Fillable Promissory Note Document for Texas

In the heart of managing financial transactions, the Texas Promissory Note form serves as a vital tool for individuals or parties. This document, specifically tailored for use within the state of Texas, is a legally binding agreement that outlines the details of a loan between two parties: the borrower and the lender. It effectively captures the essentials such as the amount borrowed, interest rates, repayment schedule, and the consequences of failing to repay the loan as agreed. Beyond serving as a formal record of the loan, this form holds significance in ensuring clarity and understanding between involved parties, reducing potential disputes by laying out expectations and responsibilities from the outset. Moreover, the form is adaptable to various lending scenarios, whether personal loans between family members or more formal loan agreements between businesses, providing a structured yet flexible framework that can be modified to suit specific lending conditions while adhering to Texas state laws. Understanding the nuances of this form is crucial for anyone entering into a loan agreement in Texas, ensuring that all legal bases are covered and that the agreement reflects the mutually agreed-upon terms in a clear and enforceable manner.

Document Example

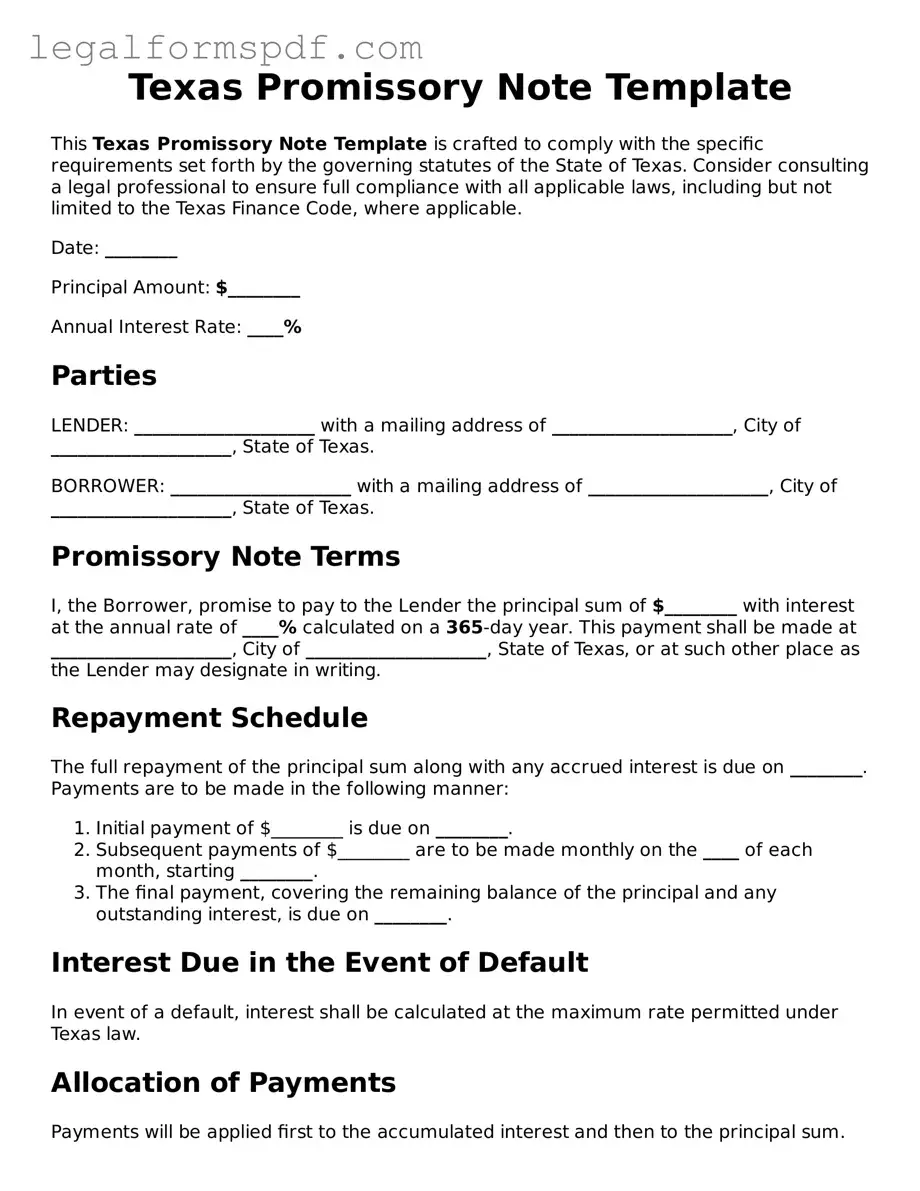

Texas Promissory Note Template

This Texas Promissory Note Template is crafted to comply with the specific requirements set forth by the governing statutes of the State of Texas. Consider consulting a legal professional to ensure full compliance with all applicable laws, including but not limited to the Texas Finance Code, where applicable.

