Fillable Prenuptial Agreement Document for Texas

Before embarking on the journey of marriage, many couples in Texas choose to prepare for all eventualities, which includes considering the practicalities of their financial future together. This is where the Texas Prenuptial Agreement form plays a pivotal role, offering a legally binding document that outlines how assets and financial matters will be handled should the marriage come to an end due to divorce or death. Designed to protect both parties' interests, this form provides a clear framework for the division of property, safeguarding personal and business assets acquired before marriage. It serves not only as a financial safety net but also as a tool for couples to communicate openly about their finances, reducing potential conflicts in the future. Despite its practicality, the process of completing a prenuptial agreement in Texas involves careful consideration of legal requirements to ensure its enforceability. This includes full disclosure of assets, fair and reasonable provisions, and voluntary agreement from both parties — elements that, when meticulously compiled, contribute to the solidity and fairness of the pact, underscoring its importance in marital planning.

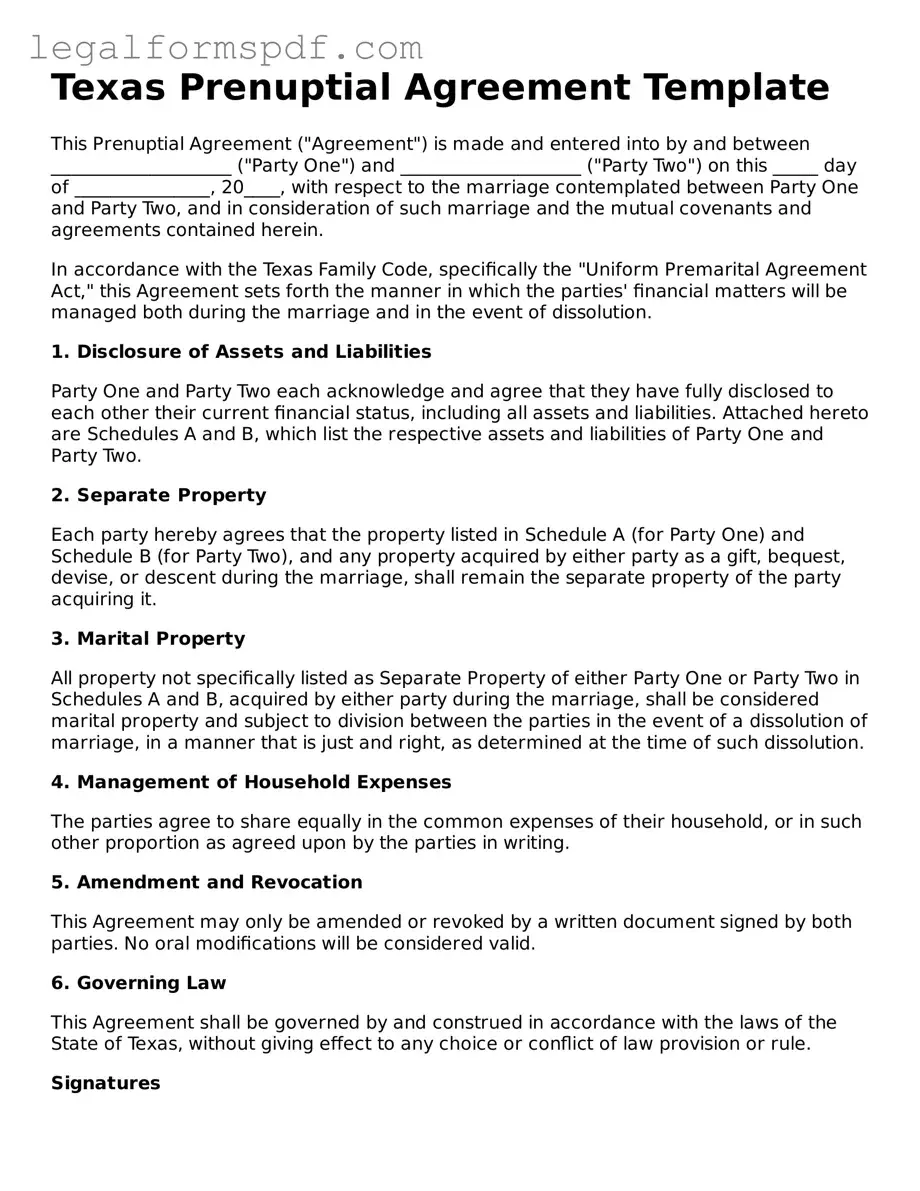

Document Example

Texas Prenuptial Agreement Template

This Prenuptial Agreement ("Agreement") is made and entered into by and between ____________________ ("Party One") and ____________________ ("Party Two") on this _____ day of _______________, 20____, with respect to the marriage contemplated between Party One and Party Two, and in consideration of such marriage and the mutual covenants and agreements contained herein.

