Fillable Durable Power of Attorney Document for Illinois

Understanding the nuances of managing one's affairs, especially in unforeseen circumstances, can bring both peace of mind and legal clarity. In Illinois, the Durable Power of Attorney (DPOA) form serves as a critical tool, empowering individuals to designate someone they trust to handle their financial matters if they become incapacitated or unable to make decisions themselves. This legal document is built on the sturdy foundation of foresight, allowing for a seamless transition of decision-making power. The choice of an agent—a person entrusted with this significant responsibility—is governed by stringent legal criteria, ensuring that the selected individual has the requisite integrity and capability to act in the best interests of the principal. Furthermore, the form encompasses a broad spectrum of financial domains, from simple banking transactions to the more complex dealings of real estate and business operations. Its durability factor comes from the fact that it remains in effect even if the principal becomes incapacitated, unlike other forms of power of attorney. The intricacies of its drafting and the implications of its execution are thus paramount, casting a protective net over the principal's assets and ensuring their well-being is safeguarded during vulnerable times.

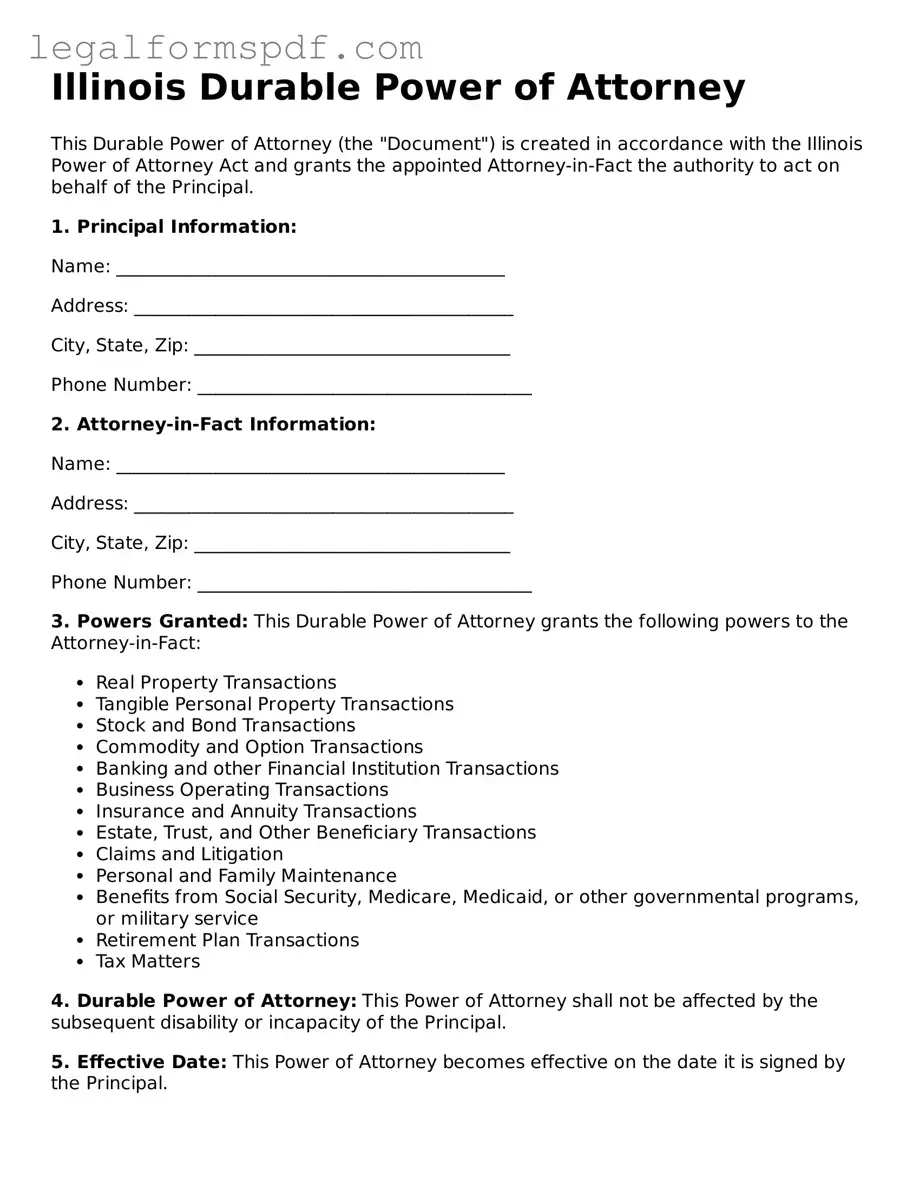

Document Example

Illinois Durable Power of Attorney

This Durable Power of Attorney (the "Document") is created in accordance with the Illinois Power of Attorney Act and grants the appointed Attorney-in-Fact the authority to act on behalf of the Principal.

