Fillable Prenuptial Agreement Document for Florida

Before embarking on the journey of marriage, many couples in Florida opt to establish clear guidelines and safeguards for their financial future through a prenuptial agreement. This document, often referred to as a "prenup," allows individuals to outline the ownership of their personal and financial assets, specify how property will be divided in the event of a divorce, and delineate any specific arrangements regarding alimony. The importance of this agreement in Florida lies not only in its ability to preemptively resolve potential disputes and provide peace of mind but also in its capacity to be tailored to the unique needs of each couple. With thoughtful consideration, a prenuptial agreement can serve as a strategic tool for managing one’s financial well-being, reinforcing the foundation upon which a lasting marriage can be built. It's crucial that this document is drafted and executed in accordance with Florida law to ensure its enforceability, making it all the more important for couples to understand the significant aspects and legal nuances involved in creating a valid prenuptial agreement in the Sunshine State.

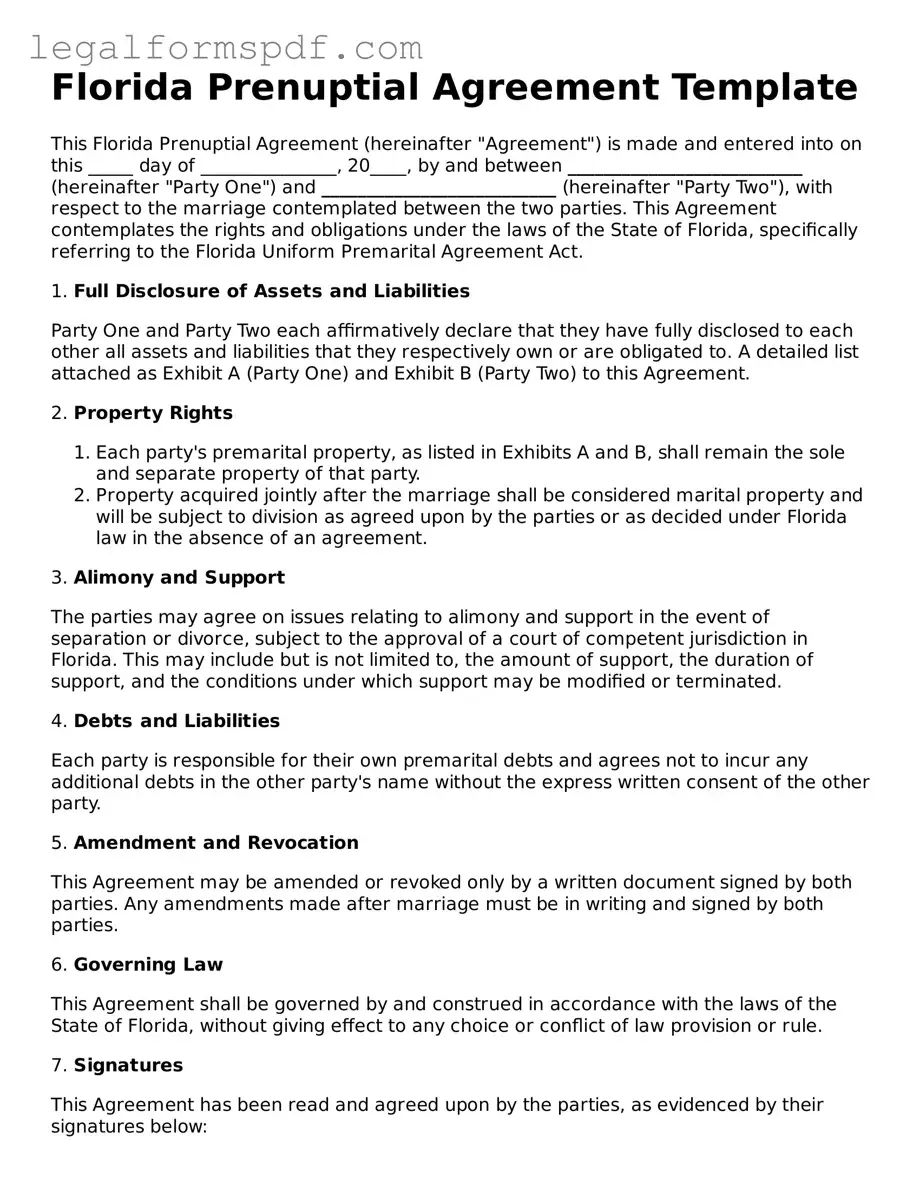

Document Example

Florida Prenuptial Agreement Template

This Florida Prenuptial Agreement (hereinafter "Agreement") is made and entered into on this _____ day of _______________, 20____, by and between __________________________ (hereinafter "Party One") and __________________________ (hereinafter "Party Two"), with respect to the marriage contemplated between the two parties. This Agreement contemplates the rights and obligations under the laws of the State of Florida, specifically referring to the Florida Uniform Premarital Agreement Act.

1. Full Disclosure of Assets and Liabilities

Party One and Party Two each affirmatively declare that they have fully disclosed to each other all assets and liabilities that they respectively own or are obligated to. A detailed list attached as Exhibit A (Party One) and Exhibit B (Party Two) to this Agreement.

2. Property Rights

- Each party's premarital property, as listed in Exhibits A and B, shall remain the sole and separate property of that party.

- Property acquired jointly after the marriage shall be considered marital property and will be subject to division as agreed upon by the parties or as decided under Florida law in the absence of an agreement.

3. Alimony and Support

The parties may agree on issues relating to alimony and support in the event of separation or divorce, subject to the approval of a court of competent jurisdiction in Florida. This may include but is not limited to, the amount of support, the duration of support, and the conditions under which support may be modified or terminated.

4. Debts and Liabilities

Each party is responsible for their own premarital debts and agrees not to incur any additional debts in the other party's name without the express written consent of the other party.

5. Amendment and Revocation

