Official Promissory Note for a Car Document

When purchasing a vehicle through a private sale, the agreement between the buyer and seller can often involve a Promissory Note for a Car. This document serves as a crucial part of the transaction, ensuring that all details of the agreement are formally recorded. It outlines the amount borrowed by the buyer to purchase the car, the interest rate if applicable, and the repayment schedule to which both parties have agreed. Additionally, it acts as a legal record, offering protection and clarity for both the buyer and seller, and includes specifics such as the identities of the parties, the vehicle's description, and any warranties or guarantees. This form not only helps in facilitating a smoother transaction but also in preventing potential disputes by setting clear expectations and obligations, making it an indispensable tool in private vehicle sales.

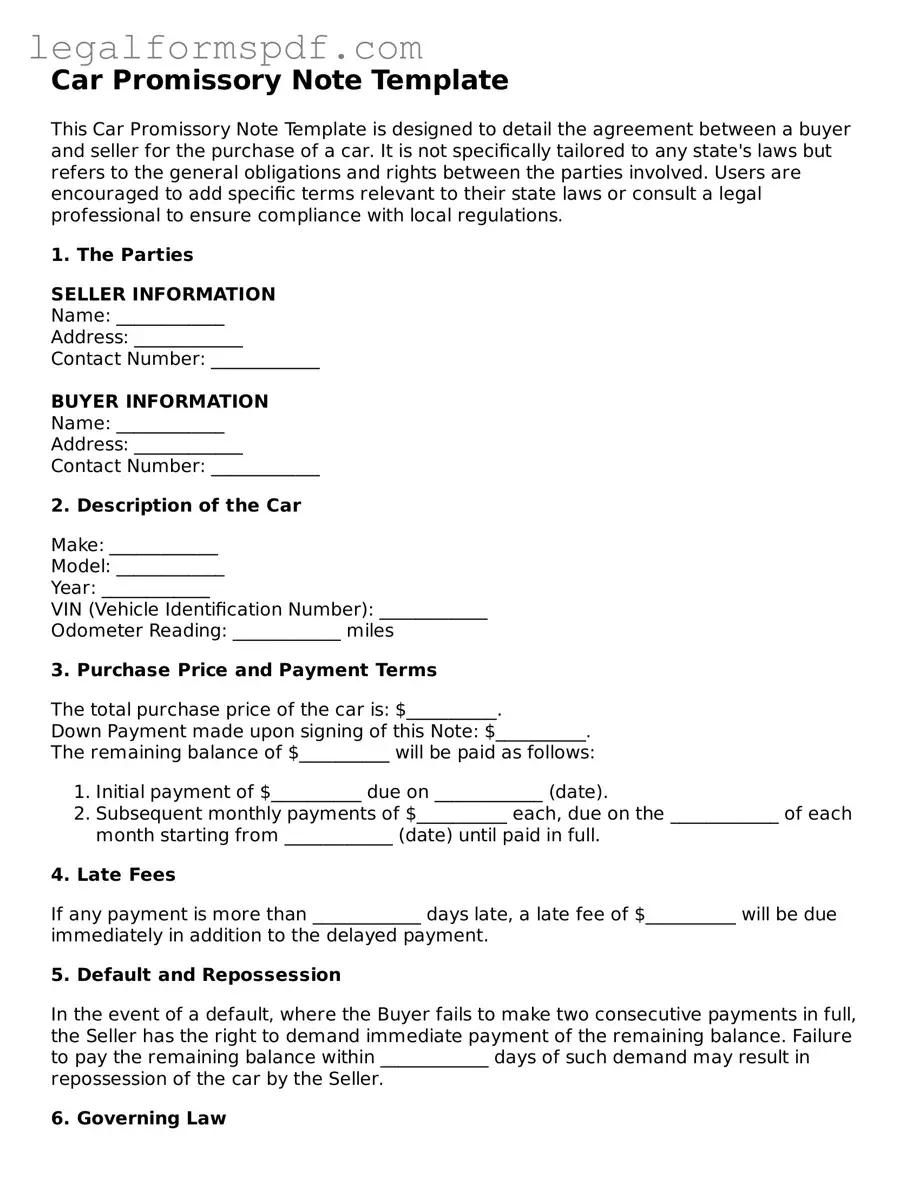

Document Example

Car Promissory Note Template

This Car Promissory Note Template is designed to detail the agreement between a buyer and seller for the purchase of a car. It is not specifically tailored to any state's laws but refers to the general obligations and rights between the parties involved. Users are encouraged to add specific terms relevant to their state laws or consult a legal professional to ensure compliance with local regulations.

1. The Parties

SELLER INFORMATION

Name: ____________

Address: ____________

Contact Number: ____________

BUYER INFORMATION

Name: ____________

Address: ____________

Contact Number: ____________

2. Description of the Car

Make: ____________

Model: ____________

Year: ____________

VIN (Vehicle Identification Number): ____________

Odometer Reading: ____________ miles

3. Purchase Price and Payment Terms

The total purchase price of the car is: $__________.

Down Payment made upon signing of this Note: $__________.

The remaining balance of $__________ will be paid as follows:

- Initial payment of $__________ due on ____________ (date).

- Subsequent monthly payments of $__________ each, due on the ____________ of each month starting from ____________ (date) until paid in full.

4. Late Fees

If any payment is more than ____________ days late, a late fee of $__________ will be due immediately in addition to the delayed payment.

5. Default and Repossession

In the event of a default, where the Buyer fails to make two consecutive payments in full, the Seller has the right to demand immediate payment of the remaining balance. Failure to pay the remaining balance within ____________ days of such demand may result in repossession of the car by the Seller.

