Official Motor Vehicle Power of Attorney Document

When dealing with the title, registration, or other transactions regarding a motor vehicle, individuals often encounter situations where they cannot be present to manage these affairs personally. This is where the Motor Vehicle Power of Attorney (MVPOA) form steps in as a crucial tool. It grants a trusted individual the legal authority to act on another person’s behalf exclusively in matters related to a motor vehicle. This form is particularly useful for those who might be traveling, dealing with health issues, or simply unable to handle the bureaucracy of vehicle transactions themselves. The MVPOA covers a range of activities, from registering the vehicle to selling it, and varies in its specifics from state to state, reflecting the unique requirements of each jurisdiction. Understanding how to properly use this form can save time, ensure compliance with the law, and provide peace of mind that vehicle-related matters are handled efficiently in one's absence.

State-specific Information for Motor Vehicle Power of Attorney Forms

Document Example

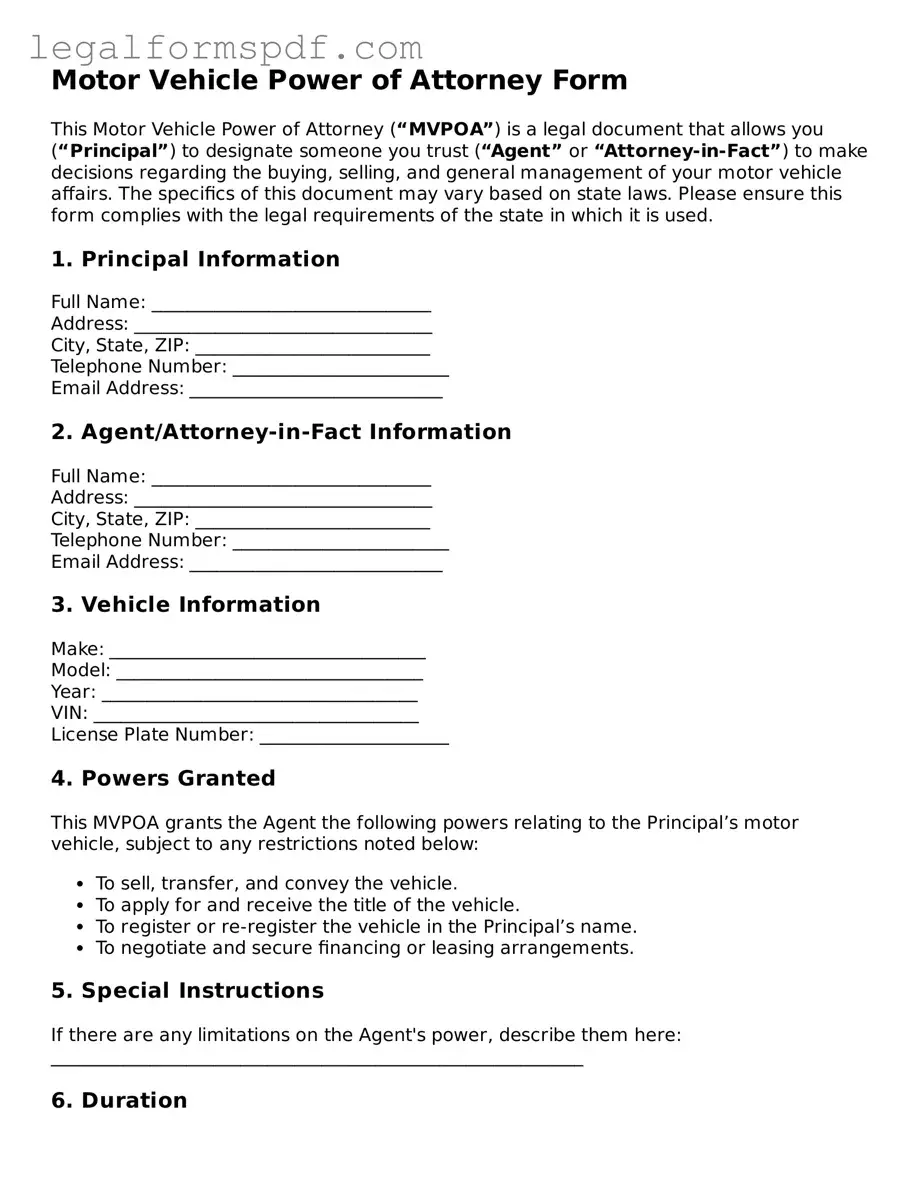

Motor Vehicle Power of Attorney Form

This Motor Vehicle Power of Attorney (“MVPOA”) is a legal document that allows you (“Principal”) to designate someone you trust (“Agent” or “Attorney-in-Fact”) to make decisions regarding the buying, selling, and general management of your motor vehicle affairs. The specifics of this document may vary based on state laws. Please ensure this form complies with the legal requirements of the state in which it is used.

