Fillable Promissory Note Document for Pennsylvania

When entering into an agreement to borrow or lend money in Pennsylvania, the documentation of the terms and conditions of the loan often takes the form of a promissory note. This legally binding document ensures clarity and enforceability of the loan details, including the repayment schedule, interest rate, and what happens in case of a default. Both lenders and borrowers benefit from the specificity and legal underpinning provided by a promissory note, making it an essential aspect of personal and business finance within the state. The form itself is straightforward, designed to be comprehensive yet accessible, ensuring that individuals without a background in law or finance can still execute a valid and effective agreement. By laying out all the obligations and rights of the involved parties, the Pennsylvania Promissory Note form acts as a safeguard against misunderstandings and potential disputes, reinforcing the commitment of both sides to uphold their part of the deal. Understanding the major components and the significance of this form is crucial for anyone looking to engage in a loan transaction within the state.

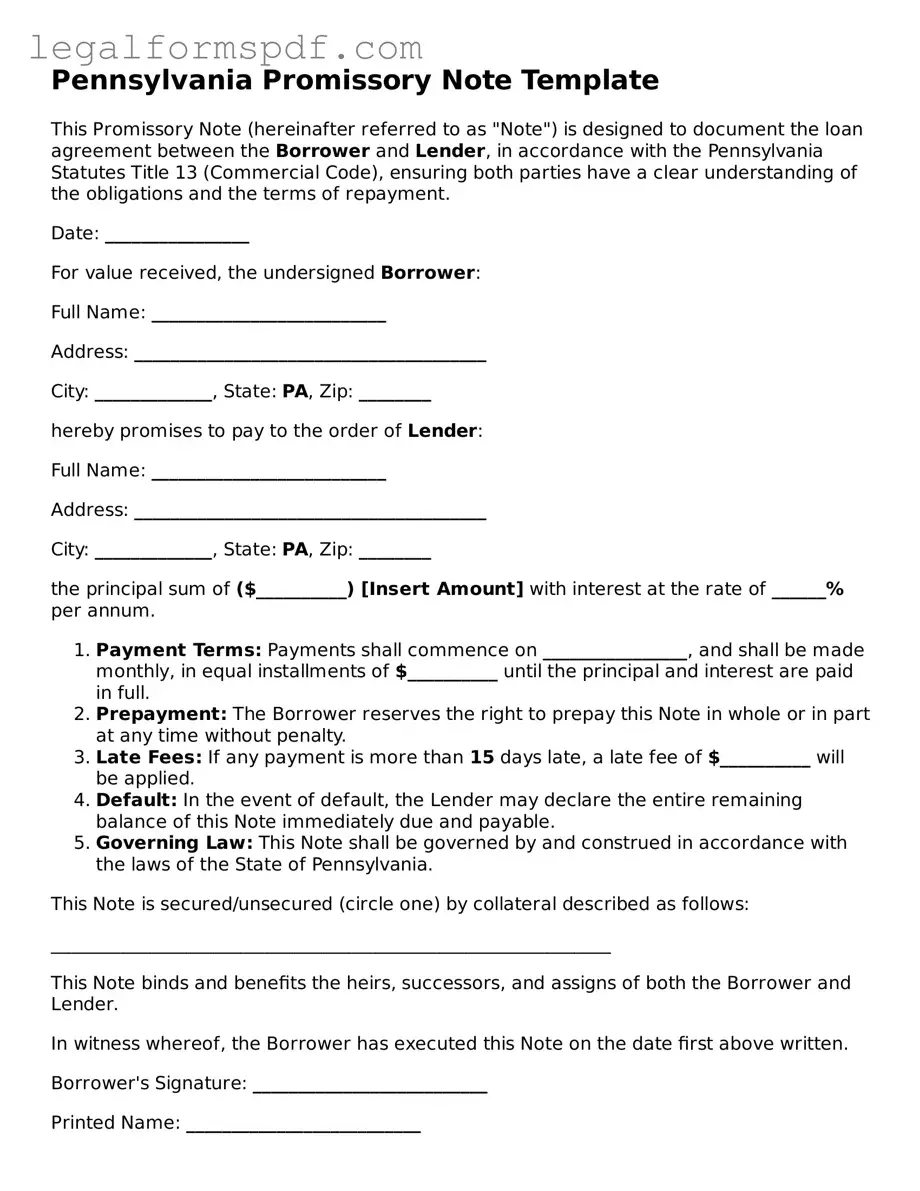

Document Example

Pennsylvania Promissory Note Template

This Promissory Note (hereinafter referred to as "Note") is designed to document the loan agreement between the Borrower and Lender, in accordance with the Pennsylvania Statutes Title 13 (Commercial Code), ensuring both parties have a clear understanding of the obligations and the terms of repayment.

Date: ________________

For value received, the undersigned Borrower:

Full Name: __________________________

Address: _______________________________________

City: _____________, State: PA, Zip: ________

hereby promises to pay to the order of Lender:

Full Name: __________________________

Address: _______________________________________

City: _____________, State: PA, Zip: ________

the principal sum of ($__________) [Insert Amount] with interest at the rate of ______% per annum.

- Payment Terms: Payments shall commence on ________________, and shall be made monthly, in equal installments of $__________ until the principal and interest are paid in full.

- Prepayment: The Borrower reserves the right to prepay this Note in whole or in part at any time without penalty.

- Late Fees: If any payment is more than 15 days late, a late fee of $__________ will be applied.

- Default: In the event of default, the Lender may declare the entire remaining balance of this Note immediately due and payable.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Pennsylvania.

This Note is secured/unsecured (circle one) by collateral described as follows:

