Official Real Estate Purchase Agreement Document

A Real Estate Purchase Agreement form is a crucial step in the journey towards homeownership, serving as the legal document that outlines the specifics of the property transaction between a buyer and a seller. This form not only stipulates the agreed-upon sale price but also details the terms and conditions of the purchase, including any contingencies that must be satisfied before the deal can be finalized, such as financing arrangements and inspections. Additionally, the agreement sets forth timelines for each step of the process, ensuring that both parties are clear on deadlines for actions like conducting appraisals and securing mortgage approval. By capturing all these elements in one formal agreement, the form acts as a safeguard for both buyers and sellers, providing a clear roadmap of the obligations and rights of each party throughout the transaction. It's an essential document that lays the foundation for a smooth and transparent property exchange, facilitating a fair and efficient path to transferring property ownership.

State-specific Information for Real Estate Purchase Agreement Forms

Real Estate Purchase Agreement Form Subtypes

Document Example

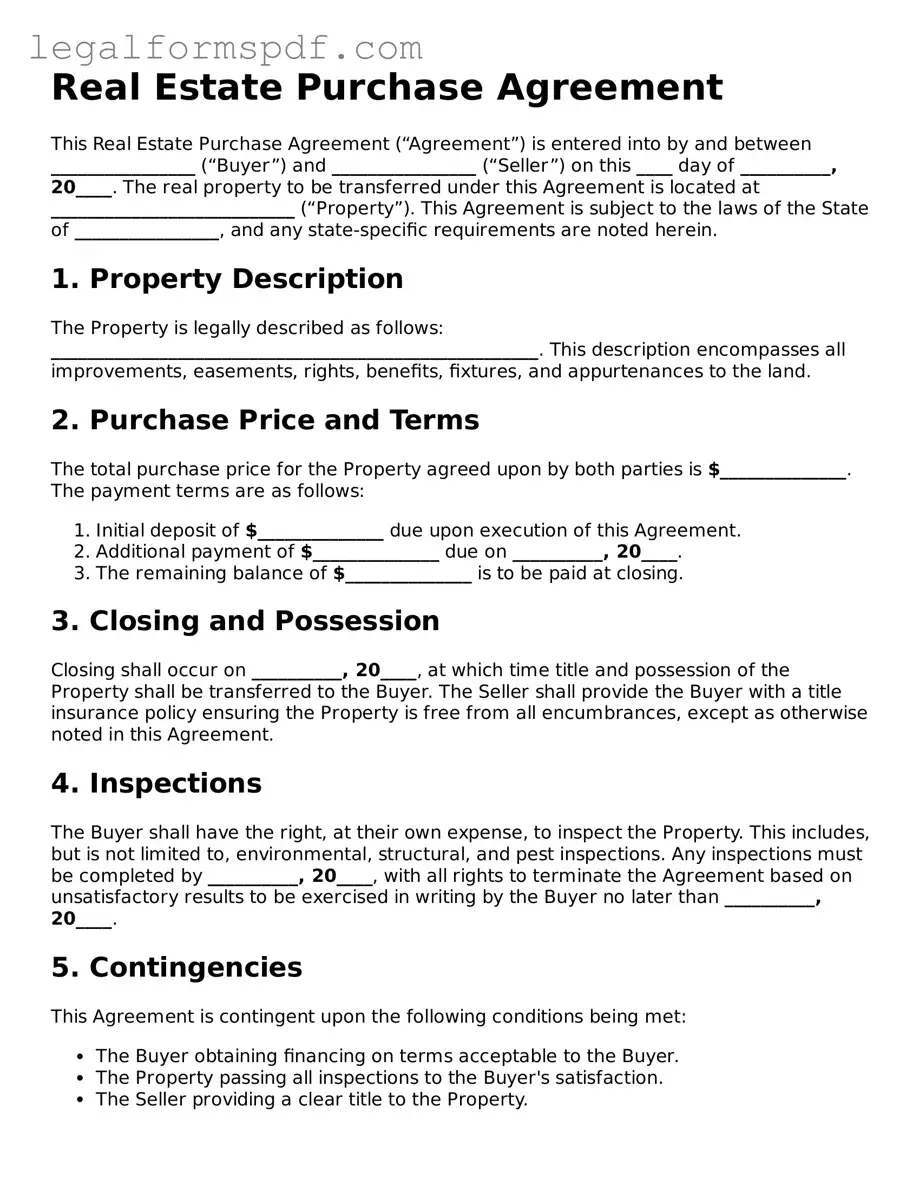

Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is entered into by and between ________________ (“Buyer”) and ________________ (“Seller”) on this ____ day of __________, 20____. The real property to be transferred under this Agreement is located at ___________________________ (“Property”). This Agreement is subject to the laws of the State of ________________, and any state-specific requirements are noted herein.

1. Property Description

The Property is legally described as follows: ______________________________________________________. This description encompasses all improvements, easements, rights, benefits, fixtures, and appurtenances to the land.

2. Purchase Price and Terms

The total purchase price for the Property agreed upon by both parties is $______________. The payment terms are as follows:

- Initial deposit of $______________ due upon execution of this Agreement.

- Additional payment of $______________ due on __________, 20____.

- The remaining balance of $______________ is to be paid at closing.

3. Closing and Possession

Closing shall occur on __________, 20____, at which time title and possession of the Property shall be transferred to the Buyer. The Seller shall provide the Buyer with a title insurance policy ensuring the Property is free from all encumbrances, except as otherwise noted in this Agreement.

4. Inspections

