Fillable Prenuptial Agreement Document for California

In California, couples on the brink of tying the knot often consider a step that can significantly impact their financial future together: entering into a Prenuptial Agreement. This legal document, far from casting a shadow over the romantic sentiment, serves as a pragmatic tool for managing assets and obligations before marriage. The California Prenuptial Agreement form facilitates discussions about how property, debts, and financial matters would be handled in the unfortunate event of a divorce or the death of a spouse. Importantly, it provides a clear framework that respects both parties' interests, potentially avoiding contentious disputes should the marriage end. The agreement can cover a wide range of financial aspects, including the division of property, allocation of debts, spousal support, and the protection of inheritances or personal business interests. However, it's essential to note that the form must comply with California's unique legal standards and requirements to ensure its enforceability. These stipulations include full financial disclosure, adequate legal representation for both parties, and the observance of a fair process, free from duress or undue influence. Designed with foresight, the California Prenuptial Agreement form sets a foundation for marital financial planning, embodying both parties' aspirations for a secure and equitable partnership.

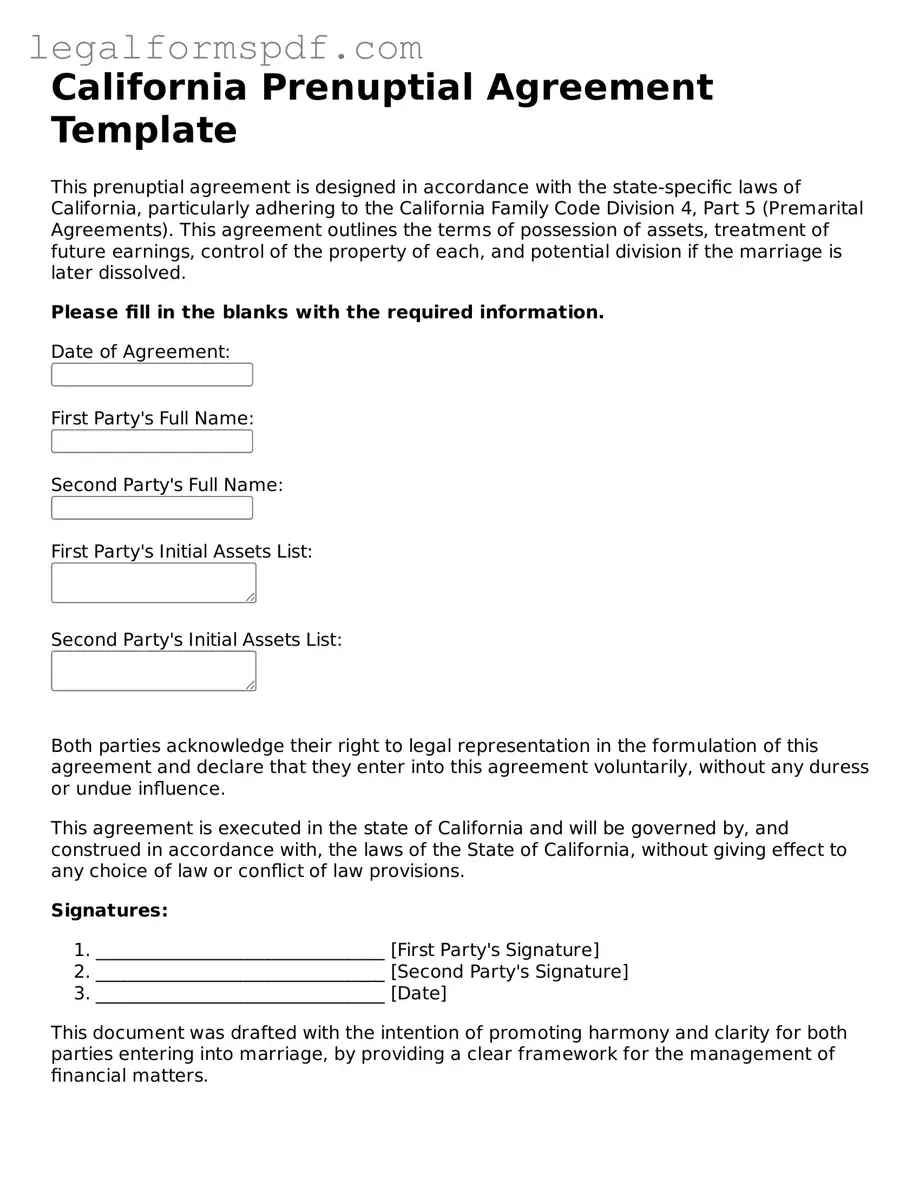

Document Example

California Prenuptial Agreement Template

This prenuptial agreement is designed in accordance with the state-specific laws of California, particularly adhering to the California Family Code Division 4, Part 5 (Premarital Agreements). This agreement outlines the terms of possession of assets, treatment of future earnings, control of the property of each, and potential division if the marriage is later dissolved.

