Fillable Power of Attorney Document for Florida

In Florida, the Power of Attorney (POA) form serves as a critical legal document, allowing individuals to designate a trusted person to manage their financial, legal, and health affairs should they become unable to do so themselves. This essential tool offers peace of mind, ensuring that personal matters are handled according to one's wishes, even in their absence or incapacity. Covering a wide range of decisions, from managing investments to making healthcare decisions, the Florida POA is versatile, catering to the specific needs and preferences of the principal—the person making the designation. It is crucial for Floridians to understand the importance of this document, the legal requirements for its validity, including the necessity for it to be witnessed and, in some cases, notarized, and the different forms it can take, such as durable, medical, or limited POA, each serving distinct purposes. Initiating discussions about the power of attorney is a step towards ensuring one's affairs are in order, highlighting the document's significance in comprehensive estate planning and personal care planning.

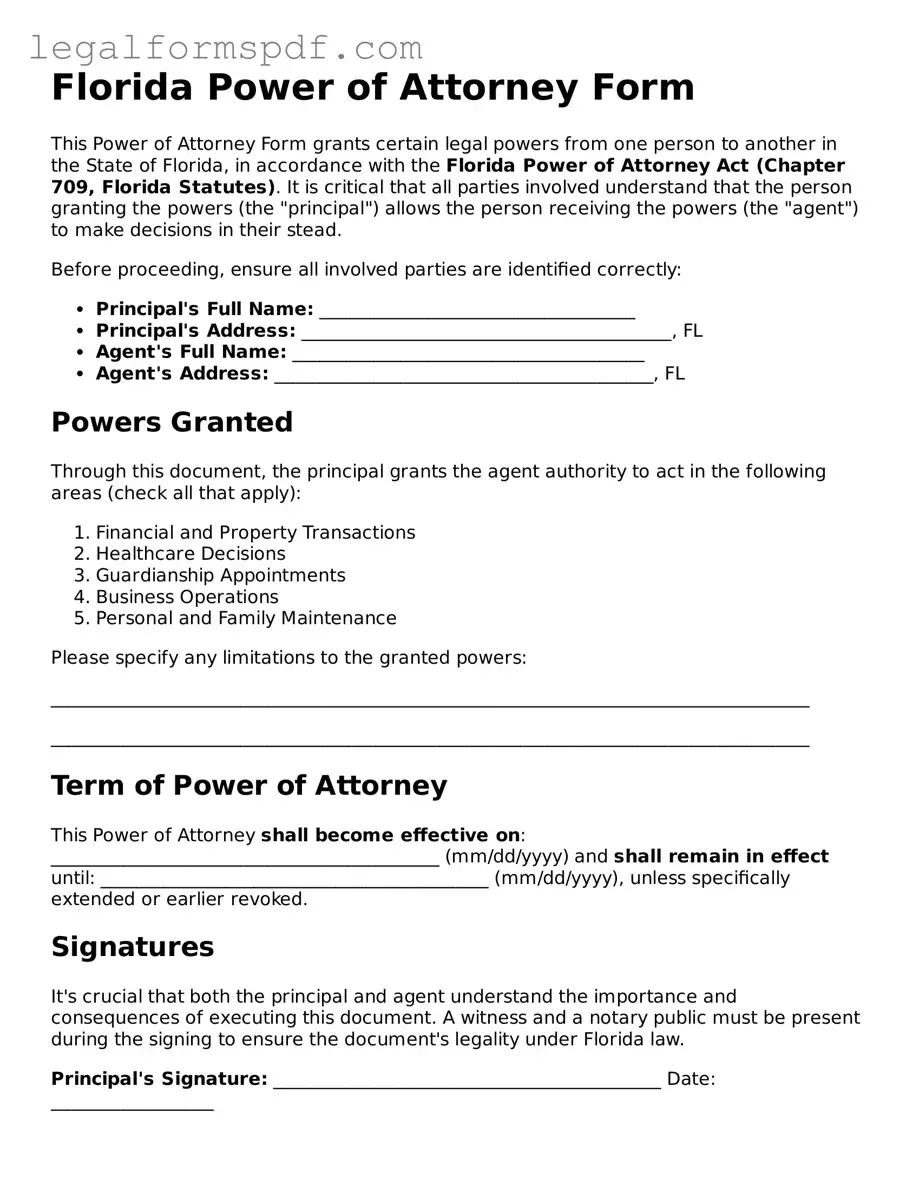

Document Example

Florida Power of Attorney Form

This Power of Attorney Form grants certain legal powers from one person to another in the State of Florida, in accordance with the Florida Power of Attorney Act (Chapter 709, Florida Statutes). It is critical that all parties involved understand that the person granting the powers (the "principal") allows the person receiving the powers (the "agent") to make decisions in their stead.

Before proceeding, ensure all involved parties are identified correctly:

- Principal's Full Name: ___________________________________

- Principal's Address: _________________________________________, FL

- Agent's Full Name: _______________________________________

- Agent's Address: __________________________________________, FL

Powers Granted

Through this document, the principal grants the agent authority to act in the following areas (check all that apply):

- Financial and Property Transactions

- Healthcare Decisions

- Guardianship Appointments

- Business Operations

- Personal and Family Maintenance

Please specify any limitations to the granted powers:

____________________________________________________________________________________

____________________________________________________________________________________

Term of Power of Attorney

This Power of Attorney shall become effective on: ___________________________________________ (mm/dd/yyyy) and shall remain in effect until: ___________________________________________ (mm/dd/yyyy), unless specifically extended or earlier revoked.

Signatures

It's crucial that both the principal and agent understand the importance and consequences of executing this document. A witness and a notary public must be present during the signing to ensure the document's legality under Florida law.

