Official Prenuptial Agreement Document

When love blends with the promise of a lifetime together, the pragmatic aspect of marriage often takes a back seat. Yet, the wisdom of preparing for the unexpected cannot be overlooked. This is where a Prenuptial Agreement form comes into play, standing as a testament to the belief that forethought and preparedness can coexist with love and romance. This form isn't about doubting a relationship's strength; rather, it provides a clear roadmap for how assets and financial matters should be handled should the unexpected happen. It delves into specifics such as the protection of individual assets, handling of debts, and even the division of property acquired during the marriage. Moreover, it's not just a document for the wealthy; individuals from all walks of life find value in the clarity and security it offers. Essentially, it lays down a financial plan that respects both parties’ interests, fostering transparency and mutual understanding from the outset.

State-specific Information for Prenuptial Agreement Forms

Document Example

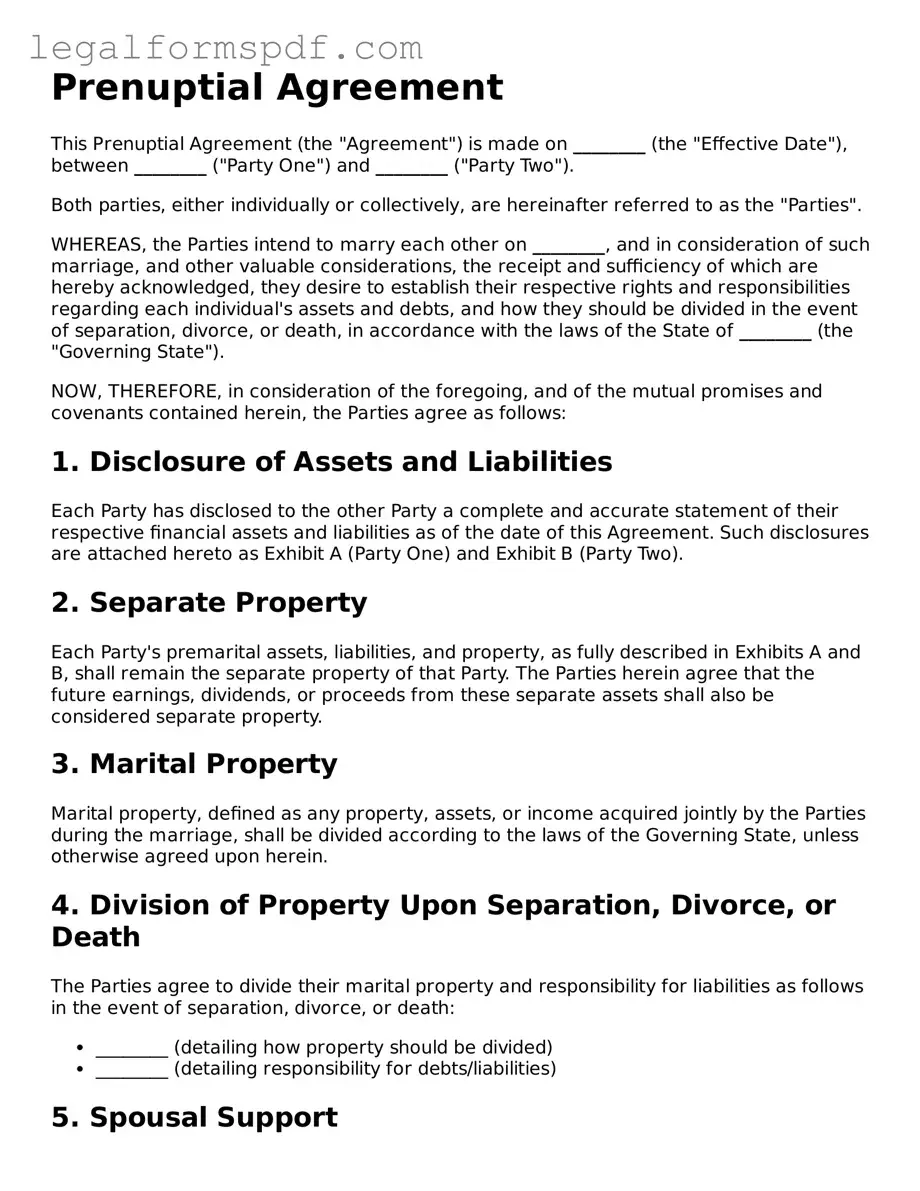

Prenuptial Agreement

This Prenuptial Agreement (the "Agreement") is made on ________ (the "Effective Date"), between ________ ("Party One") and ________ ("Party Two").

