Fillable Promissory Note Document for New York

When individuals or entities in New York decide to engage in financial transactions involving lending and borrowing money, the New York Promissory Note form serves as an essential document to formalize the agreement. This legally binding form outlines the amount of money borrowed, the interest rate agreed upon, repayment schedule, and the consequences of failing to comply with the terms. It acts as a safeguard for both the lender and the borrower, ensuring there is a clear, mutual understanding of the obligations and expectations from both sides. Understanding the major aspects of this form is crucial for anyone looking to navigate the complexities of financial agreements within the state, as it not only offers a sense of security but also minimizes potential disputes by providing a solid legal foundation for the transaction.

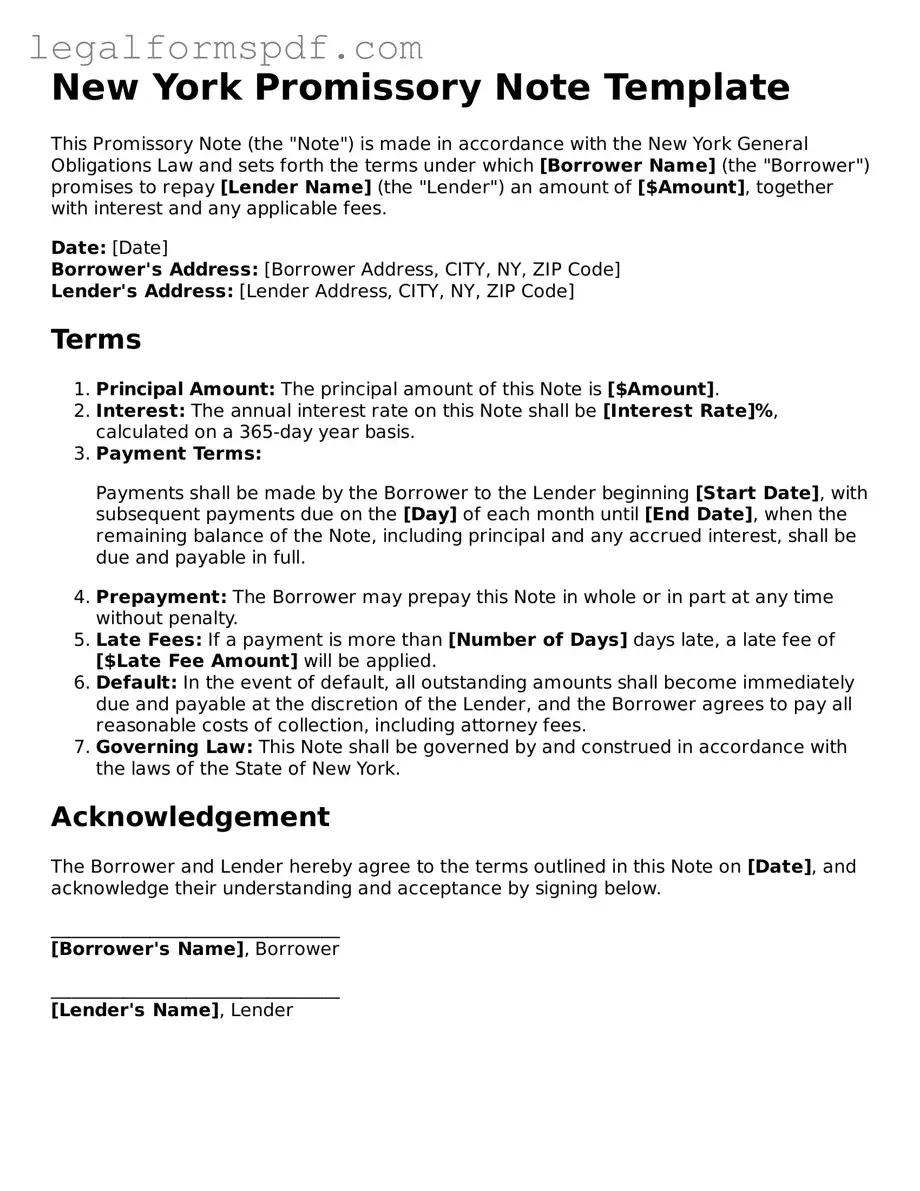

Document Example

New York Promissory Note Template

This Promissory Note (the "Note") is made in accordance with the New York General Obligations Law and sets forth the terms under which [Borrower Name] (the "Borrower") promises to repay [Lender Name] (the "Lender") an amount of [$Amount], together with interest and any applicable fees.

