Fillable Promissory Note Document for Ohio

In Ohio, the use of a Promissory Note form is a common practice for formalizing the process where money is lent, ensuring that the borrower agrees to pay back the lender under specific conditions. This critical financial document plays a vital role not only in personal loan agreements between friends and family but also in professional lending scenarios. It spells out the repayment terms, interest rates, and what happens if the borrower fails to repurchase the lender according to the agreed schedule. Including all pertinent details, such as the identities of the involved parties, the total amount borrowed, and any collateral involved, this form serves as a legally binding agreement that protects both the lender and the borrower's interests. Its structured format is designed to prevent misunderstandings and disputes, making the lending process smoother and more secure for everyone involved. Moreover, in the state of Ohio, the promissory note is subject to specific legal requirements that must be met to ensure its enforceability, highlighting its importance in the financial landscape.

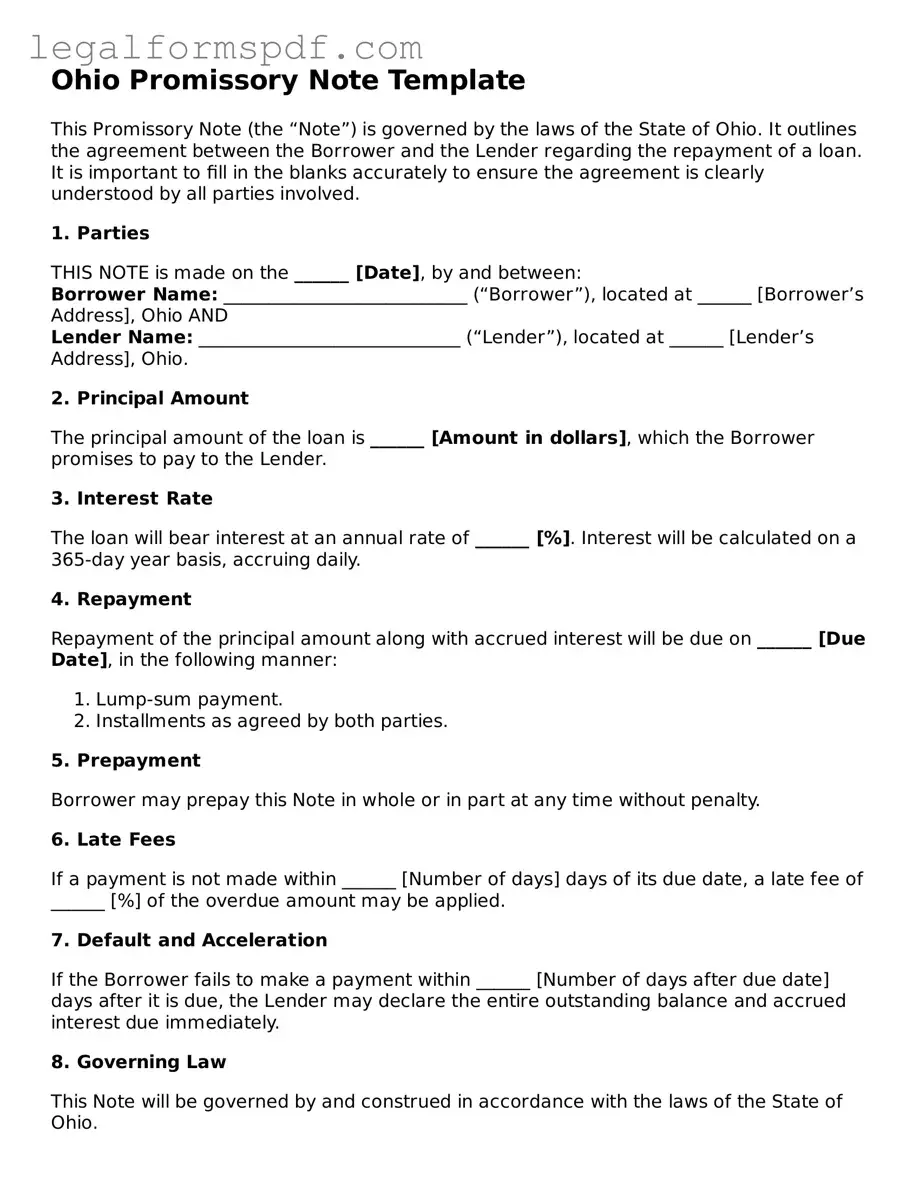

Document Example

Ohio Promissory Note Template

This Promissory Note (the “Note”) is governed by the laws of the State of Ohio. It outlines the agreement between the Borrower and the Lender regarding the repayment of a loan. It is important to fill in the blanks accurately to ensure the agreement is clearly understood by all parties involved.

1. Parties

THIS NOTE is made on the ______ [Date], by and between:

Borrower Name: ___________________________ (“Borrower”), located at ______ [Borrower’s Address], Ohio AND

Lender Name: _____________________________ (“Lender”), located at ______ [Lender’s Address], Ohio.

2. Principal Amount

The principal amount of the loan is ______ [Amount in dollars], which the Borrower promises to pay to the Lender.

3. Interest Rate

The loan will bear interest at an annual rate of ______ [%]. Interest will be calculated on a 365-day year basis, accruing daily.

4. Repayment

Repayment of the principal amount along with accrued interest will be due on ______ [Due Date], in the following manner:

- Lump-sum payment.

- Installments as agreed by both parties.

5. Prepayment

Borrower may prepay this Note in whole or in part at any time without penalty.

6. Late Fees

If a payment is not made within ______ [Number of days] days of its due date, a late fee of ______ [%] of the overdue amount may be applied.

7. Default and Acceleration

If the Borrower fails to make a payment within ______ [Number of days after due date] days after it is due, the Lender may declare the entire outstanding balance and accrued interest due immediately.

8. Governing Law