Both parties, either individually or collectively, are hereinafter referred to as the "Parties".

WHEREAS, the Parties intend to marry each other on ________, and in consideration of such marriage, and other valuable considerations, the receipt and sufficiency of which are hereby acknowledged, they desire to establish their respective rights and responsibilities regarding each individual's assets and debts, and how they should be divided in the event of separation, divorce, or death, in accordance with the laws of the State of ________ (the "Governing State").

NOW, THEREFORE, in consideration of the foregoing, and of the mutual promises and covenants contained herein, the Parties agree as follows:

1. Disclosure of Assets and Liabilities

Each Party has disclosed to the other Party a complete and accurate statement of their respective financial assets and liabilities as of the date of this Agreement. Such disclosures are attached hereto as Exhibit A (Party One) and Exhibit B (Party Two).

2. Separate Property

Each Party's premarital assets, liabilities, and property, as fully described in Exhibits A and B, shall remain the separate property of that Party. The Parties herein agree that the future earnings, dividends, or proceeds from these separate assets shall also be considered separate property.

3. Marital Property

Marital property, defined as any property, assets, or income acquired jointly by the Parties during the marriage, shall be divided according to the laws of the Governing State, unless otherwise agreed upon herein.

4. Division of Property Upon Separation, Divorce, or Death

The Parties agree to divide their marital property and responsibility for liabilities as follows in the event of separation, divorce, or death:

- ________ (detailing how property should be divided)

- ________ (detailing responsibility for debts/liabilities)

5. Spousal Support

In the event of a separation or divorce, spousal support shall be determined as follows:

- ________ (specifying terms for spousal support, if any)

- ________ (specifying conditions for modification or termination of spousal support)

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ________, without giving effect to any choice or conflict of law provision or rule.

7. Entire Agreement

This Agreement constitutes the entire agreement between the Parties pertaining to the subject matter hereof and supersedes all prior and contemporaneous agreements, representations, and understandings of the Parties. No supplement, modification, or amendment of this Agreement shall be binding unless executed in writing by both Parties.

8. Signature

IN WITNESS WHEREOF, the Parties hereto have executed this Agreement as of the first date above written.

Party One: ___________________________

Party Two: ___________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a written contract created by two people before they are married. This document lists all the property each person owns (as well as any debts) and specifies what each person's property rights will be after the marriage. |

| Purpose | The main purpose of a prenuptial agreement is to ensure that assets are distributed according to the couple's wishes in the event of a divorce, rather than according to the state law. |

| Financial Disclosure | For a prenuptial agreement to be valid, both parties must fully disclose their financial assets and liabilities. Any concealment can render the agreement invalid. |

| Legal Representation | It is advisable for both parties to have independent legal advice from different attorneys to ensure that the agreement is fair and legally binding. |

| Governing Laws | Each state has its own laws governing prenuptial agreements, which can vary widely. The agreement must comply with the laws of the state in which it is executed or the state specified in the agreement. |

| Enforceability | Prenuptial agreements are generally enforceable if they are executed voluntarily and with full and fair disclosure. However, provisions that are unjust, promote divorce, or violate public policy might not be enforced. |

| Amendment and Revocation | The agreement can usually be amended or revoked after marriage only if both parties agree and the changes are in writing and signed by both parties. |

| Common Misconceptions | Many believe that prenuptial agreements only protect the wealthier spouse or that they are planning for divorce before getting married. In reality, they can protect both parties and can also address debt, inheritance, and other financial responsibilities. |

Instructions on Writing Prenuptial Agreement

A prenuptial agreement is a practical step for couples planning to marry, offering clarity and protection for both parties' financial interests. It outlines how assets will be handled during the marriage and in the event of a divorce. Filling out the form requires careful attention to detail to ensure that all the agreements made are clear and enforceable. Follow these steps to complete your prenuptial agreement form so that it reflects your wishes and agreements.

