Fillable Power of Attorney Document for Pennsylvania

In the realm of legal instruments, the Power of Attorney (POA) holds a pivotal role, especially within the jurisdiction of Pennsylvania, where specific statutes shape its application and significance. This document, fundamentally, operates as a legal mechanism through which one individual, the principal, grants another, the agent or attorney-in-fact, the authority to make decisions on their behalf. The breadth of this empowerment can range vastly, encompassing financial, health, and even day-to-day personal matters. Under Pennsylvania law, the parameters of this delegation, alongside requisite formalities such as execution and witnessing requirements, are meticulously outlined, ensuring both the protection of the principal’s interests and the facilitation of the agent’s duties. What marks the Pennsylvania Power of Attorney form as a critical tool is not just its capacity to effectuate a wide spectrum of decisions but also its role in preemptive estate planning and personal care, underscoring the form's utility in managing affairs efficiently and according to the principal’s wishes. Thus, navigating through the statutory guidelines and understanding the potential implications of each provision within the Pennsylvania POA becomes paramount for individuals looking to secure their interests and those of their loved ones, highlighting the form’s intricate balance between legal authority and personal autonomy.

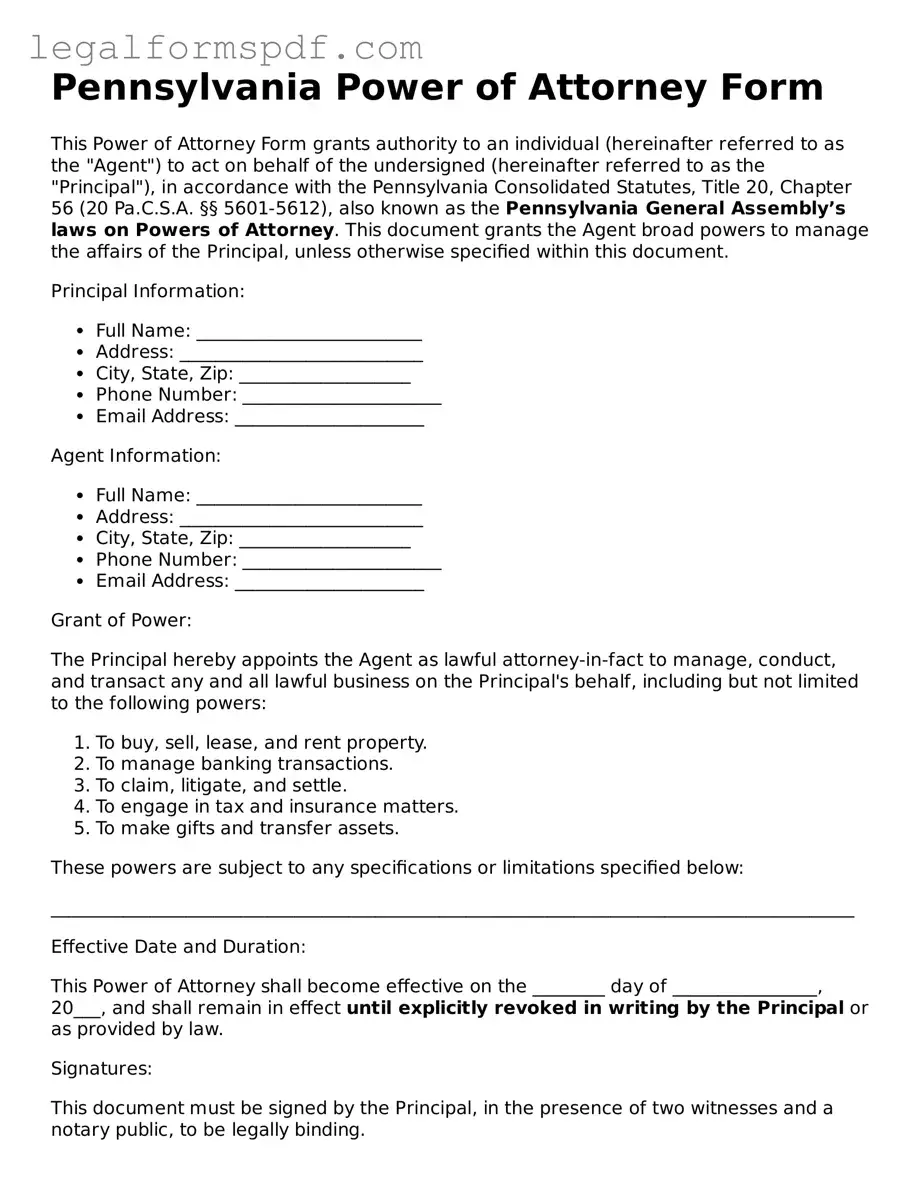

Document Example

Pennsylvania Power of Attorney Form

This Power of Attorney Form grants authority to an individual (hereinafter referred to as the "Agent") to act on behalf of the undersigned (hereinafter referred to as the "Principal"), in accordance with the Pennsylvania Consolidated Statutes, Title 20, Chapter 56 (20 Pa.C.S.A. §§ 5601-5612), also known as the Pennsylvania General Assembly’s laws on Powers of Attorney. This document grants the Agent broad powers to manage the affairs of the Principal, unless otherwise specified within this document.

Principal Information:

- Full Name: _________________________

- Address: ___________________________

- City, State, Zip: ___________________

- Phone Number: ______________________

- Email Address: _____________________

Agent Information:

- Full Name: _________________________

- Address: ___________________________

- City, State, Zip: ___________________

- Phone Number: ______________________

- Email Address: _____________________

Grant of Power:

The Principal hereby appoints the Agent as lawful attorney-in-fact to manage, conduct, and transact any and all lawful business on the Principal's behalf, including but not limited to the following powers:

