Fillable Durable Power of Attorney Document for California

In the realm of legal documentation, few things are as important as ensuring one's affairs will be handled according to their wishes, especially in situations where they might not be able to make decisions for themselves. The California Durable Power of Attorney form serves this essential function, providing a legally binding way for an individual to appoint another person, known as an agent, to manage their financial affairs. This power can include managing bank accounts, signing checks, and making decisions about property and investments, among other responsibilities. Unlike other power of attorney forms, the durable variant remains in effect even if the person who created it becomes incapacitated, making it a critical tool for estate planning and safeguarding one's financial future. It is designed with clarity and comprehensiveness in mind, ensuring that the appointed agent has clear directives on how to proceed in various circumstances, thereby providing peace of mind to the individual who has made the appointment. Moreover, this form is specific to California, taking into account the state's specific legal requirements and nuances, offering a tailored solution to residents to ensure their financial matters are handled accurately and according to state laws.

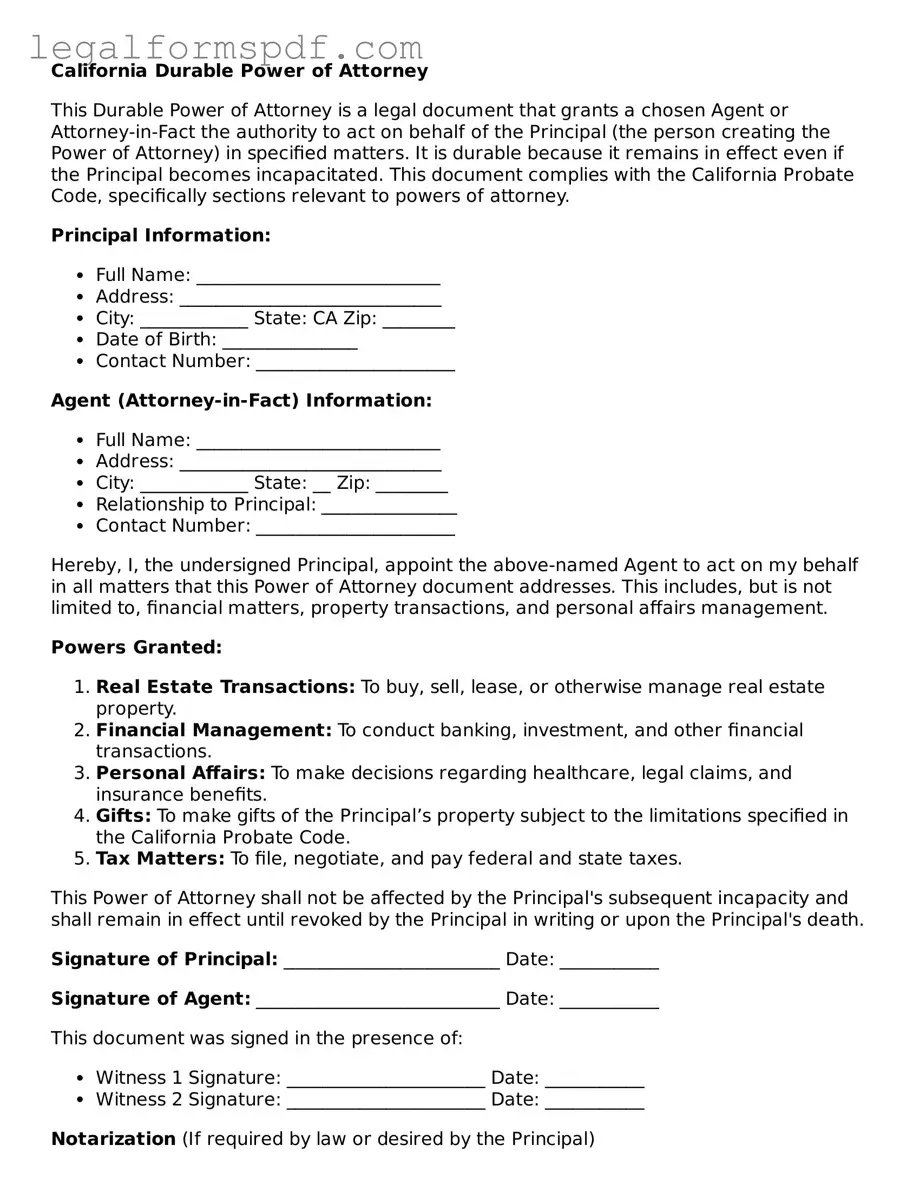

Document Example

California Durable Power of Attorney

This Durable Power of Attorney is a legal document that grants a chosen Agent or Attorney-in-Fact the authority to act on behalf of the Principal (the person creating the Power of Attorney) in specified matters. It is durable because it remains in effect even if the Principal becomes incapacitated. This document complies with the California Probate Code, specifically sections relevant to powers of attorney.

