Fillable Promissory Note Document for North Carolina

In the diverse and ever-evolving landscape of financial transactions within North Carolina, the promissory note stands out as a pivotal document, serving a key role in various monetary exchanges. This essential form, at its core, encapsulates an agreement where one party promises to pay another a specified sum of money, either upon demand or at a determined future date, thus acting as a legal testament to the commitment to repay borrowed funds. Given its significance, understanding the nuances of the North Carolina Promissory Note form is imperative for anyone engaged in lending or borrowing activities within the state. Whether it involves personal loans between individuals, financing for smaller entrepreneurial ventures, or more complex transactions within the commercial realm, this form underpins the trust and legal clarity essential for the smooth execution of agreements. It encompasses vital details such as the amount borrowed, the interest rate (if applicable), repayment schedule, and any collateral pledged against the loan, thereby providing a comprehensive framework to protect the interests of both the lender and borrower. Navigating its provisions with precision is crucial for ensuring that the agreement is enforceable and aligns with North Carolina's legal standards, highlighting the form's integral role in the state's financial transactions.

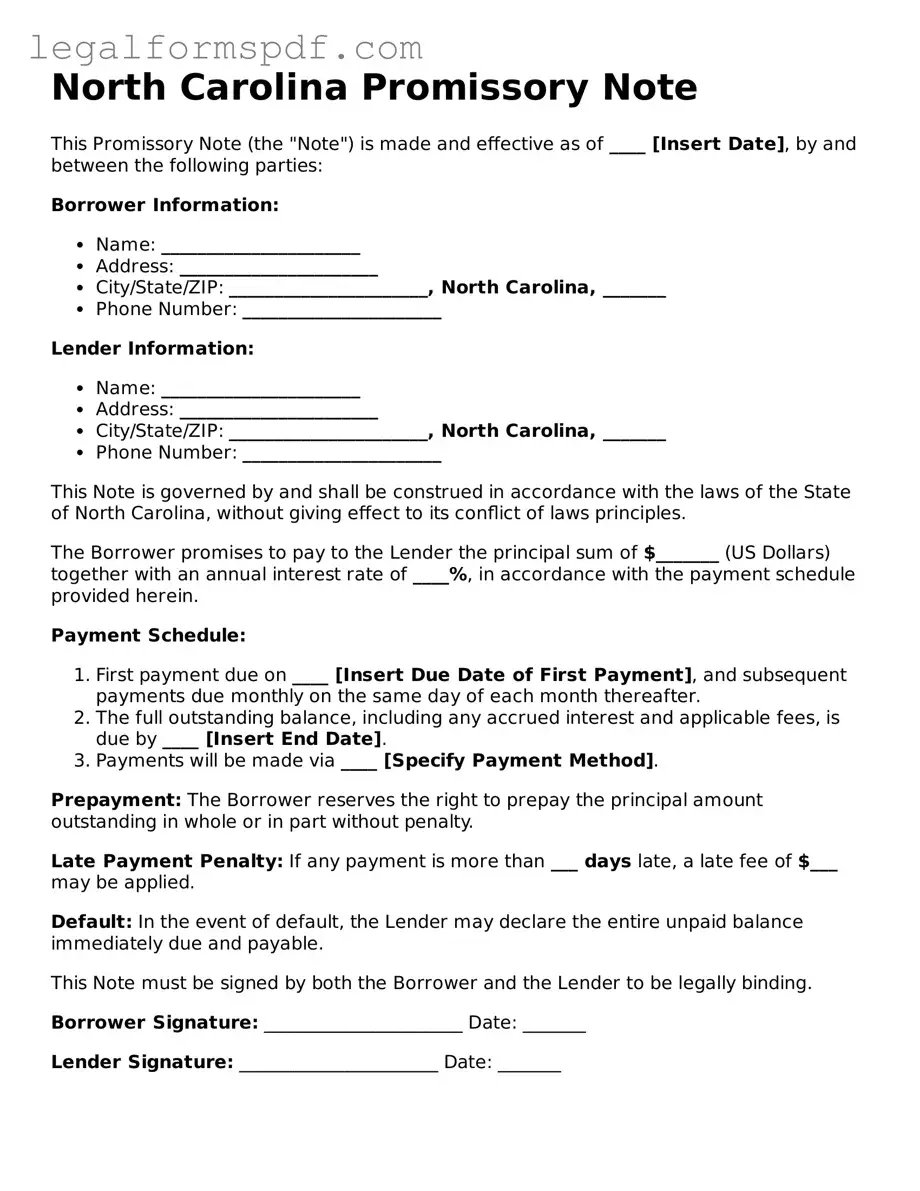

Document Example

North Carolina Promissory Note

This Promissory Note (the "Note") is made and effective as of ____ [Insert Date], by and between the following parties:

Borrower Information:

- Name: ______________________

- Address: ______________________

- City/State/ZIP: ______________________, North Carolina, _______

- Phone Number: ______________________

Lender Information:

- Name: ______________________

- Address: ______________________

- City/State/ZIP: ______________________, North Carolina, _______

- Phone Number: ______________________

This Note is governed by and shall be construed in accordance with the laws of the State of North Carolina, without giving effect to its conflict of laws principles.

The Borrower promises to pay to the Lender the principal sum of $_______ (US Dollars) together with an annual interest rate of ____%, in accordance with the payment schedule provided herein.

Payment Schedule:

- First payment due on ____ [Insert Due Date of First Payment], and subsequent payments due monthly on the same day of each month thereafter.

- The full outstanding balance, including any accrued interest and applicable fees, is due by ____ [Insert End Date].

- Payments will be made via ____ [Specify Payment Method].

Prepayment: The Borrower reserves the right to prepay the principal amount outstanding in whole or in part without penalty.

Late Payment Penalty: If any payment is more than ___ days late, a late fee of $___ may be applied.

Default: In the event of default, the Lender may declare the entire unpaid balance immediately due and payable.

