Fillable Prenuptial Agreement Document for Illinois

In Illinois, the idea of entering into a prenuptial agreement before marriage is becoming increasingly common as couples seek to determine the division of their property and financial obligations in the event of a divorce or the death of a spouse. This legal document serves as a transparent way for future spouses to outline their rights and responsibilities regarding assets, debts, and other financial matters before they tie the knot. The Illinois Prenuptial Agreement form is specifically designed to comply with state laws, ensuring that all provisions are enforceable, provided they are fair and were entered into without coercion. It covers a wide range of financial aspects, including but not limited to the protection of each party's pre-marriage assets, the division of property acquired during the marriage under certain conditions, and the delineation of inheritance rights. This agreement can also address issues like alimony and the allocation of retirement benefits, making it a comprehensive tool for financial planning before marriage. For couples who are entering into their marriage with significant assets or complexities in their financial lives, this form provides a means to set clear expectations and agreements, thus safeguarding each person's interests and contributing to a stronger foundation for their future together.

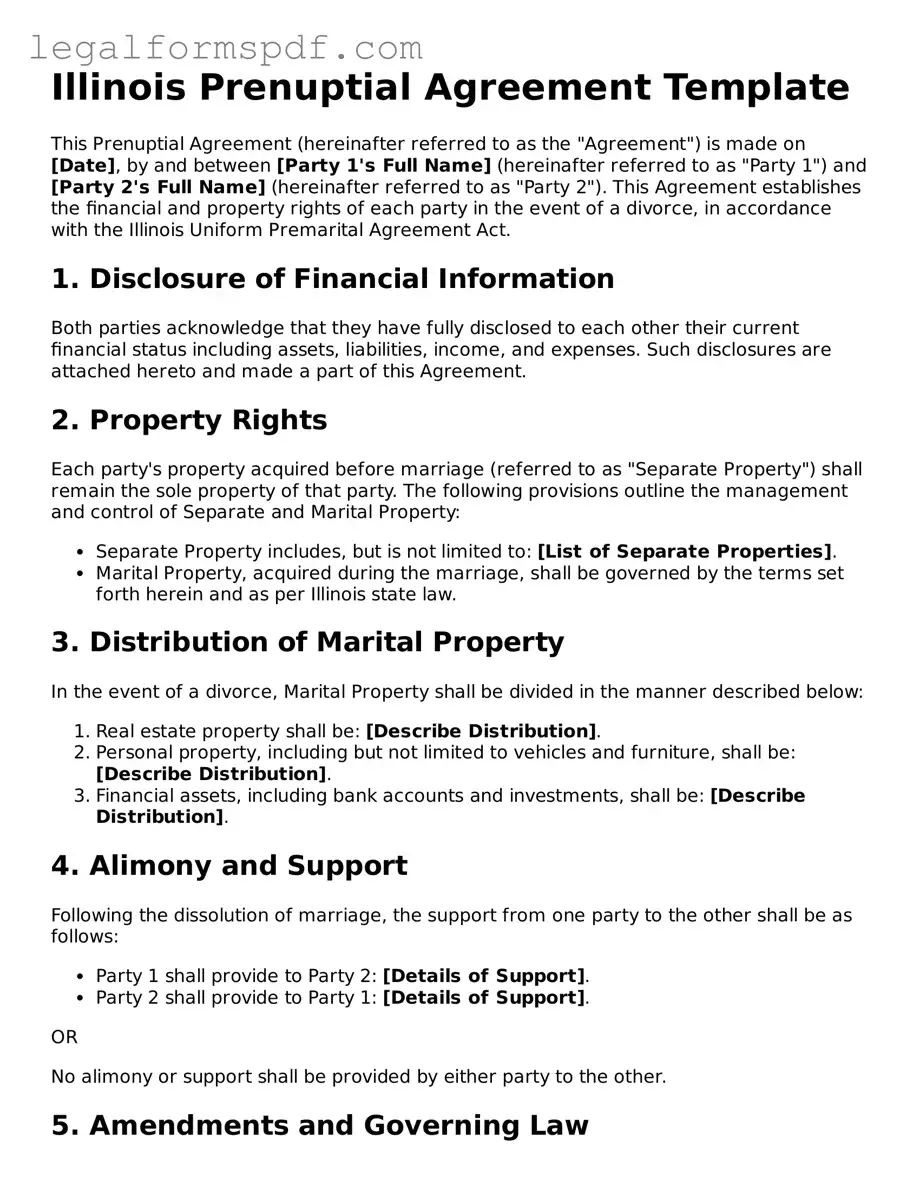

Document Example

Illinois Prenuptial Agreement Template

This Prenuptial Agreement (hereinafter referred to as the "Agreement") is made on [Date], by and between [Party 1's Full Name] (hereinafter referred to as "Party 1") and [Party 2's Full Name] (hereinafter referred to as "Party 2"). This Agreement establishes the financial and property rights of each party in the event of a divorce, in accordance with the Illinois Uniform Premarital Agreement Act.

1. Disclosure of Financial Information

Both parties acknowledge that they have fully disclosed to each other their current financial status including assets, liabilities, income, and expenses. Such disclosures are attached hereto and made a part of this Agreement.

2. Property Rights

Each party's property acquired before marriage (referred to as "Separate Property") shall remain the sole property of that party. The following provisions outline the management and control of Separate and Marital Property:

- Separate Property includes, but is not limited to: [List of Separate Properties].

- Marital Property, acquired during the marriage, shall be governed by the terms set forth herein and as per Illinois state law.

3. Distribution of Marital Property