Date: [Date]

Borrower's Address: [Borrower Address, CITY, NY, ZIP Code]

Lender's Address: [Lender Address, CITY, NY, ZIP Code]

Terms

- Principal Amount: The principal amount of this Note is [$Amount].

- Interest: The annual interest rate on this Note shall be [Interest Rate]%, calculated on a 365-day year basis.

- Payment Terms:

Payments shall be made by the Borrower to the Lender beginning [Start Date], with subsequent payments due on the [Day] of each month until [End Date], when the remaining balance of the Note, including principal and any accrued interest, shall be due and payable in full.

- Prepayment: The Borrower may prepay this Note in whole or in part at any time without penalty.

- Late Fees: If a payment is more than [Number of Days] days late, a late fee of [$Late Fee Amount] will be applied.

- Default: In the event of default, all outstanding amounts shall become immediately due and payable at the discretion of the Lender, and the Borrower agrees to pay all reasonable costs of collection, including attorney fees.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of New York.

Acknowledgement

The Borrower and Lender hereby agree to the terms outlined in this Note on [Date], and acknowledge their understanding and acceptance by signing below.

________________________________

[Borrower's Name], Borrower

________________________________

[Lender's Name], Lender

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A New York Promissory Note is a written promise to pay a specified amount of money, either on demand or at a defined future date, within the state of New York. |

| Governing Law | It is governed by New York State law, including the New York General Obligations Law. |

| Types | There are two main types: secured and unsecured. Secured notes are backed by collateral, while unsecured notes are not. |

| Co-Signer | A co-signer may be used to guarantee the loan, promising to repay if the initial borrower fails to do so. |

| Interest Rate | New York State has a legal interest rate limit, unless a different rate is agreed upon in the note itself and it does not violate state usury laws. |

| Prepayment | Borrowers may have the option to prepay the loan without penalty, though terms may vary based on the agreement. |

| Late Fees | The note may include provisions for late fees, subject to state laws limiting their amount. |

| Enforceability | To be enforceable, the note must be signed by the borrower and, in some cases, by a witness or notary public. |

Instructions on Writing New York Promissory Note

Filling out a New York Promissory Note form is a straightforward process that formalizes a loan agreement between two parties. It is a crucial document that outlines the terms of the loan, including repayment schedule, interest rate, and the consequences of non-repayment. This step-by-step guide will help ensure that you complete the form accurately and fully understand the obligations and rights of each party involved.

- Identify the Parties: Start by entering the full legal names and addresses of both the borrower and the lender. Make sure the information is accurate to avoid any confusion regarding the parties' identities.

- State the Principal Amount: Clearly write the total amount of money being loaned, in US dollars, without including the interest. This amount should be agreed upon by both parties before filling out the form.

- Define the Interest Rate: Specify the annual interest rate being applied to the principal amount. This rate must comply with New York State's legal limits to avoid being considered usurious.

- Set the Repayment Schedule: Describe the repayment plan, including start date, the frequency of payments (e.g., monthly), and the duration of the repayment period. Details should also include the final payment date when the loan will be fully repaid.

- Detail Late Fees and Penalties: If applicable, outline any fees for late payments or penalties for missing payments. Both parties should agree on these terms beforehand.

- Include a Co-Signer (if applicable): If the loan agreement involves a co-signer, provide their full legal name and address. A co-signer adds an additional layer of security for the lender.

- Mention Governing Law: Note that the agreement will be governed by the laws of the State of New York. This is important for legal enforcement and interpretation of the agreement.

