Fillable Durable Power of Attorney Document for Georgia

In Georgia, the Durable Power of Attorney form stands as a crucial legal document, empowering individuals to designate another person, known as the agent, to make important decisions on their behalf. This extends to managing financial affairs, handling business transactions, and overseeing personal matters, especially in circumstances where they might not be able to do so themselves due to illness or incapacity. Notably, the 'durable' aspect ensures that the agent's authority remains in effect even if the principal becomes incapacitated, distinguishing it from other forms of power of attorney that may terminate under such conditions. Tailored to comply with Georgia law, this form requires specific language to establish its durability. Careful consideration and selection of a trustworthy agent are paramount, as the powers granted can be broad and far-reaching. The document must be properly completed, signed, and notarized to be effective, underscoring its significance in estate planning and personal preparedness strategies.

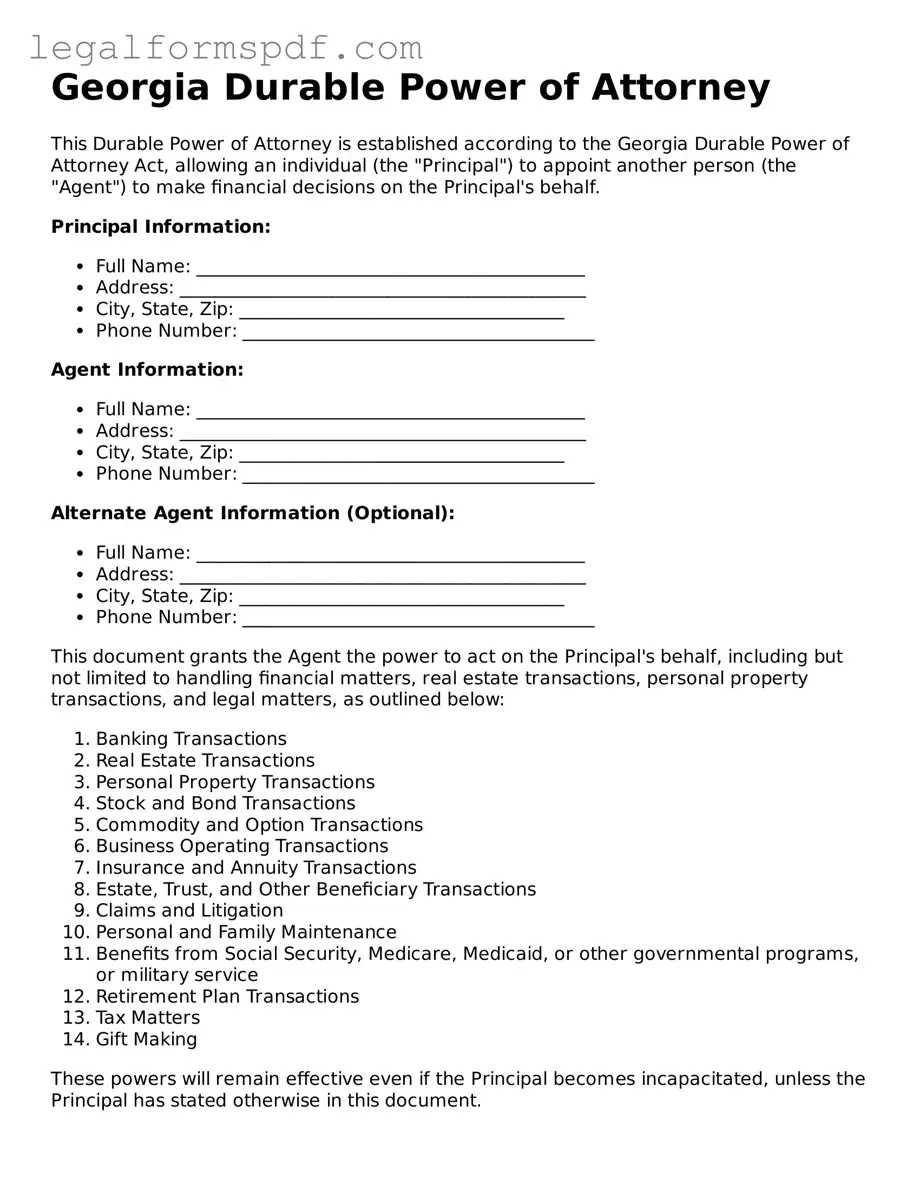

Document Example

Georgia Durable Power of Attorney

This Durable Power of Attorney is established according to the Georgia Durable Power of Attorney Act, allowing an individual (the "Principal") to appoint another person (the "Agent") to make financial decisions on the Principal's behalf.