- To buy, sell, lease, and rent property.

- To manage banking transactions.

- To claim, litigate, and settle.

- To engage in tax and insurance matters.

- To make gifts and transfer assets.

These powers are subject to any specifications or limitations specified below:

_________________________________________________________________________________________

Effective Date and Duration:

This Power of Attorney shall become effective on the ________ day of ________________, 20___, and shall remain in effect until explicitly revoked in writing by the Principal or as provided by law.

Signatures:

This document must be signed by the Principal, in the presence of two witnesses and a notary public, to be legally binding.

- Principal's Signature: _________________________ Date: ____________

- Witness #1 Signature: _________________________ Date: ____________

- Witness #2 Signature: _________________________ Date: ____________

- Notary Public: _______________________________ Date: ____________

This Power of Attorney document is intended to be compliant with the laws of Pennsylvania and should be construed broadly to grant the Agent the powers specified herein.

PDF Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Pennsylvania Power of Attorney is governed by the Pennsylvania Statutes, Title 20, Chapters 56 and 5601-5612, which outline the legal requirements and standards for creating and executing a power of attorney in Pennsylvania. |

| Form Requirements | In Pennsylvania, a power of attorney must be in writing, signed by the principal, and notarized. Additionally, if it grants the agent real estate powers, it must be acknowledged before a notary and recorded in the county where the property is located. |

| Durable Power of Attorney | A power of attorney can be made durable in Pennsylvania, meaning it remains effective even if the principal becomes incapacitated. This must be clearly stated in the document for it to be considered durable. |

| Springing Power of Attorney | Pennsylvania law allows for the creation of a springing power of attorney, which becomes effective only upon the occurrence of a specified event, typically the principal's incapacity, as clearly defined in the power of attorney document. |

| Agent's Duties | An agent under a power of attorney in Pennsylvania has the duty to act in the principal's best interest, to act in good faith, and to avoid conflicts of interest. The agent must also keep a record of all receipts, disbursements, and transactions made on behalf of the principal. |

