Fillable Durable Power of Attorney Document for New York

In New York, preparing for the future involves making important legal decisions, one of which includes the creation of a Durable Power of Attorney (DPOA). This powerful document allows individuals to appoint someone they trust to manage their financial affairs in the event they become unable to do so themselves, due to illness or incapacity. It's designed to offer peace of mind, ensuring that personal and business matters can be handled according to the individual’s wishes, even when they're not in a position to make decisions. Unlike other forms of power of attorney, the durable variant remains in effect even if the person who made it loses their mental capacity. Because of this enduring nature, selecting the right agent – someone who is both trustworthy and competent – is a critical decision. The form itself covers various aspects, from real estate transactions to handling financial and legal affairs, and it requires thorough consideration and precise completion to ensure it accurately reflects the creator’s intentions. Proper execution, including notarization, is also essential for the document to be recognized legally in the state of New York.

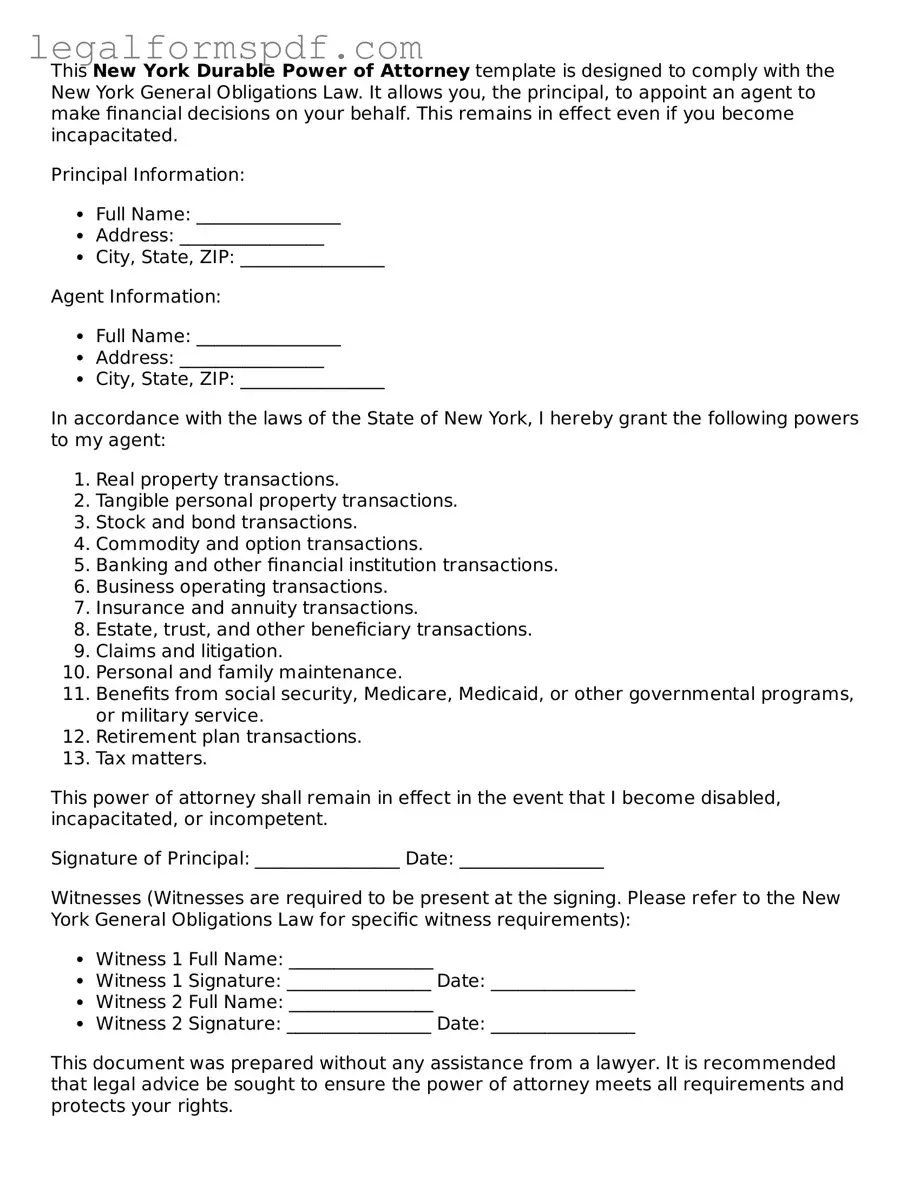

Document Example

This New York Durable Power of Attorney template is designed to comply with the New York General Obligations Law. It allows you, the principal, to appoint an agent to make financial decisions on your behalf. This remains in effect even if you become incapacitated.

