Fillable Durable Power of Attorney Document for Pennsylvania

In Pennsylvania, residents have access to a critical tool for estate planning and personal care management—the Durable Power of Attorney form. This document empowers individuals to appoint a trusted person to manage their financial and legal affairs in the event they become incapacitated. Understanding the various elements of this form is essential for anyone looking to ensure their matters are handled according to their wishes, should they be unable to make decisions for themselves. From selecting a reliable agent to specifying the extent of powers granted, the form covers several important bases. It's devised to offer peace of mind, not just for the person it protects, but also for their family and loved ones, knowing that the affairs of the estate will be managed responsibly. Moreover, being familiar with the legal requirements and potential implications of the Durable Power of Attorney can safeguard against future disputes or misunderstandings, making it a cornerstone of thorough estate planning.

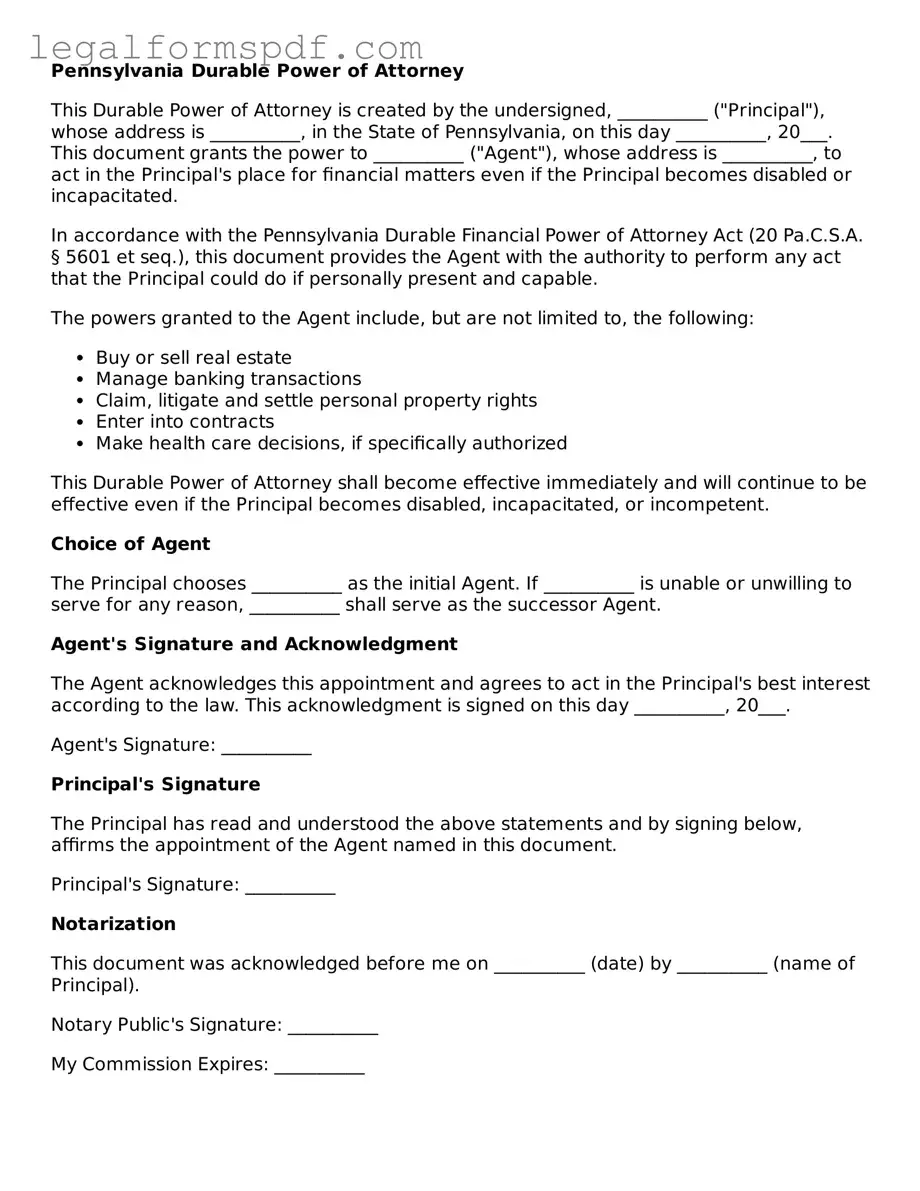

Document Example

Pennsylvania Durable Power of Attorney

This Durable Power of Attorney is created by the undersigned, __________ ("Principal"), whose address is __________, in the State of Pennsylvania, on this day __________, 20___. This document grants the power to __________ ("Agent"), whose address is __________, to act in the Principal's place for financial matters even if the Principal becomes disabled or incapacitated.

In accordance with the Pennsylvania Durable Financial Power of Attorney Act (20 Pa.C.S.A. § 5601 et seq.), this document provides the Agent with the authority to perform any act that the Principal could do if personally present and capable.

The powers granted to the Agent include, but are not limited to, the following:

- Buy or sell real estate

- Manage banking transactions

- Claim, litigate and settle personal property rights

- Enter into contracts

- Make health care decisions, if specifically authorized

This Durable Power of Attorney shall become effective immediately and will continue to be effective even if the Principal becomes disabled, incapacitated, or incompetent.

Choice of Agent

The Principal chooses __________ as the initial Agent. If __________ is unable or unwilling to serve for any reason, __________ shall serve as the successor Agent.

Agent's Signature and Acknowledgment

The Agent acknowledges this appointment and agrees to act in the Principal's best interest according to the law. This acknowledgment is signed on this day __________, 20___.

Agent's Signature: __________

Principal's Signature