Principal's Signature: ___________________________________________ Date: __________________

Agent's Signature: ______________________________________________ Date: __________________

Witness #1's Signature: _________________________________________ Date: __________________

Witness #2's Signature: _________________________________________ Date: __________________

State of Florida, County of _______________

This document was notarized in the presence of all parties and witnesses by:

Notary Public's Name: ____________________________________________

Notary Public's Signature: ____________________________________________ Date: __________________

My commission expires: ________________________.

Notice to the Principal

You have the right to revoke this Power of Attorney at any time in writing and by notifying the agent of your decision. Consult with a legal professional if you have questions.

Notice to the Agent

As an agent, you're expected to act in the principal’s best interest, to maintain accurate records, and to keep the principal’s property separate from yours. Failure to adhere to these responsibilities can lead to legal consequences.

Validity and Governing Law

This document is intended to be valid only in the State of Florida and may be subject to the state's jurisdiction for any disputes that arise as a result of its execution or the powers herein granted.

PDF Specifications

| Fact | Description |

|---|---|

| Governing Law | The Florida Power of Attorney (POA) form is governed by the Florida Statutes, Chapter 709 - Powers of Attorney and Similar Instruments. |

| Capacity Requirements | The principal, the person making the POA, must be of sound mind, which means they understand what they are signing and the implications of the document. |

| Witness Requirement | Under Florida law, the signing of a Power of Attorney must be witnessed by two individuals and duly notarized to be considered valid. |

| Durability | A Florida POA can be made durable, meaning it remains in effect if the principal becomes incapacitated, but this must be explicitly stated in the document. |

Instructions on Writing Florida Power of Attorney

A Power of Attorney (POA) in Florida grants an individual the legal authority to make decisions on another person’s behalf. This responsibility can encompass a broad range of actions, from managing financial transactions to making healthcare decisions. Considering the significant authority that comes with this document, it's essential to fill it out with the utmost care and precision. The process may appear daunting at first, but by following a series of clear steps, one can ensure that the form accurately reflects their intentions and adheres to Florida's legal requirements.

- Firstly, obtain the most recent version of the Florida Power of Attorney form. This can be found online through official state websites or legal assistance platforms.

