Fillable Power of Attorney Document for Ohio

In the state of Ohio, individuals have the power to make crucial decisions about their futures and personal affairs by utilizing the Power of Attorney (POA) form. This legal document grants a chosen agent or attorney-in-fact the authority to make decisions on behalf of the principal—the person making the appointment—concerning financial, real estate, healthcare, and other important aspects of life. Whether ensuring financial duties are managed, healthcare decisions are made according to personal wishes, or simply preparing for unexpected turns of life, the Ohio Power of Attorney form serves as an essential tool in legal planning. Its versatility allows it to be tailored to the specific needs and preferences of the individual, making it a critical component for anyone looking to secure their decisions and estate. Understanding the nuances of this form, from the types available to the legal requirements for its execution, is the first step in establishing a solid future plan that honors the individual's intentions and protects their interests.

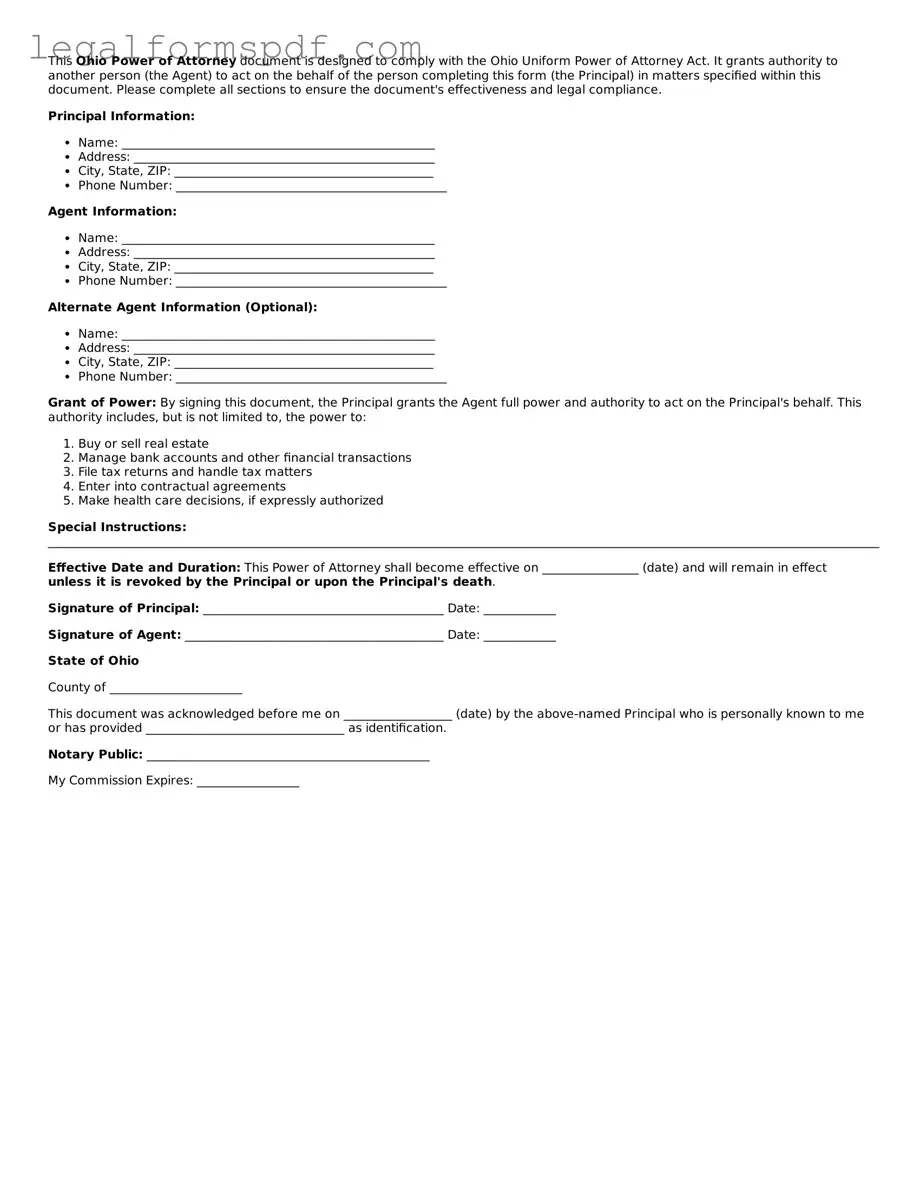

Document Example

This Ohio Power of Attorney document is designed to comply with the Ohio Uniform Power of Attorney Act. It grants authority to another person (the Agent) to act on the behalf of the person completing this form (the Principal) in matters specified within this document. Please complete all sections to ensure the document's effectiveness and legal compliance.