The Buyer shall have the right, at their own expense, to inspect the Property. This includes, but is not limited to, environmental, structural, and pest inspections. Any inspections must be completed by __________, 20____, with all rights to terminate the Agreement based on unsatisfactory results to be exercised in writing by the Buyer no later than __________, 20____.

5. Contingencies

This Agreement is contingent upon the following conditions being met:

- The Buyer obtaining financing on terms acceptable to the Buyer.

- The Property passing all inspections to the Buyer's satisfaction.

- The Seller providing a clear title to the Property.

6. Default

If either party fails to fulfill their obligations under this Agreement, the non-defaulting party shall have the right to pursue any remedies available under the laws of the State of ________________ or as provided herein.

7. Amendments

Any amendments to this Agreement must be made in writing and signed by both parties.

8. Entire Agreement

This document, including any attachments and exhibits, constitutes the entire agreement between the Buyer and the Seller. It supersedes all prior negotiations, representations, or agreements, either written or oral.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Buyer's Signature: _______________________________ Date: ______________

Seller's Signature: _______________________________ Date: ______________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | It serves as a legally binding contract between a buyer and seller for the purchase and sale of real estate. |

| Components | Typically includes terms such as purchase price, closing date, contingencies, and signatures of both parties. |

| Governing Law | Subject to state laws where the property is located, as real estate laws can vary greatly by state. |

| Customization | Can be customized or modified through addendums or amendments, provided both parties agree. |

| Importance of Accuracy | Accurate and thorough completion is essential to prevent legal disputes and ensure clear terms of agreement. |

Instructions on Writing Real Estate Purchase Agreement

When engaging in the sale of a property, the Real Estate Purchase Agreement form plays a crucial role in documenting the terms and details of the transaction between the buyer and seller. This legally binding contract outlines the purchase price, closing details, contingencies, and other conditions that both parties agree upon. Therefore, completing this form accurately is essential to ensure a smooth transaction process. The following steps guide you through filling out the Real Estate Purchase Agreement form.

- Start by entering the date on which the agreement is being made at the top of the form.

- Fill in the full legal names of both the seller(s) and buyer(s) as well as their contact information, including addresses, to accurately identify the parties involved.