6. Governing Law

This Car Promissory Note will be governed by the laws of the state where the car purchase occurred, without giving effect to any principles of conflicts of law.

7. Signatures

This document is not legally binding until signed by both parties and dated.

____________ (Seller's Signature) ____________ (Date)

____________ (Buyer's Signature) ____________ (Date)

PDF Specifications

| Fact Name | Detail |

|---|---|

| Definition | A Promissory Note for a Car is a legal document where a borrower agrees to pay back a loan used to purchase a vehicle in specified installments, with interest, by a certain date. |

| Key Elements | The note includes the amount borrowed, interest rate, repayment schedule, late fees, and the signatures of both the borrower and lender. |

| Interest Rates | Interest rates can be fixed or variable but must comply with the usury laws of the state governing the note. |

| Governing Laws | Each state may have specific laws that govern promissory notes, ensuring they comply with federal guidelines and state usury laws. |

| Importance of Signature | The signatures of both parties validate the agreement, making it legally binding and enforceable. |

| Security | Oftentimes, the car itself serves as collateral for the loan, which means the lender may repossess the vehicle if the borrower defaults on the loan. |

| Customization | While many aspects of the promissory note are standardized, terms like interest rate, repayment schedule, and late fees can often be customized to suit the agreement between the borrower and lender. |

Instructions on Writing Promissory Note for a Car

A Promissory Note for a Car is a form of agreement between a seller and a buyer. This document outlines the buyer's promise to pay back the seller for the vehicle over a certain period, including any interest, according to the terms they've agreed on. It's an essential step in the private sale of a vehicle as it protects both parties by clearly defining the payment obligations. Here are the steps to properly fill out this form to ensure a smooth transaction and legal protection.

- Identify the Parties: Start by writing the full legal names of the buyer and the seller. Include contact information such as addresses and phone numbers to clearly establish who is involved in the agreement.

- Describe the Vehicle: Provide a detailed description of the car including its make, model, year, color, VIN (Vehicle Identification Number), and any other relevant information that uniquely identifies the vehicle.

