Official Durable Power of Attorney Document

Important and practical, the Durable Power of Attorney form represents a crucial step individuals take in managing their affairs and ensuring their well-being. This legal document allows a person to designate another individual, known as an agent or attorney-in-fact, to make decisions on their behalf should they become unable to do so themselves. The "durable" aspect distinguishes it from other forms of power of attorney by allowing the designated agent's authority to continue even if the principal becomes incapacitated. Essential considerations when drafting this form include choosing a trustworthy agent, specifying the powers granted, and understanding the legal requirements for its execution. With its ability to cover financial, legal, and sometimes health-related decisions, the Durable Power of Attorney is a foundational tool for estate planning and personal care planning, providing peace of mind for both the individuals it protects and their loved ones.

State-specific Information for Durable Power of Attorney Forms

Document Example

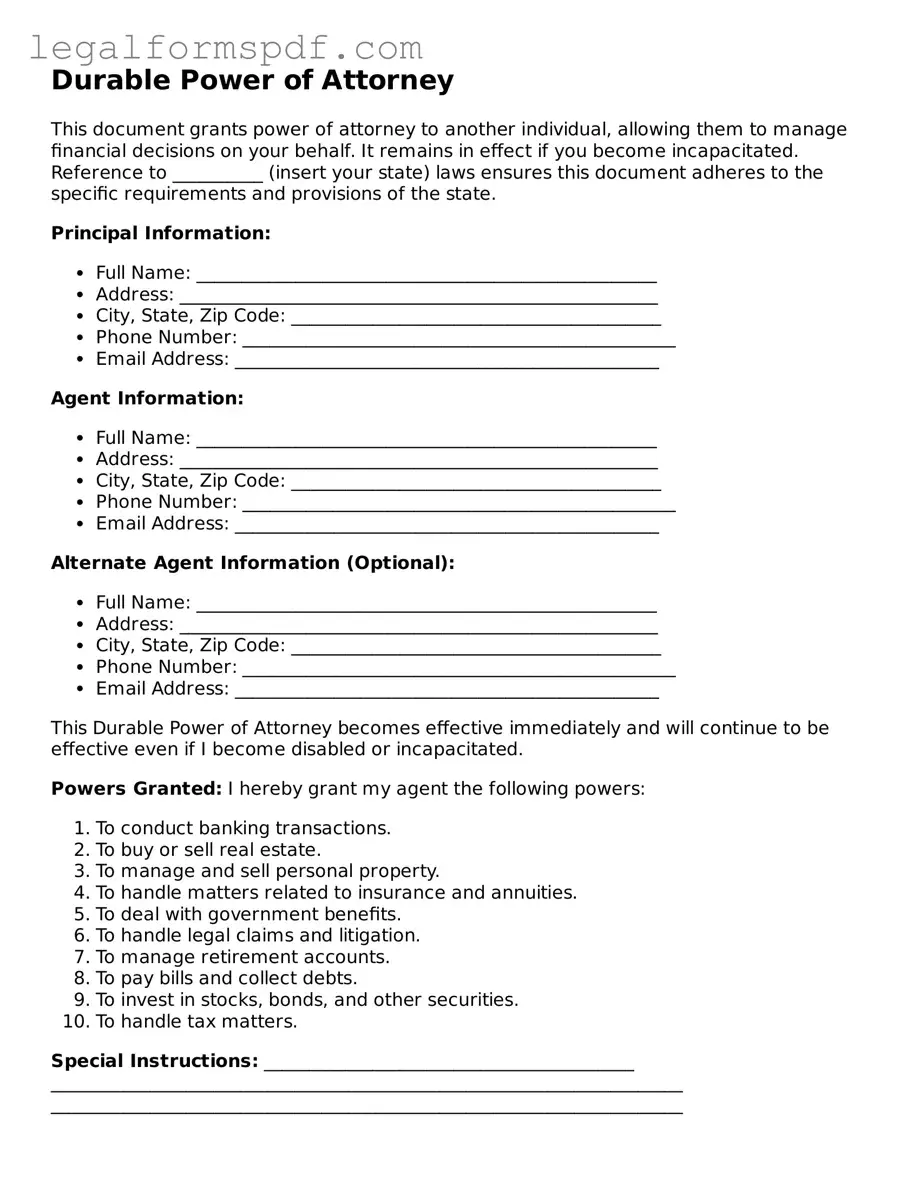

Durable Power of Attorney

This document grants power of attorney to another individual, allowing them to manage financial decisions on your behalf. It remains in effect if you become incapacitated. Reference to __________ (insert your state) laws ensures this document adheres to the specific requirements and provisions of the state.

