Official Release of Promissory Note Document

When a borrower fulfills the obligations spelled out in a promissory note, a document becomes essential in marking this significant financial milestone: the Release of Promissory Note form. This important document serves as evidence that the debtor has paid the debt in full, clearing them of future financial responsibilities related to the note. It's not only a record of a financial obligation being met but also plays a crucial role in maintaining accurate financial records for both parties involved. The form is a straightforward declaration, but it carries substantial legal weight, officially releasing the borrower from the promises made in the original agreement. For lenders, it's a tool that confirms the recovery of lent funds and for borrowers, a proof of their financial diligence. The preparation and execution of this document require careful attention to detail to ensure it accurately reflects the loan's fulfillment and adheres to any governing state laws. It represents the final interaction between the lender and borrower in their transaction, offering peace of mind and legal clearance.

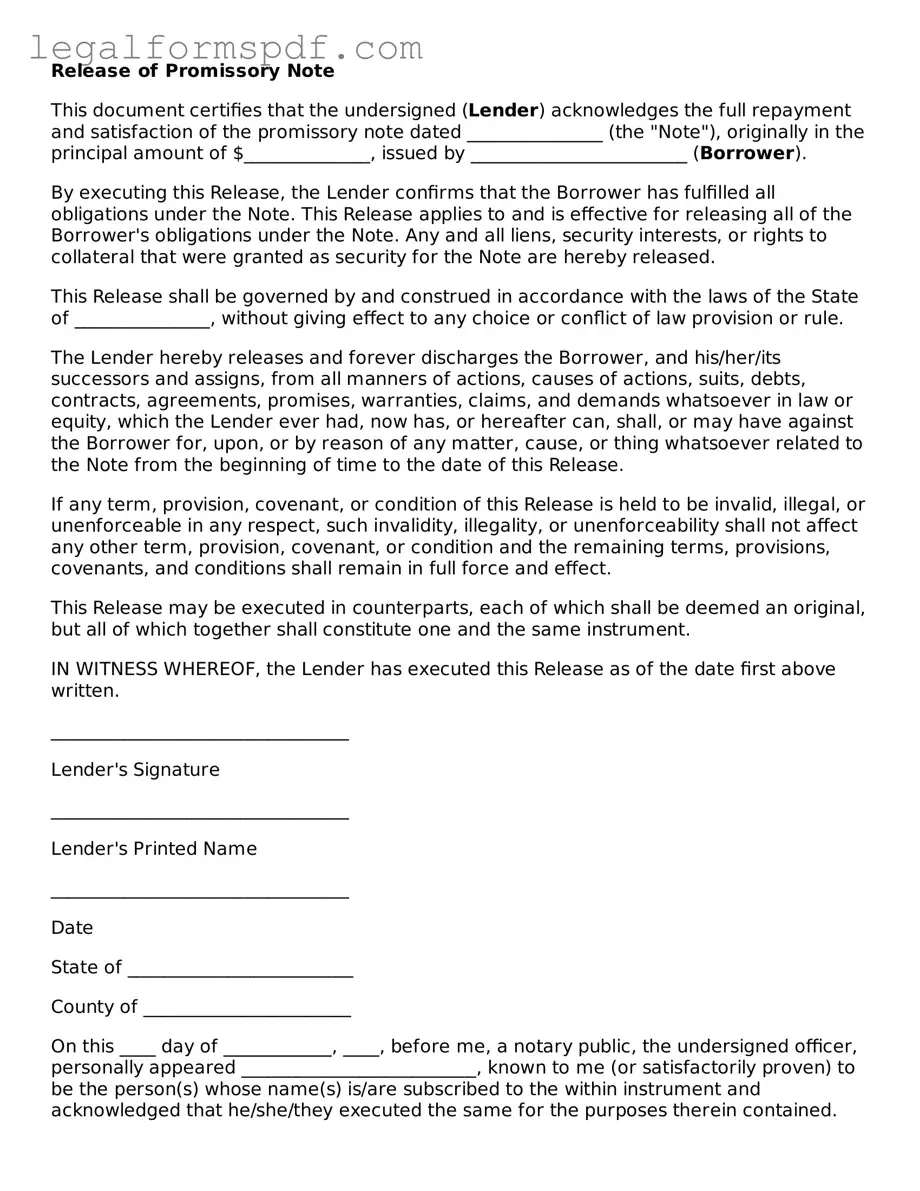

Document Example

Release of Promissory Note

This document certifies that the undersigned (Lender) acknowledges the full repayment and satisfaction of the promissory note dated _______________ (the "Note"), originally in the principal amount of $______________, issued by ________________________ (Borrower).