This Note will be governed by and construed in accordance with the laws of the State of Ohio.

9. Signatures

This Note must be signed by both the Borrower and Lender to be valid.

Borrower’s Signature: ___________________________ Date: ______

Lender’s Signature: _____________________________ Date: ______

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A promissory note in Ohio is a legal document that outlines the terms under which one party promises to repay a specified amount of money to another. |

| Governing Laws | The Ohio Revised Code, particularly titles relating to commercial transactions, governs promissory notes within the state. |

| Interest Rate Limit | Ohio law stipulates the maximum interest rate on a loan without a written agreement is 8% per annum. With a written agreement, lenders can charge up to the rate specified in the agreement, subject to state usury laws. |

| Secured vs. Unsecured | Ohio promissory notes can be either secured, meaning backed by collateral, or unsecured, with no collateral backing. |

| Co-Signer Requirements | If a borrower's creditworthiness is in question, a lender may require a co-signer, who also becomes legally obligated to repay the note if the primary borrower fails to do so. |

| Late Fees and Penalties | The terms regarding late payment penalties must be clearly stated in the promissory note and comply with Ohio state regulations. |

| Prepayment | Borrowers in Ohio have the right to prepay their debts without incurring penalties, unless the promissory note explicitly states otherwise. |

| Default Terms | The note must spell out the conditions under which the borrower is considered in default and the subsequent actions that the lender can take. |

| Notarization | While not always required, having an Ohio promissory note notarized can add a level of legal validity and deterrence against fraud. |

| Enforcement | In the event of a dispute or default, legal proceedings must be initiated in accordance with Ohio law to enforce the terms of the promissory note. |

Instructions on Writing Ohio Promissory Note

After you have the Ohio Promissory Note form in front of you, it's essential to fill it out correctly to ensure that the agreement is legal and binding. This type of document is used to outline the terms under which money is loaned and the repayment schedule. The following steps are designed to guide you through the process efficiently, making sure all necessary details are accurately provided.

- Start by entering the date the promissory note is being created at the top of the form.

- Write the full legal name of the borrower and their address, including city, state, and zip code.

- Enter the lender’s full legal name and address, using the same format as for the borrower.