Principal Information:

- Full Name: ___________________________________________________

- Address: _____________________________________________________

- City, State, Zip Code: _________________________________________

- Phone Number: ________________________________________________

- Email Address: _______________________________________________

Agent Information:

- Full Name: ___________________________________________________

- Address: _____________________________________________________

- City, State, Zip Code: _________________________________________

- Phone Number: ________________________________________________

- Email Address: _______________________________________________

Alternate Agent Information (Optional):

- Full Name: ___________________________________________________

- Address: _____________________________________________________

- City, State, Zip Code: _________________________________________

- Phone Number: ________________________________________________

- Email Address: _______________________________________________

This Durable Power of Attorney becomes effective immediately and will continue to be effective even if I become disabled or incapacitated.

Powers Granted: I hereby grant my agent the following powers:

- To conduct banking transactions.

- To buy or sell real estate.

- To manage and sell personal property.

- To handle matters related to insurance and annuities.

- To deal with government benefits.

- To handle legal claims and litigation.

- To manage retirement accounts.

- To pay bills and collect debts.

- To invest in stocks, bonds, and other securities.

- To handle tax matters.

Special Instructions: _________________________________________ ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________ (Provide any additional instructions you have for the Agent here.)

Signature and Acknowledgment:

Principal's Signature: ________________________ Date: ______________

Agent's Signature: ___________________________ Date: ______________

State of ___________

County of _________

This document was acknowledged before me on (date) _______________ by (name of principal) _________________________.

_____________________________________

(Signature of Notarial Officer)

Notary Public for the State of ___________

My commission expires: _______________

PDF Specifications

| Name of Fact | Description |

|---|---|

| Definition | A Durable Power of Attorney is a legal document that grants a chosen person or entity the authority to act on behalf of the principal in financial, legal, and medical matters, even after the principal becomes incapacitated. |

| Capacity Requirement | The principal must be of sound mind, understanding the implications of signing the document, at the time the Durable Power of Attorney is executed. |

| Revocation | It remains in effect until the principal's death unless revoked by the principal while they are of sound mind. |

| Agent Duties | The chosen agent is required to act in the principal's best interest, maintain accurate records, and keep the principal's property separate from their own. |

| Governing Laws | Each state has its own statutes governing Durable Powers of Attorney. Forms and requirements can vary widely across state lines. |

| Healthcare Decisions | Some states require a separate Durable Power of Attorney for Healthcare to authorize medical decision-making on behalf of the principal. |

Instructions on Writing Durable Power of Attorney

Filling out a Durable Power of Attorney form is an important step in planning for future scenarios where you might not be able to make decisions for yourself. It allows someone you trust to make financial decisions on your behalf. Although this process might seem daunting at first, breaking it down into clear, manageable steps can make it much easier. By following the instructions below, you can complete the form confidently, ensuring your financial matters are in safe hands.

- Start by obtaining a Durable Power of Attorney form specific to your state, as requirements can vary.

- Read through the entire document before writing anything, to understand all the sections and what information you'll need to provide.

- Fill in your full legal name and address at the top of the form, identifying you as the "Principal."

- Identify the person you are appointing as your "Agent" or "Attorney-in-Fact" by writing their full legal name and address. Ensure this person has agreed to act on your behalf and understands the responsibilities involved.

- Specify the powers you are granting your Agent. These can range from managing your bank accounts to selling property. Be clear and explicit about what decisions they can and cannot make.

- If you wish to limit your Agent's powers or the duration for which the Durable Power of Attorney is valid, clearly define these restrictions on the form.

- Many states require the Durable Power of Attorney to be witnessed or notarized, or both. Check your state's requirements and arrange for witnesses and/or a notary as needed. The witnesses should be adults, and they cannot be the Agent you have chosen.

- Sign and date the form in the presence of your witnesses and/or notary, according to your state’s laws. Your Agent may also need to sign, depending on the form's requirements.

- Keep the original signed document in a safe but accessible place. Provide your Agent with a copy, and consider giving a copy to other trusted individuals, such as family members or a lawyer.

After completing these steps, your Durable Power of Attorney should be valid and effective. However, it's a good idea to review and, if necessary, update it periodically to reflect any changes in your situation or preferences. This ensures that your financial matters will be handled according to your wishes, even if you're unable to oversee them yourself.

Understanding Durable Power of Attorney

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone you trust (called an "agent" or "attorney-in-fact") to manage your financial affairs and make decisions on your behalf. Unlike a standard Power of Attorney, it remains effective even if you become mentally incapacitated.

How is a Durable Power of Attorney different from a general Power of Attorney?

