Fillable Promissory Note Document for Georgia

In the realm of personal and business finance, a tool that often comes to the fore for facilitating loans and ensuring repayment is the promissory note. Particularly in Georgia, the Georgia Promissory Note form serves as a formal but straightforward agreement between borrower and lender, laying out the essential terms of the loan, including repayment schedule, interest rates, and what happens in case of default. Its significance cannot be overstated, as it not only conveys the borrower's promise to repay the borrowed amount under the agreed-upon conditions but also provides a clear legal framework that protects the interests of both parties involved. Tailored to meet state-specific legal requirements, this form can range from simple unsecured promises involving minor sums of money to more complex secured notes backed by collateral. Understanding these nuances and the form's comprehensive role in financial transactions within Georgia paves the way for smoother lending processes and minimizes potential disputes, ensuring that all parties have a common understanding and agreement to refer back to.

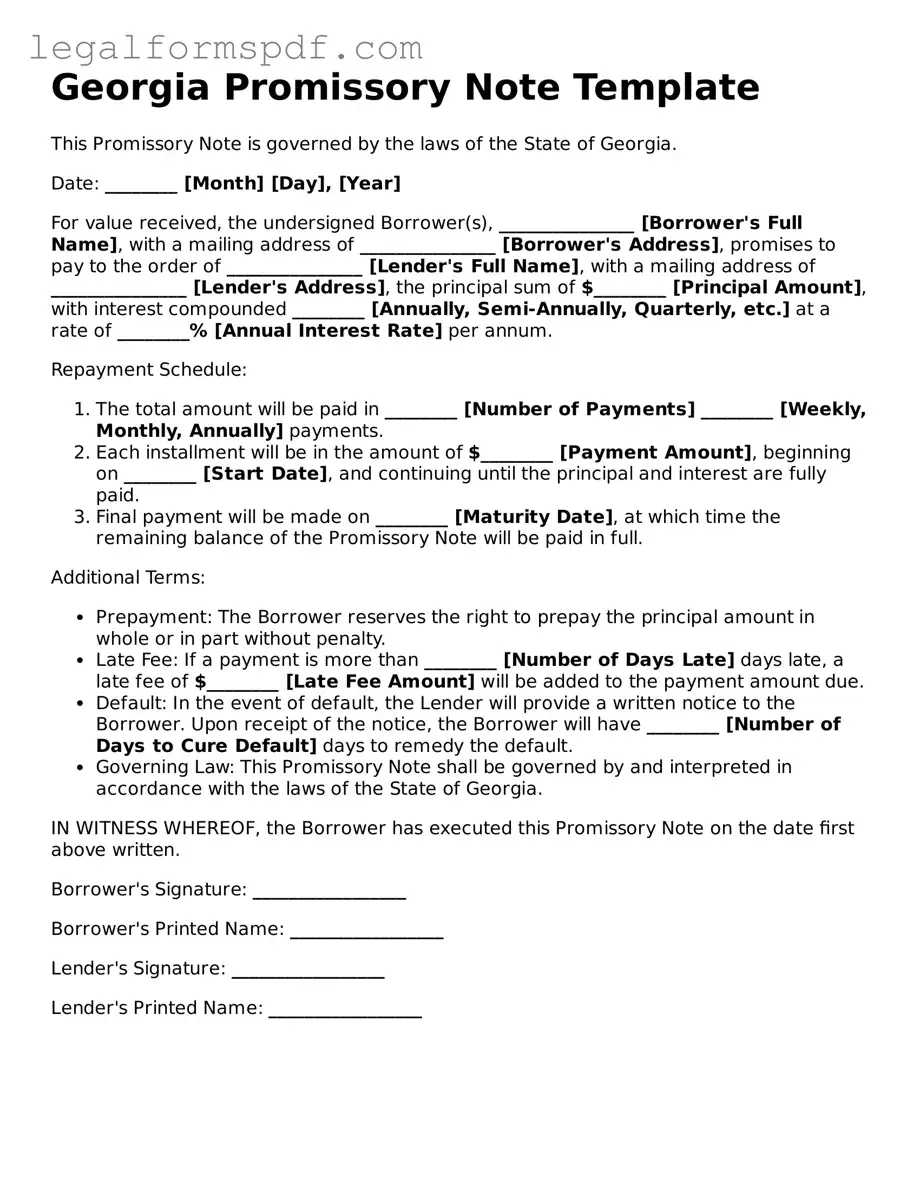

Document Example

Georgia Promissory Note Template

This Promissory Note is governed by the laws of the State of Georgia.

