Fillable Promissory Note Document for Florida

In the state of Florida, individuals looking to formalize a loan agreement can utilize the Florida Promissory Note form, a legal document that outlines the terms and conditions under which money is loaned and is to be repaid. This form serves as a crucial piece of evidence in safeguarding both the lender's and the borrower's interests, establishing a clear timeline for repayment, interest rates applicable, and the consequences of non-payment. Designed with precision to comply with local regulations, the Florida Promissory Note ensures that all parties are on the same page regarding the loan's expectations, thereby reducing the potential for disputes. By specifying the obligations of the borrower, including the repayment schedule, and detailing the lender's rights in cases of default, this document plays a pivotal role in lending transactions. Furthermore, its adaptability to both secured and unsecured loans makes it a versatile tool for various financial agreements, promoting trust and clarity in personal and business relationships across the Sunshine State.

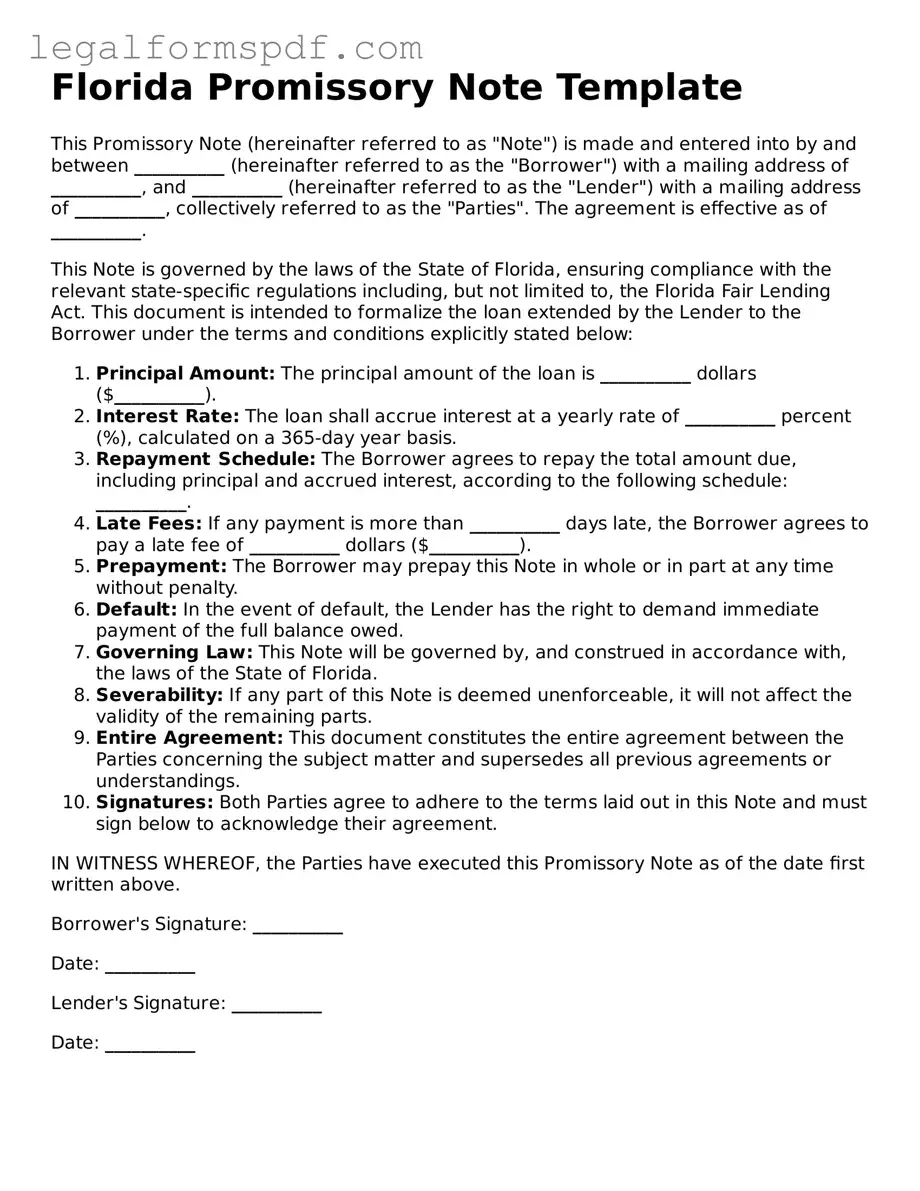

Document Example

Florida Promissory Note Template

This Promissory Note (hereinafter referred to as "Note") is made and entered into by and between __________ (hereinafter referred to as the "Borrower") with a mailing address of __________, and __________ (hereinafter referred to as the "Lender") with a mailing address of __________, collectively referred to as the "Parties". The agreement is effective as of __________.

This Note is governed by the laws of the State of Florida, ensuring compliance with the relevant state-specific regulations including, but not limited to, the Florida Fair Lending Act. This document is intended to formalize the loan extended by the Lender to the Borrower under the terms and conditions explicitly stated below:

- Principal Amount: The principal amount of the loan is __________ dollars ($__________).

- Interest Rate: The loan shall accrue interest at a yearly rate of __________ percent (%), calculated on a 365-day year basis.

- Repayment Schedule: The Borrower agrees to repay the total amount due, including principal and accrued interest, according to the following schedule: __________.

- Late Fees: If any payment is more than __________ days late, the Borrower agrees to pay a late fee of __________ dollars ($__________).

- Prepayment: The Borrower may prepay this Note in whole or in part at any time without penalty.

- Default: In the event of default, the Lender has the right to demand immediate payment of the full balance owed.

- Governing Law: This Note will be governed by, and construed in accordance with, the laws of the State of Florida.