Please fill in the blanks with the required information.

Both parties acknowledge their right to legal representation in the formulation of this agreement and declare that they enter into this agreement voluntarily, without any duress or undue influence.

This agreement is executed in the state of California and will be governed by, and construed in accordance with, the laws of the State of California, without giving effect to any choice of law or conflict of law provisions.

Signatures:

- ________________________________ [First Party's Signature]

- ________________________________ [Second Party's Signature]

- ________________________________ [Date]

This document was drafted with the intention of promoting harmony and clarity for both parties entering into marriage, by providing a clear framework for the management of financial matters.

PDF Specifications

| Name of Fact | Description |

|---|---|

| Governing Law | The California Prenuptial Agreement is governed by the California Family Code, Sections 1610-1617. This state-specific code outlines the requirements, enforceability, and limitations of prenuptial agreements within California. |

| Financial Disclosure | Full and fair disclosure of each party's financial situation is required in California. This includes assets, liabilities, income, and expenses. Failure to disclose can affect the enforceability of the agreement. |

| Right to Legal Representation | Both parties have the right to independent legal representation when drafting and signing a prenuptial agreement in California. This safeguards against undue influence and ensures each party's interests are represented. |

| Waiting Period | California law requires a seven-day waiting period between the time a prenuptial agreement is first presented and when it is signed. This period allows for consideration and legal consultation. |

| Unenforceable Provisions | Certain provisions, such as those that waive the right to child support or that promote divorce, are unenforceable in prenuptial agreements under California law. |

Instructions on Writing California Prenuptial Agreement

A prenuptial agreement in California is a legal document couples may choose to complete before getting married, outlining the management of their financial matters during and after the marriage, and in case of separation, divorce, or death. Preparing this document requires careful attention to detail, ensuring all relevant aspects are thoroughly covered. Here are the steps to fill out a California Prenuptial Agreement form effectively, starting with gathering necessary financial information from both parties.

- Begin by entering the full legal names of both parties entering into the agreement.

- Specify the date when the agreement will take effect, typically the date of marriage.

- Detail each party's current financial status, including assets, liabilities, income, and expectations of gifts and inheritances. This often requires attaching additional schedules or lists.

- Decide how property (both current and future acquisitions) will be managed during the marriage, including property purchased jointly or separately.

- Outline the terms regarding the division of property and financial responsibilities in the event of separation, divorce, or death. This may include maintenance or spousal support considerations.

- Agree on any specific arrangements concerning retirement benefits, insurance policies, and taxes.

- Discuss and decide on how disputes related to the agreement will be resolved, such as through mediation or arbitration.

- Include provisions for the amendment or revocation of the agreement, detailing how changes should be made.

- Both parties must read the agreement in its entirety, ensuring understanding and agreement on all points.

- Sign the document before a notary public to validate the agreement. It is recommended for each party to seek independent legal advice before signing.

After filling out the California Prenuptial Agreement form, it's important to keep a copy in a safe and accessible place. Both parties should have their copies, and an additional copy can be kept with a legal advisor or in a safe deposit box. This ensures that the agreement is available when needed and can be referenced or enforced in the future if necessary.

Understanding California Prenuptial Agreement

What is a California Prenuptial Agreement Form?

A California Prenuptial Agreement Form is a legal document created before marriage, setting forth how assets and financial matters will be handled during the marriage and in the event of a separation, divorce, or death. It allows couples to decide their financial rights and responsibilities, rather than leaving it to state law.

Why should a couple consider signing a Prenuptial Agreement in California?

Signing a Prenuptial Agreement in California helps protect individual assets, clarify financial rights and responsibilities, avoid potential conflicts in case of separation, and ensure financial security for both parties. It’s particularly important in California, a community property state, where without an agreement, assets acquired during marriage are typically divided equally in a divorce.

Are there any requirements for a Prenuptial Agreement to be valid in California?

Yes, for a Prenuptial Agreement to be valid in California, it must be in writing, signed by both parties, and entered into voluntarily. Both parties must have had the opportunity to consult with their own independent legal counsel, or have explicitly waived the right to do so in writing. Additionally, there must be full disclosure of all assets and liabilities by both parties, and the agreement cannot promote divorce or violate public policy.

