Fillable Durable Power of Attorney Document for Ohio

The Ohio Durable Power of Attorney form stands as a critical legal instrument, empowering individuals to appoint a trusted agent or attorney-in-fact to manage their affairs, should they become incapacitated. This form transcends the ordinary power of attorney by remaining in effect even when the principal can no longer make decisions due to mental or physical incapacity. It covers a broad spectrum of responsibilities, from financial decisions and property management to personal and healthcare matters, depending on the specific provisions stipulated within it. Its execution requires adherence to state laws, ensuring that the document is not only legally binding but also reflects the principal's wishes accurately. This preparation involves crucial decisions about selecting the right agent, specifying the powers granted, and understanding the conditions under which it becomes operative. The Ohio Durable Power of Attorney form embodies a proactive approach to planning for future uncertainties, highlighting the importance of legal and personal considerations in safeguarding an individual's interests.

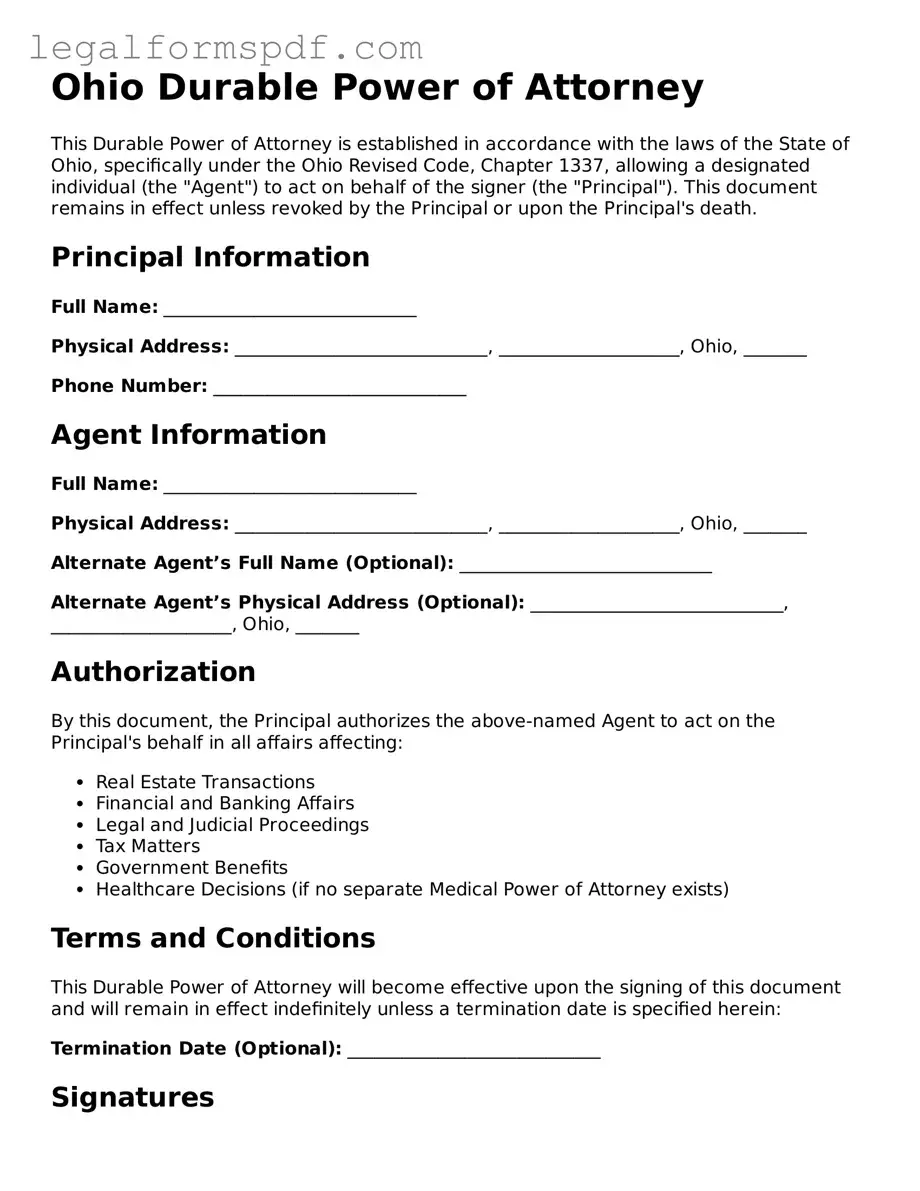

Document Example

Ohio Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the laws of the State of Ohio, specifically under the Ohio Revised Code, Chapter 1337, allowing a designated individual (the "Agent") to act on behalf of the signer (the "Principal"). This document remains in effect unless revoked by the Principal or upon the Principal's death.