- Signature and Date: Both the borrower and the lender must sign and date the form. If a co-signer is involved, they should also sign. These signatures formally acknowledge and agree to the terms outlined in the promissory note.

Once the form is completed and signed, all parties should receive a copy for their records. It's recommended to keep this document in a safe place, as it may be needed for future reference or in the event of a dispute. Completing the New York Promissory Note form correctly is a key step in ensuring a clear and enforceable loan agreement.

Understanding New York Promissory Note

What is a New York Promissory Note?

A New York Promissory Note is a legal document that acts as a written promise made by a borrower to pay back a lender a certain amount of money within a set timeframe. This type of document is commonly used for personal loans, business loans, and real estate transactions within New York State. It specifies details such as the principal amount, interest rate, repayment schedule, and the consequences of non-payment.

Is a promissory note legally binding in New York?

Yes, a promissory note is legally binding in New York when it contains all the necessary components and is signed by both the lender and borrower. It must clearly outline the terms of the loan to be considered valid. Once signed, it obligates the borrower to repay the debt under the agreed-upon terms, making it enforceable under New York law.

What are the necessary components of a New York Promissory Note?

A New York Promissory Note must include certain key components to be considered complete. These components include the amount of money being borrowed (principal), the interest rate, repayment schedule (dates and amounts of payments), and the signatures of both parties involved. It may also include clauses about late fees, prepayment penalties, or actions to be taken in case of default.

Can interest rates on a promissory note exceed a certain limit in New York?

In New York, interest rates on a promissory note are subject to the state's usury laws, which cap the maximum interest rate that can be charged. For most personal loans, the legal limit is 16% per annum. Charging interest above this rate could render the agreement usurious and potentially void, unless specific exemptions apply based on the nature of the borrower or the purpose of the loan.

How can a lender enforce a Promissory Note in New York?

Should a borrower fail to meet the terms of the promissory note, the lender has the right to take legal action to enforce the agreement. This might involve filing a lawsuit to collect the outstanding debt. The lender might also be able to seek garnishment of wages or seizure of assets, depending on the judgment issued by the court. The exact remedies available will depend on the terms of the promissory note and New York state law.

Does a New York Promissory Note need to be notarized or witnessed?

While New York law does not require a promissory note to be notarized or witnessed to be considered valid, it is often recommended to do so. Having a notary public or witnesses at the signing adds an extra layer of authenticity and can help prevent disputes over the validity of the signatures or the terms of the agreement.

Can a promissory note be modified after signing?

It is possible to modify a promissory note after it has been signed, but any changes must be agreed upon by both the lender and the borrower. The modification should be made in writing, and both parties should sign the updated document to indicate their agreement. Depending on the nature of the changes, it may be advisable to create a new promissory note that reflects the updated terms and conditions.

Common mistakes

When individuals set out to complete the New York Promissory Note form, several common mistakes can inadvertently be made, compromising the effectiveness and enforceability of the document. A promissory note, by its nature, is a financial promise or commitment, making accuracy and clarity paramount. One frequent error is the neglect to provide a comprehensive identification of all parties involved. This includes not only ensuring the correct names are used but also including relevant contact information and addresses. Without this specificity, the identities of the obligor (borrower) and obligee (lender) may be ambiguous, leading to potential disputes or complications in enforcement.

Another critical oversight is failing to clearly state the loan amount and the terms of repayment. It's essential to spell out both the principal amount loaned and the interest rate, if applicable. The repayment schedule should be delineated as precisely as possible, indicating due dates for payments and whether those payments will be made in installments or a lump sum. Ambiguities in these areas can result in misunderstandings and disagreements down the line.

Details regarding the interest rate can also be a stumbling block. In situations where an interest rate is applied, it is crucial to ensure that this rate is not only clearly stated but also does not exceed New York's usury laws. The law sets maximum legal interest rates, and failing to adhere to these limits can render the note void as to the payment of interest, and possibly more.