- Severability: If any part of this Note is deemed unenforceable, it will not affect the validity of the remaining parts.

- Entire Agreement: This document constitutes the entire agreement between the Parties concerning the subject matter and supersedes all previous agreements or understandings.

- Signatures: Both Parties agree to adhere to the terms laid out in this Note and must sign below to acknowledge their agreement.

IN WITNESS WHEREOF, the Parties have executed this Promissory Note as of the date first written above.

Borrower's Signature: __________

Date: __________

Lender's Signature: __________

Date: __________

PDF Specifications

| Fact Name | Detail |

|---|---|

| Definition | A Florida Promissory Note is a legal agreement where one party promises in writing to pay a determinate sum of money to the other, either at a fixed or determinable future time or on demand of the payee, under specific terms. |

| Governing Law | Florida Promissory Notes are governed by both Florida state law and federal law, including the Uniform Commercial Code (UCC) as adopted by Florida. |

| Types | There are two main types: secured and unsecured. A secured promissory note requires collateral to back the loan, while an unsecured note does not. |

| Interest Rate | The maximum legal interest rate on a Florida Promissory Note is set by state law. Unless a special exception applies, the general usury limit is 18% for sums under $500,000, and 25% for sums over $500,000. |

| Usury Warning | It is crucial for the note to comply with Florida's usury laws to avoid penalties. Charging an illegal interest rate can lead to forfeiture of all interest and possibly even criminal charges. |

| Signature Requirements | The promissory note must be signed by the maker of the note (the borrower) and can also be signed by a co-signer if one is involved in the agreement. It does not need to be notarized in Florida, but notarization can help enforce the document. |

Instructions on Writing Florida Promissory Note

Once you have decided to create a promissory note in the state of Florida, it is essential to understand how to accurately complete the form. A promissory note is a legal document that outlines the terms and conditions of a loan. The following steps are designed to guide you through the process of filling out the Florida Promissory Note form. By following these steps carefully, you can ensure that the document accurately reflects the agreement between the borrower and the lender.

- Start by entering the date on which the promissory note is being created at the top of the form.

- Write the full legal name of the borrower and the lender in the designated spaces. Include their addresses next to their names.

- Specify the principal loan amount in dollars. This is the amount that the borrower agrees to repay.

