Fillable Promissory Note Document for California

In the diverse realm of financial agreements, the California Promissory Note form stands out as a pivotal document for both lenders and borrowers within the state. This legal instrument, tailored specifically to adhere to California's unique statutes and regulations, operates as a formal commitment by a borrower to repay a specified sum of money to a lender under agreed-upon terms. The essence of such a note lies in its detailed encapsulation of crucial elements, including the loan amount, interest rate, repayment schedule, and any collateral involved, thus ensuring clarity and enforceability. By fortifying the financial arrangement with such precision, the form not only serves to protect the involved parties' interests but also fosters a sense of security and trust. Hence, navigating through the intricacies of the California Promissory Note form, while understanding its legal implications and the responsibilities it imposes, becomes imperative for anyone engaged in lending or borrowing transactions within the state's boundaries.

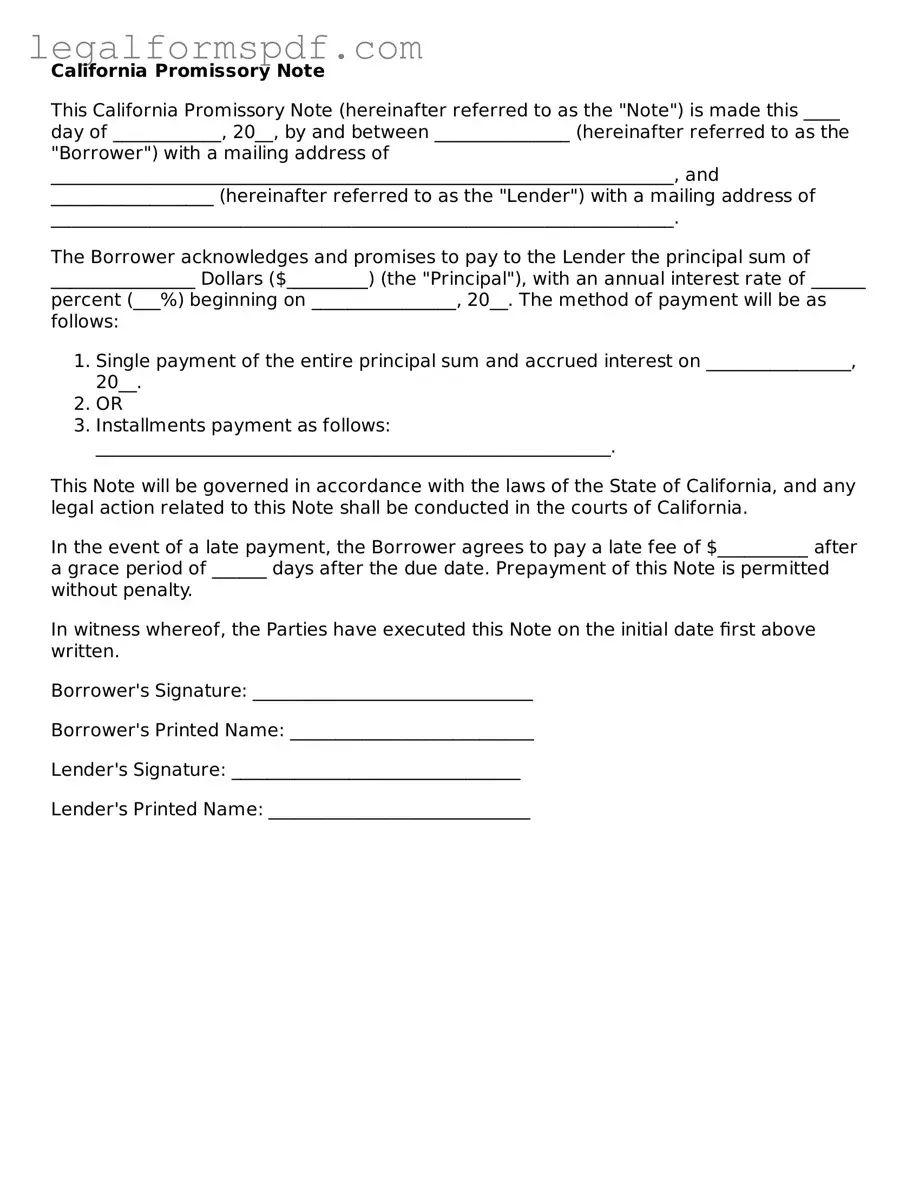

Document Example

California Promissory Note

This California Promissory Note (hereinafter referred to as the "Note") is made this ____ day of ____________, 20__, by and between _______________ (hereinafter referred to as the "Borrower") with a mailing address of _____________________________________________________________________, and __________________ (hereinafter referred to as the "Lender") with a mailing address of _____________________________________________________________________.

