Fillable Prenuptial Agreement Document for New York

In the bustling state of New York, where the dynamics of marriage intertwine with the complexities of financial assets, the New York Prenuptial Agreement form stands as a critical document for those embarking on the journey of matrimony. Designed to clarify the financial rights and responsibilities of each party before marriage, this form acts as a safeguard to protect individual interests and assets in the event of unforeseen circumstances such as divorce or death. The essence of this legal document lies not only in its capacity to preemptively resolve potential disputes but also in its power to forge transparency and open communication between partners. It meticulously outlines the treatment of various financial aspects, including but not limited to, property division, debt allocation, and inheritance rights. Additionally, it serves the dual purpose of respecting the laws specific to the state of New York while also offering couples the flexibility to tailor the agreement to their unique situation. As such, the New York Prenuptial Agreement form is a testament to the notion that a strong foundation for a marriage extends beyond emotional preparation and into the realm of fiscal responsibility and planning.

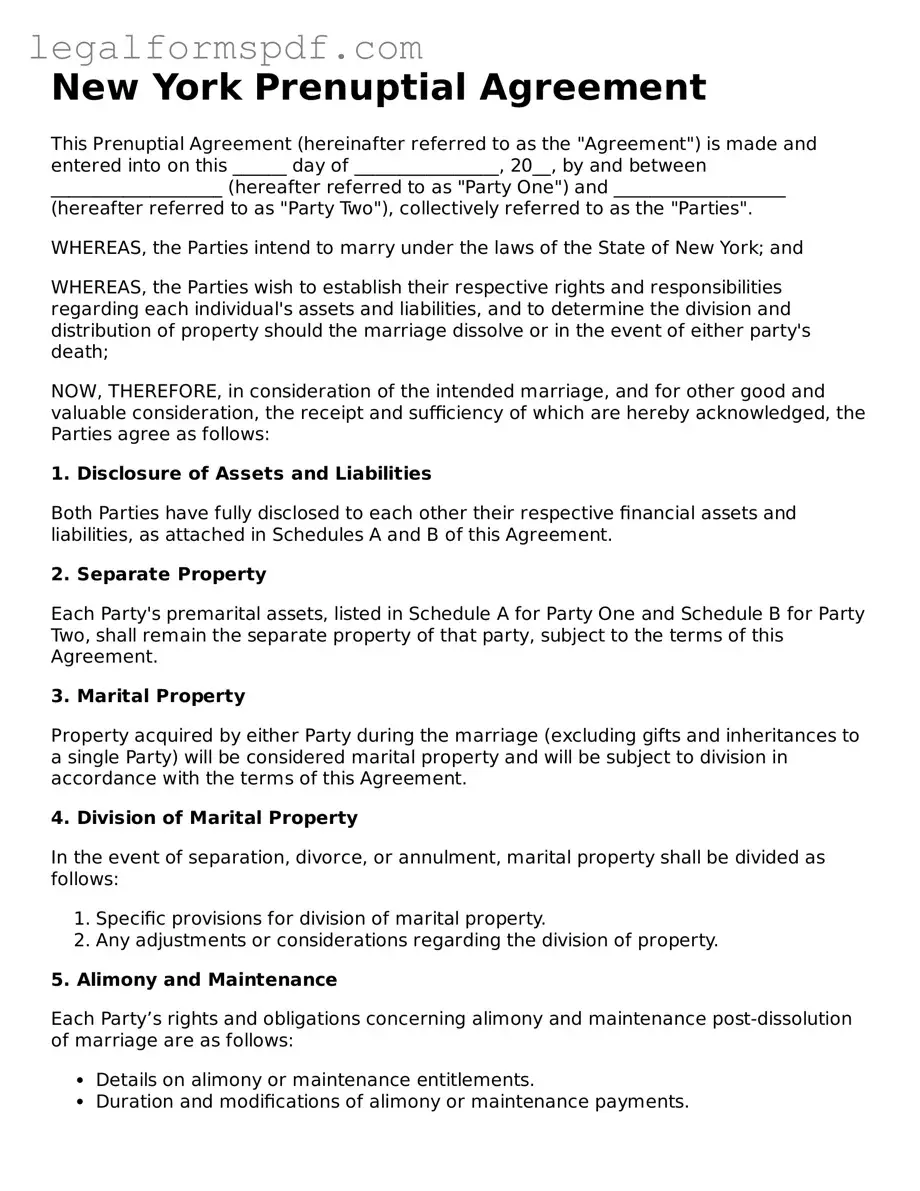

Document Example

New York Prenuptial Agreement

This Prenuptial Agreement (hereinafter referred to as the "Agreement") is made and entered into on this ______ day of ________________, 20__, by and between ___________________ (hereafter referred to as "Party One") and ___________________ (hereafter referred to as "Party Two"), collectively referred to as the "Parties".

