Fillable Durable Power of Attorney Document for Texas

Navigating the legal pathways of life's unexpected twists and turns requires preparation, understanding, and a proactive approach, especially when it comes to safeguarding one’s financial and personal affairs. At the heart of such preparation in Texas lies the Durable Power of Attorney (POA) form, a critical document that grants someone you trust the legal authority to manage your finances and property in the event you become unable to do so yourself. This form's power is not diminished by the principal's subsequent incapacity, distinguishing it from other types of power of attorney agreements. Understanding its components, the process of choosing an agent, and the legal implications therein is imperative for anyone looking to ensure their affairs are managed according to their wishes, even in the face of unforeseen health issues or incapacity. With its significance and potential complexities, the decision to create a Durable Power of Attorney should not be taken lightly, nor should it be delayed, as it plays a pivotal role in comprehensive estate planning and personal peace of mind.

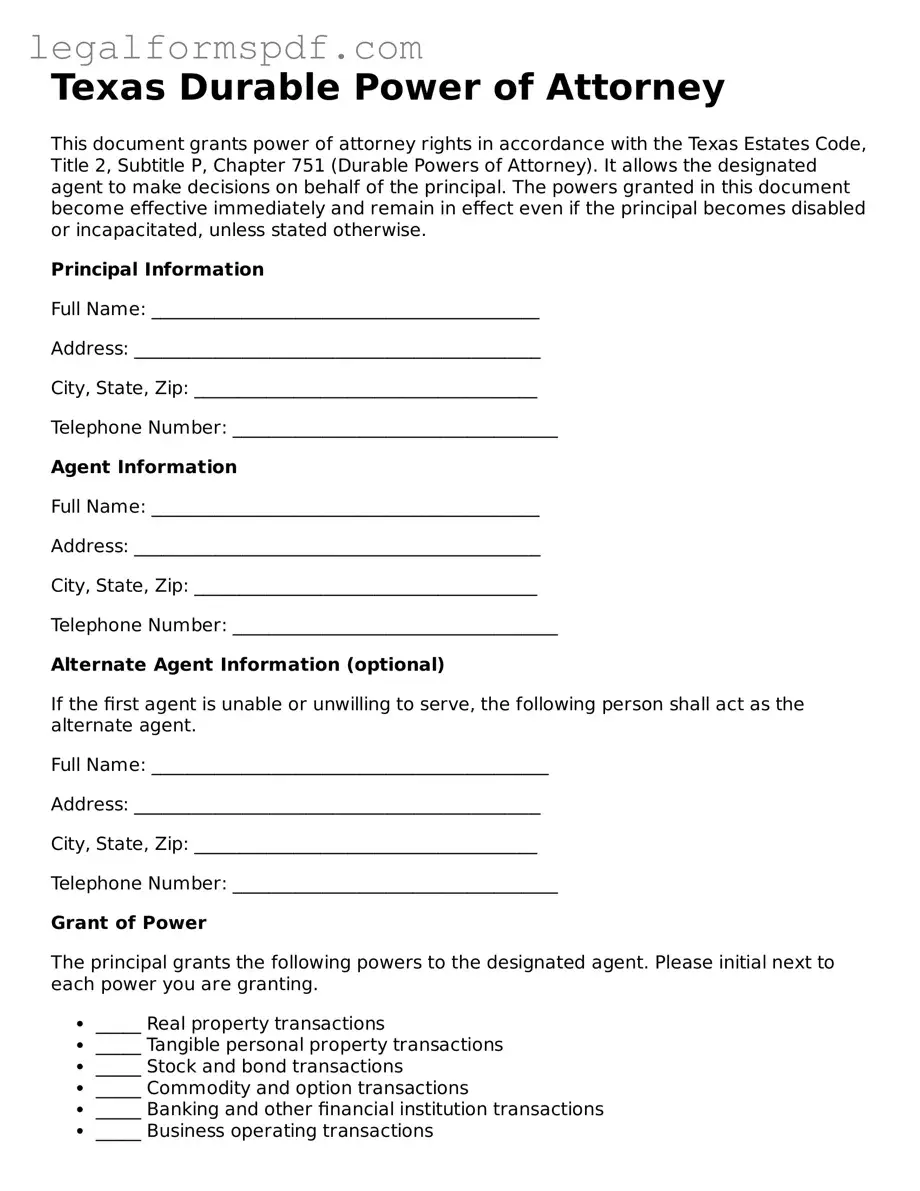

Document Example

Texas Durable Power of Attorney

This document grants power of attorney rights in accordance with the Texas Estates Code, Title 2, Subtitle P, Chapter 751 (Durable Powers of Attorney). It allows the designated agent to make decisions on behalf of the principal. The powers granted in this document become effective immediately and remain in effect even if the principal becomes disabled or incapacitated, unless stated otherwise.