In accordance with the Texas Family Code, specifically the "Uniform Premarital Agreement Act," this Agreement sets forth the manner in which the parties' financial matters will be managed both during the marriage and in the event of dissolution.

1. Disclosure of Assets and Liabilities

Party One and Party Two each acknowledge and agree that they have fully disclosed to each other their current financial status, including all assets and liabilities. Attached hereto are Schedules A and B, which list the respective assets and liabilities of Party One and Party Two.

2. Separate Property

Each party hereby agrees that the property listed in Schedule A (for Party One) and Schedule B (for Party Two), and any property acquired by either party as a gift, bequest, devise, or descent during the marriage, shall remain the separate property of the party acquiring it.

3. Marital Property

All property not specifically listed as Separate Property of either Party One or Party Two in Schedules A and B, acquired by either party during the marriage, shall be considered marital property and subject to division between the parties in the event of a dissolution of marriage, in a manner that is just and right, as determined at the time of such dissolution.

4. Management of Household Expenses

The parties agree to share equally in the common expenses of their household, or in such other proportion as agreed upon by the parties in writing.

5. Amendment and Revocation

This Agreement may only be amended or revoked by a written document signed by both parties. No oral modifications will be considered valid.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas, without giving effect to any choice or conflict of law provision or rule.

Signatures

This Agreement has been entered into voluntarily, with a full understanding of its terms and effects, and with the independent advice of legal counsel. By signing below, Party One and Party Two agree to the terms and conditions set forth in this Agreement.

_____________________________________

Signature of Party One

Date: _______________

_____________________________________

Signature of Party Two

Date: _______________

State of Texas

County of _______________

Subscribed and sworn before me on this _____ day of _______________, 20____, by ____________________ (Party One) and ____________________ (Party Two).

_____________________________________

Notary Public

My Commission Expires: _______________

PDF Specifications

| Fact | Detail |

|---|---|

| 1. Definition | A Texas Prenuptial Agreement is a written contract created by two people before they get married, outlining the management of their assets and financial matters in the event of a divorce or death. |

| 2. Governing Law | These agreements in Texas are governed by the Texas Family Code, specifically Title 1, Subtitle B, Chapter 4. |

| 3. Enforceability | To be enforceable, the agreement must be in writing and signed by both parties. |

| 4. Disclosure Requirement | Texas law requires full and fair disclosure of assets and liabilities by both parties, or a waiver of disclosure must be properly executed. |

| 5. Waiver of Rights | Parties can waive their rights to spousal support, property division, and inheritance in a prenuptial agreement, with certain limitations. |

| 6. Limitations | The agreement cannot adversely affect child support rights and some aspects of spousal support upon divorce. |

| 7. Amendment/Revocation | It can be amended or revoked only by a written document signed by both parties. |

| 8. Prior Marriages | These agreements are particularly useful for individuals entering into a marriage with significant assets or children from prior marriages, to protect inheritance rights and premarital assets. |

| 9. Financial Autonomy | The agreement allows couples to establish financial autonomy and responsibilities during their marriage. |

| 10. Preparation | It's advisable for both parties to seek independent legal advice to ensure the agreement is fair and legally valid. |

Instructions on Writing Texas Prenuptial Agreement

A prenuptial agreement in Texas serves as a financial plan for couples intending to marry, outlining the ownership and division of current and future assets and debts. This legal document can establish clear financial expectations and protections for both parties, aiming to avoid potential disputes in the event of a divorce. Completing this form with precision and thorough understanding is crucial to ensure its enforceability and that it reflects the couple's desires accurately. Follow these steps to fill out the Texas Prenuptial Agreement form correctly.

- Gather all relevant financial documents for both parties, including bank statements, property deeds, and debt records.

- Read the entire form to understand the scope and implications of the agreement fully.

- Begin by entering the full legal names of both parties entering into the agreement.

- Specify the effective date of the agreement, usually the date of the marriage.

- Detailedly list all separate property each party currently owns. This may include real estate, bank accounts, investments, and personal property considered separate from marital assets.

- Describe the handling of future earnings and assets acquired during the marriage, whether they will be considered joint or separate property.