- State the Loan Amount: Clearly mention the total amount being loaned for the purchase of the car. This figure should include the total cost of the vehicle that the buyer agrees to pay back.

- Define Payment Terms: Detail the terms of repayment. Specify the amount of each payment, when payments are due (e.g., the first of each month), and where payments should be sent. Also, clarify the number of payments to be made and the due date for the final payment.

- Include Interest Rate: If applicable, note the interest rate on the loan. This should be an annual percentage rate (APR). Detail how the interest will be applied to the payments.

- Outline Late Fees: Clearly define any late fees. Include information on when a payment is considered late and the fee amount or percentage of the payment due.

- Discuss Prepayment: Specify if the buyer is allowed to pay off the balance early and whether there’s a penalty or discount for doing so.

- Signatures: Ensure that both the buyer and the seller sign and date the promissory note. It's also a good idea to have the document witnessed or notarized to further authenticate it.

Once all of these steps are completed, keep copies of the signed document for both the buyer and seller. This form becomes a crucial piece of evidence of the agreement and is fundamental should any disputes arise. It's advisable for both parties to review the document thoroughly before signing to ensure that all the terms are clear and agreed upon.

Understanding Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document between two parties – the borrower and the lender – in which the borrower agrees to pay back the lender the amount of money borrowed to purchase a car. This note outlines the loan's terms, including the loan amount, interest rate, repayment schedule, and the consequences of defaulting on the loan.

Who needs to sign the Promissory Note for a Car?

The Promissory Note for a Car must be signed by both the borrower, who is receiving the funds to purchase the vehicle, and the lender, who is providing the loan. In some cases, if the borrower has a co-signer to guarantee the loan, the co-signer must also sign the note. Witnesses or a notary public may also sign the document, depending on state requirements, to provide additional legal validation.

What information is required on the Promissory Note for a Car?

For a Promissory Note for a Car to be valid and enforceable, specific information must be included: the full names and contact details of the borrower and lender, the amount of money borrowed, the interest rate (if applicable), the repayment schedule (including dates and amounts for each payment), any penalty for late payments, and the conditions under which the loan must be repaid in full. Additionally, it should detail the vehicle's information, such as make, model, year, and VIN (Vehicle Identification Number), to clearly identify the car being purchased.

Is a Promissory Note for a Car legally binding?

Yes, a Promissory Note for a Car is a legally binding document. Once signed by both parties, it serves as a legal agreement that the borrower will repay the borrowed amount under the terms outlined. Failure to abide by these terms can lead to legal consequences, such as lawsuits or repossession of the vehicle.

Can I modify a Promissory Note for a Car after it has been signed?

Modifying a signed Promissory Note is possible but requires agreement from both the borrower and the lender. Any changes to the original terms should be made in writing, and both parties should sign an amendment to the original note or create a new note entirely to reflect the updated terms. This ensures that the modifications are legally binding.

What happens if the borrower fails to repay the loan as agreed?

If the borrower defaults on their loan payments as outlined in the Promissory Note, the lender has the right to initiate legal proceedings to recover the owed amount. This may include repossession of the vehicle, given that it often serves as collateral for the loan. The specific consequences and available remedies will depend on the terms of the promissory note and applicable state laws.

Common mistakes

Filling out a Promissory Note for a Car requires careful attention to detail, yet errors can easily be made. Often, individuals overlook the necessity to accurately detail the full legal names of both the borrower and lender. This can cause confusion and may complicate legal enforcement of the note. Ensuring that the names are complete and match official identification documents is crucial for the legitimacy of the agreement.

Another common mistake lies in the failure to specify the loan amount in both words and numbers. This double clarification serves as a safeguard against typos or misunderstandings regarding the size of the loan. Neglecting this can lead to disputes or uncertainties about the principal amount to be repaid.

Interest rate specifications are frequently mishandled. The rate must be clear, and it must comply with state usury laws to prevent it from being considered illegal. Failure to correctly document the interest rate or to ensure its legality can render the entire agreement void or unenforceable. Additionally, it's essential to define whether the interest is compounded or simple as this impacts the total amount owed.

