Fillable Promissory Note Document for Michigan

In the world of lending and borrowing within the state of Michigan, the significance of a Promissory Note cannot be overstated. This document serves as a formal agreement between two parties, outlining the conditions under which money is lent and the commitment made by the borrower to repay the debt. It's designed to protect both the lender and the borrower, ensuring that all terms of the loan are clearly understood and agreed upon. The Michigan Promissory Note form encompasses key elements such as the amount of money borrowed, the interest rate applied, repayment schedule, and the consequences of failing to meet the agreed-upon terms. Its importance is further emphasized by its legal enforceability, making it a critical tool for anyone engaging in personal or business loans. By bringing clarity and a legal framework to the lending process, this document helps to foster trust between parties and contributes to smoother financial transactions within the state.

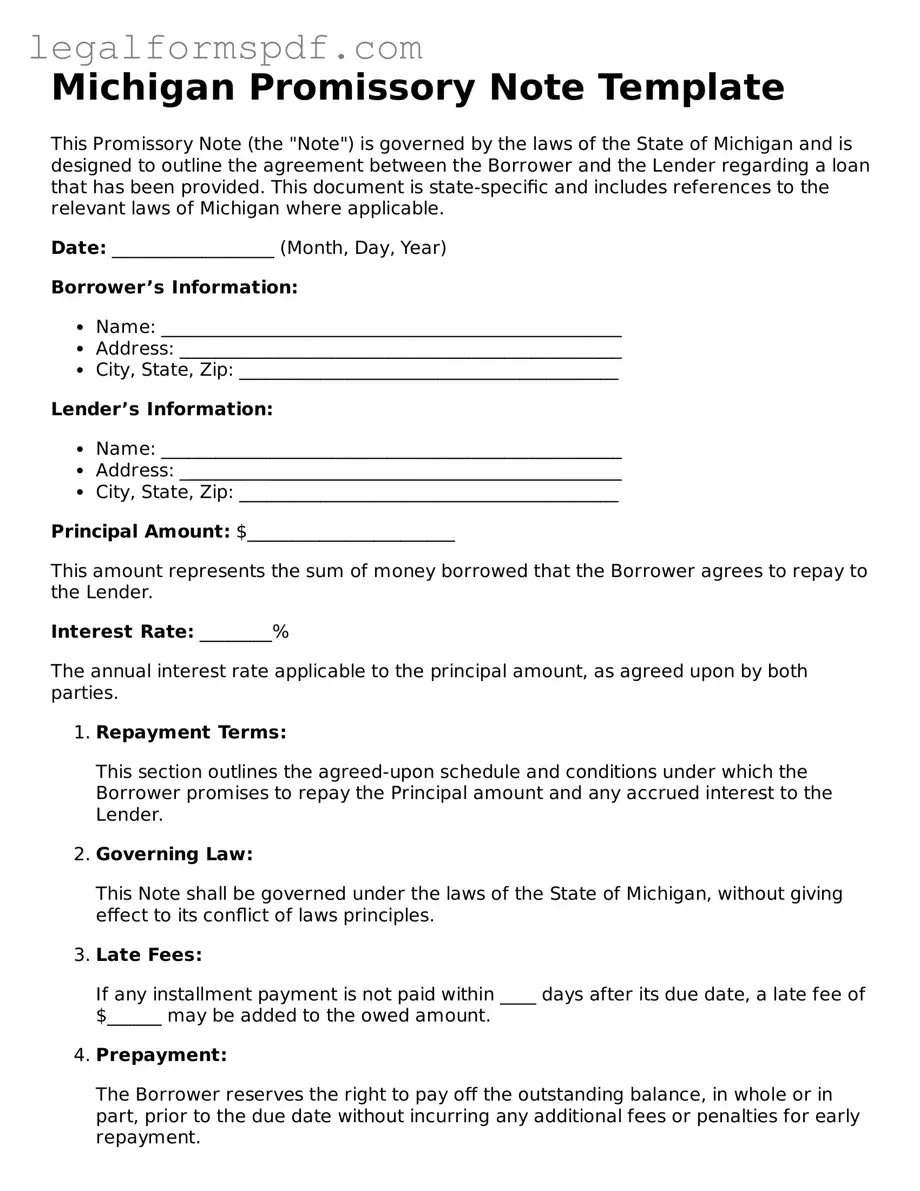

Document Example

Michigan Promissory Note Template

This Promissory Note (the "Note") is governed by the laws of the State of Michigan and is designed to outline the agreement between the Borrower and the Lender regarding a loan that has been provided. This document is state-specific and includes references to the relevant laws of Michigan where applicable.

Date: __________________ (Month, Day, Year)

Borrower’s Information:

- Name: ___________________________________________________

- Address: _________________________________________________

- City, State, Zip: __________________________________________

Lender’s Information:

- Name: ___________________________________________________

- Address: _________________________________________________

- City, State, Zip: __________________________________________

Principal Amount: $_______________________

This amount represents the sum of money borrowed that the Borrower agrees to repay to the Lender.

Interest Rate: ________%

The annual interest rate applicable to the principal amount, as agreed upon by both parties.

- Repayment Terms:

- Governing Law:

- Late Fees:

- Prepayment:

- Default Terms:

- Signatures:

This section outlines the agreed-upon schedule and conditions under which the Borrower promises to repay the Principal amount and any accrued interest to the Lender.

This Note shall be governed under the laws of the State of Michigan, without giving effect to its conflict of laws principles.

If any installment payment is not paid within ____ days after its due date, a late fee of $______ may be added to the owed amount.

