Official Promissory Note Document

In the landscape of borrowing and lending, the Promissory Note stands as a critical document that outlines the terms under which money is borrowed and must be repaid. This binding agreement serves not only as a legal obligation for the borrower to repay the loan but also provides a clear and detailed record of the loan amount, interest rate, repayment schedule, and any other conditions agreed upon by the parties involved. The versatility of the Promissory Note allows it to be used in a variety of lending transactions, from personal loans between friends and family members to more formal business and real estate financing. Its significance extends beyond its legal enforceability; the form acts as a tangible manifestation of trust between the lender and borrower, setting clear expectations and formalizing the loan process. Understanding the components and importance of a Promissory Note is essential for anyone involved in the act of lending or borrowing, ensuring that all parties are aware of their rights and obligations within the financial transaction.

State-specific Information for Promissory Note Forms

Promissory Note Form Subtypes

Document Example

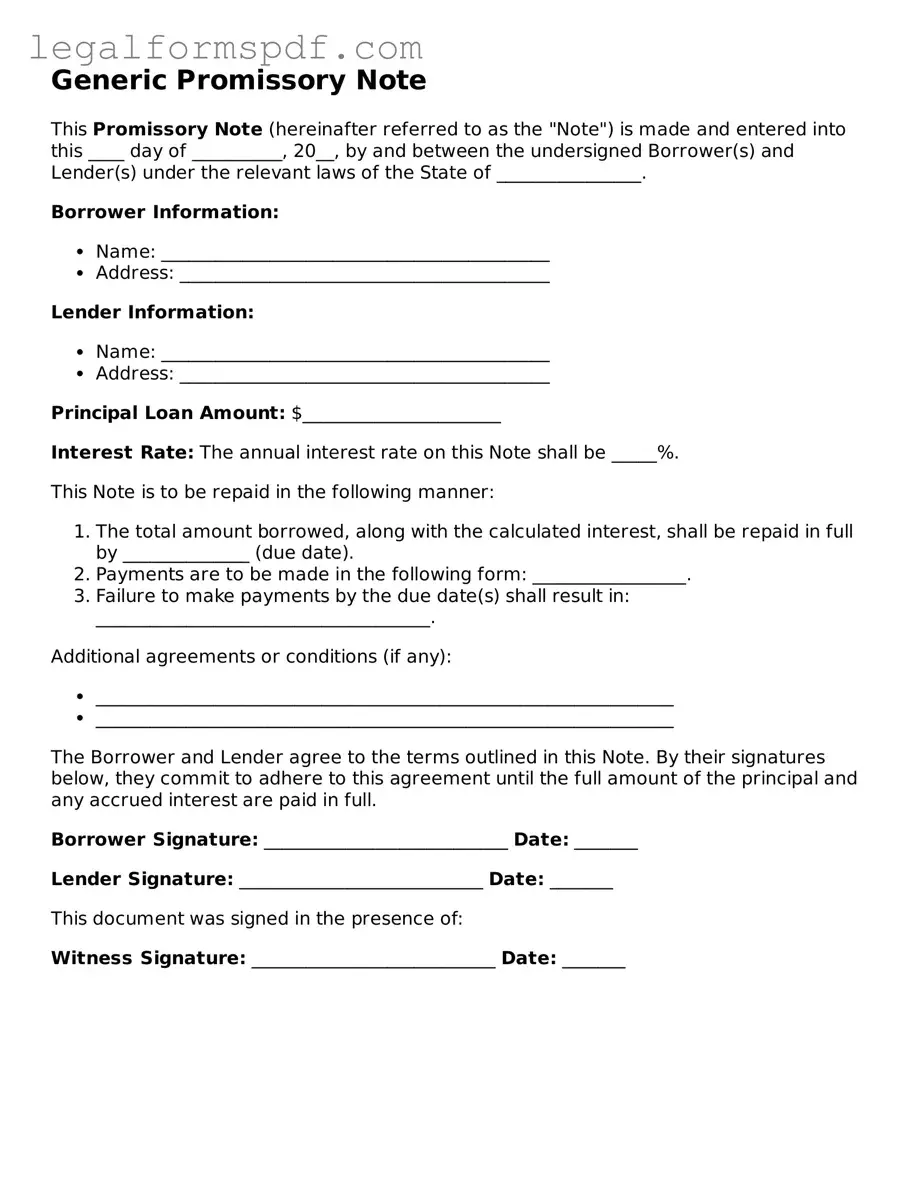

Generic Promissory Note

This Promissory Note (hereinafter referred to as the "Note") is made and entered into this ____ day of __________, 20__, by and between the undersigned Borrower(s) and Lender(s) under the relevant laws of the State of ________________.