The Principal has read and understood the above statements and by signing below, affirms the appointment of the Agent named in this document.

Principal's Signature: __________

Notarization

This document was acknowledged before me on __________ (date) by __________ (name of Principal).

Notary Public's Signature: __________

My Commission Expires: __________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | Designates an agent to handle financial and legal matters on behalf of the principal if they become incapacitated. |

| Governing Law | 20 Pa.C.S. §§ 5601-5612 (Pennsylvania Statutes Title 20, Chapter 56: Powers of Attorney). |

| Durability Clause | Includes specific language that ensures the power of attorney remains effective even if the principal becomes incapacitated. |

| Requirements for Validity | Must be signed by the principal, dated, and notarized. Two adult witnesses are also required who are not the agent or the notary. |

| Agent's Duties | The agent is required to act in the principal's best interest, maintain accurate records, and avoid conflicts of interest. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are competent, by notifying the agent and any institutions in writing. |

| Agent Acceptance | The agent must sign an acceptance to acknowledge their duties and responsibilities under the durable power of attorney. |

Instructions on Writing Pennsylvania Durable Power of Attorney

When preparing to fill out a Pennsylvania Durable Power of Attorney form, you're taking a significant step towards ensuring your affairs will be managed according to your wishes, even if you're unable to oversee them yourself. This document, once completed, grants a trusted individual the authority to make decisions on your behalf, particularly in areas concerning your finances and property. It's a task that requires attention to detail and a clear understanding of your intentions. Below are the steps aimed at guiding you through the process, ensuring that the form reflects your desires accurately and is executed correctly.

- Begin by thoroughly reading the entire form to familiarize yourself with its sections and requirements. Make sure you understand the scope of authority you're granting.

- Enter your full legal name and address in the designated section at the top of the form to identify yourself as the principal.

- Designate your agent (also known as the attorney-in-fact) by filling in their full legal name and address. This individual will be empowered to act on your behalf.

- If you wish to appoint a successor agent (a backup in case the first agent is unable or unwilling to serve), provide their full legal name and address in the specified section.