This Agreement may be amended or revoked only by a written document signed by both parties. Any amendments made after marriage must be in writing and signed by both parties.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida, without giving effect to any choice or conflict of law provision or rule.

7. Signatures

This Agreement has been read and agreed upon by the parties, as evidenced by their signatures below:

Party One: _________________________ Date: _______________

Party Two: _________________________ Date: _______________

Witness: _________________________ Date: _______________

Exhibits

Exhibit A: Party One's Assets and Liabilities

Exhibit B: Party Two's Assets and Liabilities

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Prenuptial Agreement is a legal document that a couple signs before marriage to outline the division of assets and liabilities in case of divorce or death. |

| Governing Law | It is governed by the Florida Uniform Premarital Agreement Act (FUPAA) under Florida Statutes, §§ 61.079. |

| Scope of Agreement | Includes terms for division of property, alimony, and debt. It cannot dictate child custody or support terms. |

| Enforceability Criteria | To be enforceable, the agreement must be in writing, signed voluntarily without fraud, duress, or undue influence, and with fair disclosure at the time of signing. |

| Financial Disclosure | Full financial disclosure is required between parties before signing the agreement to ensure fairness and transparency. |

| Amendment and Revocation | The agreement can be amended or revoked after marriage only by a written agreement signed by both parties. |

| Legal Representation | Though not mandatory, it's strongly recommended that each party has independent legal counsel to review the agreement before signing. |

Instructions on Writing Florida Prenuptial Agreement

Completing a Florida Prenuptial Agreement form is an essential process for couples looking to define their financial rights and responsibilities before marriage. This legal document, when done properly, can ensure clarity and fairness for both parties involved, and can significantly simplify financial matters and protect assets should the marriage ever come to an end. The steps outlined below are designed to assist you in accurately completing the form, ensuring that all necessary information is included and that the agreement is legally binding.

- Start by gathering all necessary financial documents for both parties, including bank statements, property documents, and any debt records. This will help in accurately disclosing all assets and liabilities.

- Enter the full legal names of both parties entering into the agreement at the top of the form, ensuring that the spellings are correct.

- Detail the financial assets and liabilities of each party in the designated sections. Be as specific and thorough as possible to ensure full transparency.

- Decide and document any specific terms regarding the division of property, spousal support, or debt responsibilities. Both parties must agree upon these terms.