Often, the terms of repayment are either too vague or not properly outlined. A detailed repayment schedule, including the start date, frequency of payments (monthly, weekly, etc.), and the amount of each installment, must be clearly documented. Without this specificity, enforcing the terms or managing expectations becomes problematic.

Penalties for late payments or defaults are sometimes omitted entirely. Implementing clear consequences for late payments or detailing the process for handling a default is crucial for protecting the interests of the lender. Furthermore, these terms can encourage timely repayment by the borrower.

Some individuals forget to include a clause that addresses early repayment of the loan. An early repayment clause can define whether the borrower is allowed to pay off the loan early and, if so, whether they are subject to any penalties or adjustments in interest. This omission can lead to confusion or unintended financial implications for either party involved.

Lastly, the absence of signatures from both the borrower and lender is a surprisingly common oversight. The signatures, along with the date of signing, are what make the promissory note legally binding. Without these, the document holds no legal enforceability, significantly compromising the lender's position should repayment issues arise.

In summary, when completing a Promissory Note for a Car, it is imperative to carefully address each of these areas. Avoiding these mistakes can help ensure that the agreement is fair, clear, and enforceable, thereby minimizing future disputes and complications.

Documents used along the form

When purchasing or selling a car through private sales, a Promissory Note is a crucial document. But it's not the only document you need for a smooth and legally sound transaction. A handful of other forms and documents complement the Promissory Note, ensuring that all aspects of the car sale are covered comprehensively. Here are five essential documents often used alongside a Promissory Note for a Car form, providing buyers and sellers with a framework for a secure and transparent deal.

- Bill of Sale: This document acts as a receipt for the transaction. It details the purchase price, the condition of the vehicle, and the identities of the buyer and seller. The Bill of Sale is proof of the transfer of ownership from the seller to the buyer. It's commonly used for tax and registration purposes.

- VIN Verification Form: A Vehicle Identification Number (VIN) verification form is necessary to ensure the car being sold matches its official records. This form is usually required for registration and titling of the vehicle, especially when the sale involves an out-of-state car. Law enforcement or authorized personnel typically conduct VIN verifications.

- As-Is Sale Acknowledgment: When a car is sold "as-is," it means the seller is not offering any warranties regarding the vehicle's condition. Having an As-Is Sale Acknowledgment signed by the buyer ensures that they understand they're buying the vehicle in its current condition without any guarantees from the seller. This document protects the seller from future claims about the car's condition.

- Odometer Disclosure Statement: Federal law requires that the seller disclose the vehicle's accurate mileage at the time of sale. An Odometer Disclosure Statement is a document where the seller records the car's mileage and attests to its accuracy. This form helps prevent odometer fraud and ensures the buyer is aware of the vehicle's actual use.

- Loan Agreement: If the car purchase is being financed by a third party, a Loan Agreement might be necessary. This document outlines the terms of the loan, including interest rate, repayment schedule, and the consequences of defaulting on the loan. While the Promissory Note outlines the promise to pay between the buyer and the seller, a Loan Agreement involves the financial institution in the transaction.

Together with the Promissory Note for a Car, these documents create a cohesive bundle that addresses the legal, financial, and practical aspects of a vehicle transaction. Ensuring that all these forms are properly filled out and signed can spare both parties a lot of potential legal and financial headaches down the line. It's always recommended to consult with or hire a professional when dealing with legal documents to ensure everything is in order.

Similar forms

A promissory note for a car is a financial document that spells out a borrower's promise to repay a loan used to purchase a vehicle. This type of agreement shares similarities with various other financial and legal documents, each serving unique but related purposes. One closely related document is the mortgage agreement, used when purchasing real estate. Like a promissory note for a car, a mortgage outlines the borrower’s promise to repay the loan under specific terms but is secured by the property itself, providing the lender with collateral.