Principal Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ____________ State: CA Zip: ________

- Date of Birth: _______________

- Contact Number: ______________________

Agent (Attorney-in-Fact) Information:

- Full Name: ___________________________

- Address: _____________________________

- City: ____________ State: __ Zip: ________

- Relationship to Principal: _______________

- Contact Number: ______________________

Hereby, I, the undersigned Principal, appoint the above-named Agent to act on my behalf in all matters that this Power of Attorney document addresses. This includes, but is not limited to, financial matters, property transactions, and personal affairs management.

Powers Granted:

- Real Estate Transactions: To buy, sell, lease, or otherwise manage real estate property.

- Financial Management: To conduct banking, investment, and other financial transactions.

- Personal Affairs: To make decisions regarding healthcare, legal claims, and insurance benefits.

- Gifts: To make gifts of the Principal’s property subject to the limitations specified in the California Probate Code.

- Tax Matters: To file, negotiate, and pay federal and state taxes.

This Power of Attorney shall not be affected by the Principal's subsequent incapacity and shall remain in effect until revoked by the Principal in writing or upon the Principal's death.

Signature of Principal: ________________________ Date: ___________

Signature of Agent: ___________________________ Date: ___________

This document was signed in the presence of:

- Witness 1 Signature: ______________________ Date: ___________

- Witness 2 Signature: ______________________ Date: ___________

Notarization (If required by law or desired by the Principal)

On the ____ day of ____________, 20___, before me, ___________________________ (name of the notary), a notary public, personally appeared _________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained. In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ___________________________

Seal:

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | Allows an individual to designate another person to make decisions on their behalf regarding financial matters. |

| Governing Law | California Probate Code, specifically sections 4000 to 4545. |

| Validity | Must be signed by the principal, two witnesses or a notary to be legally valid. |

| Durability | Remains in effect even if the principal becomes incapacitated. |

| Agent Powers | The agent can handle tasks such as buying or selling property, managing bank accounts, and handling other financial transactions. |

| Agent Requirements | The agent must act in the best interests of the principal and avoid conflicts of interest. |

| Revocation | The principal can revoke the power of attorney at any time as long as they are mentally competent. |

| Co-Agents | Principals can designate more than one agent to act jointly or independently. |

| Limitations | The agent cannot make healthcare decisions for the principal (a separate form is needed for healthcare decisions). |

Instructions on Writing California Durable Power of Attorney

Successfully completing the California Durable Power of Attorney form is an important process for individuals who wish to ensure their financial affairs can be managed by someone they trust, should they become unable to do so themselves. It's vital to follow the instructions step by step to ensure the document is legally binding and reflective of the principal's wishes. Once completed, this document empowers a chosen individual, known as the agent, to make financial decisions on the principal's behalf, offering peace of mind that one's affairs will be handled as desired.

Steps for Filling Out the California Durable Power of Attorney Form

- Gather necessary information, including the full legal names and addresses of the principal (the person granting the power) and the agent (the person receiving the power).

- Review the form in its entirety to understand the scope of authorities being granted.

- In the designated section, enter the principal’s complete information, including their full legal name and address.

- Fill in the agent’s full legal name and address in the assigned area.

- If a successor agent (alternate) is being appointed, enter their full legal name and address in the appropriate section. This step is optional but recommended.

- Specify the powers being granted to the agent by initialing next to each power listed that the principal wishes to grant. If the principal decides to grant all listed powers, there may be an option to initial a single box that encompasses all powers.

- Read the special instructions section carefully. Here, the principal can provide any special guidance or limit the powers granted to the agent. If no special instructions are needed, this section can be left blank.

- Identify any expiration date for the powers granted. If there is no intended expiration date, the document will remain in effect indefinitely or until revoked by the principal.

- The principal must sign and date the form in the presence of a notary public or two adult witnesses, as required by California law. The requirements for witnesses can vary, so it's important to ensure compliance with current legal standards.

- The notary public will complete the notarization process, or the witnesses must sign and date the form, acknowledging they witnessed the principal’s signature.