| Revocation | The principal may revoke a power of attorney at any time, as long as they are mentally competent. This revocation must be in writing and communicated to the agent and any institutions or parties that were relying on the power of attorney. |

| Health Care Power of Attorney | Pennsylvania allows for the creation of a Health Care Power of Attorney, empowering an agent to make healthcare decisions on behalf of the principal if they become unable to do so. This must comply with Pennsylvania's Health Care Decisions Act. |

| Penalties for Abuse | Abuse of power by an agent under a power of attorney in Pennsylvania can lead to civil liability and, in some cases, criminal charges. The agent can be required to reimburse the principal for any losses caused by their breach of duty. |

Instructions on Writing Pennsylvania Power of Attorney

Filling out a Power of Attorney (POA) form in Pennsylvania is a significant step toward ensuring your affairs are managed according to your wishes should you become unable to do so yourself. This document legally authorizes another person to make decisions on your behalf. The process can seem complex, but breaking it down into steps makes it manageable. Always ensure the form is filled out accurately to avoid any legal issues or misunderstandings in the future.

- Start by downloading the official Pennsylvania Power of Attorney form. This can usually be found on state government or legal assistance websites.

- Enter the full legal name and address of the person granting the power (known as the Principal) in the designated space at the top of the form.

- Fill in the full legal name and address of the person who will be making decisions on behalf of the Principal (known as the Agent or Attorney-in-Fact).

- Specify the powers you are granting to the Agent. Pennsylvania law requires that you be specific about the duties the Agent can perform. These can range from handling financial matters to making health care decisions.

- If you wish to limit the powers or the duration for which the POA is valid, clearly detail these limitations in the space provided on the form.

- Some situations may require the appointment of a Successor Agent. If this is the case, include the name and address of this individual. The Successor Agent will step in if the primary Agent is unable or unwilling to serve.

- Review the form with your Agent and Successor Agent (if applicable) to ensure all parties understand their responsibilities and the powers being granted.

- Find a notary public to witness the signing of the document. Pennsylvania law mandates that a Power of Attorney form must be notarized to be considered valid.

- Sign and date the form in the presence of the notary. The Agent, and if applicable, the Successor Agent, should also sign the form.

- Make several copies of the executed form. Give one to the Agent, keep one for your records, and consider providing a copy to your attorney or a trusted family member.

Once the form is fully executed, your Agent will have the authority to make decisions on your behalf as specified in the document. Remember, a Power of Attorney can be revoked at any time by the Principal, as long as they are mentally competent. It's advised to review and update your POA as needed, especially after significant life events or changes in your wishes or situation.

Understanding Pennsylvania Power of Attorney

What is a Pennsylvania Power of Attorney form?

A Pennsylvania Power of Attorney (POA) form is a legal document that allows one person, known as the principal, to appoint another person, known as the agent or attorney-in-fact, to make decisions and act on the principal's behalf. This authority can cover a wide range of actions concerning the principal's property, financial matters, or even health care decisions, depending on the type of POA executed.

Who can serve as an agent under a Power of Attorney in Pennsylvania?

Any competent adult, such as a trusted family member, friend, or a professional like an attorney, can serve as an agent. It's essential that the principal chooses someone they trust implicitly, as the agent will have significant power over the principal's affairs and legal matters.

Are there different types of Power of Attorney in Pennsylvania?

Yes. Pennsylvania recognizes several types of POA, including: 1. General Power of Attorney, which grants broad powers to the agent; 2. Limited or Special Power of Attorney, which grants the agent powers for specific tasks; 3. Health Care Power of Attorney, which allows the agent to make medical decisions for the principal; 4. Financial Power of Attorney, which gives the agent authority over the principal’s financial matters; and 5. Durable Power of Attorney, which remains in effect if the principal becomes incapacitated.

How do I revoke a Power of Attorney in Pennsylvania?