Borrower Information:

- Name: ___________________________________________

- Address: _________________________________________

Lender Information:

- Name: ___________________________________________

- Address: _________________________________________

Principal Loan Amount: $______________________

Interest Rate: The annual interest rate on this Note shall be _____%.

This Note is to be repaid in the following manner:

- The total amount borrowed, along with the calculated interest, shall be repaid in full by ______________ (due date).

- Payments are to be made in the following form: _________________.

- Failure to make payments by the due date(s) shall result in: _____________________________________.

Additional agreements or conditions (if any):

- ________________________________________________________________

- ________________________________________________________________

The Borrower and Lender agree to the terms outlined in this Note. By their signatures below, they commit to adhere to this agreement until the full amount of the principal and any accrued interest are paid in full.

Borrower Signature: ___________________________ Date: _______

Lender Signature: ___________________________ Date: _______

This document was signed in the presence of:

Witness Signature: ___________________________ Date: _______

PDF Specifications

| Name of Fact | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified sum of money to a designated person or entity at a certain time or on demand. |

| Key Parties | The borrower, who promises to repay the loan, and the lender, who provides the loan, are the primary parties involved. |

| Components | Typical components include the amount borrowed, interest rate, repayment schedule, and maturity date. |

| Secured vs. Unsecured | A promissory note can be secured, backed by collateral, or unsecured, based solely on the promise to repay. |

| Interest Rate | Interest rates can be fixed or variable, as agreed upon by the parties in the promissory note. |

| Governing Law | The laws governing a promissory note depend on the jurisdiction in which it is issued. State laws often apply, impacting interest rates, enforcement, and other terms. |

| Enforcement | If the borrower fails to repay according to the terms, the lender may pursue legal action to enforce repayment or seize any collateral. |

| Variability by State | Some aspects of promissory notes, such as maximum interest rates and specific rights in case of default, can vary widely from state to state. |

Instructions on Writing Promissory Note

Completing a Promissory Note is an essential step when someone decides to borrow money from another person or entity. This form legally documents the promise to pay back the borrowed sum under defined conditions, making it a critical element in the lending process. While the thought of filling out legal forms can seem daunting, breaking down the process into manageable steps can help simplify it. Below, you will find a straightforward guide to completing the Promissory Note form, designed to assist borrowers or lenders in accurately capturing the agreement details.

- Gather all necessary information including the full names and addresses of both the borrower and the lender, the loan amount, the interest rate (if applicable), and the repayment schedule.

- Start by filling in the date at the top of the form. This is the date the promissory note is being executed and should reflect the current date.

- Enter the full legal names and addresses of the borrower and lender in their respective sections to clearly identify the parties involved in the agreement.

- Specify the principal amount of the loan. This is the amount of money being borrowed and does not include interest that may accumulate.

- Detail the interest rate if the loan includes interest. This should be an annual rate, and it’s important to note whether it's a simple or compounded rate.

- Outline the repayment schedule, including the start date of payments, frequency of payments (monthly, quarterly, etc.), and the amount of each payment. If there are any conditions for late payments or prepayment, include these as well.

- If collateral is being used to secure the loan, describe the collateral in detail within the designated section.

- Review the default terms to ensure both parties understand what constitutes a default and the subsequent actions that can be taken.

- Both the borrower and the lender must sign and date the bottom of the promissory note. In some cases, witnesses may also be required to sign, depending on the legal requirements of the state in which it is executed.

Once the Promissory Note is fully completed and signed, it becomes a legally binding document. It's crucial that both parties retain a copy for their records. This form serves as a clear agreement and can help protect both the borrower's and lender's interests should any disputes arise concerning the loan. Remember, understanding and following these steps can greatly contribute to a smooth lending process, ensuring clarity and mutual agreement between the borrower and lender.

Understanding Promissory Note

What is a Promissory Note?

A promissory note is a written agreement where one party, known as the maker or borrower, promises to pay a specific sum of money to another, known as the lender or holder, under detailed terms and conditions. These conditions often include the interest rate, repayment schedule, and consequences of default.