By executing this Release, the Lender confirms that the Borrower has fulfilled all obligations under the Note. This Release applies to and is effective for releasing all of the Borrower's obligations under the Note. Any and all liens, security interests, or rights to collateral that were granted as security for the Note are hereby released.

This Release shall be governed by and construed in accordance with the laws of the State of _______________, without giving effect to any choice or conflict of law provision or rule.

The Lender hereby releases and forever discharges the Borrower, and his/her/its successors and assigns, from all manners of actions, causes of actions, suits, debts, contracts, agreements, promises, warranties, claims, and demands whatsoever in law or equity, which the Lender ever had, now has, or hereafter can, shall, or may have against the Borrower for, upon, or by reason of any matter, cause, or thing whatsoever related to the Note from the beginning of time to the date of this Release.

If any term, provision, covenant, or condition of this Release is held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other term, provision, covenant, or condition and the remaining terms, provisions, covenants, and conditions shall remain in full force and effect.

This Release may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the Lender has executed this Release as of the date first above written.

_________________________________

Lender's Signature

_________________________________

Lender's Printed Name

_________________________________

Date

State of _________________________

County of _______________________

On this ____ day of ____________, ____, before me, a notary public, the undersigned officer, personally appeared __________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________________

(Notary Signature)

_________________________________

(Printed Name of Notary)

My Commission Expires: ___________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Release of Promissory Note form is used to officially state that the borrower has fulfilled the terms of the promissory note, effectively releasing them from their obligation to repay the debt. |

| Required Information | The form typically requires information such as the original promissory note date, the amount, the names of the borrower and lender, and the date of release. |

| Signatories | Both the lender and the borrower, or their authorized representatives, must sign the form to validate the release of the debt obligation. |

| Notarization | Depending on state laws, the Release of Promissory Note might need to be notarized to be considered legally binding. |

| Governing Laws | State-specific laws govern the creation and enforcement of Release of Promissory Note forms, making it crucial for the document to comply with the relevant state's regulations. |

| Function | It serves as a legal receipt that confirms the debt has been paid and absolves the borrower from further obligations under the promissory note. |

| Consequences of Non-Release | Without a formal release, the borrower remains legally obligated, and the debt may still be considered unpaid, potentially affecting the borrower's credit. |

| Document Retention | Both parties should keep a copy of the Release of Promissory Note for their records to document that the debt has been satisfied. |

| Modification | Once issued, any changes to the Release of Promissory Note require the creation of a new document agreed upon and signed by both parties. |

Instructions on Writing Release of Promissory Note

After fulfilling the terms of a promissory note, which is a written promise to pay a debt, both the borrower and the lender may proceed to formally conclude their financial agreement. The next crucial step in this process involves completing the Release of Promissory Note form. This document serves to officially release the borrower from their obligations under the promissory note, indicating that the debt has been fully paid and that the lender renounces any further claims regarding this particular debt. Here is a straightforward guide on how to fill out the form accurately.

- Start by entering the date the release is being executed in the designated area at the top of the form.

- Write the full legal name of the lender (the person or entity who provided the loan) in the space provided for the releasor, as this party is releasing the borrower from the debt.

- Enter the complete legal name of the borrower (the person or entity that received the loan and is now being released from the obligation) in the space provided for the releasee.

- Fill in the original date of the promissory note being released to ensure clarity on which agreement is being concluded.

- Provide the principal amount that was loaned as per the original promissory note to accurately reflect the sum that has been satisfied.

- Include any pertinent details or identification numbers associated with the promissory note if applicable. This might be a note number or a reference number that was assigned to the loan agreement.

- If there are any specific terms or conditions attached to the release of the promissory note, make sure to clearly outline these in the space provided on the form.

- Both the borrower and the lender need to sign the form. Ensure that the lender (or an authorized representative) signs the form in the designated area, along with their printed name and the date of signing.

- The borrower (or an authorized representative) should also sign, print their name, and date the form in the allocated section to acknowledge the release.

- If required by state law or if either party prefers, consider having the form notarized to add an additional layer of legal validity. This step involves signing the document in the presence of a notary public, who will also sign and seal the document.

Completing the Release of Promissory Note form is a straightforward but important step in formally concluding a financial agreement. It’s essential for both parties to review the completed form thoroughly, ensuring all information is accurate and complete, before signing. Once this document is executed, it serves as a legal record that the debt obligation has been fully satisfied, allowing all parties to move forward without any outstanding financial obligations to each other regarding this debt.