To revoke a POA in Pennsylvania, the principal must notify the agent in writing and destroy all copies of the POA document. It's also wise to inform any financial institutions and other third parties who were relying on the document of its revocation.

Does a Power of Attorney need to be notarized in Pennsylvania?

Yes, for a Power of Attorney to be legally valid in Pennsylvania, it must be both signed and notarized. The principal, in the presence of a notary public, signs the document, ensuring it is legally recognized and can be acted upon by the agent.

What happens if the Power of Attorney is abused?

If there's evidence that the agent is misusing their powers under a POA, legal actions can be taken against them. The principal can revoke the POA and sue the agent for any losses suffered. If the principal is incapacitated, family members or other interested parties may petition the court for intervention.

Can a Power of Attorney be used after the death of the principal?

No. The authority granted under a Power of Attorney immediately ceases upon the death of the principal. At that point, the executor of the estate, as designated in the will, takes over the responsibility for the deceased's affairs.

Is a Power of Attorney from another state valid in Pennsylvania?

Generally, a POA executed in another state is recognized in Pennsylvania as long as it complies with Pennsylvania law or the laws of the state where it was executed. However, it's advisable to consult with a legal professional to ensure compliance and understand any limitations.

Common mistakes

When completing the Pennsylvania Power of Attorney (POA) form, many individuals inadvertently overlook crucial details or make errors that could significantly impact the document's validity or effectiveness. One common mistake is failing to specify the scope of authority granted to the agent. This oversight can lead to confusion or legal challenges, as it might not be clear whether the agent is authorized to make financial decisions, healthcare decisions, or both. It is essential to clearly outline the powers being delegated to ensure the agent can act as intended on behalf of the principal.

Another area often misunderstood involves the selection of the agent. Sometimes, individuals appoint an agent based on personal relationships rather than the person’s ability to handle significant responsibilities. Selecting an agent who lacks financial acumen or is not trustworthy can lead to mismanagement of the principal's affairs. It is crucial to choose someone who is both capable and reliable to fulfill the role effectively.

A critical error found in some POA documents is neglecting to include a durability provision. Without this key element, the power of attorney might automatically terminate if the principal becomes incapacitated. Since one of the primary reasons for creating a POA is to ensure that an agent can make decisions if the principal cannot, the inclusion of a durability clause is fundamental to its effectiveness in critical moments.

Failure to observe the proper signing and witnessing requirements is another prevalent mistake. The Pennsylvania statute mandates that specific procedures be followed for a POA to be legally binding, including signing in the presence of a notary and, in some cases, witnesses. Overlooking these legal formalities can result in a document that is not legally enforceable.

Moreover, some individuals make the mistake of using overly broad or vague language without considering the potential need for specificity. This can lead to disputes over the interpretation of the agent’s powers and might limit the agent’s ability to act in nuanced situations, especially concerning financial institutions or healthcare providers who may require explicit authority to act on the principal’s behalf.

Ignoring the need for a successor agent is another oversight. Life is unpredictable, and the initially chosen agent may become unable or unwilling to perform their duties when needed. Without naming a successor, the document may become useless, requiring a potentially time-consuming and expensive legal process to appoint a new agent.

Omitting a date of execution can also diminish the effectiveness of a POA. Without a clear indication of when the document becomes effective, there can be uncertainty about the timing of the agent's authority, potentially leading to legal challenges or difficulties in its acceptance by third parties.

Some individuals also fail to consult with a legal professional when creating a POA. This error can result in a document that does not align with current Pennsylvania laws or fails to adequately protect the principal’s interests. Professional guidance is crucial to navigate the complexities of the law and ensure the document is both valid and effective.

Last, there is often a failure to periodically review and update the POA. As circumstances change, the document may no longer reflect the principal's wishes or might become outdated in terms of legal requirements. Regular reviews and updates are essential to maintain the document’s relevance and effectiveness over time.