The main difference lies in its durability. A general Power of Attorney becomes invalid if you become incapacitated. In contrast, a Durable Power of Attorney is specifically designed to stay in effect if you lose the ability to make decisions for yourself, ensuring that your affairs can still be managed according to your wishes.

Why do I need a Durable Power of Attorney?

Having a DPOA in place is crucial for ensuring that your financial matters are taken care of if you're unable to do so yourself due to illness, injury, or any other reason. It helps in avoiding the potentially costly and time-consuming process of having a court appoint a guardian or conservator to manage your affairs.

Who should I choose as my agent?

It's important to choose someone you trust completely as your agent since they will have authority to manage your finances and legal matters. Most people select a close family member or a trusted friend. Consider their ability to manage finances and their willingness to take on the responsibility.

Can I revoke or change my Durable Power of Attorney?

Yes, as long as you are mentally competent, you can revoke or change your DPOA at any time. To do so, you should inform your current agent in writing and provide a copy of the revocation to anyone who was given the original DPOA. If you're appointing a new agent, you'll need to complete a new DPOA form.

What happens if I don't have a Durable Power of Attorney and I become incapacitated?

Without a DPOA, if you become unable to manage your affairs, a court may need to appoint a conservator or guardian to make decisions on your behalf. This process can be lengthy, costly, and stressful for your family and may not reflect your personal wishes.

How can I ensure my Durable Power of Attorney is legally valid?

To ensure your DPOA is legally valid, make sure to complete the form in accordance with your state's laws, which may require witnessing, notarization, or both. It's advisable to consult with a legal professional to ensure the document meets all legal requirements and accurately reflects your wishes.

Does a Durable Power of Attorney allow my agent to make healthcare decisions for me?

No, a Durable Power of Attorney is typically limited to financial and legal decisions. If you wish to appoint someone to make healthcare decisions on your behalf, you should complete a separate document known as a Healthcare Power of Attorney or an Advance Healthcare Directive.

Common mistakes

Filling out a Durable Power of Attorney (DPOA) form can be a prudent step in planning for future uncertainties. However, mistakes in completing this critical document can lead to unintended consequences, undermining the individual's wishes. One common error is not choosing the right agent. The role of the agent is pivotal; this person will make decisions on your behalf if you become unable to do so. It's essential to select someone who is not only trustworthy but also capable of making tough decisions that align with your wishes.

Another frequent mistake is being too vague or too specific when defining the powers granted. This can create confusion or limit your agent's ability to act in your best interest. A well-drafted DPOA strikes a balance, providing clear guidance without boxing the agent into a corner during unforeseen situations. It's vital to consider the scope of decisions you want your agent to make, from financial transactions to real estate management.

Failing to update the DPOA is also a critical oversight. Life's circumstances change, and so should your documents. An outdated DPOA may no longer reflect your current relationships or financial situation, potentially leading to challenges in its execution. Regularly reviewing and updating your DPOA ensures that it remains relevant and effective in carrying out your intentions.

Not clearly stating the conditions under which the DPOA becomes effective is another mistake. Some prefer their DPOA to take effect immediately, while others may want it to be conditional, activating only upon incapacity. Without specifying this, the interpretation of your DPOA terms could lead to delays or disputes at a time when swift decision-making is crucial.

Last but not least, neglecting to consult with a legal professional can result in a document that fails to comply with state laws, leaving your DPOA vulnerable to being contested or rendered invalid. Each state has specific requirements for DPOAs to be legally binding. Personalized legal advice can ensure that your document is robust and reflective of your needs and intentions.

Documents used along the form

Creating a Durable Power of Attorney (POA) form is a crucial step in managing one's financial and legal affairs, especially in anticipation of future incapacity. This form allows an individual to designate another person to make decisions on their behalf. However, to ensure comprehensive management and protection of one's interests, several other forms and documents are often utilized in tandem with a Durable POA. These documents complement the Durable POA, each serving a unique but synergistic role in one's estate planning and health care directives.

- Living Will - This document specifies an individual's wishes regarding medical treatments and life-sustaining measures in case they become unable to communicate their decisions due to illness or incapacitation. Unlike a Durable POA, which appoints someone to make health care decisions on behalf of the individual, a Living Will outlines specific wishes about end-of-life care.

- Health Care Power of Attorney - Similar to a Durable POA but specifically focused on health care, this document allows an individual to appoint someone else to make health care decisions for them if they are unable to do so. This is particularly useful in scenarios that are not covered by a Living Will.

- Last Will and Testament - This document delineates how an individual's assets and estate will be distributed after their death. It is essential for estate planning, ensuring that the individual's wishes are honored and potentially reducing conflicts among heirs.