The terms concerning late fees and penalties for missed payments are often overlooked or not specified clearly. Such terms are vital for protecting the interests of the lender and incentivizing timely repayment by the borrower. They should be reasonable, clear, and in compliance with applicable laws to be enforceable.

Not specifying the governing law is yet another common mistake. It is advisable to state explicitly that the note will be governed by and construed in accordance with the laws of the State of New York. This clarity can prove invaluable if disputes arise and legal interpretation or enforcement becomes necessary.

A crucial component that is sometimes missing is the method of payment. Detailing how payments will be made, whether by check, direct deposit, or another method, can prevent confusion and disputes. It ensures both parties are on the same page regarding the mechanics of repayment.

Securing the promissory note or failing to do so can have significant ramifications. For personal loans, especially larger sums, securing the loan with collateral can provide the lender with a level of protection. Failure to specify any collateral, when intended, or not properly describing such collateral, may limit the lender's options for recourse if the borrower defaults.

The last, but certainly not least, mistake to avoid is neglecting to have the document witnessed or notarized, depending on the requirements. While not always a legal necessity for a promissory note to be enforceable in New York, having the note witnessed or notarized can add a layer of authenticity and could be instrumental in the case of a dispute. This step should not be overlooked when finalizing the document.

In conclusion, the New York Promissory Note form, when properly executed, is a powerful legal instrument. By avoiding these common pitfalls, individuals can ensure their financial agreements are based on a solid legal foundation, fostering a smoother lending process and protecting the interests of all parties involved.

Documents used along the form

When dealing with financial agreements in New York, the Promissory Note form is often just the starting point. This document is crucial for laying out the repayment terms between a borrower and a lender. However, for the agreement to be fully comprehensive and legally robust, several other forms and documents are frequently used in conjunction. These not only reinforce the initial agreement but also provide additional legal protections and clarity for all parties involved. Below is a list of some common documents that are typically used alongside the New York Promissory Note form.

- Loan Agreement: A comprehensive contract that goes into more detail than a promissory note. It outlines all the terms and conditions of the loan, including any interest rates, collateral, and repayment plans.

- Security Agreement: If the loan is secured, this document provides a legal framework for the collateral. It describes the collateral and the conditions under which the lender can take possession if the promissory note is not fulfilled.

- Amortization Schedule: This is a detailed table that outlines each payment over the course of the loan's life. It shows the amount that goes toward the interest versus the principal for each payment.

- Guaranty: In situations where there's a guarantor, this legal document ensures that the individual or entity guarantees the loan will be repaid. It's an extra layer of security for the lender.

- Mortgage Agreement or Deed of Trust: For real estate transactions, this document secures the loan with the property being purchased. It outlines the rights and responsibilities of both parties regarding the property.

- UCC-1 Financing Statement: When personal property is used as collateral, this form is filed with the New York Department of State. It perfects the lender's interest in the collateral, making it public record.

- Late Payment Notice: This form is used to notify the borrower of a missed payment and any potential penalties. It serves as a formal reminder to ensure compliance with the promissory note.

- Release of Promissory Note: Once the loan is fully repaid, this document serves as legal proof that the borrower has fulfilled their obligations under the note, releasing them from further liability.

- Modification Agreement: If both parties agree to modify the terms of the original promissory note or loan agreement, this document outlines the changes and is signed by both the lender and borrower.

Employing these documents in conjunction with the New York Promissory Note form can significantly mitigate risks and ensure that every aspect of the loan agreement is well documented and enforceable. It's a strategic approach to not just secure the loan, but also to maintain clear, actionable records of each party's rights and responsibilities. Ensuring that these supplementary documents are properly filled out and securely stored will greatly benefit both the borrower and the lender in the long term.

Similar forms

The New York Promissory Note form is closely related to several other legal documents used in financial transactions. One such document is the Loan Agreement. Similar to a promissory note, a Loan Agreement is a comprehensive contract that outlines the terms of a loan between two parties. However, the Loan Agreement is more detailed, often specifying collateral, a repayment schedule, and what happens in case of default. The promissory note, by contrast, is usually simpler and more straightforward, focusing on the promise to repay the amount lent.

