Fillable Durable Power of Attorney Document for North Carolina

In the realm of legal planning, preparing for the unexpected is a prudent step that everyone should consider. Among the essential tools for such preparation is the North Carolina Durable Power of Attorney form, a legal document that empowers an individual to act on another’s behalf in various financial and legal matters, should the latter become unable to do so. This form, recognized specifically within the state of North Carolina, outlines the authority given to an appointed agent, ensuring that personal affairs can be managed effectively even in times of incapacity. It is different from other types of power of attorney documents as it remains in effect even if the person who granted it becomes incapacitated. It is critically important for residents to understand the nature of the powers granted, the process of choosing an appropriate agent, and the legal requirements for execution to ensure the document’s validity. The durability of this power of attorney makes it a key component of a well-rounded estate plan, providing peace of mind and continuity in the management of one’s affairs.

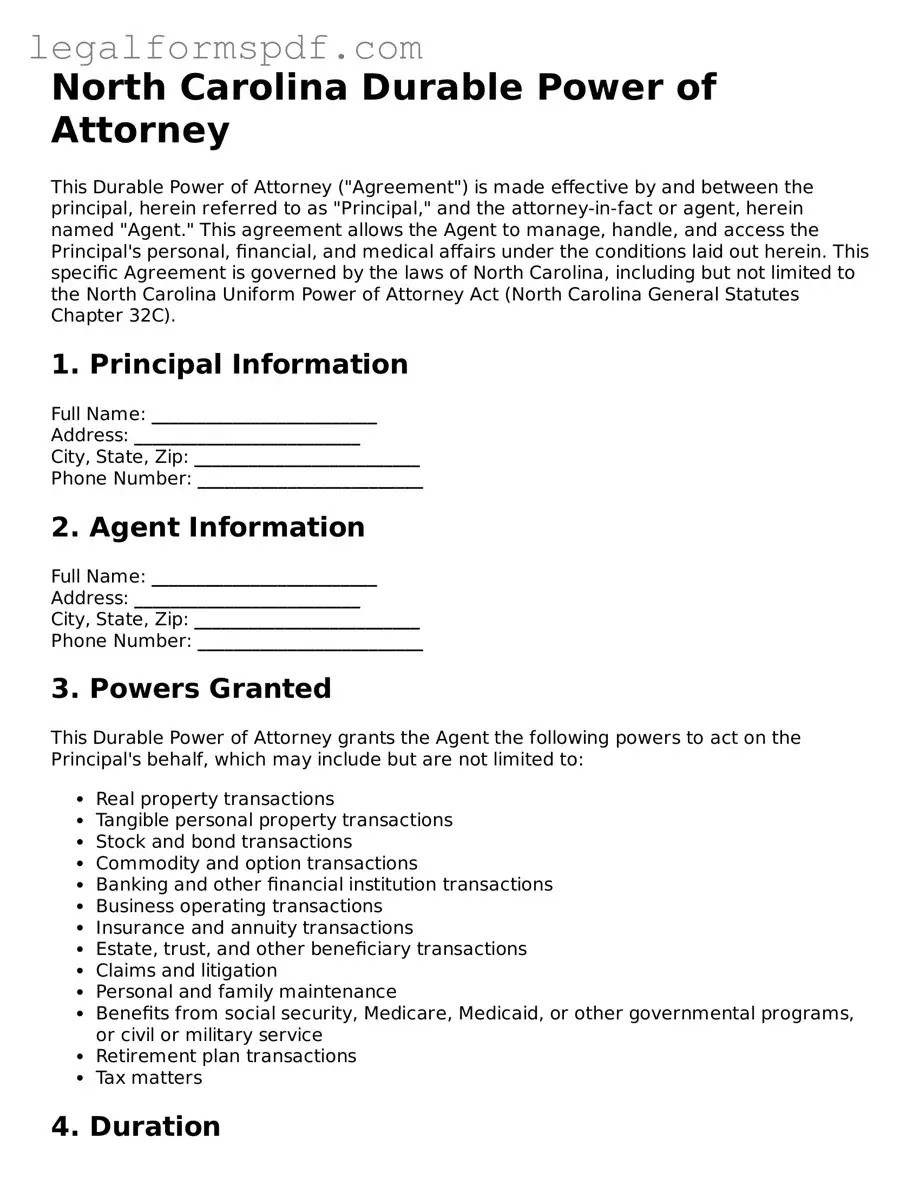

Document Example

North Carolina Durable Power of Attorney

This Durable Power of Attorney ("Agreement") is made effective by and between the principal, herein referred to as "Principal," and the attorney-in-fact or agent, herein named "Agent." This agreement allows the Agent to manage, handle, and access the Principal's personal, financial, and medical affairs under the conditions laid out herein. This specific Agreement is governed by the laws of North Carolina, including but not limited to the North Carolina Uniform Power of Attorney Act (North Carolina General Statutes Chapter 32C).

1. Principal Information

Full Name: _________________________

Address: _________________________

City, State, Zip: _________________________

Phone Number: _________________________

2. Agent Information

Full Name: _________________________

Address: _________________________

City, State, Zip: _________________________

Phone Number: _________________________

3. Powers Granted

This Durable Power of Attorney grants the Agent the following powers to act on the Principal's behalf, which may include but are not limited to:

- Real property transactions

- Tangible personal property transactions

- Stock and bond transactions

- Commodity and option transactions

- Banking and other financial institution transactions

- Business operating transactions

- Insurance and annuity transactions

- Estate, trust, and other beneficiary transactions

- Claims and litigation

- Personal and family maintenance

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or civil or military service

- Retirement plan transactions

- Tax matters

4. Duration