Principal Information

Full Name: ___________________________________________

Address: _____________________________________________

City, State, Zip: ______________________________________

Telephone Number: ____________________________________

Agent Information

Full Name: ___________________________________________

Address: _____________________________________________

City, State, Zip: ______________________________________

Telephone Number: ____________________________________

Alternate Agent Information (optional)

If the first agent is unable or unwilling to serve, the following person shall act as the alternate agent.

Full Name: ____________________________________________

Address: _____________________________________________

City, State, Zip: ______________________________________

Telephone Number: ____________________________________

Grant of Power

The principal grants the following powers to the designated agent. Please initial next to each power you are granting.

- _____ Real property transactions

- _____ Tangible personal property transactions

- _____ Stock and bond transactions

- _____ Commodity and option transactions

- _____ Banking and other financial institution transactions

- _____ Business operating transactions

- _____ Insurance and annuity transactions

- _____ Estate, trust, and other beneficiary transactions

- _____ Claims and litigation

- _____ Personal and family maintenance

- _____ Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service

- _____ Retirement plan transactions

- _____ Tax matters

Special Instructions (optional)

Provide any specific limitations or instructions you wish to place on the agent’s authority:

______________________________________________________________________________

______________________________________________________________________________

Duration

This Power of Attorney shall remain in effect in the event that I become disabled, incapacitated, or incompetent, and shall continue until I die or revoke the power of attorney in writing.

Third Party Reliance

Any third party who receives a copy of this document may act under it. Revocation of this Durable Power of Attorney is not effective as to a third party until the third party learns of the revocation. I agree to indemnify the third party for any claims that arise against the third party because of reliance on this power of attorney.

Signature of Principal

Date: ___________________________

Signature: ________________________

State of Texas

County of _____________________

This document was acknowledged before me on (date) ______________ by (name of principal) ___________________________________.

Signature of Notary Public

Name of Notary: __________________________

Notary Public for the State of Texas

My commission expires: ___________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Texas Durable Power of Attorney form allows an individual to appoint someone else to make financial decisions on their behalf. |

| 2 | This form remains in effect even if the person who created it becomes incapacitated. |

| 3 | The Texas Estates Code governs the creation and use of durable powers of attorney within the state. |

| 4 | To be valid, the form must be signed by the principal (the person granting the power) in the presence of a notary or two competent adult witnesses. |

| 5 | The appointed agent does not need to reside in Texas but must act in the principal’s best interests at all times. |

| 6 | The form can be revoked by the principal at any time, as long as they are mentally competent. |

| 7 | Specific powers granted can include handling financial transactions, real estate matters, and tax matters, among others. |

Instructions on Writing Texas Durable Power of Attorney

The pursuit of executing a Texas Durable Power of Attorney (POA) involves a process that, at its heart, empowers an individual to appoint someone else to manage their personal affairs, particularly in situations where they might not be able to do so themselves. This document, crucial in ensuring that one's matters are in trustworthy hands, requires meticulous attention to detail during completion. By following a step-by-step process, the person can ensure that their intentions are clearly articulated, thus safeguarding their autonomy and interests.

- Begin by familiarizing yourself with the form's layout and requirements to avoid any confusion or errors as you proceed. Understanding the sections in advance can save time and help in gathering the necessary information.

- Enter the principal's full legal name and address in the designated spaces. The principal is the person granting the powers.

- Identify and fill in the agent's full name and address. This is the individual whom the principal chooses to act on their behalf. Make sure the details are accurate to prevent any potential legal ambiguities.

- Specify the powers granted to the agent. This section requires careful consideration, as it outlines the scope of authority the principal is transferring. It is crucial to be as clear and detailed as possible to avoid misinterpretations.

- If the form allows, stipulate any limitations on the powers granted. This helps in setting clear boundaries on what the agent can and cannot do.

- Choose the duration for which the POA will remain effective. Some options might include a specific end date, upon the principal's death, or until revoked. Understanding the implications of each choice is crucial.

- Have the principal sign and date the form in the presence of a notary public. The notarization process is essential for authenticating the document, lending it the credibility and legal standing it requires.

- Lastly, ensure that both the principal and agent retain copies of the signed document. It is advisable for the principal to also inform any relevant financial institutions or other parties of the arrangement.

Executing a Durable Power of Attorney in Texas marks a significant step towards safeguarding one's interests and ensuring that personal affairs are managed according to their wishes. While the procedure necessitates a detailed approach, the outcome is a powerful legal instrument that secures peace of mind and future readiness.