Documents used along the form

In the realm of legal preparedness, particularly in Pennsylvania, the Power of Attorney (POA) stands as a pivotal document that enables one person to make decisions on behalf of another. However, this document does not stand alone. For a comprehensive legal plan, especially in matters of estate and healthcare planning, several other forms and documents complement the Power of Attorney, ensuring every aspect of an individual’s decision-making capabilities is covered, even in their absence or incapacity.

- Advance Health Care Directive (Living Will): This document specifies an individual's healthcare preferences in the event they are unable to make decisions themselves. It works in tandem with a healthcare POA, guiding healthcare agents in making decisions that align with the principal's wishes.

- Will (Last Will and Testament): A will outlines how an individual’s assets and estate will be distributed upon their death. It designates beneficiaries and, in some cases, can expedite the probate process, ensuring a smoother transition of assets.

- Guardianship Designation: This document is vital for parents or guardians, stipulating who will take care of their dependents should they no longer be able to. It’s a precautionary measure, ensuring dependents are cared for by a trusted person.

- Living Trust: A living trust helps manage an individual’s assets during their lifetime and distributes them upon death without the need for probate. The creator of the trust transfers ownership of their assets to the trust, which a trustee manages for the benefit of designated beneficiaries.

- Health Insurance Portability and Accountability Act (HIPAA) Authorization: This form allows specified individuals to access the principal’s private health information. It’s often essential for healthcare agents to make informed decisions on the principal's behalf.

- Financial Information Release Forms: These forms authorize the release of financial records to designated agents, facilitating the management of the principal’s financial affairs under a financial POA.

- Funeral Planning Declarations: While it may seem morbid, specifying one’s funeral arrangements in advance can ease the burden on loved ones and ensure that one’s final wishes are respected.

- Digital Asset Management: With the increasing significance of online presence, detailing how one's digital assets—ranging from social media accounts to digital currencies—are to be handled is becoming crucial in estate planning.

While the Power of Attorney form is a cornerstone document in legal and estate planning, it functions best when supported by a suite of other forms and documents that address areas beyond the scope of the POA. By adopting a comprehensive approach that includes these additional documents, individuals can secure not just their financial and property interests, but also their health care preferences and post-mortem wishes, ensuring a well-rounded and forward-thinking legal strategy.

Similar forms

The Advance Healthcare Directive, also known as a living will, mirrors the Power of Attorney (POA) form in its essence, allowing individuals to outline their preferences for medical treatment in scenarios where they cannot communicate their desires. Just like a POA grants another person the authority to make decisions on one's behalf, an Advance Healthcare Directive empowers individuals to predetermine their healthcare wishes, ensuring that their values and preferences regarding life-sustaining treatments are respected and followed, even in incapacitation.

The Durable Power of Attorney for Health Care specifically designates an agent to make healthcare decisions on behalf of someone else, closely aligning with the general concept of a Power of Attorney form. The durability aspect implies that the document remains in effect even if the person who created it becomes incapacitated. This parallels the Power of Attorney's function of entrusting an agent with the authority to act in a person's stead, focusing on healthcare decisions rather than financial matters.

A Financial Power of Attorney document is remarkably similar to the general Power of Attorney form, with its primary difference lying in its narrowed focus on financial matters. It enables an individual to designate an agent to handle their financial affairs, from managing bank accounts to selling property. Like a general POA, it can be structured to take effect immediately or upon the occurrence of a future event, typically the principal's incapacity, showcasing how both documents are tailored to safeguard an individual's affairs by delegating decision-making power to a trusted agent.

The Last Will and Testament shares conceptual similarities with a Power of Attorney, as both play pivotal roles in personal estate planning. While a Last Will and Testament comes into effect after one’s death, detailing how assets should be distributed among beneficiaries, a Power of Attorney operates during an individual’s lifetime, allowing another person to make decisions on their behalf. Both documents serve as crucial tools in the management and disposition of one’s estate, reflecting an individual's preferences and desires.