- Specify the principal amount of money being loaned in U.S. dollars.

- Detail the interest rate per annum. Ohio law limits the amount of interest that can be charged, so ensure the rate complies with state regulations.

- Outline the repayment schedule. Include the start date of payments, frequency of payments (monthly, bi-weekly, etc.), and the duration or final payment date.

- For a more secure note, describe any collateral that the borrower agrees to pledge. Collateral items must be clearly identified.

- Include any co-signer information, if applicable, ensuring their legal names are accurately recorded.

- Sign and date the form. The borrower, any co-signers, and the lender should all provide signatures to validate the agreement.

- Consider having the signatures notarized for added legal standing, even though this is not a mandatory step in Ohio.

Once completed, make sure copies of the promissory note are distributed to all parties involved. Keep this document in a safe place, as it serves as a legal record of the loan and its repayment terms. Following these steps will help ensure your financial transaction is protected and all participants are clear on their obligations.

Understanding Ohio Promissory Note

What is an Ohio Promissory Note?

An Ohio Promissory Note is a written agreement between two parties in Ohio: a borrower and a lender. It details the money borrowed, the repayment schedule, interest rates, and any collateral securing the loan. The document is legally binding, ensuring that the borrower is obligated to repay the loan under the terms outlined.

Do I need a witness or notary for an Ohio Promissory Note?

While Ohio law does not strictly require a witness or notary for a promissory note to be legally valid, having the document notarized or witnessed can add a layer of protection and authenticity. This is particularly useful in the event of a dispute or if the note is subject to legal scrutiny.

What should I include in an Ohio Promissory Note?

An Ohio Promissory Note should include the names and addresses of the borrower and lender, the amount of money borrowed, the interest rate, repayment terms (including the schedule and any balloon payments), and any collateral securing the loan. It's also wise to include the date the note was created and signatures of both parties.

Is there a maximum interest rate that can be charged in Ohio?

Yes, Ohio law caps the maximum interest rate that can be charged on a loan. The legal interest rate without a written agreement is 8%. For written contracts, the parties may agree to a higher rate, but it must not exceed the usury limits set by state law. Consult local laws or a legal professional for the current maximum rate.

Can I modify an Ohio Promissory Note after both parties have signed it?

Modifying an Ohio Promissory Note after it has been signed by both parties is possible but requires agreement from both the borrower and lender. Any modifications should be made in writing and attached to the original promissory note. Both parties should sign or initial the amendments to indicate their agreement.

What happens if the borrower fails to repay the loan as agreed?

If the borrower fails to repay the loan according to the terms of the Ohio Promissory Note, the lender has the legal right to pursue collection. This could involve filing a lawsuit to recover the outstanding amount or enforcing any collateral agreement if applicable. The specific course of action will depend on the terms of the promissory note and applicable local laws.

Is a promissory note the same as a loan agreement?

No, a promissory note is not the same as a loan agreement, though they are related. A promissory note is a simple document that outlines the promise to pay a specific sum of money under certain terms. A loan agreement is typically more comprehensive, detailing the obligations and rights of each party beyond the basic repayment terms, including clauses on default, arbitration, and more.

Can a promissory note be secured with collateral?

Yes, an Ohio Promissory Note can be secured with collateral. This means the borrower pledges an asset to ensure repayment of the loan. If the borrower defaults on the loan, the lender may have the right to seize the collateral as repayment. The details of the collateral should be explicitly mentioned in the promissory note for clarity and legal enforcement.

What are the consequences for a lender if they charge an illegal interest rate in Ohio?

If a lender charges an interest rate higher than what is permitted under Ohio law, the loan may be considered usurious. This can lead to legal penalties for the lender, including the forfeiture of all interest charged and, potentially, legal action by the borrower. It's critical for lenders to adhere to state interest rate caps to avoid these consequences.

How can I terminate an Ohio Promissory Note?