Upon completion, it’s crucial for the principal to provide the agent with a copy of the document and to store the original in a safe, accessible place. Informing financial institutions and other relevant parties of the power of attorney can streamline processes requiring their involvement. Regularly reviewing and updating the document as necessary ensures it continues to reflect the principal's wishes and adapts to changing circumstances.

Understanding California Durable Power of Attorney

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal document that allows someone (the "principal") to designate another person (the "agent" or "attorney-in-fact") to manage their financial affairs. This authority can include managing bank accounts, signing checks, and selling property, and it remains in effect even if the principal becomes incapacitated.

How does a Durable Power of Attorney differ from a General Power of Attorney in California?

The main difference between a Durable and a General Power of Attorney in California is that a Durable Power of Attorney remains in effect even if the principal becomes mentally incapacitated, while a General Power of Attorney ceases to be effective under such circumstances. This makes the Durable Power of Attorney a crucial tool for long-term planning.

Who should I choose as my agent?

Choosing an agent is a significant decision. It should be someone you trust implicitly, such as a family member, a close friend, or a trusted advisor. This person should have the ability to manage financial matters prudently and should understand your wishes and values.

Does the agent have unlimited power?

No, the agent's powers are limited to those specified in the document. The principal can choose to grant broad authority or limit the agent's powers to specific actions. Furthermore, the agent is legally obligated to act in the principal's best interest, maintain accurate records, and avoid conflicts of interest.

How do I revoke a Durable Power of Attorney in California?

To revoke a Durable Power of Attorney, the principal must communicate the revocation in writing and deliver it to the agent and any institutions or parties that were relying on the original document. It's also recommended to destroy all original copies of the power of attorney to prevent further use.

Is it necessary to have a lawyer to create a Durable Power of Attorney in California?

While it's not legally required to have a lawyer to create a Durable Power of Attorney, it's highly recommended. A lawyer can ensure that the document meets all legal requirements, accurately reflects the principal's wishes, and considers the complexity of the principal's financial matters. This can help avoid issues and disputes down the line.

Common mistakes

Filling out the California Durable Power of Attorney form can be a critical step in managing one's financial affairs, especially in circumstances where they cannot do so themselves. However, mistakes in this process can lead to significant legal headaches and can sometimes defeat the purpose of the document itself. Here are nine common errors to avoid.

One widespread mistake is not specifying the powers granted clearly. Often, individuals believe that a broad statement of power is sufficient. However, it's essential to detail the specific powers the agent has, such as the ability to manage real estate transactions, financial accounts, or personal property decisions. Without clear instructions, an agent may be unsure of their authority, leading to inaction or, worse, unintended actions.

Another error is overlooking to designate a successor agent. Life is unpredictable, and the initially chosen agent might become unavailable due to various reasons such as illness, relocation, or refusal to serve. In such cases, having a successor agent named ensures that there is no gap in the representation of one's financial interests.

Choosing an agent without due consideration can also be problematic. The role of an agent requires trust and responsibility, so it's imperative to select someone who is not only trustworthy but also capable of managing financial affairs prudently. It is a mistake to select an agent based on emotional ties alone without considering their ability and willingness to perform the required duties.

Not discussing the responsibilities with the chosen agent beforehand is another common error. This lack of communication can lead to surprises or reluctance from the agent when it's time for them to act, potentially leading to a refusal to serve. A frank discussion about the expectations and responsibilities can ensure the agent is prepared and willing to act when needed.

Failure to update the document is often overlooked. Over time, one’s financial situation or relationships may change, rendering the initial document outdated. Regularly reviewing and updating the power of attorney to reflect current wishes and circumstances is crucial.

A mistake that can have legal consequences is improperly signing the document. Each state has its own rules regarding the signing of legal documents, including the requirement for witnesses and/or a notary public. Failing to comply with these requirements can render the document invalid.

Many people mistakenly assume they don't need a lawyer to create a Durable Power of Attorney. While it's true that legal templates exist, a lawyer can provide customized advice based on an individual's specific situation, ensuring the document meets all legal requirements and truly reflects the person’s wishes.

Lack of specificity about when the power of attorney takes effect can also create confusion. Some prefer it to become effective immediately, while others may want it to spring into effect upon a certain event, such as incapacitation. Clearly stating the conditions can help avoid ambiguity.

Finally, improperly storing the document can negate its usefulness. It's vital not only to keep it in a safe place but also to ensure the agent knows where to find it and can access it when needed. If the document is locked away without the agent’s knowledge of its location or how to access it, it might as well not exist.

Avoiding these mistakes when filling out the California Durable Power of Attorney form can greatly enhance its effectiveness and ensure one's financial matters are handled according to their wishes, even when they're unable to manage them directly.