Date: ________ [Month] [Day], [Year]

For value received, the undersigned Borrower(s), _______________ [Borrower's Full Name], with a mailing address of _______________ [Borrower's Address], promises to pay to the order of _______________ [Lender's Full Name], with a mailing address of _______________ [Lender's Address], the principal sum of $________ [Principal Amount], with interest compounded ________ [Annually, Semi-Annually, Quarterly, etc.] at a rate of ________% [Annual Interest Rate] per annum.

Repayment Schedule:

- The total amount will be paid in ________ [Number of Payments] ________ [Weekly, Monthly, Annually] payments.

- Each installment will be in the amount of $________ [Payment Amount], beginning on ________ [Start Date], and continuing until the principal and interest are fully paid.

- Final payment will be made on ________ [Maturity Date], at which time the remaining balance of the Promissory Note will be paid in full.

Additional Terms:

- Prepayment: The Borrower reserves the right to prepay the principal amount in whole or in part without penalty.

- Late Fee: If a payment is more than ________ [Number of Days Late] days late, a late fee of $________ [Late Fee Amount] will be added to the payment amount due.

- Default: In the event of default, the Lender will provide a written notice to the Borrower. Upon receipt of the notice, the Borrower will have ________ [Number of Days to Cure Default] days to remedy the default.

- Governing Law: This Promissory Note shall be governed by and interpreted in accordance with the laws of the State of Georgia.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note on the date first above written.

Borrower's Signature: _________________

Borrower's Printed Name: _________________

Lender's Signature: _________________

Lender's Printed Name: _________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Georgia Promissory Note is a legal document that outlines a loan agreement between two parties in the state of Georgia. |

| 2 | It must include the amount of money being loaned and the repayment terms. |

| 3 | Interest rates on a Georgia Promissory Note must not exceed the legal maximum set by the state. |

| 4 | The document is governed by Georgia’s State laws and any applicable federal laws. |

| 5 | Both the borrower and lender must sign the promissory note for it to be considered valid. |

| 6 | The note may be secured or unsecured, depending on the agreement terms. A secured note involves collateral as security for the loan. |

| 7 | Should a dispute arise, resolution will be subject to Georgia laws and jurisdictions. |

| 8 | Late fees and consequences of default should be clearly defined in the promissory note to avoid potential legal issues. |

Instructions on Writing Georgia Promissory Note

When taking out a loan or borrowing money, it's crucial to clearly document the terms and conditions of the repayment. In Georgia, one common way to do this is by using a Promissory Note form. This document serves as a legally binding agreement between the borrower and the lender, outlining the loan's details, including repayment schedule, interest rate, and what happens if the money is not repaid on time. Completing this form accurately is essential to protect both parties' interests and ensure that there is a mutual understanding of the loan terms. Below is a step-by-step guide to filling out the Georgia Promissory Note form.

- Start by entering the date on which the Promissory Note is being created at the top of the form.

- Write the full legal names of both the borrower and the lender, along with their complete addresses.

- Specify the principal amount of the loan – the total amount of money being borrowed.

- Detail the interest rate per annum. This should comply with Georgia's legal maximum rates, if any.

- Choose the type of repayment structure (e.g., installment, lump sum, due on demand) and clearly describe the payment schedule, including due dates and the amount of each payment.

- If there are any collateral items securing the loan, list them thoroughly in the designated section.

- Include any agreed-upon clauses regarding late fees, prepayment penalties, or defaults.

- Both parties should read the document carefully, reviewing all entries for accuracy.

- Have both the borrower and the lender sign and date the form in the presence of a witness or notary public, if required by state law.

- Make sure to distribute copies of the signed document to all parties involved for their records.

Following these steps will help ensure that your Georgia Promissory Note is filled out correctly and complies with the state's legal requirements. It's a straightforward process that formalizes the loan agreement and provides a clear framework for the repayment plan, helping to prevent misunderstandings and disputes down the line. Remember, it's always a good idea to consult with a legal professional if you have any questions about your obligations or rights under the agreement.

Understanding Georgia Promissory Note

What is a Georgia Promissory Note?

A Georgia Promissory Note is a legal document where one party, the borrower, agrees to pay back a specified sum of money to another party, the lender, within a defined period, under agreed terms and conditions. This form is used to secure transactions and ensure that there is a written agreement about the loan's repayment in Georgia.

How do I ensure my Georgia Promissory Note is legally enforceable?