An Ohio Promissory Note can be terminated when the borrower repays the loan in full in accordance with the repayment terms. Both parties should document the completion of payment and ideally sign a release or cancellation statement. In situations where both parties agree to terminate the loan without full repayment, a written agreement outlining the terms of termination and release should be created and signed by both parties.

Common mistakes

One common mistake when filling out the Ohio Promissory Note form is the failure to include specific terms regarding the loan's repayment schedule. This oversight can lead to confusion and disputes regarding when payments are due and in what amount. It is crucial to clearly outline the payment plan, including the due dates and amounts for each installment, to ensure both parties have the same expectations.

Another error often made is neglecting to specify the interest rate. In Ohio, failing to include an interest rate could result in the application of the state's default rate. However, specifying too high an interest rate may violate Ohio's usury laws, leading to penalties. It is important to check the current laws to determine the maximum allowable interest rate.

Many individuals also forget to include clauses that address late fees and non-payment penalties. Without these details, the lender may find it challenging to enforce penalties if the borrower misses payments. Clearly stating the consequences for late or missed payments can encourage timely repayment and provide the lender with recourse in case of default.

Some fail to properly identify the parties involved, particularly by not using full legal names or by omitting necessary identifying information. This can lead to ambiguity about who is obligated to repay the loan, especially if the parties share common names or if there is a change in one party's legal status. Accurate and complete identification helps avoid such confusion.

A frequent oversight is not securing the promissory note with collateral when intended. If the loan is meant to be secured, the document should describe the collateral in detail and register the security interest appropriately. Failure to do so can leave the lender unprotected if the borrower defaults.

Often overlooked is the need for witnesses or a notary public to sign the promissory note. While not always a legal requirement, having the document witnessed or notarized can add a layer of security and authenticity, making it easier to enforce in court should disputes arise.

Last but certainly not least, many neglect to keep a signed copy of the promissory note for their records. This mistake can be problematic if one needs to prove the existence of the loan or the terms agreed upon. It is vital for both parties to keep a signed copy of the document to ensure transparency and to protect their interests.

Documents used along the form

When entering into a financial agreement in Ohio, the Promissory Note form is a fundamental document that outlines the terms between a borrower and lender. However, to thoroughly secure the loan and clarify the terms, additional forms and documents are often used in conjunction. These documents serve various purposes, from defining collateral to ensuring the legal rights of all parties involved. Listing some of the most commonly used forms alongside the Ohio Promissory Note will help in understanding the full scope of documentation needed for a well-structured loan agreement.

- Loan Agreement: This document complements the Promissory Note by detailing the full terms and conditions of the loan. While the Promissory Note signifies the promise to pay, the Loan Agreement specifies the obligations and rights of both the lender and borrower.

- Security Agreement: If the loan is secured with collateral, a Security Agreement is necessary. It describes the collateral that guarantees the loan, outlining what happens if the borrower fails to meet the terms of the note.

- Mortgage Agreement: For loans secured against real estate, a Mortgage Agreement is required. This document places a lien on the property as collateral for the loan, providing the lender with security interests in the property.

- Guaranty: This form is used when an additional party guarantees the loan. The guarantor agrees to fulfill the debt obligations should the original borrower default.

- Amortization Schedule: An Amortization Schedule outlines the payments schedule on the loan, including both the interest and principal amounts, showing how the loan balance decreases over time.

- Notice of Default: Used if the borrower fails to make payments according to the terms of the Promissory Note, this document formally notifies the borrower of the default.

- Release of Promissory Note: Once the loan is fully repaid, this document is issued to release the borrower from the obligations under the Promissory Note.

- UCC-1 Financing Statement: For loans involving personal property as collateral, a UCC-1 Financing Statement is filed to publicly declare the lender's interest in the property.

While the Promissory Note is crucial in documenting the promise to pay back a loan, the above-listed documents ensure a comprehensive approach to loan agreements. They protect both the borrower's and lender's interests, clarify the terms of the loan, and outline the recourse available in case of non-compliance. Ensuring that all relevant documentation is in place can make the loan process smoother and legally secure for all parties involved.