- Outline how debts incurred before and during the marriage will be managed and assigned.

- Include provisions for any other agreements, such as alimony, inheritance rights, or estate plans.

- Both parties must disclose their current financial status accurately, including assets, liabilities, income, and expectations of gifts or inheritances.

- Review the agreement thoroughly, ensuring all sections are filled out according to the mutual decisions made.

- Have the agreement reviewed by independent legal counsel for both parties to ensure it meets legal standards and fully protects each party’s interests. This step is not mandatory but highly recommended.

- Sign and date the agreement in the presence of a notary public to validate the document.

- Store the completed document in a safe location, with copies provided to each party and their respective legal representatives.

Following these steps diligently will help ensure that the Texas Prenuptial Agreement form is filled out correctly and comprehensively. It’s essential to approach this process with openness and honesty, as the agreement forms the cornerstone of financial understanding and security in the event of unforeseen circumstances. Remember, while this document can safeguard assets and clarify financial expectations, it also requires thoughtful consideration and mutual respect between partners.

Understanding Texas Prenuptial Agreement

What is a Texas Prenuptial Agreement form?

A Texas Prenuptial Agreement form is a legal document that couples intending to marry can enter into to outline the division of their assets and debts in the event of a separation, divorce, or death. It allows parties to define their financial rights and responsibilities during and after marriage.

Who should consider a Texas Prenuptial Agreement?

Any couple planning to marry in Texas might consider a Prenuptial Agreement, especially those entering the marriage with significant assets, debts, prior children, or who are concerned about preserving inheritance rights. It can provide clarity and protection for both parties.

Is a Texas Prenuptial Agreement legally binding?

Yes, provided it is executed in accordance with Texas law. The agreement must be in writing, signed by both parties, and entered into voluntarily without duress or undue influence. Full and fair disclosure of assets and liabilities is also required for it to be enforceable.

Can a Texas Prenuptial Agreement decide child support or custody issues?

No, a Texas Prenuptial Agreement cannot predetermine child custody or child support arrangements. The court retains the authority to make decisions based on the best interests of the children at the time of the divorce or separation.

What types of provisions can be included in a Texas Prenuptial Agreement?

Common provisions include the separation of property, allocation of debts, spousal support, and the rights to buy, sell, or manage specific assets. Provisions related to child support, child custody, or any terms encouraging divorce are not permitted.

Can a Texas Prenuptial Agreement be amended or revoked after marriage?

Yes, couples can amend or revoke their Prenuptial Agreement after getting married. However, any changes or revocation must be in writing and signed by both parties, following the same formalities as the original agreement.

What happens if part of the agreement is found to be invalid?

If a provision of the Prenuptial Agreement is found to be invalid, it does not necessarily void the entire agreement. Texas courts can strike out the invalid provision and enforce the remainder of the agreement, unless it is found that the invalid provision was crucial to the agreement's objectives.

Do I need a lawyer to create a Texas Prenuptial Agreement?

While it's not legally required, having a lawyer can help ensure that the agreement is properly drafted, adheres to Texas law, and adequately protects your interests. Each party should ideally have their own attorney to avoid conflicts of interest.

How can a Texas Prenuptial Agreement affect divorce proceedings?

A valid Prenuptial Agreement can streamline divorce proceedings by predetermined division of assets and responsibilities, potentially saving time and reducing conflict. Courts generally honor the agreement's terms, provided it was executed fairly and doesn't contain invalid provisions.

Can premarital debts be addressed in a Texas Prenuptial Agreement?

Yes, premarital debts can be addressed, allowing individuals to specify responsibility for debts incurred before marriage. This can protect one spouse from being liable for the other's premarital debts in case of divorce or death.

Common mistakes

When couples decide to take the prudent step of drafting a Texas Prenuptial Agreement before marriage, it's essential to approach this task with care and thoroughness. However, many make critical mistakes that could potentially render their agreements ineffective or lead to disputes later on. One common error is the failure to disclose all assets and liabilities fully. Honesty and transparency are the foundation of a valid prenuptial agreement. Without a complete disclosure, the agreement may be challenged or invalidated, as it prevents one party from making an informed decision.

Another mistake is neglecting to obtain independent legal counsel for each party. Often, couples may attempt to save on expenses by using the same attorney or not hiring one at all. This oversight can significantly impact the enforceability of the agreement, as each party's interests must be adequately represented and protected. Courts scrutinize these agreements closely, and the absence of independent legal advice can be a red flag, indicating potential unfairness or coercion.