Principal Information:

- Full Name: ___________________________________________

- Address: _____________________________________________

- City, State, Zip: ____________________________________

- Phone Number: _______________________________________

Agent Information:

- Full Name: ___________________________________________

- Address: _____________________________________________

- City, State, Zip: ____________________________________

- Phone Number: _______________________________________

Alternate Agent Information (Optional):

- Full Name: ___________________________________________

- Address: _____________________________________________

- City, State, Zip: ____________________________________

- Phone Number: _______________________________________

This document grants the Agent the power to act on the Principal's behalf, including but not limited to handling financial matters, real estate transactions, personal property transactions, and legal matters, as outlined below:

- Banking Transactions

- Real Estate Transactions

- Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement Plan Transactions

- Tax Matters

- Gift Making

These powers will remain effective even if the Principal becomes incapacitated, unless the Principal has stated otherwise in this document.

Special Instructions: (If any) _______________________________________________________________

_________________________________________________________

This Durable Power of Attorney shall become effective on the ______ day of _______________, 20____, and will remain in effect until revoked by the Principal or until the Principal's death.

Signature of Principal: ______________________________________ Date: _______________

Signature of Agent: __________________________________________ Date: _______________

Signature of Alternate Agent (Optional): _________________________ Date: _______________

Witness Attestation: This document was signed in the presence of the undersigned witnesses, who affirm that the Principal appears to be of sound mind and not under duress or undue influence.

Witness 1 Signature: __________________________________________ Date: _______________

Witness 2 Signature: __________________________________________ Date: _______________

Notarization: This document was acknowledged before me on (date) __________ by (name of Principal) _________________________________________.

_________________________________________________ (Seal)

Notary Public for the State of Georgia

My commission expires: _____________________

PDF Specifications

| Fact | Detail |

|---|---|

| Purpose | A Georgia Durable Power of Attorney form lets you choose someone to manage your financial affairs if you're unable to do so yourself. |

| Durability | This type of power of attorney remains effective even if the person who made it becomes incapacitated. |

| Governing Law | It is governed by the Georgia Code, specifically Title 10, Chapter 6B, which covers Powers of Attorney. |

| Requirements | For it to be valid, the form must be signed by the principal, notarized, and witnessed by two individuals who are not the named attorney-in-fact. |

| Revocation | The document can be revoked at any time by the principal, as long as they are mentally competent, through a written notice to the attorney-in-fact. |

| Agent's Duties | The chosen agent must act in the principal’s best interest, keep accurate records, and avoid conflicts of interest. |

| Limitations | The agent cannot make healthcare decisions for the principal under this form; a separate healthcare power of attorney is necessary for that purpose. |

Instructions on Writing Georgia Durable Power of Attorney

After deciding to grant someone else the authority to act on your behalf for financial matters in Georgia, you need to complete a Durable Power of Attorney form. This form is a legal document that empowers another person, known as the agent, to make decisions for you, the principal, if you become unable to do so. The process might seem daunting, but with careful attention to detail, you can successfully fill out the form.

- Begin by downloading the latest version of the Georgia Durable Power of Attorney form from a reliable legal website or obtain a copy from an attorney.

- Enter your full legal name and address at the top of the form to identify yourself as the principal.

- Specify the full name and address of the person you are selecting as your agent.

- Detail the powers you are granting to your agent. Be specific about what financial decisions they can make on your behalf. This might include handling banking transactions, real estate matters, tax issues, and more.

- If you wish to grant your agent the ability to make decisions after you become incapacitated, ensure the form includes language stating it is a "durable" power of attorney. Georgia law requires specificity in granting durable powers.

- Decide if you want your Durable Power of Attorney to become effective immediately or upon a certain event, such as your incapacitation. Indicate this choice clearly on the form.