- Include any provisions for the management of future earnings or acquisitions during the marriage. This can cover income, inheritances, or acquisitions of property.

- Review the conditions under which the agreement can be amended or voided. These conditions should be agreed upon by both parties.

- Both parties should carefully review the entire document to ensure that all the information provided is accurate and reflects their agreement.

- Have the agreement reviewed by independent legal counsel for each party. This step is crucial to ensure that the agreement is fair and legally binding according to Florida law.

- After review, each party must sign and date the form in the presence of a notary public. Ensure that all signatures are witnessed and properly notarized.

- Securely store the original signed document in a safe place and provide each party with a copy for their records.

It's important to approach the process of completing a Florida Prenuptial Agreement with care and diligence. By following these steps, couples can create a solid foundation for their financial future together. Remember, this legal document can offer peace of mind by providing predetermined solutions for potential financial disputes, allowing couples to focus on building their lives together without underlying concerns about financial disagreements.

Understanding Florida Prenuptial Agreement

What is a Florida Prenuptial Agreement?

A Florida Prenuptial Agreement is a legally binding contract entered into by two people before their marriage. It outlines how assets and financial issues will be handled during the marriage and in the event of a divorce. This agreement can cover a wide range of financial matters, including the division of property, spousal support, and the distribution of debts.

Who should consider a Prenuptial Agreement in Florida?

Individuals who have significant assets, debts, or children from previous relationships often consider prenuptial agreements. These agreements can also be beneficial for those who wish to protect their business interests or ensure that certain family heirlooms remain within the family. Essentially, anyone seeking to clarify financial rights and responsibilities in their marriage may find a prenuptial agreement to be beneficial.

Is a Prenuptial Agreement enforceable in Florida?

Yes, in Florida, prenuptial agreements are enforceable as long as they meet specific legal standards. The agreement must be in writing and signed by both parties. It becomes effective upon marriage. For enforcement, the agreement must be entered into voluntarily by both parties, and its terms must be fair and reasonable. Full disclosure of all assets and liabilities by both parties is required, or the document must acknowledge the express waiver of such disclosure.

Can a Prenuptial Agreement be modified or revoked?

Yes, a prenuptial agreement in Florida can be modified or revoked after it is signed, but this requires the mutual consent of both parties. Any changes or the revocation must be made in writing and signed by both parties, similar to the requirements for the original agreement.

What cannot be included in a Florida Prenuptial Agreement?

Certain subjects are not permitted within a Florida Prenuptial Agreement. Provisions regarding child custody or support are not enforceable as these decisions are based on the child's best interest at the time of the divorce or separation. Additionally, any clauses that incentivize divorce or that are deemed to violate public policy may also be considered unenforceable.

How does a Prenuptial Agreement impact divorce proceedings?

A prenuptial agreement can significantly impact divorce proceedings by predetermining how assets, debts, and spousal support are addressed. If the agreement is valid, courts generally adhere to its terms, simplifying and speeding up the divorce process. However, if the agreement is found to be invalid for any reason, such as coercion or lack of disclosure, the court may disregard its terms and the division of assets will follow Florida law.

Do both parties need their own lawyer?

While Florida law does not require each party to have their own lawyer to execute a prenuptial agreement, it is strongly recommended. Having separate legal representation helps ensure that both parties fully understand the agreement and that it is fair and voluntarily entered into. This can also facilitate enforcement of the agreement in court, should that ever become necessary.

What is the process for creating a Florida Prenuptial Agreement?

The process involves several steps, starting with each party disclosing their financial situation fully and accurately. The couple should discuss their financial expectations during and possibly after the marriage. Once they reach an agreement, they draft the document, outlining how their assets, debts, and other issues will be handled. Both parties should have separate legal advisors review the agreement to ensure it is fair and meets legal standards. After reviewing, both parties sign the document, and it becomes effective upon marriage.

Can a Prenuptial Agreement cover personal matters, like chores or raising children?