- Specify the powers you are granting to your agent. Be clear and precise about what your agent can and cannot do. This may include making decisions about real estate, personal property, banking, insurance, and other financial matters.

- For the powers to be effective even if you become incapacitated, assert that the document is to be considered "durable" by checking the appropriate box or including the necessary language, depending on the form's design.

- Review any special instructions or limitations section to provide further clarification on the extent of powers granted, or to impose specific limitations on your agent's authority.

- Include the date on which the document becomes effective. Some individuals opt for the document to take effect immediately, while others may specify a triggering event.

- Sign the document in front of a notary public and, depending on state requirements, witnesses. Having the form notarized and witnessed is crucial for its legal validity.

- Provide your agent with a copy of the completed document and store the original in a safe, yet accessible place. Inform a trusted individual of the document's location.

Filling out a Pennsylvania Durable Power of Attorney form is a proactive step in managing your personal affairs. By following these steps diligently, you can ensure that the form accurately represents your wishes and that your appointed agent is clear about their responsibilities. Remember, this document is a powerful legal tool, and its preparation should be approached with care and consideration.

Understanding Pennsylvania Durable Power of Attorney

What is a Durable Power of Attorney in Pennsylvania?

A Durable Power of Attorney (DPOA) in Pennsylvania is a legal document that empowers an individual, termed as the ‘agent’ or ‘attorney-in-fact,’ to make decisions on behalf of another person, known as the ‘principal,’ even if the principal becomes incapacitated or unable to make decisions for themselves. The term ‘durable’ signifies that the power of attorney remains effectual even if the principal becomes mentally incapacitated.

Why is having a Durable Power of Attorney important in Pennsylvania?

Having a DPOA in Pennsylvania is crucial because it ensures that someone the principal trusts can make financial, legal, and even health-related decisions on their behalf if they are unable to do so. This can include managing bank accounts, paying bills, or making healthcare decisions. Without a DPOA, family members might have to undergo a lengthy and expensive court process to be appointed as guardians to make such decisions.

How do you create a Durable Power of Attorney in Pennsylvania?

To create a DPOA in Pennsylvania, the principal must complete a DPOA form, which should specify the powers granted to the agent. The form must be signed by the principal in the presence of a notary public and, depending on the powers granted, might also require witnessing by one or two adult witnesses who are not named as agents in the document. It is advisable, although not mandatory, to consult a lawyer to ensure the DPOA meets all legal requirements and adequately reflects the principal’s wishes.

Can a Durable Power of Attorney in Pennsylvania be revoked?

Yes, as long as the principal is mentally competent, they can revoke a DPOA at any time by notifying the agent in writing and destroying all copies of the DPOA document. It is also recommended to notify any institutions or individuals that were relying on the DPOA of its revocation. A new DPOA can be established if the principal desires to appoint a different agent.

Who should be chosen as an agent in a Durable Power of Attorney?

The choice of an agent is a critically important decision. The designated agent should be someone the principal trusts implicitly, such as a family member or close friend. The agent should have the necessary skills to manage financial matters or make healthcare decisions, and be willing to act in the principal’s best interests. Additionally, the principal should discuss their wishes and expectations with the chosen agent before executing the document.

Is a lawyer required to create a Durable Power of Attorney in Pennsylvania?

While Pennsylvania law does not require a lawyer to draft a DPOA, consulting with a legal professional experienced in estate planning can provide valuable guidance and peace of mind. A lawyer can ensure that the DPOA accurately reflects the principal’s wishes, contains the necessary legal terms, and meets all state-specific requirements. This can help prevent the document from being challenged or invalidated in the future.

Common mistakes

When filling out a Pennsylvania Durable Power of Attorney form, one common mistake is not clearly identifying the parties involved. The form should accurately name and provide contact information for the person granting the power, known as the principal, and the person receiving the power, known as the agent. Failure to do so can lead to confusion and potentially render the document ineffective.