______________________________________________________________

This Note binds and benefits the heirs, successors, and assigns of both the Borrower and Lender.

In witness whereof, the Borrower has executed this Note on the date first above written.

Borrower's Signature: __________________________

Printed Name: __________________________

Lender's Signature: __________________________

Printed Name: __________________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Pennsylvania Promissory Note form is a legal document that outlines the terms under which a borrower agrees to pay back a sum of money to a lender. |

| 2 | All promissory notes in Pennsylvania are governed by Pennsylvania's statutes and the Uniform Commercial Code (UCC), specifically Article 3. |

| 3 | The form must include the full amount loaned and the interest rate, complying with Pennsylvania's usury laws to be legally enforceable. |

| 4 | Interest rates must not exceed the legal limit in Pennsylvania without a special contract, with the general legal rate being six percent (6%) per annum for loans without a specified rate. |

| 5 | Security may be required for the note, making it either secured or unsecured. A secured promissory note includes collateral, whereas an unsecured note does not. |

| 6 | Both parties, the borrower and the lender, must sign the note for it to be considered valid and legally binding in Pennsylvania. |

| 7 | The note must be clear about the repayment schedule, whether payments will be made in a lump sum, in installments, or at will (payable on demand). |

| 8 | If the borrower defaults on the note, the lender may have the right to demand full repayment immediately or take possession of the collateral, if any. |

| 9 | The form should also detail any late fees or penalties for missed payments, as agreed upon by both parties. |

| 10 | Forging, falsifying, or altering a promissory note is a criminal offense in Pennsylvania and can lead to severe penalties, including fines and imprisonment. |

Instructions on Writing Pennsylvania Promissory Note

A Promissory Note is a financial instrument that details a written promise by one party to pay another party a definite sum of money either on demand or at a specified future date. In Pennsylvania, like many states, creating a Promissory Note is a straightforward process designed to ensure the borrower's commitment to repay the lender under agreed-upon terms. This is usually in the context of loans and is crucial for both personal and business finance. The following steps are aimed at guiding through the process of filling out a Pennsylvania Promissory Note form. Ensuring all sections are completed accurately will solidify the agreement and help protect all parties involved.

- Identify the parties involved by writing the full legal names of the borrower and the lender at the beginning of the document.