- Revocable Living Trust - Often used alongside a Last Will and Testament, a Revocable Living Trust provides a mechanism for managing an individual's assets during their lifetime and distributing them upon death, often bypassing the potentially lengthy and costly probate process.

- Advance Directive - An Advance Directive serves a dual purpose, combining elements of a Living Will and a Health Care Power of Attorney. It allows individuals to express their preferences for medical treatment and appoint a health care agent in a single document.

- Financial Information Sheet - While not a legal document in the same sense as the others, a Financial Information Sheet is incredibly useful for the person holding the Durable POA. It provides a consolidated view of the principal's financial accounts, insurance policies, and other relevant information, enabling more informed decision-making.

In conclusion, while a Durable Power of Attorney is a foundational document for anyone's legal and financial planning, the additional forms and documents listed above play critical roles in ensuring that all aspects of one's personal, financial, and health care wishes are accounted for and respected. It is advisable for individuals to consider these documents in their comprehensive estate planning to provide clarity and ease for themselves and their families during challenging times.

Similar forms

A Health Care Proxy is a document that functions similarly to a Durable Power of Attorney (DPOA), specifically in the domain of healthcare. While a DPOA grants an agent authority to make a broad range of decisions on behalf of the principal, a Health Care Proxy specifically focuses on medical decisions. In the event that the principal is unable to make healthcare decisions for themselves due to incapacity, the designated proxy steps in to make those decisions, guided by the principal's stated wishes and best interests, paralleling the DPOA's role in financial and personal affairs.

A Living Will shares common ground with a Durable Power of Attorney, particularly in the aspect of preparing for scenarios of incapacitation. However, rather than designating another person to make decisions on behalf of the principal, a Living Will outlines the principal's own preferences for end-of-life care. This document specifies what medical treatments and life-sustaining measures an individual does or does not want, providing a clear directive to healthcare providers and relieving loved ones of decision-making burdens during difficult times.

The General Power of Attorney (GPA) document is akin to the Durable Power of Attorney with one notable distinction – its durability. Both documents empower an agent to act on the principal’s behalf in various matters, including financial transactions and property management. However, the GPA's authority typically ceases if the principal becomes incapacitated or mentally incompetent, contrasting the DPOA's enduring nature, which remains effective despite the principal's incapacitation.

A Financial Power of Attorney is closely related to the Durable Power of Attorney in its functionality and purpose. This document specifically authorizes an agent to handle the principal's financial affairs, such as managing bank accounts, paying bills, and buying or selling property. While a DPOA can encompass a broad range of authorizations, including healthcare decisions, a Financial Power of Attorney is strictly limited to financial matters, showcasing a more focused version of the authority granted by a DPOA.

A Springing Power of Attorney is similar to a Durable Power of Attorney in its essential purpose but comes with a built-in trigger mechanism. This type of power of attorney remains inactive until a specific event occurs, usually the principal’s incapacitation. It “springs” into effect upon the occurrence of the predetermined condition, reflecting the DPOA's intent to prepare for future incapacitation. Both documents aim to ensure that the principal's affairs can be managed without interruption, despite significant differences in their activation criteria.

The Revocable Living Trust presents parallels to the Durable Power of Attorney through its provision for managing the trustor's assets. In both cases, individuals can appoint someone to manage their affairs. A key difference is that, with a trust, the management can extend beyond the individual's lifetime or during periods of incapacitation, with emphasis on asset management and distribution. It echoes the DPOA's enduring characteristic but specifically within the realm of trust management, offering a structure for asset handling that survives the trustor’s death or incapacitation.

Lastly, a Guardianship or Conservatorship arrangement exhibits similarities to a Durable Power of Attorney by allowing another person to make decisions for someone who is unable to do so themselves. However, these are court-appointed roles, typically established through a legal process when the individual can no longer manage their own affairs due to severe incapacity. Unlike a DPOA, which is set up in advance by the individual, a guardianship or conservatorship is an involuntary process initiated by others when the need arises, reflecting a more stringent and legally intensive approach to managing one’s personal and financial matters.

Dos and Don'ts

When preparing a Durable Power of Attorney (DPOA), individuals empower someone else to make important decisions on their behalf. This process, while essential, requires attention to detail and a clear understanding of the document's implications. Below are the key dos and don'ts to consider:

- Do choose a trusted individual as your agent. This person will have substantial authority, and it’s crucial they act in your best interest.

- Do clearly specify the powers granted. Being vague can lead to confusion or misuse of the authority given.

