement form?

The form can be obtained through real estate agents, legal professionals specializing in real estate, or online platforms that provide legal forms for California. It is crucial to ensure that the version of the form obtained is up-to-date and compliant with current California real estate laws and regulations.

What happens if a party breaches the terms of the California Real Estate Purchase Agreement?

If a party breaches the terms of the agreement, the non-breaching party has several legal remedies, including seeking specific performance of the agreement (compelling the breaching party to fulfill their obligations), terminating the contract and seeking return of any deposits made, and/or pursuing damages for any financial losses incurred due to the breach.

Are there any contingencies commonly included in the California Real Estate Purchase Agreement?

Common contingencies include the buyer's ability to obtain financing, the satisfactory result of a home inspection, and a clear title search. These contingencies protect the buyer by allowing them to back out of the purchase under certain conditions without penalty, usually by forfeiting the deposit.

Common mistakes

When parties are interested in buying or selling property in California, completing the Real Estate Purchase Agreement form is a crucial step. This document outlines the terms and conditions of the sale, but it is common for individuals to make mistakes during this process, which can lead to delays, legal disputes, or the sale falling through. Here are five common errors to be aware of.

One common mistake is not specifying the correct legal description of the property. Buyers and sellers often mistakenly believe that the street address alone is sufficient. However, the legal description includes details about the property's exact boundaries and dimensions, as found in the property's deed. Without this precise description, the agreement may not accurately represent the intended property, leading to disputes over what is being bought or sold.

Another error involves unclear terms regarding the deposit. Buyers are usually required to make a deposit to demonstrate their seriousness about proceeding with the purchase. Failure to spell out the amount, due date, and conditions for the return of the deposit in the agreement can cause misunderstandings or conflicts if the deal does not close. It is critical to have all the details clear and written down to protect both parties' interests.

Incorrect or incomplete filling out of financing terms is also a frequent mistake. The agreement should detail how the purchase will be financed, including whether the buyer is obtaining a mortgage, paying cash, or using another financing method. Leaving these details vague or incomplete can lead to the seller questioning the buyer's ability to complete the purchase, potentially derailing the transaction.

Failing to include contingencies properly is another common misstep. Contingencies provide conditions that must be met for the sale to proceed, such as the buyer obtaining financing, the home passing an inspection, or the sale of the buyer's current home. Not specifying these conditions or failing to allow adequate time for them to be met can result in one party being unfairly bound to the agreement regardless of circumstances.

Last but not least, overlooking deadlines contributes to many issues in real estate transactions. The purchase agreement should clearly outline all critical dates, including those for deposit payments, inspections, mortgage approval, and the closing date. When these dates are not clearly defined, or if unrealistic timelines are set, it can lead to unnecessary pressure, missed opportunities, or the termination of the agreement altogether.

Being diligent and precise when filling out the California Real Estate Purchase Agreement is essential for a smooth transaction. Both buyers and sellers must understand and accurately complete the document, ideally with the guidance of legal counsel, to avoid these and other pitfalls.

Documents used along the form

In the complex process of buying or selling real estate in California, various forms and documents are used in conjunction with the Real Estate Purchase Agreement to ensure that the transaction is conducted efficiently and effectively. These documents are essential in clarifying the terms, conditions, and responsibilities of all parties involved. Below is an overview of five such documents that frequently accompany the Real Estate Purchase Agreement.

- Disclosure Statements: These documents provide critical information about the property's condition, including any known defects or problems that could affect the property's value or desirability. Sellers are required to complete several disclosure forms, such as the Natural Hazard Disclosure Statement, revealing if the property is in an area prone to natural risks like floods or earthquakes.

- Title Report: A title report outlines the property's ownership history, detailing any easements, covenants, liens, or other encumbrances that may impact the buyer’s use and enjoyment of the property. This report is crucial for identifying any issues that need to be resolved before transferring ownership.

- Loan Documents: If the purchase involves obtaining a mortgage, the buyer will need to sign several loan documents at closing. These documents outline the terms of the loan, including the interest rate, repayment schedule, and any conditions of the mortgage agreement.

- Home Inspection Report: Typically commissioned by the buyer, the home inspection report provides a comprehensive examination of the property’s physical condition. It covers elements such as the structure, HVAC system, plumbing, and electrical systems, identifying any repairs or maintenance that may be necessary.

- Contingency Removal Forms: These documents are used to remove contingencies that were initially part of the Real Estate Purchase Agreement, indicating that the conditions or requirements specified have been met. Common contingencies include obtaining financing, selling a current home, and satisfactory inspection results.

Each of these documents plays a vital role in the real estate transaction process, providing transparency, security, and legal protection for both buyers and sellers. By thoroughly understanding and properly managing these documents, all parties can help ensure a smooth and successful property transfer.