Principal Information

Full Name: ____________________________

Physical Address: ____________________________, ____________________, Ohio, _______

Phone Number: ____________________________

Agent Information

Full Name: ____________________________

Physical Address: ____________________________, ____________________, Ohio, _______

Alternate Agent’s Full Name (Optional): ____________________________

Alternate Agent’s Physical Address (Optional): ____________________________, ____________________, Ohio, _______

Authorization

By this document, the Principal authorizes the above-named Agent to act on the Principal's behalf in all affairs affecting:

- Real Estate Transactions

- Financial and Banking Affairs

- Legal and Judicial Proceedings

- Tax Matters

- Government Benefits

- Healthcare Decisions (if no separate Medical Power of Attorney exists)

Terms and Conditions

This Durable Power of Attorney will become effective upon the signing of this document and will remain in effect indefinitely unless a termination date is specified herein:

Termination Date (Optional): ____________________________

Signatures

Principal’s Signature: ____________________________ Date: _____________

Agent’s Signature: ____________________________ Date: _____________

If an alternate Agent is designated, their acceptance of appointment is required:

Alternate Agent’s Signature (Optional): ____________________________ Date: _____________

Acknowledgment by Notary Public

This section to be completed by a Notary Public, affirming the identities of the individuals signing the Ohio Durable Power of Attorney document.

State of Ohio,

County of _______________________

On this day, _______________, before me appeared ___________________ [Principal], and ___________________ [Agent/Alternate Agent] known to me (or satisfactorily proven) to be the individuals whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public’s Signature: ____________________________ Date: _____________

Notary Public’s Printed Name: ____________________________

My Commission Expires: _____________

PDF Specifications

| Fact | Description |

|---|---|

| Name | Ohio Durable Power of Attorney |

| Purpose | Allows someone to act on your behalf for financial decisions. |

| Durability | Remains in effect even if the person becomes incapacitated. |

| Governing Law(s) | Ohio Revised Code Section 1337.09 et seq. |

| Principal | The person who grants the power to another. |

| Agent | The person given the power to act on behalf of the principal. |

| Revocation | Can be revoked by the principal at any time as long as they are competent. |

Instructions on Writing Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form is a crucial step in planning for the future. This document allows you to appoint someone you trust to manage your affairs if you are unable to do so yourself. The process requires careful consideration and attention to detail. Below are the steps needed to ensure your Durable Power of Attorney form is correctly completed and legally binding.

- Gather all necessary information, including your full legal name, address, and the full legal name and address of the person you are appointing as your attorney-in-fact.

- Read the form thoroughly to understand the powers you are granting. This preparation ensures you're informed about the decisions you're making.

- Enter your personal information in the designated sections at the beginning of the form. This includes your name, address, and any other required identifying details.

- Specify the powers you are granting to your attorney-in-fact. Be clear and precise about what authority you are giving them, whether it’s managing your financial affairs, making healthcare decisions, or both.

- If there are specific powers you do not wish to grant, include instructions to exclude these from the attorney-in-fact's authority. Clearly stating exclusions will help prevent any unintended power from being exercised.

- Choose an effective date for the Durable Power of Attorney to become active. This can be immediately upon signing or upon the occurrence of a specific event, such as the determination of your incapacity by a physician.

- Sign the form in the presence of a notary public. Some states may require additional witnesses to sign as well. Ensure all signatures are obtained as per Ohio law to make the document legally enforceable.

- Provide your attorney-in-fact with a copy of the signed document. Keep the original in a safe place, such as a safe deposit box, and inform a trusted individual of its location.