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document. Once both parties have signed the note, it becomes a contract that obligates the borrower to repay the loan under the agreed-upon terms. Failure to comply with these terms can result in legal action.

Do I need a witness or notary for my Promissory Note?

The requirements for witnesses or notarization can vary from one jurisdiction to another. While not always necessary, notarizing a promissory note or having it witnessed can add an additional layer of legal protection and help to confirm the authenticity of the document if its validity is ever challenged.

What should be included in a Promissory Note?

A comprehensive promissory note should include the amount of money being borrowed, the interest rate, the repayment schedule, details on how and where payments should be made, and any collateral securing the loan. It should also outline the consequences of late payments or default and include the names and signatures of all parties involved.

How does a Promissory Note differ from an IOU or Loan Agreement?

An IOU merely acknowledges that a debt exists and the amount owed, without specifying repayment details. A loan agreement is more detailed than a promissory note and may include provisions on dispute resolution, amendments to the agreement, and other legal considerations in addition to what is typically included in a promissory note.

Can a Promissory Note be modified after it is signed?

Yes, a promissory note can be modified, but any changes must be agreed upon by all parties involved. The modification should be in writing and attached as an amendment to the original note to ensure that there is a clear record of the agreed changes.

What happens if the borrower defaults on a Promissory Note?

If a borrower defaults on a promissory note, the lender has the right to take legal action to enforce the note and recover the borrowed funds. This may include taking possession of any collateral that secured the loan or pursuing a judgment against the borrower for the balance due.

Can a Promissory Note be used for personal loans?

Yes, promissory notes are commonly used for personal loans between individuals. They provide a formal record of the loan and its repayment terms, which can help to prevent misunderstandings and disputes between the parties involved.

Common mistakes

Filling out a promissory note, a commitment to pay back a loan, requires careful attention to detail. Commonly, people make a range of mistakes that can lead to misunderstandings or legal complications down the line. One prevalent error is not being clear about the terms of repayment. This includes the repayment schedule, whether payments are to be made weekly, monthly, or in a lump sum, and the due date for the final payment. Without clarity, the borrower may assume one schedule while the lender expects another, leading to confusion and potential disputes.

Another mistake involves neglecting to specify the interest rate or incorrectly calculating the interest. This can significantly impact the total amount to be repaid and potentially lead to legal disputes if the borrower feels the interest applied is not what was agreed upon. It's important that both parties are crystal clear about the interest terms to prevent misunderstandings.

A critical, yet often overlooked, component is the failure to include a clause about late fees and penalties for missed payments. This omission can leave the lender unprotected if the borrower pays late or stops payments altogether. Clearly outlining the consequences of late payments encourages timely repayments and provides a legal framework for recourse if the borrower fails to adhere to the agreed schedule.

Many people also forget to specify collateral, if any, that secures the loan. Collateral can range from personal property to a portion of business earnings, providing the lender with assurance and a means to recover the loan amount if the borrower defaults. Not defining collateral in the promissory note can lead to significant risks for the lender.

Another common mistake is not including all relevant parties in the promissory note. If the loan involves multiple borrowers or guarantors, each party's responsibilities need to be clearly outlined. Failure to do so can result in legal ambiguities regarding who is liable for the debt.

The failure to properly witness and notarize the document is yet another pitfall. While not always a legal requirement, having the promissory note witnessed or notarized can add an additional layer of validity and protection in the event of a dispute. It serves as evidence that the parties entered the agreement knowingly and willingly.

Lastly, inaccuracies in personal details—such as names, addresses, and identification numbers—can lead to significant issues in enforcing the note. Such inaccuracies can invalidate the document or at least make enforcement more challenging, emphasizing the importance of double-checking all personal information.

Documents used along the form

When entering into a financial agreement, a promissory note is a crucial document that outlines the borrower's promise to repay a loan to the lender. However, this document doesn't stand alone. To ensure a comprehensive understanding and legal compliance of the agreement, several other forms and documents are often used in conjunction with a promissory note. These documents provide additional details, security, and clarity for both parties involved in the transaction.

- Loan Agreement: This document complements the promissory note by outlining the terms and conditions of the loan in more detail. While the promissory note acknowledges that a debt exists and promises repayment, the loan agreement goes further to specify the interest rate, repayment schedule, and what happens in case of default.