1. Principal Information

Full Name: _______________________________

Address: _________________________________

City, State, ZIP: __________________________

Telephone Number: ________________________

Email Address: ____________________________

2. Agent/Attorney-in-Fact Information

Full Name: _______________________________

Address: _________________________________

City, State, ZIP: __________________________

Telephone Number: ________________________

Email Address: ____________________________

3. Vehicle Information

Make: ___________________________________

Model: __________________________________

Year: ___________________________________

VIN: ____________________________________

License Plate Number: _____________________

4. Powers Granted

This MVPOA grants the Agent the following powers relating to the Principal’s motor vehicle, subject to any restrictions noted below:

- To sell, transfer, and convey the vehicle.

- To apply for and receive the title of the vehicle.

- To register or re-register the vehicle in the Principal’s name.

- To negotiate and secure financing or leasing arrangements.

5. Special Instructions

If there are any limitations on the Agent's power, describe them here: ___________________________________________________________

6. Duration

This MVPOA is effective as of ____/____/____ and shall remain in effect until ____/____/____, unless revoked sooner by the Principal.

7. Governing Law

This document shall be governed by the laws of the State of __________, without giving effect to any choice or conflict of law provision or rule.

8. Signatures

Both the Principal and the Agent must sign this document for it to be valid. Their signatures affirm that they understand and agree to the terms set forth in this MVPOA.

Principal Signature: ___________________________ Date: _____________

Agent/Attorney-in-Fact Signature: _______________ Date: _____________

This document was drafted to facilitate certain transactions related to a motor vehicle and does not cover health care decisions or other types of financial decisions.

Notice: It is wise to consult a lawyer to ensure that this document reflects your intentions and is compliant with the law of your state.

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | Allows an individual (the principal) to grant another person (the agent) the authority to make decisions and take actions concerning the principal's motor vehicle, including but not limited to, registration, title transfer, and sale transactions. |

| Validity | Must be completed accurately and, in some states, may require notarization to be considered legally valid. |

| State-Specific Forms | Many states have specific requirements and forms for a Motor Vehicle Power of Attorney, adhering to their governing laws. It is crucial to use the correct form for the state where the vehicle is registered. |

| Revocation | The principal can revoke the Power of Attorney at any time, provided the revocation is done in writing and follows the legal requirements of the state where it was issued. |

Instructions on Writing Motor Vehicle Power of Attorney

So, you've decided you need a Motor Vehicle Power of Attorney (POA). This document is a handy tool that lets someone else make decisions regarding your vehicle, from registration to selling it, on your behalf. Getting through this process smoothly involves filling out your form correctly. Below are the steps to ensure your document is filled out accurately, ensuring your vehicle matters are handled just as you wish without a hitch.

- Start by writing the date at the top of the form. This includes the month, day, and year. It's essential because it marks when the power of attorney becomes effective.

- Enter your full name and address in the designated sections. Be sure to include any apartment numbers or suite numbers. This identifies you as the principal, granting the powers.

- Fill in the name and address of the person you're giving power of attorney to. This person, known as the agent, will have the authority to make decisions about your motor vehicle on your behalf.

- Identify the vehicle in question. This typically involves providing the make, model, VIN (Vehicle Identification Number), and year. Accurate details here are crucial for clear understanding and legal validity.

- Specify the powers you're granting. This might include buying, selling, and registering the vehicle. Be clear about what your agent can and cannot do to avoid any confusion or misuse of the POA.

- Sign and date the form. Your signature is what gives the document its power, making the powers you’re granting legally effective. Make sure you sign according to the guidelines, which might include having a witness or notary present.

- If required, have the agent sign the form. Some states need the agent to acknowledge their acceptance of the powers by signing the document.