This Note must be signed by both the Borrower and the Lender to be legally binding.

Borrower Signature: ______________________ Date: _______

Lender Signature: ______________________ Date: _______

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose of the Form | A North Carolina Promissory Note form is a legal document used to outline the terms and conditions under which money is borrowed and must be repaid. It serves as a binding commitment between the borrower and the lender, ensuring repayment of the loan. |

| Governing Law | This document is specifically governed by the laws of the State of North Carolina, including but not limited to, statutes that dictate interest rates, the legal collection practices, and the penalties for non-payment. |

| Interest Rate Regulations | In North Carolina, the maximum interest rate that can be charged in the absence of a contractually agreed-upon rate is 8% per annum. However, parties can legally agree to higher rates as long as they do not violate usury laws. |

| Types | The document can either be "secured" or "unsecured." A secured promissory note requires collateral to be pledged by the borrower, offering extra security to the lender. An unsecured promissory note does not involve collateral, making it a riskier option for the lender. |

| Key Components | Essential components of a North Carolina Promissory Note include the amount borrowed, interest rate agreed upon, repayment schedule, collateral (if the note is secured), and signatures of the involved parties, confirming their agreement to the terms. |

Instructions on Writing North Carolina Promissory Note

When it comes to borrowing or lending money, a promissory note is a valuable legal document. In North Carolina, like elsewhere, this document clearly outlines the repayment terms, interest rate, and what happens if the borrowing party fails to repay the loan according to those terms. Filling out a North Carolina Promissory Note correctly is essential to ensure both parties are protected and understand their obligations. Below are step-by-step instructions to help guide you through this process.

- Start by including the date at the top of the document. This indicates when the promissory note is being executed.

- Enter the full legal names of the borrower and lender, along with their respective addresses. These are the parties involved in the loan agreement.

- Specify the amount of money being borrowed. This should be written in both numerical and written form to avoid any confusion.

- Detail the interest rate. In North Carolina, the interest rate must comply with state laws and should be specified as an annual rate.

- Describe the repayment schedule. Include the start date of the repayments, whether the payments will be made monthly or in another form, and the duration of the repayment period.

- Outline the late fees and consequences of a default. It's crucial to state any fees that will apply if payments are made past their due date and the actions that will be taken if the borrower fails to pay the loan.