Understanding Release of Promissory Note

What is a Release of Promissory Note form?

A Release of Promissory Note form is a legal document that acknowledges the fulfillment of a debt under a promissory note. This type of form is used when the borrower has paid back the money borrowed, plus any accrued interest, according to the terms of the promissory note. Upon its execution, the lender formally acknowledges that the debt has been paid in full and releases the borrower from any further obligations related to the note.

When should a Release of Promissory Note form be used?

It should be used when a debt, evidenced by a promissory note, has been fully repaid. Documenting the satisfaction of debt with a release form is crucial to provide both parties—the borrower and the lender—with a legal acknowledgment that the obligation has been met. This form is especially important to legally clear the borrower of the debt, which helps in preventing future disputes over the payment and can be important for maintaining accurate financial records.

Who needs to sign the Release of Promissory Note form?

Typically, the form needs to be signed by the lender or the legal representative of the lender. The signature certifies that the lender acknowledges the full repayment of the debt and releases the borrower from further obligations under the promissory note. In some cases, the document might also be witnessed or notarized to add an additional layer of authenticity and prevent fraud.

What happens if a Release of Promissory Note form is not used?

Without a Release of Promissory Note, there might be no formal proof that the debt has been paid off. This can lead to potential legal disputes or claims in the future, as the lender might inaccurately claim that the debt remains unpaid. Furthermore, the borrower might face challenges in proving that they no longer owe money under the promissory note, which can affect their creditworthiness and financial standing. Therefore, using this form is an essential step in the debt repayment process.

Common mistakes

When individuals complete a Release of Promissory Note form, several common errors can lead to complications or even the invalidation of the release. Understanding these mistakes is key to ensuring the process is handled correctly, providing a clear and lawful end to the obligation.

One widespread error is not ensuring that all parties involved in the original promissory note are present and sign off on the release. The note's legal binding nature requires all original signatories or their authorized representatives to acknowledge the termination of the agreement. Omitting a party's consent can render the release void and leave the door open for future disputes.

Another mistake involves failing to clearly identify the promissory note being released. Without explicitly stating the date of the original agreement and any unique identifiers, there could be confusion about which promissory note is being terminated. This ambiguity can lead to complications, especially if the parties have entered into multiple promissory notes over time.

Many individuals neglect to confirm the fulfillment of the terms outlined in the promissory note before issuing the release. A release should only be executed once all obligations, such as the full repayment of the loan with any agreed-upon interest, have been satisfactorily met. Prematurely issuing a release can forfeit the lender's right to enforce the original terms or seek remedies for unmet obligations.

Improper documentation or failure to keep copies of the release and associated communications is another error that can have lasting repercussions. Both parties should retain copies of the release and any correspondence related to the closing of the agreement. This documentation serves as proof of the discharge of debt, protecting against future claims.

Some people make the mistake of not consulting with a legal professional when completing a Release of Promissory Note form. Given the legal nuances and the potential for significant financial implications, professional guidance is advisable to ensure the document is legally sound and binding.

Incorrectly filling out the form, including typographical errors in names, addresses, or amounts, can also lead to issues. Such inaccuracies might not only delay the release process but also lead to legal challenges or misunderstandings about the terms of the release.

Lastly, many fail to report the release of a promissory note as required by tax laws. The cancellation of debt may have tax implications for the borrower, and the failure to properly report this information can result in penalties or audits by tax authorities. Therefore, it is important to understand and comply with all tax-related requirements when a promissory note is released.

Documents used along the form

When a borrower has paid off a loan in full, the lender often provides them with a Release of Promissory Note form. This document signifies that the loan has been fully repaid and that the borrower is released from their obligation to the lender. However, this form is typically not used in isolation. Several other forms and documents frequently accompany it, each serving a unique purpose in the context of a loan's conclusion. Understanding these documents is essential for both lenders and borrowers to ensure the loan process is properly finalized.

- Loan Satisfaction Letter: A Loan Satisfaction Letter is a formal acknowledgement from the lender that the borrower has paid off the loan in full. This document may be required by the borrower for record-keeping purposes or to resolve any disputes regarding the loan's status. Unlike the Release of Promissory Note, which releases the borrower from their obligation, the Loan Satisfaction Letter serves as proof that the debt was fully repaid.