- Describe the property being sold, including its legal description, address, and any additional identifying information. This ensures there is no confusion about which property is subject to the sale.

- Specify the purchase price agreed upon by the parties. Also, detail the terms of payment, including any deposit amounts, financing arrangements, and dates by which payments are to be made or financing obtained.

- Outline any contingencies that must be satisfied before the sale can proceed, such as home inspections, the buyer obtaining financing, or the sale of another property. These conditions protect both the buyer and seller and should be clearly defined.

- Determine and document the closing date, which is when the sale is officially completed, the title is transferred to the buyer, and possession of the property changes hands. This includes finalizing all payments and signing any remaining paperwork.

- Address the allocation of costs related to the sale, such as closing costs, taxes, and utility adjustments. The agreement should clearly state which party is responsible for these expenses.

- Include any additional terms or clauses relevant to the specific transaction. This might cover items such as home warranties, specific repairs to be made by the seller, or items of personal property that are included in the sale.

- Ensure both the buyer(s) and seller(s) sign and date the agreement. Witness signatures may also be required, depending on state laws and regulations.

- Make sure to distribute copies of the signed agreement to all parties involved, including their legal representatives or real estate agents, to maintain transparency and ensure all parties have access to the contractual agreement.

After the Real Estate Purchase Agreement form has been fully completed and signed, the next steps in the property sale process can begin. This typically involves meeting the conditions outlined in the agreement, such as securing financing and conducting inspections, leading up to the closing date. On closing, final documents are signed, the buyer pays the remaining balance, and ownership is officially transferred, marking the completion of the sale.

Understanding Real Estate Purchase Agreement

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions agreed upon by the buyer and seller for the sale and purchase of real property. This agreement covers details like the purchase price, property description, closing terms, and any conditions that must be met before the sale is finalized.

Who needs to sign the Real Estate Purchase Agreement?

The Real Estate Purchase Agreement must be signed by all involved parties for it to be valid. This includes the buyer(s) and seller(s) of the real property. If the property is owned or being purchased by more than one person, each person must sign the agreement. In some cases, witnesses or a notary public may also need to sign the document.

Can changes be made to the Real Estate Purchase Agreement after it has been signed?

Yes, changes can be made to the agreement after it has been signed, but any modifications must be agreed upon by all parties involved. Changes should be made in writing and added as amendments to the original agreement to ensure clarity and legal enforceability. Oral agreements or changes are not advisable as they can lead to misunderstandings and are more difficult to enforce.

What happens if either the buyer or seller breaches the Real Estate Purchase Agreement?

If either party breaches the Real Estate Purchase Agreement, the non-breaching party has certain remedies available to them. These can include seeking specific performance, which is a court order requiring the breaching party to follow through with the contract, or pursuing damages for financial losses incurred due to the breach. The available remedies will depend on the specific terms of the agreement and local laws.

Common mistakes

When it comes to real estate transactions, filling out the Real Estate Purchase Agreement form is a critical step. Unfortunately, it's also a step where many people make mistakes, sometimes with significant legal and financial consequences. Understanding these common errors can help parties navigate this complex process more effectively.

One widespread mistake is not properly identifying the parties involved. It's crucial to use full legal names and ensure they match any other legal documents related to the transaction. Without correct identification, the agreement might be deemed invalid, leading to unnecessary complications.

Another common error lies in the description of the property. This section requires precise details, including the legal description used in public records, not just the address. Overlooking this can cause disputes over exactly what land and buildings are included in the sale.

Financial details often trip people up. This includes inaccuracies in stating the purchase price, down payment amount, and the terms of the financing. Such mistakes can delay the process or, worse, lead to the agreement falling apart if the financing doesn’t align with what's erroneously stated on the form.

Contingencies are another critical component where errors frequently occur. Buyers might fail to include necessary conditions, such as the sale being subject to obtaining a mortgage or a satisfactory home inspection. Leaving out these conditions can expose buyers to significant risks.