While a Florida Prenuptial Agreement can mention personal preferences, such as responsibilities in the marriage or how to raise children, these provisions are not legally enforceable. The main purpose of a prenuptial agreement is to address financial matters and asset protection. Provisions relating to non-financial matters may be included as a way to express the couple's intentions, but they would not be grounds for legal action if breached.

Common mistakes

Filling out a prenuptial agreement in Florida, an important step for couples looking to clarify financial aspects before marriage, often involves complex considerations. Unfortunately, many make errors in this process, potentially leading to disputes or the agreement being invalidated. One common mistake is not allowing enough time for both parties to consider the agreement thoroughly. This haste can lead to accusations of coercion or lack of understanding, especially if one party feels rushed into signing without adequate time to consult with legal counsel.

Another error is neglecting to disclose all financial assets and liabilities fully. Transparency is the cornerstone of a valid prenuptial agreement in Florida. Failing to provide a complete and honest disclosure can result in parts of the agreement being voided or, in some cases, the entire agreement. It's crucial for both parties to list all their assets, debts, and income to ensure the agreement is based on mutual understanding and trust.

Some couples make the mistake of not seeking independent legal advice. It's essential for each party to have their lawyer to ensure their interests are adequately represented and protected. Without independent legal advice, there's a risk that the agreement could be challenged on the grounds that one party did not fully understand the implications of what they were signing.

Omitting specifics about the division of future assets or income can also pose problems. A prenuptial agreement should be as clear as possible regarding how future assets, including earnings, inheritances, or increases in the value of separate property, will be handled. Vagueness or ambiguity can lead to conflicts and legal challenges down the line.

Another common oversight is failing to include provisions for changes in circumstances. Life is unpredictable, and a prenuptial agreement should account for significant changes, such as the birth of children, a substantial increase or decrease in wealth, or changes in employment that could affect the agreement's fairness or relevance.

Some individuals also err by incorporating personal non-financial terms, such as household responsibilities, frequency of visits from in-laws, or decisions about children's upbringing. Courts typically do not enforce such terms, and their inclusion can risk invalidating otherwise enforceable financial provisions.

Not considering the agreement's enforceability under Florida law is a significant misstep. Laws vary by state, and what may be enforceable in one state could be void in Florida. Ensuring the agreement complies with Florida law is crucial for its validity.

Underestimating the importance of proper execution and documentation is another common mistake. For a prenuptial agreement to be valid in Florida, it must be signed by both parties voluntarily and with the proper formalities. Skimping on this process can lead to questions about the agreement's validity.

Finally, not updating the agreement over time can render it less relevant or fair as circumstances change. Regularly reviewing and amending the agreement, if necessary, ensures it remains relevant and enforceable.

Awareness and avoidance of these common mistakes can help couples ensure their Florida prenuptial agreement is valid, fair, and enforceable, providing peace of mind as they enter into marriage.

Documents used along the form

When couples decide to marry in Florida, a Prenuptial Agreement form is commonly utilized to outline the assets and financial rights of each partner before marriage. This legal document helps safeguard individual assets and clarifies financial responsibilities should the marriage end. Alongside the prenuptial agreement, there are several other forms and documents that are often used to ensure that all aspects of a couple's financial and personal affairs are clearly defined and protected. Below is a brief description of up to five other key documents that couples might consider.

- Will and Testament: This document specifies how a person’s assets will be distributed upon their death. It is crucial for ensuring that assets are allocated according to one’s wishes and not merely divided according to state law.

- Durable Power of Attorney: This grants a designated person the authority to make decisions on behalf of one party, especially concerning financial matters and health care, in case they become unable to do so themselves.

- Living Will: Often used in tandem with a durable power of attorney, a living will outlines an individual's wishes regarding medical treatment and life support in situations where they are unable to communicate their decisions due to illness or incapacitation.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is executed after marriage. It outlines how assets and debts will be handled during the marriage or in the event of divorce or death, reflecting changes in financial situations or personal wishes after the wedding.

- Financial Affidavit: This is a comprehensive statement of an individual's financial earnings, assets, liabilities, and expenses. It is often used in conjunction with prenuptial and postnuptial agreements to provide a clear, detailed snapshot of each party's financial standing at the time of the agreement's execution.