- Start by providing the full legal names of both parties entering into the agreement, often referred to as "Party 1" and "Party 2".

- Specify the date when the agreement will take effect, usually the date of the marriage.

- Detail each party's current assets, liabilities, and property. Be as specific as possible, listing the value and nature of each item.

- Describe how assets, property, and debts will be handled during the marriage. This includes who will own what and how future earnings and debts will be allocated.

- Outline the terms for division of assets and liabilities in the event of a divorce, including specifics on property division, debt responsibility, and any alimony arrangements.

- Include any provisions for inheritance and estate planning, specifying how assets will be handled in the event of one party's death.

- Clearly outline any agreements regarding financial support during the marriage, such as how joint bank accounts will be managed or contributions to savings and retirement accounts.

- If applicable, detail any amendments or conditions for the agreement's termination outside of a divorce, such as a sunset clause.

- Both parties must sign and date the agreement in the presence of a witness or notary public to make it legally binding. Ensure there is a space for the signatures of both parties, the witness or notary public, and their printed names and dates.

Remember, both parties should consider seeking independent legal advice before signing the prenuptial agreement. This ensures that both individuals fully understand the terms and the implications of the agreement. Completing the form with honesty and transparency is key to creating a fair and enforceable prenuptial agreement.

Understanding Prenuptial Agreement

What is a Prenuptial Agreement?

A Prenuptial Agreement is a legal document created and signed by two people before they get married. It outlines how assets and financial matters will be handled during the marriage and in the event of a divorce. This type of agreement aims to protect individual assets, reduce conflicts if the marriage ends, and clarify financial responsibilities and expectations.

Who should consider a Prenuptial Agreement?

Anyone who wishes to define their financial rights and responsibilities before marriage should consider a Prenuptial Agreement. This is especially relevant for individuals entering a marriage with substantial assets, prior children, or specific concerns about how their assets will be distributed in case the marriage ends.

Is a Prenuptial Agreement enforceable?

In most cases, Prenuptial Agreements are enforceable if they meet all legal requirements in the jurisdiction where they are executed. A valid agreement needs to be fair, entered into voluntarily by both parties, and based on full disclosure of all assets. Some states may have additional requirements, so it's essential to consult with a legal professional.

Do both partners need their own attorney?

While not always a legal necessity, it is highly recommended that each partner consult with their own attorney before signing a Prenuptial Agreement. This helps ensure that both parties fully understand their rights and the terms of the agreement and that the agreement is balanced and fair.

Can a Prenuptial Agreement include child support or custody arrangements?

No, Prenuptial Agreements cannot dictate child support or custody arrangements. These matters are determined by the court based on the children's best interests at the time of the divorce or separation, and any agreements made prior would be considered invalid.

What happens if we don't have a Prenuptial Agreement?

If a couple does not have a Prenuptial Agreement and decides to divorce, their assets and liabilities will be divided according to their state's laws. This often means a division of property that might not align with what either party had intended. A Prenuptial Agreement provides a way to avoid this situation by establishing clear guidelines agreed upon by both parties in advance.

Can we modify our Prenuptial Agreement after getting married?

Yes, a Prenuptial Agreement can be modified after marriage, but any changes must be made in writing and signed by both parties. Some couples may opt to sign a Postnuptial Agreement instead, which is similar to a Prenuptial Agreement but created after marriage.

Is a Prenuptial Agreement right for every couple?

No, a Prenuptial Agreement is not necessary or appropriate for every couple. The decision to create one should be based on individual circumstances, including the complexity of the couple's financial situation, their plans for their marital future, and personal preferences. It is important for both partners to have open and honest discussions about their finances and expectations before deciding.