- Lastly, if your state requires it, get the document notarized. This usually involves signing the form in front of a notary public, who then also signs and seals the document, making it officially recognized.

Once completed, your Motor Vehicle Power of Attorney is ready to be used. Ensure you keep a copy for your records and provide another to the agent. This document streamlines handling your vehicle matters, offering peace of mind that even when you can't be there in person, your vehicle is in good hands.

Understanding Motor Vehicle Power of Attorney

What is a Motor Vehicle Power of Attorney (MVPOA) form?

A Motor Vehicle Power of Attorney form is a legal document granting a person or organization the authority to handle specific matters related to a motor vehicle on behalf of the vehicle's owner. This can include buying, selling, registering, or making claims for the vehicle. The person granting this power is known as the principal, while the one receiving it is the agent or attorney-in-fact.

Why would someone need a Motor Vehicle Power of Attorney?

Individuals often use this form when they are unable to personally handle vehicle-related tasks due to reasons like being out of the country, having physical or medical limitations, or lacking time due to work obligations. It enables the agent to act in the vehicle owner’s stead, ensuring necessary transactions can be completed without delay.

How does one create a Motor Vehicle Power of Attorney?

Creating a Motor Vehicle Power of Attorney requires completing a state-specific form, which typically includes details about the principal, the agent, and the vehicle in question. It must be signed by the principal and, in some states, notarized to be legally valid. Each state has its own requirements and forms, so it’s important to consult local regulations or a legal professional.

Is a Motor Vehicle Power of Attorney permanent?

No, it is not permanent. The duration can be set according to the principal's needs. It may be for a single transaction or for a specified period. Furthermore, the principal can revoke it at any time as long as a revocation notice is properly communicated to the relevant parties.

Can a Motor Vehicle Power of Attorney be used in any state?

While a Motor Vehicle Power of Attorney can be broadly used, each state has its own legal requirements and forms. Therefore, a form executed in one state may not automatically be recognized in another. It’s crucial to use the appropriate form and follow the specific legal guidelines of the state where the vehicle transactions will occur.

What happens if the Motor Vehicle Power of Attorney is not recognized?

If a Motor Vehicle Power of Attorney is not recognized, transactions intended by the principal cannot proceed. This failure can be due to incorrect forms, lack of notarization where required, or incomplete information. To resolve this, it’s advisable to ensure that the form meets all state-specific requirements and seek advice from a legal professional if needed.

Can more than one person be named as an agent in a Motor Vehicle Power of Attorney?

Yes, more than one person can be designated as an agent in a Motor Vehicle Power of Attorney. However, it must be clear whether these agents can act independently or must make decisions together. Specifying this in the document can prevent confusion or legal challenges during its execution.

Is a Motor Vehicle Power of Attorney required to be notarized?

Whether notarization is required depends on the state in which the form is being executed. Many states do require notarization to ensure the document's authenticity and the principal’s signature. Checking the specific requirements of the state where the vehicle-related transactions will take place is essential for the form to be legally effective.

Common mistakes

Completing a Motor Vehicle Power of Attorney (POA) form requires attention to detail and an understanding of what the document entails. A common mistake made is not specifying the powers granted clearly. This lack of clarity can lead to confusion about what the appointed agent is authorized to do concerning the vehicle, whether that includes selling, registering, or performing other transactions on the owner's behalf.

Another error often encountered is neglecting to include all required personal information. This error includes incomplete details about the vehicle owner or the agent, such as full names, addresses, or adequate identification information. Such omissions can render the form invalid or cause delays in processing.

Frequently, individuals forget to check the validity period of the Power of Attorney, assuming it remains effective indefinitely. Many states have laws that limit the duration of a POA's effectiveness. Not specifying an expiration date, if required, or assuming the document lasts forever can lead to unexpected complications at a time when the POA is needed the most.

Signing the document without the presence of a notary or required witnesses is a critical mistake. The requirements regarding notarization vary from state to state, and failing to comply with these rules can invalidate the entire document. Some states require notarization for the document to be legally binding, while others might require one or more witnesses to sign the form as well.

Not giving the original copy of the POA to the agent is another oversight. Many people make photocopies or digital copies of the signed document, mistakenly thinking these will suffice. However, most institutions require the original document to process any transactions on behalf of the vehicle's owner. This mistake can result in unnecessary delays or refusal of services.