- Amortization Schedule: Though typically provided at the beginning of a loan agreement, an updated Amortization Schedule might accompany the Release of Promissory Note to illustrate the completion of all scheduled payments. This document shows a detailed breakdown of each payment made over the life of the loan, including how much was applied to the principal versus interest.

- Final Payment Receipt: A Final Payment Receipt is a simple document that acknowledges the borrower's last payment on the loan. It provides proof of payment and ensures there is a record of the transaction that finalized the loan agreement. This receipt is crucial for the borrower’s records and may be used to dispute any later claims of unpaid debt.

- Mortgage Release or Satisfaction of Mortgage: For loans secured by real estate, such as mortgages, a Mortgage Release or Satisfaction of Mortgage document is often needed in addition to the Release of Promissory Note. This legal document is recorded with a government office to officially remove the lien (the lender's legal claim on the property) from the property's title, indicating that the mortgage has been fully paid off and transferring full ownership to the borrower.

In summary, the Release of Promissory Note is a critical document signifying the end of a borrower’s obligation under a loan agreement. However, it is typically part of a suite of documents, each serving to clarify and legally solidify the borrower's freedom from debt and the lender's acknowledgement of the loan's satisfaction. Borrowers and lenders alike should be familiar with these documents to ensure a smooth and unambiguous conclusion to the loan process.

Similar forms

A Satisfaction of Mortgage document shares similarities with the Release of Promissory Note form, as both signify the fulfillment of an obligation. The Satisfaction of Mortgage is provided by a lender to acknowledge the full repayment of a mortgage loan, effectively releasing the borrower's property from the lien that the mortgage had placed upon it. This parallels how a Release of Promissory Note serves as evidence that a borrower has fully repaid the loan outlined in the promissory note, thereby nullifying the agreement and releasing the borrower from further obligations under that note.

Similarly, a Lien Release is another document that mirrors the Release of Promissory Note in its function of releasing an obligation. In the context of property or vehicles, a Lien Release is issued to indicate that a previously existing lien, or claim, on the property or vehicle has been satisfied. This is akin to how a Release of Promissory Note indicates the satisfaction of a debt obligation, thereby removing any associated claims on the borrower's assets specified in the promissory note.

The Loan Satisfaction Letter is yet another document closely related to the Release of Promissory Note, as it is a formal acknowledgment from a lender that a loan has been fully paid off. This document effectively communicates that the borrower has met all repayment obligations, allowing them to prove to other parties that they are free of that specific debt. This function closely aligns with the purpose of the Release of Promissory Note, which also serves as proof that the borrower has fulfilled their financial obligation under the promissory note.

Deed of Reconveyance documents are associated with real estate transactions and are similar to the Release of Promissory Note in the context of clearing titles. When a borrower pays off a mortgage linked to a Deed of Trust, the lender issues a Deed of Reconveyance. This action legally transfers the title of the property back to the borrower, free from the claims of the Deed of Trust. Like the Release of Promissory Note, it serves to formally remove a financial obligation that affects the ownership or use of assets.

Finally, the Cancellation of Debt (COD) letter, often issued by creditors when a debt is forgiven or deemed uncollectible, has functions akin to those of the Release of Promissory Note. It signifies that the borrower is no longer obligated to repay the forgiven debt. While a COD typically arises in situations of debt forgiveness rather than repayment, it similarly removes the borrower's obligation to pay, representing a significant commonality with the Release of Promissory Note's purpose of evidencing the fulfillment of a loan agreement.

Dos and Don'ts

When filling out the Release of Promissory Note form, ensuring accuracy and thoroughness is essential for its validity and enforceability. Here are six important dos and don'ts to guide you through the process.

Do's:

- Verify all parties' information, including full names and addresses, to confirm they match the original promissory note.

- Include the date of the promissory note release to have a clear record of when the obligation was discharged.

- Reference the original promissory note's details accurately, such as the date of issuance and the principal amount, to avoid any confusion.

- Ensure that the borrower and lender sign the form in the presence of a notary public to add a layer of legal authentication.

- Keep a copy of the release form for both the borrower and the lender's records, maintaining a thorough paper trail.

- Consult with a legal professional if there are any uncertainties or complexities about the release process to ensure compliance with state laws.

Don'ts:

- Don't leave any sections incomplete; an incomplete form may not be legally binding.

- Don't use unclear or ambiguous language that could be misinterpreted and lead to future disputes.

- Don't fail to specify whether any remaining debt is forgiven or if further actions are required from any party.

- Don't forget to date the release, as the absence of a date can complicate legal enforcement.

