Official Real Estate Power of Attorney Document

When it comes to managing property, whether you're navigating through the complex process of buying, selling, or simply maintaining real estate, the guidance and authority vested in a trusted individual can be a game-changer. This is where the Real Estate Power of Attorney form steps in, a crucial document that grants someone the legal right to make decisions about your property on your behalf. Its importance cannot be overstated, as it not only ensures that your real estate transactions are handled according to your wishes but also provides peace of mind knowing that someone you trust is in charge. The form covers various aspects, from the straightforward tasks of paying your property taxes to the more intricate dealings of buying or selling property, negotiating terms, and even managing leases. Essential for anyone who finds themselves unable to manage their real estate affairs personally, whether due to travel, health issues, or other commitments, this document simplifies what could otherwise be an overwhelming process. By exploring the major aspects of the Real Estate Power of Attorney form, individuals gain insights into how it functions as a pivotal tool in real estate management, offering clarity and control over how their property is managed in their absence.

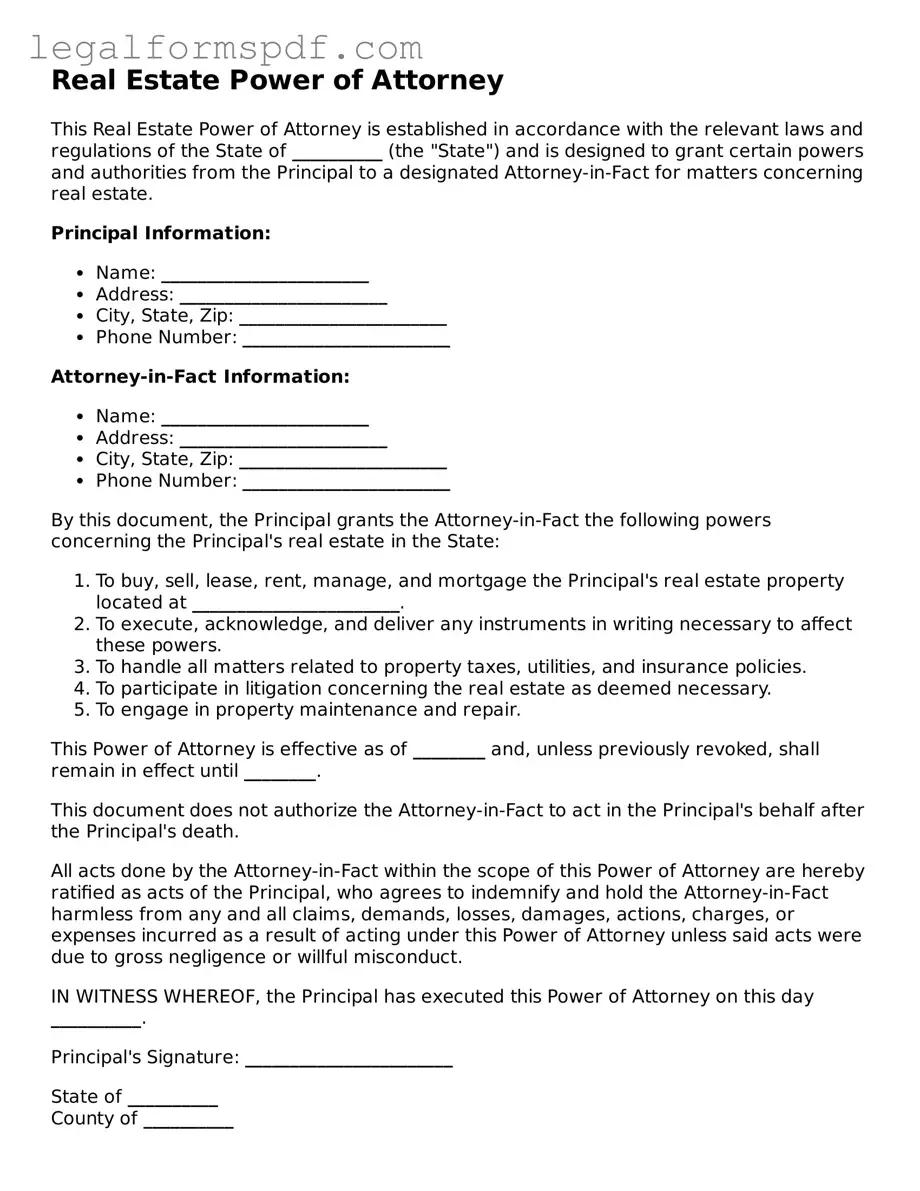

Document Example

Real Estate Power of Attorney

This Real Estate Power of Attorney is established in accordance with the relevant laws and regulations of the State of __________ (the "State") and is designed to grant certain powers and authorities from the Principal to a designated Attorney-in-Fact for matters concerning real estate.