Principal Information:

- Name: ____________________________________________________

- Address: __________________________________________________

- City, State, ZIP: ___________________________________________

- Phone Number: _____________________________________________

Agent Information:

- Name: ____________________________________________________

- Address: __________________________________________________

- City, State, ZIP: ___________________________________________

- Phone Number: _____________________________________________

Alternate Agent Information (Optional):

- Name: ____________________________________________________

- Address: __________________________________________________

- City, State, ZIP: ___________________________________________

- Phone Number: _____________________________________________

Grant of Power: By signing this document, the Principal grants the Agent full power and authority to act on the Principal's behalf. This authority includes, but is not limited to, the power to:

- Buy or sell real estate

- Manage bank accounts and other financial transactions

- File tax returns and handle tax matters

- Enter into contractual agreements

- Make health care decisions, if expressly authorized

Special Instructions: ____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Effective Date and Duration: This Power of Attorney shall become effective on ________________ (date) and will remain in effect unless it is revoked by the Principal or upon the Principal's death.

Signature of Principal: ________________________________________ Date: ____________

Signature of Agent: ___________________________________________ Date: ____________

State of Ohio

County of ______________________

This document was acknowledged before me on __________________ (date) by the above-named Principal who is personally known to me or has provided _________________________________ as identification.

Notary Public: _______________________________________________

My Commission Expires: _________________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The Ohio Power of Attorney form allows individuals to appoint someone else to manage their financial or healthcare decisions. |

| 2 | There are different types of Power of Attorney forms in Ohio, including those for financial matters and healthcare decisions. |

| 3 | The person creating a Power of Attorney in Ohio is called the "principal," and the person given authority is known as the "agent" or "attorney-in-fact." |

| 4 | Ohio law requires certain forms, like the Healthcare Power of Attorney, to be notarized or witnessed by eligible individuals to be valid. |

| 5 | Ohio's Financial Power of Attorney form often grants the agent broad powers to handle the principal's financial affairs, unless specifically limited within the document. |

| 6 | A durable Power of Attorney in Ohio remains in effect even if the principal becomes incapacitated, unless it strictly states otherwise. |

| 7 | Under Ohio law, the principal has the right to revoke a Power of Attorney at any time, as long as they are mentally competent. |

| 8 | The Ohio Revised Code, specifically sections 1337.01 to 1337.64, governs the use and requirements of Power of Attorney forms in the state. |

| 9 | For a Power of Attorney to be legally used in Ohio, it must clearly state the powers granted, be signed by the principal, and meet all state-specific signing requirements. |

Instructions on Writing Ohio Power of Attorney

Filling out an Ohio Power of Attorney (POA) form is a crucial step in ensuring that your financial affairs can be handled by someone you trust, in case you're unable to do so yourself. This document grants another person, known as an agent, the authority to make decisions on your behalf. While the idea might seem daunting at first, breaking down the process into simple steps can make it manageable. Here’s how to approach it:

- Begin by downloading the latest version of the Ohio Power of Attorney form. Ensure it's up to date to comply with current Ohio laws.

- Read the form carefully before you start filling it out. Understanding each section will help you complete it accurately.

- Enter your full name and address in the designated spaces at the top of the form to identify yourself as the principal.

- Designate your chosen agent by writing their full name and address in the specified section. Make sure to discuss this role with them beforehand and confirm they're willing and able to act on your behalf.

- Detail the specific powers you are granting to your agent. Be clear about what they can and cannot do. You can specify financial decisions, property transactions, and any other powers relevant to your situation.

- If you wish to limit the duration of the POA, specify the dates of commencement and termination. Without this, the POA will remain in effect indefinitely or until it is revoked.

- Appoint a successor agent, if desired, by providing their name and address. This step is optional but recommended in case your primary agent is unable or unwilling to serve.

- Review the form with your agent to ensure they understand their responsibilities and any limitations on their authority.

- Sign and date the form in the presence of a notary public to officially authorize it. Many banks and legal offices offer notary services.

- Have your agent(s) sign the form, if required. Some POA forms require the agent's signature, while others do not.

- Distribute copies of the signed form to your agent, relevant financial institutions, and anyone else who may need to know about the POA arrangement.

Once your Ohio Power of Attorney form is filled out and properly signed, you've taken a significant step in planning for your future financial wellbeing. This document ensures that your affairs will be in trusted hands, providing peace of mind to both you and your loved ones. Remember, circumstances change, so it's wise to review and, if necessary, update your POA periodically.

