Fillable Power of Attorney Document for Illinois

In Illinois, the Power of Attorney form serves a crucial function, allowing individuals the peace of mind that their affairs will be managed according to their wishes in the event they are unable to do so themselves. This legal document covers a broad spectrum of authority, from financial decisions and property management to personal care and healthcare directives. Designed to be comprehensive, it ensures that the chosen representative, or agent, can act in the best interest of the person granting this authority, known as the principal. Understanding the major aspects of this form is essential for anyone considering setting up a Power of Attorney in Illinois. It encompasses details on how to correctly appoint an agent, the extent of powers granted, conditions under which the powers come into effect, and the process for revocation, ensuring that the principal's autonomy and preferences are respected and protected.

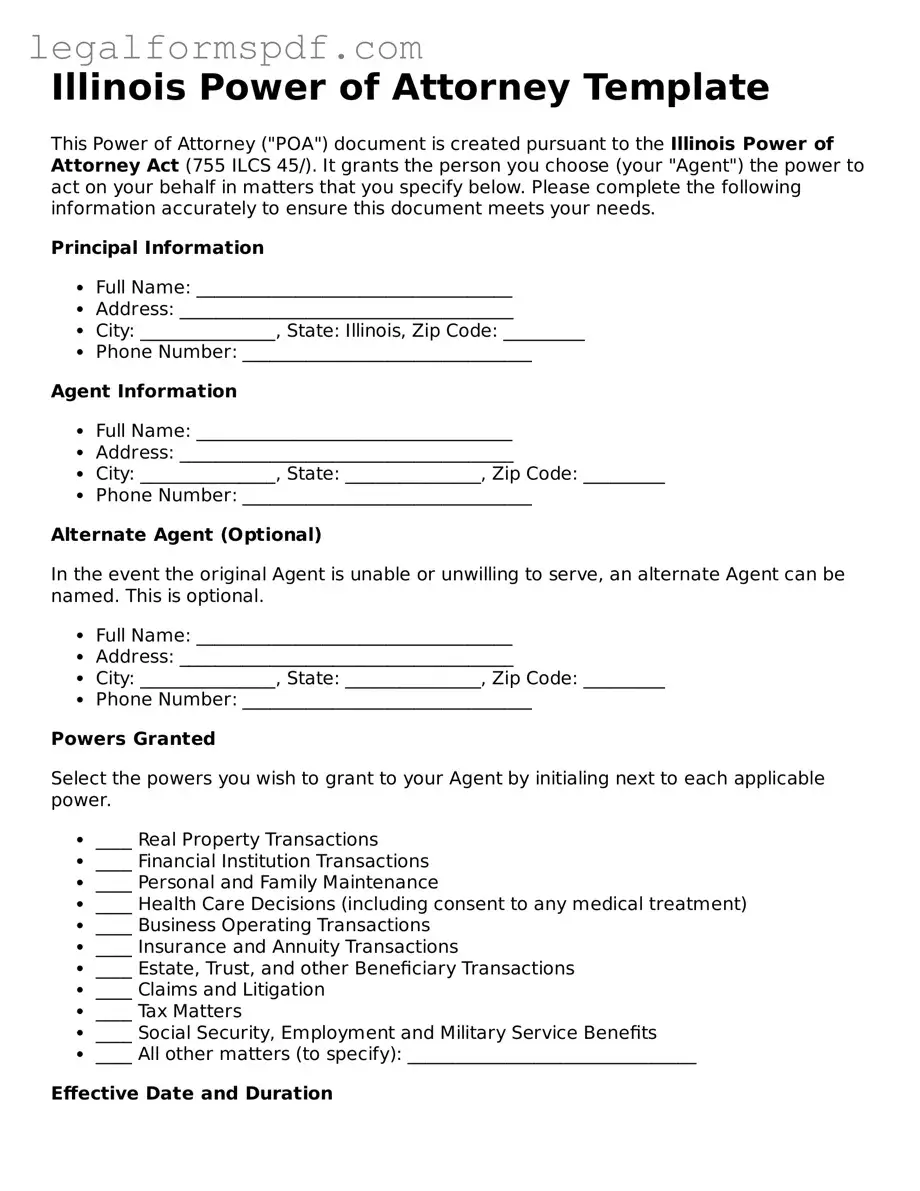

Document Example

Illinois Power of Attorney Template

This Power of Attorney ("POA") document is created pursuant to the Illinois Power of Attorney Act (755 ILCS 45/). It grants the person you choose (your "Agent") the power to act on your behalf in matters that you specify below. Please complete the following information accurately to ensure this document meets your needs.

