Fillable Promissory Note Document for Illinois

In the state of Illinois, individuals and businesses often turn to a legal instrument known as a promissory note when a loan is made. This document is pivotal in setting forth the terms of repayment, including the loan amount, interest rate, repayment schedule, and any collateral securing the loan. It serves as a binding agreement between the borrower and the lender, ensuring that there is a clear understanding of the financial transaction and its conditions. The importance of a promissory note goes beyond its basic function of detailing the loan; it also provides legal protection for both parties involved. By clearly stating the obligations of the borrower and the rights of the lender, it helps to prevent misunderstandings and disputes that could arise during the repayment period. Whether the transaction involves a significant sum for a major purchase or a smaller loan among acquaintances, the Illinois Promissory Note form plays a critical role in facilitating smooth financial exchanges, maintaining trust between parties, and safeguarding the interests of all involved.

Document Example

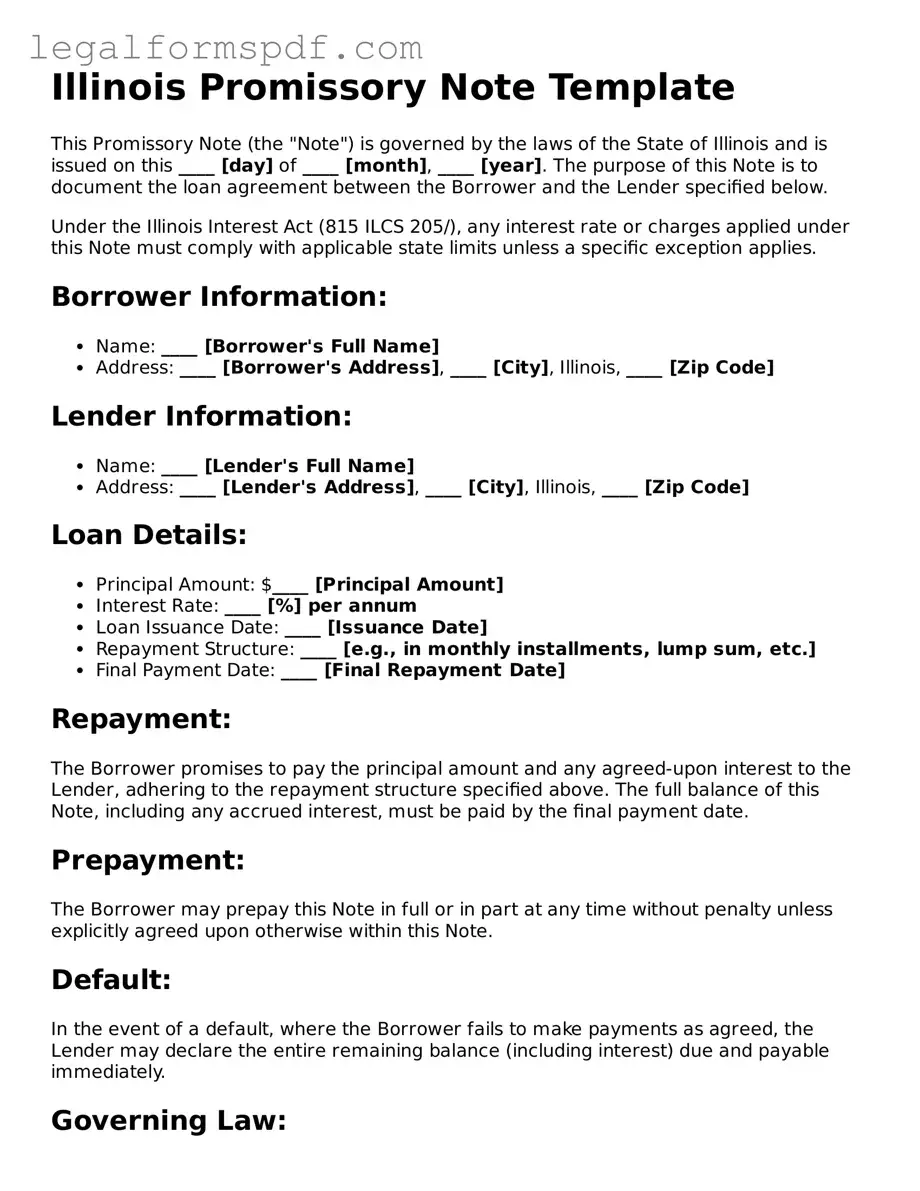

Illinois Promissory Note Template

This Promissory Note (the "Note") is governed by the laws of the State of Illinois and is issued on this ____ [day] of ____ [month], ____ [year]. The purpose of this Note is to document the loan agreement between the Borrower and the Lender specified below.

Under the Illinois Interest Act (815 ILCS 205/), any interest rate or charges applied under this Note must comply with applicable state limits unless a specific exception applies.

Borrower Information:

- Name: ____ [Borrower's Full Name]

- Address: ____ [Borrower's Address], ____ [City], Illinois, ____ [Zip Code]

Lender Information:

- Name: ____ [Lender's Full Name]

- Address: ____ [Lender's Address], ____ [City], Illinois, ____ [Zip Code]

Loan Details:

- Principal Amount: $____ [Principal Amount]

- Interest Rate: ____ [%] per annum

- Loan Issuance Date: ____ [Issuance Date]

- Repayment Structure: ____ [e.g., in monthly installments, lump sum, etc.]

- Final Payment Date: ____ [Final Repayment Date]

Repayment:

The Borrower promises to pay the principal amount and any agreed-upon interest to the Lender, adhering to the repayment structure specified above. The full balance of this Note, including any accrued interest, must be paid by the final payment date.

Prepayment:

The Borrower may prepay this Note in full or in part at any time without penalty unless explicitly agreed upon otherwise within this Note.