- Include information about secured or unsecured loan status. A secured loan is backed by collateral which the lender can claim if the loan is not repaid, whereas an unsecured loan is not.

- Have both parties sign and date the document. For additional legal protection, you may also want to have the signatures notarized.

- If applicable, include a cosigner section. A cosigner agrees to take responsibility for repaying the loan if the original borrower defaults. This section should also be signed.

Filling out a North Carolina Promissory Note with careful attention to detail ensures that both lender and borrower are clear about the terms of the loan. Accurately completing this form serves as a solid foundation for the financial transaction, protecting the interests of all involved parties. After these steps are complete, make sure to store the document in a safe place, as it will be important for any future references or legal actions related to the loan.

Understanding North Carolina Promissory Note

What is a North Carolina Promissory Note?

A North Carolina Promissory Note is a legal document that establishes a written agreement between two parties: a borrower and a lender. In this document, the borrower promises to repay a certain amount of money to the lender, usually with interest, under specified terms and conditions. This form is tailored to comply with the laws of North Carolina, ensuring that both parties understand their rights and obligations under state regulations.

How does one create a legally binding promissory note in North Carolina?

To create a legally binding promissory note in North Carolina, the document must meet several requirements. Firstly, it must clearly identify both the borrower and lender, including their names and addresses. The amount of money being borrowed (the principal) and the interest rate must be explicitly stated. Repayment terms, including the schedule and any late fees or penalties for non-payment, should be detailed. Both parties must sign the document, with witnesses or a notarial acknowledgment often recommended to ensure enforceability.

Are there different types of promissory notes?

Yes, there are generally two main types of promissory notes: secured and unsecured. A secured promissory note requires the borrower to pledge an asset as collateral to guarantee loan repayment. If the borrower fails to repay according to the terms of the note, the lender has the right to seize the collateral. An unsecured promissory note does not require collateral but is often more challenging to obtain, as it poses a higher risk to the lender. The choice between a secured or unsecured note depends on the agreement between the lender and the borrower, taking into account the loan amount and the borrower's financial stability.

What are the legal consequences of failing to repay a promissory note in North Carolina?

If a borrower fails to repay a promissory note in North Carolina, the lender has the right to take legal action to enforce repayment. This could include suing for the unpaid amount plus any interest and legal fees. In the case of a secured promissory note, the lender might also have the right to seize and sell the collateral specified in the document. Failure to repay can result in damage to the borrower's credit score and potential future legal and financial consequences, stressing the importance of understanding and complying with the terms of the agreement.

Common mistakes

When filling out the North Carolina Promissory Note form, one common mistake people make is not specifying the terms of the interest rate clearly. The interest rate should be clearly stated as an annual percentage and needs to comply with state laws to avoid being considered usurious. Failure to detail the interest rate properly can lead to misunderstandings between the lender and borrower, and may even result in legal challenges.

Another frequent oversight is not adequately identifying the parties involved by their full legal names and addresses. This might seem like a minor detail, but correctly identifying the lender and borrower in the promissory note is crucial for its enforceability. Should disputes arise, or should enforcement of the note become necessary, having precise and full information about the parties involved simplifies the legal process.

A third mistake involves neglecting to outline the repayment schedule in a detailed and clear manner. It is essential for the promissory note to have a clear repayment plan, specifying when payments are due, the amount of each payment, and over what period. Without this, enforcing the terms or understanding when the debt is fully repaid becomes challenging. A well-defined repayment schedule prevents disputes over missed or incomplete payments.

Last, individuals often fail to include what happens in the event of a default. The promissory note should specify the actions that can be taken if the borrower fails to make payments as agreed. This might include late fees, acceleration of the debt, or legal actions. Failing to define these terms can leave the lender with limited options for recourse if the borrower does not meet their obligations under the agreement.

Documents used along the form

When working with a North Carolina Promissory Note, several other documents can play crucial roles in ensuring all aspects of a loan agreement are covered comprehensively. These documents help in detailing the terms, securing the loan, and ensuring that both parties understand their rights and obligations completely.

- Loan Agreement – This document outlines the full details of the loan between a borrower and lender, including repayment terms, interest rates, and what happens if the loan is not repaid. It's more detailed than a promissory note and may include clauses about the use of the loaned funds.