Understanding Ohio Power of Attorney

What is a Power of Attorney (POA) form in Ohio?

A Power of Attorney (POA) form in Ohio is a legal document that allows an individual, known as the principal, to delegate authority to another person, called the agent or attorney-in-fact, to make decisions and act on the principal's behalf. These decisions can pertain to financial matters, health care, or other personal affairs. The scope of authority granted can be broad or limited, depending on the wishes of the principal.

How do I create a Power of Attorney in Ohio?

To create a Power of Attorney in Ohio, you must complete a POA form detailing the powers you wish to grant to your agent. This form must include the signature of the principal and, depending on the type of POA, may also need to be witnessed or notarized. Ohio law may have specific requirements for different types of POA forms (e.g., financial vs. health care), so it is crucial to ensure that the form complies with state law and addresses all necessary elements.

Who can serve as an agent under a POA in Ohio?

In Ohio, an agent under a POA can be almost any competent adult whom the principal trusts to manage their affairs. This could be a family member, friend, attorney, or other professional. The chosen agent should be someone reliable, willing to take on the responsibility, and ideally, someone who understands the principal's wishes and values.

Are there different types of POA in Ohio?

Yes, Ohio recognizes several different types of Power of Attorney. The most common include General Power of Attorney, which grants broad powers, and Limited Power of Attorney, which grants specific powers for a limited time or purpose. There are also Durable Powers of Attorney, which remain in effect even if the principal becomes incapacitated, and Health Care Powers of Attorney, allowing agents to make medical decisions on behalf of the principal.

When does a POA become effective in Ohio?

The effectiveness of a POA in Ohio depends on the terms specified within the document. A POA can become effective immediately upon signing, at a future date mentioned in the document, or upon the occurrence of a specific event, such as the principal's incapacitation. The principal can tailor the POA's terms to fit their preferences and needs.

Can a Power of Attorney be revoked in Ohio?

Yes, a principal can revoke a Power of Attorney at any time, as long as they are mentally competent. To revoke a POA, the principal should provide a written notice of revocation to the agent and any institutions or individuals who were aware of the original POA. It is also recommended to destroy all copies of the revoked POA to prevent confusion or unauthorized use.

Does a POA allow an agent to make healthcare decisions for the principal in Ohio?

An agent can make healthcare decisions for the principal in Ohio only if the POA specifically grants such authority. This typically requires a Health Care Power of Attorney or a separate Living Will that explicitly provides the agent with the right to make medical decisions on the principal's behalf, in accordance with the principal's wishes and best interests.

What happens if someone doesn't have a POA in Ohio?

If someone becomes incapacitated without a Power of Attorney in Ohio, it may be necessary for a court to appoint a guardian or conservator to make decisions on their behalf. This process can be lengthy, costly, and stressful for family members. Having a POA in place ensures that someone the principal trusts can manage their affairs without court intervention, making it an essential part of estate planning.

Common mistakes

In Ohio, when individuals fill out a Power of Attorney (POA) form, several common errors can occur, potentially invalidating the document or causing confusion. One frequent mistake is not specifying the powers granted to the attorney-in-fact clearly. The POA should clearly delineate what decisions the agent can make on behalf of the principal, such as financial, real estate, or medical decisions.

Another error is choosing the wrong type of POA. There are different types of Power of Attorney — such as durable, springing, or medical. Selecting the wrong type can result in the POA not functioning as intended during critical times. For instance, a durable POA remains in effect if the principal becomes incapacitated, while a non-durable POA does not.

A common pitfall is failing to appoint a trustworthy agent. The person you choose to act on your behalf should be trustworthy and capable of handling the responsibilities. Sometimes, individuals make the mistake of selecting an agent based on obligations or relationships rather than aptitude and reliability.

Not having the document properly witnessed or notarized, where required, is another crucial mistake. Ohio law may require your POA to be notarized and/or witnessed to be legally binding. Skipping this step can lead to the POA being questioned or not recognized when it is needed most.

Omitting a sunset clause or not specifying when the POA becomes effective is a common oversight. Without explicit instructions on when the POA starts and if or when it ends, there can be significant confusion, potentially rendering the document ineffective when it’s most needed.

Ignoring the need for a backup agent is another issue. If the original agent is unable or unwilling to serve, having no alternate can cause delays and complications. It is prudent to appoint a successor agent in the POA document.