Default:

In the event of a default, where the Borrower fails to make payments as agreed, the Lender may declare the entire remaining balance (including interest) due and payable immediately.

Governing Law:

This Note will be interpreted and enforced in accordance with Illinois laws, without regard to conflicts of law principles.

Signature:

By signing below, both parties agree to the terms of this Promissory Note.

Borrower's Signature:

_____________________________________

Date: ____ [Date of Signing]

Lender's Signature:

_____________________________________

Date: ____ [Date of Signing]

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Illinois Promissory Note form is a legal document that outlines the details of a loan between two parties in Illinois. |

| 2 | It must include the amount of money being loaned and the interest rate applied to the principal amount. |

| 3 | The form should clearly state the repayment schedule, including due dates and the number of payments. |

| 4 | Under Illinois law, the maximum interest rate that can be charged is 9% per annum unless otherwise agreed upon. |

| 5 | Late fees and penalties for missed payments must be stipulated in the form to be enforceable. |

| 6 | The names and addresses of both the borrower and the lender must be included for identification purposes. |

| 7 | A promissory note in Illinois can be secured or unsecured, meaning collateral may or may not be required to guarantee repayment. |

| 8 | The document becomes a legal obligation once it is signed by both parties, making it enforceable in a court of law. |

| 9 | It is governed by Illinois state law, specifically the Illinois Interest Act (815 ILCS 205/), among other relevant statutes. |

Instructions on Writing Illinois Promissory Note

Filling out an Illinois Promissory Note form is a critical step in formalizing an agreement between a borrower and a lender. This document, once completed, holds the borrower legally responsible for repaying the borrowed amount under agreed-upon terms. The process may seem daunting at first, but by following a systematic approach, one can efficiently navigate through the form. Compliance with precise and accurate information ensures the enforceability of the note. The following steps are designed to guide individuals through this process.

- Gather all necessary information, including the full legal names of both the borrower and the lender, addresses, the loan amount, the interest rate, and the repayment schedule.

- Enter the date on which the promissory note is being executed at the top of the form.