The Borrower reserves the right to pay off the outstanding balance, in whole or in part, prior to the due date without incurring any additional fees or penalties for early repayment.

In the event of a default, where the Borrower fails to pay the principal and interest by the agreed-upon due date, the Lender may demand immediate payment of the remaining balance, including any late fees.

This section finalizes the agreement where both the Borrower and the Lender must sign, acknowledging that they understand and agree to the terms set forth in this Note.

Borrower’s Signature: _______________________________ Date: _____________

Lender’s Signature: _______________________________ Date: _____________

PDF Specifications

| Fact | Description |

|---|---|

| 1. Purpose | The Michigan Promissory Note form is used as a written promise to pay a specified amount of money, either on demand or at a set time, to a person or entity in Michigan. |

| 2. Legal Framework | It is governed by Michigan's state laws, including but not limited to the Michigan Compiled Laws related to contracts and promissory notes. |

| 3. Types | There are two main types: secured and unsecured. Secured notes require collateral, whereas unsecured notes do not. |

| 4. Interest Rate | Michigan law stipulates a maximum legal interest rate, but parties can agree on a different rate if it is within legal limits. |

| 5. Key Components | Important components include the principal amount, interest rate, maturity date, and the parties' signatures. |

| 6. Enforcement | If the borrower fails to repay according to the note's terms, the lender can seek legal enforcement to recover the owed amount. |

| 7. Co-signer | A co-signer can be included to guarantee repayment, adding an additional layer of security for the lender. |

| 8. Amendments | Any changes to the agreed terms of the promissory note must be in writing and signed by all parties involved. |

| 9. Release of Obligation | Once the debt is fully repaid according to the promissory note's terms, the borrower is released from their obligation. |

Instructions on Writing Michigan Promissory Note

Upon embarking on the process of filling out the Michigan Promissory Note form, one engages in a formal commitment to repay a specified sum of money. This document, serving as a written promise, outlines the terms under which the borrower agrees to pay back the lender. The process requires attention to detail and a clear understanding of the financial obligations set forth. Here is a straightforward guide to help you complete the form accurately, ensuring that all parties are protected under the agreement.

- Begin by clearly printing the full legal names of both the borrower and the lender at the top of the form. Ensure that the spelling is accurate to avoid any identification misunderstandings.