WHEREAS, the Parties intend to marry under the laws of the State of New York; and

WHEREAS, the Parties wish to establish their respective rights and responsibilities regarding each individual's assets and liabilities, and to determine the division and distribution of property should the marriage dissolve or in the event of either party's death;

NOW, THEREFORE, in consideration of the intended marriage, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Disclosure of Assets and Liabilities

Both Parties have fully disclosed to each other their respective financial assets and liabilities, as attached in Schedules A and B of this Agreement.

2. Separate Property

Each Party's premarital assets, listed in Schedule A for Party One and Schedule B for Party Two, shall remain the separate property of that party, subject to the terms of this Agreement.

3. Marital Property

Property acquired by either Party during the marriage (excluding gifts and inheritances to a single Party) will be considered marital property and will be subject to division in accordance with the terms of this Agreement.

4. Division of Marital Property

In the event of separation, divorce, or annulment, marital property shall be divided as follows:

- Specific provisions for division of marital property.

- Any adjustments or considerations regarding the division of property.

5. Alimony and Maintenance

Each Party’s rights and obligations concerning alimony and maintenance post-dissolution of marriage are as follows:

- Details on alimony or maintenance entitlements.

- Duration and modifications of alimony or maintenance payments.

6. Governing Law

This Agreement shall be governed by, enforced, and construed under the laws of the State of New York, without regard to its conflict of law principles.

7. Entire Agreement

This document and any attachments represent the entire agreement between the Parties concerning the subject matter hereof and supersede all prior negotiations, agreements, and understandings between them. It can be amended only by a written agreement duly executed by both parties.

8. Acknowledgment

Each Party acknowledges that they have had sufficient time to review this Agreement and consult with legal counsel. This Agreement is entered into voluntarily, with full understanding of its effects.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the first date above written.

Party One: ___________________________

Party Two: ___________________________

PDF Specifications

| Fact Name | Detail |

|---|---|

| Definition | A New York Prenuptial Agreement is a written contract between two people before they are married, outlining the division of assets and financial responsibilities in the event of a divorce or death. |

| Governing Law | The agreement is governed by the Domestic Relations Law of New York State, particularly sections 236(B) for matrimonial matters. |

| Requirements for Validity | To be valid, the agreement must be in writing, signed by both parties, and acknowledged before a notary public in the manner required for a deed to be recorded. |

| Disclosure | Full and fair disclosure of assets by both parties is required at the time of the agreement's execution, though the parties may waive this requirement in the document itself. |

| Scope | The agreement can cover property division, spousal support, and inheritance, but cannot decide child custody or support issues in advance. |

Instructions on Writing New York Prenuptial Agreement

Preparing for a wedding is an exciting time, full of planning and promise. Part of this preparation might also include thinking about the legal aspects of marriage, such as entering into a prenuptial agreement. In New York, a prenuptial agreement can help couples set clear financial expectations and protections should the future unfold in unexpected ways. Filling out a New York Prenuptial Agreement form might seem daunting, but by breaking it down into steps, it becomes manageable. Here’s how to do it.

- Start by gathering all necessary personal and financial documents. You'll need detailed information about your assets, debts, income, and expenses.

- On the first page of the form, fill in the date and the full names of both parties entering into the agreement.

- In the sections provided, detail each party's current financial status. This includes assets, liabilities, income, and any future expectations of wealth (such as inheritances).

- Read through the clauses that outline how assets and liabilities will be handled both during the marriage and in the event of a separation, divorce, or death. Amend or add clauses as necessary to fit your unique situation. It’s highly recommended to seek legal advice for this step to ensure the agreement is fair and enforceable.

- If there are specific items, properties, or financial assets each party wishes to declare as separate property (not subject to division in the event of a divorce), list these in the specified section.

- Discuss and decide on any provisions for spousal support or alimony, including amounts and durations. Include these details in the agreement.

- Both parties should carefully review the entire document to ensure it fairly and accurately reflects their wishes and intentions. Make any revisions as needed.

- Once the document is finalized, both parties must sign and date it in the presence of a notary public. The notarization process formalizes the document, making it legally binding.

- After notarization, make several copies of the agreement. Each party should keep a copy, and one should be stored in a safe but accessible place.