- Write the full legal name of the borrower and the lender in their respective fields.

- Specify the principal loan amount in the designated section.

- Record the annual interest rate agreed upon by both parties.

- Detail the repayment schedule, including the start date, frequency of payments (e.g., monthly), and the duration of the repayment period.

- Include any agreed-upon provisions regarding late fees or prepayment penalties.

- If collateral is being used to secure the loan, clearly describe the collateral in the appropriate section of the form.

- Both the borrower and the lender must sign and date the bottom of the form, making the document legally binding. If applicable, witness signatures may also be required.

- It is advisable to make copies of the signed promissory note. One copy should be kept by the lender, and another should be given to the borrower for record-keeping purposes.

Once the form is fully completed and signed, the legal obligation of the borrower to repay the loan according to the terms laid out in the document is established. Ensuring the accuracy of every detail filled out on the form will protect both parties' interests throughout the duration of the loan. Proper documentation and adherence to the agreed-upon terms are essential for maintaining a positive financial relationship between the borrower and the lender.

Understanding Illinois Promissory Note

What is an Illinois Promissory Note?

An Illinois Promissory Note is a legal document that records a loan agreement between two parties in the state of Illinois. It outlines how the borrower promises to repay the lender, including details such as the loan amount, interest rate, repayment schedule, and any other terms and conditions regarding the loan.

Is an Illinois Promissory Note legally binding?

Yes, an Illinois Promissory Note is legally binding once it is signed by both the borrower and the lender. This means both parties are legally obligated to follow the terms outlined in the document. Failure to do so may result in legal consequences.

Do I need a witness or notary for an Illinois Promissory Note?

While not always mandatory, having a witness or notarizing your Illinois Promissory Note can add a layer of authenticity and may be beneficial for legal enforcement. Illinois law does not specifically require a promissory note to be witnessed or notarized, but it is good practice, especially for significant loan amounts.

What should be included in an Illinois Promissory Note?

An Illinois Promissory Note should include the loan amount, interest rate, repayment schedule (including dates and amounts), the names and signatures of the borrower and lender, and any collateral securing the loan. It should also detail the consequences of non-payment and any other conditions agreed upon by both parties.

How can I enforce an Illinois Promissory Note if the borrower fails to pay?

If the borrower fails to make payments according to the agreed-upon schedule, the lender may seek legal recourse to enforce the Illinois Promissory Note. This often involves filing a lawsuit to collect the due amount, which may include the principal, interest, and legal costs.

Can an Illinois Promissory Note include interest?

Yes, an Illinois Promissory Note can include interest. However, it's important to ensure that the interest rate complies with Illinois' usury laws to avoid charging illegal interest rates. The usury laws establish the maximum interest rate that can be charged on a loan.

Is it possible to modify an Illinois Promissory Note?

Yes, an Illinois Promissory Note can be modified if both the borrower and lender agree to the changes. Any modifications should be made in writing and signed by both parties, with the modification becoming part of the original agreement.

Where can I obtain an Illinois Promissory Note form?

Illinois Promissory Note forms can be obtained from legal document websites, attorneys specializing in financial agreements, or financial institutions offering loan services. Ensure the form complies with Illinois state laws to avoid any legal issues.

Common mistakes

Filling out a promissory note in Illinois requires attention to detail and an understanding of the agreement you're entering into. A common mistake is not specifying the type of promissory note - whether it is secured or unsecured. A secured note means that the borrower pledges an asset as collateral, which the lender can claim if the loan isn't repaid. An unsecured note has no collateral backing it, posing a higher risk to the lender. Neglecting to clarify this can lead to confusion and potential legal disputes.

Another oversight is failing to clearly define the terms of repayment. The note should outline how often payments will be made (e.g., monthly), the amount of each payment, and over what period. Without this detail, the repayments could become a contentious issue. Additionally, not including the interest rate or improperly calculating it can lead to discrepancies between the lender and borrower regarding the total amount to be repaid.