This Durable Power of Attorney is effective immediately upon the signing of the Principal and shall remain in effect indefinitely unless it is revoked by the Principal or upon the death of the Principal.

5. Signature of Principal

Signed this ____ day of ______________, 20__.

Principal Signature: _________________________

Print Name: _________________________

6. Signature of Agent

I, the undersigned, accept the powers granted to me as specified in this Durable Power of Attorney, effective as of the date signed by the Principal.

Signed this ____ day of ______________, 20__.

Agent Signature: _________________________

Print Name: _________________________

7. Acknowledgment and Notarization

This section will facilitate the notarization of the document, affirming the identities of the Principal and Agent, and ensuring that the Principal signs this document willingly and under no duress.

8. Acceptance by Agent

I accept this appointment and agree to serve as agent, acting in the Principal's best interest and in accordance with all applicable laws and this Durable Power of Attorney.

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The North Carolina Durable Power of Attorney form allows an individual to appoint someone else to manage their financial affairs. |

| 2 | It remains effective even if the principal becomes mentally incapacitated. |

| 3 | The form must be signed in the presence of a notary public to be legally valid. |

| 4 | Governing laws for the form are found in Chapter 32C of the North Carolina General Statutes, which covers the North Carolina Uniform Power of Attorney Act. |

| 5 | The appointed agent is granted wide-ranging powers, which can include handling banking transactions, real estate matters, and tax matters, among others. |

| 6 | Principals have the flexibility to tailor the agent's powers according to their specific needs and preferences. |

| 7 | The form can only be revoked by the principal through a written document or by creating a new Power of Attorney form. |

| 8 | It is recommended that principals notify any financial institutions and third parties of the Power of Attorney's revocation to prevent further unauthorized actions by the agent. |

Instructions on Writing North Carolina Durable Power of Attorney

Filling out the North Carolina Durable Power of Attorney form is a significant step in planning for one’s future, ensuring that personal, financial, and business needs are attended to by a trusted individual when you are unable to do so yourself. This document allows you to appoint a person, known as an agent, to make important decisions on your behalf. Getting it right is crucial, so here’s a straightforward, step-by-step guide to help you through the process, void of the complicated legal jargon, to make your experience as smooth as possible.

- Begin by reading through the entire form carefully to understand its scope and implications. Familiarize yourself with the terminologies used such as "principal," "agent," and "durable power."