Understanding Texas Durable Power of Attorney

What is a Texas Durable Power of Attorney?

A Texas Durable Power of Attorney is a legal document that allows an individual, known as the 'principal', to designate another person, known as the 'agent', to manage their financial affairs. Unlike other types of power of attorney, it remains in effect even if the principal becomes incapacitated, ensuring decisions can still be made on their behalf.

How does one create a Texas Durable Power of Attorney?

To create a Texas Durable Power of Attorney, the principal must complete a form that identifies the agent and specifies the powers granted to them. The form must be signed by the principal in the presence of a notary public or two adult witnesses, making it legally binding. It is recommended to consult with an attorney to ensure the form accurately reflects the principal's wishes and complies with Texas law.

What powers can be granted with a Durable Power of Attorney in Texas?

The powers granted can be broad or limited, depending on the principal's preferences. They may include managing bank accounts, buying or selling property, filing taxes, and making investment decisions. The principal can specify the exact powers they wish to grant in the document, ensuring they retain control over which decisions the agent can make.

Can a Texas Durable Power of Attorney be revoked?

Yes, a Texas Durable Power of Attorney can be revoked at any time by the principal as long as they are of sound mind. To revoke the power of attorney, the principal must notify the agent in writing and retrieve all copies of the document. Additionally, they should inform any financial institutions or other parties that were relying on the power of attorney of its revocation.

What happens if the principal becomes incapacitated without a Durable Power of Attorney in place?

If the principal becomes incapacitated without a Durable Power of Attorney in place, their family members might need to go to court to seek permission to manage their financial affairs. This process, known as guardianship or conservatorship, can be lengthy, expensive, and stressful. Having a Durable Power of Attorney can prevent this complexity and ensure someone the principal trusts can make decisions on their behalf.

Common mistakes

When filling out the Texas Durable Power of Attorney (POA) form, many people rush through the process, leading to significant mistakes that can affect its validity and effectiveness. One common error is not specifying the powers granted clearly. The form allows you to grant broad or specific powers to your agent, and being vague or overly general can create confusion and legal challenges down the road.

Another frequent oversight is failing to appoint a successor agent. Life can be unpredictable. If your primary agent is unable to serve, and you haven't named a successor, the POA might become ineffective when you need it most. It's important to think ahead and name someone you trust as a backup.

Ignoring the signing requirements is also a notable mistake. Texas law has strict rules about how a POA must be signed, often requiring it to be notarized or witnessed by specific individuals. Failing to follow these rules can render the document invalid, leaving individuals unprotected when they assume their affairs are in order.

Some people overlook the importance of discussing the POA with their chosen agent. This role comes with significant responsibilities, and it's crucial that the agent understands what is expected of them. Without a clear understanding and agreement, the agent might not act in the principal's best interest, or worse, be unwilling or unable to take on the role when needed.

Not reviewing the document for errors is another common pitfall. Even small mistakes in names, addresses, or the description of powers can lead to big problems. Careful review and correction of any errors before finalizing the document ensure that it accurately reflects the principal's wishes.

Many also make the mistake of not updating the document. Relationships, circumstances, and laws change, which can affect the suitability of your chosen agent and the relevance of the powers granted. Regularly reviewing and updating the POA ensures it remains effective and reflective of your current wishes.

Ignoring the need for a durability provision is another error. For a POA to remain effective even if the principal becomes incapacitated, it must explicitly state that intention. Without this critical provision, the document might not serve its purpose when it's most needed.

Last but not least, not seeking legal advice can lead to issues. Many think they can complete the form without any help, but consulting with a lawyer ensures that the POA meets all legal requirements and truly reflects the principal's wishes. A professional can offer valuable guidance through the complexities of the law, helping to avoid mistakes that could undermine the document's purpose.

Documents used along the form

When you're setting up a Durable Power of Attorney in Texas, it's part of a larger picture to ensure your wishes are honored and your affairs are in order, especially during times when you can't make decisions for yourself. Apart from the Durable Power of Attorney form, there are several other documents and forms you might consider to make your legal and healthcare preferences known and to protect your assets. Each serves a unique yet complementary purpose to the others, offering a more comprehensive approach to planning for the future.

- Medical Power of Attorney: This document allows you to appoint someone to make healthcare decisions on your behalf if you become unable to do so. It's similar to the Durable Power of Attorney, but specifically focuses on medical choices, including treatments and end-of-life care.

- Directive to Physicians and Family or Surrogates (Living Will): This form lets you specify your wishes regarding medical treatment if you have a terminal condition or are in a persistent vegetative state. It guides your healthcare providers and loved ones in making decisions that align with your preferences.