Another error is neglecting to specify the powers being granted. The form allows the principal to give the agent broad legal authority or limit them to specific acts. Without clear instructions, agents may not understand the extent of their responsibilities, and third parties may challenge their authority.

Often, individuals forget to address the durability of the Power of Attorney. For a Power of Attorney to remain in effect even if the principal becomes incapacitated, it must be explicitly stated as "durable." Omitting this crucial detail can significantly impact the document's effectiveness in critical situations.

Not selecting an alternate agent is a mistake that can lead to issues down the line. If the first agent is unable or unwilling to perform their duties, having no successor agent mentioned leaves the principal without representation until a new Power of Attorney can be established.

Ignoring the need for witness signatures and notarization is another common oversight. Pennsylvania law may require these steps for the document to be legally valid. Without following these formalities, the entire agreement could be questioned or deemed invalid.

Many also mistakenly believe that once the form is filled out, no further review or updates are necessary. Life changes, such as the principal's relocation to another state or changes in the agent's ability to serve, require updates to the Power of Attorney to ensure it remains effective and relevant.

Failing to provide clear instructions for the termination of the Power of Attorney is another oversight. Unless the document specifies circumstances or a date upon which the powers cease, it may remain in effect indefinitely, potentially against the principal's later wishes.

Another common error is not discussing the contents of the Power of Attorney with the chosen agent. Understanding and agreeing to the responsibilities are crucial for the agent to act effectively and in the principal's best interests. Surprising someone with this responsibility can lead to refusal or mismanagement.

Lastly, improperly storing the Power of Attorney document can render it useless when needed. If the document is not easily accessible or copies are not provided to relevant parties such as financial institutions or healthcare providers, it cannot serve its purpose during crucial times.

Documents used along the form

When handling personal matters and planning for future uncertainties, it’s important to have all your bases covered. Along with the Pennsylvania Durable Power of Attorney form, which allows you to designate an agent to manage your affairs if you're unable to do so, there are several other key documents that are often used together to ensure thorough planning. Each of these documents serves a specific purpose and complements the protections and directives outlined in a Durable Power of Attorney.

- Living Will: This document outlines your preferences regarding medical care in the event you can no longer communicate your wishes, especially concerning life-sustaining treatments. It acts as a guide for your healthcare agent and medical providers.

- Last Will and Testament: It details how you want your property and assets to be distributed after your death. This document is crucial for preventing potential conflicts among heirs and ensuring your wishes are respected.

- Health Care Power of Attorney: Similar to a Durable Power of Attorney but specifically for health care decisions. This designates someone to make medical decisions on your behalf if you're incapacitated.

- Living Trust: This helps manage your assets during your lifetime and distribute them after your death without the need for probate. You can name yourself as the trustee and maintain control over your assets with provisions for a successor trustee.

- Advance Directive: A broader term that encompasses both living wills and health care powers of attorney. It covers all your preferences regarding medical care and names an agent for health care decisions.

- HIPAA Authorization Form: This permits designated individuals to access your medical records and speak with health care providers, ensuring your health care agent has the information needed to make informed decisions.

- Financial Information Sheet: Not a formal legal document, but extremely helpful for the person you designate in your Durable Power of Attorney. It lists all your financial accounts, insurance policies, and other important financial information in one place.

- Memorial Instructions: While not legally binding, this document specifies your wishes for funeral arrangements and how you'd like your remains to be handled, providing guidance for your loved ones during a difficult time.

- Letter of Intent: A non-binding document that provides additional context to your wishes and the reasons behind them, often used to clarify the choices made in other legal documents.

In crafting a comprehensive plan for the future, integrating these documents with a Pennsylvania Durable Power of Attorney can provide peace of mind knowing that your affairs, both personal and financial, will be handled according to your wishes. It’s not only about preparing for the worst; it’s about making things easier for you and those you care about, ensuring that your well-being and legacy are protected.