- Security Agreement: Used alongside a promissory note when the loan is secured by collateral. This agreement grants the lender a security interest in specified assets of the borrower. In the event the borrower defaults, the lender has the right to seize the collateral as a form of repayment.

- Guaranty: This document is signed by a third party, known as a guarantor, who agrees to repay the loan if the original borrower fails to pay. A guaranty is often used when the borrower's creditworthiness is questionable, providing the lender with an additional layer of security for the loan.

- Amortization Schedule: Typically used for loans with fixed monthly payments, this document outlines each payment over the life of the loan and shows how it's split between principal and interest. An amortization schedule helps both the borrower and lender track the balance of the loan over time.

Together, these documents form a robust framework that supports the promissory note, ensuring clear communication and understanding between the borrower and lender. By providing a detailed snapshot of the loan's terms, conditions, and expectations, they help prevent disputes and misunderstandings, making the lending process smoother and more transparent for both parties.

Similar forms

A promissory note shares similarities with a loan agreement, as both documents outline the terms under which money is borrowed and repaid. A key difference, however, lies in the detail and complexity; loan agreements typically provide more comprehensive details about the obligations of the parties involved, including collateral, repayment schedules, and remedies in the case of default. Whereas a promissory note might be considered a simpler, more straightforward declaration of the borrower's intent to repay a sum under agreed-upon conditions.

Much like an IOU (I Owe You), a promissory note serves as a written promise to pay a specific amount of money to another party. The primary distinction between the two is the level of formality and the detail included. An IOU is often more informal and may not include specifics about repayment terms or interest rates, making a promissory note more legally binding and comprehensive in outlining the terms of the financial obligation.

A mortgage agreement is another document that has parallels to a promissory note, particularly in that it also entails a promise to repay a loan used to purchase real property. The promissory note represents the borrower's pledge to repay the loan, while the mortgage itself is a separate document that secures the loan with the property as collateral. Thus, while they work in tandem, the promissory note is more focused on the repayment of funds, and the mortgage concerns the legal ramifications involving the property if the debt is not repaid.

Deeds of trust are similar to promissory notes in the sense that they are used in financing agreements involving real estate. However, a deed of trust involves three parties—the borrower, the lender, and a trustee—and serves to place the real property in question into a trust until the loan is fully repaid. The promissory note accompanies this, detailing the borrower's promise to pay back the loan, thereby highlighting the borrower's financial obligations separate from the physical collateral.

The bond indenture, found in corporate financing, parallels a promissory note in its essence of delineating terms for borrowing and repaying money. This agreement is between a bond issuer and the bondholders and includes comprehensive details such as the interest rate, repayment schedule, and covenants to protect the interests of the bondholders. While serving a similar purpose, bonds are typically used for larger financial needs and involve multiple investors, as opposed to the more direct, oftentimes personal, lender-borrower relationship of a promissory note.

Credit agreements, which outline the terms under which credit is extended from a lender to a borrower, also share characteristics with promissory notes. Both set forth the conditions of the financial arrangement, including interest rates and repayment terms. However, credit agreements are usually more complex and may cover revolving credit lines or other flexible credit facilities, contrary to the typically fixed terms of repayment laid out in promissory notes.

Student loan agreements, specific to the context of borrowing for educational purposes, resemble promissory notes in that borrowers agree to repay the borrowed funds under prescribed terms. These documents go beyond the basic promise to pay by including specific provisions related to deferment, forbearance, and loan forgiveness opportunities, which are not commonly found in the more generalized context of a promissory note.

Commercial paper is a type of unsecured promissory note that is used by corporations to raise funds for short-term financial needs. Its similarity to personal promissory notes lies in the promise to pay a specified sum at a future date. However, commercial paper typically involves larger amounts and is traded on the financial markets, thus carrying implications for broader economic considerations beyond the simpler lender-borrower dynamic of individual promissory notes.

Lease agreements, while primarily contracts for the use or rental of property, can embody elements similar to those in a promissory note when they include clauses related to payment commitments. The lessee promises to pay a specified amount regularly for the right to occupy or use the lessor's property. Unlike a promissory note, however, a lease agreement focuses on the exchange of property use rather than the borrowing of funds, but both entail a promise to make scheduled payments.