Can a Prenuptial Agreement in California cover child support or custody issues?

No, in California, a Prenuptial Agreement cannot dictate terms regarding child support or custody issues. These matters are determined based on the child's best interest at the time of the legal separation or divorce, and not by prior agreements between parents.

How can someone modify or revoke a Prenuptial Agreement in California?

In California, a Prenuptial Agreement can be modified or revoked only by a written agreement signed by both parties. The process is similar to creating the initial agreement and requires full transparency and mutual consent.

Does a couple need a lawyer to create a Prenuptial Agreement in California?

While it's not legally required, having a lawyer is highly recommended when creating a Prenuptial Agreement in California. Lawyers can ensure that the agreement complies with state laws, represents both parties' interests fairly, and is enforceable in court. Additionally, the requirement for independent legal advice or the voluntary waiver of that advice is a critical aspect of ensuring the agreement's validity.

What happens if a Prenuptial Agreement is deemed invalid in California?

If a Prenuptial Agreement is deemed invalid in California, the court may disregard the entire agreement or certain provisions. The division of assets and financial obligations would then be resolved in accordance with California's community property laws or other relevant state statutes, treating the couple as if no agreement had ever existed.

Are Prenuptial Agreements effective in preventing disputes in the event of divorce?

While not absolute, Prenuptial Agreements can significantly reduce disputes during a divorce, especially those related to asset division and financial matters. By clarifying rights and responsibilities from the start, these agreements can mitigate potential misunderstandings and disagreements. However, issues related to child support and custody will always be open to review and modification by the court.

Common mistakes

One common mistake made when filling out the California Prenuptial Agreement form is overlooking the full disclosure requirement. Individuals often fail to disclose all assets and liabilities, either intentionally or accidentally. This oversight not only undermines the trust between partners but also potentially invalidates the agreement, since California law mandates complete transparency about each party's financial situation before the agreement is executed. Such an omission can lead to complications and disputes in the event that the marriage dissolves, affecting the equitable division of assets and liabilities.

Another critical error is neglecting to seek independent legal advice. Some couples, in the spirit of trust and companionship, opt to use the same attorney or, worse, forego legal advice altogether. This approach can lead to a significant imbalance in the agreement, favoring one party over the other. Independent legal counsel ensures that both parties fully understand the terms of the agreement and the rights they may be waiving. California courts are known to scrutinize prenuptial agreements for fairness, and without evidence of independent legal review, there's a risk the agreement could be deemed invalid.

A lack of precision in drafting the terms of a prenuptial agreement constitutes a further common mistake. Ambiguities in language or failure to specify certain conditions can create loop-holes that render some clauses of the agreement ineffective. It is crucial that the document is clear, detailed, and leaves no room for interpretation on issues such as asset distribution, debt responsibility, and spousal support. The agreement should be tailored to the couple's unique situation, avoiding generic terms that may not adequately address their specific needs and conditions.

Lastly, couples often underestimate the importance of timing when signing a prenuptial agreement in California. Rushing to sign the document close to the wedding date can lead to challenges later on, with claims that one party was coerced into signing under duress. California law recommends executing the agreement well in advance of the wedding. This ensures that both parties have had sufficient time to contemplate the agreement's implications and consult with their respective legal advisors. Giving the process the time it deserves minimizes the likelihood of future contests on the grounds of undue pressure or lack of understanding.

Documents used along the form

When couples in California decide to create a Prenuptial Agreement, it often involves careful consideration and planning. This legal document is just one part of a suite of forms that can help protect assets, define property rights, and outline responsibilities before marriage. While the Prenuptial Agreement is crucial, several other documents often accompany it, ensuring comprehensive coverage of all aspects of the couple's financial and personal affairs. Below are some of the commonly used documents alongside a California Prenuptial Agreement.

- Will and Testament: This document outlines how an individual's assets and responsibilities are managed and distributed in the event of their death. It's essential for ensuring that assets are allocated according to the individual's wishes and can complement a Prenuptial Agreement by clarifying the distribution of property upon death.

- Durable Power of Attorney for Finances: It allows one partner to manage the financial affairs of the other if they become unable to do so. This document can be crucial if one partner becomes incapacitated and decisions need to be made regarding shared financial interests.

- Advanced Healthcare Directive: This document specifies an individual's preferences for medical care if they're unable to make decisions themselves. It can designate a health care proxy, who will make decisions based on the incapacitated person's wishes, ensuring personal choices are respected even in dire circumstances.