Not updating the POA to reflect current laws or life changes is a mistake individuals often overlook. Laws governing POAs can change, and if the document is not updated accordingly, it might not work as intended. Additionally, changes in your personal circumstances, such as marriage, divorce, or the death of the designated agent, necessitate updates to the document.

Some people fail to communicate their wishes and the contents of the POA to their agent. It's crucial that the person appointed understands their responsibilities and your expectations. Without clear communication, the agent might make decisions that do not align with the principal’s wishes.

Lastly, leaving the POA inaccessible is a practical mistake to avoid. If the document is locked away or the appointed agent does not have access to it, it cannot serve its purpose. Ensure that both your agent and any relevant institutions know where to find the POA when necessary.

Documents used along the form

When preparing an Ohio Power of Attorney form, it’s vital to consider other essential documents that complement or are often required in conjunction with it. These documents encompass a variety of legal, financial, and medical directives that support a comprehensive estate plan or legal arrangement. Each serves a unique purpose and ensures that the individual's preferences are clearly outlined and can be legally enforced.

- Advance Healthcare Directive: This document, also known as a living will, outlines an individual's preferences regarding medical treatment and life support in situations where they cannot communicate their decisions. It works in tandem with a Healthcare Power of Attorney, providing clear instructions to healthcare providers and family members.

- Healthcare Power of Attorney: Specifically designed to grant a trusted individual the authority to make healthcare decisions on another’s behalf, this form is crucial when the principal cannot make or communicate their medical choices due to incapacity or illness.

- Financial Power of Attorney: Although a general Power of Attorney might cover financial matters, a document explicitly focused on financial decisions allows an appointed agent to manage bank accounts, investments, and other economic affairs, ensuring financial continuity.

- Last Will and Testament: This legal document spells out how an individual's assets and estate will be distributed upon their death. It identifies heirs, outlines asset distribution, and may appoint a guardian for minor children, complementing the powers granted in a Power of Attorney.

- Living Trust: A living trust helps manage an individual's assets during their lifetime and simplifies the distribution of those assets upon death, often bypassing the lengthy and costly probate process. It can work alongside a Power of Attorney by providing detailed instructions for asset management and distribution.

- Declaration for Mental Health Treatment: Specific to mental health decisions, this form allows individuals to state their preferences for mental health treatment and medication, and appoint an agent to make decisions on their behalf if they are deemed unable to do so.

These documents collectively ensure that a wide range of personal, financial, and health-related decisions are covered, creating a solid legal foundation for managing one’s affairs. Given the complexity of legal and health matters, it’s advisable to consult with legal professionals to tailor these documents to accommodate individual circumstances and state-specific legal requirements.

Similar forms

The Ohio Power of Attorney (POA) form is closely related to a Living Will in that both documents allow an individual to outline their preferences and directives for future scenarios. A Living Will specifically focuses on health care desires, especially the kinds of medical treatment an individual wishes to accept or refuse in the event they can no longer communicate their decisions. This parallels the function of a medical POA, which designates an agent to make health care decisions on one's behalf, underlining the proactive approach in planning for unforeseen medical circumstances.

Similarly, a Health Care Proxy is another document with a purpose akin to a segment of the Ohio POA, especially concerning medical decisions. This document appoints someone to make health-related decisions for the signatory if they are unable to do so themselves. The distinctiveness of a Health Care Proxy lies in its exclusive focus on health care decisions, mirroring the scope of a medical POA and thereby ensuring an individual's health care wishes are respected and followed.

A Durable Power of Attorney for Finances shares significant features with the Ohio POA, notably in allowing an individual to designate another person to handle their financial matters. The “durable” aspect means that the document remains in effect even if the person who created it becomes incapacitated. This provides a safety net, ensuring that financial duties such as paying bills, managing investments, and handling transactions continue smoothly, reflecting a key utility of a comprehensive POA.

An Advance Directive is a broader term that encom

Dos and Don'ts

When filling out the Ohio Power of Attorney (POA) form, it is important to approach the process with great care and attention to detail. This document grants another person authority to make decisions on your behalf, which can include financial, health, and other personal matters. To ensure that your interests are properly protected and your wishes accurately reflected, here are several do's and don'ts you should consider:

- Do read all instructions associated with the Ohio POA form carefully to fully understand the scope and implications of the powers being granted.

- Do choose a trusted individual who understands your values and wishes to act as your agent. This person will make decisions on your behalf, so trust and communication are key.

- Do clearly specify the powers you are granting to your agent. Be precise about what they can and cannot do to avoid any ambiguity.