- Specify the amount of money being borrowed. Write this amount in both numeric and word formats to prevent ambiguities.

- Document the interest rate being applied to the borrowed sum. This should be an annual percentage rate (APR), and it must comply with Michigan's usury laws to be enforceable.

- Choose the repayment structure. The form allows for various repayment schedules, such as lump sum, installments, or at will (payable on demand). Make sure this section is filled out in accordance with the agreement between the borrower and the lender.

- If the repayment plan involves installments, include a detailed schedule. This should cover the frequency of payments (e.g., monthly, quarterly), the amount of each payment, and the due date for the first payment and subsequent payments.

- Include any provisions for late fees or penalties in case of default by the borrower. These conditions must be reasonable, clear, and agreed upon by both parties.

- Address how the loan will be secured, if at all. In cases where the loan is secured with collateral, describe the asset(s) being used as security. This could be property, vehicles, or other valuables that the lender has the right to claim if the borrower fails to fulfill the repayment terms.

- Both parties should review the completed form in detail. Any errors or omissions can lead to disputes or legal complications down the line.

- Have the borrower and the lender sign and date the bottom of the form. Depending on local regulations or the preference of the parties, you might also wish to have the signatures notarized for additional legal validation.

- Make copies of the signed document. Each party should retain a copy for their records, and an extra copy should be securely stored in case the original is lost or damaged.

Filling out the Michigan Promissory Note form is a critical step in formalizing a loan agreement. By meticulously following these steps, both lender and borrower can ensure clarity and mutual understanding, laying a strong foundation for a successful financial arrangement. Remember, this document is not merely a formality; it is a binding agreement that spells out the rights and responsibilities of both parties. Thus, accuracy, thoroughness, and transparency throughout this process are paramount.

Understanding Michigan Promissory Note

What is a Michigan Promissory Note?

A Michigan Promissory Note is a legal document that outlines a loan's terms between a borrower and a lender. In Michigan, this document is a binding agreement that obligates the borrower to repay the lent money under agreed-upon conditions such as interest rates, repayment schedule, and other terms.

How do I ensure a Promissory Note is legally binding in Michigan?

To ensure a Promissory Note is legally binding in Michigan, it must contain signatures from both the borrower and the lender, clear terms of the loan such as amount, interest rate, repayment schedule, and be in compliance with Michigan state laws, especially regulations regarding interest rates and lending practices.

What types of Promissory Notes are available in Michigan?

In Michigan, there are typically two types of Promissory Notes: secured and unsecured. A secured Promissory Note requires collateral to secure the loan, protecting the lender in case of default. An unsecured Promissory Note does not require collateral, making it riskier for the lender.

Can I charge any interest rate on a Michigan Promissory Note?

No, Michigan law limits the amount of interest that can be charged on a Promissory Note. The maximum interest rate is defined by state law, and charging more can result in penalties. It's essential to check current legal limits to ensure compliance.

How can I modify a Promissory Note in Michigan if both parties agree to changes?

If both parties agree to changes in the Promissory Note, they must draft an amendment to the original document, outlining the specific alterations. Both parties should sign this amendment. It's advisable to consult legal advice to ensure the changes are valid and enforceable.

What are the consequences if the borrower defaults on the Promissory Note in Michigan?

If a borrower defaults on a Promissory Note in Michigan, the lender has the right to take legal action to recover the owed amount. This could include taking possession of collateral in the case of a secured Promissory Note, or other collection actions. The specific consequences and available remedies may depend on the terms of the Note and state law.

Is a witness or notarization required for a Michigan Promissory Note to be legally binding?

While not always required, having a witness or notarizing a Michigan Promissory Note can add a layer of protection and authenticity to the agreement. Notarization can help in the enforcement of the Note, but the absence of a notary or witness does not inherently nullify the agreement.

How does a Promissory Note differ from a Loan Agreement in Michigan?