Remember, a prenuptial agreement can be a positive step towards a transparent and secure financial future together. It’s about protection and planning, not mistrust or pessimism. Open communication during this process is key to building a strong foundation for your marriage.

Understanding New York Prenuptial Agreement

What is a New York Prenuptial Agreement?

A New York Prenuptial Agreement is a legal document created and signed by two people before they get married. This contract outlines how they wish to divide their assets and debts should they separate, divorce, or in the event of one spouse's death. It's designed to provide clarity and protect each person's interests, making future financial expectations clear from the outset.

Is a Prenuptial Agreement legally binding in New York?

In New York, a Prenuptial Agreement is considered legally binding as long as it meets certain requirements. It must be in writing, signed by both parties, and acknowledged in the manner required for a deed to be recorded. Furthermore, it must be entered into voluntarily and without coercion, with both parties fully disclosing their financial situations, or waiving the right to disclosure, in a fair and equitable manner.

Can you modify or revoke a New York Prenuptial Agreement after getting married?

Yes, couples can modify or revoke a New York Prenuptial Agreement after they get married. However, any modifications or the decision to revoke must be made in writing and signed by both parties, similar to the original agreement's requirements. It's important that both individuals fully agree to the changes or the dissolution of the agreement for them to be legally valid.

What happens if a New York Prenuptial Agreement is deemed invalid?

If a New York Prenuptial Agreement is found to be invalid by a court, any decisions regarding the division of assets and debts would then be subject to New York's laws of equitable distribution or, in the case of a spouse's death, the applicable inheritance laws. Reasons for a prenuptial agreement being deemed invalid might include lack of voluntary consent, lack of proper acknowledgment, failure to disclose all assets and liabilities, or provisions that promote divorce. In such instances, the court may disregard the entire agreement or specific provisions that led to the invalidation.

Common mistakes

One common mistake people make when filling out the New York Prenuptial Agreement form is not disclosing all financial assets and liabilities completely and accurately. Full transparency is crucial in these agreements, as any undisclosed assets or debts can cause problems down the line, potentially leading to the agreement being challenged or invalidated.

Another error involves not having independent legal advice. Each party should have their own lawyer who can explain the implications of the agreement and provide advice based on each person's specific circumstances. This helps ensure that both parties fully understand what they are agreeing to, reducing the likelihood of disputes or challenges in the future.

A third misstep is not considering future changes. Life circumstances can change drastically, including children, changes in wealth, or differences in career paths. When an agreement does not account for these potential changes, it might not provide the protection or flexibility needed in the future, making it potentially obsolete or unfair.

Attempting to include illegal or unreasonable terms is another mistake. Certain provisions, such as those concerning child custody or support, cannot be predetermined in a prenuptial agreement. Trying to include such terms can not only invalidate those provisions but can also risk the enforceability of the entire agreement.

Rushing the process is a frequent error. Given the importance of a prenuptial agreement, it’s critical to give both parties enough time to thoroughly consider and understand the agreement. Signing a prenuptial agreement too close to the wedding date can sometimes be viewed as coercion, jeopardizing the agreement's validity.

Using vague or ambiguous language can lead to interpretation issues. The agreement should be as clear and specific as possible to avoid different interpretations that could lead to disputes. Ambiguities in the document can make it harder to enforce and may result in a court interpreting the terms in a way neither party intended.

Last but not least, forgetting to update the agreement. As life goes on, situations change and so might the relevance of the initial prenuptial agreement. Failing to revisit and potentially revise the agreement to reflect significant life changes, like the birth of children, inheritance, or major career changes, can make parts of the agreement ineffective or irrelevant.

Documents used along the form

When couples decide to marry in New York, a Prenuptial Agreement is often considered an essential document for managing financial expectations and protections for both parties. However, it's not the only document that can be valuable in this process. Several other forms and documents may be used alongside a New York Prenuptial Agreement to ensure a comprehensive approach to financial and legal planning before marriage. The following list offers a brief description of each document, understanding their purposes can benefit couples in creating a solid foundation for their future together.

- Financial Disclosure Statement: This document provides a detailed account of each party's financial situation, including assets, debts, income, and expenses. It's crucial for the transparency and fairness of the prenuptial agreement.

- Will or Testament: Outlining how assets should be distributed after one's death, this document can complement a prenuptial agreement to ensure a person's wishes are honored.

- Life Insurance Policy: It specifies beneficiaries and coverage amounts, which can be aligned with the terms of a prenuptial agreement to provide for a surviving spouse.