By carefully completing the Ohio Durable Power of Attorney form, you're taking a significant step towards ensuring your affairs can be managed according to your wishes if you're unable to do so yourself. Ensure to review the document periodically and update it as needed to reflect any changes in your life circumstances or in your relationship with the person you have appointed as your attorney-in-fact.

Understanding Ohio Durable Power of Attorney

What is a Durable Power of Attorney in Ohio?

A Durable Power of Attorney (DPOA) in Ohio is a legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This authority can include managing financial matters, real estate transactions, and other personal affairs. What makes it "durable" is its ability to remain in effect if the principal becomes incapacitated and is unable to make decisions for themselves.

How do you create a Durable Power of Attorney in Ohio?

To create a Durable Power of Attorney in Ohio, the principal must complete a DPOA form that meets state requirements. This includes clearly identifying the principal and agent, specifying the powers granted, and having the document signed in the presence of a notary public. It's important that the form is completed accurately to ensure it is legally enforceable. Consulting with a legal expert can help ensure that all aspects of the DPOA adhere to Ohio laws and that the document reflects the principal's wishes accurately.

Can a Durable Power of Attorney be revoked in Ohio?

Yes, a Durable Power of Attorney can be revoked in Ohio at any time by the principal, as long as they are mentally competent. To revoke the DPOA, the principal should provide a written notice of revocation to the agent and to any institutions or parties that were relying on the DPOA. It's also recommended to retrieve all copies of the DPOA document and to destroy them. If possible, a legal notice should also be placed in the local newspaper to inform others of the revocation.

Is a lawyer necessary to create a Durable Power of Attorney in Ohio?

While it is possible to create a Durable Power of Attorney without a lawyer in Ohio, consulting with one is highly recommended. A lawyer can offer valuable advice on how to tailor the DPOA to fit the principal’s specific needs and circumstances and can ensure that the document complies with all relevant Ohio laws. They can also help address any potential issues that might arise in the future and provide guidance on how to make the DPOA as effective as possible.

Common mistakes

One common mishap when completing the Ohio Durable Power of Attorney form is not clearly specifying the scope of authority granted. This document empowers another individual to make decisions on your behalf, and being vague about the extent of this power can lead to confusion or misuse. It's crucial that the principal meticulously outlines the specific areas in which the agent has the authority to act, such as financial matters, real estate transactions, or healthcare decisions. A failure to delineate these powers can result in the agent either overstepping their bounds or hesitating to take necessary actions due to uncertainty about their authority.

Another frequent mistake is overlooking the necessity of selecting an alternate agent. Life's unpredictability dictates the wisdom in having a backup plan, yet many people neglect this precaution. Should the primary agent be unwilling, unable, or unavailable to serve when needed, the absence of an alternate can compromise the principal's affairs seriously. By appointing a successor agent, continuity is ensured, safeguarding against periods during which no one is authorized to act on the principal's behalf.

Ignoring the need to notarize the document is yet another oversight with severe repercussions. In Ohio, for a Durable Power of Attorney to be legally binding, proper notarization is required. Some individuals may either skip this step or assume it's optional, which can render the document ineffective. This formal verification process by a notary public is not just a formality; it validates the identity of the signing parties, thereby helping to prevent fraud and ensuring the document's acceptance by third parties.

People often fail to address the durability clause explicitly. This clause ensures that the Power of Attorney remains in effect if the principal becomes incapacitated. Without clearly stating the document's durability, there's a risk that the agent's authority may not be recognized precisely when it's most needed. Clarification within the document that it is to remain effective even in the event of the principal’s incapacitation is not just a procedural detail; it's a fundamental component that secures the principal's interests under all circumstances.

Lastly, a significant number of individuals postpone creating or updating their Durable Power of Attorney, a mistake stemming from procrastination or the discomfort of considering one’s own incapacity or mortality. Delaying this critical task can lead to a situation where it’s too late to legally empower another person to make decisions on one's behalf. This can result in a burdensome, often complicated, legal process for loved ones to obtain the authority to manage the principal’s affairs during a period of vulnerability.

Documents used along the form

When preparing an Ohio Durable Power of Attorney, several other documents are often needed to complete your estate planning or to handle your affairs properly. These documents complement the Durable Power of Attorney by addressing different aspects of your health, finances, and personal wishes. Ensuring you have a comprehensive set of documents will help in managing your affairs effectively.