In the event of a divorce, Marital Property shall be divided in the manner described below:

- Real estate property shall be: [Describe Distribution].

- Personal property, including but not limited to vehicles and furniture, shall be: [Describe Distribution].

- Financial assets, including bank accounts and investments, shall be: [Describe Distribution].

4. Alimony and Support

Following the dissolution of marriage, the support from one party to the other shall be as follows:

- Party 1 shall provide to Party 2: [Details of Support].

- Party 2 shall provide to Party 1: [Details of Support].

OR

No alimony or support shall be provided by either party to the other.

5. Amendments and Governing Law

This Agreement may only be amended or revoked by a written document signed by both parties. This Agreement shall be governed by and construed in accordance with the laws of the State of Illinois.

6. Acknowledgment

Both parties affirm that they enter into this Agreement voluntarily, without any duress or undue influence, and with a full understanding of its terms. They also acknowledge the right to consult with independent legal counsel regarding this Agreement and state that they have either availed themselves of such counsel or voluntarily waived the right to do so.

Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

Party 1's Signature: ___________________________ Date: [Date]

Party 2's Signature: ___________________________ Date: [Date]

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Prenuptial Agreement form is governed by the Illinois Uniform Premarital Agreement Act. |

| Purpose | The primary purpose of this form is to allow couples planning to marry to define their rights and obligations regarding property and financial matters. |

| Financial Disclosure | Full financial disclosure is required by both parties for the agreement to be enforceable under Illinois law. |

| Enforceability | The agreement must be in writing and signed by both parties to be enforceable. It cannot be enforced if found to be unconscionable or if signed under duress. |

Instructions on Writing Illinois Prenuptial Agreement

Embarking on marriage is an exciting journey, filled with plans for the future and shared dreams. An essential step for many couples in Illinois is to consider a prenuptial agreement. This legal document, often seen as a practical measure, allows both parties to outline the ownership of their individual assets and define financial terms in case the marriage ends. It's an opportunity to navigate potential future complexities with transparency and mutual understanding. To ensure the process runs smoothly, it's crucial to understand how to properly fill out the Illinois Prenuptial Agreement form.