- Read through the entire form before starting to fill it out. This will give you a complete understanding of the information required and how to provide it accurately.

- Enter the full legal name and address of the person granting the power (referred to as the Principal) in the designated sections of the form.

- In the space provided, input the full legal name and address of the person who will be granted the power (referred to as the Agent).

- Specify the powers being granted to the Agent. This section is crucial and requires the Principal to be precise about what decisions the Agent is authorized to make on their behalf. If the document should only apply in specific circumstances, such as in the event of the Principal’s incapacitation, this should be clearly stated.

- If the POA should become effective immediately, indicate this clearly on the form. If it is intended to come into effect under certain circumstances, such as the Principal's incapacitation, detail these conditions explicitly.

- Many Florida POA forms require the Principal to initial next to specific powers they are granting to the Agent, as a means of acknowledging these powers explicitly. Make sure all the necessary sections are initialed.

- Ensure that any special instructions or limitations to the Agent’s powers are detailed in the provided section. This may include restrictions on selling certain assets, making gifts, or any other limitations the Principal wishes to impose.

- After reviewing all the information and ensuring its accuracy, the Principal must sign and date the form in the presence of two witnesses and a Notary Public. Both witnesses must also sign and print their names, acknowledging that they have witnessed the Principal’s signature.

- Finally, have the document notarized. This typically involves the Notary Public verifying the identities of the Principal and the witnesses, witnessing the signing of the document, and then sealing the document with their official seal.

Once completed, this document empowers the chosen Agent to act on the Principal’s behalf according to the specified conditions and limitations. It is advisable for both the Principal and the Agent to keep copies of the notarized document for their records. Should the need arise to amend or revoke the POA, the Principal must follow Florida's legal procedures to ensure the changes are legally binding.

Understanding Florida Power of Attorney

What exactly is a Florida Power of Attorney (POA)?

A Florida Power of Attorney is a legal form that allows you to give someone else the authority to make decisions on your behalf. This could relate to financial matters, health care, or any other personal decision. It is especially useful if you're unable to make these decisions yourself due to illness or absence.

Who can I appoint as my Power of Attorney in Florida?

You can appoint almost anyone as your POA in Florida, including a trusted family member, friend, or even a professional like an attorney. The person you choose should be someone you trust to act in your best interest. Remember, Florida law requires that your POA must be at least 18 years old and of sound mind.

How do I make a Florida Power of Attorney legally binding?

To make your Florida Power of Attorney legally binding, you need to complete the form accurately, sign it, and have it notarized. In some cases, it may also require witnesses to sign. It is vital to review Florida's specific requirements to ensure your document is valid.

Can I revoke my Florida Power of Attorney?

Yes, at any time, you have the right to revoke or change your Power of Attorney as long as you are of sound mind. This can be done by informing your appointed agent in writing and destroying all previous copies of the POA document. It's also wise to inform any institutions or individuals that might have acted on the old POA of the revocation.

What happens if my Power of Attorney is abused?

If you believe your Power of Attorney is being abused, it's important to act quickly. You can revoke the existing POA and appoint a new agent. It’s also advisable to consult with a legal professional who can offer guidance based on Florida laws and help you take any necessary legal action to protect your interests.

Common mistakes

The process of filling out the Florida Power of Attorney (POA) form is a crucial step in ensuring that an individual's financial, health, and legal affairs can be managed by someone else should the need arise. However, it's common for people to make mistakes during this process, which can lead to unnecessary complications. Here are nine common errors to avoid.

One common mistake is not choosing the right type of POA. Florida law recognizes several types of POAs, each with its own scope and duration. For example, a Durable Power of Attorney remains effective even after the principal becomes incapacitated. Choosing the incorrect type can result in the document not functioning as intended when it's most needed.

Another error involves not being specific enough about the powers granted. A POA can grant broad authority or be limited to specific actions or decisions. Failing to clearly define these powers can lead to confusion and potential legal challenges regarding the agent's authority.