Similar forms

The Ohio Promissory Note form shares similarities with a Loan Agreement. Both documents serve as binding legal contracts between two parties outlining the terms of a loan. They describe the amount borrowed, interest rates applicable, repayment schedule, and the consequences of failing to repay the loan. While the Promissory Note may be less comprehensive, focusing more on the promise to pay, a Loan Agreement typically includes detailed lender and borrower obligations, covenants, and representations.

A Mortgage Agreement can also be compared to an Ohio Promissory Note, in that both involve the borrowing of money to be repaid over time. The key difference, however, is that a Mortgage Agreement is secured by real property. This means if the borrower fails to make payments, the lender can foreclose on the property to recover the owed amount. In contrast, a Promissory Note might not necessarily be secured by collateral and might rely more on the borrower's promise to repay.

Similar to an Ohio Promissory Note, an IOU (I Owe You) document acknowledges the existence of a debt between two parties. Both are straightforward in their purpose to document a borrower's obligation to repay a lender. However, an IOU is often less formal and does not typically include detailed terms of repayment, such as payment schedules, interest rates, or legal remedies for non-payment, which are standard in a Promissory Note.

Debt Settlement Agreements resemble Ohio Promissory Notes in their focus on resolving and documenting the repayment of debts. While a Debt Settlement Agreement is used to negotiate repayment terms for an existing debt under new conditions - often less than the original amount owed - a Promissory Note outlines the original terms and conditions for repaying a loan. Both serve to clearly define the obligations of the borrower towards the lender.

A Personal Guarantee is akin to an Ohio Promissory Note when an individual (the guarantor) agrees to be responsible for the debt of the borrower if the borrower cannot pay. The primary distinction is that a Promissory Note is an agreement directly between the borrower and the lender, whereas a Personal Guarantee involves a third party agreeing to fulfill the obligation if the primary party defaults.

Lastly, a Student Loan Agreement bears resemblance to the Ohio Promissory Note since both are used for the purpose of borrowing money that must be repaid with interest. Student Loan Agreements are specific to the context of financing education and often include special terms such as deferment periods and income-based repayment plans, which are not typically found in standard Promissory Notes.

Dos and Don'ts

When it comes to filling out the Ohio Promissory Note form, ensuring the accuracy and legality of the document is paramount. Below are some essential do's and don'ts to help guide you through the process.

Do:Review Ohio's legal requirements for a promissory note before beginning.

Clearly state the names and addresses of both the borrower and lender.

Specify the amount of money being borrowed and the interest rate, adhering to Ohio's usury laws.

Include the repayment schedule in detail, outlining when payments are due and in what amount.

Clarify the consequences of default to ensure both parties understand the potential repercussions.

Specify any collateral securing the loan, if applicable, to protect the lender’s interests.

Ensure both parties sign and date the note to make it legally binding.

Keep a secure, legible copy of the note for both borrower and lender’s records.

Consider having the note notarized or witnessed to further substantiate its validity.

Consult with a legal professional if you have any doubts about the note's terms or its legality.

Forget to include any essential terms, such as the loan amount, interest rate, or repayment schedule.

Overlook the importance of specifying both parties' full names and addresses to avoid future disputes.

Charge an interest rate that exceeds what is allowed by Ohio law, as this could render the note unenforceable.

Omit specifying the consequences of default, which could complicate enforcing the note.

Ignore the need to clarify whether the note is secured or unsecured; this detail significantly impacts both parties' rights.

Fail to have both the borrower and the lender sign the document, as an unsigned note might not be legally binding.

Leave out having the document witnessed or notarized, even though it's not always required, it adds to its legal strength.

Discard drafts or copies of the note, as they could be useful for reference or in legal proceedings.

Assume a verbal agreement is sufficient; a written and signed promissory note is crucial for legal enforceability.

Delay seeking legal advice if there are any uncertainties about the promissory note's content or implications.