Documents used along the form

When preparing for the future, it's not just about making one document and thinking it's all done. A comprehensive plan often includes several forms and documents, each serving unique purposes but working together to protect an individual's interests. Alongside the California Durable Power of Attorney form, which authorizes another person to act on one's behalf regarding financial matters, several other documents are typically utilized to ensure thorough coverage of one's legal and personal preferences. These documents, detailed below, make sure all aspects of one's life are managed according to their wishes, even when they can't express those wishes themselves.

- Advance Health Care Directive: This vital document lets individuals specify their preferences for medical treatment in situations where they cannot communicate their desires. It also allows them to appoint a health care agent to make decisions on their behalf.

- Living Will: Often included as part of the Advance Health Care Directive, a Living Will specifically addresses end-of-life care preferences, such as life support and pain management options.

- Will: This document outlines how an individual's property and assets should be distributed upon their death. It can also appoint guardians for any minor children.

- Trust: A Trust is used to manage an individual's assets during their lifetime and distribute them after their death. A Trust can help avoid probate, potentially saving time and money.

- HIPAA Authorization Form: This form allows designated persons to access an individual's healthcare information. It's crucial for agents acting under an Advance Health Care Directive or Durable Power of Attorney to have this access for decision-making purposes.

- Financial Records Release: Similar to the HIPAA Authorization but for financial matters, this document grants an agent access to an individual's financial records, essential for making informed decisions on their behalf.

Each of these documents plays a crucial role in a comprehensive estate plan. They work in concert to ensure an individual's health care preferences, financial matters, and estate are handled according to their wishes, providing peace of mind to both the individual and their loved ones. Considering these documents in addition to the California Durable Power of Attorney can help create a robust framework to manage one’s affairs, come what may.

Similar forms

The California Durable Power of Attorney form shares similarities with the Advance Healthcare Directive. Both serve as crucial planning tools, allowing individuals to appoint someone they trust to make decisions on their behalf. However, while the Durable Power of Attorney typically covers a broad range of financial affairs, the Advance Healthcare Directive focuses specifically on medical decisions. This includes treatment preferences and end-of-life care, ensuring that a person's healthcare wishes are respected even if they become unable to communicate them themselves.

Another document similar to the California Durable Power of Attorney is the General Power of Attorney. Both enable an individual to designate an agent to act in their stead for various legal and financial matters. The significant difference lies in their continuity; the Durable Power of Attorney remains in effect even after the grantor becomes incapacitated, whereas the General Power of Attorney becomes void if the person granting it loses mental capacity. This distinction makes the durable version a critical tool for long-term planning.

Comparable to the California Durable Power of Attorney is the Limited Power of Attorney. The Limited Power of Attorney allows individuals to appoint someone to act on their behalf, but, unlike its durable counterpart, it is restricted to specific circumstances or transactions. For example, one might authorize another person to sell a property, manage certain financial accounts, or handle legal matters, but only for a time or under conditions set out in the document. This specificity contrasts with the durable power, which broadly covers financial affairs without such restrictions.

The Springing Power of Attorney is also conceptually akin to the California Durable Power of Attorney, with the primary distinction being when they become effective. A Springing Power of Attorney "springs" into action upon the occurrence of a specific event, typically the incapacitation of the principal. In comparison, a Durable Power of Attorney can be arranged to take effect immediately upon signing and continues to be valid if the principal becomes incapacitated. The flexibility in choosing when the power becomes active makes each document suited to different planning needs and preferences.

Dos and Don'ts

When filling out the California Durable Power of Attorney form, it's important to approach the process with care and attention to detail. This document grants another person the authority to make decisions on your behalf, so it's crucial to be precise and considerate in your choices. Here are ten do's and don'ts to guide you through completing this form:

- Do take the time to carefully select your agent. This person will have a significant amount of power over your financial affairs, so trust and reliability are key.

- Do clearly define the scope of power you are granting. Be as specific as possible to ensure your wishes are accurately followed.

- Do discuss your decision with the person you're appointing as your agent. It's important that they understand the responsibilities involved and are willing to take them on.

- Do keep a signed copy in a safe and accessible place. Inform a trusted family member or friend of its location.

- Do consult with a legal professional if you have questions or require clarification on any part of the form. It's important to fully understand the document before signing it.

- Don't leave any sections of the form blank. If a section does not apply, mark it as "N/A" to indicate this.

- Don't rush through the process. Filling out the form properly requires thought and consideration.