- For added validity, Georgia law recommends having your signature on the Durable Power of Attorney form notarized. Some banks and all law offices provide notarization services.

- If the form allows for a successor agent, consider naming one. This person would act for you if your first choice is unable or unwilling to serve.

- Review the completed form to ensure all information is accurate and reflects your wishes. Look for any sections you might have missed or any information that requires clarification.

- Sign and date the form in the presence of a Notary Public and, if required by the form, one or two disinterested witnesses. Their signatures will also be necessary.

- Provide your agent with a copy of the signed and notarized Durable Power of Attorney. It's also advisable to keep a copy for your records and consider giving copies to relevant financial institutions or advisors.

After completing these steps, your Durable Power of Attorney form will be valid, and your agent will have the authority to make financial decisions on your behalf under the conditions you've specified. Should your situation change or you decide to revoke the power of attorney, it's important to consult with an attorney to ensure the process is handled correctly.

Understanding Georgia Durable Power of Attorney

What is a Georgia Durable Power of Attorney?

A Georgia Durable Power of Attorney is a legal document that allows a person (the "principal") to designate another person (the "agent" or "attorney-in-fact") to make decisions and take actions on their behalf, even if the principal becomes unable to do so themselves due to incapacity. This document remains in effect even if the principal becomes mentally incompetent.

When does a Durable Power of Attorney become effective in Georgia?

In Georgia, a Durable Power of Attorney becomes effective as soon as it is signed and notarized, unless the document specifies a different start date or condition for its effect to commence.

How can I terminate a Durable Power of Attorney in Georgia?

To terminate a Durable Power of Attorney in Georgia, the principal can revoke it by notifying the agent in writing and destroying all copies of the document. Additionally, it can be terminated if the principal dies, if the document specifies an end date, or if the purpose of the power of attorney is completed. A court can also terminate it under certain circumstances.

Who should I choose as my agent in a Georgia Durable Power of Attorney?

It's crucial to choose someone you trust completely as your agent. This person should also be reliable, competent, and well-informed about your wishes. Consider their ability to make difficult decisions under pressure, especially those related to your health and financial matters.

Can I have more than one agent on my Georgia Durable Power of Attorney?

Yes, you can appoint more than one agent on your Georgia Durable Power of Attorney. You can choose to have them act together (jointly) or separately (severally). However, specifying how they should make decisions together can prevent potential conflicts or confusion.

Do I need a lawyer to create a Durable Power of Attorney in Georgia?

While you don't legally need a lawyer to create a Durable Power of Attorney in Georgia, it is wise to consult one. A lawyer can ensure that the document fulfills all legal requirements and accurately reflects your wishes, providing you with peace of mind.

What kinds of decisions can my agent make with a Durable Power of Attorney in Georgia?

An agent can make a wide range of decisions on your behalf, including financial matters, real estate transactions, business operations, and personal affairs. However, you can limit their powers in the document to certain areas or types of decisions.

Is a Georgia Durable Power of Attorney form the same as a medical power of attorney?

No, a Georgia Durable Power of Attorney is not the same as a medical power of attorney. A Durable Power of Attorney often covers financial and general affairs, while a medical power of attorney is specifically for healthcare decisions. However, in Georgia, you can include healthcare decision-making powers within a Durable Power of Attorney, making it effectively serve both purposes.

What are the risks of not having a Durable Power of Attorney in Georgia?

Without a Durable Power of Attorney, if you become incapacitated, your loved ones may need to go through a lengthy and costly court process to be appointed as your guardian or conservator. This process can create additional stress during an already difficult time and may not result in the person you would have chosen.

How can I ensure my Georgia Durable Power of Attorney is legally valid?

To ensure your Georgia Durable Power of Attorney is legally valid, it must be in writing, signed by you (as the principal), witnessed by two individuals who are not the agent, and notarized. Being clear about the powers granted and any limitations is also crucial. Reviewing the document with a legal professional can help ensure its validity.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form in Georgia is a crucial step for ensuring that someone can legally make decisions on your behalf should you be unable to do so yourself. However, many individuals make mistakes during this process, potentially compromising the effectiveness of their DPOA. Understanding these common errors can help you avoid them.