Another document akin to the promissory note for a car is a personal loan agreement. This agreement is a bit broader in scope, covering any loan between two parties for personal needs beyond just vehicle purchase. It outlines the amount borrowed, the interest rate, repayment schedule, and any collateral. While promissory notes for cars are targeted, personal loan agreements can be used for a multitude of purposes, including debt consolidation or home improvement.

The student loan agreement is also similar, focusing on the borrower's commitment to repay borrowed money used for educational expenses. Like vehicle promissory notes, these agreements detail the loan terms, including repayment schedule and interest rates, but are specifically geared towards funding education rather than acquiring tangible assets.

A business loan agreement shares similarities with a promissory note for a car, particularly in outlining terms for borrowing money. However, this document is tailored for business financing needs, like startup expenses or expansion. Both agreements spell out repayment terms and interest rates but serve different purposes—one for personal vehicle purchase and the other for business financial support.

Lease agreements, while generally associated with rental properties, bear resemblance to promissory notes for a car in that they set terms for use of an asset. However, instead of detailing a loan's repayment, lease agreements outline terms under which one party can use the other party’s property, including duration and payment structure, without transferring ownership.

The bill of sale is another document related to the process of purchasing a vehicle, serving as proof of the transaction between buyer and seller. It confirms the sale of the vehicle, detailing the price, date of sale, and identification information of the vehicle. While not a loan document, it often goes hand-in-hand with a promissory note for a car by validating the transaction that necessitated the loan.

Debt settlement agreements also share some characteristics with promissory notes for cars, focusing on the resolution of debt under renegotiated terms. While a promissory note establishes the initial terms of a loan’s repayment, a debt settlement agreement might come into play if the borrower is unable to meet those terms, offering a way to settle the debt, potentially for less than the original amount owed.

Finally, an IOU (I Owe You) is a simplified version of a promissory note, documenting a borrower's obligation to repay a debt to a lender. It is less formal and detailed than a promissory note for a car, usually lacking specifics on repayment terms and schedules. However, both serve as written acknowledgements of debt and the borrower’s intention to repay it.

Dos and Don'ts

When the time comes to fill out a Promissory Note for a car, it is essential to approach this task with diligence and attention to detail. A Promissory Note is a legal agreement that outlines the borrower's promise to repay a debt under specific terms. This document is particularly significant when buying or selling a car under a private party transaction, as it formalizes the agreement and provides a clear repayment plan. Here are nine things you should and shouldn't do to ensure the process is completed correctly and effectively.

Do:- Review the form carefully before starting to fill it out. Ensure you understand every section to avoid any mistakes that could impact the agreement's legality or enforceability.

- Fill in all required details accurately. This includes the full names and addresses of both the borrower and the lender, the total loan amount, the interest rate (if any), and a detailed description of the car (make, model, year, and VIN).

- Be clear about the repayment plan. Specify the payment amounts, the frequency of payments (weekly, monthly, etc.), and the duration of the loan. Clarity here will help avoid misunderstandings later.

- Decide on the interest rate fairly. If you decide to include interest, make sure it is a reasonable rate agreed upon by both parties. Check the maximum legal interest rate in your state to stay within legal limits.

- Have witnesses or a notary present when signing, if required by your state. This step can add an extra layer of legality and enforceability to the document.

- Overlook specifying a late payment policy. It's critical to define the consequences of late payments, including any penalties or interest rate increases, to encourage timely payments and protect the lender.

- Forget to outline the course of action in case of default. Clearly state what will happen if the borrower cannot repay the loan. Will the car be repossessed? Is there a grace period before taking such action? This section is essential for protecting the lender's interests.

- Ignore state-specific laws and requirements. Each state may have different laws regarding Promissory Notes. Ensure you're complying with these laws to maintain the document's legal standing.