Principal Information:

- Name: _______________________

- Address: _______________________

- City, State, Zip: _______________________

- Phone Number: _______________________

Attorney-in-Fact Information:

- Name: _______________________

- Address: _______________________

- City, State, Zip: _______________________

- Phone Number: _______________________

By this document, the Principal grants the Attorney-in-Fact the following powers concerning the Principal's real estate in the State:

- To buy, sell, lease, rent, manage, and mortgage the Principal's real estate property located at _______________________.

- To execute, acknowledge, and deliver any instruments in writing necessary to affect these powers.

- To handle all matters related to property taxes, utilities, and insurance policies.

- To participate in litigation concerning the real estate as deemed necessary.

- To engage in property maintenance and repair.

This Power of Attorney is effective as of ________ and, unless previously revoked, shall remain in effect until ________.

This document does not authorize the Attorney-in-Fact to act in the Principal's behalf after the Principal's death.

All acts done by the Attorney-in-Fact within the scope of this Power of Attorney are hereby ratified as acts of the Principal, who agrees to indemnify and hold the Attorney-in-Fact harmless from any and all claims, demands, losses, damages, actions, charges, or expenses incurred as a result of acting under this Power of Attorney unless said acts were due to gross negligence or willful misconduct.

IN WITNESS WHEREOF, the Principal has executed this Power of Attorney on this day __________.

Principal's Signature: _______________________

State of __________

County of __________

Sworn to and subscribed before me this __________ day of __________, 20__.

Notary Public Signature: _______________________

My Commission Expires: _______________________

PDF Specifications

| Fact Number | Fact Detail |

|---|---|

| 1 | A Real Estate Power of Attorney form allows an individual (the principal) to grant someone else (the agent) the authority to make decisions about their property. |

| 2 | It can be used for buying, selling, managing, or refinancing real estate on behalf of the principal. |

| 3 | The form must be customized to comply with state laws where the property is located, as real estate laws vary significantly by state. |

| 4 | In many states, the form must be notarized and/or witnessed to be valid. |

| 5 | Some states require the Real Estate Power of Attorney to be recorded in the same public records where the property deed is recorded. |

| 6 | The principal can specify whether the power is durable (remains in effect if the principal becomes incapacitated) or springing (only comes into effect upon a specific event, usually the incapacity of the principal). |

| 7 | The principal can always revoke the power of attorney, as long as they are mentally competent. |

| 8 | Choosing a trusted individual as the agent is critical, as they will have significant control over the principal’s property and financial transactions. |

| 9 | If the principal dies, the Real Estate Power of Attorney immediately becomes invalid, and the estate's matters are then handled according to the will or state law. |

Instructions on Writing Real Estate Power of Attorney

After obtaining a Real Estate Power of Attorney form, it's crucial to fill it out carefully to ensure it accurately reflects the powers being granted regarding real estate transactions. This document will enable a chosen individual to act on another's behalf in property matters. The steps listed below will guide you through completing the form correctly. Following these instructions is essential for the document to be valid and to facilitate the intended real estate transactions without complications.

- Start by entering the full legal name of the individual granting power, known as the Principal, at the top of the form.

- Input the full legal name of the person being granted power, referred to as the Agent or Attorney-in-fact, in the designated space.

- Specify the exact powers being granted to the Agent. Be explicit whether the agent can buy, sell, manage, or refinance properties, among other powers. Check the relevant boxes if provided, or write out the powers if the form has a blank section for this purpose.

- Determine the scope of the powers - whether they apply to all of the Principal's real estate or only specific properties. If only specific properties are concerned, clearly describe these properties, including their addresses and legal descriptions.

- Select the duration of the Power of Attorney. Indicate the start date and, if applicable, an end date. Some forms allow you to stipulate that the Power of Attorney remains in effect until revoked.

- If the form includes a section for special instructions, fill this out according to any additional stipulations or limitations the Principal wishes to impose.

- Review local laws regarding witness requirements and notarization. Many states require the Principal's signature to be witnessed and/or notarized to ensure the document's legality.

- Sign and date the form in the presence of the required witnesses and/or notary public, as your state's law dictates. Ensure the Agent also signs and dates the form, if required.

- Store the completed Real Estate Power of Attorney in a safe place and provide copies to the Agent and any involved parties, such as a title company or real estate agent.