Principal Information:

- Full Name: ________________

- Address: ________________

- City, State, ZIP: ________________

Agent Information:

- Full Name: ________________

- Address: ________________

- City, State, ZIP: ________________

In accordance with the laws of the State of New York, I hereby grant the following powers to my agent:

- Real property transactions.

- Tangible personal property transactions.

- Stock and bond transactions.

- Commodity and option transactions.

- Banking and other financial institution transactions.

- Business operating transactions.

- Insurance and annuity transactions.

- Estate, trust, and other beneficiary transactions.

- Claims and litigation.

- Personal and family maintenance.

- Benefits from social security, Medicare, Medicaid, or other governmental programs, or military service.

- Retirement plan transactions.

- Tax matters.

This power of attorney shall remain in effect in the event that I become disabled, incapacitated, or incompetent.

Signature of Principal: ________________ Date: ________________

Witnesses (Witnesses are required to be present at the signing. Please refer to the New York General Obligations Law for specific witness requirements):

- Witness 1 Full Name: ________________

- Witness 1 Signature: ________________ Date: ________________

- Witness 2 Full Name: ________________

- Witness 2 Signature: ________________ Date: ________________

This document was prepared without any assistance from a lawyer. It is recommended that legal advice be sought to ensure the power of attorney meets all requirements and protects your rights.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A New York Durable Power of Attorney (DPOA) allows an individual, known as the principal, to appoint someone they trust, known as the agent, to manage their financial affairs and make decisions on their behalf, especially in the instance where they become incapacitated. |

| Governing Law | The New York General Obligations Law, Article 5, Title 15 (Sections 5-1501 to 5-1514) governs the creation and use of Durable Powers of Attorney in New York State. |

| Revocation | The principal has the right to revoke their Durable Power of Attorney at any time as long as they are mentally competent to do so, through a written revocation notice to the agent and any third parties who were relying on the original DPOA. |

| Witnesses Requirement | For a Durable Power of Attorney to be legally valid in New York, it must be signed and dated by the principal in the presence of two adult witnesses who are not named as agents in the document. |

| Durability | The "durability" aspect means that the Power of Attorney remains effective even if the principal becomes physically or mentally incapacitated, ensuring that the agent can still act on behalf of the principal during such challenging times. |

| Statutory Short Form | New York provides a statutory short form for a Durable Power of Attorney and specific instructions on its execution in the New York General Obligations Law, aiming to simplify the process for individuals to grant powers to their chosen agent. |

Instructions on Writing New York Durable Power of Attorney

Filling out the New York Durable Power of Attorney form is a major step towards ensuring that your affairs can be handled in your absence or inability to make decisions. This form is a legal document that grants another person the authority to make decisions on your behalf. The process can feel daunting, but by breaking it down into manageable steps, it becomes much simpler. Whether you are planning for future contingencies or dealing with current necessities, completing this form correctly is crucial to ensure your wishes are followed.

- Start by gathering all necessary information, including the full legal names, addresses, and contact information for both the principal (you) and the agent(s) you are appointing.

- Download a current version of the New York Durable Power of Attorney form from a reputable source to ensure compliance with state law.

- Fill in the date the document is being executed (signed) at the top of the form.

- Enter the full legal name and address of the principal in the designated section.

- Input the full legal name(s) and address(es) of the agent(s) you are appointing in the respective fields.

- Specify the powers you are granting your agent. This step is pivotal: review each power carefully and initial next to the powers you are granting. If you wish to grant all powers listed, you may have an option to initial a single box indicating this choice.

- If applicable, detail any specific powers not explicitly listed on the form that you wish to grant to your agent in the section provided for special instructions.

- Decide on the durability of the Power of Attorney. A Durable Power of Attorney remains in effect even if you become incapacitated. Ensure that this section reflects your choice accurately.

- Review the section pertaining to the compensation of your agent, if any, and fill it in according to your agreement.

- Sign the form in the presence of a notary public. This is a crucial step, as the notarization legitimizes the document.

- Have the appointed agent(s) sign the form, if required by state law or your personal preference, acknowledging their acceptance of the responsibilities and powers you've granted them.

- Store the completed and notarized document in a safe but accessible place. Inform your agent(s) and perhaps a trusted third party where the document is stored.