The steps for completing the Illinois Prenuptial Agreement form involve gathering necessary information, careful consideration of each section, and ensuring accuracy in every detail. Follow these steps to create a comprehensive and legally sound agreement:

- Gather Financial Information: Both parties should prepare a detailed list of their assets, liabilities, income, and any expected inheritances or gifts. This encompasses everything from bank accounts, investments, and property to debts such as loans or credit card balances.

- Engage Legal Counsel: Although not mandatory, consulting with separate attorneys can provide invaluable advice and ensure the agreement meets legal standards and addresses both parties' interests. Attorneys can also clarify any legal terminology and implications.

- Draft the Agreement: Begin by entering the full names and addresses of both parties. This clearly identifies who is entering into the agreement.

- Detail the Financial Disclosures: Include the financial information gathered in step one, accurately listing all assets and liabilities. This ensures full transparency and inform decisions within the agreement.

- Outline Terms: Carefully define how assets and liabilities will be handled both during the marriage and in the event of a separation, divorce, or death. This might include details on property distribution, debt responsibility, and alimony.

- Define Any Special Arrangements: If there are specifics such as keeping family property within biological lines or arrangements for pre-marriage debt, include these details clearly.

- Signature and Notarization: After reviewing the agreement for accuracy and ensuring both parties understand and agree to the terms, sign the document in the presence of a notary. This step is crucial for the agreement's validity.

With thoughtful preparation and clear communication, a prenuptial agreement can serve as a foundational element of mutual respect and understanding in a marriage. Each step, though requiring attention to detail and sincerity, is a step towards securing a future that aligns with the aspirations and protections desired by both parties. After filling out the form, it's critical to keep it in a safe place and copies with each party's attorney, ensuring it can be readily accessed when needed.

Understanding Illinois Prenuptial Agreement

What is a Prenuptial Agreement in Illinois?

A prenuptial agreement in Illinois is a legal contract entered into by two people before they get married. This agreement outlines how assets will be divided and managed in the event of a divorce or the death of one spouse. It can also include terms concerning alimony. The goal is to provide clarity and protect each individual's interests.

Who should consider a Prenuptial Agreement?

Anyone with personal or business assets, debts, children from previous relationships, or who expects a large inheritance should consider a prenuptial agreement. It’s also wise for those looking to protect their financial future or ensure clarity in managing their affairs.

Are Prenuptial Agreements enforceable in Illinois?

Yes, prenuptial agreements are enforceable in Illinois, provided they meet specific legal requirements. The agreement must be in writing, signed by both parties voluntarily, and not include any unfair or unreasonable terms. Both parties should disclose all their assets and liabilities completely and honestly.

Can a Prenuptial Agreement decide child support or custody issues in Illinois?

No, prenuptial agreements in Illinois cannot predetermine child support or custody issues. These matters are decided by the court at the time of divorce, based on the child's best interests. A prenup can, however, address other financial aspects regarding children from previous relationships.

How can one ensure a Prenuptial Agreement is valid and enforceable in Illinois?

To ensure a prenuptial agreement is valid and enforceable in Illinois, both parties should: fully disclose their assets and liabilities, sign the agreement voluntarily, have the agreement in writing, and ideally, have independent legal counsel review. This helps avoid disputes over fairness or pressure to sign.

Can a Prenuptial Agreement be modified or revoked after it's been signed?

Yes, a prenuptial agreement in Illinois can be modified or revoked after it's been signed, but only if both parties agree to the changes. This agreement to modify or revoke must also be in writing.

Does a Prenuptial Agreement cover debts acquired during the marriage?

A prenuptial agreement primarily deals with each party's individual debts and assets before marriage. However, it can include provisions related to debts acquired during the marriage if the parties agree to this in the document. These specifications will determine how debts are handled in the event of divorce.

Common mistakes

Filling out a prenuptial agreement form in Illinois requires careful consideration and attention to detail. Mistakes in this process can have serious implications. One common error is not providing full financial disclosure. Both parties must fully disclose their assets, liabilities, income, and expenses. Without this transparency, the agreement can be vulnerable to challenges in the future. It's essential that both parties are honest and thorough in detailing their financial situation.