To make sure your Georgia Promissory Note is legally enforceable, it needs to contain clear terms about the loan amount, interest rate, repayment schedule, and the signatures of both parties involved. It’s also recommended to have the document notarized or witnessed to add another layer of legal protection. Be sure that both parties have a copy of the signed document for their records.

Is interest required on a Promissory Note in Georgia, and is there a maximum rate?

Interest is not required on a promissory note in Georgia, but it's common to include it. If you choose to add interest, the rate must not exceed the maximum legal rate set by the state. In Georgia, the legal limit for interest is generally 7% per year for written contracts that do not specify a rate. However, the parties can agree to a higher rate up to 16% in some circumstances. Always make sure the interest rate complies with state law to ensure the note's enforceability.

Can modifications be made to a Georgia Promissory Note after it's signed?

Yes, modifications can be made to a Georgia Promissory Note after it has been signed, but any changes should be agreed upon by both the lender and the borrower. It's crucial to document these changes in writing and have both parties sign the amendment. This documentation should be attached to the original promissory note to maintain a complete record of the agreement.

What happens if the borrower fails to repay the loan as agreed in the Promissory Note in Georgia?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender has the right to pursue legal action to recover the owed amount. This can include filing a lawsuit to enforce the note and seeking a judgment for the amount due, plus any applicable interest and legal fees. The specific course of action will depend on the terms of the promissory note and Georgia law.

Common mistakes

One common mistake people make when filling out the Georgia Promissory Note form is not specifying the type of interest rate. Borrowers and lenders often overlook the importance of delineating between a fixed and a variable interest rate, which can lead to confusion and disputes over fluctuating payment amounts. A fixed interest rate remains constant throughout the term of the loan, whereas a variable interest rate can change based on external financial indexes.

Another frequent error is omitting the repayment schedule. This schedule is crucial as it outlines how and when the borrower will repay the loan. Failure to detail whether payments are due weekly, monthly, or at another interval can result in missed payments and legal complications. It also adds clarity for both parties on when the loan should be fully repaid.

Failing to include a late payment policy is also a common oversight. Without clearly defined consequences for late payments, enforcing penalties becomes difficult. This section should articulate any fees or additional interest incurred from late payments to encourage timely repayment and protect the lender's investment.

Many people mistakenly leave out the clause regarding prepayment. If a borrower decides to pay off their loan early, the terms under which they can do so should be clearly stated. Some lenders charge a prepayment penalty, while others do not. Specifying these terms helps avoid future misunderstandings.

Not properly identifying the parties involved is a critical error as well. The full legal names and addresses of the borrower and lender ensure that the promissory note is legally binding and enforceable. This clarity is essential for any legal actions that may need to be taken based on the document.

A significant mistake is not adhering to Georgia's legal requirements. Each state has its own laws governing promissory notes, and Georgia is no exception. Ignorance of these requirements can render the note unenforceable. Therefore, it is crucial to understand and comply with Georgia's specific legal standards and statutes related to lending and borrowing.

Finally, many fail to have the promissory note witnessed or notarized, omitting a layer of legal protection. While not always a legal necessity in Georgia, having an impartial third party witness or notarize the document adds credibility and can assist in enforcing the terms of the note, should disputes arise.

Documents used along the form

In the financial realm, particularly when dealing with loans or debts in Georgia, the promissory note is a crucial document. However, it seldom stands alone. A variety of other forms and documents often accompany it to ensure clarity, legality, and the security of the agreement between the parties involved. Understanding these supplemental documents is vital for both lenders and borrowers, as they add layers of protection and detail to the financial transaction.

- Loan Agreement: Often used in conjunction with a promissory note, the loan agreement provides a more detailed outline of the terms and conditions of the loan. While the promissory note signifies the promise to pay, a loan agreement can set forth interest rates, payment schedules, collateral (if any), and the consequences of default. This document is crucial for setting clear expectations and responsibilities for both parties.

- Security Agreement: When a loan is secured with collateral, a security agreement is a must. This document outlines the details about the collateral that is being used to secure the loan, such as real estate, vehicles, or other valuable assets. It gives the lender a legal right to seize the asset in case of default, thus protecting the lender's interest.

- Guaranty: A guaranty is a pledge by a third party, known as the guarantor, to pay back the loan if the original borrower defaults. This form is especially common in situations where the borrower's creditworthiness is in doubt. The guarantor provides an extra layer of security for the lender by promising to fulfill the debt obligation if necessary.