Once your New York Durable Power of Attorney form is duly filled out and notarized, you've taken a significant step in estate planning, ensuring that your affairs can be appropriately handled without delay. Remember, laws can change, and individual situations can vary, so consider consulting with a legal professional if you have questions about your specific circumstances or if there are recent updates to the law that may affect your Power of Attorney.

Understanding New York Durable Power of Attorney

What is a Durable Power of Attorney form in New York?

A Durable Power of Attorney form in New York is a legal document that allows an individual (the principal) to designate another person (the agent) to make decisions and act on their behalf in various matters, including financial and legal issues. The term "durable" indicates that the document remains in effect even if the principal becomes incapacitated or unable to make decisions on their own.

Who should have a Durable Power of Attorney?

Any adult who wants to ensure that their affairs can be handled by someone they trust in case they become incapacitated or are unable to manage them on their own should consider having a Durable Power of Attorney. It's particularly important for individuals with complex financial matters, health concerns, or those approaching a stage in life where they may become more vulnerable to incapacity.

How can one create a Durable Power of Attorney in New York?

To create a Durable Power of Attorney in New York, the principal must complete the form by filling out their information and that of the designated agent. The document must clearly state that the principal intends for the power of attorney to be durable. It requires the signatures of the principal and the agent, in the presence of a notary public. Additionally, it must comply with all New York state legal requirements to be considered valid.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney in New York can be revoked at any time by the principal as long as they are mentally competent. The revocation must be done in writing, and the principal should inform the agent and any institutions or individuals that were relying on the previous Durable Power of Attorney of the revocation. It is advisable to also destroy all copies of the old Durable Power of Attorney document.

What happens if there is no Durable Power of Attorney in place and the individual becomes incapacitated?

If there is no Durable Power of Attorney in place and an individual becomes incapacitated, a court proceeding may be necessary to appoint a guardian or conservator to make decisions on behalf of the incapacitated person. This process can be lengthy, costly, and stressful for family members and may not result in the selection of a person whom the incapacitated individual would have chosen.

Common mistakes

Filling out a New York Durable Power of Attorney (POA) form involves making critical decisions that can significantly impact an individual's life and finances. One common mistake is not being specific enough about the powers granted. This document allows an individual (the principal) to grant another person (the agent) the authority to make decisions on their behalf. If the powers aren't clearly defined, it might result in the agent not having enough authority to act in certain situations or, conversely, having too much freedom, which could lead to abuse of power.

Another oversight is neglecting to appoint a successor agent. Life is unpredictable. If the initially designated agent is unable to perform their duties due to reasons like illness, relocation, or death, and no successor agent is named, the POA can become ineffective. This oversight can lead to the necessity of court intervention to appoint a new agent, which can be time-consuming and costly.

Additionally, many individuals fail to discuss their wishes and the specifics of the POA with their chosen agents. Communication is critical. Without a clear understanding of the principal's preferences, values, and specific directives, an agent might make decisions that are not in line with the principal’s wishes. This can lead to unintended financial or health-related outcomes that could have been avoided with thorough discussion.

Lastly, a significant mistake is not properly executing the document according to New York State laws. The durable POA form has specific signing and notarization requirements to be legally binding. Failure to correctly follow these procedures can render the document invalid. This simple oversight could lead to significant legal challenges, especially during times of crisis when the document is urgently needed.

Documents used along the form

When someone decides to create a Durable Power of Attorney in New York, it's often not the only document they need. A Durable Power of Attorney is crucial for allowing someone else to manage your affairs if you can't. But there are several other forms and documents commonly used alongside it to ensure comprehensive legal and medical planning. Each plays a vital role in securing one's personal, financial, and health-related interests.

- Last Will and Testament: This document outlines how someone wants their property and assets distributed after they pass away. It's essential for anyone looking to have control over their estate beyond their lifetime.

- Health Care Proxy: Similar to a Durable Power of Attorney but specific to medical decisions. This form allows someone to appoint a trusted person to make healthcare decisions on their behalf if they become unable to do so.

- Living Will: This document specifies an individual's wishes regarding medical treatments they want or do not want if they're unable to communicate. It helps guide healthcare providers and loved ones in critical care decisions.

- Revocable Living Trust: It allows individuals to manage their assets while they're alive and distribute them when they pass away, without the need for probate. It can be changed or terminated by the person who created it at any time.

- Financial Records Organizer: An organized compilation of one’s financial accounts, insurance policies, and other vital financial information. It's crucial for the appointed attorney-in-fact to know where to find all necessary documents quickly.

- Designation of Guardian: Should there be future incapacity, this document expresses an individual's preference for a guardian to look after their personal and property interests.