Failure to specify a clear closing date is a common oversight. The agreement should state a specific date or formula for determining the date, such as "45 days after the agreement is signed." Vague terms can lead to confusion and disputes between the buyer and seller.

Incorrect or missing signatures can invalidate the entire agreement. Every party needs to sign, and if a party is a corporation or other entity, the person signing must have the authority to commit that entity. Sometimes, a witness or notary seal is required, depending on state law.

Often, people neglect to specify who pays for what closing costs. The agreement should detail whether the buyer or seller (or both) pays for inspections, title insurance, escrow fees, and more. Overlooking this can cause last-minute disputes about who owes what.

Agreements often omit necessary disclosures, such as known defects or lead-based paint presence in older homes. Sellers must disclose certain information, and failing to include this in the agreement can lead to legal penalties or the buyer backing out.

Amendments and addenda are a source of confusion. If any terms change after the initial agreement, a formal amendment should be added. Informal agreements or verbal changes are not legally binding and can create significant issues.

Lastly, people sometimes do not review the agreement closely before signing. This might seem obvious, but in the eagerness to proceed, parties might overlook critical details or errors. A thorough review by all parties, and ideally a legal professional, can catch and correct mistakes before they become problems.

By being aware of these common pitfalls, buyers and sellers can navigate the Real Estate Purchase Agreement process more smoothly, ensuring a more secure and legally sound transaction.

Documents used along the form

When navigating the purchase of real estate, the process involves more than just the Real Estate Purchase Agreement form. This critical document lays the foundation for the transaction, detailing the terms between buyer and seller. However, to successfully move through the entire process, several other documents play crucial roles. These documents ensure legality, accuracy, and protection for both parties involved. Let's explore some of these essential forms that are typically used together with the Real Estate Purchase Agreement form.

- Loan Application: If financing is needed to purchase the real estate, a loan application must be completed. This form starts the process of obtaining a mortgage and requires detailed financial information from the borrower.

- Title Search and Title Insurance: A title search examines public records to ensure the seller has the legal right to sell the property. Title insurance protects the buyer (and lender) from any legal claims that might arise against the property in the future.

- Home Inspection Report: This report, prepared by a professional home inspector, provides an in-depth look at the property’s condition. It reveals any repairs that may be necessary, informing the buyer's decision and potentially impacting the purchase terms.

- Appraisal Report: An appraisal determines the property's fair market value, often required by lenders to ensure the loan amount does not exceed the property's worth. This report influences the final loan approval.

- Closing Disclosure: This document outlines the final terms and costs of the mortgage for the buyer. It is issued by the lender at least three days before closing, giving the buyer time to review it before finalizing the purchase.

Arming yourself with knowledge about these documents ensures a smoother real estate transaction. Each form plays its part in verifying the deal, protecting all parties involved, and fulfilling legal requirements. Understanding their significance and how they complement the Real Estate Purchase Agreement can help you navigate the complexities of buying or selling property with greater confidence and security.

Similar forms

The Bill of Sale is a document closely related to the Real Estate Purchase Agreement in that it also serves as a formal record of a transaction. However, the Bill of Sale is primarily used for the purchase of personal property, such as vehicles or equipment, rather than real estate. Both documents outline the terms of the sale, including the sale price and a description of the item being transferred, but the specific details and legal requirements differ based on the type of property involved.

A Lease Agreement, much like a Real Estate Purchase Agreement, governs the terms under which property is used or occupied, but it does so in the context of rental arrangements, not ownership transfers. Lease Agreements detail the landlord and tenant’s rights and responsibilities, including rent, maintenance, and use of the property, aiming to protect both parties during the rental period, whereas a Real Estate Purchase Agreement culminates in the transfer of property ownership from seller to buyer.