Date: ________

Principal Amount: $________

Annual Interest Rate: ____%

Parties

LENDER: ____________________ with a mailing address of ____________________, City of ____________________, State of Texas.

BORROWER: ____________________ with a mailing address of ____________________, City of ____________________, State of Texas.

Promissory Note Terms

I, the Borrower, promise to pay to the Lender the principal sum of $________ with interest at the annual rate of ____% calculated on a 365-day year. This payment shall be made at ____________________, City of ____________________, State of Texas, or at such other place as the Lender may designate in writing.

Repayment Schedule

The full repayment of the principal sum along with any accrued interest is due on ________. Payments are to be made in the following manner:

- Initial payment of $________ is due on ________.

- Subsequent payments of $________ are to be made monthly on the ____ of each month, starting ________.

- The final payment, covering the remaining balance of the principal and any outstanding interest, is due on ________.

Interest Due in the Event of Default

In event of a default, interest shall be calculated at the maximum rate permitted under Texas law.

Allocation of Payments

Payments will be applied first to the accumulated interest and then to the principal sum.

Prepayment

The Borrower reserves the right to prepay the principal amount, in whole or in part, at any time without penalty.

Acceleration Clause

If the Borrower fails to make a scheduled payment, the Lender may demand the immediate payment of the entire remaining balance and accrued interest.

Governing Law

This Promissory Note is to be governed under the laws of the State of Texas.

Agreement to Terms

The Parties agree to the terms outlined in this Promissory Note. Signatures below serve as confirmation of the agreement.

Lender Signature: ____________________ Date: ________

Borrower Signature: ____________________ Date: ________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | A Texas Promissory Note form is a legal document used to outline the terms of a loan between two parties in Texas. |

| 2 | This form specifies the amount of money borrowed, the interest rate, and the repayment schedule. |

| 3 | It must comply with Texas state law, including the Texas Finance Code, which governs the creation and enforcement of promissory notes within the state. |

| 4 | Interest rates in Texas are capped by state law, and the agreed-upon rate in the note must not exceed these limits. |

| 5 | The form can include property as collateral, making it a secured promissory note, or it might not include collateral, making it unsecured. |

| 6 | Both parties must sign the document for it to be considered valid and legally binding. |

| 7 | If the borrower fails to meet the repayment terms, the lender has the right to pursue legal action according to the stipulations of the note and Texas law. |

| 8 | A Texas Promissory Note form may be used for personal loans, business loans, real estate transactions, and other financing arrangements within the state. |

| 9 | The document should be notarized to increase its authenticity and enforceability in legal proceedings. |

Instructions on Writing Texas Promissory Note

Filling out a Texas Promissory Note form is an important step in formalizing a loan between two parties. It creates a legal obligation for the borrower to repay the lender under agreed terms and conditions. This document is crucial in ensuring both parties understand their rights and responsibilities. It's a straightforward process, but attention to detail is key to ensure all the information is accurate and complete.

Here are the steps you will need to follow to fill out the Texas Promissory Note form correctly:

- Gather the necessary information, including the names and addresses of the borrower and lender, the loan amount, the interest rate, and the repayment schedule.

- Enter the date the promissory note is being created at the top of the form.

- Write down the full legal name and address of the borrower and lender in their respective sections.

- Specify the principal amount of the loan in the section provided. This is the amount the borrower is agreeing to repay, excluding any interest.

- Determine the interest rate and document it in the designated area. Ensure this rate adheres to Texas state law limits.

- Detail the repayment plan. Choose whether the loan will be repaid in a lump sum, in regular installments, or on demand, and enter the relevant information such as due dates or payment intervals.

- Decide on the course of action in case of a late payment and outline any late fees or penalties. This should be clearly stated in the promissory note.

- Include any security or collateral that will be used to secure the loan, if applicable. Clearly describe the collateral and the conditions under which the lender can take possession of it should the borrower default on the loan.

- Both the borrower and the lender must sign and date the form. Witnesses or a notary public may also be required, depending on the nature of the loan.

Once completed, it's essential to make copies of the Texas Promissory Note form. Each party should retain a copy for their records. This document serves as a legal record of the loan and can be used in court if necessary to enforce the terms of the loan agreement. Carefully storing this document will help protect both the borrower's and lender's interests.