- Federal and State Tax Forms: Depending on the financial transactions carried out by the attorney-in-fact, there might be a need to file certain tax forms on behalf of the principal.

- Document of Gift: This form allows individuals to make gifts of their personal property or money, sometimes used as part of estate planning to decrease the size of the estate for tax purposes.

Together with a Durable Power of Attorney, these documents form a safety net, ensuring that an individual's wishes are respected and their affairs are in order, no matter what the future holds. It's a comprehensive approach to planning that can provide peace of mind to both the individuals involved and their loved ones.

Similar forms

The New York Durable Power of Attorney form shares similarities with the Health Care Proxy, in that both documents allow an individual to appoint someone else to make decisions on their behalf. The key difference lies in the scope of decisions each document covers: while the Durable Power of Attorney is focused on financial and legal matters, the Health Care Proxy is specifically designed for making health care decisions when the individual is unable to do so themselves.

Comparable to a Living Will, the Durable Power of Attorney also enables individuals to plan for future circumstances. A Living Will, however, is intended to communicate an individual’s wishes regarding medical treatment in end-of-life situations, not to grant decision-making power to another person. Both documents serve as crucial parts of a comprehensive life planning strategy.

A General Power of Attorney shares the principle of granting authority to another person, but it differs from a Durable Power of Attorney because it becomes invalid if the individual becomes incapacitated. This fundamental distinction makes the Durable Power of Attorney an essential tool for long-term planning.

Similar in purpose to a Trust, the Durable Power of Attorney allows for the management of an individual’s affairs. However, a Trust is typically used for estate planning, specifying how an individual’s assets should be handled and distributed upon their death or incapacitation. The Durable Power of Attorney focuses more on granting someone the authority to manage various aspects of the individual’s life and affairs in real time, including financial and legal matters.

The Limited Power of Attorney and the Durable Power of Attorney both enable someone to act on behalf of the grantor but differ in their scope and duration. A Limited Power of Attorney is often specific to certain tasks or for a fixed period, unlike the broader and enduring nature of the Durable Power of Attorney which remains effective even if the grantor becomes incapacitated.

Not unlike an Advance Directive, the Durable Power of Attorney plays a pivotal role in planning for the future. While the Advance Directive outlines specific healthcare wishes and may include a Living Will and a Health Care Proxy, the Durable Power of Attorney complements these by covering financial and legal decisions, thus providing a more comprehensive approach to future planning.

The Executor of a Will acts under the guidelines of the will, following someone’s passing. Similarly, a person appointed through a Durable Power of Attorney handles affairs as per the grantor's wishes, but their role is active while the individual is still alive, particularly if they are unable to make decisions themselves.

The Guardianship or Conservatorship documents, much like the Durable Power of Attorney, establish a legal mechanism for someone to manage the affairs of another. The primary distinction being that the appointment of a guardian or conservator usually requires a court process and is often implemented when the individual has not arranged for their own future representation through a Durable Power of Attorney.

Dos and Don'ts

Filling out a Durable Power of Attorney (POA) in New York is a crucial step in managing your affairs should you become unable to do so yourself. It's important to approach this task with care and diligence. Below, you'll find a list of dos and don'ts that guide you through the process of completing this important document.

Do:

- Read every section of the form thoroughly to ensure you understand the powers you are granting. This understanding is critical for making informed decisions.

- Choose an agent you trust implicitly. This person will have significant control over your affairs, so it's essential to pick someone who has your best interests at heart.

- Be specific about the powers you are granting. The more detailed you are, the less room there will be for interpretation or misuse of these powers.

- Consult with a lawyer if you have any doubts or questions. A professional can provide valuable advice tailored to your situation.

- Inform the person you've chosen as your agent about the responsibilities and powers you're giving them. It's important they understand and agree to their role.

- Sign the form in the presence of a notary public. This step is essential for the document to be legally binding.

- Keep the original document in a safe but accessible place, and inform your agent where it is stored.

Don't:

- Rush the process. Taking your time to fill out the form carefully can prevent issues later.

- Choose an agent based solely on relationship status. It's crucial that the person is responsible and capable of handling your affairs effectively.

- Forget to specify limitations or conditions for the use of your power of attorney. Setting boundaries can help protect your interests.

- Overlook the importance of periodic reviews. Your wishes and circumstances can change, so it's a good idea to revisit and potentially update the POA as needed.

- Ignore the need to discuss your decisions with family or other affected parties. Open communication can prevent conflicts and ensure everyone understands your choices.