- Amortization Schedule: This detailed document breaks down each loan payment over the life of the loan into principal and interest portions. It provides both the lender and the borrower with a clear picture of what is owed and when. An amortization schedule is instrumental in budget planning and ensures that both parties are on the same page regarding the repayment timeline and amounts.

- Release of Promissory Note: After the loan has been fully paid off, a release of the promissory note is issued by the lender. This document formally recognizes that the borrower has fulfilled their obligations under the promissory note, releasing them from any further liability. It is a critical document for the borrower to prove that the debt has been satisfied.

While the Georgia Promissory Note form initiates the lender-borrower relationship, these accompanying documents fortify and detail the transaction's nuances. Each serves a unique purpose, from laying down the loan's terms and conditions to releasing the borrower from the debt upon its full payment. For anyone navigating loans, understanding these forms can make the process smoother and more transparent.

Similar forms

The Georgia Promissory Note form shares similarities with a Loan Agreement, primarily in its function as a legally binding document dictating the terms under which money is borrowed and repaid. Both outline the amount borrowed, interest rates, repayment schedule, and actions in the case of default. However, a Loan Agreement typically encompasses more detailed provisions regarding the obligations of both parties and often includes clauses on dispute resolution, confidentiality, and securities, making it more comprehensive than a promissory note.

Similar to a Mortgage Agreement, the Georgia Promissory Note also serves as a pledge to pay a specific sum of money over time. The key distinction lies in the Mortgage Agreement's specifics; it is secured against real property as collateral. If the borrower fails to meet the payment obligations, the lender can foreclose on the property. Whereas a promissory note might not necessarily be secured, and even if it is, it could involve various types of collateral, not just real estate.

An IOU (I Owe You) is another document akin to the Georgia Promissory Note in its simplicity and acknowledgment of debt. Both serve as acknowledgments that the borrower owes money to the lender. However, an IOU is far less formal and typically lacks comprehensive details like repayment terms, interest rates, and dates, making a promissory note a more formal and legally binding document that is preferred for substantial financial transactions.

The Bill of Sale shares common ground with the Georgia Promissory Note since both can signify a transaction between two parties. A Bill of Sale proves the transfer of ownership of personal property, from the seller to the buyer, and outlines the specifics of the transaction. In contrast, a Promissory Note is an agreement to repay a debt rather than a direct transfer of ownership. Although their purposes differ, they both play crucial roles in documenting transactions between parties.

A Lease Agreement, much like the Georgia Promissory Note, is a contractual arrangement. While a Lease Agreement covers the terms and conditions under which one party agrees to rent property from another, a Promissory Note entails the specifics of a borrower repaying a lender. Both documents establish terms, conditions, and the obligations of parties involved in a binding legal framework, although they apply to different scenarios of occupancy versus borrowing.

Debt Settlement Agreements and Georgia Promissory Notes both involve the repayment of debt. A Debt Settlement Agreement is used when the borrower is unable to repay the full amount owed and the lender agrees to accept a lesser amount. The focus is on adjusting the initial terms of the debt repayment in light of financial hardship. Unlike a straightforward plan to repay as detailed in a promissory note, a settlement agreement redefines the terms to mitigate a potentially untenable financial situation for the borrower.

Lastly, the Student Loan Agreement shares key features with the Georgia Promissory Note, as it specifically pertains to borrowing money for educational purposes. Both documents delineate the amount borrowed, interest rate, repayment schedule, and the legal obligations of the borrower. However, a Student Loan Agreement often includes additional provisions relevant to educational funding, such as deferment options and grace periods post-graduation, framing it within the context of academic advancement.

Dos and Don'ts

When it comes to filling out the Georgia Promissory Note form, it's vital to be thorough and cautious. This document is a legal contract between a borrower and a lender, specifying the amount of money borrowed and the repayment terms. To help you navigate the filling-out process smoothly, here are some essential dos and don'ts:

- Do review the entire form before you start filling it out. Understanding every section ensures that you know what information is required.

- Do use black or blue ink when filling out the form by hand. These colors are recognized for their clarity and permanence.

- Do ensure all information is complete and accurate. Double-check figures, such as the loan amount, interest rate, repayment schedule, and any collateral specified.

- Do include specific terms about the interest rate to avoid any ambiguity. Specify whether it’s fixed or variable and how it's calculated.

- Do make a clear distinction between the borrower and the lender by providing full legal names and contact information.

- Don’t leave blanks unfilled. If a section doesn’t apply, consider writing “N/A” (not applicable) to indicate that you didn’t overlook it.