Understanding Texas Promissory Note

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document outlining the terms under which one party (the borrower) agrees to pay back money borrowed from another party (the lender). This document is vital as it legally binds the borrower to repay the loan in accordance with the agreed-upon terms, such as the repayment schedule, interest rate, and any collateral securing the loan.

Is a Texas Promissory Note required to be in writing?

Yes, for a promissory note to be enforceable in Texas, it must be in writing. Oral agreements regarding loans might be challenging to enforce. Having a written promissory note not only provides clear terms and conditions but also serves as a legal record that can be used in court if necessary to enforce repayment.

What are the essential elements to include in a Texas Promissory Note?

An effective Texas Promissory Note should include the date the note was issued, the names of the borrower and lender, the principal amount borrowed, interest rate, repayment schedule, maturity date, and signatures of the involved parties. It may also detail any collateral securing the loan, late payment fees, and what constitutes a default.

How is interest determined on a Texas Promissory Note?

In Texas, the interest rate on a promissory note must not exceed the legal limit unless a specific exception applies. The interest rate should be agreed upon by the borrower and lender and clearly stated in the promissory note. This rate can be fixed or variable, as long as it does not violate Texas usury laws.

Does a Texas Promissory Note need to be notarized?

While notarization is not a legal requirement for a Texas Promissory Note, having it notarized can add an extra layer of legal protection. Notarization formally certifies that the signatures on the document are genuine, potentially preventing disputes about the document's authenticity.

What happens if the borrower defaults on the loan outlined by the Texas Promissory Note?

If the borrower defaults on the loan, the lender has the legal right to pursue collection, which may include filing a lawsuit to recover the unpaid amount. The specific actions that can be taken often depend on the terms outlined in the promissory note, such as any agreed-upon collateral that can be seized or sold by the lender.

Can a Texas Promissory Note be modified?

Yes, a Texas Promissory Note can be modified, but any modifications must be agreed upon by both the lender and the borrower. The changes should be documented in writing, and both parties should sign the amended agreement to avoid future disputes.

Is a witness required for a Texas Promissory Note?

A witness is not legally required for a Texas Promissory Note to be valid. However, having a witness sign the document can provide additional evidence of the agreement's authenticity, which could be valuable if there's ever a dispute.

Where can I find a template for a Texas Promissory Note?

Templates for Texas Promissory Notes can be found online through various legal services and websites. However, it's crucial to ensure that any template used is tailored to meet the specific requirements of Texas law and the specific terms of your agreement. Consulting with a legal professional to review or draft your promissory note is always recommended to ensure it complies with state laws and fully protects your interests.

Common mistakes

One common mistake people make when filling out the Texas Promissory Note form is inaccurately specifying the loan amount. Precision in stating the borrowed amount is vital because it directly influences the repayment obligations. An inaccurate figure can lead to disputes regarding the actual amount that was lent and the amount due for repayment, ultimately causing confusion and potential legal issues in the contractual agreement.

Another frequent error is failing to detail the repayment schedule. The terms should clearly indicate how the repayment is structured, including the due dates and whether the repayments are to occur weekly, monthly, or in a lump sum. Omitting these details can result in misunderstandings between the lender and the borrower regarding repayment expectations, which may complicate or delay repayment process.

Overlooking the interest rate is also a critical mistake. By law, promissory notes must include the interest rate being charged on the loaned amount. Failing to specify this or setting a rate that does not comply with Texas state law can not only make the promissory note invalid but can also expose the lender to legal penalties. It is essential for the interest rate to be clearly documented to avoid any ambiguity over the financial obligations of the borrower.

Last but not least, neglecting to have the note witnessed or notarized can be a significant oversight. While Texas law may not require notarization for all promissory notes, having the document witnessed or notarized can add a layer of verification and legal authenticity. It acts as a form of protection for both parties, confirming that the signatures are genuine and that both parties entered into the agreement willingly and without duress.

Documents used along the form

When handling the Texas Promissory Note form, it's often not alone in the paperwork process. Various other documents and forms frequently accompany it to ensure a thorough and legally binding agreement. While the Texas Promissory Note lays out the repayment terms of a loan between two parties, other documents may detail collateral security, outline detailed payment plans, or disclose relevant personal or business financial information. Familiarizing yourself with these documents can provide a clearer, more secure framework for both lender and borrower.

- Security Agreement: This document is used alongside a secured Promissory Note to outline the collateral that the borrower offers against the loan. It details the rights of the lender to seize the collateral if the borrower fails to repay the loan as agreed.

- Loan Agreement: Typically more detailed than a Promissory Note, a Loan Agreement includes comprehensive terms and conditions of the loan, such as the obligations of both parties, representations and warranties, and the consequences of a default.