Another document that shares similarities with the promissory note is the IOU (I Owe You). An IOU is a simple acknowledgment of debt, but unlike a promissory note, it is less formal and might not include specific terms of repayment such as interest rates and due dates. The promissory note, on the other hand, is legally binding and encompasses more detailed information about the loan's conditions.

The Mortgage Agreement is also akin to a promissory note but is specifically secured by the mortgage on real property. Like a promissory note, it outlines the borrower's promise to repay the loan but goes further to attach the property as collateral for the loan. This means that if the borrower defaults, the lender can foreclose on the property to recover the owed amount, a feature that is distinct from unsecured promissory notes.

Debentures are another type of document related to promissory notes, used primarily in corporate finance. They signify a medium to long-term debt instrument but are unsecured, unlike mortgage agreements. Both debentures and promissory notes involve a written promise to pay back a loan, though debentures are more likely to be used by companies and involve larger sums of money and longer repayment periods.

The Bill of Exchange also shares similarities with promissory notes. Both are written orders to pay a certain sum of money to a person at a future date. However, a Bill of Exchange involves three parties (the drawer, the drawee, and the payee), whereas a promissory note typically involves just the borrower and the lender. The international trade commonly uses Bills of Exchange.

Credit Agreements are similar to promissory notes, as they detail the terms under which credit is extended to the borrower by the lender. However, Credit Agreements are generally more complex and often encompass revolving credit lines, such as credit cards or overdraft facilities, unlike the typically lump-sum loan of a promissory note.

The Personal Guarantee is another related document, wherein an individual (the guarantor) agrees to take responsibility for the loan repayment if the original borrower fails to make payments. While not a loan document itself, it is often required by lenders alongside a promissory note to secure the loan, particularly for business loans or large personal loans.

Bonds, especially corporate bonds, are somewhat similar to promissory notes as they represent a loan made by an investor to a borrower (typically corporate or governmental). Both outline a promise to pay back the principal along with interest. However, bonds are traded on markets, can have a wide range of investors, and usually represent a longer-term obligation than promissory notes.

Lastly, Payday Loans can be documented through agreements that resemble promissory notes. These documents outline a short-term, high-interest loan that is intended to be repaid at the borrower's next payday. While both involve a promise to repay, payday loan agreements specifically cater to short-term lending with distinctly higher interest rates and fees than what is typical for promissory notes.

In conclusion, while the New York Promissory Note form is distinctive in its purpose and scope, it shares essential attributes with a variety of other legal and financial documents. Understanding these similarities and differences can help parties involved in financial transactions choose the most appropriate instrument for their needs.

Dos and Don'ts

Filling out a New York Promissory Note form is an important step in formalizing a loan agreement. To ensure accuracy and legality, here are some dos and don'ts to keep in mind:

- Do ensure all parties' full legal names are accurately listed. This clarifies who is involved.

- Do specify the loan amount in words and numbers to avoid any confusion.

- Do detail the interest rate, making sure it complies with New York's usury laws to avoid illegal terms.

- Do outline the repayment schedule clearly, including due dates, to set expectations.

- Do include consequences of late payments or defaulting on the loan to protect the lender.

- Don't leave blanks on the form; unspecified terms could lead to future disputes.

- Don't sign without witnesses or a notary present, depending on the legal requirements, to add an extra layer of legitimacy.

- Don't agree to terms that are unclear or seem unfair. Both parties should understand and agree to all conditions.

- Don't forget to provide each party with a copy of the signed promissory note for their records.

Following these guidelines can help create a transparent and enforceable promissory note that safeguards the interests of both the borrower and lender.

Misconceptions

When it comes to New York Promissory Notes, several misconceptions can lead individuals astray, impacting legally binding agreements. It's essential to clear up these misunderstandings for parties involved in lending or borrowing.

All promissory notes are the same: This is a common misconception. New York promissory notes must adhere to state-specific laws, which can vary significantly from other states. It means that a promissory note in New York may require different terms or conditions than one in another state.