Similar forms

The Residential Lease Agreement shares similarities with the California Real Estate Purchase Agreement in their foundational aim to delineate the rights and responsibilities of each party involved in a real estate transaction. Both documents lay out terms such as payment schedules, property details, and the obligations each party must uphold. However, a lease agreement specifically focuses on the rental of property, detailing terms including rent amounts, security deposits, and lease duration, whereas a purchase agreement outlines the conditions under which property ownership is transferred.

A Bill of Sale closely mirrors the structure and purpose of the Real Estate Purchase Agreement by acting as a formal document that records the transfer of ownership of an asset from one party to another. The primary similarity lies in their function to ensure a legal and verifiable transfer of property. While a bill of sale is commonly used for personal property such as cars and boats, a real estate purchase agreement specifically deals with the sale and transfer of real estate.

The Land Contract is another document that bears resemblance to the California Real Estate Purchase Agreement, as both are involved in the process of buying and selling real estate. A land contract, however, is a form of seller financing where the seller retains the title to the property until the buyer completes all payment installments. Like the purchase agreement, it spells out the sale price, property description, and payment terms, but it serves additionally as a financing agreement between the buyer and seller.

An Earnest Money Agreement has parallels with the Real Estate Purchase Agreement because both involve the initial stages of a real estate transaction. This document specifics the earnest money deposit that a buyer offers as a sign of good faith when making an offer on a property. The Real Estate Purchase Agreement typically references this deposit and includes it as part of the overall financial terms. Although serving different purposes, both documents play crucial roles in securing and finalizing real estate transactions.

The Property Disclosure Statement aligns with the California Real Estate Purchase Agreement by addressing the condition and details of the property being sold. This statement requires sellers to disclose known issues or defects that could affect the property's value or desirability. While the Real Estate Purchase Agreement encompasses the terms of the sale, the Property Disclosure Statement focuses on ensuring that the buyer is fully informed about the property's condition before the sale is finalized.

The Title Insurance Commitment bears resemblance to the Real Estate Purchase Agreement in that both are integral to the process of transferring ownership of real estate. The Title Insurance Commitment provides details about what a title insurance policy will cover once issued, including any exclusions or exceptions. This commitment is often a condition within the Real Estate Purchase Agreement, signifying the importance of protecting the buyer from future title disputes and ensuring clear ownership.

An Option to Purchase Agreement is likened to the California Real Estate Purchase Agreement as both documents pertain to the potential sale of property. This agreement grants the buyer the exclusive right to purchase the property at a predetermined price within a certain time frame but does not obligate the buyer to proceed. While it primarily serves to secure the buyer's right to buy, the Real Estate Purchase Agreement finalizes the terms under which the property will be sold if the option is exercised.

The Deed of Trust is comparable to the Real Estate Purchase Agreement in that it is used in real estate transactions, specifically in securing a mortgage loan. This document involves three parties: the borrower, the lender, and the trustee, and it holds the property as collateral for the loan. Whereas the purchase agreement outlines the agreement to sell and buy property, the Deed of Trust concerns the financing aspect and the legal structure for securing the property until the loan is repaid.

A Homeowners Association (HOA) Agreement shares common ground with the California Real Estate Purchase Agreement in terms of regulating the use and responsibilities of property ownership within a community. This agreement sets forth the rules, regulations, and fees associated with living in an HOA-governed community. When purchasing property within such a community, the purchase agreement often references and is contingent upon agreement to the HOA's terms, linking the two documents in the transaction process.

The Mortgage Agreement is closely aligned with the Real Estate Purchase Agreement by its involvement in financing the purchase of property. This legal document outlines the terms of the mortgage loan, including interest rates, repayment schedule, and the rights of the lender in case of default. While the purchase agreement secures the terms of the sale, the Mortgage Agreement secures the terms of the loan used to finance that sale, making them complementary pieces of the real estate transaction puzzle.

Dos and Don'ts

Filling out a California Real Estate Purchase Agreement form is a critical step in the process of buying or selling property. This document serves as a binding contract between the buyer and seller, outlining the terms and conditions of the sale. To ensure the process goes smoothly, it is important to be mindful of the dos and don'ts when filling out this form.

Do:

- Provide accurate information: Ensure all the details you enter, such as names, addresses, and legal descriptions of the property, are accurate and match any corresponding legal documents.

- Review for completeness: Double-check the form to make sure all required fields have been filled out. Missing information can lead to unnecessary delays or legal issues.

- Understand the terms: Make sure you fully understand every clause and condition laid out in the agreement. If there's anything unclear, it's wise to consult with a real estate professional or legal advisor.

- Sign and date correctly: Ensure that all parties involved in the transaction sign and date the form where indicated. These signatures are what make the agreement legally binding.