- Don't neglect to have the document notarized, as this step is often required to validate the release officially.

- Don't discard the original promissory note after the release is signed; it should be kept on file as a part of the transaction's history.

Misconceptions

When discussing the Release of Promissory Note form, several misconceptions frequently emerge. These misunderstandings can significantly impact the parties involved in a promissory note agreement, potentially leading to unnecessary disputes or legal complications. This exposition aims to clarify some of the most common fallacies surrounding the Release of Promissory Note.

- Misconception 1: A verbal agreement is sufficient to release a promissory note. Many assume that a simple oral agreement between the parties can effectively release the obligations under a promissory note. However, for a release to be legally binding and enforceable, it typically must be documented in written form. This written release helps ensure clarity and provides a tangible record of the parties' intention to discharge the borrower from their obligations under the note.

- Misconception 2: Only the lender needs to sign the Release of Promissory Note. It might seem logical to some that only the lender's signature is necessary to effectuate the release, given that the lender is the party releasing the borrower from the debt. However, best practice and, in many jurisdictions, legal requirement call for both parties to sign the release. This dual-signature requirement not only confirms that the borrower acknowledges the release but also protects against later disputes over the validity of the release.

- Misconception 3: A Release of Promissory Note immediately terminates the note’s existence. Another common misunderstanding is that the act of releasing a promissory note instantly nullifies the document itself. In reality, the release signifies that the borrower is discharged from their payment obligations under the terms of the note. The note, as a document, continues to exist as evidence of the now-fulfilled debt and the subsequent release, serving as a crucial piece of the financial history between the parties.

- Misconception 4: The Release of Promissory Note is not necessary if the debt is paid off. Some believe that once a debt is fully repaid, the promissory note is automatically void, rendering a formal release unnecessary. This perspective overlooks the importance of documenting the completion of the payment obligations. A formal release provides clear legal evidence that the debt has been fully satisfied, protecting both parties against future claims regarding the note.

- Misconception 5: Any template or form can be used for the Release of Promissory Note, regardless of the original agreement's specifics. Finally, there's a tendency to underestimate the importance of the release form's content, with some opting for generic templates without considering the original promissory note's unique terms and conditions. It is critical to either draft a customized release that reflects the specific provisions of the original agreement or to meticulously choose a template that can be suitably adapted to meet those original terms. This ensures that the release is comprehensive and prevents potential legal issues that could arise from ambiguous or incomplete releases.

In summary, while the Release of Promissory Note might seem straightforward, these misconceptions underscore the necessity for careful attention to the legal formalities involved. Properly executing the release protects the interests of all parties and ensures that the closure of the debt obligation is clear-cut and beyond dispute.

Key takeaways

When you've made the final payment on a loan, or if the lender decides to forgive the loan, a Release of Promissory Note form is an important document. It formally acknowledges that the borrower is released from their obligation to repay the loan detailed in the Promissory Note. Understanding the critical aspects of filling out and using this form can help ensure the process is smooth and legally sound.

A Release of Promissory Note form should be completed as soon as the loan is fully paid off or forgiven. This timely action prevents any future disputes over the loan's status.

The form must clearly identify the original Promissory Note by including its date and the parties involved. This specificity ensures there's no confusion about which loan is being released.

Both the lender and the borrower must sign the Release form for it to be effective. This mutual agreement confirms that both parties acknowledge the end of their financial agreement.

Include the payment details that led to the release, whether it's the final payment or a settlement. This record is crucial for financial documentation and transparency.

It's wise to have the form notarized. While not always required, notarization adds a level of authenticity and may be necessary depending on state laws or the specifics of the Promissory Note.

After the form is completed and signed, distribute copies to all involved parties. Keeping a record is important for both the borrower and the lender for future reference.

Check your local laws for any specific requirements. Legal requirements for releasing a Promissory Note can vary by state, so it's important to ensure your Release form complies with local regulations.

Store the Release form in a safe place with other important financial documents. Its presence confirms the loan's closure and protects against any future claims.

Lastly, remember that releasing a Promissory Note might have tax implications. The lender, for instance, may need to report the canceled debt. Both parties should consult with financial advisors to understand these effects.

Properly completing and using a Release of Promissory Note form signifies the end of a financial agreement and liberates the borrower from further obligations. It's a critical step in ensuring both parties can move forward without future disputes or legal issues related to the loan.

Consider More Types of Release of Promissory Note Forms

Create Promissory Note - Helps facilitate financing arrangements that might not be possible through banks or traditional lenders, making private sales smoother.