- Do include limitations or conditions if necessary. Tailoring the document can prevent the misuse of power and clarify your intentions.

- Do consult with a legal professional. Legal advice can help ensure the document is properly executed and meets all legal requirements.

- Don't leave any sections incomplete. An incomplete form can render the document invalid or ineffective.

- Don't use unclear language. Precision in wording prevents misinterpretation and ensures your wishes are accurately followed.

- Don't forget to sign and date the document in the presence of a notary public. This step is often legally required to validate the form.

- Don't neglect to provide copies to relevant parties, such as your chosen agent, family members, or your attorney. This ensures everyone is informed of the DPOA’s existence and its contents.

Following these guidelines can help safeguard your interests and ensure that your Durable Power of Attorney form is effective and reflective of your wishes. Taking the time to carefully select your agent and clearly outline the scope of their powers is a critical step in this process.

Misconceptions

When it comes to planning for future incapacity or delegating financial management, a Durable Power of Attorney (DPOA) form is an essential document. However, numerous misconceptions cloud its understanding and proper use. Below are eight common misconceptions about the Durable Power of Attorney form explained:

- It grants unlimited power: Many believe that executing a DPOA provides the agent with unrestricted power over all financial matters. However, the scope of authority given to the agent can be specifically tailored within the document to include or exclude certain powers.

- It is effective only after incapacitation: Contrary to this belief, a DPOA can be effective immediately upon signing, depending on how it's structured. It does not need to be activated by a medical declaration of incapacity unless explicitly stated in the document.

- It supersedes a will: A common misunderstanding is that a DPOA can override the terms of a will. In truth, a DPOA is only operational during the principal’s lifetime and does not affect the distribution of assets after death.

- It is valid after death: The authority granted under a DPOA ends at the principal's death. At that point, the executor or personal representative named in the will takes over the management and distribution of the estate.

- Only one agent can be designated: While simplicity often guides the choice of having a single agent, the principal can name multiple agents and specify whether they must act jointly or can act independently.

- It is difficult to revoke: As long as the principal is competent, they can revoke a DPOA at any time. Revocation procedures should be followed as specified by state law, including notifying any appointed agents.

- A DPOA and a medical power of attorney are the same: This is incorrect; a DPOA is primarily for financial decisions, whereas a medical power of attorney designates someone to make healthcare decisions on the principal's behalf.

- Creating a DPOA means losing control: By granting a DPOA, principals do not forfeit their right to manage their own finances or make decisions as long as they remain competent. It enables the agent to act concurrently or if the principal cannot manage their affairs.

Key takeaways

Navigating the complexities of legal documents can be daunting. Among these, the Durable Power of Attorney (DPOA) stands out as a pivotal tool in estate planning and personal finance management. It authorizes someone you trust to handle your financial matters if you're unable to do so yourself. Below are key takeaways to consider when filling out and using a DPOA form.

- Understand the Scope: A DPOA can be as broad or as specific as you wish. It's crucial to understand the extent of power you're granting, which can range from managing daily finances to selling property.

- Select Someone Trustworthy: The person you choose to hold your DPOA is called your "agent" or "attorney-in-fact." This should be someone reliable and capable of handling financial tasks, as they will act in your best interest.

- Be Specific About Powers Given: Clearly outline what your agent can and cannot do. This may include operating your business, handling transactions, or managing real estate. Being specific helps prevent misuse of the document.

- Durability is Key: The “durability” aspect ensures that the DPOA remains in effect if you become mentally incompetent. Without specifying durability, the document may not serve its purpose when you need it most.

- Legal Requirements Vary: Every state has its own legal requirements for a DPOA to be valid. These may include witnessing, notarization, or specific wording. Consulting with a legal professional can ensure your document meets all local criteria.

- Keep it Updated: Life changes such as marriage, divorce, relocation, or the death of your designated agent can affect the relevance and effectiveness of your DPOA. Regularly review and update the document to reflect your current situation and wishes.

- Secure Storage and Accessibility: Store your DPOA document in a safe yet accessible place. Make sure that your agent and other pertinent parties know where to find it and how to access it if necessary.

Embarking on the process of establishing a Durable Power of Attorney is a significant step towards ensuring your affairs are managed according to your wishes, even if you are not in a position to oversee them yourself. With careful consideration and adherence to legal standards, you can secure peace of mind for yourself and your loved ones.

Consider More Types of Durable Power of Attorney Forms

Sample of Power of Attorney to Sell Property - Allows for the seamless management of real estate assets during absences or inability to act personally.

Power of Attorney for a Motor Vehicle - By facilitating authorized transactions in the owner's absence, it eliminates delays and complications in vehicle management.