One common mistake is not specifying the powers granted clearly. A DPOA can cover a broad range of decisions, including financial, medical, and administrative tasks. If the form lacks specificity about what the agent can and cannot do, it might lead to confusion or abuse of power. It's essential to clearly outline the scope of authority granted to the agent.

Another error is choosing the wrong person as an agent. This role requires immense trust and responsibility. Often, people select their agent based on emotional relationships rather than considering the individual's capability, reliability, and financial acumen. This oversight could result in mismanagement of affairs or even exploitation.

Many individuals also neglect to communicate their wishes and the details of their DPOA arrangement to their chosen agent and loved ones. This lack of communication can lead to unnecessary confusion and conflict during critical times when swift decision-making is needed. Ensuring everyone involved understands your wishes can help avoid these issues.

Forgetting to specify a successor agent is another oversight. If the initially chosen agent is unable or unwilling to serve at the needed time, having no named successor can complicate matters significantly. It is wise to appoint a backup to ensure continuity in managing your affairs.

Not regularly reviewing and updating the DPOA is a critical mistake. Personal circumstances and relationships change over time, as do laws regarding durable powers of attorney. Regularly reviewing and, if necessary, updating your DPOA ensures that it reflects your current wishes and complies with the latest laws.

Failure to properly execute the document according to Georgia state laws is a fundamental error. Georgia law may have specific signing, witnessing, or notarization requirements that must be met for the DPOA to be legally valid. Overlooking these legal formalities can render the document ineffective just when it is needed the most.

Some individuals mistakenly believe that a DPOA can be used after their death. However, a DPOA is only effective during the lifetime of the person who made it. Upon death, the authority of the agent ceases, and the estate will be managed according to the will or state laws governing intestacy if there is no will.

Lastly, people often fail to keep their DPOA document in an accessible location. If the document can't be found or accessed when needed, its purpose is defeated. It's imperative to keep the DPOA in a secure, yet accessible place and to inform the agent and relevant family members of its location.

Documents used along the form

When preparing for future legal and financial matters, the Georgia Durable Power of Attorney form is a critical document that allows someone to act on your behalf if you become unable to do so. However, to ensure comprehensive planning, several other important documents are often used alongside it. Here is a list of forms and documents that are frequently paired with the Georgia Durable Power of Attorney to help manage various aspects of an individual's affairs effectively.

- Advance Directive for Health Care - This document enables individuals to outline their wishes concerning medical treatment and end-of-life care. It also allows them to appoint a health care agent.

- Will - A will is used to specify how a person's assets and estate should be distributed after their death. It can also appoint a guardian for minor children.

- Living Trust - A living trust helps in managing a person's assets during their lifetime and allows for the easy transfer of assets after their death, often without the need for probate.

- Financial Information Sheet - This document organizes financial account information, assets, liabilities, and other financial details in one place, making it easier for the appointed agent to manage financial affairs.

- HIPAA Authorization Form - This form allows designated individuals to access your medical records, making it easier to make informed health care decisions on your behalf.

- Guardianship Designation - A document that specifies your choice for a guardian for your children or yourself in the event that you become incapable of making decisions.

- Personal Property Inventory - This is a detailed list of valuable personal properties, such as jewelry, art, and heirlooms, which can be useful for estate planning and distribution.

- Digital Assets Inventory - With digital assets becoming more common, this document lists accounts, passwords, and other digital information crucial for managing your online presence.

- Real Estate Deeds - Documents that transfer property ownership. If you have real estate investments, having current deeds is essential for estate planning and management.

- Marital Property Agreement - For married individuals, this agreement outlines which properties are considered marital assets and how they should be handled.

Together, these documents provide a robust framework for managing a wide range of personal, financial, and health care matters. It's important to consult with a legal professional to ensure that all documents are completed correctly and reflect your current wishes. Proper planning with these forms can offer peace of mind knowing that your affairs will be handled according to your preferences.

Similar forms

The Georgia Durable Power of Attorney form is similar to a Healthcare Proxy or Medical Power of Attorney. Both documents allow an individual to appoint someone else to make decisions on their behalf. While the Durable Power of Attorney can apply to various decisions including financial and legal matters, a Healthcare Proxy specifically focuses on medical decisions when the individual is incapacitated. They grant the appointed agent the authority to make healthcare decisions according to the individual’s wishes, preferences, or instructions provided in the document.