- Living Will: This document outlines your wishes regarding medical treatment and life-support measures if you become unable to communicate your decisions due to illness or incapacity.

- Healthcare Power of Attorney: It allows you to appoint someone to make medical decisions on your behalf if you're unable to do so yourself, complementing the Durable Power of Attorney for handling non-health related matters.

- Last Will and Testament: Specifies how you want your property and assets to be distributed after your death. It also allows you to appoint an executor to manage the estate settlement process.

- Revocable Living Trust: Enables you to maintain control over your assets while you're alive but have them transferred to beneficiaries upon your death without the need for probate.

- Declaration for Mental Health Treatment: Indicates your preferences for mental health treatment and can include decisions about medication, therapy, and hospitalization.

- Financial Inventory: Though not a legal document, a comprehensive list of your financial accounts, real estate, and other assets is crucial for the person you designate in your Power of Attorney or other estate planning documents.

- Funeral Planning Declaration: Allows you to express your preferences for funeral arrangements and the handling of your remains. This document can ease the decision-making burden on loved ones.

- HIPAA Release Form: Permits healthcare providers to share your health information with designated individuals, ensuring that the person handling your healthcare Power of Attorney is fully informed.

Each of these documents plays a vital role in comprehensive estate and personal planning. They ensure that your wishes are known and can be acted upon in various circumstances, from healthcare decisions to the distribution of your estate. Properly preparing and maintaining these documents is an essential part of managing your affairs and providing peace of mind for both you and your loved ones.

Similar forms

One document that bears resemblance to the Ohio Durable Power of Attorney (DPOA) form is the General Power of Attorney. Both documents grant an individual, known as the agent or attorney-in-fact, the authority to make decisions on behalf of the principal. However, a DPOA remains effective even if the principal becomes incapacitated, while a General Power of Attorney typically does not.

Another similar document is the Medical Power of Attorney. This, like the DPOA, allows an individual to appoint someone to make decisions on their behalf. The critical difference is in the scope; a Medical Power of Attorney is specifically limited to healthcare decisions, whereas a DPOA can encompass a broader range of decisions including financial and legal matters, depending on how it is drafted.

The Living Will is another document related to the DPOA, especially in the context of healthcare decisions. While a DPOA appoints an agent to make healthcare decisions when the principal is incapacitated, a Living Will provides direct instructions on life-sustaining treatment preferences. Essentially, the Living Will speaks for the patient when they cannot make their wishes known, without appointing a specific intermediary.

A similar yet distinct document is the Limited Power of Attorney. Like the DPOA, it allows an individual to appoint an agent to act on their behalf. The difference lies in the scope; a Limited Power of Attorney grants the agent power for a specific task or for a limited time, unlike the broad and enduring authority typically granted in a DPOA.

The Trust is another legal instrument that shares commonalities with the DPOA, particularly in estate planning. Both allow for the management of the principal's affairs. However, a Trust involves transferring assets into a legal entity to be managed by a trustee, whereas a DPOA assigns an agent to manage the principal's affairs directly, without transferring assets into a separate entity.

The Advanced Healthcare Directive, often considered in conjunction with a Medical Power of Attorney, is also related to the DPOA focused on healthcare. It combines the features of a Living Will and a Medical Power of Attorney by both appointing a healthcare agent and specifying treatment preferences. It’s a comprehensive approach to planning for medical decisions if the person is unable to communicate their wishes.

Finally, the Springing Power of Attorney shares a triggering mechanism concept with some DPOAs. It only comes into effect upon the occurrence of a specified event, usually the incapacity of the principal. While a DPOA can be effective immediately upon signing, or springing, based on the terms set out in the document, the Springing Power of Attorney by definition does not activate until the defined condition is met.

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it's crucial to approach the task with care and precision. This legal document grants someone else the power to make important decisions on your behalf, so accuracy is key. Below are the lists of dos and don'ts to help guide you through the process.

Things You Should Do

- Read the form thoroughly to understand what powers you are granting and under what circumstances they can be exercised.

- Choose a trustworthy person as your agent who will act in your best interests, making decisions as you would.