The Trust Agreement, much like the Pennsylvania Power of Attorney, is a vital estate planning tool that stipulates how assets are managed and distributed, either during one's lifetime or after death. The creator of a trust, similar to the principal in a POA, places trust in another party, known as the trustee, to manage the trust assets for the benefit of a third party, the beneficiary. This parallels the Power of Attorney in its foundational principle of entrusting someone else with the authority to act in the best interest of the creator or principal.

A Guardianship or Conservatorship agreement also bears resemblance to the Power of Attorney by providing a mechanism for someone to make decisions on behalf of another, typically due to incapacity or disability. However, unlike a POA, which is created voluntarily by the individual appointing their agent, a guardianship or conservatorship is established by a court and involves a judge determining that an individual is unable to make decisions on their own behalf, appointing a guardian or conservator accordingly.

The Living Trust is akin to the Power of Attorney in that it allows for the handling and protection of an individual's assets during their lifetime, with provisions for management in the event of incapacitation. Both instruments ensure that an individual's affairs can be managed according to their wishes without the need for court intervention, emphasizing preparation and personal choice in financial and estate planning.

A Business Power of Attorney enables a business owner to authorize an agent to make business-related decisions on their behalf, closely resembling a general POA’s functionality. This specificity to business operations allows for seamless continuity of the business in the owner's absence or incapacity, illustrating how Power of Attorney forms can be customized to address various aspects of an individual's personal and professional life.

The Representation Agreement is a legal document similar to a Power of Attorney found in some jurisdictions, focusing on the designation of a representative to handle personal and health care decisions. It emphasizes a broader scope of decision-making, including routine financial matters and personal care, highlighting the flexibility of Power of Attorney documents to cater to the specific needs and wishes of individuals in planning for future incapacity or delegating decision-making authority.

Dos and Don'ts

When filling out a Power of Attorney (POA) form in Pennsylvania, there are specific actions to undertake and others to avoid to ensure the form is legally binding and reflects your wishes accurately. The following guidelines can help you navigate the process smoothly.

Do:

- Read instructions carefully: Each Power of Attorney form has a set of instructions. It's crucial to read these thoroughly before starting to ensure you understand the document's scope and implications.

- Choose the right agent: Select someone you trust implicitly to act as your agent. This person will have significant control over your affairs, so their reliability and understanding of your wishes are paramount.

- Be precise: When giving powers to your agent, be clear and specific about what they can and cannot do. This precision will prevent any misinterpretation of your intentions.

- Include a durability clause: If you want the Power of Attorney to remain effective even if you become incapacitated, make sure to include a durability clause.

- Sign in the presence of a notary: Pennsylvania law requires your Power of Attorney to be notarized to be legally valid. Make sure this step is completed correctly.

- Keep records: Ensure you keep a copy of the signed document for your records and provide one to your agent as well.

Don't:

- Delay: Don't wait for an emergency or incapacitation to occur before preparing a Power of Attorney. By then, it could be too late to ensure your affairs are managed as you wish.

- Use vague language: Avoid using unclear or general terms when describing the powers granted to your agent. Vagueness can lead to disputes or unintended uses of power.

- Forget to specify limits: If there are specific decisions or actions you do not want your agent to make on your behalf, clearly state these limitations in the document.

- Omit a successor agent: Failing to appoint a successor agent can create complications if your initial choice is unable or unwilling to serve. Always have a backup.

- Ignore state laws: State laws can vary significantly, so it’s important not to overlook Pennsylvania's specific requirements for creating a valid Power of Attorney.

- Assume it's permanent: Remember, you can revoke your Power of Attorney at any time as long as you are competent. Therefore, make sure you understand the process for revocation.

Misconceptions

When individuals consider the Pennsylvania Power of Attorney (POA) form, several misconceptions often arise. These misunderstandings can affect a person's decision-making regarding their legal and financial affairs. It is essential to debunk these myths to ensure individuals are well-informed and can make decisions that best serve their interests and those of their loved ones.