Each of these documents plays a vital role in managing personal and financial affairs, providing peace of mind for the future. Couples considering a Prenuptial Agreement in Florida should also explore these additional documents. Consulting with a legal advisor familiar with family law in Florida can help ensure that all paperwork is thorough and reflects the couple's intentions accurately.

Similar forms

Similar to the Florida Prenuptial Agreement form, a Postnuptial Agreement outlines how a couple's assets and debts will be divided in case of separation, divorce, or death, but it's established after the couple has already gotten married. Both documents are designed to clarify financial rights and responsibilities during marriage and in the event of a marriage ending. They share the goal of creating a clear financial understanding between the parties, but the timing of their creation is what sets them apart.

A Cohabitation Agreement is another document that bears resemblance to a Florida Prenuptial Agreement, tailored for couples who live together but are not legally married. This agreement allows partners to define the division of their assets, debts, and responsibilities if the relationship ends or if one partner passes away. While serving a similar protective purpose for the parties involved, it caters to those who choose not to marry or those awaiting legal marriage rights.

The Florida Prenuptial Agreement form is also akin to a Financial Affidavit in its need for full financial disclosure from both parties involved. A Financial Affidavit is often used in divorce proceedings to declare an individual's financial earnings, assets, and liabilities. It ensures transparency and fairness in the division of assets and determination of support obligations. Both documents rely on accurate, honest accounting of each party's financial situation to fulfill their objectives.

Another related document is the Will or Last Will and Testament, which specifies how a person’s assets and estate will be distributed upon their death. Both a Will and the Prenuptial Agreement deal with the distribution of assets and ensure that a person’s wishes are respected after they're no longer able to make decisions. They differ in scope and timing, yet both serve to protect assets and respect the wishes of the individuals involved.

Lastly, the Marital Settlement Agreement, which is an essential document during a divorce process, shares similarities with a Florida Prenuptial Agreement. Both parties determine how their finances, assets, and other personal matters will be resolved. While a Prenuptial Agreement is prepared before any conflict arises, a Marital Settlement Agreement is drafted when the marriage is already set to end, outlining the terms of the divorce agreed upon by both parties.

Dos and Don'ts

When you're filling out the Florida prenuptial agreement form, it's important to approach the task with care and precision. This document outlines how assets and financial responsibilities will be handled during the marriage and potentially upon its dissolution. To assist you, here are essential dos and don'ts to consider:

Do:

- Review all financial information thoroughly. Both parties should fully disclose their assets, liabilities, and income to each other to ensure the agreement is based on a solid foundation of trust and transparency.

- Seek independent legal advice. It's crucial for each person to have their lawyer who can provide guidance and ensure their interests are protected. This also helps in making the agreement enforceable.

- Discuss the agreement well in advance of the wedding. This provides ample time for both parties to consider the agreement carefully and make any necessary adjustments.

- Consider future changes. Life circumstances change, so it’s important to include provisions for future adjustments to the agreement. This can include changes in income, inheritance, or the birth of children.

- Ensure the agreement is in writing and signed by both parties. A prenuptial agreement must be documented properly to be valid. Both parties must sign the agreement willingly and without any form of pressure or duress.

Don't:

- Hide any financial information. Withholding details about your financial situation can render the agreement void or unenforceable. Honesty is not just the best policy; it’s a vital legal requirement.

- Rush the process. Taking the time to carefully consider and understand the agreement is crucial. Rushing can lead to oversights or misunderstandings that could significantly impact both parties in the future.

- Ignore state laws. Florida has specific requirements for prenuptial agreements. Ignoring these can result in the agreement not being recognized by a court.

- Use ambiguous language. Clarity is key in legal documents. Ambiguous terms or unclear provisions can lead to disputes and may result in parts of the agreement being invalidated.

- Forget to update the agreement. As time passes, circumstances change. Neglecting to revise your prenuptial agreement to reflect these changes can lead to complications should the agreement ever need to be enforced.