The Borrower acknowledges and promises to pay to the Lender the principal sum of ________________ Dollars ($_________) (the "Principal"), with an annual interest rate of ______ percent (___%) beginning on ________________, 20__. The method of payment will be as follows:

- Single payment of the entire principal sum and accrued interest on ________________, 20__.

- OR

- Installments payment as follows: _________________________________________________________.

This Note will be governed in accordance with the laws of the State of California, and any legal action related to this Note shall be conducted in the courts of California.

In the event of a late payment, the Borrower agrees to pay a late fee of $__________ after a grace period of ______ days after the due date. Prepayment of this Note is permitted without penalty.

In witness whereof, the Parties have executed this Note on the initial date first above written.

Borrower's Signature: _______________________________

Borrower's Printed Name: ___________________________

Lender's Signature: ________________________________

Lender's Printed Name: _____________________________

PDF Specifications

| Fact | Description |

|---|---|

| 1. Purpose | A California Promissory Note form is used to document a loan agreement between a lender and a borrower. |

| 2. Types | There are two main types: secured and unsecured. A secured note requires collateral, whereas an unsecured note does not. |

| 3. Interest Rate | The maximum interest rate allowed without a written agreement is 10% per annum. |

| 4. Usury Laws | California's usury laws cap the amount of interest that can be charged on a loan to prevent predatory lending practices. |

| 5. Governing Law | California promissory notes are governed by the California Civil Code, Sections 1916-1916.7. |

| 6. Co-Signer | A co-signer can be included to provide additional security for the lender. |

| 7. Repayment Schedule | The form must detail the repayment schedule, including the amount, frequency, and number of payments. |

| 8. Default Terms | The conditions under which the borrower is considered in default should be clearly stated. |

| 9. Late Fees | The promissory note can include terms regarding late fees, specifying the amount and conditions for imposition. |

| 10. Prepayment | The note may specify if the borrower is allowed to pay off the loan early and if any penalties apply for prepayment. |

Instructions on Writing California Promissory Note

After signing a promissory note in California, the next steps involve setting up a payment schedule and adhering to it according to the terms agreed upon in the promissory note. This document ensures a borrower's promise to repay a loan to a lender, setting the stage for a contractual commitment. Repayment should follow the guidelines stated in the note, which typically includes the amount borrowed, interest rate, repayment schedule, and consequences of non-payment. Properly filling out the promissory note is crucial for the legitimacy and enforceability of the agreement.

- Start by entering the date of the note at the top of the form.

- Write the full name of the borrower and the lender along with their respective mailing addresses.

- Specify the principal loan amount in US dollars.

- Document the interest rate per annum. California's usury laws may cap the maximum interest rate, so ensure compliance with current state regulations.

- Choose the type of repayment structure (e.g., interest-only, lump sum, installments) and detail the repayment terms, including frequency of payments and the due date for the final payment.

- If there are any agreed-upon collateral items securing the loan, describe these comprehensively in the section provided.

- Include clauses regarding late fees and conditions under which the lender can declare the full balance due immediately (acceleration).

- State the legal actions that will be taken in case of default by the borrower.

- Both the borrower and the lender must sign and date the document in front of a notary public. If witnesses are required or deemed necessary, make sure the witness(es) also sign and date the promissory note.

- Keep multiple copies of the promissory note for both the borrower's and the lender's records, ensuring both parties have access to the signed agreement.

Upon completion, it's important that all parties involved fully understand their obligations as outlined in the promissory note. Both the borrower and the lender should keep the document in a secure location for reference. Regular communication between the borrower and the lender can further ensure that repayment is proceeding as planned. For legal enforcement or in case of discrepancies, it is advisable to consult a legal professional familiar with California's lending laws.

Understanding California Promissory Note

What exactly is a California Promissory Note?

A California Promissory Note is a legal agreement used to document a loan between two parties in the state of California. It outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and the consequences of non-payment. This document serves as a binding commitment by the borrower to repay the lender, providing a clear record of the loan that can be enforceable in court, if necessary.

Is a written Promissory Note required in California?

While verbal agreements can be legally binding in certain situations, a written Promissory Note is highly recommended in California for loans of money. The statute of limitations for written contracts, including promissory notes, is four years in California, compared to only two years for oral contracts. Having a written document provides clarity and a secure record of the terms agreed upon by both parties, which can be crucial in the event of a dispute or if legal action becomes necessary.