1. Principal Information:

Name: ___________________________________________

Address: __________________________________________

City, State, Zip: ___________________________________

Phone Number: _____________________________________

2. Attorney-in-Fact Information:

Name: ___________________________________________

Address: __________________________________________

City, State, Zip: ___________________________________

Phone Number: _____________________________________

3. Powers Granted: This Durable Power of Attorney grants the following powers to the Attorney-in-Fact:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement Plan Transactions

- Tax Matters

4. Durable Power of Attorney: This Power of Attorney shall not be affected by the subsequent disability or incapacity of the Principal.

5. Effective Date: This Power of Attorney becomes effective on the date it is signed by the Principal.

6. Termination: This Power of Attorney will remain in effect until the Principal's death, revocation by the Principal, or until specified otherwise in this Document.

7. Principal Signature:

Date: _______________________________________

Signature: __________________________________

8. Attorney-in-Fact Signature:

Date: _______________________________________

Signature: __________________________________

9. Witnesses: (If required by jurisdiction)

- Name: _________________________________

- Name: _________________________________

Signature: _________________________________

Signature: _________________________________

10. Notarization (If required by jurisdiction)

This Document was acknowledged before me on ________ (date) by ____________________________ (name/s of Principal and/or Attorney-in-Fact).

Name of Notary: ____________________________________

Signature of Notary: _______________________________

Commission Expires: _______________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | A Durable Power of Attorney form in Illinois allows a person to designate another individual to make important decisions on their behalf regarding financial matters, especially when they are no longer able to do so themselves due to incapacity or disability. |

| Governing Law | The Illinois Power of Attorney Act (755 ILCS 45/) governs the creation and use of Durable Power of Attorney forms in Illinois. |

| Requirements | The form must be signed by the principal (the person granting the power), witnessed by at least one adult, and notarized in Illinois to be legally valid. |

| Durability | The "durability" feature signifies that the power of attorney remains in effect even if the principal becomes incapacitated or disabled. This is what differentiates a durable power of attorney from other types of power of attorney forms. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time as long as they are mentally competent. This revocation should be in writing and provided to any parties who were relying on the document, as well as to the agent appointed in the power of attorney. |

Instructions on Writing Illinois Durable Power of Attorney

When preparing to secure one's financial affairs, the Illinois Durable Power of Attorney stands out as a critical legal document. It authorizes someone you trust to manage your financial matters if you are unable to do so yourself. The significance of this document underscores the importance of filling it out meticulously and thoughtfully. The following steps are designed to guide you through this process with clarity and precision.

- Gather all necessary personal information, including the full legal names and addresses of the principal (the person granting the power) and the agent (the person receiving the power).

- Obtain the Illinois Durable Power of Attorney form. This form is available through legal services or online resources that provide state-specific legal forms.

- Read the form carefully to familiarize yourself with its contents and requirements. This step ensures you understand the powers you are granting and the scope of the document.

- Fill in the principal's name and address in the designated section at the top of the form.

- Enter the agent's name and address in the appropriate section, ensuring accuracy to avoid any potential legal issues.

- Specify the powers being granted to the agent. This section allows you to delineate which financial decisions the agent can make on your behalf. Be as detailed as necessary to clearly define the scope of authority.

- Look for any sections that require you to initial beside specific powers or decisions, indicating your explicit consent for those specified powers to be granted.

- If you wish to appoint a successor agent (someone who will take over should your first choice be unable or unwilling to serve), include this person’s full legal name and address in the designated section.

- Review the section about the effective date and duration of the power of attorney. Some forms allow the document to take effect immediately, while others may specify a triggering event, such as the principal’s incapacity.

- Sign and date the form in the presence of a notary public. The notarization process is essential as it validates the identity of the signer and certifies the signature.

- Have the form notarized. The notary will fill in their section, stamp, and sign the document.