Common mistakes

Filling out a prenuptial agreement is a significant step for couples planning to tie the knot, ensuring clarity and fairness should they part ways in the future. However, it's fraught with potential mistakes if not approached with the necessary care and consideration. One common error is not disclosing all financial assets and liabilities. The essence of a prenuptial agreement lies in transparency, allowing both parties to make informed decisions. Neglecting to reveal the full extent of one's finances can lead to the agreement being invalidated in court, undermining the very purpose of its creation.

Another frequent oversight is failing to seek independent legal advice. Each person should have their own lawyer to prevent conflicts of interest and ensure that the agreement fairly represents both parties' interests. Without independent legal counsel, there's a significant risk that the agreement could be challenged on the grounds that one party didn't fully understand the implications or was coerced into signing.

Many couples also make the mistake of waiting until the last minute to draft and sign the prenup. This rush can result in a document that doesn't reflect the couple's actual needs and desires, besides the higher likelihood of coercion claims. Ideally, the agreement should be finalized well before the wedding, providing ample time for thorough review and revisions without the pressure of an impending ceremony.

Overlooking state laws is another pitfall. Family law varies significantly from one state to another, and what's enforceable in one state may not be in another. Ignorance of these differences can render parts of the agreement unenforceable or even void the entire document. It's critical to ensure that the prenuptial agreement aligns with the state's legal requirements where the couple intends to reside.

A common but critical mistake is including invalid provisions, such as clauses about child support, custody, or visitation. Courts have the final say in matters concerning children based on their best interests at the time of the divorce or separation, making such provisions null and void. Including them can cast doubt on the validity of the entire agreement.

Last but certainly not least, many underestimate the importance of regular updates to the agreement. As life circumstances change, so should the prenuptial agreement to reflect the couple's current situation, financial or otherwise. Failure to update the agreement can lead to disputes and portions of the agreement being disregarded because they no longer match the couple's reality. Regular reviews and revisions are crucial to maintaining its integrity and relevance over time.

Documents used along the form

When couples decide to marry, they might consider setting up a prenuptial agreement to manage their finances, assets, and responsibilities during and possibly after marriage. However, to ensure comprehensive asset management and legal protection, there are several other forms and documents often used in conjunction with a prenuptial agreement. These documents can further secure the couple's financial future and clarify their wishes in various scenarios.

- Will and Testament: A legal document that outlines the distribution of assets and care of dependents upon one's death. This is crucial for ensuring that assets are distributed according to the individual’s wishes and not solely based on state laws, which might override prenuptial agreements under certain circumstances.

- Living Will: This document specifies a person's wishes regarding medical treatment in scenarios where they are unable to make decisions due to incapacity or terminal illness. It complements a prenuptial agreement by addressing health care decisions, not covered in a prenuptial agreement.

- Durable Power of Attorney for Healthcare: A document that designates someone to make healthcare decisions on behalf of a person, should they become unable to do so. It ensures that someone trusted will make healthcare decisions in line with the person’s preferences.

- Durable Power of Attorney for Finances: This form designates someone to handle financial decisions and transactions on behalf of the individual, should they become incapacitated. It's important for managing assets and financial obligations laid out in the prenuptial agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, but established after a couple marries. It can be useful if financial situations change significantly after marriage, altering the original terms of the prenuptial agreement.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for financial accounts, retirement accounts, and life insurance policies. They're essential for ensuring that assets are distributed to the chosen beneficiaries without going through probate.

- Marital Settlement Agreement: In the event of divorce, this document outlines the terms of the division of assets, debt responsibilities, alimony, and other financial arrangements. It works in concert with a prenuptial agreement to streamline the divorce process.

- Trust Documents: Trusts can be established to manage assets during the couple’s life and after their death. These documents can specify how assets should be used and distributed, offering a layer of control and protection beyond what a prenuptial agreement provides.

Together, these documents can create a comprehensive legal and financial plan for couples, covering aspects of their lives together and individually that a prenuptial agreement alone cannot address. They ensure clarity and peace of mind regarding financial matters, health care decisions, and asset distribution, enhancing the protections a prenuptial agreement offers.