Similar forms

The Pennsylvania Durable Power of Attorney form shares similarities with a Living Will, primarily in the handling of personal affairs. Both documents grant authority to another individual to make critical decisions on one’s behalf. While the Durable Power of Attorney often focuses on financial and property matters, enabling someone to pay bills, manage investments, or buy and sell real estate when the principal cannot, a Living Will generally deals with healthcare decisions, including end-of-life treatment preferences. Both serve as essential tools in planning for future incapacity or unexpected situations, ensuring that the individual's wishes are respected and fulfilled by a trusted person.

Similar to a Healthcare Power of Attorney, the Durable Power of Attorney provides a proactive approach to personal planning. The Healthcare Power of Attorney is designed specifically to address medical decisions, appointing an agent to make healthcare choices if the individual is unable to do so. This resemblance lies in their commonality of delegating decision-making authority to a trusted person. However, the scope differs, with the Durable Power of Attorney often encompassing a broader range of responsibilities beyond healthcare, such as financial and legal affairs, making it a more encompassing tool for future planning.

A General Power of Attorney form is another document closely related to the Durable Power of Attorney, with the main distinction being in their durability. Both documents authorize an agent to act on behalf of the principal in various matters, including financial transactions and business dealings. The key difference is that a General Power of Attorney typically becomes void if the principal becomes incapacitated or dies. Conversely, a Durable Power of Attorney is specifically designed to remain in effect upon the principal's incapacitation, ensuring continuous management of the individual's affairs without court intervention.

The Revocable Living Trust also shares a conceptual kinship with the Durable Power of Attorney, as both are established to manage and protect assets. The trustee of a Revocable Living Trust directly manages the trust's assets, similar to how an agent in a Durable Power of Attorney might handle financial affairs. Both aim to provide smooth transitions in case of incapacity. However, they operate differently; the trust is more focused on avoiding probate and can provide clear instructions for asset distribution upon death, whereas the Durable Power of Attorney ceases to be effective when the individual dies, focusing instead on managing affairs during their lifetime.

Dos and Don'ts

When preparing a Pennsylvania Durable Power of Attorney (POA), it is of paramount importance that you approach the process with diligence and attention to detail. This document not only grants authority to another individual to make decisions on your behalf but also remains in effect if you become incapacitated. To ensure that your Power of Attorney form accomplishes its intended purpose without complications, consider the following guidelines:

- Do: Read the entirety of the form carefully before starting to fill it out. Understanding each section fully can help prevent mistakes that might render the document invalid.

- Do: Choose a trusted individual as your agent. This person will have broad powers over your affairs, so it’s critical to select someone who is not only trustworthy but also capable of making decisions in your best interest.

- Do: Be specific about the powers granted. Although the form might offer broad powers by default, you have the option to limit this authority to ensure your wishes are precisely followed.

- Do: Include a successor agent. Circumstances may change, making it impossible for your initial choice to fulfill their duties. Having a backup ensures that your affairs remain in good hands.

- Do: Sign the document in the presence of a notary. In Pennsylvania, notarization is a requirement for the POA to be legally valid. This step also adds a layer of protection against disputes over authenticity.

- Don't: Leave any sections of the form blank. Incomplete information can lead to misunderstandings or a lack of proper authority when needed.

- Don't: Use vague language when defining the scope of authority. Ambiguities can create legal challenges or prevent your agent from acting on your behalf efficiently and effectively.

- Don't: Forget to review and update the document periodically. As your life circumstances change, so too may your needs for a power of attorney. Regularly revising the POA ensures that it always reflects your current wishes and circumstances.

Misconceptions

Understanding the nuances of the Pennsylvania Durable Power of Attorney (POA) form is crucial for effectively managing one’s legal and financial matters. However, misconceptions abound, leading to confusion and potentially grave errors in judgment. Here, we clarify some common misunderstandings:

It comes into effect immediately after signing: Many believe the POA is active the moment it’s signed. In reality, the document can be structured to become effective upon a certain condition, such as the principal's incapacity.