Choosing an agent without sufficient trust or reliability is a significant error. The role of an agent in a Motor Vehicle Power of Attorney is crucial, as they will have the authority to make potentially significant decisions about one’s vehicle. Assigning this responsibility to someone who may not act in the owner's best interest or who is not dependable can lead to misuse of the powers granted.

Some individuals make the mistake of not reviewing and updating the POA as circumstances change. Life events such as a change in marital status, relocation, or the chosen agent becoming unavailable can impact the relevance and functionality of the existing POA. Regular review and necessary updates ensure the document reflects the current wishes and situation of the vehicle owner.

Last but not least, overlooking the requirement to file the POA with the relevant motor vehicle department or agency can cause significant issues. Depending on the jurisdiction, simply completing and notarizing the POA may not be sufficient. Filing the document with the appropriate agency ensures that records are updated and the agent's authority is recognized for vehicle-related transactions.

Documents used along the form

The Motor Vehicle Power of Attorney form is a crucial document that enables an individual to grant another person the authority to handle matters related to their vehicle on their behalf. This might include tasks such as registration, title transfer, and dealings with the Department of Motor Vehicles (DMV). Alongside this important form, there are several other documents that are often used to ensure the comprehensive management and legal compliance of vehicle-related affairs. These documents serve various purposes, from establishing proof of insurance to granting authorization for vehicle use.

- Bill of Sale: This document serves as a receipt and proof of purchase for the sale of a vehicle between two parties. It typically includes details of the transaction such as the purchase price, vehicle description, and the date of sale.

- Vehicle Title: The title of a vehicle acts as the official document that establishes the legal owner of the vehicle. It is necessary for transferring ownership and registering the vehicle.

- Proof of Insurance: Proof of insurance is required in almost all transactions involving vehicles. It verifies that the vehicle is covered under an insurance policy, fulfilling legal requirements and providing protection against potential liabilities.

- Odometer Disclosure Statement: An odometer disclosure statement is required when a vehicle is sold to ensure the buyer is aware of the actual mileage of the vehicle. It helps prevent odometer fraud and guarantees transparency in the transaction.

- Vehicle Registration Application: This is a form submitted to the DMV to register a vehicle under an individual’s name. Registration must be renewed regularly, and this application is necessary for the initial registration and any subsequent renewals.

- Release of Liability: When selling or transferring ownership of a vehicle, this document is used to release the seller from any future liabilities related to the vehicle. It essentially notifies the DMV that the vehicle is no longer under the seller's ownership.

- Permission for Vehicle Use: This document grants explicit authorization to another individual to use the vehicle for a specified period. It's particularly useful in situations where the vehicle might be driven by someone other than the owner or the person holding the power of attorney.

Together, these documents facilitate the smooth transfer of ownership, registration, and permission for use of vehicles, ensuring all legal requirements are met. They serve as essential companions to the Motor Vehicle Power of Attorney form, allowing vehicle owners and their authorized agents to navigate the intricacies of vehicle management and compliance with relevant laws and regulations effectively.

Similar forms

The Motor Vehicle Power of Attorney (MVPOA) form is closely related to the General Power of Attorney (GPOA) form. Both documents allow individuals to grant others the authority to make decisions and take actions on their behalf. However, while the MVPOA is specifically designed for transactions involving a motor vehicle, such as registration or sale, the GPOA covers a broader spectrum of actions across various aspects of one's life, including financial matters, property transactions, and personal affairs.

Another document similar to the MVPOA is the Limited Power of Attorney (LPOA). Like the MVPOA, the LPOA grants someone else the power to act in your stead for specific tasks. The critical difference is that the LPOA can apply to various scenarios, not solely related to motor vehicles. It specifies the exact powers granted, which can range from handling financial transactions to making healthcare decisions, depending on the granter's preferences.

The Durable Power of Attorney (DPOA) shares similarities with the MVPOA, as it allows an individual to appoint another person to make decisions on their behalf. What sets the DPOA apart is its durability - it remains in effect even if the grantor becomes incapacitated. Unlike the MVPOA, which is often used for a particular transaction and may not include stipulations for the grantor's incapacitation, the DPOA is designed to ensure continuous representation regardless of the grantor's health status.