A Mortgage Agreement is another document with similarities to a Real Estate Purchase Agreement, as it is pivotal in the process of financing real estate transactions. This agreement outlines the borrower's promise to repay the lender the borrowed amount to purchase property, secured by the property itself. While the Real Estate Purchase Agreement finalizes the terms of the sale, the Mortgage Agreement sets forth the terms of the financing, including interest rates, payment schedules, and consequences of default.

The Deed of Trust serves a similar purpose to a Mortgage Agreement and is often used in place of a mortgage in some states. Like a Real Estate Purchase Agreement, it involves the transfer of real estate; however, it facilitates this through a trustee, who holds the property's title until the loan is paid off. The key difference is the involvement of a third party (the trustee), which does not occur in a typical real estate purchase agreement.

Title Insurance Commitment documents also share a connection with Real Estate Purchase Agreements as they provide a precursor to insurance policies that protect buyers and lenders against losses due to title defects. Before concluding a Real Estate Purchase Agreement, a title search is performed, and the commitment to insure is provided based on the search's results. This document ensures that the buyer is aware of any potential title issues before finalizing the purchase.

A Property Disclosure Statement, while informational and not a binding agreement, complements a Real Estate Purchase Agreement by disclosing the condition of the property for sale. Sellers complete this document to reveal any known issues or defects with the property, thereby giving buyers informed consent ahead of the purchase. This advance disclosure helps to prevent disputes and litigation after the sale, ensuring a smoother transaction.

An Earnest Money Agreement often accompanies a Real Estate Purchase Agreement, detailing the preliminary commitment of the buyer to the property transaction. This document records the buyer’s deposit of earnest money as a sign of good faith ahead of completing the purchase. It outlines conditions under which the deposit can be retained by the seller or returned to the buyer, thus securing the agreement prior to the final sale.

A Home Inspection Report, unlike the Real Estate Purchase Agreement, does not involve the negotiation or terms of sale. Instead, it provides an expert assessment of the property's condition, informing the agreement process. Buyers typically commission this report to identify any problems that could affect the property's value or safety. The findings can influence negotiations in the Real Estate Purchase Agreement, such as adjustments to the sale price or terms.

Finally, the Closing Statement, or Settlement Statement, relates closely to the Real Estate Purchase Agreement as it itemizes the final closing costs connected with the transaction. It is provided at the culmination of the buying process, offering a detailed breakdown of payments made by and due to both buyer and seller. This document ensures transparency and agreement of all charges and credits involved in the real estate transaction, sealing the deal outlined in the initial purchase agreement.

Dos and Don'ts

Filling out a Real Estate Purchase Agreement is a critical step in buying or selling property. It legally documents the terms and conditions of the sale, making it essential to handle this document with careful attention to detail. Below are lists of dos and don'ts to guide you through this process effectively.

Do:

Thoroughly review all sections of the agreement before filling it out. Understanding every part ensures you know the commitments you're making.

Use clear, precise language to describe the terms of the sale, such as the purchase price, closing date, and any contingencies. Ambiguity could lead to misunderstandings or legal disputes later on.

Include all necessary attachments and disclosures required by law, such as lead-based paint disclosures for older homes or other material facts about the property.

Have a lawyer or real estate professional review the agreement before signing. Their expertise can help catch any issues or areas that could be improved for your protection.

Don't:

Rush through the process. Taking the time to fill out the form carefully can prevent costly errors.

Leave blanks on the form. If a section doesn't apply, write "N/A" to show that you didn't overlook it. Blank spaces can cause confusion or be a risk for unwelcome alterations later.

Forget to specify who pays for certain costs, such as closing costs, inspections, and repairs. Clear agreements on these points can prevent disagreements during the closing process.

Ignore local and state laws that may affect the sale. Real estate laws vary greatly, and certain local requirements must be met for a legally binding sale.