Another mistake is neglecting to have independent legal advice. Many individuals enter into prenuptial agreements without consulting their own attorney, who can advise them of their rights and the implications of the agreement. This independent legal advice is crucial for ensuring that the agreement is fair and that both parties fully understand the terms they are agreeing to.

Some people rush the process, which is a significant error. A prenuptial agreement should not be something that's done in haste. Illinois law requires that there be adequate time for both parties to consider the agreement before signing. Rushing can lead to oversights and a lack of understanding of the agreement's terms, potentially making it invalid.

People often make the mistake of including invalid provisions, such as decisions about child custody or support. These are matters that cannot be predetermined in a prenuptial agreement, as the court retains the right to make decisions based on the child's best interests at the time of the separation or divorce.

Another error is not updating the agreement as circumstances change. A prenuptial agreement is made based on the current state of affairs. However, financial situations and relationships evolve. Regular reviews and updates to the agreement can ensure that it remains fair and relevant.

Failing to ensure the agreement is procedurally correct is another common mistake. This includes having it in writing, signed by both parties, and witnessed as required by Illinois law. If these procedural elements are not correctly followed, the agreement may not be enforceable.

Lastly, some individuals treat the prenuptial agreement too casually. This is a legally binding document that can significantly affect both parties' financial and personal lives. Treating it with the seriousness it deserves, understanding its content fully, and considering its long-term implications is crucial. Inadequate consideration or treatment of this nature often leads to regret and legal complications down the line.

Documents used along the form

When couples decide to enter into a prenuptial agreement in Illinois, they're taking a step towards defining their financial rights and responsibilities before marriage. The Illinois Prenuptial Agreement form is just the starting point. To complement this agreement, and to ensure a comprehensive approach to their financial and legal planning, several other documents are often used. Here are some of these important documents, briefly explained.

- Will: A legal document that outlines how a person's assets and estate will be distributed upon their death. It's important to ensure it aligns with the prenuptial agreement.

- Living Will: Specifies a person's wishes regarding medical treatment in the event they become unable to communicate their decisions due to illness or incapacity.

- Durable Power of Attorney for Health Care: Authorizes a designated person to make healthcare decisions on someone's behalf if they are unable to do so themselves.

- Financial Power of Attorney: Grants a trusted individual the authority to handle financial affairs, often aligning with decisions made in the prenuptial agreement.

- Life Insurance Policy: A contract that pays out a sum of money upon the policyholder's death. Beneficiary designations should be consistent with the agreement's terms.

- Postnuptial Agreement: Similar to a prenuptial agreement but executed after marriage. It can be used to make adjustments to the initial prenup or to address new financial matters.

- Separation Agreement: In case of a separation, this document outlines the division of assets and responsibilities. While not always necessary, it's relevant for couples considering future contingencies.

- Trust Documents: Can be established to manage assets during a person's lifetime and distribute them after death, often used in conjunction with a will for estate planning.

- Marriage Certificate: Official proof of marriage. Though not directly related to financial agreements, it's required for legal changes post-marriage, affecting joint accounts and property ownership.

Engaging with these documents alongside the Illinois Prenuptial Agreement form can provide couples with a deeper layer of financial and legal security. Each document serves a specific purpose, contributing to a well-rounded approach to marital planning. It's advisable for couples to consider their unique circumstances and consult with a professional to ensure all paperwork supports their objectives and legal requirements.

Similar forms

The Illinois Prenuptial Agreement form shares similarities with a Postnuptial Agreement in several fundamental ways. Both documents are legal agreements between spouses or future spouses, with the key difference being the timing of their execution – the former is entered into before marriage, and the latter after the wedding has taken place. Each agreement outlines how assets, debts, and financial matters will be handled during the marriage or in the event of a divorce, providing a clear framework for the financial relationship between the spouses.