- Postnuptial Agreement: Similar to a prenuptial agreement but executed after the marriage has taken place, it can amend or reaffirm agreements made before marriage.

- Power of Attorney: This legal document allows one spouse to make decisions on behalf of the other, useful in case of incapacity or for managing certain jointly-held assets.

- Living Will: It outlines a person's wishes regarding medical treatment in cases where they can't communicate their decisions themselves, ensuring that these wishes are known to their spouse.

- Marriage License Application: Required to legally marry in New York, this form must be filed and approved before a marriage ceremony can occur.

- Real Estate Title Documents: If real estate is to be considered separate property under a prenuptial agreement, title documents must clearly reflect the ownership as described in the agreement.

- Business Ownership and Valuation Documents: For parties owning businesses, these documents verify the value and structure of the business, important for determining assets and liabilities.

Engaging with these documents in addition to a Prenuptial Agreement ensures that couples approach their union with clarity and preparedness. For a smooth process, it's advisable to consult legal professionals who can guide the drafting, review, and filing of these documents. This careful preparation helps safeguard the interests of both parties, paving the way for a stronger partnership.

Similar forms

The New York Prenuptial Agreement form shares similarities with a Postnuptial Agreement. Both documents establish agreements between spouses regarding the division of assets, debts, and financial responsibilities, but the key difference lies in their timing. A Prenuptial Agreement is executed before the marriage, whereas a Postnuptial Agreement is signed after the couple has wed. Each serves to clarify financial matters and protect individual assets, but they cater to couples at different stages in their relationship.

Similar to a Living Will, the New York Prenuptial Agreement form allows individuals to outline their wishes in advance, although in different areas. A Living Will specifies preferences for medical treatment and end-of-life care, whereas a Prenuptial Agreement focuses on financial arrangements and asset division in the event of a divorce or death. Both documents provide a proactive approach to planning for the future, ensuring that personal decisions are honored.

Another related document is the Last Will and Testament, which also deals with the distribution of an individual's assets posthumously. Like a Prenuptial Agreement, it serves as a preemptive measure to manage assets and specify beneficiaries. While the Last Will and Testament becomes effective after death, the Prenuptial Agreement addresses the distribution of assets due to divorce or death, highlighting its dual purpose and broader preventive scope.

The Financial Affidavit is akin to the Prenuptial Agreement form in that it requires full disclosure of an individual's financial situation. A Financial Affidavit is often used in legal proceedings related to divorce, child support, and alimony, providing a snapshot of income, expenses, assets, and liabilities. Similarly, a Prenuptial Agreement necessitates transparent financial disclosure to ensure fair and informed agreement between partners, reinforcing its role in preemptive financial planning.

A Business Partnership Agreement echoes the Prenuptial Agreement in structuring the division of assets and liabilities, albeit in a business context. Both outline the terms of a partnership, whether marital or business-related, including how assets will be divided in the event of a dissolution. The main difference lies in the nature of the relationship: one is personal and romantic, the other purely business-oriented.

A Cohabitation Agreement is closely related to a Prenuptial Agreement, designed for couples who live together but are not married. It outlines how assets and financial responsibilities will be shared or divided if the relationship ends. Though serving a similar purpose, the Prenuptial Agreement is unique to couples planning to marry, demonstrating its legal foresight in marital asset and responsibility allocation.

The Trust Agreement also shares elements with the Prenuptial Agreement through its role in managing and protecting assets. Trusts can be set up for various reasons, including tax benefits and ensuring beneficiaries receive assets in a specific manner. While a Prenuptial Agreement can specify asset division between spouses, a Trust Agreement can provide for a wider range of beneficiaries and situations, offering a different level of control and protection over assets.

Lastly, the Marriage Settlement Agreement (MSA) is similar to a Prenuptial Agreement but is executed at the end of a marriage, typically during divorce proceedings. It outlines how assets, debts, alimony, and other marital issues will be handled. While an MSA is retrospective, addressing issues after they arise, a Prenuptial Agreement is prospective, aiming to prevent disputes before they occur by establishing clear expectations and agreements upfront.

Dos and Don'ts

Navigating the process of filling out a New York Prenuptial Agreement form can feel overwhelming, but it doesn't have to be. To ensure you're approaching it correctly and safeguarding your future, here are carefully compiled dos and don'ts. Keep these tips handy as you fill out your form to make the process smoother and more effective.

Do's:

- Do gather all necessary financial information before starting. This includes documentation of all assets, debts, income, and expenses for both parties.