Misconceptions

When it comes to navigating the complexities of buying or selling property, understanding the Real Estate Purchase Agreement (REPA) is crucial. However, misconceptions about this vital document are common. Clarifying these misunderstandings ensures that all parties enter into agreements fully informed. Here are nine common misconceptions about the Real Estate Purchase Agreement form:

- It’s Just a Formality: Many believe that the REPA is a standard procedure without much significance. In truth, it is a legally binding contract that outlines the terms and conditions of the property sale, holding both parties accountable.

- They’re All the Same: No two real estate transactions are identical, and neither are their REPA forms. While templates exist, agreements should be customized to reflect the specifics of the sale, including contingencies, deadlines, and the parties’ obligations.

- Verbal Agreements Suffice: While casual discussions may play a role in the negotiation process, only the written and signed agreement is legally binding. Relying on verbal agreements can lead to disputes and misunderstandings.

- Legal Representation Isn’t Necessary: Given the legal and financial implications of the REPA, having a lawyer review the document is advisable. Legal professionals can identify potential issues, ensuring the agreement serves the client’s best interests.

- It’s Only About the Sale Price: While the sale price is a critical component, the REPA covers much more, including inspection rights, financing terms, closing dates, and other essential conditions of the sale.

- Changes Can’t Be Made Once Signed: Amendments can be made to the REPA if both the buyer and seller agree. These changes should be documented in writing and signed by both parties.

- It Guarantees the Sale Will Close: The REPA sets the stage for the transaction, but it doesn’t guarantee closure. Issues like financing failures, inspection problems, or failure to meet contingencies can still derail the sale.

- Deposits Are Non-Refundable: Whether or not a deposit is refundable depends on the agreement’s terms and the fulfillment of contingencies. In some cases, buyers can legally recover their deposit if certain conditions aren’t met.

- Sellers Must Fix All Problems Identified in Inspections: The REPA may allow buyers to request repairs, but sellers aren’t obligated to make all requested repairs. Negotiations usually determine which repairs will be made or if the sale price will be adjusted instead.

Understanding these points clarifies the significance, flexibility, and complexity of the Real Estate Purchase Agreement. Both buyers and sellers should approach these agreements with care, awareness, and, when necessary, professional guidance to ensure their interests are adequately protected.

Key takeaways

When it comes to filling out and using a Real Estate Purchase Agreement form, there are several key points to keep in mind:

-

Accurate Information: Ensure all information is accurate and complete. Mistakes or omissions can lead to delays or complications in the buying process.

-

Legal Descriptions: Include a detailed legal description of the property. This goes beyond the address and should be an exact legal description that is often found in deed records.

-

Terms of Sale: Clearly outline the terms of sale, including the purchase price, deposit amount, and any contingencies like financing or inspections.

-

Financing: If the purchase is contingent on financing, specify the type of financing and the terms, including the amount and the deadline for securing it.

-

Closing Costs: Identify which party is responsible for which closing costs. Closing costs can vary widely, so clear agreements prevent misunderstandings.

-

Inspection Contingencies: Include any inspection contingencies that allow the buyer to have the property inspected within a certain timeframe. This can offer an escape clause if significant issues are found.

-

Closing Date: Specify the expected closing date. This helps both parties plan for the transfer of ownership and the moving process.

-

Signatures: Ensure that all parties involved in the transaction sign the agreement. Without the proper signatures, the agreement may not be enforceable.

-

Legal Advice: Consider consulting a real estate attorney. They can provide valuable advice and help avoid legal problems down the line.

-

State Laws: Be aware that real estate laws vary by state. The agreement should comply with the laws of the state where the property is located.

Understanding and addressing these points can help ensure a smooth and successful real estate transaction.

Other Templates

Nursing Reference Example - An essential tool for nursing professionals seeking employment, showcasing their clinical abilities and interpersonal skills.

Personal Trainer Waiver - This form serves as a mutual understanding that participating in exercise programs carries an inherent risk of physical injury.

Does Durable Power of Attorney Cover Medical - This document provides a legal pathway for your chosen agent to act in your best interest, even in unforeseen circumstances.