Similarly, a Living Will bears resemblance to the Georgia Durable Power of Attorney form in that both are advance directives used to communicate an individual's wishes regarding care and treatment should they become unable to make decisions for themselves. However, a Living Will primarily documents preferences regarding end-of-life care, such as life support and resuscitation efforts, rather than appointing an agent to make decisions. It specifies what medical actions should be taken in various scenarios, whereas a Durable Power of Attorney for Healthcare includes the designation of a decision-maker.

Another document similar to the Georgia Durable Power of Attorney form is the General Power of Attorney. Both documents empower an agent to act on behalf of the principal. The key difference lies in their durability. A General Power of Attorney typically becomes invalid if the principal becomes mentally incapacitated. In contrast, a Durable Power of Attorney retains its validity even if the principal loses the ability to make informed decisions, making it more comprehensive for long-term planning.

The Financial Power of Attorney document also shares similarities with the Georgia Durable Power of Attorney form, as both authorize an agent to manage the financial affairs of the principal. These tasks can include handling banking transactions, paying bills, and managing investments. However, the scope of a Financial Power of Attorney is limited to financial matters, whereas a Durable Power of Attorney might encompass a broader range of responsibilities, depending on how it is drafted.

Lastly, the Springing Power of Attorney is akin to the Georgia Durable Power of Attorney form in its function of designating an agent to make decisions on behalf of the principal. The distinguishing feature of a Springing Power of Attorney is that it only comes into effect under circumstances defined in the document, such as the principal’s incapacitation. This is in contrast to a Durable Power of Attorney, which is typically effective immediately upon execution unless specifically stated otherwise, providing no delay in the ability of the agent to act when needed.

Dos and Don'ts

When preparing to complete a Durable Power of Attorney (DPOA) form in Georgia, understanding the do's and don'ts can ensure the process is done correctly, reflecting the principal's wishes accurately and legally. The following list provides guidance to help navigate the process effectively.

Do's:

- Fully understand the powers being granted. Make sure you clearly comprehend which decisions you are allowing the agent to make on your behalf. This understanding is crucial for both the principal and the agent.

- Select a trustworthy agent. The person you choose should be someone you trust implicitly to make decisions in your best interest, as they will have considerable control over your affairs.

- Be specific about powers granted. Clearly outline what the agent can and cannot do. Specificity can prevent future misunderstandings or abuse of power.

- Include a durability clause. This ensures that the power of attorney remains in effect even if you become incapacitated, which is often the primary purpose of a DPOA.

- Sign in the presence of a notary. Georgia law requires notarization for the DPOA to be valid. Ensure this step is not overlooked.

- Inform your family. Discussing your decision and the reasons for it with close family members can prevent conflicts and confusion later on.

- Keep the document accessible. Once signed, keep the DPOA in a safe but accessible place, and let your agent know where to find it if needed.

Don'ts:

- Delay in executing the form. Unexpected situations can arise at any time. It's better to have the DPOA in place well before it's needed.

- Use a generic form without reviewing state-specific requirements. Georgia has particular requirements that may not be met by a generic form.

- Forget to review and update the document regularly. As your situation or Georgia law changes, your DPOA may need updates to remain effective and relevant.

- Fail to consult with a legal professional. While not strictly necessary, getting legal advice can ensure that the document meets all legal requirements and your needs.

- Overlook alternates. If your first choice for an agent is unable to serve, having an alternate can prevent a legal vacuum.

- Ignore the need for witnesses. Georgia law requires that certain documents, including DPOA, be witnessed. Make sure you meet this legal requirement.

- Assume the agent's power is unlimited. Ensure both you and the agent understand the extent of the powers granted to avoid unintended consequences.

Misconceptions

When it comes to planning and preparing legal documents, it's essential that we base our actions on accurate information. This is particularly true of the Georgia Durable Power of Attorney form, a critical legal tool that allows someone else to make decisions on your behalf, should you become unable to do so. Unfortunately, there's a lot of misinformation out there. Here are ten common misconceptions, debunked to help you navigate this essential legal step with confidence.