Similar to a Living Trust, the Illinois Prenuptial Agreement form helps individuals manage and protect their assets. While a prenuptial agreement sets forth the distribution and management of assets in the context of a marriage, a Living Trust is used to manage an individual's assets during their lifetime and distribute them upon their death. Both legal documents are proactive measures aimed at safeguarding assets and ensuring they are distributed according to the individual's wishes, albeit in different contexts.

Another document that bears resemblance to the Illinois Prenuptial Agreement is the Will or Testament. Both are used to dictate how assets and responsibilities are to be distributed; however, a Will takes effect after one's death, outlining the distribution of assets to heirs, whereas a prenuptial agreement addresses the allocation and management of assets during the marriage and potentially upon divorce. Each serves to clarify intentions and provide instructions for the management of one's estate.

The Illinois Prenuptial Agreement also shares characteristics with a Property Agreement, as both involve the delineation and handling of assets. In a Property Agreement, typically used by non-married couples or business partners, the focus is on who owns what and how assets will be divided in the event of a separation or dissolution of the partnership. The prenuptial agreement functions similarly within the context of marriage, detailing how assets and debts are categorized and handled.

Lastly, a Cohabitation Agreement is akin to the Illinois Prenuptial Agreement, though it is designed for couples who live together without getting married. Both agreements establish financial terms and asset distribution, aiming to protect each party’s interests. While the prenuptial agreement is tailored for those planning to marry, a Cohabitation Agreement applies to couples who choose to live together without legalizing their union, showcasing the adaptability of relationship agreements to various living situations and commitments.

Dos and Don'ts

When considering a Prenuptial Agreement in Illinois, it's essential to approach the process with careful thought and due diligence. This document, designed to clarify financial rights and responsibilities during a marriage and in the event of a divorce, requires both parties to pay close attention to detail. Below are the things individuals should and shouldn't do when filling out the Illinois Prenuptial Agreement form to ensure that the agreement is fair, transparent, and enforceable.

Things You Should Do

Ensure full disclosure of all assets and liabilities. Both parties involved must be completely transparent about their financial situation, including income, properties, and debts. This honesty helps create a foundation of trust and ensures the agreement is based on accurate data.

Seek independent legal advice. It is crucial for each person to have their own lawyer. This practice helps in understanding the rights and obligations that are being agreed upon, ensuring that the agreement is fair and that each person's interests are adequately protected.

Consider future changes. Life circumstances change over time. It's wise to account for potential future shifts such as inheritance, changes in income, or the possibility of children. Incorporating flexibility and conditions for future modifications can make the agreement more enduring and fair.

Give yourselves ample time. Do not rush the process. Both parties should have enough time to carefully review the agreement, seek advice, and consider its implications. Rushing can lead to oversight and misunderstanding of important details.

Things You Shouldn't Do

Don’t skip hiring a lawyer. It might be tempting to cut costs by not engaging lawyers or to have one lawyer for both parties. However, individual legal representation is key to ensuring that the agreement is both equitable and in line with Illinois law.

Avoid signing under pressure or duress. The agreement should be signed willingly by both parties, without any form of pressure, coercion, or undue influence. If one party feels pressured, the agreement's enforceability could later be challenged.

Don't ignore state laws. Illinois has specific requirements for prenuptial agreements under the Illinois Uniform Premarital Agreement Act. It's important that the form complies with these laws to ensure its validity. For instance, neglecting to have the agreement in writing or failing to properly execute it can render it unenforceable.

Refrain from unfair or unreasonable terms. An agreement that significantly favors one party over the other, or that imposes unreasonable conditions, might not be upheld in court. Fairness plays a critical role in the enforceability of a prenuptial agreement.

Misconceptions

When discussing prenuptial agreements in Illinois, there are several misconceptions that can lead to confusion and misunderstandings. It's imperative to address these inaccuracies to ensure that individuals are fully informed about what entering into a prenuptial agreement entails.