A Promissory Note is a straightforward document that outlines the promise to pay back a loan. A Loan Agreement is more comprehensive, detailing the obligations and rights of both the borrower and the lender beyond the repayment of the loan. Loan Agreements often include clauses on dispute resolution, confidentiality, and more detailed terms of the loan arrangement.

Common mistakes

One common mistake when filling out the Michigan Promissory Note form is not specifying the interest rate. The document must clearly state the interest rate being charged on the loaned amount. Without this, it's not only difficult to calculate the exact amount that needs to be repaid, but it can also lead to legal complications. The state of Michigan has usury laws in place that cap the maximum interest rate that can be charged, and failing to adhere to these laws can render the contract void.

Another frequent error is not clearly identifying the parties involved; both the lender and borrower must have their full names and addresses listed. This can prevent any ambiguity about who is obligated to repay the loan and who is entitled to receive the repayment. Any confusion in this area can complicate or delay legal actions if they become necessary.

A third mistake is neglecting to include the repayment schedule. Detailed terms, such as the frequency of payments (monthly, quarterly, etc.), the amount of each payment, and when the first payment is due, must be noted. This schedule outlines the expectations for both parties and helps avoid disputes over the payment terms.

Not defining what constitutes a default on the loan is another overlooked aspect. This includes not only failure to make timely payments but can also cover other situations such as bankruptcy or death. Detailing these conditions upfront can protect the lender's investment and provide clear guidelines for how to proceed under unfortunate circumstances.

Failing to state the governing state laws that apply to the agreement is a mistake that can lead to complications if a dispute arises. Michigan law should govern the promissory note for Michigan residents, ensuring that any legal proceedings are performed under local statutes. This can significantly impact the enforcement of the note.

Skipping a clause on late fees and penalties for missed or late payments is also a common error. Such terms serve as a deterrent against late payments and compensate the lender for the inconvenience of delayed repayments. Without these terms, enforcing penalties or collecting additional fees becomes challenging.

Last but not least, not securing signatures from both parties at the end of the document is a critical mistake. A promissory note is a legally binding contract only if it is signed by the borrower and the lender. The absence of signatures undermines the enforceability of the agreement, making it difficult to take legal action in case of nonpayment.

Documents used along the form

When dealing with financial agreements, especially in Michigan, the Promissory Note Form is a crucial document that outlines the borrower's promise to repay a sum of money to the lender. However, this form rarely stands alone in the context of financial transactions. Various other forms and documents often accompany it to ensure a smooth, legally sound agreement. Each of these documents plays a key role in clarifying terms, securing the loan, and ensuring compliance with state laws.

- Loan Agreement: This comprehensive document includes detailed terms of the loan, such as interest rates, repayment schedule, and consequences of default. It often encompasses the promissory note but provides a more thorough contractual framework.

- Security Agreement: For loans that are secured with collateral, this document outlines the specifics of the property or assets securing the loan. It ensures the lender has a claim to the collateral if the borrower defaults.

- Guaranty: This document involves a third party, guaranteeing to repay the loan if the original borrower fails to do so. It serves as an additional layer of security for the lender.

- Amortization Schedule: This provides a detailed breakdown of each payment over the course of the loan, showing how much goes toward interest vs. principal, and how the balance changes over time.

- Mortgage: In real estate transactions, a mortgage document secures the loan against the property being purchased. It outlines the rights and responsibilities of both the borrower and the lender.

- Personal Financial Statement: This document outlines the borrower's financial status, including assets, liabilities, income, and expenses. Lenders use it to assess the borrower’s ability to repay the loan.

- Business Plan: For business loans, a comprehensive business plan may be required to demonstrate the viability of the business and its ability to repay the loan.

- Credit Report Authorization: This form gives the lender permission to check the borrower’s credit history, crucial for assessing creditworthiness.