- Specify the principal amount of the loan. This refers to the total amount of money being loaned, excluding any interest that may accrue.

- Detail the interest rate being applied to the principal amount. This is typically represented as an annual percentage rate (APR).

- Choose the type of repayment structure. This could be a lump sum on a certain date, multiple payments over time, or payment on demand.

- Include the date for the commencement of the loan and specify the maturity date - the date by which the loan must be repaid in full.

- If there will be collateral securing the loan, describe the collateral in detail within the relevant section of the note. Collateral may include real estate, vehicles, or other valuable assets that the lender can claim if the loan is not repaid.

- Detail any late fees or penalties for missed payments to ensure clarity on the consequences of defaulting on the note.

- List any co-signers if the loan requires a guarantee. A co-signer is someone who also signs the promissory note, agreeing to repay the loan if the primary borrower does not.

- Include the governing state law under which the promissory note will be enforced. For a note in Pennsylvania, specify that Pennsylvania laws govern the agreement.

- Finally, both the borrower and the lender must sign and date the promissory note. Witnesses or a notary public may also sign, depending on the legal requirements in Pennsylvania.

Once the Promissory Note is fully completed with all relevant sections carefully filled out, it serves as a binding legal agreement. It should be kept in a secure location, with both the borrower and lender retaining copies for their records. Following these steps ensures that the financial duties and responsibilities of both parties are clearly outlined, reducing potential disputes and fostering a positive lending and borrowing experience.

Understanding Pennsylvania Promissory Note

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document that outlines a loan agreement between two parties, typically a borrower and a lender. It serves as a written promise that the borrower will repay the lender the borrowed amount, plus any agreed-upon interest, according to the terms and schedule specified in the document. This form is governed by Pennsylvania state laws, ensuring that all terms and conditions comply with local regulations.

How does one create a Pennsylvania Promissory Note?

To create a Pennsylvania Promissory Note, the parties involved must agree on the loan amount, interest rate, repayment schedule, and any other conditions relevant to the loan. It is crucial to clearly specify all these terms in writing to make the note legally binding. Both the borrower and the lender should sign the document, and it's recommended to have a witness or notary public sign as well, to add an extra layer of legal protection. For ensuring compliance with Pennsylvania state laws, consulting with a legal professional is advisable.

Is a Pennsylvania Promissory Note legally enforceable?

Yes, a Pennsylvania Promissory Note is legally enforceable, provided it contains all necessary components and is signed by both parties. In the event that the borrower fails to meet the repayment terms, the lender has the right to pursue legal action based on the promissory note. The enforceability of the document relies on its adherence to Pennsylvania state laws and the inclusion of clear, unambiguous terms detailing the obligations of each party.

Can a Pennsylvania Promissory Note include collateral?

Yes, a Pennsylvania Promissory Note can include collateral. This type of promissory note is known as a secured promissory note. It means that the borrower pledges an asset as security for the loan. Should the borrower default on the loan, the lender has the right to seize the collateral to recover the borrowed amount. Clearly identifying and describing the collateral within the promissory note is essential for ensuring that the security interest is legally binding and enforceable under Pennsylvania law.

Common mistakes

Filling out the Pennsylvania Promissory Note form can seem straightforward, but a few common mistakes often trip people up. Understanding these pitfalls can help ensure a smooth and legally sound agreement. One major mistake is not specifying the type of interest rate. In Pennsylvania, it's essential to clarify whether the interest rate is simple or compounded, as this affects how interest accumulates over time. Without this clarity, disputes over the amount owed can arise, potentially leading to legal complications.

Another common issue is failing to include a clear repayment schedule. This schedule should detail when payments are due, in what amounts, and over what period. Omitting these details can lead to confusion and disagreements down the line. Additionally, leaving out the total amount loaned and the final payment date makes it difficult for both parties to understand when the debt is fully repaid, potentially leading to unintended default or overpayment.