- Clearly state the interest rate per annum. This rate should comply with Florida's legal limits to avoid being deemed as usurious.

- Outline the repayment schedule. Detail whether payments are due weekly, monthly, or in a lump sum. Include specific dates if applicable.

- Choose and indicate the type of promissory note: secured or unsecured. If secured, describe the collateral that the borrower is providing as security for the loan.

- Detail any late fees and the grace period before these fees apply. These must also adhere to state regulations.

- Include provisions for dealing with a default on the loan. This should describe the steps the lender will take if the borrower fails to make payments as agreed.

- Specify if there are any prepayment penalties or if the borrower is allowed to pay the loan off early without extra charges.

- Both the borrower and the lender should sign and date the form. Witness signatures may also be required, depending on state law.

After the Florida Promissory Note form is fully completed and signed, it is important to keep a copy in a safe place. Both the lender and the borrower should retain a copy for their records. This document serves as a legally binding agreement that outlines the obligations of each party, and it can be used in legal proceedings if disputes arise concerning the loan.

Understanding Florida Promissory Note

What is a Florida Promissory Note form?

A Florida Promissory Note form is a legal document that outlines an agreement between two parties, where one party (the borrower) promises to repay a sum of money to the other party (the lender). This form specifies the loan amount, interest rate, repayment schedule, and any other terms agreed upon by both parties.

Is a Florida Promissory Note form legally binding?

Yes, a Florida Promissory Note form is legally binding if it meets the requirements set forth by Florida law. This means it must be signed by both parties and should include essential details such as the amount borrowed, interest rate, repayment terms, and the parties' signatures.

Do I need a witness or notary for a Florida Promissory Note?

While Florida law does not require a witness or notary for a promissory note to be legally binding, having the document notarized or witnessed can add an extra layer of authenticity and may help in the enforcement of the note.

How can interest rates be determined in a Florida Promissory Note?

Interest rates in a Florida Promissory Note can be determined by the agreement between the borrower and lender. However, it is important to note that the interest rate must comply with Florida’s usury laws to avoid charging an illegal amount of interest.

Can a Florida Promissory Note be modified?

Yes, a Florida Promissory Note can be modified if both the borrower and the lender agree to the changes. The modifications should be made in writing and signed by both parties, to ensure the agreement remains enforceable.

What happens if the borrower fails to repay according to the Florida Promissory Note?

If the borrower fails to make payments as agreed in the Florida Promissory Note, the lender has the right to pursue legal action to recover the debt. The specific remedies available to the lender can include filing a lawsuit to enforce the repayment or taking other legal actions allowed under Florida law.

Can a Florida Promissory Note be used for personal loans between friends or family?

Yes, a Florida Promissory Note can be used for personal loans between friends or family. It’s a good practice to formalize the loan agreement to clarify the terms and protect the relationship should any disputes arise over the repayment terms.

Common mistakes

Filling out the Florida Promissory Note form can seem straightforward, but many people often overlook crucial details that could lead to issues down the line. One common mistake is not specifying the exact date the loan was issued or terms commenced. This can create confusion about when payments should start or when the loan should be fully repaid.

Another frequent error is failing to clearly outline the repayment schedule. Whether it's monthly, quarterly, or on another basis, the repayment terms need to be clearly defined to avoid misunderstandings between the lender and the borrower. Without this clarity, disputes over missed or late payments are more likely to arise.

People often underestimate the importance of defining the interest rate correctly. In Florida, the interest rate on a promissory note must not exceed the state's usury limit unless certain exceptions apply. An incorrectly stated interest rate can render the agreement void or subject to legal scrutiny, which could be unfavorable for both parties involved.

Not including a clause about late fees or charges for missed payments is another oversight. This omission can leave the lender without recourse in encouraging timely payments. Conversely, it's important for borrowers to be aware of any additional charges they may incur to avoid surprises.

Skipping the inclusion of a security agreement, if applicable, is a mistake that diminishes the lender's protection. If the loan is supposed to be secured by collateral, this must be explicitly mentioned, along with a description of the collateral. Neglecting this can complicate the process of recourse for the lender if the borrower defaults.