- Disclosure Statements: Various state and federal laws require lenders to provide borrowers with disclosures, outlining the loan’s terms, the annual percentage rate (APR), and other rights and responsibilities.

Together, these documents form a comprehensive framework that supports the Promissory Note Form, providing clarity, legal protection, and confidence for all parties involved in the loan process. Whether securing a personal loan, financing a business venture, or purchasing a home, these documents ensure that both borrower and lender are well-informed and mutually protected throughout the transaction.

Similar forms

The Michigan Promissory Note form shares similarities with the Loan Agreement. Both documents are legally binding, detailing the specifics of a loan transaction between a lender and a borrower. The main distinction lies in their complexity and detail level; the Loan Agreement typically encompasses broader terms and conditions, including collateral requirements, amendment procedures, and detailed recourse actions in the event of default. Whereas, a Promissory Note tends to be more straightforward, focusing primarily on the repayment schedule, interest rates, and basic terms of the loan.

Another document akin to the Michigan Promissory Note is the IOU (I Owe You). Both instruments acknowledge a debt owed and promise repayment. However, a promissory note is more formal and includes specific terms regarding how and when the debt will be repaid, interest rates, and the consequences of default. In contrast, an IOU is generally informal, offering a simple acknowledgment of debt without the robust legal conditions and protections found in a promissory note.

The Mortgage Agreement also parallels the Michigan Promissory Note, as both pertain to borrowing deals, often tied to real estate transactions. The crucial distinction is that a Mortgage Agreement secures the loan against a tangible property, providing the lender with a lien on the property as collateral until the debt is fully repaid. This security feature adds a layer of protection for the lender that is not typically inherent in a Promissory Note, which may or may not be secured.

The Personal Guarantee is somewhat similar to the Michigan Promissory Note in that it involves a promise to pay. A Personal Guarantee is an assurance provided by a third party, usually to bolster the debtor's credibility and reassure the lender of repayment. This third party commits to fulfilling the debt obligations should the primary debtor fail to pay. Unlike a promissory note, which binds the borrower directly to the lender, a personal guarantee involves a tri-party relationship, adding an additional layer of security for the lender.

Dos and Don'ts

Filling out a Michigan Promissory Note form requires attention to detail and a clear understanding of what is expected. Whether you are the borrower or the lender, ensuring an accurate and legally sound document is crucial for protecting both parties' interests. Below are some do's and don'ts to keep in mind:

Do's:- Read and understand the form fully before starting to fill it out. Ensure that you comprehend every section and its implications.

- Write clearly and legibly using black or blue ink to ensure that all information is easily readable.

- Include all the necessary details such as the amount borrowed, interest rate, repayment schedule, and any collateral involved. This specificity prevents misunderstandings later.

- Verify the accuracy of all names, addresses, and legal descriptions related to the parties and any collateral. Mistakes here can invalidate the document or cause legal disputes.

- Sign and date the form in the presence of a notary public or witnesses as required. This step is often mandatory for the document to be legally binding.

- Leave blank spaces on the form. This can lead to fraudulent additions or misunderstandings. If a section does not apply, write "N/A" to indicate this.

- Use white-out or correction tape for mistakes. Instead, it's better to start over on a new form to maintain the document's integrity.

- Sign without ensuring that both parties understand and agree to the terms. Agreement and understanding are key to preventing future disputes.

- Rely solely on verbal agreements to supplement the note. If something is important, it should be written down in the document.

- Forget to keep a copy for your records. Both the borrower and the lender should have a full copy of the signed and dated promissory note for their records.

By following these do's and don'ts, parties can create a solid, reliable Michigan Promissory Note that safeguards everyone's interests.

Misconceptions

When dealing with a Michigan Promissory Note form, people often have several misconceptions. Understanding these can help in accurately navigating legal obligations and rights associated with promissory notes. Here are eight common misconceptions clarified:

All promissory notes are essentially the same: The truth is, they can vary significantly depending on the specific terms and conditions they contain. A Michigan Promissory Note might have different legal requirements or clauses compared to those from other states.