Only wealthy people need them: This is a common misconception. In reality, prenuptial agreements can benefit anyone who wants to clarify financial rights and responsibilities during marriage and in the event of divorce or death.

They are planning for divorce: Many believe that prenuptial agreements suggest a lack of trust or a anticipation of divorce. However, these agreements can actually strengthen a relationship by ensuring that both parties have a clear understanding of financial matters.

Prenuptial agreements cover child support and custody: In Illinois, prenuptial agreements cannot determine child support or custody arrangements. These matters are decided by the court based on what is in the best interest of the child at the time of the divorce.

All assets acquired after marriage are excluded: Not necessarily. The agreement can specify how future assets and earnings will be treated, including those acquired after marriage.

They are set in stone: While prenuptial agreements are legally binding, they can be amended or revoked after marriage if both parties agree.

They can waive the right to alimony: Although a prenuptial agreement can include provisions about alimony, Illinois law allows courts to invalidate these provisions if enforcing them would cause undue hardship to a party at the time of divorce.

They are only valid if both parties have lawyers: While it's highly recommended for each party to have legal representation, it is not a legal requirement for a prenuptial agreement to be valid in Illinois as long as it meets all other statutory requirements.

Signing close to the wedding date invalidates them: Not necessarily true. However, signing the agreement under duress, such as shortly before the wedding day, can be a reason for a court to invalidate the agreement.

Anything goes in a prenuptial agreement: The law places limits on what can be included in prenuptial agreements. Provisions that are illegal or against public policy will not be enforced by courts.

Understanding these misconceptions about Illinois prenuptial agreements can help individuals make informed decisions about their financial futures and the protection of their rights within a marriage.

Key takeaways

A prenuptial agreement in Illinois is a legal document couples may enter into before getting married to outline the distribution of assets and financial responsibilities during the marriage or in the event of divorce. When filling out and using an Illinois prenuptial agreement form, it's essential to keep several key points in mind to ensure the agreement is valid, enforceable, and reflects the intentions of both parties. Here are 10 critical takeaways:

- Both parties should fully disclose their financial assets and liabilities. In Illinois, a prenuptial agreement can be considered void if it's found that either party did not disclose their financial information fully and accurately.

- The agreement must be in writing. Oral prenuptial agreements are not enforceable under Illinois law.

- Each party should have their own attorney. This helps ensure that both individuals fully understand the agreement and that it is fair and legally binding.

- The agreement cannot be unconscionable. This means it should not be extremely unfair to one party to the extent that it would cause severe financial hardship were the marriage to end.

- The agreement must not include terms that violate public policy or law. For example, a prenuptial agreement cannot dictate child custody or child support terms.

- Both parties must sign the agreement voluntarily. Any sign of coercion, fraud, or duress can invalidate the document.

- Consider future changes in circumstances. While you can't predict everything, discussing and including provisions for potential future changes can help make your agreement more robust.

- Update the agreement as needed. Life changes such as the birth of children, significant increases or decreases in wealth, and moving to another state may necessitate changes to your prenuptial agreement.

- The agreement should be signed well before the wedding date. Signing too close to the wedding date may give the appearance of coercion.

- It must be notarized. In Illinois, a prenuptial agreement needs to be notarized to be considered legally binding.

By keeping these key takeaways in mind, couples can create a prenuptial agreement in Illinois that is fair, enforceable, and reflective of their wishes and financial situation. It's always recommended to consult with legal professionals who are experienced in family law to guide you through the process and ensure your rights and interests are fully protected.

More Prenuptial Agreement State Forms

Pennsylvania Premarital Agreement - The form can detail how debts accumulated before and during the marriage will be handled, protecting each spouse from potential liabilities.

Florida Premarital Agreement - The form is an expression of care, allowing couples to protect each other's financial interests.

Georgia Premarital Agreement - Document that ensures personal and business assets are clearly defined and protected in various circumstances.

Texas Premarital Agreement - Can include clauses on the inheritance of property to protect assets for children from previous relationships.