Timing is also crucial when drafting a prenuptial agreement. Rushing to sign a prenup right before the wedding can lead to its enforceability being questioned. This haste can be perceived as coercion or duress, particularly if one party felt pressured to sign without sufficient time for consideration or legal advice. It’s advisable to complete the prenup well in advance of the wedding day to ensure both parties have ample time to review and understand the agreement fully.

Some couples err by inserting invalid provisions into their prenuptial agreements. For example, decisions regarding child custody or support cannot be predetermined in a prenuptial agreement. Courts have the final say in these matters, based on the best interests of the child at the time of the divorce. Including such provisions can threaten the validity of the entire agreement.

Failure to observe the formal requirements for a prenuptial agreement set by Texas law is another common mistake. In Texas, the agreement must be in writing and signed by both parties. Overlooking these formalities can lead to the agreement being unenforceable. Additionally, merely having a verbal agreement or informal written notes will not meet the legal standards required.

Underestimating the impact of changes in circumstances can also jeopardize a prenuptial agreement. Life events, such as the birth of children, significant changes in financial status, or relocation to another state, can affect the relevance and fairness of a prenup. Regular reviews and updates to the agreement can help ensure its continued enforceability and fairness over time.

Lastly, the gravest mistake is approaching a prenuptial agreement with the wrong intentions or mindset. Viewing it purely as a means to protect assets or as planning for divorce can overlook the opportunity to strengthen the relationship through open and honest communication about finances and expectations. A prenuptial agreement, approached correctly, can be a constructive part of planning for a shared future, not just a safeguard in the event of a marriage ending.

Documents used along the form

When couples decide to marry, they often focus on the joy and excitement of their upcoming nuptials. However, taking steps to protect their financial future is also a wise measure. In Texas, alongside the Prenuptial Agreement form, there are several other important forms and documents that can further secure each party's financial interests before saying "I do". These documents can address a variety of concerns, from designating assets to outlining wishes in case of a divorce or death. Below is a list of other forms and documents that are commonly used in conjunction with a Texas Prenuptial Agreement.

- Will: A legal document that outlines how a person's assets and estate will be distributed upon their death. It can complement a prenuptial agreement by ensuring assets are allocated according to the individual's wishes, potentially reducing disputes among surviving family members.

- Living Will: Also known as an advance healthcare directive, this document specifies a person's wishes regarding medical treatment and life-sustaining measures in the event they are unable to communicate their decisions due to illness or incapacity.

- Power of Attorney: Grants a designated individual the authority to make financial or health-related decisions on behalf of the person granting it, should they become incapacitated. There are two main types: a financial power of attorney and a medical power of attorney, each serving distinct purposes.

- Life Insurance Policy: Often secured by individuals as part of premarital planning, this ensures that surviving spouses or family members are financially supported in the event of death. The details of beneficiaries can be specified within this policy, aligning with the wishes laid out in the prenuptial agreement.

- Financial Disclosure Forms: These forms provide a comprehensive overview of each party's financial situation, including assets, liabilities, income, and expenses. They are critical for the transparency and fairness of the prenuptial agreement process, ensuring both parties make informed decisions.

- Property Deeds: If real estate is involved, property deeds must be clearly documented, especially if the property is to remain separate property or if it's being transferred into joint ownership. The deeds help in clarifying ownership status and rights.

- Postnuptial Agreement: Similar to a prenuptial agreement but executed after the couple marries. This document can modify or validate the initial prenuptial agreement, adapting to changes in the couple's financial situation or perspectives over time.

Each of these documents plays a vital role in comprehensive premarital planning, complementing the protections a prenuptial agreement offers. By carefully considering and incorporating these documents, couples in Texas can ensure that their legal and financial bases are covered, providing peace of mind as they embark on their future together. It's advisable for couples to consult with legal professionals who can guide them through the process of drafting these documents to ensure they accurately reflect the couple's wishes and are legally binding.

Similar forms

A Postnuptial Agreement is closely related to a Texas Prenuptial Agreement, with the primary difference being the timing of when it's executed. While a prenuptial agreement is signed before marriage, a postnuptial agreement is signed after a couple has already entered into marriage. Both documents outline how assets and debts will be divided in the event of a separation, divorce, or death, offering a clear financial plan for the future.