The Health Care Power of Attorney is another document that, while distinct in purpose, shares the fundamental principle of granting decision-making authority to another individual. Unlike the MVPOA, which focuses on vehicle-related matters, the Health Care Power of Attorney allows an appointed person to make medical and health care decisions on behalf of the grantor should they become unable to make those decisions themselves.

The Financial Power of Attorney (FPOA) document is akin to the MVPOA in that it permits someone else to handle specific transactions on behalf of the grantor. The FPOA, however, is more comprehensive regarding financial matters, enabling the appointed individual to manage bank accounts, pay bills, and invest in securities, among other financial activities, which contrasts with the MVPOA's limited scope concerning motor vehicle transactions.

A Real Estate Power of Attorney grants an appointed individual authority to act in real estate transactions on behalf of the grantor, drawing a parallel to the MVPOA's focus on motor vehicle transactions. This document covers a wide range of real estate dealings, including buying, selling, and managing property, showcasing its flexibility in the real estate realm compared to the MVPOA's vehicle-centric approach.

Parents or guardians can use the Child Care Power of Attorney to give another individual the authority to make decisions regarding their child's welfare, including education and healthcare. This contrasts with the MVPOA, which is strictly for vehicle-related matters, emphasizing the Child Care Power of Attorney's focus on ensuring a child's needs are met in the parent's or guardian's absence.

The Tax Power of Attorney, officially known as the IRS Power of Attorney, allows an individual to designate someone else, typically a tax professional, to handle tax matters with the IRS. It closely relates to the MVPOA's concept of representation on another's behalf but diverges in scope, specifically targeting tax issues versus the MVPOA's concentration on motor vehicle concerns.

Lastly, the Springing Power of Attorney is structured to become effective only under specific conditions, usually the grantor's incapacitation, differing from the typically immediate activation of the MVPOA once signed. This conditional activation mechanism provides a safeguard, ensuring that the power is granted only when strictly necessary, contrasting with the MVPOA's purpose of enabling vehicle-related transactions without such constraints.

Dos and Don'ts

Navigating the process of filling out a Motor Vehicle Power of Attorney (MVPOA) form can be straightforward when you're aware of the do's and don'ts. This document grants another person the authority to make decisions and act on your behalf regarding your vehicle. Whether you're unable to be present to handle matters yourself or you prefer someone to take care of all your vehicle-related transactions, knowing the correct steps to follow and pitfalls to avoid is crucial. Below is a list to guide you through this process.

Things You Should Do- Fully read and understand the MVPOA form before you begin filling it out. It’s important to grasp every aspect of the authority you're granting.

- Gather all necessary information about the vehicle, including the make, model, year, and Vehicle Identification Number (VIN), before starting the form.

- Clearly identify the individual you're granting power to. Include their full name and contact information to avoid any ambiguity.

- Specify the powers being granted, whether broad or limited to certain acts, such as registering the vehicle or selling it on your behalf.

- Sign the form in the presence of a notary public to validate its authenticity. Some jurisdictions require this step for the document to be legally binding.

- Keep a copy of the notarized document for your records. It’s essential to have your own record of the powers you've granted.

- Inform the person you’ve appointed about their responsibilities and any limitations on their authority. Clear communication can prevent misunderstandings.

- Consult with a legal expert if you have any doubts or questions. Professional advice can help you navigate any complexities.

- Don’t leave any sections of the form blank. Incomplete information can lead to delays or rejection of the document.

- Avoid using unclear language that might be open to interpretation. Be concise and specific about the authority being granted.

- Don't sign the form without a notary public present if your state requires notarization. Doing so might invalidate the document.

- Avoid neglecting to verify the identity of the person you are granting power to. Ensure they are trustworthy and capable of handling the responsibilities.

- Don’t forget to check whether your state has a specific MVPOA form that you need to use. Using the wrong form can invalidate the document.

- Do not fail to review the document thoroughly before signing. Ensure all information is correct and reflects your intentions clearly.

Following these guidelines can help ensure that your Motor Vehicle Power of Attorney form is filled out correctly and effectively. It's about making sure you're well-informed and confident in the decisions you're making. Taking the time to do it right can save you time and potential legal hassles down the road.