- Distribute copies of the notarized document to relevant parties. These might include the agent, financial institutions, and family members, as appropriate.

Completing the Illinois Durable Power of Attorney is a forward-thinking step to ensure your financial affairs are in trusted hands. Once the form is properly filled out and notarized, you will have laid a foundational piece in safeguarding your future financial well-being. It’s advisable to store the original document in a secure place and inform the trusted individuals where it can be found if needed.

Understanding Illinois Durable Power of Attorney

What is a Durable Power of Attorney (DPOA) in Illinois?

A Durable Power of Attorney in Illinois is a legal document that allows an individual, known as the principal, to appoint another person, referred to as the agent, to make decisions on their behalf. This arrangement becomes particularly important if the principal becomes incapacitated or unable to make decisions for themselves. Unlike a general Power of Attorney, a Durable Power of Attorney remains in effect even if the principal becomes mentally incompetent or physically unable to make decisions.

How can one create a Durable Power of Attorney in Illinois?

To create a Durable Power of Attorney in Illinois, the principal must complete a specific form that complies with state laws. The document must clearly state the principal's intention for it to remain effective even in the event of their incapacitation. It should precisely define the powers granted to the agent. The form must be signed by the principal in the presence of a witness, and, depending on the powers granted, it may also need to be notarized to achieve legal validity.

Who should be chosen as an agent in a DPOA?

In selecting an agent for a Durable Power of Attorney, it is crucial to choose someone trustworthy and reliable, as this individual will have extensive control over the principal's affairs, potentially including financial and medical decisions. It is recommended to select an agent who understands the principal's wishes and values. Often, people choose a close family member or a long-time friend, but it can also be an attorney or another professional who has the requisite expertise and ethical grounding.

Can a Durable Power of Attorney be revoked in Illinois?

Yes, a Durable Power of Attorney can be revoked in Illinois at any time by the principal, as long as the principal is mentally competent. To revoke the document, the principal must notify the agent in writing. For added formality and to ensure all relevant parties are aware of the revocation, it is wise to also notify any institutions or organizations that may have been dealing with the agent under the authority of the DPOA. In some cases, a new Durable Power of Attorney may also be established to replace the previous arrangement.

What happens if the appointed agent in a DPOA is unable or unwilling to serve?

Should an agent in a Durable Power of Attorney become unable or unwilling to serve, the document can include provisions for successor agents. These successors can step in without any interruption in the continuity of authority. If no successors are named and the agent can no longer serve, it may become necessary for a court to appoint a guardian or conservator, a process that can be time-consuming and costly. Therefore, it is often a good practice to designate a successor agent in the original DPOA document.

Common mistakes

Filling out the Illinois Durable Power of Attorney (POA) form is a pivotal step in planning for future uncertainty. However, it's common to encounter mistakes during this process. One frequent error is not specifying the powers granted clearly. Without explicit instructions, the agent may not understand the extent of their authority, leading to confusion or misuse of power.

Another mistake is choosing an agent without sufficient deliberation. The role of an agent is crucial and requires someone trustworthy, reliable, and capable of making decisions that align with the principal’s wishes. Often, people select an agent based on their relationship rather than their ability to act responsibly in critical situations.

Failure to designate a successor agent is also a common oversight. Life is unpredictable, and if the original agent is unable to serve for any reason, having a successor ensures that the principal's affairs will still be managed as intended without unnecessary delays or court intervention.

Many individuals neglect to discuss their wishes with the agent they’ve chosen. Communication is key to ensuring that the agent fully understands their responsibilities and the principal’s expectations. This oversight can lead to decisions that may not reflect the principal’s true desires.

Omitting a date on the document is another simple yet significant error. The POA form becomes legally valid once it’s signed, but if there's no date, it may raise questions about its validity or the timing of the agent's authority.

Not tailoring the POA to individual needs is a mistake as well. The Illinois Durable Power of Attorney form allows for customization based on specific needs and preferences. A generic form may not adequately cover all aspects of one’s affairs, from healthcare decisions to financial management.

Last but not least, not having the form properly witnessed or notarized as required can invalidate the document. The requirements can vary, but usually involve witnesses who are not named as agents and an official notarization to confirm the identity of the signer. Overlooking these requirements can lead to a POA that is not legally enforceable.

To avoid these common errors, individuals should approach the filling of the Illinois Durable Power of Attorney form with care and thoroughness. Consulting legal advice to ensure that all aspects of the document are properly addressed can safeguard against future complications, ensuring that one's affairs are managed exactly as intended.

