Fillable Durable Power of Attorney Document for Florida

In the Sunshine State, the Florida Durable Power of Attorney form stands as a critical legal document, empowering individuals to appoint someone they trust to manage their affairs, especially in times when they are not able to do so themselves. This form navigates through the complexities of financial and property interests, ensuring that decision-making processes are not hindered by the unforeseen incapacitation of the principal. Its durability means that the powers granted through this form remain in effect even if the principal becomes unable to make decisions for themselves, a feature that distinguishes it from other power of attorney documents which may become null under such circumstances. Careful consideration and understanding of this form are paramount as it encompasses not just the delegation of authority but an expression of trust and foresight in planning for the future. The execution of this form demands meticulous attention to legal requirements to ensure its validity and enforceability, making it a document of profound importance and utility in the realm of personal and estate planning.

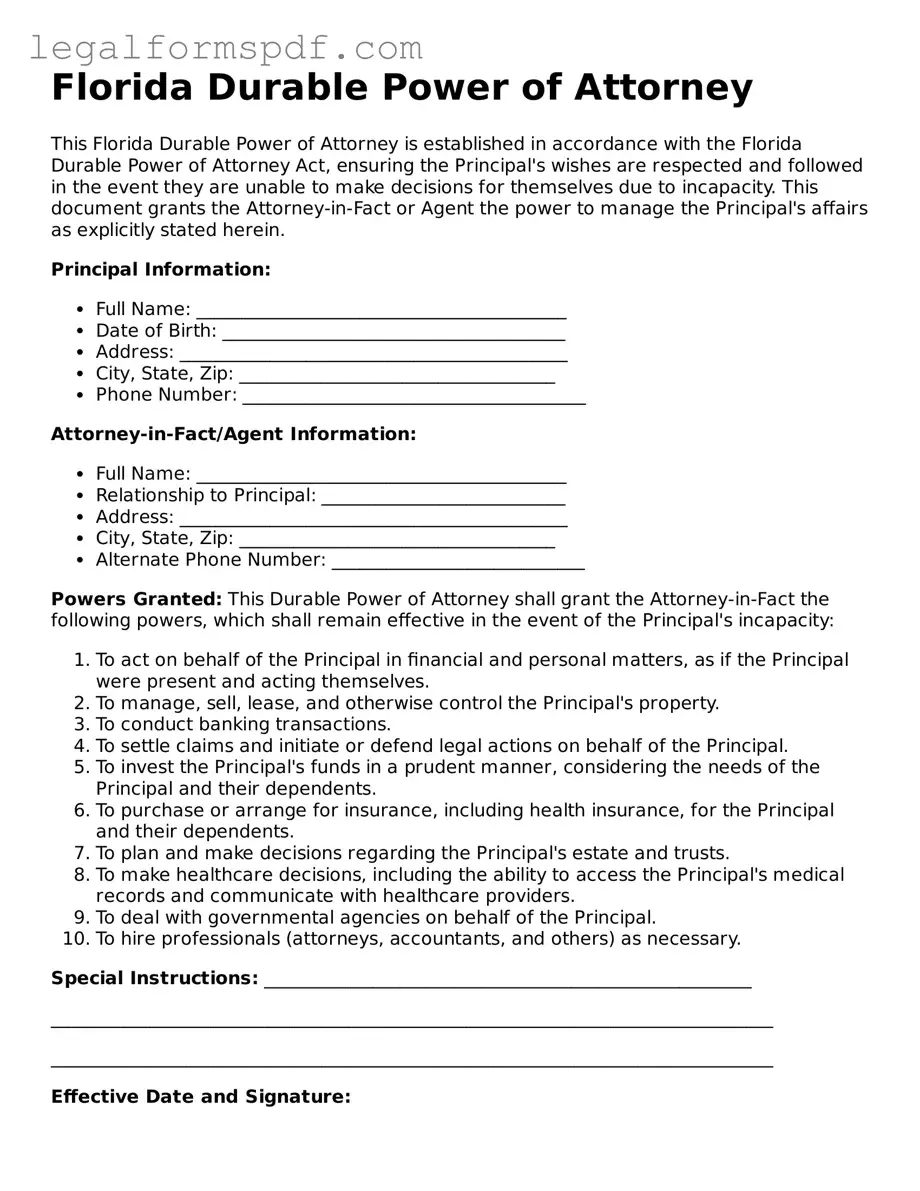

Document Example

Florida Durable Power of Attorney

This Florida Durable Power of Attorney is established in accordance with the Florida Durable Power of Attorney Act, ensuring the Principal's wishes are respected and followed in the event they are unable to make decisions for themselves due to incapacity. This document grants the Attorney-in-Fact or Agent the power to manage the Principal's affairs as explicitly stated herein.

Principal Information:

- Full Name: _________________________________________

- Date of Birth: ______________________________________

- Address: ___________________________________________

- City, State, Zip: ___________________________________

- Phone Number: ______________________________________

Attorney-in-Fact/Agent Information:

- Full Name: _________________________________________

- Relationship to Principal: ___________________________

- Address: ___________________________________________

- City, State, Zip: ___________________________________

- Alternate Phone Number: ____________________________

Powers Granted: This Durable Power of Attorney shall grant the Attorney-in-Fact the following powers, which shall remain effective in the event of the Principal's incapacity:

- To act on behalf of the Principal in financial and personal matters, as if the Principal were present and acting themselves.

- To manage, sell, lease, and otherwise control the Principal's property.

- To conduct banking transactions.

- To settle claims and initiate or defend legal actions on behalf of the Principal.

- To invest the Principal's funds in a prudent manner, considering the needs of the Principal and their dependents.

- To purchase or arrange for insurance, including health insurance, for the Principal and their dependents.

- To plan and make decisions regarding the Principal's estate and trusts.

- To make healthcare decisions, including the ability to access the Principal's medical records and communicate with healthcare providers.

- To deal with governmental agencies on behalf of the Principal.