Similar forms

A Postnuptial Agreement bears a close resemblance to a Prenuptial Agreement, with the key difference being when it is executed. Both documents outline how assets and liabilities will be handled during a marriage or in the event of divorce, but a Postnuptial Agreement is created after the couple has already married. This allows spouses to manage financial matters and asset distribution should they decide to part ways later on, providing clarity and protection for both parties involved.

Wills and Living Trusts share similarities with Prenuptial Agreements, as they all address the distribution of assets. Wills and Living Trusts come into play after a person's death, detailing how their assets should be allocated among heirs or designated beneficiaries. Prenuptial Agreements can influence these documents by specifying how assets acquired before or during marriage are to be handled, ensuring the wishes of the individual and their spouse are honored, and potentially simplifying asset distribution upon one's passing.

A Financial Affidavit is another document that, while used in a different context, has common ground with Prenuptial Agreements. Typically used in legal proceedings like divorce or child support cases, a Financial Affidavit outlines an individual’s income, expenses, assets, and debts providing a snapshot of their financial health. Similarly, a Prenuptial Agreement may contain detailed information about each party's financial status before marriage, helping to establish fairness and transparency right from the start.

Separation Agreements are closely linked to Prenuptial Agreements in that they both manage the division of assets and financial responsibilities between parties. However, Separation Agreements are crafted at the end of a marriage when a couple decides to live apart but are not yet pursuing a divorce. This document ensures that financial matters, such as alimony, child support, and asset division, are settled upon, mirroring the forward-planning nature of Prenuptial Agreements.

Property Settlement Agreements (PSAs) also share commonalities with Prenuptial Agreements, focusing on the distribution of assets and liabilities among spouses in the event of a divorce. Both documents clearly define how property should be divided, which can prevent disputes and make the process of separation smoother and more straightforward. PSAs, however, are negotiated at the end of a marriage, making them responsive rather than preventative measures.

Co-habitation Agreements often precede or substitute for Prenuptial Agreements among couples who choose to live together without marrying. These agreements delineate financial obligations, asset distribution, and responsibilities towards shared property, similar to how Prenuptial Agreements work, but without the legal bonds of marriage. They provide a way for partners to protect their individual interests while building a life together.

Business Partnership Agreements and Prenuptial Agreements both aim to protect assets and outline responsibilities in a legally binding document. In a business context, a Partnership Agreement specifies how the business is run, how disputes are settled, and how assets are divided among partners, paralleling the way a Prenuptial Agreement establishes guidelines for managing and dividing marital assets.

Loan Agreements, while primarily financial and unrelated to the dynamics of marriage, contain elements that echo the essence of a Prenuptial Agreement. Both agreements set forth terms and conditions clearly to protect involved parties’ interests, specifying the obligations and rights of each party. Loan Agreements ensure borrowers and lenders understand the repayment terms, much like Prenuptial Agreements ensure both spouses understand their financial rights and responsibilities.

Lastly, Alimony Agreements, often a component of broader separation or divorce agreements, share objectives with Prenuptial Agreements. They specifically focus on financial support that one spouse agrees to provide to the other post-divorce, which can be addressed and predetermined in a Prenuptial Agreement. This pre-planning can streamline the divorce process, making the transition less stressful for both parties.

Dos and Don'ts

When you're getting ready to fill out a Prenuptial Agreement form, it's vital to approach the task with care and thoughtfulness. Here are some important do's and don'ts to keep in mind:

Do's

- Discuss the agreement openly and honestly with your partner well before the wedding date. This ensures both parties fully understand and agree with the terms.

- Ensure full disclosure of all assets and liabilities. Withholding information can invalidate the agreement.

- Seek independent legal advice. Both partners should have their own lawyers to ensure their interests are protected and the agreement is fair.

- Consider the future. Life changes, such as children or significant changes in finances, should be factored into the agreement.

- Keep the language clear and specific. Avoid vague terms that could lead to misunderstandings or disputes later on.

- Update the agreement as needed. Life events may necessitate changes, and the agreement should be reviewed regularly.

- Copy and store the document securely. Both parties should keep a copy in a safe place.