Principal Information

- Full Name: ___________________________________

- Address: _____________________________________

- City: _______________, State: Illinois, Zip Code: _________

- Phone Number: ________________________________

Agent Information

- Full Name: ___________________________________

- Address: _____________________________________

- City: _______________, State: _______________, Zip Code: _________

- Phone Number: ________________________________

Alternate Agent (Optional)

In the event the original Agent is unable or unwilling to serve, an alternate Agent can be named. This is optional.

- Full Name: ___________________________________

- Address: _____________________________________

- City: _______________, State: _______________, Zip Code: _________

- Phone Number: ________________________________

Powers Granted

Select the powers you wish to grant to your Agent by initialing next to each applicable power.

- ____ Real Property Transactions

- ____ Financial Institution Transactions

- ____ Personal and Family Maintenance

- ____ Health Care Decisions (including consent to any medical treatment)

- ____ Business Operating Transactions

- ____ Insurance and Annuity Transactions

- ____ Estate, Trust, and other Beneficiary Transactions

- ____ Claims and Litigation

- ____ Tax Matters

- ____ Social Security, Employment and Military Service Benefits

- ____ All other matters (to specify): ________________________________

Effective Date and Duration

This Power of Attorney shall become effective on the date of _______________ and, unless revoked earlier, will continue until _______________.

Signature of Principal

By signing below, I confirm that I understand and agree to the terms of this Power of Attorney.

_______________________________________

Signature of Principal

Date: _______________

Signature of Agent

By signing below, I accept my appointment as Agent under this Power of Attorney.

_______________________________________

Signature of Agent

Date: _______________

Witness Declaration

This Power of Attorney was signed in the presence of the undersigned witnesses, who affirm that the Principal appeared to understand the purpose of the document and was free from duress or undue influence at the time of signing.

- Witness #1 Signature: _____________________________________

- Name: ___________________________________________________

- Date: _______________

- Witness #2 Signature: _____________________________________

- Name: ___________________________________________________

- Date: _______________

Notarization (if required)

This section should be completed by a Notary Public if notarization is required or desired for added legal formality.

State of Illinois )

County of ___________ )

On ______________________ (date), before me, ________________________ (Notary’s name), personally appeared ________________________ (Name of Principal), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_______________________________________

Notary Public

My Commission Expires: _______________

PDF Specifications

| # | Fact | Detail |

|---|---|---|

| 1 | Type of Forms | Illinois offers specific power of attorney forms for health care and property. |

| 2 | Governing Laws | The Illinois Power of Attorney Act (755 ILCS 45/) governs both health care and property POA forms. |

| 3 | Requirement for Validity | These forms must be signed by the principal in the presence of a witness and notarized to be valid. |

| 4 | Age of Principal | The person creating a POA in Illinois must be at least 18 years old. |

| 5 | Mental Capacity | The principal must have the mental capacity to make their own decisions at the time of signing. |

| 6 | Duration | Unless stated otherwise, a power of attorney continues until the principal's death. |

| 7 | Durable Powers of Attorney | In Illinois, a power of attorney can be made durable, meaning it remains in effect if the principal becomes incapacitated. |

| 8 | Revocation | The principal can revoke their power of attorney at any time, as long as they are mentally competent. |

| 9 | Springing Powers | Illinois allows for "springing" powers, where the POA becomes effective upon a certain event or condition, such as the principal's incapacity. |

Instructions on Writing Illinois Power of Attorney

Filling out the Illinois Power of Attorney form is a critical step for those planning to legally authorize someone else to make decisions on their behalf. This form allows the individual to appoint another person, known as an agent, to manage affairs when they're unable to do so themselves due to illness, absence, or any other reason. The process is straightforward but requires careful attention to detail to ensure that the document accurately reflects the individual's wishes and is legally valid. Follow the steps below to complete the form correctly.

- Begin by gathering all necessary information, including the full legal names, addresses, and contact details of the principal (the person granting power) and the agent (the person receiving power).

- Read the entire form to ensure understanding of the powers being granted and any limitations that may apply. This includes reviewing any specific terms and instructions detailed within the form.

- In the designated section, print the principal's full name and address.

- Enter the agent's complete name and contact information in the corresponding area. If appointing more than one agent, be sure to specify whether they must act together or if they can act separately.

- Specify the powers granted to the agent. This involves checking boxes next to the relevant authorities, such as managing financial accounts, making healthcare decisions, or signing legal documents. If granting broad powers, ensure this is clearly indicated on the form.

- If there are any powers the principal wishes to withhold, they should clearly state these exceptions in the designated section of the form.