- To hire professionals (attorneys, accountants, and others) as necessary.

Special Instructions: ______________________________________________________

________________________________________________________________________________

________________________________________________________________________________

Effective Date and Signature:

This Durable Power of Attorney shall become effective immediately upon the date of the last signature herein and shall remain in effect indefinitely unless specified otherwise or revoked by the Principal.

Principal's Signature: _______________________________ Date: _________________

Attorney-in-Fact/Agent's Signature: ___________________ Date: _________________

Notarization:

This document was acknowledged before me on ____________(date) by ____________________________________(name of Principal) and ____________________________________(name of Attorney-in-Fact/Agent).

Notary Public's Signature: ___________________________

My commission expires: ______________________________

PDF Specifications

| # | Fact | Detail |

|---|---|---|

| 1 | Definition | A Florida Durable Power of Attorney (DPOA) is a legal document that allows an individual (the principal) to designate another person (the agent) to manage their financial affairs, even if the principal becomes incapacitated. |

| 2 | Governing Law | The Florida Durable Power of Attorney is governed by the Florida Statutes, Chapter 709, which outlines powers of attorney and similar instruments. |

| 3 | Form Requirements | To be valid, the form must be signed by the principal, two adult witnesses, and be notarized by a qualified notary public. |

| 4 | Witness Restrictions | Neither of the witnesses can be the agent designated in the DPOA, and at least one witness must not be a spouse or a blood relative of the principal. |

| 5 | Signing Protocol | The principal must be of sound mind at the time of signing the DPOA, understanding the implications of the document. |

| 6 | Agent’s Powers | The agent may have the authority to make financial decisions, such as handling bank accounts, paying bills, managing real estate, and making investment decisions, among other powers specified by the principal. |

| 7 | Revocation | The principal can revoke the DPOA at any time as long as they are mentally competent, by providing written notice to the agent. |

| 8 | Effectiveness | The DPOA is effective immediately upon signing, unless the document specifies a different effective date or triggering event. |

| 9 | Termination | The DPOA automatically terminates upon the death of the principal, or if the principal becomes bankrupt or insolvent, unless the document states otherwise. |

Instructions on Writing Florida Durable Power of Attorney

Filling out the Florida Durable Power of Attorney form is a critical step in planning for future financial management. This legal document allows you to appoint someone you trust to handle your financial affairs if you become unable to do so yourself. It's important to complete the form accurately and clearly, to ensure that your agent has the authority they need to act on your behalf without encountering unnecessary hurdles. Here's a step-by-step guide to help you fill out the form correctly.