Once the Real Estate Power of Attorney form is filled out and properly executed, it grants the Agent authority to perform real estate transactions as specified in the document. It is vital for both the Principal and Agent to fully understand the powers being granted and to act in accordance with the document's terms and applicable state laws. This document plays a critical role in managing real estate matters efficiently, especially when the Principal cannot be present to act in person.

Understanding Real Estate Power of Attorney

What is a Real Estate Power of Attorney form?

A Real Estate Power of Attorney form is a legal document that grants an individual, known as the agent or attorney-in-fact, the authority to make decisions regarding the principal's property. This can include buying, selling, managing, or refinancing real estate on behalf of the principal. It is a powerful tool for individuals who are unable to manage their real estate affairs due to absence, illness, or other reasons.

Who can be appointed as an agent in a Real Estate Power of Attorney?

Any competent adult whom the principal trusts can be appointed as an agent. This could be a family member, friend, attorney, or any trusted individual. The key factor is trust, as the agent will have significant control over the principal's real estate matters. It's crucial that the chosen agent is reliable, willing to act in the principal's best interest, and knowledgeable about real estate, if possible.

How is a Real Estate Power of Attorney activated?

Activation procedures can vary. Typically, a Real Estate Power of Attorney becomes effective immediately upon signing, unless the document specifies a different arrangement, such as coming into effect upon the principal's incapacitation. Some jurisdictions may require notarization or recording at a local office for the document to be legally binding, especially for transactions involving real estate.

Can a Real Estate Power of Attorney be revoked?

Yes, the principal can revoke a Real Estate Power of Attorney at any time, as long as they are mentally competent. To revoke, the principal must notify the agent in writing and, if the power of attorney has been recorded, file the revocation with the same authority to notify third parties of the change. Destroying the original document and any copies is also recommended to prevent its future use.

Does a Real Estate Power of Attorney grant permanent authority to the agent?

No, the authority granted by a Real Estate Power of Attorney can be temporary or permanent, depending on the principal's needs. The principal can set a specific duration or condition for the power of attorney, such as authorizing it only for the duration of a real estate transaction or until the principal is incapacitated or deceased. Permanent authority typically ceases upon the principal’s death or incapacitation unless otherwise specified.

Are there different types of Real Estate Power of Attorney forms?

Yes, there are generally two types: general and specific. A general Real Estate Power of Attorney grants broad powers to the agent to handle all of the principal's real estate matters. In contrast, a specific or limited Real Estate Power of Attorney restricts the agent's authority to a particular transaction or set of transactions. The type chosen depends on the principal's needs and the level of authority they wish to grant.

How does one ensure a Real Estate Power of Attorney is legally valid?

To ensure a Real Estate Power of Attorney is legally valid, the document must be constructed according to state laws where the real estate is located. This often includes signing requirements, notarization, and sometimes witnesses. It is advisable to consult with a legal professional to draft the document accurately and to review the specific legal requirements in your state to ensure compliance and enforceability.

Common mistakes

When handling Real Estate Power of Attorney (POA) forms, people often make mistakes that can lead to complications down the line. A POA is a powerful document that grants someone the authority to act on your behalf concerning your property. It's crucial to fill it out correctly to ensure that your real estate transactions are handled according to your wishes.

One common mistake is not specifying the powers granted clearly. It's essential to delineate the exact actions the agent can perform, whether it's selling property, managing it, or making financial decisions related to it. Vague descriptions can lead to misunderstandings or misuse of power.

Another error is choosing the wrong agent. The agent should be someone trustworthy and capable of handling real estate matters. Not considering the agent's location can also be problematic, especially if they are in a different state or country, which might complicate their ability to act effectively on your behalf.

People often neglect to include a termination date for the POA. Without this, the POA might remain in effect longer than desired, potentially leading to unwelcome decisions or actions. It's also a mistake not to plan for contingencies, like what should happen if your chosen agent is unable to serve. Failing to designate an alternate can leave your affairs in limbo.

Ignoring state-specific requirements can invalidate the POA. Laws vary by state, and what's acceptable in one might not be in another. Not getting the form notarized or witnessed as required by many states is another oversight that can render the document legally ineffective.

Sometimes, individuals fill out the form without fully understanding the implications of granting power of attorney. A lack of clarity about the agent's authority or the type of transactions they can perform can lead to issues that might run contrary to the principal's interests.

Moreover, not discussing the POA with the chosen agent before completion often leads to confusion. This step is vital to ensure they are willing and prepared to take on the responsibilities. Lastly, failing to keep the signed document in a secure but accessible place can be a critical error, making it difficult for the agent to act when needed.