Only for the elderly: The notion it’s solely for senior citizens is misleading. Anyone can face situations where they're unable to manage their affairs, making a Durable POA important for adults of all ages.

It grants unlimited power: Contrary to what some think, the document’s scope is defined by the principal. It can be broad or limited to specific acts, ensuring control over what the agent can do.

Revocation is impossible after incapacity: Many misunderstand that once they become incapacitated, they can’t revoke the POA. As long as the principal is competent, they retain the power to revoke or amend the document.

It eliminates the need for a will: A Durable POA covers decisions during the principal’s lifetime, while a will addresses matters after death. Both documents serve different purposes and are important parts of estate planning.

A spouse automatically has POA rights: There’s a misconception that marital status grants automatic authority over a spouse’s affairs. Legally, a POA document must be executed to grant such authority.

All POAs are the same: The assumption that all POA forms are identical overlooks state-specific regulations and the distinction between durable and non-durable POAs. Pennsylvania law has specific requirements that must be met for validity.

It covers medical decisions: People often confuse a Durable POA, which typically covers financial and legal matters, with a healthcare POA, which is specifically designed for medical decisions. These are separate documents with different functions.

Dispelling these misconceptions is vital for ensuring individuals are adequately prepared to safeguard their interests and those of their loved ones. Proper legal advice should always be sought when creating or amending any legal document, including a Durable Power of Attorney.

Key takeaways

Filling out a Pennsylvania Durable Power of Attorney form is a critical step in ensuring your affairs can be managed by someone you trust in the event that you're unable to do so yourself. This legal document allows you to appoint an "agent" or "attorney-in-fact" to make decisions on your behalf, covering a broad spectrum of activities from financial to personal and health-related decisions. Understanding the key aspects of how to correctly fill out and use this document is essential for it to be effective and to give you peace of mind.

Here are several key takeaways to consider:

- Choose Your Agent Wisely: It's imperative to select someone who is not only trustworthy but also capable of managing your affairs according to your wishes. The person you choose should have a good understanding of your values and be willing to act in your best interest, even under stressful situations.

- Be Specific About Powers Granted: The document should clearly outline the specific powers you are granting to your agent. You can limit their powers to certain activities, such as managing your finances, or you can grant them broader authority to act in almost any legal capacity on your behalf. Being precise can help prevent any confusion or abuse of power in the future.

- Understand the "Durable" Aspect: The term "durable," in the context of a Power of Attorney, means that the document remains in effect even if you become incapacitated or unable to make decisions for yourself. This feature is what distinguishes a Durable Power of Attorney from other forms of Power of Attorney which may become null and void if the principal becomes incapacitated.

- Follow Pennsylvania’s Legal Requirements: For the Durable Power of Attorney to be legally binding in Pennsylvania, it must adhere to specific state laws. This includes being signed by the principal in the presence of two witnesses and notarized. Ensuring that the form fulfills Pennsylvania's legal requirements is crucial for it to be recognized and for your agent to act on your behalf without legal hurdles.

In conclusion, the Pennsylvania Durable Power of Attorney is a powerful tool in estate planning and managing affairs. It's designed to ensure that your decisions and desires are honored, even if you're not in a position to make those decisions yourself. Properly completing this form involves careful consideration, clear communication of your wishes, and adherence to legal standards. Safeguarding your future with this legal document requires thoughtful preparation, and understanding these key takeaways can help make the process smoother and more effective.

More Durable Power of Attorney State Forms

Does a Power of Attorney Need to Be Notarized in Ohio - It acts as a fail-safe, ensuring that day-to-day financial obligations, such as paying bills and managing accounts, continue seamlessly.

Illinois Durable Power of Attorney Form Pdf - This legal document grants a chosen individual the authority to manage your financial, legal, and medical affairs in case of incapacitation, providing peace of mind for you and your loved ones.