Another similar document to the Texas Prenuptial Agreement is a Cohabitation Agreement. This agreement is designed for couples who live together but are not married. It helps in managing how property and finances are shared and divided if the relationship ends. While it operates under a similar premise of outlining financial rights and responsibilities, its application is for non-married partners.

The Living Will is another document that, like a prenuptial agreement, prepares individuals for future uncertainties. However, instead of focusing on financial affairs or asset division, a Living Will outlines a person's wishes regarding medical treatment and life-support measures in scenarios where they are unable to communicate their decisions due to illness or incapacitation.

A Financial Power of Attorney is a document that grants someone authority to handle your financial affairs. This can include managing, selling, or buying assets, similar to how assets might be managed in a Prenuptial Agreement. The key difference lies in the scope—while a Prenuptial Agreement is focused on the division of assets upon certain events, a Financial Power of Attorney is about managing one's affairs, often while they are still alive but incapacitated.

The Will, or Last Will and Testament, shares a protective ambition with the Texas Prenuptial Agreement. Both documents prepare for the future by dictating how assets should be handled. While a Prenuptial Agreement addresses asset division due to divorce or separation, the Will outlines asset distribution upon the drafter's death to their chosen beneficiaries.

A Separation Agreement is structured to address the division of assets and debts along with spousal support and child custody arrangements when a couple decides to live apart but remains legally married. It shares similarities with a Texas Prenuptial Agreement by pre-defining the division of financial responsibilities and assets, but it applies after a marital breakdown has occurred.

The Trust is an estate planning tool, like the Prenuptial Agreement, focusing on asset protection and management. Trusts are set up to manage property and assets for beneficiaries and can include specific directions on distribution similar to a Prenuptial Agreement. However, Trusts can operate during an individual’s life and after their death, offering a broader application.

A Property Agreement among Unmarried Couples often has components similar to a Texas Prenuptial Agreement, with a focus on individuals who own property together but aren't married. It outlines how property is shared, managed, bought, or sold, providing a legal framework that mirrors the financial and asset considerations seen in prenuptial agreements, tailored to the needs of unmarried couples.

The Business Continuity Plan, although not a personal legal document, shares an objective with the Prenuptial Agreement of preparing for future change or unforeseen events. This document focuses on ensuring business operations can continue smoothly in the event of a disruption. Like a Prenuptial Agreement, it involves planning ahead for various scenarios to protect assets and interests, albeit in a business context rather than a personal or marital one.

Dos and Don'ts

When filling out a Texas Prenuptial Agreement form, it is important to approach the task with thoroughness and clarity. This document, aimed at protecting the financial interests of both parties before marriage, requires careful consideration. Below are essential dos and don'ts to guide you through the process.

Do:

- Discuss the agreement openly with your partner. Transparency and honesty are crucial in laying a strong foundation for both the agreement and the marriage.

- Consult with an attorney. Since Texas law governs the enforcement of prenuptial agreements, professional legal advice can ensure that the document meets all legal requirements and addresses your specific needs.

- Disclose all financial information. Accurate disclosure of assets, liabilities, income, and expectations of gifts and inheritances is essential for an enforceable agreement.

- Consider the future. Think about future changes in finances, potential inheritance, and the impact of having children, and address these issues within the agreement.

- Review and update the agreement periodically. As circumstances change, it may be necessary to adjust the agreement to reflect your current situation and financial landscape.

- Ensure both parties have ample time to review the agreement before the wedding. This prevents claims of duress or coercion, which can invalidate the agreement.

Don't:

- Rush the process. Creating a prenuptial agreement under pressure or without sufficient time for consideration and legal advice can lead to problems later on.

- Hide or misrepresent financial information. A prenuptial agreement based on deceit can be challenged and potentially deemed invalid.

- Use generic templates without customization. While templates can be a starting point, the agreement should be tailored to your specific situation.

- Include personal non-financial demands. Prenuptial agreements are designed to address financial matters, not personal preferences or lifestyle clauses.

- Forget to consider state laws. The validity and enforcement of prenuptial agreements can vary widely from state to state. It's important to understand how Texas law applies.

- Sign without independent legal advice. Both parties should have their own attorney to ensure their rights and interests are fully protected and represented.

Misconceptions

Many people have misconceptions about the Texas Prenuptial Agreement form, which can lead to confusion and misunderstanding about its purpose and effect. It's important to clarify these misconceptions to ensure individuals are fully informed before entering into such an agreement. Here are some of the most common misconceptions:

- Prenuptial agreements are only for the wealthy. This common misconception overlooks the fact that prenuptial agreements can benefit anyone who wants to clarify the financial aspects of their marriage, protect their assets, or manage their debts, regardless of their wealth.