- Amortization Schedule: This document provides a breakdown of each payment throughout the life of the loan into principal and interest. It helps both the lender and borrower track the balance of the loan and the interest accrued over time.

- Guaranty: To provide additional security to the lender, a Guaranty can be used. This form involves a third party, guaranteeing to repay the loan if the original borrower defaults.

- Co-signer Agreement: Similar to a Guaranty, a Co-signer Agreement involves a co-signer in the loan agreement who becomes equally responsible for the repayment of the loan.

- Release of Promissory Note: Once the loan is fully repaid, this document serves as proof that the borrower has fulfilled their obligations under the Promissory Note and that the lender releases them from further liability.

- Notice of Default: This form is used by the lender to inform the borrower that they have failed to make a scheduled payment and are in default on their loan. It typically outlines the steps to cure the default and the potential consequences of failure to do so.

Understanding and properly using these forms together with the Texas Promissory Note can help ensure a legally sound and smooth lending process. Each document plays a crucial role in clarifying the obligations of all parties involved, offering protection and peace of mind. It's always advisable to review these forms carefully and, if possible, seek legal advice to ensure compliance and protect your interests fully.

Similar forms

The Texas Promissory Note form shares similarities with a Loan Agreement, both serving as legally binding documents between two parties concerning the borrowing and repaying of money. While a Promissory Note often outlines the obligation of the borrower to repay a debt under agreed terms, a Loan Agreement delves deeper, detailing the responsibilities of both the lender and borrower. This includes interest rates, repayment schedule, and collateral, offering a more comprehensive framework for the transaction.

Similar to an IOU (I Owe You), the Promissory Note denotes an acknowledgment of debt. However, the Promissory Note is more formal and contains specific terms regarding repayment, including interest and the timeline. An IOU, by contrast, is generally less formal and might simply state that one party owes another a certain amount of money without specifying repayment details.

A Mortgage Agreement also parallels the Texas Promissory Note, as both involve a promise to repay a debt. The key difference lies in their focus and security. While a Promissory Note signifies a promise to pay, a Mortgage Agreement specifically ties that promise to a piece of real estate as collateral, securing the loan by granting the lender a lien on the property until the debt is fully repaid.

The Texas Promissory Note is akin to a Personal Guarantee, under which an individual commits to repaying a debt if the primary borrower fails to do so. This document acts as a safety net for lenders but focuses on the guarantor's promise, which could be linked to the fulfillment of a Promissory Note, thereby intertwining their purposes when securing a loan or debt.

In resemblance to a Bill of Sale, the Promissory Note evidences an agreement between two parties. While the Bill of Sale confirms the transfer of ownership of personal property from seller to buyer, the Promissory Note corroborates a borrower's commitment to repay a lender, both serving as proof of an agreed-upon transaction.

A Credit Agreement shares characteristics with a Promissory Note, especially in detailing the borrowing terms. However, Credit Agreements are typically more complex, involving extensive terms that may cover revolving amounts of credit, repayment conditions, and legal recourse. The Promissory Note tends to be simpler, focusing on a single loan amount and straightforward repayment expectations.

Likewise, a Debt Settlement Agreement is related to a Promissory Note in its focus on managing debt. This type of agreement is designed for negotiating terms to settle a debt for less than the amount owed, often necessitating a lump sum payment. Though both documents pertain to debt repayment, the Promissory Note establishes the obligation while the Debt Settlement Agreement aims to modify or conclude it under new terms.

Lastly, the Amortization Schedule accompanies a Promissory Note by providing a detailed breakdown of payments over the loan's lifetime. It delineates the portion of each payment attributed to principal versus interest, showcasing the loan's repayment progress. Though not a standalone legal document, the Amortization Schedule enhances the transparency and understanding of the repayment plan outlined in a Promissory Note.

Dos and Don'ts

Things You Should Do

Verify the full legal names of all parties involved and make sure they're spelled correctly. Accuracy here is key to the validity of the agreement.

Be clear and detailed about the loan amount and repayment terms. This includes the interest rate, repayment schedule, and any specific conditions for repayment.

Ensure that the interest rate complies with Texas state laws. Interest rates that exceed legal limits can render the note unenforceable and possibly expose you to legal penalties.

Date the document accurately. The date of signing is critical for the enforcement and may also be relevant for legal purposes outside of the immediate terms of the note.

Have all parties sign the document in the presence of a notary public to add an extra layer of authenticity and legal protection.

Things You Shouldn't Do

Neglect to outline any late fees or penalties for missed payments. Without this, enforcing penalties for late payments becomes much harder.

Forget to specify whether the loan is secured or unsecured. This details what assets, if any, the lender can claim if the borrower fails to repay the loan.