Misconceptions

When it comes to handling matters related to vehicle transactions or registrations via a Motor Vehicle Power of Attorney (MVPOA) form, several misconceptions often arise. These misunderstandings can lead to misuse of the form or a lack of adequate protection for the principal. Here are six common misconceptions fully explained.

Any Power of Attorney Form Can Be Used for Vehicle Transactions: A common misconception is that a general power of attorney form is sufficient to handle vehicle transactions, such as buying or selling a car. However, many states require a specific MVPOA form that is tailored to authorize another person to act on your behalf only in vehicle-related matters.

Once Signed, It Is Valid Indefinitely: People often think that once the MVPOA form is signed, it remains valid indefinitely. In reality, many of these forms have an expiration date, and states may vary in terms of how long the form is considered valid. It's crucial to check the specific requirements in your state.

The Agent Can Make Any Decision: There's a belief that once appointed, the agent (the person given authority) can make any decision relating to the vehicle. This is not true. The scope of the agent's authority is limited to what is explicitly mentioned in the MVPOA form. It's important to clearly state what decisions the agent is authorized to make.

No Need for Witnesses or Notarization: Many assume that the MVPOA does not need to be witnessed or notarized. This is incorrect as most states require the form to be either witnessed, notarized, or both to ensure its validity. This process adds a layer of protection against fraud.

The Form Grants Ownership of the Vehicle: This misconception leads people to believe that granting someone a MVPOA equates to transferring ownership of the vehicle. The truth is, the form only allows the agent to make certain decisions or perform specific actions related to the vehicle on the principal's behalf; it does not transfer the ownership.

Revocation Happens Automatically Upon the Principal’s Death: It's commonly misunderstood that the MVPOA is automatically revoked upon the death of the principal. While it is true that the authority granted through the MVPOA does end with the principal’s death, appropriate steps must sometimes be taken to notify relevant parties of the revocation, especially if the vehicle is part of the principal’s estate.

Understanding these misconceptions about the Motor Vehicle Power of Attorney form is crucial for anyone looking to use this legal document effectively and according to state laws. By clarifying these points, individuals can better navigate their vehicle-related transactions with confidence and legal assurance.

Key takeaways

The Motor Vehicle Power of Attorney form is an essential document for individuals seeking to grant another person the authority to handle certain matters related to their vehicle. This could include tasks such as registration, obtaining a title, or even selling the vehicle on their behalf. Understanding the key elements and precautions of filling out and using this form can help ensure that your vehicle-related affairs are managed smoothly in your absence. Here are four key takeaways:

- Filling out the form accurately is crucial. Ensure all information provided on the Motor Vehicle Power of Attorney form is accurate and matches the details on your vehicle registration documents. This includes full names, addresses, and specific details about the vehicle in question, such as its make, model, and VIN (Vehicle Identification Number).

- Be specific about granted powers. Clearly identify the tasks you are delegating to the agent. The form allows you to specify the extent of power you are granting, which can range from authorization to make a single transaction on your behalf to handling all matters related to your vehicle. Limiting the powers to only what is necessary can help prevent misuse.

- Choose your agent wisely. The person you appoint as your agent will have significant control over your vehicle-related transactions. It is vital to choose someone who is not only trustworthy but also has the ability and availability to handle the tasks effectively. This is often a close family member, a friend, or a trusted advisor.

- Understand the legal implications. Executing a Motor Vehicle Power of Attorney form has legal ramifications. Once signed, it grants the agent the authority to act on your behalf within the scope defined in the document. It's essential to know that, depending on your state's law, this power can be revoked at any time, provided you follow the correct legal process to do so. Ensure you are fully informed about how this document operates within your jurisdiction.

Properly executed, a Motor Vehicle Power of Attorney form can be a powerful tool for managing your vehicle-related affairs efficiently and securely. Always make sure to consult with a legal professional or advisor to ensure that the form is filled out and executed according to your state's laws and regulations.

Consider More Types of Motor Vehicle Power of Attorney Forms

Sample of Power of Attorney to Sell Property - Empowers an agent to negotiate, sign documents, and take legal actions related to real estate on someone’s behalf.

Free Revocation of Power of Attorney Form - Ensures that once it's signed, the agent previously designated can no longer operate under the originally given powers.

Medical Poa for Child - Offers a way for parents to ensure their child's continuity of care and lifestyle.