- Security Agreement – If the loan is secured, this document lists the collateral that the borrower agrees to put up to secure the loan. It gives the lender a claim to this collateral if the loan is not repaid according to the agreed terms.

- Guaranty – This is an agreement whereby a third party agrees to be responsible for the debt if the primary borrower fails to repay the loan. It provides an additional layer of security for the lender.

- Mortgage or Deed of Trust – Used for real estate transactions, this document places a lien on the property being purchased with the loan. It secures the property as collateral for the loan.

- Amendment Agreement – If both parties decide to make changes to any terms of the original promissory note or related agreements, this document legally records those changes.

- Release of Promissory Note – Once the loan is fully repaid, this document serves as proof that the borrower has fulfilled their repayment obligations, releasing them from the note.

Having these documents in order, alongside a North Carolina Promissory Note, not only provides a clear understanding and agreement between the lender and borrower but also protects both parties' interests. Proper documentation is key to a successful and hassle-free lending process.

Similar forms

A Mortgage Agreement is one document closely related to a North Carolina Promissory Note, primarily because it also involves a borrower agreeing to pay back a sum of money, typically to purchase real estate. While a promissory note is a simple promise to pay, a mortgage agreement adds another layer by securing the loan with the property being purchased. If the borrower fails to make payments as agreed, the lender has the right to take legal action to foreclose on the property, using it as collateral to recover the owed amount.

Another similar document is an IOU (I Owe You). This document is a more informal acknowledgment of debt compared to a promissory note. While it specifies the amount owed and sometimes the repayment terms, it lacks the detailed legal obligations and protections found in promissory notes. IOUs are often used between individuals in simple loan situations and do not typically involve complex terms or large sums of money. They also might not be legally binding in the same way and lack the formal requirements of notarization.

The Loan Agreement shares similarities with the North Carolina Promissory Note, as both outline the terms for borrowing money, including the repayment schedule, interest rate, and the consequences of failing to repay the loan. The key difference is that a loan agreement is usually more comprehensive, covering a broader range of terms and conditions, and is used in more complex financial transactions. It often includes clauses on dispute resolution, borrower representations and warranties, and conditions precedent to funding, making it more detailed than a promissory note.

A Deed of Trust is related to a promissory note in the context of real estate transactions. In states where deeds of trust are used instead of mortgages, a borrower signs both a promissory note and a deed of trust when taking a loan to purchase property. The promissory note serves as the borrower's personal promise to pay back the loan, while the deed of trust transfers legal title to the property to a trustee. The trustee holds this title as security for the loan, and the arrangement provides the lender with a mechanism for foreclosure if the borrower defaults on the loan terms.

Lastly, a Credit Agreement often found in commercial lending and corporate finance, closely resembles a promissory note but is tailored for more complex relationships and larger amounts of money. This type of agreement outlines the borrowing terms, including the loan amount, interest rate, repayment schedule, and covenants the borrower must adhere to. Credit Agreements provide detailed provisions on the rights and obligations of all parties involved, including conditions under which the loan must be repaid earlier than scheduled or can be extended. While serving the same purpose as ensuring the repayment of borrowed money, credit agreements are far more detailed and are typically negotiated between the parties.

Dos and Don'ts

Filling out the North Carolina Promissory Note form requires attention to detail. This document serves as a promise from one party to pay a specific amount of money to another. It's important to follow guidelines to ensure the note's effectiveness and legality. Below, find a compilation of things you should and shouldn't do when completing this document.

Do:Read the form carefully before starting. Understand every section to ensure proper completion.

Use clear and concise language. The details of the agreement should be easily understood by all parties involved.

Include the full names and addresses of both the borrower and the lender to clearly identify the parties.

Specify the loan amount in words and numbers to avoid any confusion.

Clearly outline the repayment schedule, including due dates, to ensure both parties are on the same page.

Leave any sections incomplete. Every part of the form is important for the legal standing of the note.

Use informal language or slang. The promissory note is a legal document and should be treated as such.

Forget to specify the interest rate, if applicable. This is crucial for calculating the total repayment amount.

Sign the note without having a witness or notary, if required by North Carolina law. This can affect the enforceability of the note.