Misconceptions

When considering a prenuptial agreement in Florida, it's easy to find oneself overwhelmed by misconceptions. These documents are not only for the wealthy but serve as a proactive approach to managing financial matters and expectations in a marriage. Here, we address some common misunderstandings:

Prenuptial agreements are only for the wealthy. This misconception stems from the notion that prenuptial agreements are designed to protect vast assets. However, they serve all levels of income, focusing on clarifying financial rights and responsibilities, safeguarding individual assets, and planning for future financial matters.

Discussing prenups means you anticipate divorce. Many view prenuptial agreements as a negative omen for marriage. In contrast, these agreements encourage couples to communicate openly about finances, fostering a stronger foundation for the relationship.

Prenuptial agreements only cover assets and debts. While assets and debts are significant components, prenuptial agreements can also detail how couples will handle earnings during the marriage, spousal support, and the division of property if the marriage ends or upon one partner's death.

Prenups strip away spousal rights. Far from eliminating spousal rights, prenuptial agreements can ensure financial fairness and security. It outlines conditions agreed upon by both parties, considering both partners' interests.

Children from the marriage can be included in the prenup. Florida law does not allow the inclusion of child support or custody arrangements in prenuptial agreements. Decisions regarding children must be made based on the children's best interests at the time of the divorce or separation, not pre-determined in a prenup.

You can sign a prenup right before the wedding. While you technically can, it's not advisable. Last-minute agreements are more susceptible to challenges based on duress or lack of adequate consideration. Adequate time for review and negotiation is crucial.

If my spouse cheats, the prenup is void. Infidelity clauses can be included in Florida prenuptial agreements; however, the overall enforceability of the prenup does not automatically become void due to infidelity. The effect of an infidelity clause depends on its specific terms and conditions.

Prenuptial agreements are set in stone. Although prenuptial agreements are legally binding, changes can be made post-marriage through a postnuptial agreement, as long as both parties agree. Life changes, and so can agreements made between spouses.

Understanding and dispelling these misconceptions are vital steps toward recognizing the true value and function of a prenuptial agreement in Florida. Proper legal guidance can help ensure that a prenuptial agreement accurately reflects a couple's wishes and complies with Florida law.

Key takeaways

In preparing and utilizing the Florida Prenuptial Agreement form, it is essential to understand its purpose and implications within a marriage. This legal document, designed prior to marriage, outlines the ownership of personal and financial assets should the marriage dissolve. Here are four key takeaways that individuals entering into such agreements should consider:

- Full Disclosure is Necessary: Both parties must be completely transparent about their financial situations. This includes revealing all assets, liabilities, income, and expectations of gifts or inheritances. The aim is to ensure that both individuals are making informed decisions, avoiding any future disputes over nondisclosure.

- Legal Advice is Recommended: Although not obligatory, consulting with legal counsel can be invaluable. Each party should ideally have their own attorney to help navigate the complexities of the agreement, ensuring that it is fair and adheres to Florida laws. Legal professionals can also foresee potential future scenarios that could affect the agreement’s fairness and enforceability.

- Understand Your Rights: Under Florida law, certain rights and obligations are automatically bestowed upon married individuals. A prenuptial agreement can alter or waive these rights, which might otherwise be entitled to upon divorce or death. It is critical to comprehend how this agreement modifies those rights and the implications thereof.

- Amendment and Revocation: Once signed, the agreement is not set in stone. It can be amended or revoked, but this must be done in writing and with the mutual consent of both parties. Any changes to the agreement post-marriage also need to follow these formalities to be valid.

Utilizing a Florida Prenuptial Agreement form is a significant step for couples as they prepare for marriage. It provides a clear framework for managing individual and joint financial matters, offering peace of mind. By thoroughly understanding and thoughtfully considering the above points, couples can ensure that their agreement aligns with their expectations and legal standards.

More Prenuptial Agreement State Forms

Michigan Premarital Agreement - This form can be used to establish guidelines for managing joint financial accounts and investments, promoting transparency and mutual understanding.

Ohio Premarital Agreement - This legal formality is especially crucial in marriages with international assets, addressing different legal systems.

California Premarital Agreement - Important for couples where one or both partners own a business, protecting business assets from marital claims.

Texas Premarital Agreement - This document allows couples to establish financial expectations before tying the knot.