- Sign without a witness or notary present, as this could potentially invalidate your document.

- Fail to provide copies to relevant parties, such as your chosen agent and financial institutions, as they will need to verify its authenticity.

Misconceptions

The New York Durable Power of Attorney form is a powerful and important legal document, but it's often misunderstood. Misconceptions can easily spread, leading to confusion about its purpose and implications. Let's clear up some of the most common misunderstandings:

It grants unlimited power. Many people believe that by signing a New York Durable Power of Attorney, they are giving away unlimited control over all their affairs. In reality, the scope of authority granted is clearly defined in the document itself, and the principal (the person who signs the power of attorney) can set limits on the kinds of decisions the agent can make.

It's effective immediately upon signing. While this can be true, it's not always the case. The document can be structured to become effective only upon the occurrence of a specific event, such as the principal's incapacitation. This is known as a "springing" power of attorney.

It's only for the elderly. People of all ages can benefit from having a Durable Power of Attorney. Accidents and sudden illnesses can happen to anyone, making it critical to have arrangements in place for managing one's affairs during incapacitation.

It overrides a will. Some think that a Durable Power of Attorney can change a person's will. However, the authority it grants ends upon the principal's death, at which point the will becomes the guiding document for the estate's management and distribution.

Any form will do. There's a misconception that any form grabbed off the internet will suffice. New York has specific requirements for what must be included in a Durable Power of Attorney for it to be valid, emphasizing the importance of using the state-specific form or consulting a legal professional.

It's irrevocable. Contrary to this belief, the principal can revoke a Durable Power of Attorney at any time as long as they are mentally competent. This revocation must be communicated to the agent and, ideally, to any institutions or parties relying on the document.

It allows the agent to make health care decisions. In New York, the Durable Power of Attorney is intended for financial or property matters. Health care decisions require a separate document, known as a Health Care Proxy.

Signing one means you no longer control your assets. Another common misconception is that once a Durable Power of Attorney is signed, the principal can no longer make decisions about their property or finances. In reality, the principal retains the ability to act on their own behalf, sharing authority with the agent rather than relinquishing it.

Understanding these misconceptions can help ensure that individuals are fully informed about their rights and the powers they are granting when they sign a New York Durable Power of Attorney. It's a crucial step in planning for the future, but it must be approached with clear knowledge and understanding.

Key takeaways

The New York Durable Power of Attorney (POA) form is a document that allows an individual (the principal) to legally designate another person (the agent) to make certain financial decisions and actions on their behalf. It is a powerful document that remains in effect even if the principal becomes incapacitated. Here are five key takeaways about filling out and utilizing this form:

- Understand the scope of authority: Before filling out the form, it's crucial to understand the extent of power you're granting to your agent. The POA can be as broad or as limited as you choose, covering actions like managing bank accounts, selling property, or making investment decisions.

- Choose the right agent: The agent you select will have significant control over your financial affairs, so it's important to choose someone who is trustworthy, reliable, and capable of handling these responsibilities. Consider their ability to act in your best interest and their willingness to serve.

- Clearly specify powers and limitations: When filling out the form, be as clear and precise as possible in defining what the agent is allowed to do. If certain areas of your finances or property should remain untouched, explicitly state these limitations in the document.

- Signing requirements: For the POA to be legally valid in New York, it must be signed by the principal, two witnesses, and notarized. The witnesses cannot be the agent or the notary. This process ensures that the principal’s signing is voluntary and authentic.

- Revocation process: Should you change your mind, it's possible to revoke the Power of Attorney at any time, as long as you're mentally competent. Revocation should be done in writing, and all parties involved, including any financial institutions or entities relying on the POA, should be notified.

Completing the New York Durable Power of Attorney form demands careful consideration and planning. It's not only about choosing an agent but also about specifying their powers with precision, understanding the legal requirements for its execution, and knowing how to revoke the document if necessary. This process ensures that your financial matters will be handled according to your wishes, even if you are unable to manage them personally.

More Durable Power of Attorney State Forms

Durable Power of Attorney Michigan - This document can specifically authorize the agent to manage retirement accounts, conduct tax matters, and engage in estate planning activities.

Texas Durable Power of Attorney - An essential component of a comprehensive estate plan, ensuring all financial bases are covered.

Power of Attorney California Form - An essential estate planning document that appoints an agent to act in a range of financial activities.

Durable Power of Attorney Form Pa - This document can be revoked or modified as long as you are mentally competent, allowing you the flexibility to adjust to changing circumstances or relationships.