Many people mistakenly believe they don't need to include a late payment policy in the promissory note. Specifying what constitutes a late payment and any applicable penalties can help prevent late payments and give the lender recourse if payments are not made on time. Similarly, failing to mention the course of action in case of a default by the borrower is another common mistake. This should detail the steps the lender can take to recover their money, providing clarity and protection for both parties.

Skipping the inclusion of a co-signer section when one is part of the agreement is also problematic. A co-signer provides an extra layer of security for the lender, agreeing to take on the debt if the primary borrower fails to make payments. Not documenting this in the promissory note could lead to complications in enforcing the co-signer's obligations.

Ignoring state-specific requirements is another misstep. Illinois, like all states, has its own laws governing promissory notes. For instance, failing to adhere to Illinois' maximum interest rate can render the note usurious and legally void. Furthermore, not having the note signed or witnessed in accordance with state laws can question its enforceability. A promissory note needs to be executed properly to be considered a valid contract under Illinois law.

Finally, neglecting to keep a signed copy of the promissory note is a mistake that can jeopardize the lender's ability to enforce the agreement. Both parties should have a copy of the signed note for their records, ensuring that they can refer to the exact terms of the agreement if any disputes arise.

Documents used along the form

In the realm of lending and borrowing, particularly in Illinois, the Promissory Note form is often accompanied by several other forms and documents to ensure a comprehensive and legally sound transaction. Each of these additional documents serves its own purpose, complementing the Promissory Note and providing both the lender and the borrower with legal clarity and protection. Understanding these documents is crucial for anyone involved in the lending process, from individuals to institutions.

- Security Agreement: This legal document is used alongside a promissory note especially when the loan is secured with collateral. It details the property or assets pledged by the borrower as security for the loan, outlining the rights of the lender to seize the collateral if the borrower fails to fulfill the obligations outlined in the Promissory Note.

- Loan Agreement: While a Promissory Note outlines the promise to pay, a Loan Agreement covers the terms and conditions of the loan in detail. It includes the obligations of both parties, interest rates, repayment schedule, and what happens in case of default. This document provides a broader context for the loan, beyond the repayment promise.

- Amortization Schedule: This is a table detailing each payment on a loan over time. An Amortization Schedule breaks down the payments into interest and principal, showing how the loan is intended to be paid off by the end of its term. It helps both borrower and lender track the progress toward repayment of the loan.

- Guaranty: A Guaranty is often required when the borrower's creditworthiness is in question. It is a promise made by a third party, the guarantor, to pay the loan if the primary borrower fails to do so. This provides an additional layer of security for the lender.

- UCC Financing Statement: In the case of secured loans, a UCC Financing Statement, often referred to as a UCC-1, is filed with a state's secretary of state to publicly declare the lender's interest in the collateral offered by the borrower. This is a critical step in perfecting a security interest and protecting the lender's rights to the collateral in the event of borrower default.

Together, these documents form a robust framework around the Promissory Note, ensuring that all aspects of the loan are clearly defined and legally enforceable. They protect the interests of both lender and borrower, making the lending process more transparent and reliable. By familiarizing oneself with these documents, parties involved in lending can navigate the process with greater confidence and security.

Similar forms

The Illinois Promissory Note form is closely related to the Loan Agreement, both of which are foundational to setting the terms for borrowing money. The Loan Agreement goes beyond the basic promise to pay found in a Promissory Note by detailing the responsibilities of each party, including interest rates, repayment schedule, and what happens in the event of a default. This makes the Loan Agreement more comprehensive, while the Promissory Note serves as a straightforward acknowledgment of the debt.

Similarly, a Mortgage Agreement shares a connection with the Promissory Note, especially within the context of real estate transactions in Illinois. While a Promissory Note signifies the borrower's promise to repay the loan, a Mortgage Agreement secures the loan by using the property as collateral. If the borrower fails to comply with the terms of the Promissory Note, the Mortgage Agreement provides the legal framework for the lender to foreclose on the property.