Documents used along the form

When preparing for future uncertainties, it's wise to consider more than just the Illinois Durable Power of Attorney form. This document allows someone you trust to handle your affairs if you become unable to do so. However, complementing this form with other legal documents can provide a more comprehensive approach to planning for the future. Here are four other forms and documents often used in conjunction with the Illinois Durable Power of Attorney form.

- Advance Healthcare Directive (Living Will): This document outlines your wishes regarding medical treatment if you become incapacitated and cannot communicate your healthcare preferences. It works in tandem with the Durable Power of Attorney, focusing on health care decisions.

- Last Will and Testament: A Last Will and Testament specifies how you want your assets distributed after your death. It also can appoint guardians for any minor children. This document ensures that your wishes are followed and can help prevent disputes among surviving family members.

- HIPAA Authorization Form: This form gives your health care providers permission to discuss your medical information with designated individuals, including the person holding your Durable Power of Attorney. It's essential for ensuring that your health proxy has access to the information needed to make informed decisions about your care.

- Revocable Living Trust: A trust allows you to manage your assets during your lifetime and specify how they are distributed upon your death, often bypassing the costly and time-consuming probate process. A Durable Power of Attorney can be designated to manage the trust if you become unable to do so.

Together, the Illinois Durable Power of Attorney and these additional documents create a robust plan that addresses a wide range of potential scenarios. This comprehensive approach can give you peace of mind, knowing that your preferences are documented and can be followed, even if you're unable to communicate them yourself.

Similar forms

The Illinois Durable Power of Attorney form is quite similar to a Living Will. A Living Will focuses specifically on an individual's health care preferences, especially regarding life-sustaining treatment when they are unable to communicate their wishes. It too grants a type of decision-making authority, but strictly within the scope of medical care and end-of-life decisions. This similarity lies in their shared goal of preparing for situations where one cannot express their desires due to incapacity.

A General Power of Attorney document also shares characteristics with the Illinois Durable Power of Attorney form. Unlike the durable variant, a General Power of Attorney usually becomes void if the principal becomes incapacitated. Both forms authorize someone else to act on your behalf, but the durable power remains effective even if the person granting it loses mental competency.

Similarly, a Healthcare Proxy is akin to the Illinois Durable Power of Attorney, but it is exclusively concentrated on healthcare decisions. It designates another person to make medical decisions for you if you are unable. Both documents are prepared with foresight, granting someone authority to act in your stead for personal matters or medical care during incapacity.

Another related document is the Limited or Special Power of Attorney. This document permits someone to act on your behalf but limits their authority to specific situations or tasks, like selling a property. It contrasts with the broad, enduring authority granted in the Illinois Durable Power of Attorney form but is similar in the concept of delegating decision-making powers.

The Advance Directive is another comparable document, combining elements of a Living Will and a Healthcare Proxy. It outlines your healthcare preferences and appoints someone to make healthcare decisions for you. This document shares with the Illinois Durable Power of Attorney the proactive approach to handling personal and medical decisions when you cannot.

Lastly, the Financial Power of Attorney has similarities, granting someone authority to handle your financial affairs. It can be durable or non-durable, but when it is durable, it closely resembles the Illinois Durable Power of Attorney in that it stays effective even if you become mentally incapacitated. These documents ensure that someone can manage your financial matters without court intervention.

Dos and Don'ts

When preparing the Illinois Durable Power of Attorney (POA) form, it's crucial to pay attention to detail to ensure your document is legally binding and reflects your wishes accurately. Below are essential do's and don'ts to consider:

Do's:- Read the form thoroughly before filling it out, to understand all sections and requirements.

- Use a black or blue pen if you are filling out the form by hand, ensuring legibility for all involved parties.

- Clearly identify the principal (person granting the power) and the agent (the person receiving the power) with full legal names and addresses.

- Specify the powers you are granting to your agent with as much detail as possible, to avoid any ambiguity or confusion.

- Have the form notarized, as it is required in Illinois for the POA to be considered valid.

- Discuss your wishes and any specifics of the POA with the chosen agent, ensuring they understand their responsibilities and agree to them.

- Keep a copy of the signed and notarized form in a safe place and distribute copies to relevant parties, such as your attorney, family members, or healthcare provider.