- Enter your full legal name and address in the designated space at the top of the form, establishing you as the principal.

- Identify the person you choose as your agent by writing their full legal name and address in the specified section. It is crucial that this person is trustworthy and capable of handling your affairs.

- For the alternate agent section, if you choose to appoint one, repeat the previous step with the information of an alternate individual who can act if your primary agent is unable or unwilling to serve.

- Clearly specify the powers you are granting to your agent. This can range from financial decisions, property transactions, to business operations. Be as detailed as necessary to ensure there’s no ambiguity regarding the agent’s authority.

- If there are specific powers that you do not wish to delegate, list these exceptions clearly on the form to restrict your agent’s authority in those areas.

- Date the document. The date is crucial as it marks the moment from which the document is effective and your agent's authority becomes valid.

- Sign the form in front of a notary public to validate the document. The presence of a notary ensures that there's a legal witness to your signature, confirming your identity and your willingness to grant these powers to the named agent.

- Make sure your agent and any alternate agents sign the document as well, acknowledging their acceptance of the duties and responsibilities assigned to them. This step is often overlooked, but it’s essential for the document’s validity.

- Finally, store the completed and signed document in a safe but accessible place. Inform your agent and a close family member or friend of the location. It’s also advisable to keep a digital copy for backup.

Always remember, the North Carolina Durable Power of Attorney is a powerful document that should be completed with precision and care. Taking the time to accurately fill out each section ensures that your wishes are clearly communicated and will be followed. If at any point you feel unsure about the process, consider seeking legal advice to ensure that your bases are covered. Remember, preparing today can significantly impact your peace of mind and future well-being.

Understanding North Carolina Durable Power of Attorney

What is a Durable Power of Attorney form in North Carolina?

A Durable Power of Attorney form in North Carolina is a legal document that lets you appoint someone you trust (referred to as your agent) to manage your affairs, especially financial matters, if you become unable to make decisions for yourself. The "durable" nature means that the document remains in effect even if you become incapacitated.

Who should have a Durable Power of Attorney?

Any adult who wants to ensure that their affairs can be handled by someone they trust in case they become unable to do so themselves should consider having a Durable Power of Attorney. It's particularly important for individuals with complex financial matters or those in declining health.

How do I choose an agent for my Durable Power of Attorney?

When choosing an agent, it's crucial to select someone who is trustworthy, reliable, and capable of handling financial decisions responsibly. This person could be a spouse, adult child, friend, or even a professional like an attorney. Make sure that the individual you choose is willing to take on this responsibility and understands your wishes.

What powers can I grant to my agent?

In North Carolina, the powers you can grant to your agent can be broad or specific, depending on your preferences. This can include managing bank accounts, paying bills, investing money, handling real estate transactions, and making financial decisions on your behalf. However, you can customize the powers to include any specific wishes or limitations you desire.

Is a Durable Power of Attorney form in North Carolina revocable?

Yes, as long as you are mentally competent, you can revoke or change your Durable Power of Attorney at any time. To do this, you should notify your agent in writing and retrieve all copies of the document, plus inform any institutions or individuals that were aware of its existence.

Do I need a lawyer to create a Durable Power of Attorney in North Carolina?

While not strictly required, consulting with a lawyer to create a Durable Power of Attorney is highly recommended. A lawyer can ensure that the document clearly outlines your wishes, complies with North Carolina laws, and addresses any specific concerns or complexities in your situation. They can also offer advice on selecting your agent.

How do I execute a Durable Power of Attorney so it's legally valid in North Carolina?

To execute a Durable Power of Attorney in North Carolina, you must sign the document in the presence of a notary public. It's also recommended to have witnesses present who can attest to your signature and mental competency, though not legally required.

What if my agent is unable or unwilling to serve?

If your initially chosen agent is unable or unwilling to serve, it's a good practice to have named a successor agent in your Durable Power of Attorney document. If no successor is named and your agent cannot serve, you may need to go through the courts to have a guardian or conservator appointed.