An IOU (I Owe You) document also bears similarity to the Illinois Promissory Note but is much less formal and detailed. An IOU simply acknowledges that a debt exists, often without specifying repayment terms such as interest rates or due dates. In contrast, a Promissory Note includes a detailed repayment schedule and is legally binding, making it a more reliable document for lending and borrowing money.

The Installment Agreement is akin to the Promissory Note in that it sets forth a plan for repaying a debt over a period of time. However, an Installment Agreement typically involves more detailed descriptions of the installment payments, including the number of payments, the amount of each payment, and the interest charged. This makes an Installment Agreement ideal for more complex repayment terms, while a Promissory Note might be used for simpler lending arrangements.

A Debt Settlement Agreement stands in relation to the Illinois Promissory Note as a tool for modifying the terms of an original debt obligation. Often used when a borrower is unable to fulfill the terms of the original Promissory Note, a Debt Settlement Agreement allows the parties to negotiate a reduction in the amount owed or to alter the repayment schedule, providing a formal method for adjusting the terms of the original debt.

The Personal Guarantee is another document related to the Promissory Note, commonly required by lenders to secure a loan. While a Promissory Note is the borrower's pledge to repay the debt, a Personal Guarantee further secures the loan by holding an individual, often someone with a stake in the borrowing entity, personally liable if the original borrower defaults. This added layer of security complements the original promise to pay, ensuring the lender has another avenue for recovery.

The Bill of Sale intertwines with the Promissory Note when personal property is used as collateral to secure a loan. While the Promissory Note acknowledges the debt and promises repayment, a Bill of Sale documents the transfer of ownership of personal property from the seller to the buyer. If the loan is not repaid according to the terms of the Promissory Note, the lender may have the right to claim the collateral as outlined in the Bill of Sale.

A Security Agreement is another document that shares its purpose with the Promissory Note when it comes to secured loans. It outlines the details regarding the collateral that is being used to secure the loan—detailing what assets are held against the borrower's promise to pay. If the borrower defaults, the Security Agreement provides the legal framework for the lender to seize the collateral, offering a more detailed procedure on handling secured assets than a Promissory Note.

Lastly, the Letter of Intent (LOI) can serve a similar preliminary purpose to the Illinois Promissory Note in financial transactions, though it is used in a broader context. A Letter of Intent may outline the intention to lend or borrow money, along with the basic terms, before drafting the more detailed Promissory Note. It serves as a formal yet non-binding overview of the proposed agreement, setting the stage for the official lending documents to be prepared.

Dos and Don'ts

When filling out the Illinois Promissory Note form, it's important to approach the task with care to ensure that the agreement is legally binding and clear to all parties involved. Below are some essential dos and don'ts to consider:

Dos:

- Read the Form Carefully: Before you start filling it out, make sure you understand every part of the form. This ensures that you know what information is required and where to put it.

- Use Clear, Precise Language: When detailing the terms of the loan, such as the repayment schedule, interest rate, and any collateral, use language that is straightforward and unambiguous to prevent misunderstandings.

- Verify All Parties’ Information: Double-check the names, addresses, and other identifying details of all parties involved in the agreement to make certain they are accurate.

- Outline Repayment Terms Specifically: Clearly state the repayment expectations including start date, frequency of payments, amount per payment, and the final due date for the loan to be fully repaid.

- Include the Interest Rate: Illinois law requires stating the interest rate on a promissory note. Ensure this rate is clearly defined and complies with state usury laws to avoid legal issues.

- Sign and Date the Form: A promissory note must be signed and dated by all parties to be considered valid. Make sure this is done once the form is completely filled out.

Don'ts:

- Avoid Leaving Spaces Blank: Do not leave any space blank. If a section does not apply, indicate with “N/A” (not applicable) to show that it was not overlooked.