- Signing a prenup means you don’t trust your partner. This is not true. Many couples view a prenuptial agreement as a practical decision that can help prevent potential financial disputes in the future. It's about protection and clarity, not lack of trust.

- Prenuptial agreements are only useful in case of divorce. While it's true that prenups clarify the division of assets in the event of a divorce, they can also offer protections during the marriage, such as preserving family heirlooms or business interests.

- Prenups can include personal non-financial clauses. In Texas, prenuptial agreements are meant to address financial matters. Non-financial stipulations, such as household chores or personal behaviors, are generally not enforceable.

- Prenuptial agreements are set in stone once signed. The terms of a prenuptial agreement can be modified after it's signed if both parties agree to the changes. It's not uncommon for couples to update their prenup as their financial situations evolve.

- If you don’t have a prenup, the state will take all your assets. Without a prenuptial agreement, property division in Texas is subject to state law, which aims for a fair and equitable distribution, not seizing all assets. However, a prenup can specify a different arrangement.

- Getting a prenup is a complicated and lengthy process. While drafting a prenuptial agreement does require careful consideration and legal guidance, it doesn't have to be a daunting process. With clear communication and the right support, couples can efficiently create a prenup tailored to their needs.

- If my spouse cheats, I can void the prenup. Infidelity clauses are complex and enforcing them can be difficult. The impact of infidelity on a prenuptial agreement varies and is often specified within the agreement itself. Simply put, cheating doesn't automatically void a prenup.

Understanding these misconceptions is crucial for couples considering a prenuptial agreement in Texas. By debunking these myths, individuals can approach the process with clarity and confidence, ensuring that the agreement they enter into serves their best interests.

Key takeaways

Understanding the nuances of a Texas Prenuptial Agreement form is crucial for couples looking to safeguard their financial future before tying the knot. These agreements are legally binding contracts that outline the distribution of assets and responsibilities in the event of a divorce or the death of one partner. While these topics may be uncomfortable, addressing them proactively can prevent much hardship and legal wrangling later on. Here are key takeaways about filling out and using the Texas Prenuptial Agreement form:

- Ensure full disclosure: Both parties must fully disclose their financial assets and liabilities. The transparency is not just a matter of trust; it's a legal requirement for the agreement to be valid. Failure to disclose or misrepresenting assets can result in the agreement being voided.

- Understand property classification: Texas law distinguishes between community property (assets acquired during the marriage) and separate property (assets acquired before the marriage, through inheritance, or as gifts). A prenuptial agreement can redefine these terms or detail specific arrangements that differ from state law.

- Consider future changes in circumstances: While it's impossible to predict every life change, the agreement can include provisions for possible future scenarios, such as the birth of children, changes in financial situations, or moving to another state or country. Addressing these potential changes can make the agreement more resilient over time.

- Seek independent legal advice: Each party should engage their own lawyer. This helps ensure that both individuals fully understand the agreement and that it fairly represents their interests. Lawyers can also identify any potential issues that could arise based on current or future anticipated state laws.

- Be mindful of timing: The agreement should be completed well before the wedding date. A prenup signed under duress, such as immediately before a wedding, may not be enforceable. Ideally, the agreement should be signed months before the marriage, allowing both parties ample time to consider and discuss the terms without pressure.

- Understand that amendments are possible: Circumstances change, and so can a prenuptial agreement. Both parties can amend the agreement after marriage, but any changes must be made in writing and signed by both parties. This flexibility allows the agreement to adapt over time, reflecting the couple’s evolving financial situation and personal wishes.

When approached with care, respect, and transparency, a prenuptial agreement can strengthen a couple's commitment to each other by ensuring that financial matters are addressed responsibly and equitably. It’s an essential step for many couples and should be navigated with diligence and legal guidance.

More Prenuptial Agreement State Forms

Ohio Premarital Agreement - It is a practical approach for managing financial risks, especially for entrepreneurs with significant business assets.

Pennsylvania Premarital Agreement - The agreement can stipulate the exclusion of certain assets from the communal property, maintaining them as individual property post-divorce.

Michigan Premarital Agreement - For individuals with significant debt, a prenuptial agreement can protect their partner from being held responsible for this debt after marriage.

North Carolina Premarital Agreement - It plays a critical role in estate planning, ensuring that assets are distributed according to the couple's wishes, not just state laws.