Some people forget to document any collateral securing the loan, especially if the promissory note is for a significant amount. Identifying the collateral clearly in the agreement ensures the lender has a legal right to seize it if the borrower defaults. Without this, the lender's options to recoup the loaned amount are limited.

Overlooking the necessity of witness signatures or notarization is another mistake. In Pennsylvania, having the promissory note witnessed or notarized can add an extra layer of legal protection and authenticity. While not always a legal requirement, it can help prevent disputes over the validity of the document.

A crucial yet often overlooked detail is failing to outline the conditions under which the note can be declared in default. Clearly defined default conditions make it easier to handle missed payments or other breaches of the agreement. Without these specifics, enforcing the promissory note or taking legal action becomes more challenging.

Incorrectly assuming that a promissory note does not require legal language or understanding is a significant misstep. While the document doesn't need to be overly complex, using precise legal terms correctly can protect both parties' interests. Mistakes in wording can lead to interpretations that favor one party over the other.

Not keeping a copy of the signed promissory note is a simple yet common error. Both the lender and the borrower should keep a copy of the agreement for their records. This ensures each party can reference the original terms in case of disputes or misunderstandings.

Lastly, ignoring state laws that govern promissory notes in Pennsylvania can lead to serious legal ramifications. Each state has its regulations around interest rates, fees, and collection practices. Failing to comply with these laws can invalidate the note or expose parties to legal penalties.

By avoiding these common mistakes, individuals can create a legally binding Pennsylvania Promissory Note that protects the interests of both the lender and the borrower. Paying attention to detail and understanding the legal requirements are crucial steps in this process.

Documents used along the form

When dealing with financial agreements, particularly in Pennsylvania, the Promissory Note is a pivotal document formalizing the promise of repayment from one party to another. However, to ensure a comprehensive and secure transaction, several other documents are typically utilized alongside a Promissory Note. These documents serve various purposes, from affirming the identity of the involved parties to stipulating the terms of collateral, if any. Here's a look at four such documents often used in conjunction.

- Loan Agreement: While a Promissory Note outlines the promise to repay a loan, a Loan Agreement goes further, detailing the loan's terms and conditions, including the repayment schedule, interest rates, and what happens in the event of a default. This document provides a thorough framework for the financial transaction.

- Security Agreement: If the loan is secured with collateral, a Security Agreement is essential. This document describes the collateral that secures the loan, ensuring that the lender has a legal claim to the property if the borrower defaults. It outlines the rights and responsibilities of both parties concerning the collateral.

- Guaranty: A Guaranty is used when a third party agrees to be responsible for the debt should the original borrower default. This document is vital in situations where the borrower's ability to fulfill the repayment obligation is in doubt, providing an additional layer of security for the lender.

- Amortization Schedule: This document is often attached to a Promissory Note to outline the payment plan for the loan. It details the amount of each payment that will go towards the principal and interest over the loan period, offering a clear timeline and financial breakdown for both borrower and lender.

In the realm of financial transactions, documents like the Promissory Note form the backbone of mutual understanding and agreement. However, the supportive documents mentioned play crucial roles in clarifying, securing, and detailing the nuances of these agreements. For anyone navigating through loans and financial agreements in Pennsylvania, being familiar with these documents can significantly ease the process, ensuring all legal and practical bases are covered.

Similar forms

The Pennsylvania Promissory Note form shares similarities with a Loan Agreement, mainly in its function as a binding agreement between a borrower and a lender. Both documents outline the loan's terms, including the principal amount, interest rate, repayment schedule, and both parties' obligations. However, a Promissory Note is often simpler and may not include as many details regarding the legal recourse and operational procedures in case of default as a Loan Agreement.

Compared to a Mortgage Agreement, the Pennsylvania Promissory Note also shares the principle of obligating the borrower to repay a debt. While a Mortgage Agreement specifically secures the loan with real estate as collateral and details rights around foreclosure, a Promissory Note could be secured or unsecured but does not inherently include specifics on real estate as collateral. The use, therefore, dictates whether property is involved as a backing for the repayment of the loan.