- Gather necessary information including your full legal name, the full legal name of your chosen agent (or "attorney-in-fact"), and the specifics of the powers you wish to grant.

- Begin by entering your full legal name and address at the top of the form, indicating that you are the principal granting the power.

- Fill in the full legal name and address of the person you are appointing as your agent in the designated section.

- Specify the powers you are granting to your agent by initialing next to each power listed on the form that you wish to include. If you wish to grant all listed powers, you may be able to initial a single box or statement indicating such, depending on the form’s layout.

- If you want your agent to have the authority to handle real estate transactions, make sure to provide the legal description of the property and include any additional powers you wish to grant that are not listed on the standard form in the special instructions section.

- Appoint a successor agent (optional). If you wish, fill in the information of an alternate person to act on your behalf if your primary agent is unable or unwilling to serve.

- Review all sections of the form to ensure all necessary information is complete and accurate. This may include limits on your agent’s powers, or specifying when the powers begin and end.

- Sign and date the form in the presence of two witnesses and a notary public. The witnesses cannot be the agent you have appointed. Make sure the notary public properly notarizes the form with their seal.

- Provide your agent with a copy of the signed document, and consider giving copies to financial institutions and others who may need to be aware of the document's contents.

Once the form is fully completed and properly executed, your agent will have the authority to act on your behalf concerning the powers you have granted. It's a good idea to discuss your wishes and instructions with your agent ahead of time, to ensure they understand their responsibilities and your expectations. This proactive approach helps in managing your financial affairs smoothly, even when you're unable to do so yourself.

Understanding Florida Durable Power of Attorney

What is a Durable Power of Attorney (DPOA) in Florida?

A Durable Power of Attorney in Florida is a legal document that allows an individual, referred to as the principal, to designate another person, known as the agent or attorney-in-fact, to make decisions and act on their behalf. Unlike a regular power of attorney, a DPOA remains effective even if the principal becomes incapacitated or unable to make decisions for themselves.

How does one create a Durable Power of Attorney in Florida?

To create a Durable Power of Attorney in Florida, the principal must complete a form that meets state requirements. This includes using specific statutory language, having the principal's signature witnessed by two adults, and notarizing the document. It's highly recommended to consult with a legal professional to ensure the form accurately reflects the principal's wishes and complies with Florida law.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. This is usually done in writing, through a formal revocation document that is distributed to the agent and any institutions or entities that were made aware of the original power of attorney. It is also advised to destroy any physical copies of the DPOA document to prevent confusion.

Who should be chosen as an agent in a DPOA?

The choice of an agent is a critical decision. This person should be trustworthy, reliable, and capable of handling financial and legal matters responsibly. Most people choose a close family member or a dear friend, but it's also possible to choose a professional, such as an attorney or financial advisor. It's important to discuss this responsibility with the chosen agent beforehand to ensure they are willing and able to act on your behalf.

Is a Florida Durable Power of Attorney effective in other states?

Generally, a Durable Power of Attorney created in Florida is recognized in other states. However, because laws can vary significantly from state to state, it's possible that certain provisions in a Florida DPOA may not be enforceable elsewhere. If you spend a lot of time in another state or own property in another state, it's wise to consult with an attorney in that state to ensure your DPOA will be effective.

What happens if someone does not have a Durable Power of Attorney in Florida?

If an individual becomes incapacitated without a Durable Power of Attorney in place, it may be necessary for a family member or interested party to petition the court for guardianship or conservatorship. This process can be time-consuming, costly, and invasive, as it requires court intervention to appoint someone to manage the incapacitated person's affairs. Having a DPOA in place helps avoid this complexity and allows for a more seamless management of one’s affairs.