- Don't Be Vague: Avoid using vague terms or unclear language. Specificity is key in legal documents to ensure enforceability and clarity.

- Don't Forget to Include All Relevant Details: Missing out on crucial details such as collateral or a co-signer can lead to significant issues down the line. Ensure everything pertinent is included.

- Avoid Ignoring State Laws: Illinois laws regarding promissory notes and interest rates are specific. Ignoring these could invalidate your note or even lead to legal penalties.

- Don't Skip the Fine Print: Sometimes, standard forms include clauses that you may not necessarily agree with. Read every part of the form, including the fine print, before signing.

- Don't Rely Solely on Verbal Agreements: Verbal agreements regarding the note should be avoided. Ensure all terms are written down in the note, as this is what will be legally binding.

Misconceptions

There are several misconceptions about the Illinois Promissory Note form that people often believe. Dispelling these myths is crucial for understanding the significance of this legal document and its proper use.

It doesn't need to be legally compliant: A common error is the belief that any written promissory note will suffice, regardless of its adherence to Illinois law. However, for a promissory note to be enforceable, it must comply with state regulations, including the inclusion of specific terms and disclosures.

Oral agreements are just as effective: While oral agreements can be legally binding, proving the terms without a written document is challenging. In Illinois, a written promissory note is the best practice to ensure all parties clearly understand their obligations and rights.

All promissory notes are the same: Each promissory note should be tailored to the specific loan agreement. Different situations, such as secured versus unsecured loans, may require different terms and conditions to be included in the document.

It's only necessary for large loans: Regardless of the size of the loan, a promissory note provides a clear record of the loan's terms, which can help prevent misunderstandings and legal disputes. Even for loans among family or friends, a promissory note can be essential.

Signing does not require witnesses or notarization: While Illinois law does not always require a witness or notarized signature for a promissory note to be valid, having these can add a layer of validity and may help enforce the note if disputes arise.

Template forms are always sufficient: Relying on a generic template without adjusting it to the specific needs and laws of Illinois can result in a promissory note that is not fully enforceable or does not protect all parties' interests. Customizing the document is often necessary.

Understanding these misconceptions can help individuals and businesses create more effective and legally compliant promissory notes. It's advisable to consult with a legal professional when drafting or reviewing any legal document to ensure it meets all requirements and protections.

Key takeaways

Before filling out the Illinois Promissory Note form, parties should ensure they have a clear understanding of the loan amount, interest rate, and repayment schedule. This preliminary clarity will help in avoiding disputes in the future.

It is crucial for both the lender and the borrower to accurately fill out all sections of the form to prevent legal ambiguity. This includes the full legal names of the parties involved.

The interest rate specified in the promissory note cannot exceed the maximum allowed by Illinois law. Researching current regulations or seeking legal advice can prevent unlawful agreements.

Clearly outline the repayment schedule including the due dates and the amount due at each period. This foresight can prevent misunderstandings regarding the payment expectations.

Both parties should agree on the security, if any, for the loan. Securing the loan with collateral and detailing this within the promissory note provides legal recourse in case of default.

The consequences of defaulting on the loan should be explicitly stated in the note, offering protection to the lender and clarity to the borrower on the seriousness of the obligations.

Ensure that the promissory note includes a clause about any prepayment penalties or allowances. This could provide the borrower with an option to repay the loan early without extra charges, if both parties agree.

For legality and formalization, signatures from both the borrower and the lender, along with the date of signing, must be included at the bottom of the document.

After completing the promissory note, both parties should keep a copy for their records to ensure all have proof of the agreement and its stipulations.

Consider having the document notarized or witnessed to add an extra layer of validation to the agreement, although not a requirement under Illinois law, it can strengthen the enforceability of the note.

More Promissory Note State Forms

Michigan Promissory Note - It's an essential document for anyone considering lending or borrowing money, ensuring clarity and legal protection.

Texas Promissory Note - It often includes a way to enforce the agreement, giving the lender peace of mind about the borrower's repayment.