A verbal agreement is as valid as a written promissory note: While verbal agreements can be enforceable under certain conditions, a written promissory note is significantly more reliable and easier to enforce in court. New York law places importance on written agreements, especially for financial matters.

Promissory notes are only for banks: It's a misconception that only banks and financial institutions can issue promissory notes. Individuals can also create them for personal loans between family members or friends, as long as the note complies with New York laws.

No legal expertise is needed to draft a promissory note: While it's possible to draft a promissory note without legal assistance, understanding the legal requirements in New York can ensure the note is enforceable. Mistakes or omissions could render the note void or unenforceable.

Interest rates can be freely determined: In New York, the interest rate on a promissory note must not exceed the state’s usury limits. Charging an interest rate above the legal maximum can lead to penalties, including making the note void.

Signing in front of a notary is a requirement: While notarization can add an extra layer of authenticity to the document, it is not a legal requirement for a promissory note to be enforceable in New York. However, notarization can be beneficial, especially if the note's validity is questioned.

Electronic signatures aren't valid: New York, like many states, accepts electronic signatures as valid and binding. Hence, a promissory note signed electronically is just as enforceable as one signed with pen and ink, provided all parties agree to this method.

The borrower must provide collateral: A promissory note does not automatically require collateral. Whether or not collateral is necessary depends on the agreement between the lender and borrower. Secured promissory notes include collateral; unsecured ones do not.

There's no need to outline repayment terms: It's a critical mistake to leave repayment terms vague or undefined. A well-constructed promissory note in New York will clearly outline the repayment schedule, interest rates, and any penalties for late payments to avoid future disputes.

Addressing these misconceptions ensures that individuals can create enforceable promissory notes that serve their intended purpose while adhering to New York's legal standards.

Key takeaways

When dealing with the New York Promissory Note form, individuals and entities are provided a structured means of documenting a loan transaction. This not only ensures clarity and enforceability in the arrangement but also aligns with New York's legal requirements. Below are key takeaways to guide users through filling out and utilizing this form effectively.

- Understanding Its Purpose: The Promissory Note serves as a binding legal document that evidences a loan's existence and stipulates the repayment terms. It's crucial in formalizing the borrower's obligation to repay the lender.

- Accurate Information is Key: Both parties must ensure that all provided information is accurate and comprehensive. This includes the full names and addresses of the lender and borrower, alongside the loan amount and interest rate.

- Adherence to State Laws: The New York Promissory Note must comply with New York's interest rate laws and usury limits to maintain its validity and prevent legal disputes.

- Clear Repayment Terms: The document should explicitly state the repayment schedule, whether in installments or a lump sum, including due dates and any grace periods for late payments.

- Interest Rate Specification: It's vital to specify the interest rate on the loan clearly. Failure to do so can complicate enforcement and may result in defaulting to the state's legal rate.

- Security Interests if Applicable: If the loan is secured by collateral, the promissory note should detail this arrangement, including a description of the collateral, to ensure enforceability.

- Signatures Matter: The execution of the promissory note with signatures from both parties is essential to its legitimacy and enforceability in legal proceedings.

- Witness or Notarization: While not always mandatory, having the note witnessed or notarized can add a layer of verification and can be crucial in the event of a dispute.

- Keep It Confidential: Like any contract, the promissory note contains sensitive information about the parties and their financial agreement. It should be kept confidential and shared only with relevant parties.

- Prepayment and Late Fees: The promissory note should address the possibility of prepayment and outline any applicable fees or penalties for late payments, ensuring both parties are aware of these conditions.

Following these guidelines will not only help ensure that the New York Promissory Note is filled out correctly but will also help in safeguarding the rights and responsibilities of all parties involved. It's always recommended to consult with a legal professional to navigate any complexities or specific legal questions related to the promissory note or the lending agreement it supports.

More Promissory Note State Forms

Promissory Note Template Georgia - Often used for loans between individuals, it clearly lays out the obligations of the party receiving money.

Simple Promissory Note - It can be secured by collateral, offering an extra layer of protection for the lender.