Can a Durable Power of Attorney be used to make healthcare decisions?

No, a Durable Power of Attorney in North Carolina is generally used for financial management and does not grant authority to make healthcare decisions. For healthcare decisions, you should consider establishing a Healthcare Power of Attorney or a Living Will.

What happens if I don't have a Durable Power of Attorney and I become incapacitated?

If you become incapacitated without a Durable Power of Attorney in place, your family members or loved ones may have to petition the court to appoint a guardian or conservator to make decisions on your behalf. This process can be time-consuming, costly, and stressful for your loved ones.

Common mistakes

Filling out a North Carolina Durable Power of Attorney form requires attentiveness and understanding of its implications. However, individuals often make mistakes that can undermine the document's effectiveness or even render it invalid. One common mistake is neglecting to specify the scope of authority granted to the attorney-in-fact. Without clear limits or definitions, it may lead to confusion or misuse of power.

Another frequent error is failing to designate an alternate attorney-in-fact. Life circumstances can change, and if the initially chosen attorney-in-fact is unable to fulfill their duties, having no alternative can create a legal vacuum. This oversight can significantly delay necessary actions on behalf of the principal.

Many also make the mistake of not having the document properly witnessed or notarized, as required by North Carolina law. This critical step ensures the document's legality and may prevent it from being challenged in the future. Without proper witnessing and notarization, the document might be considered invalid.

Overlooking the need to regularly update the document is another common error. As life changes occur, such as marriage, divorce, or the death of a designated attorney-in-fact, the document needs to reflect current wishes and circumstances. Failing to update it can lead to complications or it not working as intended.

A significant number of individuals mistakenly believe that once the form is signed, it cannot be revoked. However, as long as the principal is of sound mind, they can revoke or amend the Durable Power of Attorney at any time. Not knowing this can result in people feeling trapped by decisions made in the past.

Some people incorrectly fill out the form without consulting a legal professional. This mistake can lead to misunderstandings about the legal terms and implications of the document. A professional can provide valuable advice tailored to the individual's specific situation.

Another error is assuming that the Durable Power of Attorney covers healthcare decisions. In North Carolina, healthcare decisions require a separate document, known as a Healthcare Power of Attorney. This misunderstanding may leave individuals without the necessary legal documents to make healthcare decisions on their behalf.

Finally, a common mistake is not communicating the specifics of the Durable Power of Attorney to the appointed attorney-in-fact. Failure to discuss the scope of authority, duties, and the principal's wishes can lead to mismanagement or inaction when action is required.

Documents used along the form

When managing personal affairs, especially for future planning, it's common to focus solely on a Durable Power of Attorney (DPOA) form. However, this critical document is often just one part of a comprehensive legal toolkit. In North Carolina, alongside a DPOA, several other forms are essential in ensuring one's wishes are honored across different scenarios. By including these additional documents, individuals can provide a clear, broad directive for their care and the management of their assets. Here are five key forms that are frequently used in conjunction with the North Carolina Durable Power of Attorney form.

- Health Care Power of Attorney: This document allows an individual to designate another person to make decisions about their health care should they become unable to do so themselves. Unlike the DPOA, which often focuses on financial decisions, the Health Care Power of Attorney is specifically designed to address medical treatment and health care decisions.

- Living Will: Also known as an Advance Directive, this document outlines an individual's wishes regarding end-of-life care. It activates only under specific circumstances, such as terminal illness or permanent unconsciousness, directing medical professionals on whether or not to extend life through medical interventions.

- Last Will and Testament: This essential document goes into effect after one's death, detailing how they wish their estate to be distributed among heirs and beneficiaries. It may also appoint a guardian for minor children and specify funeral arrangements, complementing the directives laid out in a Durable Power of Attorney.

- Declaration for Mental Health Treatment: Specific to mental health decisions, this document outlines preferences for treatment in the event the individual cannot make decisions due to mental illness. It can specify consent or refusal for particular types of medications, therapies, or hospitalizations.