How does one ensure that a Promissory Note is legally binding in California?

To ensure a Promissory Note is legally binding in California, it must include specific elements: the names of the lender and borrower, the amount of money being loaned, the interest rate, repayment schedule, and the signatures of both parties involved. Additionally, it is recommended to have the note witnessed or notarized, although it is not strictly necessary for legality. Importantly, the terms of the Promissory Note must comply with California’s regulations, particularly concerning interest rates and lending practices, to safeguard against it being deemed usurious or unfair.

Can modifications be made to a Promissory Note after it has been signed?

Yes, modifications can be made to a Promissory Note after it has been signed, but any changes require the agreement of both the lender and the borrower. These changes must be documented in writing and attached to the original Promissory Note, or by preparing a new Promissory Note that both parties will sign. It's vital to clearly document any and all amendments to ensure they are legally enforceable and to maintain a transparent record of the agreed-upon terms.

Common mistakes

Overlooking the Necessity of Precise Details: A common misstep individuals encounter when filling out a California Promissory Note form is not including detailed information. It is crucial to specify the names of the borrower and lender, along with their full addresses. This specificity not only clarifies the parties involved but also aids in the enforceability of the agreement.

Ignoring the Importance of Interest Rates: Another regularly overlooked element is neglecting to specify the interest rate. In California, the law mandates that a promissory note must contain an interest rate to avoid being considered as a gift or subject to legal scrutiny for usury. Setting a clear, agreed-upon interest rate ensures compliance with state laws and reduces future disputes.

Forgetting to Mention Payment Terms: Many people fail to detail the repayment schedule, which is a critical component of the promissory note. Clearly outlining whether the loan is to be repaid in installments, a lump sum, or on demand creates a transparent agreement between lender and borrower, minimizing misunderstandings about payment obligations.

Omitting the Consequences of Default: Failures often occur when individuals do not define the consequences of default on the loan. Addressing what constitutes a default, such as missed payments, and specifying the actions that can be taken, like calling the full loan due immediately, protects the lender and informs the borrower of the seriousness of their commitment.

Not Securing the Loan: Some people choose not to secure the loan with collateral. While not always necessary, including collateral can offer protection to the lender if the borrower defaults. Deciding whether to secure the loan and clearly stating it in the promissory note is a vital step that should not be ignored.

Disregarding the Significance of Signatures: A surprisingly common error is not having the promissory note signed by both parties. Signatures are essential for the document to be considered legally binding. Moreover, depending on the amount of the loan and the parties' preferences, notarization might also be advisable to further validate the authenticity of the signatures.

Skipping Legal Advice: Lastly, a significant misstep is filling out the promissory note without seeking legal advice. Given the complexities of state laws and the potential for personal and financial consequences, consulting a legal professional can ensure that the promissory note meets all legal requirements and protects the interests of both parties.

Documents used along the form

When dealing with the process of lending or borrowing money in California, the Promissory Note form plays a crucial role in outlining the repayment terms between the borrower and the lender. However, this form does not stand alone. Several other documents are often utilized alongside the Promissory Note to ensure a comprehensive and secure transaction. These additional forms help in detailing the terms, conditions, and legal obligations more extensively, safeguarding both parties' interests throughout the duration of the loan agreement.

- Loan Agreement: This document complements the Promissory Note by specifying the terms and conditions of the loan in more detail. It includes clauses on interest rates, repayment schedules, and what happens in case of default.

- Security Agreement: If the loan is secured by collateral, this document outlines the details of that collateral. It describes the borrower's pledge of certain assets to secure the repayment of the debt.

- Amortization Schedule: This is a table detailing each periodic payment on a loan over time. It breaks down the amount going towards interest and the amount applied to the principal balance.

- Guaranty: Required if there is a third party guarantor for the loan, this document outlines the guarantor's liability and the conditions under which they would be required to fulfill the repayment of the loan.

- Notice of Default: A document that specifies the procedure and consequences in case the borrower fails to make payments as per the agreed terms in the Promissory Note and Loan Agreement.

- Release of Promissory Note: This document is issued once the loan is fully paid off. It indicates that the borrower has fulfilled their repayment obligations and releases them from further liability.

- Modification Agreement: If both parties agree to modify any of the terms of the original Promissory Note or Loan Agreement, this document outlines those changes and updates the original agreement.

- Deed of Trust: In cases where real estate is used as collateral, a Deed of Trust is required. It grants a trustee the power to sell the property if the borrower defaults on the loan.