- Life Insurance Policies: Often, couples will update or purchase new life insurance policies as part of their pre-marital planning to ensure financial security for the surviving spouse. This can be particularly important when there are specific obligations or debts that need to be covered.

- Property Deeds: When real estate is involved, deeds and other property documents become critical. These outline the ownership and can specify how the property is to be divided or managed in the event of death or divorce, working in tandem with the Prenuptial Agreement to ensure clarity and fairness.

- Beneficiary Designations: Updating beneficiary designations on retirement accounts, investment accounts, and other financial instruments is necessary to align with the agreements made in the Prenuptial Agreement. This ensures that, in the event of death, assets are distributed according to the couple's shared plans.

While the Prenuptial Agreement is a foundational document for marrying couples in California, the addition of these supporting documents ensures a holistic approach to pre-marital planning. They serve to not only protect individual interests but also strengthen the partnership by setting clear expectations and provisions for the future. By considering each of these documents, couples can ensure they are well-prepared for all of life's eventualities, making their commitment with confidence and security.

Similar forms

The Postnuptial Agreement, similar to the California Prenuptial Agreement, is utilized by married couples to specify the distribution of assets and financial responsibilities in the event of a separation or divorce. While both documents serve a similar purpose in managing financial arrangements between couples, the key distinction lies in their timing. The Postnuptial Agreement is executed after the marriage has taken place, unlike the Prenuptial Agreement, which is arranged prior to the wedding.

A Cohabitation Agreement is another document closely related to the California Prenuptial Agreement, aimed at protecting the assets of unmarried couples who live together. This agreement outlines how assets and finances should be handled during the relationship and in the event of a breakup. While a Prenuptial Agreement is designed for couples planning to marry, a Cohabitation Agreement caters to those who choose to cohabit without formalizing their relationship through marriage.

The Separation Agreement shares similarities with the California Prenuptial Agreement as both outline the division of assets, debts, and other responsibilities in the event of a separation. However, the Separation Agreement is specifically designed for couples who are considering or have decided to live apart, detailing the terms of their separation. This document comes into play after issues arise in the marriage, contrasting with the Prenuptial Agreement, which is preventive and established before marriage.

A Will or Last Testament, while primarily focused on dictating the distribution of an individual's assets posthumously, bears resemblance to the California Prenuptial Agreement in terms of asset distribution. Both documents allow individuals to specify how their assets should be handled, but while a Prenuptial Agreement addresses asset division in the context of marriage dissolution, a Will pertains to asset division after the individual's death.

Lastly, the Financial Affidavit is a document often used in divorce proceedings to declare an individual's financial status, including income, assets, debts, and expenses. It is akin to the California Prenuptial Agreement in that it involves the disclosure of financial information by parties in a marriage. However, the Financial Affidavit is used for court proceedings to assist in determining alimony, child support, and asset division, whereas the Prenuptial Agreement sets forth the agreement between parties regarding finances before any conflicts arise.

Dos and Don'ts

Filling out a California Prenuptial Agreement form is a significant step for couples planning to marry. It’s important to approach this document thoughtfully and meticulously to ensure it reflects both parties' wishes and complies with California law. Here are key dos and don'ts to remember:

- Do thoroughly discuss the terms of the prenuptial agreement before starting the form. It's crucial for both parties to have a clear understanding and agreement on the terms.

- Do fully disclose all assets and liabilities. Transparency is foundational to a valid prenuptial agreement in California.

- Do consult with separate attorneys. Each party should have their own legal representation to ensure their interests are fully protected and the agreement is fair.

- Do consider including a sunset clause. Some couples opt for the agreement to expire after a certain period of marriage.

- Don't rush the process. California law requires a seven-day waiting period from the time the agreement is first presented until it is signed. This allows time for careful consideration and legal advice.

- Don't include provisions about child support or custody. California courts will not uphold terms concerning child support or custody in a prenuptial agreement.

- Don't sign the agreement under duress. For a prenuptial agreement to be valid, both parties must sign it voluntarily and without any pressure.

- Don't forget to update the agreement as circumstances change. It’s a good idea to review and possibly revise the prenuptial agreement to reflect significant changes in finances or other relevant aspects.

Misconceptions

Prenuptial agreements, often referred to as "prenups," are a common legal step taken before marriage. These agreements address the division of assets and financial arrangements should the marriage dissolve. Despite their utility, many misconceptions about the California Prenuptial Agreement form persist, affecting couples' decisions to pursue this legal safeguard. Here are seven of those misconceptions explained.