- Don’t sign the form without reviewing it with all parties involved. It’s crucial that both the borrower and the lender agree on the terms stated in the promissory note.

- Don’t forget to make copies of the filled-out form. Each party should have a copy for their records to ensure transparency and accountability.

- Don’t hesitate to seek legal advice if there’s any confusion or uncertainty. Professional guidance can help clarify legal terms and ensure the promissory note is legally binding and enforceable in Georgia.

By following these guidelines, you’ll be better prepared to complete the Georgia Promissory Note form correctly and efficiently. Remember, this document is not only a record of a loan but also serves as protection for both the borrower and the lender. It's in everyone's best interest to handle it with care and attention.

Misconceptions

Misunderstandings about the Georgia Promissory Note form can lead to significant legal and financial mishaps. Here, several common misconceptions are addressed to help clarify the facts surrounding these important financial documents.

- One does not need a witness or notarization for a promissory note to be valid in Georgia. While Georgia law does not strictly require a promissory note to be witnessed or notarized to be considered legally enforceable, having these formalities can add a layer of security and authenticity to the document, making it easier to enforce in a court of law.

- A promissory note is just an informal agreement and does not need to be taken seriously. This misconception could not be further from the truth. A promissory note is a legally binding document wherein the borrower agrees to pay back a specified amount of money to the lender under the terms and conditions they have outlined. Failure to abide by these terms can result in legal action.

- Terms and conditions in a promissory note are not enforceable in Georgia. The terms and conditions set forth in a promissory note are indeed enforceable, provided they do not violate state or federal laws. Both parties should carefully review these terms, as they outline the repayment schedule, interest rates, and what happens in case of a default.

- There's only one standard form of promissory note for use in Georgia. In reality, there are several types of promissory notes, including secured and unsecured notes. The specific type suitable for a transaction depends on the needs and agreement of the parties involved. Customization may be necessary to accurately reflect the terms agreed upon by both the lender and the borrower.

- Promissory notes are only for financial institutions. While banks and other financial institutions frequently use promissory notes, these documents are not exclusive to such entities. Individuals can and often do utilize promissory notes for personal loans, property transactions, and other financial agreements between private parties.

- If the borrower defaults, the lender cannot take legal action if the promissory note is not notarized in Georgia. Even if a promissory note is not notarized, the lender still has the right to seek legal recourse in the event of a default. Notarization is not a prerequisite for enforceability. However, notarization can strengthen the evidence that the parties entered into the agreement.

Understanding these misconceptions about the Georgia Promissory Note form can help parties involved in such agreements approach them with the seriousness and attention to legal detail they require. Proper legal advice should be sought to ensure that the promissory note is correctly drafted and to understand the rights and obligations it entails.

Key takeaways

Understanding how to correctly fill out and use the Georgia Promissory Note form can significantly streamline the lending process between parties and ensure that the agreement complies with Georgia laws. Here are key takeaways to consider:

- Legal Requirements: Georgia promissory notes must comply with state laws, including interest rates and usury laws. It's crucial to ensure the interest rate on the loan does not exceed the legal limit to avoid invalidating the note.

- Details Matter: Accurately filling out the form requires attention to detail. The names and addresses of both the borrower and the lender, the loan amount, and the interest rate must be clearly stated. Ambiguities can lead to disputes or legal challenges.

- Repayment Terms: The note should specify the repayment terms, including the schedule (e.g., monthly payments), any late fees, and the consequences of default. Detailing these terms can prevent misunderstandings and provide clear guidelines for repayment.

- Secured vs. Unsecured: Decide whether the promissory note will be secured by collateral. A secured note requires the borrower to pledge assets as security for the loan, providing the lender with added protection. The decision should be clearly reflected in the document.

- Signatures: For the promissory note to be legally binding, it must be signed by both the borrower and the lender. Witness signatures or notarization may also be required, depending on the nature of the loan and the amount. Verify whether these steps are necessary in your specific situation.

Adhering carefully to these practices when filling out and using a Georgia Promissory Note can help ensure the agreement is enforceable and both parties are protected under state law. Always consider consulting with a legal professional to address specific concerns or complexities.

More Promissory Note State Forms

Promissory Note for Loan - When used in education funding, Promissory Notes detail the terms under which students must repay loans used for tuition, books, and other expenses.

Blank Promissory Note - In the context of personal loans, a promissory note establishes a legal obligation for the borrower to repay the amount borrowed, according to the terms agreed upon.