Similar to an IOU (I Owe You), the Pennsylvania Promissory Note serves as an acknowledgment of debt. Both document the fact that one party owes another a certain amount of money. The primary difference lies in the level of detail and legal weight; a Promissory Note typically includes a repayment schedule and interest, making it more formal and comprehensive than an IOU, which is a more informal acknowledgment of debt without detailed repayment terms.

An Installment Agreement is another document similar to the Pennsylvania Promissory Note, especially when the note specifies repayment in parts over a set period. Both detail the payment plan for a debt, including the amount of each installment and the due dates. However, an Installment Agreement may be used for various types of payments beyond loans, such as installment sales, and might not always include interest or the legal weight of a Promissory Note.

The Pennsylvania Promissory Note also bears resemblance to a Personal Loan Agreement, as both pertain to money being lent and the conditions of repayment. The distinction often lies in the scope and detail, where a Personal Loan Agreement might include clauses about the relationship between the entities involved, collateral requirements, and detailed legal remedies. In contrast, a Promissory Note focuses on the acknowledgment of the debt and the repayment schedule.

Lastly, a Debt Settlement Agreement shares the concept of repaying a debt under agreed-upon terms with the Pennsylvania Promissory Note. The significant difference is that a Debt Settlement Agreement is used to negotiate the terms for settling a debt often at a reduced amount, while a Promissory Note asserts the original terms of repayment for the full amount owed plus any applicable interest or fees.

In summary, while these six documents share a common goal of detailing the terms for borrowing and repaying money, each serves a specific purpose, ranging from the formal and detailed to the informal acknowledgment of a debt. The Pennsylvania Promissory Note sits within this spectrum, providing a balance between formality and simplicity in documenting a loan agreement.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, there are several do's and don'ts you should be aware of to ensure the process is smooth and the agreement is legally binding. Below is a list of steps and mistakes to avoid.

Do's:

Double-check the details of both the lender and the borrower, including full names and addresses, to confirm their accuracy.

Specify the loan amount clearly in U.S. dollars to ensure there is no confusion about the sum being borrowed.

Include the interest rate in the document, adhering to Pennsylvania's legal maximum, to make sure the agreement is enforceable.

Define the repayment schedule in clear terms, whether it's on a monthly basis or a lump-sum, to prevent any misunderstandings.

Detail any collateral securing the loan, if applicable, to clarify the rights of the lender regarding foreclosure on the collateral.

Insert any agreed-upon clauses about late fees or penalties for missed payments to encourage timely repayment.

Ensure both parties sign and date the form in front of a witness or notary public to boost the document's legal standing.

Keep copies of the signed agreement for both the lender and the borrower for record-keeping and to resolve any future disputes.

Review the agreement periodically and document any agreed-upon changes in writing, with both parties endorsing the updates.

Don'ts:

Don't neglect to specify the loan's terms, including interest rate and repayment schedule, to avoid legal ambiguities.

Don't fail to check Pennsylvania's current laws on maximum allowable interest rates to avoid creating an illegal agreement.

Don't skip including a clause about the governing state laws, which would be Pennsylvania, to ensure clarity on which state's laws apply to the agreement.

Don't leave any sections blank; if a section does not apply, indicate with “N/A” (not applicable) to prevent unauthorized alterations.

Don't forget to have the document witnessed or notarized, as this step adds a layer of verification and enforcement.

Don't omit details about any collateral, if the loan is secured, to protect the lender's interests.

Don't neglect to provide each party with a copy of the signed document, as this ensures both have proof of the agreement.

Don't make verbal agreements or changes to the promissory note without documenting and signing these modifications.

Don't hesitate to consult with a legal professional if there are any uncertainties about the promissory note's terms or requirements.