Overall, filling out a Real Estate Power of Attorney form requires careful attention to detail and a clear understanding of the legal implications. By avoiding these common mistakes, you can ensure that your real estate transactions are managed smoothly and according to your wishes.

Documents used along the form

When dealing with real estate, especially when empowering someone else to act on your behalf, there are several documents that often accompany the Real Estate Power of Attorney form. These documents ensure that every aspect of your real estate transactions is covered, legally binding, and documented. Here is a list of documents that are commonly used along with the Real Estate Power of Attorney to facilitate seamless transactions and protect the interests of all parties involved.

- Property Deed: This document proves ownership of the property. It's essential to have a current copy to verify that the person granting the power of attorney has the authority to do so regarding the property in question.

- Title Search Report: Before any transaction, a title search is critical to identify any encumbrances or liens against the property. It ensures the property can be legally transferred or used as collateral.

- Loan Documents: If the property is under a mortgage, these documents outline the terms of the loan, the remaining balance, and other specifics crucial for the person wielding the power of attorney to know.

- Homeowners Insurance Policy: This document provides details about the insurance coverage on the property, which is vital information for managing or selling real estate.

- Property Tax Records: Up-to-date tax records are necessary to prove that all property taxes have been paid. This information is crucial for closing sales or refinancing efforts.

- Home Inspection Reports: These reports detail the condition of the property, including any necessary repairs or maintenance. They are often required for sales, refinancing, or securing loans against the property.

- Estoppel Certificate: In cases involving rental properties, this document from tenants verifies the status of their lease agreements, their current rent, and whether any breaches of the lease have occurred. It's critical for real estate transactions involving leased properties.

Together, these documents provide a comprehensive overview of a property's legal, financial, and physical status. They play a crucial role in facilitating transparent and efficient real estate transactions. Ensuring these forms are in order, alongside a Real Estate Power of Attorney, not only protects the principal's assets but also empowers the agent to make informed decisions.

Similar forms

The General Power of Attorney form shares similarities with the Real Estate Power of Attorney, primarily in its broad authorization scope. Unlike the specific assignment of real estate duties in the latter, a General Power of Attorney grants an agent the ability to manage a wide range of the principal's affairs, including financial transactions, personal matters, and business decisions. This makes it more versatile but less focused compared to its real estate-specific counterpart.

A Limited Power of Attorney is another document that closely resembles the Real Estate Power of Attorney, with the pivotal difference being its scope and duration of authority. While the Real Estate Power of Attorney specifically focuses on real estate transactions, a Limited Power of Attorney can be tailored for a variety of specific actions, such as selling a car or handling a particular financial account, and typically expires once the specified task is completed.

The Durable Power of Attorney stands out for its enduring quality in the face of the principal's incapacitation. Similar to the Real Estate Power of Attorney, it can encompass a range of authorities, including handling real estate. The key distinction lies in its durability; it remains in effect if the principal becomes unable to make decisions, unlike other powers of attorney that may terminate upon the principal's incapacitation unless stated otherwise.

The Medical Power of Attorney diverges in focus, concentrating on the principal's health care decisions rather than financial or real estate matters. Like the Real Estate Power of Attorney, it grants an agent authority, but this time to make medical decisions on the principal’s behalf when they are incapacitated. This document underscores the different areas in which an individual might need representation and support, highlighting the specialization of each Power of Attorney type.

A Springing Power of Attorney, similar to the Real Estate Power of Attorney in its potential to cover real estate affairs, has a unique trigger for its activation. It "springs" into effect upon the occurrence of a specific event, usually the principal's incapacitation. This feature means that, while it can grant authority over real estate decisions like its counterpart, it remains dormant until the defined conditions are met, offering a safeguard for the principal’s interests.

The Financial Power of Attorney, while encompassing a broad range of financial responsibilities, can be tailored to include real estate transactions, mirroring the real estate-specific document. The former, however, is more wide-ranging, authorizing an agent to handle various financial matters on the principal’s behalf, from banking transactions to investment management. This document illustrates a broader application of authority compared to the narrowly focused Real Estate Power of Attorney.

Dos and Don'ts

Filling out a Real Estate Power of Attorney form requires careful attention and knowledge about what should and shouldn't be done. This document empowers someone else to handle your real estate transactions on your behalf, making it critical to follow certain guidelines for accuracy and legal compliance.

Things You Should Do

- Verify the agent’s qualifications and trustworthiness. Ensure the person you are appointing has the knowledge, skills, and integrity to handle your real estate affairs effectively.

- Be specific about the powers granted. Clearly outline what the agent can and cannot do with your property to prevent any abuse of power or misunderstandings.