Misconceptions

When dealing with the Ohio Promissory Note form, several misconceptions frequently surface. Clarifying these misunderstandings is crucial to ensure proper handling and expectations regarding these legal documents. Here's a comprehensive look at the common inaccuracies:

- All promissory notes in Ohio are identical: In reality, promissory notes can vary greatly depending on the nature of the loan, the specific terms agreed upon by the involved parties, and whether the note is secured or unsecured.

- Laypeople can't draft them without a lawyer: While it is advisable to seek legal advice when creating any legal document, particularly for substantial loans, Ohio law does not prohibit individuals from drafting their own promissory notes for simpler transactions.

- They must be notarized to be valid: Notarization is not a requirement for a promissory note to be enforceable in Ohio. However, it can add a layer of authenticity and help protect against fraud claims.

- A promissory note and a loan agreement are the same: Although they both relate to borrowing practices, a promissory note is a straightforward promise to pay back a specific amount under agreed terms, whereas a loan agreement is a more comprehensive document that includes additional clauses and actions in case of default.

- Interest rates can be as high as the parties agree: While parties have flexibility in setting interest rates, they must adhere to Ohio's usury laws, which cap the maximum interest rate that can be charged to avoid predatory lending.

- Only the borrower needs to sign the promissory note: While the borrower's signature is indeed essential, having the lender or witness signatures can also be important, especially for legal enforcement and to prevent disputes.

- Signing a promissory note means you can't negotiate the debt: Both parties can later agree to modify the note's terms if both parties consent to the changes. This can include altering repayment schedules or interest rates.

- A promissory note guarantees payment: Unfortunately, a promissory note, while legally binding, does not absolutely guarantee that the borrower will repay the loan. Lenders may still need to take legal action in case of default.

- It's only used for personal loans between individuals: Promissory notes are versatile and can be used for a wide range of lending transactions, including but not limited to personal loans. They're used in business transactions, real estate dealings, and between financial institutions.

Understanding the actual stipulations and applications of an Ohio Promissory Note not only demystifies these documents but also empowers individuals to utilize them more effectively and responsibly within their legal boundaries.

Key takeaways

When considering the use of a promissory note in Ohio, it's important to remember that this document acts as a formal agreement for the borrowing and repayment of money. It's not just any piece of paper; it's a contract that outlines the obligations of the borrower to the lender. Here are seven key takeaways to keep in mind regarding the Ohio Promissory Note form:

- Understand the Terms: Before filling out a promissory note, both parties should clearly understand the terms, including the loan amount, interest rate, repayment schedule, and any collateral involved. This clarity will help prevent misunderstandings or disputes.

- Compliance with Ohio Law: The promissory note must comply with Ohio laws, including those governing interest rates and lending practices. It's advisable to familiarize oneself with these laws to ensure the note is legally valid and enforceable.

- Complete Information: Make sure all information on the promissory note is accurate and complete. This includes the names and addresses of the borrower and lender, the principal amount, and the interest rate.

- Interest Rate Specification: Ohio has specific statutes that cap the amount of interest that can be charged. Ensure that the interest rate specified in the promissory note does not exceed these legal limits.

- Signatures: A promissory note must be signed by the borrower, and sometimes by the lender as well. The signatures make the agreement legally binding. Consider having the signatures notarized for added legal protection.

- Keep a Record: Both parties should keep a copy of the signed promissory note. This will serve as a record of the agreement and can be crucial if there is a dispute or if the note needs to be enforced.

- Consideration of Collateral: If collateral is being used to secure the loan, this should be clearly stated in the promissory note, including a description of the collateral. Secured transactions must adhere to additional legal requirements, so it's important to handle them correctly.

Using a promissory note involves a significant level of trust and legal obligation. By diligently following these guidelines, parties can ensure that their agreement is respected and enforced according to Ohio law. Remember, when in doubt, consulting with a legal professional can provide valuable guidance and peace of mind.

More Promissory Note State Forms

Michigan Promissory Note - A promissory note's enforceability makes it a strong deterrent against non-payment and financial irresponsibility.

Printable Promissory Note Template - Can be a critical record for tax purposes, proving the existence of a loan and the obligation to pay interest.