Don't:

- Leave blanks: Avoid leaving any sections of the form blank. If a section does not apply, it is better to fill it with "N/A" or "None" to confirm that the question was not overlooked.

- Make assumptions: Do not assume anything about the terms or conditions. If something is not explicitly stated in the agreement, do not assume it is included. Everything should be put in writing.

- Forget to review for errors: Once you've completed the form, review it thoroughly for any typos or errors. Mistakes can lead to misunderstandings or disputes later on.

- Overlook attachments: If the agreement refers to additional documents or attachments, ensure they are completed and included with the agreement. These could include disclosures or inspection reports.

Misconceptions

The California Real Estate Purchase Agreement form is crucial in the process of buying or selling property within the state. However, many misconceptions surround its usage and contents. Clarity on these points can help parties avoid common pitfalls.

It’s Just a Standard Form: Many people believe the California Real Estate Purchase Agreement form doesn’t need much attention because it’s a standard document. However, every real estate transaction is unique, and the agreement should be carefully reviewed and customized to fit the specific terms and conditions of the sale.

It Covers Everything Automatically: Another misconception is that this form automatically covers all aspects of the sale. In truth, details about fixtures, legal disclosures, and contingencies must be explicitly stated to ensure they are included in the deal.

Verbal Agreements Are Enforceable: People often assume that verbal agreements made outside the context of the written purchase agreement could be enforceable. However, in California, the statute of frauds requires that agreements for the sale of real property be in writing to be enforceable.

Signing Is the Final Step: Many believe that once the purchase agreement is signed, the transaction is final. The truth is, the signing initiates the escrow process, during which inspections occur, and contingencies must be met or waived before the sale can close.

Only Purchase Price Matters: While the purchase price is significant, there are many other critical elements in the agreement, such as terms of deposit, inspection rights, and contingencies. Overlooking these can affect the transaction substantially.

No Need for Inspections If Waived: Some buyers believe that they cannot or should not conduct inspections if they have waived their inspection contingencies in a competitive market. Despite the waiver, buyers always have the right to inspect; waiving contingencies simply affects their ability to renegotiate or withdraw based on inspection results.

Buyers Always Post an Earnest Money Deposit: It's commonly thought that an earnest money deposit is always required to bind the agreement. While customary, the terms regarding earnest money are negotiable, and deals can proceed without such deposits under certain circumstances.

Sellers Must Make Repairs: A myth persists that sellers are obligated to make repairs identified during inspections. The purchase agreement may allow negotiations for repairs, but unless agreed upon in the contract, sellers are not automatically responsible for making them.

All Sales Are Final: There’s a misconception that once the purchase agreement is executed, the buyer is locked into the sale regardless of circumstances. In reality, the agreement contains contingencies that allow either party to back out of the sale under specific conditions.

Attorney Review Is Optional: Finally, some parties skip attorney review, assuming it’s an optional step. While not legally required, consulting with a real estate attorney can provide crucial insights and help avoid legal issues, making it a wise step for most transactions.

Key takeaways

When dealing with the California Real Estate Purchase Agreement, it's important to approach this document with care and thoroughness. Whether you're a buyer or a seller, this agreement is the first major step toward transferring property ownership. Here are several key takeaways that can help ensure the process goes smoothly.

- Accuracy is key: Every detail entered into the agreement must be accurate, including names, property address, price, and terms. Mistakes can lead to disputes or transaction failures.

- Legal descriptions: Apart from the address, the agreement requires the legal description of the property. This might involve lot numbers, subdivision name, or other details found in the property's current deed. The legal description ensures the exact property is being transferred.

- Disclosures: California law mandates various disclosures during a real estate transaction, such as natural hazards, the presence of lead-based paint (for homes built before 1978), and others. Ensure all required disclosures are attached and complete to avoid future legal challenges.

- Contingencies: These conditions must be met for the transaction to proceed. Common contingencies include the buyer securing financing, the home passing inspection, and the ability to sell an existing home. Both parties should understand these conditions clearly.

- Close of escrow date: This is when the transaction is expected to be completed. Understanding this date helps both parties plan for moving, financing, and other arrangements. Delays can occur, but the purchase agreement should outline procedures for extending the close of escrow if necessary.

This agreement is legally binding once signed. Before signing, make sure to review it with a professional if you're unsure about its terms. Real estate transactions are significant, and every precaution should be taken to ensure a smooth and successful transfer of property.

More Real Estate Purchase Agreement State Forms

Nc Real Estate Purchase Agreement - Provides a clear legal foundation for the transaction, reducing the risk of misunderstandings or disputes between the parties involved.

Texas Realtors Commission - It serves as a comprehensive outline of the deal, from initial offer acceptance to the final closing, guiding all parties through the process.

Generic Home Purchase Agreement - A legal document outlining the terms under which a property will be sold from one party to another.