- Indicate the duration of the power of attorney. If it is to remain effective despite the principal's incapacitation, this must be explicitly stated.

- Review the document carefully to ensure that all entered information is accurate and complete. Make any needed corrections before proceeding to the next step.

- The principal must sign and date the form in the presence of a witness or notary public, as required by Illinois law. The specific witnessing requirements can vary, so it's important to verify what is needed for the document to be legally binding.

- Finally, the agent (and any co-agents, if applicable) should also sign the document, acknowledging their acceptance of the responsibilities being entrusted to them.

Following these steps helps ensure that the Power of Attorney form is filled out properly, reflecting the principal's intentions and complying with Illinois state law. Once completed, the document should be kept in a secure location, with copies provided to the agent and any relevant institutions or individuals. It's advisable for the principal to also inform family members or other trusted individuals of the arrangement.

Understanding Illinois Power of Attorney

What is an Illinois Power of Attorney form?

A Power of Attorney form in Illinois is a legal document that allows you to appoint someone else, known as the "agent," to make decisions on your behalf. These decisions can relate to financial, health, or legal matters. The purpose is to ensure that your affairs can be handled according to your wishes, even if you're unable to manage them yourself due to illness or absence.

Do I need a lawyer to create a Power of Attorney in Illinois?

No, you don't necessarily need a lawyer to create a Power of Attorney in Illinois. However, consulting with a legal professional can be beneficial to ensure that the document meets all legal requirements and accurately reflects your wishes. It's especially recommended if your situation involves complex assets or decisions.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a crucial decision. The person should be trustworthy, reliable, and capable of handling the responsibilities you're entrusting to them. Consider choosing someone who understands your values and is comfortable making decisions that align with your wishes. It's also wise to discuss your expectations with the potential agent before officially appointing them to ensure they're willing and able to take on the role.

Can I have more than one agent on my Illinois Power of Attorney?

Yes, you can appoint more than one agent on your Illinois Power of Attorney. When appointing multiple agents, you can decide whether they must make decisions together (jointly) or if they can act independently of each other. Specifying how you want the agents to work together is important to prevent any confusion or conflict in the future.

How can I revoke a Power of Attorney in Illinois?

Revoking a Power of Attorney in Illinois can be done at any time, as long as you are mentally competent. To revoke it, you should provide written notice to your agent and any institutions or individuals that were informed of the power of attorney. It's also a good practice to destroy any physical copies of the document to avoid confusion.

Does a Power of Attorney in Illinois expire?

A Power of Attorney in Illinois can be set up to expire on a specific date or upon the occurrence of a specific event, such as the principal's death or incapacitation. If no expiration date or event is specified, the power of attorney typically remains in effect until it is revoked or the principal passes away.

What happens if my agent abuses their power?

If your agent abuses their power, Illinois law allows you to take legal action against them. This can include suing the agent for any damages caused by their abuse of power. It's critical to choose someone you trust as your agent and to clearly outline the agent's powers and limitations within the Power of Attorney document to prevent abuse.

Common mistakes

Many individuals find themselves navigating the complex process of filling out an Illinois Power of Attorney (POA) form. This document, crucial for delegating legal authority to another person, is often filled out incorrectly due to misunderstandings or lack of information. One common mistake is not being specific enough about the powers being granted. It's vital to clearly define the scope of authority given to avoid any confusion or legal issues down the line.

Another frequent error is neglecting to choose an alternate agent. Life can be unpredictable, and if the primary agent is unable to perform their duties, having a successor already named keeps things moving smoothly without delay. Additionally, many fail to discuss the responsibilities with their chosen agent(s) beforehand. It's essential the person understands what's expected of them and agrees to the role before being officially designated.

A significant oversight is not having the document witnessed or notarized, as required by Illinois law. This step is crucial for the POA to be legally binding. Incorrectly assuming a notary can act as a witness leads to issues as well, since the role of a notary is distinct from that of a witness. People often forget to specify a start and end date for the power of attorney, which can lead to confusion or misuse of the document.

Failing to provide clear guidance on the agent's compensation is another common mistake. This can result in disputes or reluctance on the agent's part due to misunderstandings about reimbursement for their efforts. Many also overlook the need to update the POA document after significant life changes, such as marriage, divorce, or the death of the named agent, which can invalidate the document or render it ineffective.

Some individuals mistakenly believe that a power of attorney covers healthcare decisions; this is a separate document known as a healthcare power of attorney in Illinois. Mixing up these forms can leave critical healthcare decisions unaddressed. Lastly, a number of people attempt to fill out the POA without any consultation from a legal professional. This can lead to errors in judgment and misunderstandings about the document's legal implications, underlining the importance of seeking expert advice for such significant legal actions.