Omit the governing law. It should be expressly stated that the note is governed under the laws of Texas. This is crucial for legal clarity.

Overlook the necessity of having witnesses during the signing. While not always legally required, witnesses can provide additional verification if the agreement’s validity is questioned.

Rush through the process without reviewing all sections of the form. Each portion serves a purpose and misunderstanding or misrepresenting any part of it can lead to complications down the line.

Misconceptions

Promissory notes are legal agreements in which one party promises to pay another party a certain amount of money under specified conditions. In the state of Texas, there are several misconceptions regarding the promissory note form, which can lead to confusion and legal mishaps. Below, five common misconceptions are clarified to shed light on the correct understanding and use of these financial instruments.

- One size fits all: Many people believe that a single, standard form can be used for all promissory notes in Texas. However, the terms and conditions of promissory notes can vary significantly depending on the specific agreement between the parties, the nature of the loan, and the requirements of Texas law. Customization may be necessary to address the particulars of the loan, such as repayment schedules, interest rates, and security agreements.

- Not legally binding: Another common misconception is that promissory notes are not legally enforceable in Texas. This is not true. When properly executed, a promissory note is a legally binding contract that obligates a borrower to repay the lender according to the terms of the note. If the borrower fails to fulfill their obligation, the lender has the right to seek legal recourse to enforce the agreement.

- Oral agreements are sufficient: Some people mistakenly believe that verbal agreements can serve as a substitute for a written promissory note in Texas. While oral contracts can be enforceable under certain circumstances, a written promissory note is necessary to clearly define the terms of the loan and to provide tangible evidence of the agreement, which is crucial in the case of a dispute.

- No need for witness or notarization: It's a common misconception that signatures on Texas promissory notes do not need to be witnessed or notarized. While Texas law does not specifically require a witness or notary for a promissory note to be valid, having the signatures witnessed or notarized can add a layer of protection against claims of forgery or fraud, and may be required by the lender for their own records or procedures.

- Only for formal loans: Finally, many believe that promissory notes are only used for formal loans from financial institutions. In reality, promissory notes can be used for a wide range of lending situations, including personal loans between family members or friends. They provide a formal record of the loan and its repayment conditions, which can help prevent misunderstandings and ensure that the agreement is clear to both parties.

Understanding these misconceptions is crucial for anyone involved in lending or borrowing money in Texas. Properly executed promissory notes ensure that both the lender and borrower are protected and that the terms of the loan are clearly defined and legally enforceable.

Key takeaways

The Texas Promissory Note form is an important financial document that outlines the agreement between a borrower and a lender. With Texas law guiding its interpretation and execution, it's crucial for both parties to understand the key aspects of filling out and using this form. Here are some vital takeaways:

Include Complete and Accurate Information: The effectiveness of a promissory note hinges on the details. Make sure every piece of information, from the full names and addresses of the parties involved to the loan amount, interest rate, and repayment schedule, is accurately included. Leaving out or inaccurately reporting any of this information can lead to disputes or legal challenges down the line.

Understand the Types: Texas recognizes both secured and unsecured promissory notes. A secured note is backed by collateral, such as property or a vehicle, which the lender can claim if the borrower defaults. An unsecured note does not have this backing, representing a higher risk to the lender. The choice between the two affects the interest rate and the terms of the agreement.

Clear Repayment Terms: The repayment terms outline how and when the borrower will repay the loan. This can include the duration of the loan, payment amounts, and the frequency of payments. Ensuring these terms are clear and agreed upon prevents misunderstandings and legal issues. It also provides a clear path for the borrower to follow to repay the debt.

Legal Requirements and Implications: The promissory note must comply with Texas state laws, including those regarding interest rates (usury laws) and signatures. Both parties should understand the legal obligations and rights the document confers, including the lender’s right to seek repayment through court action if necessary and the borrower’s rights in case of a dispute.

Consider Notarization: While not always required, having the promissory note notarized can add a layer of authenticity and may help enforce the document in some cases. This step involves signing the document in front of a notary public, who then officially stamps it. Although this is an extra step, it can provide both parties with additional peace of mind.

Ultimately, the Texas Promissory Note is a binding agreement that demands careful attention to detail and understanding from all parties involved. By following these key takeaways, individuals can avoid common pitfalls and ensure that their interests are protected, whether lending or borrowing.

More Promissory Note State Forms

Printable Promissory Note Template - Enables lenders to impose and collect interest on the loan, often necessary for business and personal finance loans.

Simple Promissory Note - It serves as a formal IOU, outlining the borrower's commitment to pay back a loan to the lender.