A number of individuals forget to print and sign their names at the end of the document. An unsigned promissory note is not legally binding, which fundamentally undermines the purpose of creating the document in the first place. Both parties must sign to acknowledge their understanding and agreement to the terms.

Another error is not considering the legal necessity of having the document witnessed or notarized, depending on the type and amount of the loan. While not always required, this step can lend authenticity to the document and protect against claims of forgery or disputes about its validity.

Omitting the full legal names and addresses of all parties involved is a surprisingly common mistake. This can lead to confusion or difficulty in enforcing the note, especially if there is more than one person on either side of the agreement. Clear identification is crucial for the enforceability of the document.

Lack of clarity on the course of action if the borrower defaults is another overlooked detail. Without a predefined process, resolving such a situation can become significantly more complicated and may require costly legal intervention.

Lastly, some people fail to include an amendment clause, which outlines how changes to the agreement should be made. This is important because circumstances change, and the promissory note may need to be amended in the future. Without such a clause, modifications could be deemed invalid.

In all, while filling out a Florida Promissory Note form might seem easy at first glance, paying attention to these details can prevent a multitude of problems. Ensuring clarity, legality, and completeness from the outset can save both the lender and borrower time and legal expenses later on.

Documents used along the form

When dealing with a Florida Promissory Note, a crucial legal instrument for outlining repayment terms between a lender and a borrower, it's important to understand that it often comes with additional documents. These documents provide a comprehensive legal framework, ensuring clarity and enforceability of the loan agreement. Below are commonly used forms and documents that support or are used in conjunction with a Florida Promissory Note.

- Mortgage Agreement: Offers legal protection for the lender by securing the loan with the borrower’s property. This ensures the lender can foreclose on the property if the borrower defaults on the promissory note obligations.

- Loan Agreement: A detailed contract that outlines the terms of the loan, including interest rates, repayment schedule, and the responsibilities of each party. It is more comprehensive than a promissory note.

- Security Agreement: Establishes a lien on a specific asset, providing the lender with a claim to the asset if the loan is not repaid as agreed.

- Personal Guarantee: A promise made by a third party to repay the loan if the original borrower fails to do so. This adds an additional layer of security for the lender.

- Amortization Schedule: Breaks down each loan payment over time into principal and interest, providing a clear timeline for the borrower on when the loan will be repaid in full.

- UCC-1 Financing Statement: Filed with the state, this document is used to publicly declare the lender’s interest in the collateral offered by the borrower in secured loans.

- Deed of Trust: Similar to a Mortgage Agreement, it involves a trustee who holds the property’s title until the loan is fully repaid. It's commonly used in some states instead of a mortgage.

- Lien Waiver: Document in which the lender agrees to waive their rights to a secured interest in the borrower’s assets after a specific condition, typically the full repayment of the loan, is met.

- Default Notice: A formal notice sent by the lender to the borrower indicating that the borrower has failed to meet their obligations under the terms of the promissory note and/or related agreements.

Together, these documents form a solid legal foundation for both the lender and the borrower, ensuring that all parties are aware of their rights and responsibilities. It is critical to consult with legal professionals to ensure that all paperwork is correctly executed and aligns with Florida law, providing all parties with the necessary legal protections and clarity on the loan agreement.

Similar forms

Similar to the Florida Promissory Note form, a Mortgage Agreement is a binding document between a borrower and a lender where the borrower pledges real estate as collateral for a loan. This similarity lies in the financial obligation the borrower agrees to, and both documents outline repayment terms, interest rates, and the consequences of non-payment. However, the Mortgage Agreement specifically ties the debt to a real property, offering the lender security through a lien on the property.

Another document akin to the Florida Promissory Note is the Personal Loan Agreement. This agreement outlines the terms under which one party lends money to another. The parallels include details about the loan amount, repayment schedule, interest rate, and actions to be taken in the event of default. What sets them apart is the Personal Loan Agreement's broader application to various types of loans, not limited to a promissory note's formal structure or specific legal standing in Florida.