When entering a lending agreement, it's essential for both the borrower and the lender to be well-informed and prepared. Understanding and using these documents in conjunction with the California Promissory Note can provide a solid foundation for that agreement. It ensures clarity and legal protection, minimizing the risk of future disputes. For anyone involved in a loan transaction, familiarization with these forms and documents is a critical step towards achieving a successful financial outcome.

Similar forms

The California Promissory Note form shares similarities with a Loan Agreement, primarily through their function of documenting the terms and conditions under which money is borrowed and repaid. Both outline the amount loaned, interest rates, repayment schedule, and the consequences of defaulting. The key difference often lies in the level of detail, with loan agreements typically providing more exhaustive terms and conditions, including covenants, representations, warranties, and conditions precedents.

Similar to a Mortgage Agreement, the Promissory Note may also secure a loan through collateral, typically real estate. While the Mortgage Agreement specifically creates a lien on the property as security for the loan, a Promissory Note might mention the collateral but focuses on the borrower's promise to repay the amount. Both documents are integral in real estate transactions, ensuring the lender's interest is protected and specifying foreclosure rights in the event of non-payment.

The similarity with a Deed of Trust is evident, as both can be used in financing real property. In states where Deeds of Trust are utilized, this document, along with a Promissory Note, outlines the borrower's obligation to repay the loan, while the Deed of Trust transfers legal title to a trustee as collateral for the loan. The trustee holds the property's title until the borrower fulfills the terms of the Promissory Note, paralleling the role of collateral in both documents.

The IOU (I Owe You) is another document similar to the Promissory Note; it acknowledges that a debt exists and promises repayment. However, the IOU is typically less formal and does not detail the repayment terms, interest rates, or collateral. Despite these differences, both serve as written promises to pay a specific amount, making them foundational for personal and small-scale lending.

A Bill of Sale, while primarily confirming the transfer of ownership of goods or property from seller to buyer, shares a commonality with the Promissory Note when the latter includes clauses about securing the debt with personal property. This similarity can be seen when a Promissory Note specifies items as collateral, should the borrower default, reminiscent of the property mentioned in a Bill of Sale.

Comparatively, an Installment Agreement is akin to a Promissory Note that stipulates repayment over a set period in defined amounts. Both documents outline the terms of repayment for a debt, including the schedule and amounts due at each installment. However, an Installistment Agreement might include more comprehensive details on late fees and consequences of default, similar to some Promissory Notes.

In the realm of business transactions, a Corporate Bond mirrors the Promissory Note by representing a formal commitment by the entity to repay borrowed funds with interest. Corporate Bonds, issued by companies to raise capital, detail the repayment terms, interest rates, and maturity date, akin to the essential elements of a Promissory Note. The difference primarily lies in the scale and formalities involved, with corporate bonds engaging in broader public markets.

Lastly, a Student Loan Agreement, tailored specifically for educational borrowing, aligns closely with a Promissory Note in its promise of repayment under defined terms. Both outline the amount borrowed, interest rate, repayment schedule, and consequences if the borrower fails to comply with the terms. The specificity of the Student Loan Agreement to educational expenses represents a more focused application of the general principles underpinning a Promissory Note.

Dos and Don'ts

When filling out the California Promissory Note form, individuals are undertaking a significant financial agreement. This legal document, crucial for both lender and borrower, should be approached with a thorough understanding of its terms and implications. Below, guidance is provided to navigate this process effectively, ensuring that this financial commitment is handled with the necessary care and attention to detail.

What You Should Do

- Ensure all parties involved have their complete legal names, addresses, and contact information accurately included. This clarity in identification aids in the enforceability of the agreement.

- Clearly specify the loan amount and the interest rate, adhering to California's usury laws to prevent legal complications. This transparency in financial terms prevents future misunderstandings.

- Define the repayment schedule in detail, including due dates, amounts, and the final payment date. This schedule acts as a roadmap for the borrower's obligations and ensures both parties are aligned on expectations.

- Sign and date the document in the presence of a notary public if required. This formalization of the agreement lends it legal credibility and may aid in its enforcement.

What You Shouldn't Do

- Overlook the requirement to provide a detailed purpose for the loan if applicable. Stating the purpose can sometimes be vital, especially for loans that are intended for specific uses.

- Ignore state-specific regulations, such as maximum allowable interest rates. Failure to adhere to these can render the promissory note unenforceable and possibly subject to penalties.

- Leave blanks in the document. Incomplete forms may lead to disputes or a lack of legal standing. It is essential that every applicable section is filled with accurate information.

- Forget to keep a copy of the fully executed document for your records. Both the lender and the borrower should have a copy, ensuring that there is evidence of the agreement and its terms.