- Misconception 1: A Power of Attorney Grants Unlimited Power

One common misconception is the belief that a Power of Attorney provides the agent with unlimited control over the principal's affairs. However, in Pennsylvania, the scope of authority granted to the agent can be as broad or as specific as the principal desires. The principal has the flexibility to tailor the POA, granting only the powers they feel comfortable sharing. This ensures the principal's wishes are respected and that the agent has clear directives on managing their affairs.

- Misconception 2: A Power of Attorney is Only for the Elderly

Another widespread belief is that POAs are solely for elderly individuals. This is far from the truth. Individuals of all ages can benefit from having a POA in place. Accidents, illnesses, and unexpected events do not discriminate by age. Having a POA ensures that someone can legally make decisions on your behalf if you become unable to do so, regardless of your age.

- Misconception 3: A Power of Attorney is Effective Immediately Upon Signing

Many assume that once a POA document is signed, it becomes effective immediately. However, in Pennsylvania, the principal can specify whether the POA should take effect immediately or upon the occurrence of a specified event, such as the principal's incapacitation. This distinction allows principals to maintain control over their affairs until they deem it necessary for the agent to step in.

- Misconception 4: Creating a Power of Attorney Means Losing Control

A significant fear is that by creating a POA, the principal is giving up control over their personal and financial matters. This is not accurate. The principal not only dictates the extent of the agent's powers but also can revoke or alter the POA at any time, as long as they have the mental capacity to do so. Further, Pennsylvania law requires agents to act in the principal's best interests, ensuring that the principal's autonomy and control are preserved.

Clearing up these misconceptions allows for a more informed conversation about Powers of Attorney. Understanding the realities behind these legal documents can provide peace of mind to individuals and families as they plan for the future.

Key takeaways

Understanding the Pennsylvania Power of Attorney (POA) form is crucial for individuals who wish to grant someone else the authority to make decisions on their behalf. Here are key takeaways to ensure its correct completion and use:

- The person granting authority is known as the principal, and the one receiving authority is the agent or attorney-in-fact.

- A POA can be durable, meaning it remains in effect even if the principal becomes incapacitated, or non-durable, meaning it is no longer valid if the principal loses the ability to make decisions.

- It's essential to clearly define the scope of authority given to the agent. This can range from broad, general powers to specific, limited acts.

- The Pennsylvania POA form must be signed by the principal in the presence of a notary public and, depending on the powers granted, may also require witness signatures.

- Choosing a trustworthy and reliable agent is crucial, as they will have significant control over aspects of the principal’s life and finances.

- It is possible to name a successor agent in the event that the primary agent is unable or unwilling to serve.

- The document should be clearly dated and specify when the agent’s authority begins and ends, if not indefinite.

- If the POA is to be used for real estate transactions, it must be recorded with the county recorder’s office.

- A principal can revoke the POA at any time, provided they are mentally competent. This revocation should be in writing and communicated to the agent and any institutions or parties that were relying on the original POA.

- It is advisable to consult with a legal professional when creating a POA to ensure it complies with current Pennsylvania laws and fully reflects the principal's intentions.

Adhering to these guidelines will help in correctly filling out and using a Pennsylvania Power of Attorney form, facilitating an effective legal arrangement between the principal and the agent.

More Power of Attorney State Forms

Poa Financial Form - State-specific forms and rules should be followed to ensure that the Power of Attorney is valid and enforceable.

New York Power of Attorney Form - Creating a Power of Attorney can ensure affairs are managed during times of incapacitation.

How to Get Power of Attorney for Elderly Parent in Georgia - This form grants an agent the authority to act in legal and financial matters for the principal.

Power of Attorney Michigan Pdf - Empower someone you trust to make medical decisions on your behalf when you can't communicate your wishes directly.