Don'ts

- Rush the process. Giving yourselves ample time to consider and discuss the agreement's terms is crucial.

- Sign without understanding every aspect. If something is not clear, ask for clarification until you're confident in your understanding.

- Use a generic form without customization. The agreement should reflect your unique situation and needs.

- Forget to consider joint property and how it will be handled. Clarification on this can prevent significant issues later.

- Let emotion override practicality. While discussing financial matters can be challenging, it's important for protecting both parties’ interests.

- Ignore state laws. Prenuptial agreements are subject to state laws, and failing to consider these can result in parts of the agreement being unenforceable.

- Attempt to include anything illegal or unfair. Such terms can invalidate the entire agreement.

Misconceptions

Many misconceptions surround the topic of Prenuptial Agreement forms. By clarifying these misunderstandings, individuals can make more informed decisions regarding their finances and relationships. Below are eight common misconceptions about Prenuptial Agreements:

Only for the Wealthy: A common belief is that prenuptial agreements are only necessary for those with a high net worth. In reality, these agreements can benefit anyone who wishes to clarify financial matters and protect assets, regardless of their wealth.

Indicates Lack of Trust: Some people think that getting a prenuptial agreement signals a lack of trust between partners. However, it’s often a practical tool for discussing finances openly and planning for the future, rather than a sign of distrust.

Only Protects One Party: The misconception exists that prenuptial agreements only protect the wealthier spouse. Both parties can benefit from these agreements, as they provide clarity and fairness for all involved, especially about dividing assets and liabilities.

Set in Stone: It's wrongly assumed that once a prenuptial agreement is signed, it cannot be altered. The truth is, as circumstances change, couples can modify these agreements with consensual revisions.

All Assets Are Covered: Not all assets are or can be covered by a prenuptial agreement. Certain rights, especially those related to future children (like custody and support), cannot be predetermined in these documents.

It Makes Divorce Easier: There's a belief that prenuptial agreements encourage divorce. While they can simplify the divorce process by pre-determining the division of assets, they do not make the decision to divorce any easier on an emotional level.

Negatives Overweigh the Positives: The focus often falls on the negative aspects and stigmas of prenuptial agreements, overshadowing the benefits such as financial protection, clarity, and peace of mind they can offer both parties.

Handling It Yourself Is Enough: Many think they can create and finalize a prenuptial agreement without legal help. Proper legal guidance is recommended to ensure the agreement is enforceable and meets all legal standards and requirements.

Key takeaways

A Prenuptial Agreement form is a practical tool for couples planning to marry, allowing them to outline the distribution of assets and financial responsibilities should the marriage end. Understanding its key aspects can ensure that both parties feel secure and informed. Here are nine crucial takeaways to keep in mind:

- Discussing a Prenuptial Agreement openly can strengthen your relationship by ensuring transparent communication about finances from the start.

- Both parties should seek independent legal advice before signing. This ensures that both understand the document's terms and the implications of signing it.

- Be honest and thorough when disclosing your assets and liabilities. Incomplete or dishonest disclosures can render the agreement invalid.

- The agreement must be signed voluntarily by both parties, without any pressure or coercion.

- Consider future changes in circumstances. The agreement can include provisions for modifications based on specific milestones or events, such as the birth of children.

- Ensure the agreement is fair to both parties. An agreement heavily favoring one side may not be enforceable.

- The document should be signed well in advance of the wedding. A last-minute agreement could be seen as coercive and might be challenged.

- Professional drafting and review are crucial. Errors, vague language, or omissions can make the agreement difficult to enforce.

- State laws vary regarding prenuptial agreements. The agreement should conform to the laws of the state in which it will be enforced.

Proper execution of a Prenuptial Agreement can protect both individuals, providing clarity and legal safeguards for their future. Paying attention to these details can lead to a more secure and straightforward path, no matter what the future holds.

Other Templates

Permission to Use Artwork Form - Great for setting up guidelines for how the artwork will be credited across different platforms and uses.

Pwc Bill of Sale - It should be copied and kept by both parties for their records and future reference.