The IOU (I Owe You) document also shares characteristics with the Promissory Note, serving as an acknowledgment of debt. Though less formal, an IOU specifies the debtor and the amount owed. Unlike the more detailed Promissory Note, IOUs typically lack comprehensive terms like repayment schedules and interest rates, making them less enforceable but similar in their basic function of acknowledging debt.

A Student Loan Agreement, specifically tailored for educational purposes, is comparable to the Promissory Note. It outlines the borrowing terms for a student, including the loan amount, interest rate, and repayment conditions. Both documents are legally binding and set forth the obligations of the borrower. The Student Loan Agreement, however, is distinguished by its focus on funding education and may involve specific conditions related to the student's academic performance or attendance.

The Car Loan Agreement, similar to the Promissory Note, is a contract that specifies the terms under which a lender provides a loan to purchase a vehicle. Key similarities include the loan amount, interest rate, and repayment obligations. The distinction lies in the Car Loan Agreement's focus on auto loans, often including specific details like the vehicle's identification number (VIN), make, model, and any warranties.

A Business Loan Agreement shares many elements with the Florida Promissory Note form, particularly in setting terms for a loan, including repayment schedules and interest. Designed for business financing, these agreements also detail the purpose of the loan and any business-specific conditions, like financial performance requirements or the use of the loan exclusively for business expenses.

The Line of Credit Agreement, while offering more flexibility than a Promissory Note, sets up a borrowing limit that a borrower can draw against, repay, and then borrow from again. It details interest rates, repayment terms, and fees, much like a Promissory Note. The primary difference is the revolving nature of the credit, as opposed to a lump sum loan outlined in a Promissory Note.

Lastly, the Lease Agreement, while primarily used for rental agreements for property or equipment, shares the contractual nature of setting terms between parties. Similar to a Promissory Note, it outlines the financial obligations of the leaseholder (similar to the borrower) toward the leaser (similar to the lender) including payments, security deposits, and breach of contract terms. The main difference is that a Lease Agreement typically involves payment in exchange for the use of property, unlike a monetary loan.

Dos and Don'ts

When filling out the Florida Promissory Note form, it is essential to approach this task with care. To ensure that the form is completed accurately and effectively, here are five things you should do and five things you shouldn't do.

Things You Should Do:

- Verify the identities of both the borrower and the lender, including their legal names and addresses, to ensure the note is enforceable.

- Clearly state the loan amount in USD to avoid any confusion regarding the currency or the total amount being borrowed.

- Include the interest rate in the agreement, ensuring it complies with Florida's usury laws to avoid legal penalties.

- Define the repayment schedule in detail, including the due dates, to establish clear expectations for both parties.

- Have all parties sign and date the document in front of a notary public to enhance its legal enforceability and validity.

Things You Shouldn't Do:

- Avoid leaving any sections blank, as incomplete information can lead to misunderstandings or legal disputes.

- Do not use vague terms for the repayment schedule or the loan's conditions, as clarity is critical for enforceability.

- Refrain from setting an interest rate that exceeds Florida's legal limit, as doing so can render the note void and subject you to legal consequences.

- Do not forget to include any agreed-upon collateral if the loan is secured, as this detail is essential for protecting the lender's interests.

- Avoid relying solely on verbal agreements or promises that are not reflected in the written promissory note, as written agreements are crucial for legal enforcement.

Misconceptions

In the realm of financial agreements, promissory notes are crucial for setting out the terms of a loan in clear, unambiguous language. Particularly in Florida, the promissory note form carries its own set of rules and common misunderstandings. This list aims to clarify some of the most prevalent misconceptions about the Florida Promissory Note form:

Any form will do. It’s a common belief that any generic promissory note template can serve the purpose. However, Florida law has specific requirements that may not be covered by an out-of-state or generic document. It’s essential to use a form designed with Florida’s legal requirements in mind.

It's only for real estate transactions. While promissory notes are often associated with mortgages, they can be used for a wide range of loans, including personal loans between individuals. They are flexible documents that can cover various lending scenarios beyond real estate.