- Declaration of Guardian in Advance of Need: In this document, you can declare your preferred guardian for yourself before such a need arises. This can be crucial in situations where you may become incapacitated and unable to express your preferences for guardianship.

- Last Will and Testament: This crucial document outlines how you want your property and assets distributed after your death. It can also specify guardians for any minor children, ensuring that your wishes are respected and carried out.

- HIPAA Release Form: The Health Insurance Portability and Accountability Act (HIPAA) keeps your medical information private. By signing a HIPAA release form, you give specific individuals or entities permission to access your medical records, which can be important for those making healthcare decisions on your behalf.

- Revocable Living Trust: This document helps manage your assets during your lifetime and distribute them after your death, often without the need for probate. You can change or cancel it anytime as long as you are mentally competent.

Taking the time to prepare these documents now can save your loved ones a lot of stress and confusion later. Each one serves as a building block toward creating a comprehensive plan that ensures your desires are honored, both in life and after. Consulting with legal professionals to understand and draft these documents can provide peace of mind to you and your family by making sure that your legal and health care decisions are in capable hands.

Similar forms

The Texas Medical Power of Attorney is a document that closely resembles the Durable Power of Attorney, as both empower an individual, known as the agent, to make decisions on behalf of the principal. However, while the Durable Power of Attorney grants broad authority over financial and legal matters, the Medical Power of Attorney specifically addresses decisions related to the principal's health care, including treatment options and end-of-life care. This differentiation ensures that the principal's wishes regarding their health and well-being are respected, even when they are unable to communicate them personally.

Another document akin to the Texas Durable Power of Attorney is the General Power of Attorney. This document also allows the principal to appoint an agent to handle their affairs. However, the primary difference is its durability. A General Power of Attorney typically becomes void if the principal is incapacitated or deemed incapable of making decisions, unlike the Durable Power of Attorney, which remains in effect even under these circumstances. This distinction makes the Durable Power of Attorney a more reliable tool for long-term planning.

The Limited or Special Power of Attorney document shares similarities with the Texas Durable Power of Attorney by allowing a principal to appoint an agent. Nonetheless, its scope is much narrower. This type of Power of Attorney grants the agent authority to act on behalf of the principal in specific scenarios or for designated tasks only, such as selling a property or handling certain financial transactions, contrasting the broader, more encompassing powers provided by a Durable Power of Attorney.

The Advance Healthcare Directive, also known as a Living Will, parallels the Texas Durable Power of Attorney through its feature of designating an individual to make healthcare decisions if the principal is unable. While the Durable Power of Attorney covers a comprehensive range of decisions, the Advance Healthcare Directive focuses solely on healthcare preferences, particularly concerning life-sustaining treatment and pain management preferences, at times when the principal cannot make those decisions independently.

The Springing Power of Attorney is similar to the Texas Durable Power of Attorney in its function to designate an agent for making decisions on the principal's behalf. The unique aspect of the Springing Power of Attorney is its activation condition; it only comes into effect upon the occurrence of a specific event, typically the principal's incapacitation. This contrasts with the Durable Power of Attorney, which is usually effective immediately upon execution, providing no delay in the agent's authority to act, unless specifically stated otherwise in the document.

Lastly, the Guardianship or Conservatorship arrangement shares objectives with the Texas Durable Power of Attorney by arranging for a person's affairs to be managed when they're incapable of doing so themselves. However, unlike a Durable Power of Attorney, which the principal arranges voluntarily, a court usually establishes Guardianship or Conservatorship. This legal process is often more intrusive and complex, as it involves proving the individual's incapacity in court, making the Durable Power of Attorney a more straightforward and autonomous way to manage one's affairs preemptively.

Dos and Don'ts

When preparing to fill out the Texas Durable Power of Attorney form, individuals are embarking on a crucial step towards ensuring their affairs are managed according to their wishes, should they become unable to do so themselves. It's important to approach this document with care and attention, to avoid common pitfalls and ensure the document’s effectiveness. Below are several recommended dos and don’ts.

Do:- Read instructions carefully: Before filling out the form, thoroughly read all instructions. Understanding each section's purpose ensures that the information provided is accurate and relevant.

- Choose a trusted agent: Select someone you trust completely to act as your agent. This individual will have significant control over your financial or medical decisions, depending on the form’s scope.

- Be specific about powers granted: Clearly outline the duties and powers you are assigning. Specificity can prevent confusion and misuse of power.

- Consult with professionals: Seeking advice from legal or financial advisors can offer valuable insight into the consequences of decisions made within the form.