Documents used along the form

When managing Power of Attorney forms in Illinois, several additional documents often come into play. These forms and documents are essential for a comprehensive approach to affairs ranging from healthcare decisions to financial management. Each document serves a specific purpose and complements the Power of Attorney, ensuring clarity, legality, and adherence to the principal's wishes.

- Living Will: This document outlines the principal's healthcare preferences in case they become unable to make decisions due to illness or incapacity. It specifies which life-sustaining treatments should or should not be administered.

- Healthcare Proxy: Similar to a healthcare Power of Attorney, this document appoints someone to make healthcare decisions on behalf of the principal if they are unable to do so themselves.

- Advance Directive: An advance directive combines a living will and a healthcare proxy. It records the principal's healthcare preferences and appoints a healthcare agent.

- Do Not Resuscitate (DNR) Order: This medical order instructs healthcare providers not to perform CPR if the principal's breathing stops or if the heart stops beating. It is signed by a physician after discussion with the patient or the healthcare proxy.

- Last Will and Testament: This legal document outlines how the principal's assets and estate will be distributed upon their death. It also names an executor to manage the estate distribution.

- Revocation of Power of Attorney: This form is used when the principal decides to terminate the powers granted to their agent. It must be signed and sometimes notarized, depending on state laws.

- Financial Records Release: This authorization allows the designated agent to access the principal's financial records. It is often necessary for managing the principal's financial affairs effectively.

Understanding and preparing these documents in conjunction with the Illinois Power of Attorney form can ensure well-rounded coverage of one's legal and personal affairs. Proper completion and filing of these forms are critical for their effectiveness and to safeguard against future uncertainties.

Similar forms

The Illinois Power of Attorney form shares similarities with the Living Will, another pivotal document in estate planning. Both serve as advance directives, guiding decisions when an individual is unable to communicate their wishes personally. The Living Will specifically addresses end-of-life care, detailing the treatments a person does or does not want to receive under certain medical conditions. This predefined course allows healthcare professionals to adhere to a person’s wishes without direct input, mirroring the Power of Attorney’s role in enabling agents to act on behalf of the grantor in various capacities.

Similarly, a Healthcare Proxy is akin to a Power of Attorney, as both designate another individual to make decisions on one’s behalf. The Healthcare Proxy is specifically tailored to medical decisions, appointing a representative to make healthcare choices if the principal is incapacitated or otherwise unable to make these decisions independently. This document parallels the Health Care Power of Attorney, a subtype of the broader Power of Attorney form in Illinois, highlighting a focused commitment to honor the principal's health-related preferences through the chosen agent’s actions.

The Durable Power of Attorney also aligns closely with the general concept of the Illinois Power of Attorney. Durable refers to the Power of Attorney's ability to remain in effect after the principal becomes incapacitated. This enduring nature ensures that the designated agent can continue to manage the principal’s affairs, financial or otherwise, without interruption, despite any changes in the principal's mental or physical health. This characteristic is crucial for executing long-term plans and managing continuous care or estate affairs, providing peace of mind for both the principal and their loved ones.

Furthermore, a Financial Power of Attorney document shares the principal’s intent with the Illinois Power of Attorney form to entrust an agent with specific responsibilities. In this case, the focus is on financial matters, allowing the agent to handle transactions, manage accounts, and make financial decisions on behalf of the principal. This form ensures the principal’s financial obligations and goals are met, even if they are unable to manage these tasks themselves. The specificity and authority granted in a Financial Power of Attorney mirror the purposeful delegation of powers found in the Illinois Power of Attorney, although with a narrower scope focused on financial matters.

Dos and Don'ts

When filling out an Illinois Power of Attorney form, it is crucial to adhere to certain guidelines to ensure the document is valid and reflects your intentions accurately. Below are five dos and don'ts to consider during this process.

Things You Should Do:

- Read through the entire form before you start filling it out. This ensures you understand the nature of the document and the responsibilities it entails.

- Provide complete and accurate information about the principal (the person granting the power) and the agent (the person receiving the power). This includes full legal names, addresses, and contact information.

- Clearly specify the powers you are granting. Whether these powers are broad or limited to specific affairs, they should be described in as much detail as possible to avoid ambiguity.

- Have the document notarized. While not all power of attorney forms require notarization in Illinois, getting your document notarized can add a layer of authenticity and may help in situations where its validity is questioned.

- Keep the original document in a safe but accessible place and provide copies to the agent and any relevant institutions, such as banks or healthcare providers, to ensure they recognize the agent's authority.