Failing to designate an alternate or successor agent is also a mistake. If the primary agent is unable or unwilling to serve, the POA could become ineffective unless an alternate is named. It's wise to have a backup to ensure continuity in managing your affairs.

Overlooking the requirement for witnesses and notarization is another common oversight. In Florida, POA documents must be signed by the principal, witnessed by two individuals, and notarized to be legally valid. Neglecting these formalities can render the document invalid.

Assuming all states’ laws are the same is a mistake. People often forget that POA laws can vary significantly from one state to another. A POA executed in Florida might not be recognized or could operate differently in another state, so it's important to understand these nuances.

Not discussing the POA with the chosen agent before finalizing it can lead to problems. Ensuring that the agent understands their responsibilities and is willing to accept them is crucial for the smooth execution of the document.

Another common error is not updating the POA. Life changes such as divorce, death, or estrangement can render the chosen agent unsuitable or unavailable. Regularly reviewing and updating the POA ensures that it still reflects your wishes.

Forgetting to revoke an old POA when creating a new one can lead to confusion and conflict. Without a clear revocation, there might be more than one POA in effect, which could create a legal mess.

Last but not least, attempting to DIY without seeking legal advice is a significant risk. While many templates and resources are available, consulting with a legal professional ensures that the POA complies with current Florida laws and truly reflects the individual's needs and intentions.

Avoiding these mistakes can help ensure that your Florida Power of Attorney form is valid, effective, and accurately reflects your wishes, providing peace of mind to both you and your appointed agent.

Documents used along the form

Preparing for one's future involves thorough planning and often requires the creation of several critical documents, especially when ensuring that personal and financial matters are handled according to one's wishes. In addition to the Florida Power of Attorney (POA) form that allows you to designate someone to make decisions on your behalf, there are other forms and documents often used alongside it to provide a comprehensive legal framework for your plans. These documents complement the POA, each serving distinct roles in safeguarding an individual’s interests.

- Advanced Healthcare Directive (Living Will): This document specifies a person's healthcare preferences in case they become unable to make decisions for themselves. It guides healthcare providers on the types of life-support measures an individual wishes to receive or avoid, ensuring that the person's medical care preferences are respected.

- Designation of Healthcare Surrogate: Similar to a POA but specifically for healthcare, this form enables an individual to appoint someone to make healthcare decisions on their behalf if they are incapacitated. This role includes decisions about medical treatments, healthcare providers, and, at times, end-of-life care.

- Last Will and Testament: This legal document spells out how a person’s property and assets should be distributed after their death. While a Power of Attorney is only effective during the individual's lifetime, a will takes effect after death, making it an essential document for long-term planning.

- Declaration of Preneed Guardian: By completing this form, a person can select a preferred guardian in advance should they become incapacitated. This pre-emptive measure helps avoid potential disputes or court interventions by clearly stating the individual's choice for their guardian.

Together, these documents form a robust legal safety net, ensuring that both healthcare and financial decisions are handled according to the individual’s desires. It’s important to consult with a legal professional when preparing these documents to ensure they are correctly executed and reflective of your wishes, as laws and requirements can vary significantly by state. The interplay between a Florida Power of Attorney and these additional forms can make all the difference in achieving the peace of mind and security we all seek for ourselves and our loved ones.

Similar forms

The Florida Power of Attorney (POA) form shares similarities with the Advance Directive, as both allow individuals to appoint someone else to make decisions on their behalf. While a POA focuses on financial or legal decision-making, an Advance Directive often includes health care decisions, specifying what medical actions should be taken if the individual is unable to make decisions for themselves due to illness or incapacity. Both documents ensure that the principal’s wishes are respected, even when they can't express those wishes themselves.

Comparable to the POA is the Living Will, which outlines a person’s wishes regarding medical treatments and life-sustaining measures in the event they cannot communicate their desires due to severe illness or incapacitation. Unlike a POA, which delegates decision-making power to another individual, a Living Will specifically addresses healthcare procedures and interventions, conveying instructions directly to healthcare providers without necessarily appointing a surrogate to make those decisions.