Does a Durable Power of Attorney cover medical decisions?

In Florida, a Durable Power of Attorney typically does not cover medical decisions; a separate document, known as a Designation of Health Care Surrogate, is used for this purpose. While a DPOA covers financial and legal decisions, the Health Care Surrogate designation allows you to appoint someone to make medical decisions on your behalf if you are unable to do so. It's a good practice to have both documents in place as part of a comprehensive estate plan.

Common mistakes

Filling out the Florida Durable Power of Attorney form can be fraught with complications. One common mistake is not specifying the extent of the powers granted. This ambiguity can lead to uncertainty and potentially legal challenges. It’s crucial that the powers granted are detailed explicitly to avoid misunderstandings about the agent's authority.

Another area often overlooked is the failure to specify a successor agent. Life is unpredictable, and the initially chosen agent might become unable or unwilling to act. Without a designated successor, this oversight can render the document ineffective just when it’s needed the most.

People sometimes assume that a durable power of attorney covers health care decisions, which is not the case. This misunderstanding can result in a critical gap in planning, as a separate document, known as a health care surrogate designation, is needed to address medical decisions.

The process of signing the document also presents challenges. Without the proper witnesses or notarization as required by Florida law, the document may not be legally valid. This technical requirement, though seemingly minor, is essential for the document’s enforceability.

Another common mistake is not updating the document. Life changes, such as divorce, death, or estrangement, can make the original document not reflective of the current wishes of the person. Regular reviews and updates are necessary to keep it relevant and effective.

Some individuals mistakenly believe that a power of attorney granted in another state will be automatically valid in Florida. However, Florida has specific requirements that may not be met by an out-of-state document, potentially leading to its non-recognition.

A critical error is choosing the wrong agent. This role requires trust, understanding, and the ability to act in the best interest of the person granting the power. Not carefully considering who is best suited for this responsibility can result in poor management or abuse of the powers granted.

Lastly, many fail to consult with a legal professional. Drafting a durable power of attorney involves complex decisions that can benefit from professional advice. Without it, individuals may inadvertently create a document that does not serve its intended purpose or fails to meet legal standards.

Documents used along the form

When preparing for future legal and financial decision-making, the Florida Durable Power of Attorney (DPOA) form plays a crucial role. This document allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf should they become incapacitated. However, to ensure comprehensive coverage and protect all aspects of one’s interests, other forms and documents are often used in conjunction with the DPOA. Here’s a look at some of the most common ones.

- Living Will: Outlines an individual's preferences regarding medical treatments and life-support measures in cases where recovery is unlikely. It serves to guide healthcare providers and loved ones through difficult decisions.

- Health Care Surrogate Designation: Allows an individual to appoint a surrogate to make healthcare decisions on their behalf if they are unable to do so. This document complements the living will by covering health care decisions not specified in the living will.

- Last Will and Testament: Specifies how an individual’s properties and assets are to be distributed after their death. It can also appoint a guardian for minor children.

- Revocable Living Trust: Enables an individual to maintain control over their assets while alive but ensures that these assets are passed on to chosen beneficiaries without going through probate after death.

- Declaration of Pre-Need Guardian: Allows an individual to nominate a guardian for themselves and their minor children in the event of incapacity, avoiding court-appointed guardianships.

- HIPAA Release Form: Permits healthcare providers to disclose an individual's health information to designated persons, ensuring loved ones and appointed agents have access to crucial medical information when needed.

- Do Not Resuscitate Order (DNR): A doctor’s order that instructs healthcare providers not to perform CPR if breathing stops or if the heart stops beating. It is intended for use by individuals seeking natural death without life-prolonging procedures.

- Designation of Pre-Need Guardian for Minor: Similar to the declaration of pre-need guardian, this document specifically focuses on appointing a guardian for minor children in the event of the parent’s or legal guardian’s incapacity.

- Bank Account Beneficiary Designations: Forms provided by banks that allow an account holder to designate beneficiaries who will receive the account's assets upon the account holder’s death, bypassing probate.