- Don't use vague language. Precision is necessary to ensure your wishes are clearly understood and carried out.

- Don't forget to sign and date the form according to the instructions. Without your signature, the document is not valid.

- Don't hesitate to revise and update the document as needed. Life changes might necessitate adjustments to your Power of Attorney.

Misconceptions

There are several misconceptions surrounding the Durable Power of Attorney (POA) form in California. Correcting these misconceptions is crucial for anyone considering creating a POA to ensure their wishes are duly executed in the event they're unable to make decisions for themselves. Here are eight common misunderstandings:

- A Durable Power of Attorney covers medical decisions. This is a misconception because a standard Durable Power of Attorney in California primarily covers financial decisions, not healthcare ones. For medical decisions, a separate document, known as an Advance Healthcare Directive, is necessary.

- It grants power immediately upon signing. While this can be true, a Durable Power of Attorney can be structured to become effective immediately, or it can be springing—meaning it only comes into effect upon the principal's incapacity. The choice must be clearly stated in the document.

- Signing a Durable Power of Attorney means losing control over your finances. This is not the case; the principal retains control over their affairs and can revoke or amend the POA as long as they remain mentally competent.

- Any form of POA will suffice. California law has specific requirements for these documents. A generic or out-of-state form might not comply with California's legal requirements, potentially rendering it invalid.

- Once incapacitated, it's too late to create a Durable Power of Attorney. This is true and highlights the importance of executing a POA while the principal is still cognitively able. After losing capacity, the only option may be a court-appointed conservatorship, which is often more complex and costly.

- A Durable Power of Attorney allows the agent to make decisions after the principal's death. The authority granted by a Durable Power of Attorney ends at the principal's death. At that point, the executor of the estate, as designated in the will, takes over.

- You can appoint multiple agents and they must work together. While you can appoint more than one agent, you can also allow them to act independently of each other, depending on how the POA is structured. It's critical to specify how you want multiple agents to make decisions in the document.

- The best choice for an agent is always a family member. Though family members are commonly chosen, the best agent is someone who is trustworthy, competent to manage your finances, and understands your wishes. This doesn't necessarily have to be a family member. In some cases, a professional fiduciary is a better choice.

Understanding these points ensures that anyone considering a Durable Power of Attorney can make informed decisions that best suit their needs and those of their loved ones.

Key takeaways

Understanding the California Durable Power of Attorney (DPOA) form is essential for anyone looking to establish a legal arrangement that allows another person to manage their affairs. This document plays a crucial role in ensuring your financial matters are handled according to your wishes, especially if you become unable to manage them yourself. Below are six key takeaways regarding the filling out and use of the California DPOA form:

- Selecting an Agent Wisely: Your agent, also known as an attorney-in-fact, is given significant power over your finances. Choose someone trustworthy, reliable, and capable of managing financial tasks. It's also recommended to appoint a successor agent in case the primary agent is unable to serve.

- Specific Powers: The California DPOA form allows you to specify exactly what powers your agent can exercise. This can include managing bank accounts, buying or selling real estate, and handling transactions with the government. Clearly delineate these powers to ensure your agent’s authority matches your expectations.

- Duration of Powers: As a "durable" form, the powers you grant through the DPOA remain in effect even if you become incapacitated. This is a critical feature that makes the DPOA a powerful tool for incapacity planning. However, it's possible to specify a termination date if you wish.

- Legal Requirements: To make a DPOA valid in California, certain legal requirements must be met. These include properly signing and dating the document, and having it either notarized or witnessed by two adult witnesses, depending on the specific requirements outlined in California’s statutes.

- Revocation: Should your circumstances or wishes change, you have the right to revoke your DPOA at any time as long as you are mentally competent. Revocation should be done in writing, and all relevant parties, especially the named agent, should be notified.

- Safekeeping and Copies: Once executed, keep the original DPOA document in a secure but accessible place. Inform your agent, successor agent, and possibly family members of its location. Providing copies to your financial institutions can also streamline the process when your agent needs to act on your behalf.

The California Durable Power of Attorney form is a powerful legal document that requires thoughtful consideration. By understanding its key aspects and following these takeaways, you can ensure it serves your financial management needs effectively and aligns with your long-term planning goals.

More Durable Power of Attorney State Forms

New York Statutory Power of Attorney - By signing a Durable Power of Attorney, you can ensure that your finances are managed according to your wishes, even if you become incapacitated.

How to File for Power of Attorney in Florida - This document can significantly reduce legal hurdles and financial burdens on your family during difficult times.