Another document similar to the POA is the Durable Power of Attorney for Healthcare, also known as a Healthcare Proxy. This document allows an individual to designate another person to make healthcare decisions on their behalf if they become unable to do so. Like a general POA, a Durable Power of Attorney for Healthcare becomes effective under the conditions specified within it, often at the point of incapacitation of the principal, highlighting its importance for medical decision-making.

The Financial Power of Attorney bears resemblance to the Florida POA, focusing specifically on financial matters. This document grants the appointed agent authority to manage financial transactions and decisions, such as banking, investing, and property management, on behalf of the principal. Its specificity to financial affairs distinguishes it from a broader POA, which may cover a wider range of authorities.

Similar in nature to the Florida POA is the Limited Power of Attorney, which confers narrow authority or tasks to the agent. This could involve specific financial decisions, real estate transactions, or attending a particular legal proceeding. The principal’s control over the scope of authority distinguishes this from a general POA, where broader powers are typically granted.

The Revocable Living Trust operates in the vicinity of a POA by allowing an individual (the grantor) to manage their assets during their lifetime and specify how these assets should be distributed upon their death. While it does not grant decision-making authority to another person during the grantor’s lifetime in the manner of a POA, it serves a similar purpose of ensuring the person’s wishes are fulfilled without the need for probate.

The Will, or Last Will and Testament, also shares attributes with the POA, mainly in its function of specifying the principal’s wishes regarding asset distribution after death. Although it does not authorize another person to make decisions on behalf of the individual while they are alive, it ensures that personal wishes regarding their estate and assets are followed, akin to how a POA operates in delegating authority during the principal’s lifetime.

Finally, the Guardianship or Conservatorship arrangement is akin to the POA in that it involves appointing someone to make decisions on behalf of another, typically due to incapacity or disability. Unlike a POA, which is a private agreement, Guardianship or Conservatorship is established through a court process and involves judicial oversight. This legal mechanism ensures the well-being and financial management of the individual under guardianship or conservatorship, mirroring the intent behind a POA to safeguard the principal’s interests.

Dos and Don'ts

Filling out a Florida Power of Attorney (POA) form is a significant step in managing your financial, legal, or medical decisions. To ensure that the process is done correctly and your interests are adequately protected, here is a list of dos and don'ts to keep in mind:

Do:Use the correct form for your specific needs, whether it's for financial matters, healthcare decisions, or other purposes.

Fill out the form with complete and accurate information to avoid any misunderstandings or legal issues in the future.

Hire a notary public or attorney to witness the signing of the POA to ensure its legality and to meet Florida state requirements.

Choose a trustworthy person as your agent (attorney-in-fact) who will act in your best interest.

Be specific about the powers you are granting to your agent to prevent any abuse of authority.

Inform your agent about their appointment and discuss your expectations and the extent of their responsibilities.

Keep a record of all individuals or entities that receive a copy of the POA.

Regularly review and update the POA as needed to reflect any changes in your desires or circumstances.

Consult with a legal professional if you have questions or if your situation involves complex estate planning issues.

Ensure that the POA complies with Florida law, especially since laws regarding powers of attorney can vary significantly from one state to another.

Delay in executing a POA until it is too late and you're unable to express your wishes clearly.

Use generic forms without verifying that they comply with Florida statutes or meet your specific needs.

Forget to specify the duration for which the power of attorney will be effective, especially if you intend it to be temporary.

Overlook the importance of selecting an alternate agent in case your primary agent cannot serve for any reason.

Fail to revoke a previous POA when creating a new one, as this may lead to confusion about which one is valid.

Assume that your POA will be recognized by other states or countries without checking their laws and requirements.

Neglect to provide your agent with the necessary documents and information they will need to act on your behalf.

Appoint someone based solely on personal relationships without considering their ability or willingness to handle the responsibilities effectively.

Ignore the need for a durable POA if you want it to remain effective even if you become incapacitated.