Together with the Florida Durable Power of Attorney, these documents can create a comprehensive plan that addresses both current and future financial, legal, and health-related situations. Crafting a complete estate plan with these documents ensures that your wishes are honored no matter what future circumstances may arise. While it's advisable to seek professional guidance when preparing these documents, understanding their purpose and how they complement each other is the first step toward securing your and your loved ones’ futures.

Similar forms

The Florida Durable Power of Attorney form shares similarities with a Medical Power of Attorney. Both documents entrust an individual, often referred to as the agent, with decision-making powers on behalf of another person, the principal. However, while a Durable Power of Attorney typically covers a broad range of financial and legal affairs, a Medical Power of Attorney is specifically focused on healthcare decisions. This empowerment becomes particularly crucial when the principal cannot make their own healthcare decisions due to incapacity.

Comparable to the Living Will, the Florida Durable Power of Attorney allows individuals to prepare for circumstances in which they might be unable to make decisions for themselves. A Living Will, however, is primarily concerned with end-of-life decisions, providing instructions for healthcare providers regarding the principal's preferences in prolonging life or administering life-saving measures. Conversely, the Durable Power of Attorney encompasses a wider range of authority, from financial to legal decision-making, not limited to healthcare or end-of-life situations.

A General Power of Attorney document is quite akin to the Durable Power of Attorney but with a key difference in durability. The former ceases to be effective if the principal becomes incapacitated or unable to make decisions on their own. In contrast, the durability aspect of a Durable Power of Attorney means that the agent's power remains intact even if the principal is incapacitated, ensuring continuous management of the principal's affairs without court intervention.

Similarly, the Limited Power of Attorney shares a foundational concept with the Florida Durable Power of Attorney—both delegate authority from the principal to an agent. Yet, the Limited Power of Attorney narrows this scope significantly, conferring authority for specific acts or situations, such as selling a particular asset. This contrasts with the broad and enduring powers granted under a Durable Power of Attorney.

The Trust Agreement, while serving a distinct purpose, parallels the Durable Power of Attorney in its capacity to manage assets. In a Trust Agreement, an individual (the trustor) places assets within a trust to be managed by a trustee for the benefit of a third party, the beneficiary. The Durable Power of Attorney similarly allows an agent to manage the principal's assets, but it is not limited to this function and does not require transferring assets into a trust to take effect.

Another document that bears resemblance is the Conservatorship, which like the Durable Power of Attorney, involves managing another individual's affairs. However, a Conservatorship is a court-appointed role, instigated when a person is deemed incapable of managing their own affairs due to mental or physical limitations. Unlike the proactive decision to appoint an agent through a Durable Power of Attorney, Conservatorship is a reactive legal measure.

The Guardianship Appointment is closely related to both the Durable Power of Attorney and Conservatorship. It involves the appointment of an individual, by a court, to handle personal and/or financial matters for someone unable to do so themselves, often a minor or an incapacitated adult. While Guardianship is court-ordered and may encompass a broad range of responsibilities, a Durable Power of Attorney is voluntarily established and can be specifically tailored to the principal's needs.

The Business Power of Attorney is a specialized form that allows business owners to designate individuals to act on behalf of the business. This resembles the Durable Power of Attorney in the way it delegates decision-making authority. However, the scope is limited to business decisions, highlighting the adaptability of power of attorney documents to meet varying needs, whether personal, health-related, or business-centric.

Lastly, the Financial Power of Attorney, much like the Durable Power of Attorney, permits an agent to handle the principal's financial affairs. The primary distinction lies in the durability aspect; while both can be crafted to manage a wide array of financial transactions, the Durable Power of Attorney remains effective even when the principal is incapacitated. This durability ensures continuous financial management without the need for court involvement.

Dos and Don'ts

When preparing a Durable Power of Attorney in Florida, it's crucial to understand the responsibilities and implications. Missteps can lead to legal complications or unintended consequences. Here's a list of do's and don'ts to keep in mind:

- Do: Clearly identify the principal (the person granting power) and the agent (the person receiving power) with full legal names and addresses to avoid any confusion.

- Do: Specify the powers you are granting with as much detail as possible. Vagueness can lead to misinterpretation.