- Prenups are only for the wealthy. This common misconception overlooks the broad utility of prenuptial agreements. While it's true that individuals with substantial assets may benefit from a prenup, these agreements also serve middle-income individuals by protecting future earnings, safeguarding against debt acquired by a spouse, and outlining terms for spousal support, making them a practical consideration for many.

- Prenups inevitably predict divorce. Viewing prenups as a sign of mistrust or a prediction of divorce is a misunderstanding of their purpose. In reality, prenups encourage couples to have honest discussions about finances, expectations, and the future, which can strengthen a relationship by ensuring both parties enter marriage with clear, mutual understanding and respect for each other's wants and needs.

- Prenups strip away all rights. Some believe that signing a prenup means relinquishing all rights to financial support or assets in the event of a divorce. However, prenups cannot legally include terms that are unjust, illegal, or diminish the right to child support. A fair and well-constructed prenup outlines agreed-upon terms and can provide security and clarity for both parties.

- Prenuptial agreements are final and cannot be changed. Contrary to what some might think, prenups are not set in stone. Couples can modify their agreement post-marriage through a postnuptial agreement as long as both parties agree to the changes. This flexibility allows the agreement to evolve alongside the marriage, adapting to changing circumstances and priorities.

- Everything acquired during marriage is shared, regardless of a prenup. This misunderstanding neglects the power of a prenup to classify certain future acquisitions as separate property. While state law generally dictates that property acquired during marriage is marital property, a prenup can specify different terms, protecting individual assets or inheritances from becoming shared marital assets.

- A spouse can be forced into signing a prenup. Legally, an agreement entered into under duress or without proper disclosure of assets is voidable. For a prenup to be valid in California, both parties must have had enough time to consider the agreement and seek independent legal advice, ensuring that consent is given freely and informatively.

- Prenups are too expensive and not worth the cost for most people. While drafting a prenup does involve legal fees, the cost can be a wise investment in comparison to the potential future costs of a divorce without such an agreement. By setting clear terms upfront, a prenup can save individuals significant legal fees and financial turmoil in the event of a divorce, making it a financially prudent option for many.

Key takeaways

When considering a prenuptial agreement in California, it's important to understand both its purpose and the legal requirements that accompany it. A prenuptial agreement, colloquially known as a "prenup," is a written contract created by two people before they marry. This document typically lists all of the property each person owns, as well as any debts, and specifies what each person's property rights will be after the marriage. In the state of California, which follows community property law, these agreements are particularly significant. Below are key takeaways to guide you through the process of filling out and using the California Prenuptial Agreement form:

- Full Disclosure is Key: Both parties must fully disclose their assets and liabilities. Transparency here is not just encouraged; it's legally required for the agreement to be valid. Concealing assets can lead to an agreement being voided.

- Legal Representation is Advisable: Each party should have their own attorney. This ensures that both individuals understand the agreement fully and that it's fair to both sides. California law strongly favors parties having independent legal counsel to avoid issues of unfairness or coercion.

- Consider the Timing: Don't rush into this agreement. California law requires a waiting period of at least seven days from the time the agreement is first presented until it is signed. This allows both parties adequate time to consider the agreement and seek independent legal advice.

- Understand What Can and Cannot Be Included: A prenuptial agreement can cover a wide range of financial matters, including the division of property and spousal support in the event of a divorce. However, it cannot adversely affect child support and cannot include personal rules about the marriage (such as who has what chores).

- Consider the Future: Life situations change, and the agreement can be designed to account for future changes in finances, including increases in income or inheritances. It is possible to include clauses that adapt to these changes, ensuring the agreement remains fair over the years.

- Validity Factors: For the agreement to be valid, it must be in writing and signed by both parties. The enforceability of a prenuptial agreement depends on it being entered into voluntarily, with full and fair disclosure, without duress or undue influence, and the terms cannot be unconscionable.

Understanding these key points can help couples navigate the complexities of prenuptial agreements in California. While the process might seem daunting, it's designed to ensure that both parties enter into their marriage with a clear understanding of their financial rights and obligations. Prenuptial agreements are not about distrust; they are about creating a transparent, honest foundation for the future. If you're considering a prenuptial agreement, it's advisable to consult with a legal professional who can guide you through the process and ensure that your rights are protected.

More Prenuptial Agreement State Forms

Illinois Premarital Agreement - It serves as a financial planning tool, enabling couples to address and organize their fiscal affairs before entering into marriage.

Michigan Premarital Agreement - When structured properly, prenuptial agreements are difficult to challenge in court, offering a strong legal foundation for the agreed-upon terms.

North Carolina Premarital Agreement - For couples entering second marriages or those with significant age differences, the form addresses unique concerns and financial implications.