Underestimate the peace of mind that comes from knowing your affairs will be handled according to your wishes.

Misconceptions

In understanding the Florida Power of Attorney form, several misconceptions often arise. Clarifying these misunderstandings is crucial to ensure the proper use and effectiveness of such legal documents. Below are seven common misconceptions and the realities that counter them:

A Power of Attorney grants unlimited power. Contrary to what some believe, the scope of authority granted through a Power of Attorney in Florida can be limited and specifically tailored. It can be structured to address narrowly defined tasks or broad financial powers, depending on the granter's wishes.

Power of Attorney remains valid after the death of the granter. In reality, the authority granted by a Power of Attorney automatically ceases upon the death of the granter. At that point, the executor or personal representative named in the will assumes responsibility for the decedent’s estate.

A Power of Attorney can make decisions after the granter is incapacitated. This statement is partially true but misleading. Only a Durable Power of Attorney, specifically designed to remain in effect upon the incapacitation of the granter, can enable this. Regular Power of Attorney documents do not have this capacity.

Only family members can be designated as agents. While family members are commonly appointed, any trusted individual, friend, or even an organization can be named as an agent in a Florida Power of Attorney. The key requirement is trust in the agent's willingness and ability to act in the granter's best interest.

Creating a Power of Attorney is a complex legal procedure. Though it is a legal document, creating a Power of Attorney in Florida does not necessarily require complex legal proceedings. It must, however, comply with Florida laws, including being signed in the presence of two witnesses and notarization, to be legally valid.

The agent under a Power of Attorney can override the wishes of the granter. Agents have a fiduciary duty to act in the best interest of the granter and according to their wishes, as expressed in the Power of Attorney document. They do not have free rein to act against the granter's instructions or best interests.

A Power of Attorney document from another state is invalid in Florida. While Florida law governs the validity and use of Power of Attorney documents within the state, a Power of Attorney executed in another state according to that state's laws can be valid in Florida. However, there may be practical difficulties in using an out-of-state Power of Attorney, and it's often advisable to create a new one that complies with Florida statutes.

Dispelling these misconceptions is essential for anyone considering the preparation and use of a Florida Power of Attorney form. It ensures individuals can make informed decisions about their financial and healthcare directives in advance, providing peace of mind and legal clarity.

Key takeaways

The Florida Power of Attorney (POA) form serves as a critical tool for authorizing a designated person, known as the agent, to make decisions on behalf of another person, referred to as the principal, under specified circumstances. Understanding its proper completion and use is vital for its effectiveness in ensuring the principal's wishes are honored. Below are key takeaways regarding the Florida Power of Attorney form.

- It is essential that the person designated as the agent is someone the principal trusts implicitly, as this individual will have considerable authority over significant aspects of the principal's life, which may include financial, legal, and medical decisions.

- The Florida POA must adhere to state laws for it to be considered valid. This entails following specific signing requirements, such as needing to be witnessed by two individuals and, in some cases, notarized.

- The scope of authority granted to the agent can be customized. The principal has the discretion to grant broad general powers or to limit the agent's powers to specific actions or timeframes, which must be clearly outlined in the document.

- There are different types of POA forms for various purposes, such as a Durable Power of Attorney, a Medical Power of Attorney, or a Limited Power of Attorney. Each serves distinct roles, and the principal must select the type that best suits their needs.

- The principal has the right to revoke the Power of Attorney at any time as long as they are mentally competent. The revocation must be done in writing and communicated to the agent and any third parties relying on the POA.

Correctly completing and using the Florida Power of Attorney form is a significant responsibility. The principal should consider consulting with a legal professional to ensure their intentions are effectively and legally expressed, safeguarding their welfare and interests.

More Power of Attorney State Forms

Free Power of Attorney Form Texas - Revocable at any time, it allows you to make changes as your life circumstances evolve, ensuring your current intentions are always represented.

How to Get Power of Attorney for Elderly Parent in Georgia - It becomes effective immediately upon signing, unless otherwise stated.