- Revocation of Power of Attorney: While not a planning document itself, this form is essential as it allows an individual to cancel a previously granted Durable Power of Attorney. It is crucial for maintaining control over one's affairs and ensuring that the designated agent's authority remains aligned with the individual's current wishes.

Each of these documents plays a vital role in a well-rounded legal and personal planning strategy. The Durable Power of Attorney form for financial affairs, paired with these additional documents, ensures that an individual's wishes regarding health, mental health, end-of-life care, and the distribution of their estate are clearly expressed and legally binding. By comprehensively addressing these aspects, one can achieve peace of mind for themselves and provide clear guidance for their loved ones.

Similar forms

The North Carolina Durable Power of Attorney form is similar to a General Power of Attorney form in that they both allow individuals to appoint someone else to manage their affairs. However, the durable version remains in effect even if the principal becomes incapacitated, whereas a General Power of Attorney does not.

Comparable to the Medical Power of Attorney, the Durable Power of Attorney in North Carolina grants authority to an agent. While the Durable Power of Attorney covers a broad range of actions including financial decisions, the Medical Power of Attorney is specifically designated for health care decisions when the principal cannot make those decisions themselves.

Like the Limited Power of Attorney, the Durable Power of Attorney authorizes an agent to act on the principal's behalf. The difference lies in the scope of authority granted; the Limited Power of Attorney is for specific tasks or time periods, whereas the durable form provides broad and enduring powers.

The Springing Power of Attorney shares a unique feature with the Durable Power of Attorney: it becomes effective under certain conditions, such as the incapacitation of the principal. However, unlike the durable form which is effective immediately upon execution, the springing version only takes effect upon the occurrence of specified conditions.

Similar to a Financial Power of Attorney, the North Carolina Durable Power of Attorney allows an individual to manage another’s financial matters. While both give financial authority, the durable variant ensures the agent can continue to act even if the principal becomes incapacitated.

The Durable Power of Attorney and the Revocable Living Trust both allow for the management of a person’s affairs without court intervention. However, a Durable Power of Attorney appoints an agent to make decisions, while a Revocable Living Trust involves transferring assets into a trust to be managed by a trustee.

Similar to an Advance Healthcare Directive, the Durable Power of Attorney can include provisions for healthcare decisions. The difference is that an Advance Healthcare Directive can specifically contain a living will, outlining wishes for medical treatment, in addition to appointing a healthcare agent.

The Durable Power of Attorney is akin to a Guardianship or Conservatorship arrangement in its purpose to manage the affairs of someone who cannot do so themselves. However, these are court-appointed roles following a legal process, offering a significant distinction in terms of establishment and oversight.

Comparable to a Real Estate Power of Attorney, the Durable Power of Attorney could include the power to handle real estate transactions. The main difference is that the Durable Power of Attorney is not limited to real estate matters and can encompass a wider array of powers.

Similarly, the Business Power of Attorney allows for the handling of business-related decisions on someone else’s behalf, a function that can also be included within the scope of a Durable Power of Attorney. The notable distinction is that a Durable Power of Attorney doesn’t limit the agent’s powers solely to business activities.

Dos and Don'ts

When completing the North Carolina Durable Power of Attorney form, individuals should be mindful of the following dos and don'ts to ensure the document is legally effective and accurately reflects their wishes.

- Do read the entire form carefully before starting to fill it out. This ensures that you understand every section and how it applies to your situation.

- Do consider consulting with a legal professional to ensure that the form meets all legal requirements in North Carolina and truly represents your interests.

- Do be clear and specific about the powers you are granting. This helps in avoiding any ambiguity regarding your agent's authority.

- Do choose a trusted individual as your agent, someone who has your best interests at heart and whom you believe will carry out your wishes faithfully.

- Don't leave any sections blank unless the form specifically instructs you to do so. Incomplete information can lead to confusion or challenges to the document's validity.

- Don't use vague language. Clarity and specificity are crucial in legal documents to prevent misunderstandings.

- Don't forget to sign and date the form in front of a notary public, as this step is essential for the document to be legally binding.