Interest rates are negotiable. While it's true that the parties can negotiate interest rates, Florida law sets a ceiling on how high these rates can go to prevent usury. Understanding these legal caps is crucial to ensure that a promissory note remains enforceable and fair.

No need for witnesses or notarization. Although not every state requires a promissory note to be witnessed or notarized, Florida law has specific stipulations about these requirements, especially for notes related to real estate. Ignoring these requisites can impact the document's legal enforceability.

A verbal agreement is just as binding. While verbal contracts can be enforceable under certain conditions, a written promissory note is far more definitive and easier to uphold in Florida courts. Relying on verbal agreements opens up risks of misunderstanding and difficulty in proving terms.

It must be paid off at a set date. Not all promissory notes have a fixed end date. Some are based on demand, which means repayment is requested at a specific time determined by the lender, not set in stone at the issuance of the note.

Collateral must be involved. While many promissory notes are secured by collateral, especially in significant amounts or real estate transactions, it’s not a mandatory element. An unsecured promissory note is still a valid, legal agreement; however, it poses a higher risk to the lender.

Only the borrower needs to sign. It’s a widespread assumption that only the borrower’s signature is necessary. Actually, Florida law requires both parties in the agreement to sign the promissory note to make it valid and binding.

Late fees and penalties don’t need to be outlined. Failing to specify the conditions under which late fees or penalties apply can lead to disputes and difficulties in enforcing these terms. Precisely outlining any additional costs associated with late payments is critical for clarity and enforceability.

Amendments require issuing a new note. It's often believed that any changes to the terms of a promissory note necessitate drafting a new document. In reality, amendments can typically be made through a written agreement between the parties, as long as both agree and sign off on the changes, avoiding the need to start from scratch.

Understanding the nuances of Florida's requirements for promissory notes can save parties from potential legal headaches and financial loss. When in doubt, consulting with a legal professional knowledgeable in Florida’s specific provisions can provide guidance and peace of mind.

Key takeaways

Filling out and using the Florida Promissory Note form is a straightforward process, but it's crucial to get it right. This document is a legal agreement where one party promises to pay another a certain amount of money under specified conditions. Here are some key takeaways to ensure you're on the right track:

- Clearly Identify the Parties: Start by accurately naming the lender and borrower. These are the individuals or entities entering the agreement, and their legal names and addresses should be on the form.

- Specify the Loan Amount: The principal amount, which is the money being lent before interest, must be clearly written in the document.

- Detail the Interest Rate: Florida law dictates the maximum interest rate that can be charged. Ensure the rate is legal and clearly specified in the promissory note.

- Define the Repayment Schedule: The document should outline how and when the loan will be repaid. This could be in installments, a lump sum, or on demand, among other methods.

- Include Late Fees and Penalties: If applicable, the note should detail any fees for late payments or penalties for defaulting on the loan.

- Secured or Unsecured: Clarify whether the loan is secured by collateral. If it is, describe the collateral. If not, state that the note is unsecured.

- Co-signer Information: If there is a co-signer guaranteeing payment, their information and signature should also be included.

- Governing Law: Specify that Florida law governs the note. This is important for enforcement and interpretation of the agreement.

- Signatures: Ensure both the borrower and lender (and the co-signer, if applicable) sign the promissory note. These signatures legally bind the parties to the agreement.

- Keep Records: Both parties should keep a signed copy of the promissory note for their records. This document is crucial evidence of the loan terms and agreement.

Understanding these key aspects will help ensure that the Florida Promissory Note form is correctly filled out and legally binding. It's a practical step to formalize a loan, providing security and clarity to both the lender and the borrower.

More Promissory Note State Forms

Texas Promissory Note - In personal finance, it can be used to formalize loans for big purchases like cars or significant personal events.

Blank Promissory Note - A promissory note must be signed by the borrower to be considered legally binding and enforceable.

Promissory Note Template Ohio - The promissory note can be secured or unsecured, offering flexibility depending on the agreement's nature.