- Don't leave any sections blank; if a section does not apply, write "N/A" to indicate this.

- Don't use vague language when describing the powers being granted; specificity is key to an effective POA.

- Don't choose an agent without thoroughly considering their ability to act on your behalf in a responsible and trustworthy manner.

- Don't forget to specify any limitations or conditions under which the POA is effective, especially if you only want it to become active under certain circumstances.

- Don't sign the form without a notary or required witnesses present, as failing to meet signing requirements can invalidate the document.

- Don't fail to update the document as your situation changes or if you wish to appoint a different agent.

- Don't neglect to review state laws or consult with a legal professional if you have any questions or concerns regarding the POA.

Misconceptions

In discussions about planning for the future, the topic of a Durable Power of Attorney (POA) often arises, bringing with it a host of misconceptions, especially in the context of Illinois law. Clearing up these misunderstandings is crucial for effective planning and peace of mind.

Misconception 1: Setting up a Durable Power of Attorney is complex and costly.

Many think creating a Durable Power of Attorney involves convoluted legal procedures or high costs. In reality, Illinois has made the process straightforward. Forms are readily available, and while it’s wise to consult with an attorney for advice tailored to specific circumstances, the process need not be expensive or overly complicated.Misconception 2: A Durable Power of Attorney grants someone the right to do whatever they want with your assets.

Some fear that a Durable Power of Attorney allows the agent to act without restraint. However, in Illinois, the principal can set limitations within the document, specifying what the agent can and cannot do. Moreover, agents are legally obligated to act in the principal’s best interest, and there are legal mechanisms in place to deal with abuse.Misconception 3: A Durable Power of Attorney is only for the elderly.

While it's true that the elderly may have more immediate needs for a Durable Power of Attorney, accidents and sudden illnesses can happen to anyone at any time. Everyone, regardless of age, should consider setting one up as part of their overall contingency planning.Misconception 4: You can only name one person as your agent.

This is not the case. Illinois law allows for the appointment of more than one agent, either to act jointly in making decisions or separately, in which each can act independently of the other. This flexibility can be particularly useful for ensuring that the principal's affairs are managed efficiently.Misconception 5: Once set, a Durable Power of Attorney cannot be changed or revoked.

People often think that once a Durable Power of Attorney is established, it is set in stone. On the contrary, as long as the principal is mentally competent, they can amend or revoke their Durable Power of Attorney at any time to address changes in their situation or wishes.

Dispelling these misconceptions is key to understanding and utilizing the Durable Power of Attorney effectively, allowing individuals to make informed decisions that best suit their needs and preferences.

Key takeaways

Understanding how to correctly fill out and use the Illinois Durable Power of Attorney form is crucial for ensuring that your wishes are respected and your affairs are properly managed in case you are unable to do so yourself. Here are key takeaways to guide you through this process:

- Understand the purpose: The Illinois Durable Power of Attorney form allows you to appoint someone, known as an agent, to make financial decisions on your behalf. It's called "durable" because it remains effective even if you become incapacitated.

- Select your agent carefully: Choose someone you trust deeply as your agent. This person will have significant control over your financial matters, and it's crucial they act in your best interest.

- Be specific about powers: The form allows you to specify exactly which powers your agent will have. You can grant them broad authority or limit them to specific actions. It's important to tailor this to your personal needs.

- Consider appointing a successor agent: In case your first choice for agent is unable or unwilling to serve, having a successor agent named ensures there's no gap in managing your affairs.

- Sign in the presence of a notary: For your Illinois Durable Power of Attorney to be legally valid, you must sign it in front of a notary public. This formal step helps protect against fraud and misunderstandings.

- Keep it accessible: Once completed and notarized, keep the form in a safe but accessible place. Make sure your agent and a trusted family member or friend know where to find it if it becomes necessary to use.

Correctly filled out and understood, the Illinois Durable Power of Attorney is a powerful tool for managing your financial life, especially during times when you might not be able to do so yourself. Remember, laws can change, so it's wise to review your durable power of attorney periodically and consult with a legal professional to ensure it remains in compliance with current Illinois law.

More Durable Power of Attorney State Forms

New York Statutory Power of Attorney - The powers granted by a DPOA can be customized to meet your unique financial situation and needs.

How to File for Power of Attorney in Florida - It allows your agent to speak on your behalf with financial institutions, ensuring no disruption in your financial management.