- Do: Consider including a clause that requires the agent to provide regular accounting to a third party. This adds a layer of accountability.

- Do: Have the document notarized. Florida law requires notarization for the Durable Power of Attorney to be legally binding.

- Don't: Leave any sections blank. If a section does not apply, indicate this with "N/A" to confirm you didn't overlook anything.

- Don't: Appoint an agent without discussing it with them first. Ensure they understand the responsibilities and accept them.

- Don't: Forget to sign and date the document in the presence of a notary and, if applicable, witnesses. This step is crucial to validate the document.

- Don't: Fail to keep the document in a safe, accessible place. Additionally, inform a trusted person of where it is stored and provide copies to relevant parties, such as your attorney or family members.

Following these guidelines will help ensure that your Durable Power of Attorney in Florida accurately reflects your wishes and is legally effective.

Misconceptions

A Durable Power of Attorney (DPOA) in Florida is an important legal document that allows an individual to appoint someone else to manage their financial affairs if they become incapacitated. Despite its importance, there are several misconceptions about how it works. Here's a look at five common misunderstandings:

- Many people believe that a Durable Power of Attorney grants unlimited authority from the moment it's signed. In reality, the specifics of the powers granted depend on the language used in the document itself. It's tailored to meet the principal's needs and preferences.

- There's a common misconception that a DPOA is only for the elderly. While it's particularly important for aging individuals to have a DPOA in place, adults of all ages can benefit. Accidents or sudden illness can happen at any time, so it's prudent for anyone to consider their financial management needs in such cases.

- Some believe that if you don't have a DPOA, your spouse automatically has the legal authority to manage all your affairs. However, without a DPOA in Florida, even spouses may face limitations and need to seek court approval for certain actions.

- A DPOA is sometimes mistakenly thought to cover medical decisions. In fact, medical decisions require a separate legal document called a Healthcare Power of Attorney. The DPOA focuses solely on financial and legal decisions.

- Lastly, there's a misconception that once you sign a DPOA, you're locked into it permanently. The truth is, as long as the principal is mentally competent, they can revoke or update their DPOA at any time to reflect changes in their life or wishes.

Understanding the specifics of the Florida Durable Power of Attorney can empower individuals to make informed decisions about their financial management plans, ensuring their welfare and peace of mind.

Key takeaways

Filling out a Florida Durable Power of Attorney form is a significant step in managing your affairs. This document allows you to appoint someone to handle your financial matters if you're unable to do so yourself. Here are key takeaways to keep in mind:

- Ensure accuracy: Fill out the form with accurate information to avoid any potential legal issues. This includes the full legal names and addresses of all parties involved.

- Choose wisely: The appointed person, or your agent, should be someone you trust deeply. They will have significant control over your financial assets.

- Understand the scope: Know what powers you are granting. These can range from handling bank accounts to selling property on your behalf.

- Notarization is a must: A Florida Durable Power of Attorney must be notarized to be legally valid. Some counties may also require witnesses.

- Consider a lawyer's advice: Consulting with a lawyer can ensure that the document meets all legal requirements and accurately reflects your wishes.

- Communicate with your agent: Discuss your expectations and the contents of the document with your appointed agent. They should fully understand their responsibilities.

- Safe storage: Keep the original document in a secure place, and let your agent know where it is. You might also give copies to trusted family members or advisors.

- Review periodically: Over time, your circumstances or relationships may change. Review and update the document as necessary.

- Revoke if necessary: You have the right to revoke this power of attorney as long as you're mentally capable. If you decide to do so, inform your agent and all relevant institutions in writing.

Following these guidelines will help ensure that your Florida Durable Power of Attorney effectively protects your interests and provides peace of mind for you and your loved ones.

More Durable Power of Attorney State Forms

Durable Power of Attorney Michigan - The agent must act in a fiduciary capacity, making decisions that are in the best interest of the principal, adhering to their wishes as expressed in the document.

New York Statutory Power of Attorney - Communicating your wishes and expectations to the individual you designate as your agent is an essential part of the DPOA process.