- Be specific about the powers you are granting to avoid any confusion or misuse of the authority given.

- Sign the form in the presence of a notary public to ensure its legality and enforceability.

- Inform your family members or other relevant parties about the existence of the form and where it can be found.

Things You Shouldn't Do

- Don't rush through the form without fully understanding the implications of each section.

- Don't choose an agent based solely on personal relationships without considering their ability to act responsibly and in your best interest.

- Don't leave any sections blank; if a section is not applicable, mark it as "N/A" to indicate it was not overlooked.

- Don't forget to update the form as circumstances change, such as if your chosen agent is no longer able or willing to serve in that role.

- Don't fail to consult with a legal professional if you have questions or concerns about the form or the process of granting a durable power of attorney.

Misconceptions

When it comes to understanding the Ohio Durable Power of Attorney (DPOA) form, there are several misconceptions that can lead to confusion. Clarifying these will help individuals make more informed decisions regarding their own estate planning and personal care.

- Only for the elderly: Many believe that a DPOA is only necessary for older adults. However, anyone over the age of 18 can benefit from having a DPOA in place. It ensures that someone can manage your affairs if you become unable to do so yourself due to any reason.

- Immediate loss of control: There's a common misconception that once you sign a DPOA, you immediately lose control over your decisions and assets. This isn't true. As long as you are competent, you retain control over all your decisions and can revoke or amend the DPOA at any time.

- Complex and expensive to create: Some people think that creating a DPOA is a complex and costly process that requires an attorney. While legal advice is beneficial, especially for complicated estates, Ohio provides statutory forms that individuals can complete on their own. However, consulting with a professional can ensure that the form accurately reflects your wishes.

- Covers medical decisions: There's a mistaken belief that the DPOA covers healthcare decisions. In Ohio, financial and healthcare decisions are separate; a Durable Power of Attorney for Health Care is needed to authorize someone to make medical decisions on your behalf.

- Valid in all states: People often think that a DPOA created in Ohio will automatically be valid in all other states. While many states do recognize out-of-state DPOAs, there can be specific requirements or additional forms in other jurisdictions. It's advisable to check the requirements of the state in which you will be using the DPOA.

- Only for the terminally ill or incapacitated: The assumption that a DPOA is only for those who are terminally ill or already incapacitated is incorrect. In reality, a DPOA is a proactive measure that addresses the possibility of future incapacity. It is an essential part of planning for the unexpected, regardless of your current health status.

Understanding these misconceptions about the Ohio Durable Power of Attorney form can help ensure that individuals are better prepared to manage their affairs and make informed decisions about their future needs and care.

Key takeaways

The Ohio Durable Power of Attorney form is an essential legal document that allows an individual to appoint another person to make decisions on their behalf, should they become unable to do so. Understanding the core aspects of filling out and using this form can ensure that the document reflects the principal's wishes accurately and is executed correctly. Here are four key takeaways to consider:

- Choose the right agent: The selection of an agent, also known as an attorney-in-fact, is a critical decision. This person should be someone the principal trusts implicitly, as they will have the authority to make financial, legal, and sometimes health-related decisions on their behalf. Careful consideration should be given to the agent’s ability to act responsibly and in the principal’s best interest.

- Be specific about powers granted: The form allows the principal to specify exactly what powers the agent will have. These can range from managing bank accounts to selling property. It’s important to be as detailed as possible to avoid any ambiguity regarding the agent's authority.

- Understand the durability aspect: The term "durable" in context means that the power of attorney remains in effect even if the principal becomes incapacitated. This is crucial for ensuring that the agent can act when needed most, without the necessity of court intervention.

- Follow Ohio laws for signing and witnessing: For a Durable Power of Attorney to be legally binding in Ohio, it must be signed by the principal and be witnessed by two non-related adults or notarized. Ohio law may have specific requirements regarding notarization and witnessing, so it's vital to understand these rules to ensure the form is executed correctly.

More Durable Power of Attorney State Forms

Durable Power of Attorney Michigan - This legal document grants a chosen representative the authority to handle transactions, manage businesses, and make decisions regarding the principal's assets.

Power of Attorney California Form - An authorization that distinctly allows selected individuals to carry out duties across various affairs.