- Do consider consulting with a financial advisor. Understanding the full scope of your financial situation can help you make more informed decisions during the agreement process.

- Do hire separate attorneys. Each party should have their own legal counsel to ensure their interests are fully represented and protected.

- Do be transparent about all financial matters. Honesty is key in these agreements to avoid disputes or challenges in the future.

- Do discuss the agreement well in advance of the wedding. This avoids any perception of coercion or undue pressure.

- Do consider including a sunset clause, which is a provision that states the agreement will expire after a certain period of marriage, if both parties agree to it.

- Do keep the tone respectful and cooperative. A prenuptial agreement is about protecting both parties, not about winning or losing.

Don'ts:

- Don't leave any sections blank. If a section does not apply, mark it as “Not Applicable” or “N/A” to ensure clarity and completeness.

- Don't rush through the process. Take the time needed to consider all aspects carefully and to discuss them thoroughly with your partner and legal counsel.

- Don't try to include provisions about non-financial matters, like children from future marriages, personal chores, or relationship expectations. These are not enforceable and can invalidate the agreement.

- Don't sign without understanding every part of the agreement. If there's something you don't understand, ask your attorney to explain it to you.

- Don't forget to update the agreement as circumstances change. Significant changes in financial situations, like inheritances or changes in income, may necessitate adjustments to the agreement.

- Don't use online templates without consulting an attorney. These templates may not meet specific New York requirements or fully protect your interests.

- Don't ignore the emotional aspect. Discussions around prenuptial agreements can be sensitive, so approach them with empathy and understanding towards your partner.

Misconceptions

When it comes to planning a marriage in New York, many couples have misconceptions about the purpose and workings of a prenuptial agreement. Understanding these common misunderstandings can ensure couples are making informed decisions before tying the knot.

Only the Wealthy Need It: A common misconception is that prenuptial agreements are only for those with substantial assets. In reality, these agreements benefit anyone who wants to protect their financial interests, manage debt issues, or clarify financial responsibilities during a marriage.

It's Preparing for Divorce: Many believe that crafting a prenuptial agreement means a couple anticipates divorce. However, its true purpose is to provide clarity and reassurance for the future, allowing couples to enter marriage with a clear understanding of their financial rights and responsibilities.

They Are Unromantic and Distrustful: While discussing financial matters may seem unromantic, having a prenuptial agreement can actually strengthen a relationship. It encourages open and honest communication about finances, which is a crucial aspect of a healthy partnership.

All Assets Are Split Equally: Without a prenuptial agreement in New York, assets might not necessarily be divided 50/50 in the event of a divorce. New York follows the principle of equitable distribution, meaning assets are divided in a way that is fair but not always equal. A prenuptial agreement allows couples to decide for themselves how they would like their assets to be divided.

It Can Include Personal Obligations: Some think that prenuptial agreements can dictate personal behavior, chores, or decisions regarding children. In reality, prenuptial agreements in New York are limited to financial matters and cannot enforce personal duties or decisions about child custody or support.

Key takeaways

When preparing to fill out and use the New York Prenuptial Agreement form, individuals are taking a significant step toward protecting their financial future and ensuring clear communication between partners. Here are key takeaways to keep in mind:

- Understand the purpose: A prenuptial agreement is designed to clarify the financial rights and responsibilities of each party in the event of a divorce or death. It's essential to approach this document with transparency and honesty.

- Seek independent legal advice: Both parties should obtain independent legal advice before signing any agreement. This ensures that each person fully understands the terms and that the agreement is fair and legally binding.

- Disclose all assets and liabilities: Full disclosure of each party's financial situation is a cornerstone of the prenuptial agreement process. Concealing assets can lead to the agreement being challenged or invalidated.

- Consider future changes: Life circumstances change, and the prenuptial agreement can include provisions for future adjustments. Couples may stipulate how potential future events, such as the birth of children or significant changes in wealth, will be handled.

Remember, a prenuptial agreement in New York offers a way for couples to communicate openly about finances and establish a foundation for mutual understanding. Careful consideration and honesty during this process can contribute to a stronger and more transparent relationship.

More Prenuptial Agreement State Forms

California Premarital Agreement - A Prenuptial Agreement form outlines the financial rights and obligations of each spouse in the event of a divorce or death.

Texas Premarital Agreement - Allows for jurisdiction-specific provisions to ensure the agreement complies with local laws.

Illinois Premarital Agreement - It allows for customized agreements, taking into account unique family situations, personal wealth, and mutual understandings between partners.