Ignore state-specific requirements. Each state has its own laws governing promissory notes, and it’s important to comply with North Carolina's specific regulations.

Misconceptions

Understanding the North Carolina Promissory Note form is crucial for anyone engaged in lending or borrowing money in the state. However, several misconceptions surround this legal document, leading to confusion and potential legal issues. Here are ten common misconceptions explained:

All promissory notes are the same. It's a common belief, but each state has specific laws that affect the validity and enforcement of promissory notes. The North Carolina Promissory Note form is tailored to comply with the state's legal requirements, differentiating it from those used in other states.

Legal representation is not necessary. While individuals can create and sign a promissory note without legal help, seeking advice from a legal professional ensures that the document meets all legal requirements and protects both lender's and borrower's rights in North Carolina.

Only the borrower needs to sign. This is incorrect. While it's essential for the borrower to sign the promissory note, best practice in North Carolina often requires witnesses or a notary public’s signature to ensure its enforceability.

Interest rates can be as high as agreed. North Carolina law sets a maximum interest rate that can be charged. Agreements charging more than this legal limit could be deemed usurious and not enforceable.

A promissory note and a loan agreement are identical. Though they are related, they serve different purposes. A promissory note is a promise to pay back a sum of money under specified terms. A loan agreement is more detailed, covering broader terms of the lending arrangement.

Verbal agreements are sufficient for a promissory note. Verbal agreements for loan repayments are incredibly risky and are generally unenforceable in court. Written promissory notes are necessary to secure repayment terms legally in North Carolina.

Security is not needed for a promissory note. While unsecured promissory notes exist, securing the note with collateral offers the lender protection against default. The choice between secured and unsecured should be carefully considered based on the lending situation.

Any template found online will work. Generic templates might not meet specific North Carolina legal requirements, potentially making the note unenforceable. It’s essential to use a template that is designed to comply with state laws.

Promissory notes are only used in personal loan transactions. This is a misconception. Businesses frequently use promissory notes for various transactions, including loans, purchasing goods, or services on credit.

Once signed, the terms of a promissory note cannot be changed. Amendments can be made if both parties agree and the changes are documented properly. It's vital for any modifications to be written down and signed by both parties to maintain the document's legal standing.

Understanding these misconceptions is key to navigating the complexities of North Carolina promissory notes effectively. Whether lending or borrowing, clarity and compliance with state laws protect everyone involved.

Key takeaways

Filling out and using the North Carolina Promissory Note form is a step that requires attention to detail and understanding of its implications. Through this form, individuals can outline the terms of a loan in a structured and legally recognized manner. Here are five key takeaways to consider:

- Understand the Types: In North Carolina, promissory notes can be secured or unsecured. A secured note means that the loan is backed by collateral, offering more security to the lender. An unsecured note does not have this backing, posing more of a risk.

- Fill Out Completely: Every field in the form is important. Include comprehensive details like the full names of all parties involved, the loan amount, interest rate, repayment schedule, and any collateral if the note is secured.

- Interest Rate Compliance: North Carolina has laws that cap interest rates to prevent usury. Ensure that the interest rate on your promissory note adheres to these legal limits to avoid any legal complications.

- Legal Binding: Once all parties have signed, the promissory note becomes a legally binding document. This means that the obligations outlined, including payment terms and amounts, are enforceable by law in North Carolina.

- Keep Records: After completing the form, make sure all parties receive a copy and keep it for their records. This ensures that everyone has access to the agreed terms, which can help in resolving any future disputes.

Having a clear and comprehensive North Carolina Promissory Note can protect the interests of both the borrower and the lender. It clarifies the terms of the loan, setting out a clear path for repayment and what happens if those terms are not met. Always review the filled-out form thoroughly before signing to ensure all information is correct and all parties understand their obligations.

More Promissory Note State Forms

Promissory Note Illinois - The form can be tailored to include a co-signer, adding an extra layer of security for the lender.

Promissory Note Template Georgia - This written promise helps prevent misunderstandings about the loan details between the borrower and lender.

Promissory Note Template California Word - It serves to protect the lender's interest by legally enforcing the borrower's obligation to repay the loan.