- Neglect to make copies of the signed Promissory Note for both the borrower and the lender. Keeping a physical or digital copy is crucial for record-keeping and resolving any future disputes.

Misconceptions

When it comes to financing a car through a private sale, many turn to a Promissory Note for a Car form. This document is essential for creating a legally binding agreement between the buyer and the seller regarding the repayment terms of the loan used to purchase the vehicle. However, several misconceptions surround its use and formalities. Understanding these misconceptions is crucial to ensuring that both parties are fully informed and the process runs smoothly.

-

Misconception 1: A Promissory Note is Not Legally Binding

Many believe that a promissory note for a car is more of a casual agreement rather than a legally enforceable document. This is not the case. A well-crafted promissory note, which outlines the loan amount, interest rate, repayment schedule, and the consequences of non-payment, is indeed legally binding. Both parties should treat it with the same seriousness as any other financial contract.

-

Misconception 2: Only the Buyer Needs to Sign the Promissory Note

Typically, the assumption is that since the buyer is the one who promises to pay, they are the only party required to sign the promissory note. However, having both the buyer and the seller sign can provide additional legal security. The seller's signature acknowledges their agreement to the terms of the sale and the financing arrangement, which can be crucial in the event of a dispute.

-

Misconception 3: A Promissory Note Replaces a Bill of Sale

Some individuals might think that the promissory note can serve as a replacement for a bill of sale. This is not correct. The promissory note details the financial aspects of the deal, such as the loan amount and repayment terms. Conversely, the bill of sale acts as a receipt, detailing the transaction that transferred ownership of the vehicle from the seller to the buyer. Both documents play distinct and important roles in the transaction.

-

Misconception 4: All Promissory Notes for Cars Are the Same

It's often assumed that one standard promissory note applies universally to all car transactions. Each sale, however, may have unique terms, such as different interest rates or repayment schedules. Consequently, it's crucial to tailor the promissory note to the specific deal at hand. This ensures all terms are clear and agreed upon by both parties.

-

Misconception 5: No Need for Witnesses or Notarization

While not always a legal requirement, having the promissory note signed in the presence of a witness or notarized can significantly enhance its enforceability. Witnesses or a notary public can verify the identity of the signees and confirm that all signatures were obtained voluntarily, adding an extra layer of security against potential future disputes.

Key takeaways

Securing a vehicle through a private sale often involves a promissory note, which serves as a formal agreement to pay the seller a specified amount over time. Understanding the complexities of the Promissory Note for a Car form is crucial for both buyers and sellers in these transactions. Here are five key takeaways that individuals should consider:

- Accurate Details: Ensure that all information is filled out accurately on the form. This includes the full names of both buyer and seller, the agreed-upon sale price, and the specifics of the vehicle (make, model, year, and VIN).

- Payment Plan Clarity: The promissory note must clearly outline the payment schedule, including the amount of each payment, due dates, and where payments should be sent. Clear terms help avoid misunderstandings and potential disputes.

- Interest Rate: If the agreement includes interest on the unpaid balance, the interest rate should be explicitly stated within the form. Interest rates should comply with state-specific usury laws to avoid illegal interest charges.

- Signature Requirement: A pivotal part of the promissory note is the signature of both parties, which legally binds them to the agreement. It is advisable for each party to keep a signed copy of the document for their records.

- Consequences for Default: The form should specify the recourse available to the lender if the buyer defaults on payments. This usually includes, but is not limited to, repossession of the vehicle. Clearly defined consequences ensure that both parties understand the seriousness of the agreement.

Treating the Promissory Note for a Car form with the importance it merits ensures a smoother transaction and helps maintain a positive relationship between buyer and seller. By paying careful attention to the form’s details and requirements, both parties can help protect their interests and ensure a clear, fair agreement.

Consider More Types of Promissory Note for a Car Forms

Release of Promissory Note Template - It's crucial for safeguarding against any claims of unpaid debt after the loan has been satisfied.