Verbal agreements are as binding as written promissory notes: While oral contracts can be enforceable, a written Promissory Note is far more reliable and easier to enforce. It serves as a physical record of the agreement's terms, which is crucial in case of disputes.

A Promissory Note and a loan agreement are identical: Although they may sound similar and are related, a promissory note is a promise to pay back a debt. In contrast, a loan agreement typically includes a broader range of clauses, such as those related to collateral and the responsibilities of each party.

Only the borrower needs to sign the Michigan Promissory Note: Depending on the agreement's terms and the involved parties’ preferences, co-signers might also need to sign to ensure the note's enforceability, especially if they're guaranteeing the debt.

Promissory notes don’t require witness or notarization in Michigan: While not always required, having a witness or notarizing the document can add an extra layer of legal protection and authenticity to the promissory note, making it easier to enforce in court if necessary.

Interest rates can be as high as both parties agree: Michigan law caps the interest rate that can be charged on loans. Interest rates specified in promissory notes must comply with these legal limits to avoid being deemed usurious and potentially void.

Defaulting on a promissory note has no legal repercussions: Failure to comply with the terms of a Promissory Note can lead to legal action, including lawsuits or other methods of debt collection. The consequences can be significant for the borrower.

Promissory notes are only for financial transactions between individuals: They can also be used in business transactions, sales of goods, or any situation where one party needs to confirm in writing their promise to pay another party.

Clearing up these misconceptions is vital for anyone involved in creating, signing, or enforcing a Michigan Promissory Note. Doing so ensures all parties understand their obligations and rights under the law.

Key takeaways

When it comes to creating a legally binding agreement for borrowing money, the Michigan Promissory Note form is an essential document. This form outlines the terms and specifics of the loan agreement between a borrower and a lender. To ensure that both parties are protected and fully informed, here are seven key takeaways to consider when filling out and using the form:

- Accuracy is crucial: Every detail in the Michigan Promissory Note, from the names and addresses of the parties involved to the loan amount and interest rate, must be accurate. This accuracy ensures that there is no ambiguity regarding the terms of the loan, which can be critical if a dispute arises.

- Clarify repayment terms: The form should include clear repayment terms, such as the schedule for repayment (monthly, quarterly, annually), the due date for the first payment, and the maturity date of the loan. Specifying these terms helps both the lender and the borrower understand their obligations.

- Interest rates must comply with state laws: The interest rate specified in the promissory note must adhere to Michigan’s legal limits. Setting an interest rate that violates state law could render the agreement void or unenforceable.

- Include late fees and penalties: If the borrower fails to make payments on time, the lender may wish to impose late fees or penalties. These should be clearly stated in the promissory note to ensure they are enforceable.

- Secured vs. Unsecured Loans: The form should specify whether the loan is secured (backed by collateral) or unsecured. This distinction affects the lender's recourse in the event of non-payment and should be clearly documented.

- Co-signers should be noted: If the loan has a co-signer, their information and signatures must also be included in the promissory note. This adds an additional layer of security for the lender, as the co-signer becomes equally responsible for the debt.

- Legal advice is advisable: Before finalizing the promissory note, both parties may benefit from consulting with legal professionals. This ensures that the agreement complies with state laws and effectively protects both parties' interests.

Utilizing the Michigan Promissory Note form correctly is key to establishing a clear, enforceable loan agreement. Both lenders and borrowers should pay careful attention to the details and requirements outlined in these takeaways to avoid potential disputes and legal challenges down the road.

More Promissory Note State Forms

Blank Promissory Note - Customizing a promissory note to include specific terms can provide flexibility and clarity for both the lender and the borrower.

Simple Promissory Note - A Promissory Note can be a tool for financial planning, allowing the borrower to anticipate costs related to repayment.

Printable Promissory Note Template - An important document for financial planning and management, helping parties to enforce and adhere to the loan terms.