- Sign in the presence of a notary: Ensure the form is signed according to Texas law, which often requires notarization to be legally valid.

- Provide copies to relevant parties: Once complete, give copies to your agent, family members, and perhaps your lawyer, so that everyone is aware of the document's existence and its contents.

- Review and update periodically: As circumstances change, your Durable Power of Attorney may need updating. Regular reviews ensure it remains aligned with your current wishes and legal standards.

- Rush the process: Take your time when filling out the form to avoid errors that could invalidate the document or cause issues later.

- Use vague language: Ambiguity can lead to disputes or misinterpretation of your intentions. Use precise language to describe the scope of authority granted.

- Forget to consider alternates: Naming an alternate agent can be crucial if your primary choice is unable or unwilling to act when needed.

- Leave sections blank: If a section does not apply, indicate this by writing “N/A” (not applicable) instead of leaving it blank to avoid potential alterations after signing.

- Ignore state-specific requirements: Each state has unique laws regarding Durable Powers of Attorney. Ensure that your document complies with Texas law specifically.

- Fail to communicate with your agent: Discuss your wishes and the contents of the document with your chosen agent to ensure they understand and are willing to undertake the responsibilities.

- Overlook the importance of witnesses: While not always legally required, having witnesses can add an extra layer of validity and protection against claims of coercion or misunderstanding.

Misconceptions

When it comes to the Texas Durable Power of Attorney (DPOA), people often hold certain misconceptions. It's important to clear these up to understand how this legal document can serve you and your loved ones effectively. Here are four common misunderstandings:

- It's only for the elderly. Many people think a DPOA is something only the elderly should consider. The truth is, life is unpredictable. An accident or sudden illness can happen at any age, making it wise for anyone to have a DPOA in place.

- It grants immediate control over all your assets. Another misconception is that once someone is designated as your agent in a DPOA, they have instant and total control over your assets. In reality, the specifics of what your agent can do depend on what powers you grant them in the document itself. You can choose to limit their powers significantly.

- It remains valid after death. Some people mistakenly believe that a DPOA continues to be effective after the principal's (the person who made the DPOA) death. This is not the case. The authority granted through a DPOA ends the moment the principal dies.

- It can't be revoked. There's also a common belief that once a DPOA is created, it can't be revoked. On the contrary, as long as the principal is mentally competent, they can revoke a DPOA at any time for any reason.

Understanding these aspects of the Texas Durable Power of Attorney can help ensure your interests are protected during unforeseen events. Always consult with a legal professional when drafting or making decisions related to a DPOA to align with current laws and personal wishes.

Key takeaways

When it comes to managing your affairs, especially in times when you might not be able to do so yourself, a Durable Power of Attorney (POA) in Texas is a significant legal tool. Here are some key takeaways to consider when filling out and using a Texas Durable Power of Attorney form:

- The Durable Power of Attorney form allows you to appoint someone you trust, often referred to as an "agent" or "attorney-in-fact," to manage your financial affairs. This person can do things like handle banking transactions, manage real estate, and make other financial decisions on your behalf.

- It's called "durable" because it remains in effect even if you become incapacitated, meaning you are no longer mentally or physically able to make decisions for yourself.

- Choosing the right agent is crucial. You should select someone who is not only trustworthy but also capable of managing the responsibilities that come with this role.

- The form requires you to be clear about which powers you are granting to your agent. You can choose to give them broad authority or limit them to specific actions.

- To be valid, the Texas Durable Power of Attorney form must be signed in the presence of a notary public. This ensures that your signature is verified and the document is legally binding.

- Once the form is notarized, it should be given to your agent and any institutions or parties that may need to acknowledge the authority it grants. For instance, banks, brokers, and healthcare providers should have a copy on file.

- It's important to specify a start date for the powers granted. Some POA forms take effect immediately upon signing, while others activate only upon the occurrence of a specific event, usually when the principal becomes incapacitated.

- You have the right to revoke or change your Durable Power of Attorney at any time as long as you are competent. This should be done in writing, and all relevant parties should be notified of the change.

- Lastly, it’s wise to consult with an attorney before finalizing your Durable Power of Attorney form. They can help ensure the document meets all legal requirements in Texas and accurately reflects your wishes.

Understanding these key points can help ensure that your Texas Durable Power of Attorney form serves your interests and secures your financial wellbeing, even when you're unable to do so yourself.

More Durable Power of Attorney State Forms

North Carolina Durable Power of Attorney - The form requires careful consideration, emphasizing the importance of choosing an agent who is both trustworthy and capable.

Durable Power of Attorney Georgia - By detailing your wishes in advance, it ensures that your financial goals continue to be achieved, regardless of your health status.