- Consult with a legal professional. Before finalizing the document, seek advice from a lawyer to ensure it complies with state laws and fully protects your interests.

- Include a termination date. To avoid the open-ended delegation of your powers, specify when the document will expire, if applicable.

- Sign in the presence of a notary. Many states require notarization for the document to be legally effective, which also helps prevent forgery and fraud.

Things You Shouldn’t Do

- Don’t leave any sections blank. Incomplete forms might lead to legal uncertainties or provide an opportunity for misuse.

- Don’t choose an agent based solely on personal relationship. Evaluate their ability to manage your property transactions effectively, regardless of your personal connection.

- Don’t forget to review and update. As circumstances change, your selected agent or your directives might need adjustments.

- Don’t overlook local laws. The requirements for a Real Estate Power of Attorney can vary by state, so ensure your document adheres to local statutes.

- Don’t use ambiguous language. Clarity is key in legal documents; ambiguous terms can lead to interpretations that may not align with your intentions.

Misconceptions

There are several misconceptions about the Real Estate Power of Attorney (POA) form that are worth clarifying. Understanding these can help individuals make informed decisions when considering granting someone else the authority to act on their behalf in real estate matters.

All Real Estate POAs are the same. Many believe that a Real Estate POA is a one-size-fits-all document. However, they can vary significantly in their scope and duration. Some may grant broad powers over all real estate transactions, while others are limited to specific actions or deals.

The agent can make decisions against the principal’s wishes. It is a common misunderstanding that once an agent is granted a Real Estate POA, they can act however they please. In reality, the agent is bound to act within the scope of authority granted by the POA and in the best interests of the principal.

A Real Estate POA grants permanent authority. Many people mistakenly think that once signed, a Real Estate POA grants authority forever unless revoked. In truth, POAs can be set to expire on a specific date or upon the completion of a certain event.

Creating a Real Estate POA is a complex legal process. While it's important to ensure that a Real Estate POA is correctly drafted to reflect the principal's wishes accurately, creating one does not have to be a complicated legal process. It is advisable, however, to consult with a professional to ensure it meets all legal requirements.

Only family members can be named as agents. There is a misconception that agents under a Real Estate POA must be family members. The truth is, any trusted individual can be named, including friends or professional advisors.

A Real Estate POA is only for the elderly. While it’s true that Real Estate POAs are often used as part of elder law and estate planning, they can be a useful tool for anyone needing to delegate real estate transaction authority, regardless of age or health status.

Signing a Real Estate POA means losing control over property. Some people fear that granting a POA means they will lose control over their real estate. However, a Real Estate POA is a flexible tool that allows the principal to define the extent of the agent’s powers, which can be revoked at any time should the need arise.

Key takeaways

When it comes to managing real estate transactions on behalf of someone else, a Real Estate Power of Attorney (POA) form is a critical document. It allows an individual, referred to as the principal, to grant another person, known as the agent or attorney-in-fact, the authority to act on their behalf in real estate matters. Understanding the key aspects of filling out and using this form can ensure the process is handled correctly and effectively.

- Selecting the right agent is crucial. The person you choose to act on your behalf should be someone you trust implicitly. This individual will have the power to make decisions about your property, including selling, buying, and managing it. Therefore, it's important to choose someone who is reliable, trustworthy, and has a good understanding of real estate.

- Be specific about the powers granted. The Real Estate POA form should clearly outline the scope of authority you're giving to your agent. This might include powers to buy or sell real estate, manage property, participate in legal proceedings, and more. Specifying these powers can prevent any confusion and ensure that your agent acts within the boundaries you've set.

- The document must be duly executed according to state laws. For a Real Estate POA to be valid, it must comply with the legal requirements of the state where the property is located. This often means the document must be signed in the presence of witnesses, notarized, or both. Failure to properly execute the form can render it invalid, so it's essential to understand and follow these legal requirements closely.

- Understand the termination conditions. A Real Estate POA may be set to expire on a specific date, upon the completion of the task, or when the principal revokes it. It's also important to note that the form automatically becomes invalid if the principal dies or becomes incapacitated, unless otherwise specified in a durable POA. Being aware of what conditions will terminate the powers granted can help in planning and might necessitate the preparation of additional documents to ensure continuous management of the property.

Properly managing the use of a Real Estate Power of Attorney ensures that real estate transactions can be handled efficiently and legally on behalf of the principal. Taking the time to understand and accurately complete the form can provide peace of mind to everyone involved.

Consider More Types of Real Estate Power of Attorney Forms

Does Durable Power of Attorney Cover Medical - It's an act of responsibility, securing your legacy and relieving your loved ones from making tough decisions without guidance.