- Don't neglect to inform the agent about their appointment. Ensure they understand their duties and agree to take on the responsibility.

Misconceptions

Understanding the North Carolina Durable Power of Attorney form is critical, as misconceptions can lead to significant legal and personal complications. Here are six common misunderstandings:

A Durable Power of Attorney and a Will are the same. This is not true. A will becomes effective upon death, distributing one's estate as directed. In contrast, a Durable Power of Attorney allows a designated individual to make decisions on behalf of the person while they are still alive, ceasing to operate upon death.

It grants immediate control over all aspects of the individual's life. The truth is, the powers can be as broad or as limited as the person decides. They can specify what decisions the Attorney-in-Fact can make, such as financial, legal, or healthcare decisions.

The appointed Attorney-in-Fact can make decisions after the person’s death. This is incorrect. The authority of the Attorney-in-Fact ends upon the death of the person who granted it. After death, the executor of the will or state laws will guide the disposition of the estate.

Creating a Durable Power of Attorney means losing all personal control. Many believe that once signed, they relinquish all control over their affairs. However, as long as the person is capable, they retain full control and can revoke or change the Durable Power of Attorney at any time.

Only elderly people need a Durable Power of Attorney. This misconception fails to acknowledge that accidents or sudden illnesses can happen at any age, making it prudent for adults of all ages to prepare a Durable Power of Attorney.

Any form found online will suffice. While templates are available, North Carolina has specific requirements that might not be met by a generic form. It is crucial to use a form that complies with state laws or risk the document being invalid.

Each of these misconceptions underscores the importance of obtaining accurate information and legal advice when considering the creation of a Durable Power of Attorney. It is an essential tool for financial and health care planning, but it must be approached with careful thought and legal guidance.

Key takeaways

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to manage your financial affairs if you are unable to do so. When preparing and using the North Carolina Durable Power of Attorney form, consider the following key points:

- Understand the purpose: A DPOA allows your appointed agent to make financial decisions on your behalf, which becomes especially crucial if you are incapacitated.

- Choosing an agent: Select someone you trust implicitly, as they will have significant control over your financial matters. This person could be a family member, friend, or trusted advisor.

- Be specific: Clearly outline the powers you are granting to your agent. These can range from managing daily expenses to making decisions about real estate and investments.

- Durability: Unlike a general Power of Attorney, a Durable Power of Attorney remains in effect if you become incapacitated. This is a critical feature that ensures continued management of your affairs without court intervention.

- Signing requirements: For the document to be valid in North Carolina, it must be signed in the presence of a notary public. Some counties may have additional requirements, such as witness signatures.

- Revocation: You have the right to revoke or change your DPOA at any time, as long as you are mentally competent. This should be done in writing and communicated to your agent and any institutions that were relying on the original DPOA.

- Notification: Inform relevant parties—such as your bank, financial advisors, and family members—about the DPOA and your appointed agent.

- Legal guidance: While North Carolina provides a statutory DPOA form, consulting with a legal professional can ensure that the document meets your specific needs and circumstances.

- Records: Keep a copy of the DPOA in a safe but accessible place. Provide your agent with a copy or inform them of where to locate it if needed.

- State-specific laws: Be aware that DPOA laws and requirements can vary by state. The North Carolina form is designed to comply with state law, but if the agent will need to act on your behalf in another state, check that state's requirements as well.

Remember, creating a Durable Power of Attorney is a formidable step in managing your future financial health. Ensure it reflects your wishes by carefully selecting your agent and specifying their powers. Regularly review and update it as your circumstances change.

More Durable Power of Attorney State Forms

How to File for Power of Attorney in Florida - Without this form, your loved ones may have to go through a lengthy court process to manage your affairs if you become incapacitated.

Does a Power of Attorney Need to Be Notarized in Ohio - This legal form offers a safety net, ensuring critical financial matters are not left unattended if you are suddenly unable to manage them.

New York Statutory Power of Attorney - The agent in a Durable Power of Attorney takes on a fiduciary role, meaning they must act in your best financial interest at all times.