Misconceptions

When dealing with the California Promissory Note form, several misconceptions may arise due to its complex nature and the specific legal requirements of California. Understanding these misunderstandings is crucial for individuals to manage their obligations and rights accurately. Below are five of the most common misconceptions associated with the California Promissory Note form.

- All promissory notes are the same: A common misconception is the belief that all promissory notes are identical, regardless of the state in which they are executed. However, California law may impose specific requirements or provisions that can significantly alter the legal and financial obligations of the parties involved. Therefore, it is essential to recognize the unique aspects of the California Promissory Note form.

- Legal representation is unnecessary: Many individuals assume that executing a promissory note in California is straightforward and does not require professional legal advice. This presumption can lead to significant legal and financial consequences. Considering the potential complexities and legal requirements of California law, consulting with a knowledgeable attorney is advisable to ensure the note's enforceability and compliance with state regulations.

- Verbal agreements are sufficient: While certain verbal agreements may be legally binding, relying solely on verbal promises when creating a promissory note poses substantial risks. California law, along with the statute of frauds, typically requires that agreements involving the borrowing of money be in writing to be enforceable. Thus, a properly drafted and executed promissory note is essential for protecting the interests of both parties.

- Interest rates can be freely agreed upon: Another misconception is that the lender and borrower can agree on any interest rate, regardless of its level. However, California has usury laws that cap the maximum interest rate which can be charged. If a promissory note stipulates an interest rate exceeding the legal limit, it can lead to penalties for the lender and potentially render the interest provision unenforceable.

- Securing the note is optional: Finally, there is often a misunderstanding about the need to secure a promissory note with collateral. While not all promissory notes are secured, deciding whether to secure a note involves understanding the implications for both the borrower and lender. In California, securing a note with collateral can provide lenders with additional remedies in the event of a default, but it also imposes additional obligations under state law to properly record and enforce such security interests.

Navigating the specifics of the California Promissory Note form requires a detailed understanding of state laws and a keen awareness of the common misconceptions surrounding its use. This will ensure that both lenders and borrowers are fully informed of their rights and obligations, leading to a more stable and enforceable agreement.

Key takeaways

In California, using a Promissory Note form is a critical step in ensuring that both the borrower and lender are clear about the terms of a loan. This document is legally binding and outlines the repayment plan, interest rates, and the consequences of non-payment. When dealing with a Promissory Note, it is crucial to handle it with precision and thorough understanding, making sure all involved parties are well-informed. Below are seven key takeaways to consider when filling out and using the California Promissory Note form:

- Accuracy is paramount: Ensure all personal information for both the lender and borrower, including legal names and addresses, is accurately recorded. This helps in verifying the parties involved and enforcing the agreement, if necessary.

- Define the loan terms clearly: Specify the loan amount, interest rate, repayment schedule, and any applicable fees in clear terms. This avoids any ambiguity and ensures both parties have the same expectations regarding the loan’s terms.

- State the interest rate: California law requires the promissory note to include the interest rate. It’s essential to ensure this rate complies with the state's usury laws to prevent it from being deemed illegal.

- Choose the right type of note: Decide whether the note will be secured or unsecured. A secured note requires collateral from the borrower, offering the lender protection against default. An unsecured note does not require collateral but may come with a higher interest rate due to increased risk.

- Include a co-signer if necessary: If the borrower's credit history or financial stability is in question, considering a co-signer can provide additional security for the loan. This individual would also be legally responsible for repayment if the primary borrower fails to meet the obligations.

- Detail the repayment plan: Clearly outline how and when the loan will be repaid. This can include the frequency of payments (e.g., monthly), the amount of each payment, and the duration of the loan period. Clarity in this section prevents misunderstandings and potential disputes.

- Understand the legal implications: Both parties should be aware of the legal ramifications of the promissory note. This includes understanding the actions that can be taken in the event of a default, such as initiating a lawsuit or seizing collateral. Awareness and acknowledgment of these implications at the outset can motivate timely repayment and adherence to the agreed terms.

Adhering to these key points can significantly reduce risks and misunderstandings in loan transactions. Before signing, both lender and borrower should review the document thoroughly to ensure it accurately reflects the agreed-upon terms. Engaging a legal professional for advice or to review the document can also provide additional assurance that the Promissory Note complies with California laws and regulations.

More Promissory Note State Forms

Michigan Promissory Note - It often includes a provision for late fees and collection costs if the borrower defaults.

Promissory Note Illinois - The document can include specifics about the method of repayment, such as lump sum payments or installments.