Things You Shouldn't Do:

- Don’t choose an agent without thought. Select someone you trust completely, as they will have significant control over your affairs, potentially including financial, legal, and health-related decisions.

- Don’t leave any sections blank. If a section does not apply to your situation, mark it as “N/A” (not applicable) instead of leaving it empty to prevent unauthorized additions later.

- Don’t use vague language when describing the powers granted. Ambiguities can lead to disputes or misinterpretations regarding the agent’s authority.

- Avoid not informing your chosen agent about their appointment. The agent should fully understand their responsibilities and agree to them before the document comes into effect.

- Don’t forget to revoke the power of attorney when it is no longer needed or if you wish to appoint a different agent. This should be done in writing and communicated to any institutions or parties who were aware of the original document.

Misconceptions

The Illinois Power of Attorney form is a legal document that allows someone to make decisions on your behalf, but there are common misconceptions about how it works. Understanding the truth behind these myths is essential for anyone considering creating a Power of Attorney (POA) in Illinois.

Myth 1: Once signed, a Power of Attorney cannot be revoked. In reality, as long as the person who created the Power of Attorney (the principal) is mentally competent, they can revoke or change their POA at any time.

Myth 2: A Power of Attorney grants the agent the right to do whatever they want. The truth is, the document specifies the powers granted to the agent. The agent has a legal duty to act in the principal’s best interests and within the scope of authority granted by the POA.

Myth 3: A Power of Attorney is effective even after the principal's death. A common misunderstanding is that the POA remains in effect after the principal's death. In fact, the POA becomes null and void once the principal passes away.

Myth 4: Creating a Power of Attorney means losing control over your finances and decisions. The principal is not relinquishing control by appointing an agent. They are simply assigning someone to act on their behalf under certain conditions, and they can specify what decisions the agent can make.

Myth 5: A Power of Attorney document is the same in every state. Actually, the laws governing POA documents vary from state to state. A POA drafted in Illinois is tailored to Illinois law and might not be fully recognized in other states without additional measures.

Myth 6: You can only assign a Power of Attorney to a family member. While many choose a family member, the principal can select anyone they trust to act as their agent, including friends or professional advisors.

Myth 7: A Power of Attorney for healthcare and finances can be combined into one document. Illinois requires separate documents for healthcare and financial decisions to ensure clarity and prevent any conflict of interest.

Myth 8: A Power of Attorney is only for the elderly. While it’s commonly used as part of estate planning, anyone at any age can become incapacitated by accident or illness. Having a POA in place is a prudent decision regardless of age.

Myth 9: You don’t need a lawyer to create a valid Power of Attorney. While it’s possible to create a POA without legal assistance, consulting with an attorney can ensure that the document meets all legal requirements and truly reflects your wishes, avoiding potential problems in the future.

Key takeaways

When it comes to managing your affairs or making crucial decisions in times when you might not be able to do so yourself, the Illinois Power of Attorney (POA) form is an essential tool. This document allows you to appoint someone you trust, known as an "agent," to act on your behalf. The following key takeaways provide valuable insights into filling out and using the Illinois POA form effectively:

- Understanding the Different Types: Illinois offers various POA forms for different needs, like healthcare or financial decisions. It's crucial to choose the one that fits your current requirements.

- Choosing Your Agent Wisely: Your agent will have considerable control over important aspects of your life, so it’s vital to select someone who is not only trustworthy but also capable of handling the responsibilities that come with the role.

- Be Specific About Powers Granted: The form allows you to specify exactly what powers your agent will have. You can limit their authority to certain areas, or grant them broad powers, depending on your needs.

- Understanding the Durability of the Power: A durable POA means that the document remains in effect even if you become incapacitated. If this is important to you, make sure the form you fill out has this feature.

- Signing Requirements Must Be Met: For a POA to be legally valid in Illinois, it must meet specific signing requirements such as being witnessed by one or two adults (depending on the type of POA) who are not named as agents in the document.

- Revocation Process: If you decide to revoke the POA, it’s important to understand and follow the correct process to ensure that the document is legally terminated. This usually involves signing a revocation form and notifying any relevant parties, like your agent or financial institutions.

Completing and utilizing the Illinois Power of Attorney form is a significant step in managing your affairs and ensuring that your decisions are honored. By carefully selecting your agent and clearly defining their powers and limitations, you can secure peace of mind for yourself and your loved ones.

More Power of Attorney State Forms

How to Get Power of Attorney for Elderly Parent in Georgia - It can specify either broad or limited powers, depending on the principal's needs.

Free Power of Attorney Form Texas - Gives peace of mind to you and your family, knowing that a plan is in place for unforeseen circumstances.