Misconceptions

When it comes to the Pennsylvania Promissory Note form, there are several misconceptions that can lead to confusion and sometimes legal missteps. Understanding these common mistakes can help ensure that both lenders and borrowers are fully aware of their rights and obligations.

- All promissory notes are the same. This is a common misconception. Although the fundamental purpose of a promissory note is to document a loan and its repayment terms, the specific provisions can vary widely. Pennsylvania law may have unique requirements or customary practices that aren't applicable in other jurisdictions.

- A promissory note does not need to be witnessed or notarized to be legally binding. While Pennsylvania law does not strictly require a promissory note to be witnessed or notarized to be enforceable, having these measures in place can significantly enhance the document’s legal standing, especially when disputes arise.

- Verbal agreements are just as binding as written promissory notes. This is a risky assumption. While Pennsylvania recognizes verbal contracts under certain conditions, proving the terms of a verbal agreement can be exceedingly difficult. A written and signed promissory note provides clear evidence of the loan’s terms, protecting both parties.

- The interest rate on a loan can be as high as the parties agree upon. Pennsylvania, like many states, has usury laws that cap the interest rate which can be charged on a loan. Lenders must ensure the interest rates on their promissory notes do not exceed these legal limits to avoid the loan being considered usurious and potentially void.

- A borrower cannot be pursued legally if they fail to sign the promissory note. If a borrower receives funds but doesn't sign the promissory note, it doesn’t mean they are not obligated to repay the loan. While having a signed promissory note is the clearest proof of a loan agreement, lenders may still pursue legal action based on the evidence of the transaction and repayment terms agreed upon by other means.

- If a promissory note is lost, the debt is no longer valid. The validity of the debt is not dependent on the promissory note's physical presence. If the original document is lost, a duplicate can be produced as evidence of the loan. Both parties should keep copies of the note and any payment records to safeguard against such situations.

Understanding these misconceptions about the Pennsylvania Promissory Note form can help prevent legal misunderstandings and promote smoother financial transactions between lenders and borrowers.

Key takeaways

When filling out and using the Pennsylvania Promissory Note form, it is essential to keep several key points in mind. These points ensure that the process goes smoothly and that the document meets legal requirements.

- Details of the Parties Involved: Clearly state the names and addresses of both the borrower and the lender. This establishes who is obliged to repay the loan and who is owed the money.

- Loan Amount: Specify the principal loan amount. This is the initial sum of money borrowed, not including any interest that may accrue.

- Interest Rate: Pennsylvania law regulates interest rates, so make sure the rate is compliant. The agreed-upon interest rate should be clearly stated.

- Repayment Schedule: Outline how repayments will be made (e.g., in installments, a lump sum). Include frequency (monthly, quarterly) and due dates for payments.

- Security: If the loan is secured, describe the collateral that the borrower pledges. Clearly identifying collateral prevents misunderstandings.

- Default Terms: Define what constitutes a default and the consequences. This may include late fees or acceleration of the loan balance.

- Signature Requirement: A legal promissory note must be signed by both the borrower and the lender. This formalizes the agreement and makes it legally binding.

- Governing Law: State that Pennsylvania law governs the note. This indicates which state's laws will resolve any disputes related to the agreement.

- Prepayment: Specify if the borrower can pay off the loan early and if any penalties apply. This detail should be agreed upon by both parties.

- Witness or Notarization: While not always required, having the note witnessed or notarized can add legal strength. This verifies that the signatures are genuine.

By keeping these points in mind, individuals can ensure that their Pennsylvania Promissory Note is comprehensive, clear, and compliant with state laws. This document not only provides legal protection but also sets clear expectations for both parties involved in the loan agreement.

More Promissory Note State Forms

Simple Promissory Note - It acts as a crucial document in securing private loans, where traditional loan documents may not be as detailed.

Printable Promissory Note Template - Details the consequences, including legal actions, that may occur if the borrower fails to repay the loan as agreed.

Promissory Note Template Ohio - An essential tool for real estate transactions, it specifies the conditions under which money is lent for property purchases.