Finally, letters of credit, used in international trade, provide a guarantee from a buyer's bank to the seller's bank for payment of goods or services, contingent on the seller meeting specified terms. Like a promissory note, they signify a commitment to pay, ensuring the seller receives payment as agreed upon in the contract. Although serving different functions and involving banking institutions as intermediaries, both documents underscore the importance of a written promise in facilitating transactions.

Dos and Don'ts

When filling out a Promissory Note form, attention to detail is crucial. This legal document outlines how the borrower promises to repay a specific amount of money to the lender over a set period. To ensure clarity and avoid potential disputes, here are key dos and don'ts:

Do:Ensure all parties' information is complete and accurate. This includes names, addresses, and contact details.

Specify the loan amount in both words and numbers to prevent any confusion regarding the total sum to be repaid.

Clearly state the interest rate, if applicable, and how it will be applied to the principal amount.

Include a repayment schedule that outlines due dates, amounts, and the total number of payments.

Omit any details that pertain to the loan’s terms and conditions. Incomplete forms can lead to misunderstandings or legal challenges.

Sign the promissory note without reviewing all sections thoroughly. Both the lender and the borrower should understand their obligations.

Forget to make a copy of the signed promissory note for both the borrower and the lender. Keeping a record is vital for both parties.

Assume verbal agreements will be upheld in court. Always include all agreed terms in the promissory note to ensure they are legally binding.

Misconceptions

When dealing with promissory notes, many people harbor misconceptions about their purpose, legality, and overall use. These documents are crucial for clearly outlining the terms of a loan between parties, ensuring there is a written record that can be legally enforced. Here are five common misunderstandings about promissory notes:

- All promissory notes are essentially the same. This is not true. Different types of promissory notes serve various purposes, such as commercial, real estate, and personal loans. Each type may have unique terms and conditions that reflect the specifics of the loan agreement.

- A promissory note is legally binding without witness signatures. While promissory notes do outline the terms between a lender and a borrower, having a witness or notary sign the document can add an extra layer of legal protection and authenticity. This practice varies by the legal requirements of the state.

- Only the borrower needs to sign the promissory note. It’s a common misconception that only the borrower's signature is necessary. However, it’s critical for both the lender and the borrower to sign the promissory note. This mutual agreement confirms that both parties have agreed to the terms outlined in the document.

- Promissory notes are only for large loan amounts. Some people think promissory notes are exclusively for large sums of money. In reality, they can be used for any amount. They are a smart way to document any loan, providing a clear agreement and expectations for repayment, regardless of the loan size.

- If you didn't draft a promissory note at the time of the loan, you can't create one later. This is incorrect. Although it's best to create a promissory note at the time of the loan, you can still draft one after the fact if both the lender and borrower agree to it. This late agreement helps formalize the loan terms and repayment expectations, even after the money has exchanged hands.

Understanding these misconceptions can help ensure that when you're involved in a loan, whether you're lending money or borrowing it, you handle the documentation correctly. Properly executed promissory notes are powerful tools that provide clarity, legality, and peace of mind for financial transactions.

Key takeaways

A Promissory Note is a vital legal document that outlines the terms of a loan between a borrower and a lender. When filling out and using a Promissory Note form, it's important to ensure accuracy and completeness to avoid future disputes. Below are four key takeaways to consider:

- Details Matter: Include all relevant details such as the amount borrowed, the interest rate (if any), repayment schedule, and what happens in the event of a default. Being precise helps prevent misunderstandings.

- Clarity on Terms: Clearly define the terms of the loan within the document. This includes how and when the loan will be repaid. Options might include a lump sum, regular payments, or at the discretion of the lender. Specify the method of payment as well.

- Legal Requirements: Ensure the Promissory Note complies with state and federal laws, including usury laws limiting the amount of interest that can be charged. Each state may have different requirements for what needs to be included in the Promissory Note to be considered valid.

- Signatures: Both the borrower and the lender must sign the Promissory Note. Their signatures make the document legally binding and enforceable. It's also a good practice to have the signatures witnessed or notarized, although not always required, to add an additional layer of authenticity.

By considering these key points when filling out and using a Promissory Note, both parties can ensure that the agreement is fair and legally enforceable, which can help prevent future complications.

Other Templates

Partial Lien Waiver Form Pdf - The document is drafted to provide clarity and legal validity to the partial release of a property from a lien, ensuring that all parties understand the extent of the release.

Is There Rental Agreement Template in Word? - Includes a confidentiality clause regarding the contents of the stored items.