- Anyone can be your agent. While it’s true that you can choose a wide range of people to act as your agent, it’s crucial to pick someone who is not only trustworthy but also financially savvy, legally capable, and generally available to handle the responsibilities that come with this role.

- The form is the same in every state. Each state has its specifics when it comes to legal forms, and Georgia is no exception. A Georgia Durable Power of Attorney form is tailored to meet the state’s legal requirements and may differ significantly from those of other states.

- Filling out the form gives your agent immediate power. This isn't always the case. You can specify within the document that the agent’s power only begins under certain conditions, such as if you become incapacitated.

- It's only for the elderly. People of any age can find themselves in situations where they're unable to make decisions for themselves. Accidents, sudden illness, or unexpected travel can happen at any time, making a Durable Power of Attorney a wise precaution for adults of all ages.

- It grants unlimited power. The reality is you can tailor the document to limit your agent's power to specific decisions or actions. It’s not inherently an all-encompassing grant of authority unless you make it so.

- Your agent can make healthcare decisions for you. In Georgia, the Durable Power of Attorney for healthcare is a separate document from the financial Durable Power of Attorney. Ensure you have both if you want your agent to handle both your finances and health care decisions.

- You don’t need a lawyer to create one. While it’s possible to fill out a form on your own, consulting with a legal professional can ensure that the document meets all legal requirements and truly reflects your wishes.

- It lasts forever. Although "durable" implies longevity, the power of attorney can be revoked by you at any time as long as you're mentally competent. Also, it automatically terminates upon your death.

- All your financial information must be disclosed to your agent immediately. You can choose to keep your financial information private until the document comes into effect, which might be only if and when you become incapacitated.

- It's too late to create one once you become incapacitated. Unfortunately, this is true. Legal capacity is required to assign a power of attorney; therefore, it’s critical to set up a durable power of attorney before any issues arise that might impair your ability to do so.

Understanding the specifics of a Durable Power of Attorney in Georgia is crucial for making informed decisions about your future and ensuring your affairs will be handled according to your wishes. Misconceptions can lead to unnecessary complications and stress. By debunking these common misunderstandings, we hope you feel more equipped to take the appropriate steps in planning for the future.

Key takeaways

Filling out a Durable Power of Attorney (DPOA) form in Georgia allows you to designate someone to manage your affairs if you're unable to do so yourself. This document is a powerful tool in estate planning, ensuring your decisions are in trusted hands. Here are key takeaways to consider when approaching this important document:

- Choose your agent wisely. Your agent will have far-reaching powers to manage your finances and legal affairs. Select someone you trust implicitly.

- Be specific about powers granted. The DPOA form lets you outline exactly what your agent can and cannot do. Consider limitations you may want to impose.

- Understand durability. "Durable" means the power of attorney remains in effect if you become incapacitated. Make sure this aligns with your intentions.

- Georgia law requires witnesses and a notary. To execute a DPOA, Georgia law necessitates your signature be witnessed by two individuals and notarized.

- Consider naming a successor agent. Should your initial agent be unable or unwilling to serve, having a successor already named ensures continuity.

- Review and update regularly. Life changes such as divorce, relocation, or the death of your chosen agent can affect your DPOA. Review it periodically.

- Communicate with your agent. Ensure your agent understands your wishes and knows where to find important documents.

- The DPOA is revocable. You can revoke your DPOA at any time as long as you are mentally competent.

- File it where it can be found. Inform loved ones where the DPOA and other estate planning documents are kept.

- Professional advice is invaluable. Consider consulting with an attorney to ensure the DPOA meets your specific needs and complies with Georgia law.

By keeping these key points in mind, you can make informed decisions that will safeguard your assets and health care wishes effectively. Planning ahead with a Durable Power of Attorney is a proactive step towards managing your future well-being and peace of mind.

More Durable Power of Attorney State Forms

Durable Power of Attorney Form Pa - While many resort to online templates, a custom Durable Power of Attorney drafted by a legal professional can provide better security and specificity for your situation.

Texas Durable Power of Attorney - A legal document allowing someone to act on your behalf in financial matters.