- Do discuss your wishes and expectations with the person you are appointing as your agent to ensure they are willing and able to act according to your instructions.

- Do have the POA form notarized if required by Ohio law, as this step often adds a level of legal validity and helps prevent any challenges to the document's authenticity.

- Don't fill out the form in a hurry. Take your time to consider all aspects of your current and future needs.

- Don't use vague language when detailing the powers granted. Specificity helps prevent confusion and potential misuse of authority.

- Don't forget to review and update your POA as necessary. Life changes such as marriage, divorce, the birth of a child, or a change in your health condition can affect your POA needs.

- Don't hesitate to seek legal advice if there are any aspects of the POA form or process that you do not understand. A qualified attorney can provide valuable guidance tailored to your situation.

By following these recommendations, you can help ensure that your Ohio Power of Attorney form accurately reflects your wishes and provides the protection and authority you intend. Remember, this document is a crucial part of your estate planning and should be approached with the seriousness and care it deserves.

Misconceptions

When dealing with the Ohio Power of Attorney (POA) form, many individuals find themselves wrapped up in misconceptions. Understanding these misconceptions is essential for anyone planning to grant someone else the authority to make legal decisions on their behalf.

A Power of Attorney grants complete control. One common misunderstanding is that by signing a POA form, you are giving away all control over your personal and financial affairs. The truth is, the scope of authority granted to an agent can be as broad or as limited as you wish. You have the power to specify exactly what decisions your agent can make on your behalf.

A Power of Attorney is irrevocable. Many people mistakenly believe once a POA is created, it cannot be changed or cancelled. However, as long as you remain mentally competent, you can revoke or modify your POA at any time to better suit your needs or to appoint a different agent.

Creating a Power of Attorney means you no longer can make decisions for yourself. This is a misconception. A POA does not strip you of your power to make your own decisions; it simply grants another person the authority to make decisions alongside you or in situations where you might not be able to do so yourself.

A Power of Attorney survives death. Some people believe that a POA remains effective after the principal's death. This is not true. The authority granted through a POA ends at the moment of the principal’s death. After that, the management of the deceased's affairs is handled according to their will or, in the absence of a will, through the state’s laws of intestacy.

Only family members can be named as agents. There is a widespread belief that only a relative can be designated as your agent under a POA. In reality, you can choose anyone you trust to act as your agent, whether they are related to you or not. The key factor is trust, not blood relation.

Overcoming these misconceptions about the Ohio Power of Attorney form ensures you are making informed and effective decisions about who can make choices on your behalf should you be unable to do so yourself. Always seek legal advice to ensure your Power of Attorney form best suits your needs and is executed in compliance with Ohio law.

Key takeaways

When preparing to use the Ohio Power of Attorney form, it's important to ensure the process is handled correctly to ensure the document is legal and effective. Below are key takeaways you should keep in mind:

- Understand the different types: There are various forms of Power of Attorney in Ohio, such as financial, healthcare, or general. It's imperative to choose the one that best suits your needs and situation.

- Choose an agent wisely: The person you designate as your agent should be someone you trust implicitly. This individual will be making decisions on your behalf, possibly in critical situations.

- Be specific about powers granted: Clearly outline what powers you are granting to your agent. Being vague or overly broad can lead to confusion or misuse of authority.

- Consider durability: A durable Power of Attorney remains in effect even if you become incapacitated. Deciding whether your document should be durable is a crucial consideration.

- Legal requirements: The form must comply with Ohio law, including being signed by the principal (the person making the Power of Attorney) and possibly notarized, depending on the type of Power of Attorney being executed.

- Revocation process: You have the right to revoke your Power of Attorney at any time, as long as you are mentally competent. It's important to understand the process for doing so and to inform any relevant parties if the Power of Attorney is revoked.

- Consult a professional: While it’s possible to fill out the Power of Attorney form on your own, consulting with a legal professional can provide clarity, ensure the form's legality, and tailor it to your specific circumstances.

By keeping these key takeaways in mind, you can more confidently navigate the process of establishing a Power of Attorney in Ohio, ensuring that your interests are protected and your wishes are effectively communicated.

More Power of Attorney State Forms

Florida Durable Power of Attorney - Provides the legal authority for someone to make decisions in diverse areas of your life.

Power of Attorney Michigan Pdf - Enable trusted individuals to make donations to charities on your behalf, continuing your legacy of giving.

How to Get Power of Attorney for Elderly Parent in Georgia - This document is governed by state law, and requirements can vary from one jurisdiction to another.